HIGHLIGHTS:

- Net sales of $376.9 million, down 16% compared to prior year,

primarily due to repositioning actions in Performance

Chemicals

- Net loss of $107.2 million and diluted loss per share of $2.95

reflects before-tax restructuring charges of $86.9 million and

contract termination fees of $100.0 million; adjusted earnings of

$40.2 million and diluted adjusted earnings per share (EPS) of

$1.10

- Adjusted EBITDA of $106.4 million and adjusted EBITDA margin of

28.2%

- Operating cash flow of $46.5 million with free cash flow of

$28.5 million

- Affirms full year guidance of sales between $1.40 billion and

$1.50 billion and adjusted EBITDA between $350 million and $360

million

The results and guidance in this release

include non-GAAP financial measures. Refer to the section entitled

“Use of non-GAAP financial measures” within this release. All

comparisons are made versus the same period in 2023 unless

otherwise stated.

Ingevity Corporation (NYSE: NGVT) today reported its financial

results for the third quarter 2024.

Third quarter net sales of $376.9 million declined 16% primarily

due to the repositioning of the Performance Chemicals segment which

included reducing exposure to certain markets in the Industrial

Specialties product line and weather-related impacts in the Road

Technologies product line. The decline was partially offset by

higher sales in Performance Materials and Advanced Polymer

Technologies.

The net loss of $107.2 million and diluted loss per share of

$2.95 reflects before-tax restructuring charges of $86.9 million

primarily related to the closure of our Crossett, Arkansas,

facility and $100.0 million for the termination of a long-term

crude tall oil (CTO) contract, both associated with the

repositioning of our Performance Chemicals segment. Adjusted

earnings were $40.2 million and diluted adjusted earnings per share

(EPS) was $1.10. Adjusted Earnings before Interest, Taxes,

Depreciation and Amortization (EBITDA) was $106.4 million, down

3.6%, with adjusted EBITDA margin of 28.2%. Adjusted EBITDA

included a $3.8 million inventory charge related to the shutdown of

our Crossett, Arkansas, facility and approximately $5 million for

CEO severance charges.

“This quarter's results demonstrate the strong foundation that

Ingevity has established,” said Luis Fernandez-Moreno, interim

president and CEO. “Performance Materials continues to deliver

outstanding results, Advanced Polymer Technologies has shown it can

maintain strong margins even in a prolonged industrial slowdown,

and Performance Chemicals is beginning to show the benefits of its

lower cost structure driven by our repositioning actions. I am

excited and energized to step into this role where my focus will be

on accelerating the teams’ existing business strategies through

improved execution and focus to drive consistent revenue growth and

margin improvement.”

Performance Materials

Sales in Performance Materials were $151.1 million in the

quarter, up 3%, primarily from strategic pricing adjustments.

Segment EBITDA was $80.6 million, up 8%, primarily driven by

operational improvements that contributed to lower input costs and

improved manufacturing efficiency, resulting in segment EBITDA

margins of 53.3%.

Advanced Polymer Technologies

Sales in Advanced Polymer Technologies (APT) were up 14% to

$48.8 million primarily due to higher volumes. Segment EBITDA was

$9.8 million, down 13%, and segment EBITDA margin was 20.1%. Higher

volume resulted in improved utilization rates, but these benefits

were largely offset by lower price and unfavorable product mix. In

addition, foreign exchange negatively impacted this quarter’s

EBITDA.

Performance Chemicals

Sales in Performance Chemicals were $177.0 million, down

31%.

Road Technologies product line sales of $119.0 million were down

8% driven by unfavorable weather conditions in key regions in North

America. Industrial Specialties product line sales of $58.0 million

were down 54% due primarily to the impact of the segment’s

repositioning actions which are focused on reducing exposure to

lower margin end markets, as well as continued weakness in

industrial demand.

Segment EBITDA was $19.8 million, down 20%, reflecting the

impact of higher CTO costs and continued weak industrial demand.

Segment EBITDA margin improved 160 basis points to 11.2% as the

segment benefited from the exit of lower margin end markets and

cost savings as a result of repositioning actions.

Liquidity/Other

Third quarter operating cash flow was $46.5 million with free

cash flow of $28.5 million, which includes the first of two $50.0

million payments to terminate a long-term CTO supply contract, as

well as the cash impact of $21.0 million in restructuring charges.

The second and final termination payment of $50.0 million was

completed in October. There were no share repurchases for the

quarter and $353.4 million remains available under the current $500

million Board authorization. Net leverage was flat to last quarter

at 4.0 times but is expected to improve beginning next quarter.

Full Year 2024 Guidance

“We began to see the positive impact of the Performance

Chemicals segment repositioning during the quarter. Our focus over

the next several quarters will be on execution to ensure we

maximize the benefits of our strategy. We are affirming our

guidance of sales between $1.40 billion and $1.50 billion and our

adjusted EBITDA to between $350 million and $360 million,” said

Fernandez-Moreno.

Additional Information

The company will host a live webcast on Wednesday, October 30,

at 10:00 a.m. (Eastern) to discuss third quarter 2024 fiscal

results. The webcast can be accessed here or on the investors

section of Ingevity’s website. You may also listen to the

conference call by dialing 833 470 1428 (inside the U.S.) and

entering access code 381718. Callers outside the U.S. can find

global dial-in numbers here. For those unable to join the live

event, a recording will be available beginning at approximately

2:00 p.m. (Eastern) on October 30, 2024, through October 29, 2025,

at this replay link.

Ingevity: Purify, Protect and Enhance

Ingevity provides products and technologies that purify, protect

and enhance the world around us. Through a team of talented and

experienced people, we develop, manufacture and bring to market

solutions that help customers solve complex problems and make the

world more sustainable. We operate in three reporting segments:

Performance Materials, which includes activated carbon; Advanced

Polymer Technologies, which includes caprolactone polymers; and

Performance Chemicals, which includes specialty chemicals and road

technologies. Our products are used in a variety of demanding

applications, including adhesives, agrochemicals, asphalt paving,

certified biodegradable bioplastics, coatings, elastomers,

lubricants, pavement markings, oil production and automotive

components. Headquartered in North Charleston, South Carolina,

Ingevity operates from 31 countries around the world and employs

approximately 1,700 people. The company’s common stock is traded on

the New York Stock Exchange (NYSE:NGVT). For more information,

visit ingevity.com.

Use of non-GAAP financial measures: This press release

includes certain non‐GAAP financial measures intended to

supplement, not substitute for, comparable GAAP measures.

Reconciliations of non‐GAAP financial measures to GAAP financial

measures are provided within the Appendix to this press release.

Investors are urged to consider carefully the comparable GAAP

measures and the reconciliations to those measures provided. The

company does not attempt to provide reconciliations of

forward-looking non-GAAP guidance to the comparable GAAP measure

because the impact and timing of the factors underlying the

guidance assumptions are inherently uncertain and difficult to

predict and are unavailable without unreasonable efforts. In

addition, Ingevity believes such reconciliations would imply a

degree of certainty that could be confusing to investors.

Forward Looking Statements

This press release contains “forward looking statements” within

the meaning of the Securities Exchange Act of 1934, as amended, and

the Private Securities Litigation Reform Act of 1995. Such

statements generally include the words “will,” “plans,” “intends,”

“targets,” “expects,” “outlook,” “guidance,” “believes,”

“anticipates” or similar expressions. Forward looking statements

may include, without limitation, anticipated timing, charges and

costs of any current or future repositioning of our Performance

Chemicals segment, including the oleo-based product refining

transition, Crossett, Arkansas plant closure, and the previously

announced closure of our DeRidder, Louisiana plant; the potential

benefits of any acquisition or investment transaction, expected

financial positions, guidance, results of operations and cash

flows; financing plans; business strategies and expectations;

operating plans; capital and other expenditures; competitive

positions; growth opportunities for existing products; benefits

from new technology and cost reduction initiatives, plans and

objectives; litigation-related strategies and outcomes; and markets

for securities. Actual results could differ materially from the

views expressed. Factors that could cause actual results to

materially differ from those contained in the forward looking

statements, or that could cause other forward looking statements to

prove incorrect, include, without limitation, charges, costs or

actions, including adverse legal or regulatory actions, resulting

from, or in connection with, the current or future repositioning of

our Performance Chemicals segment, including the oleo-based product

refining transition, Crossett, Arkansas plant closure, and the

previously announced closure of our DeRidder, Louisiana plant;

losses due to resale of crude tall oil at less than we paid for it;

adverse effects from general global economic, geopolitical and

financial conditions beyond our control, including inflation and

the Russia Ukraine war and conflict in the middle east; risks

related to our international sales and operations; adverse

conditions in the automotive market; competition from substitute

products, new technologies and new or emerging competitors;

worldwide air quality standards; a decrease in government

infrastructure spending; adverse conditions in cyclical end

markets; the limited supply of or lack of access to sufficient raw

materials, or any material increase in the cost to acquire such raw

materials; issues with or integration of future acquisitions and

other investments; the provision of services by third parties at

several facilities; supply chain disruptions; natural disasters and

extreme weather events; or other unanticipated problems such as

labor difficulties (including work stoppages), equipment failure or

unscheduled maintenance and repair; attracting and retaining key

personnel; dependence on certain large customers; legal actions

associated with our intellectual property rights; protection of our

intellectual property and other proprietary information;

information technology security breaches and other disruptions;

complications with designing or implementing our new enterprise

resource planning system; government policies and regulations,

including, but not limited to, those affecting the environment,

climate change, tax policies, tariffs and the chemicals industry;

losses due to lawsuits arising out of environmental damage or

personal injuries associated with chemical or other manufacturing

processes; and the other factors detailed from time to time in the

reports we file with the Securities and Exchange Commission (the

“SEC”), including those described in Part I, Item 1A. Risk Factors

in our most recent Annual Report on Form 10 K as well as in our

other filings with the SEC. These forward looking statements speak

only to management’s beliefs as of the date of this press release.

Ingevity assumes no obligation to provide any revisions to, or

update, any projections and forward looking statements contained in

this press release.

INGEVITY CORPORATION

Condensed Consolidated

Statements of Operations (Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

In millions, except per share

data

2024

2023

2024

2023

Net sales

$

376.9

$

446.0

$

1,107.6

$

1,320.4

Cost of sales

247.0

317.0

754.8

908.0

Gross profit

129.9

129.0

352.8

412.4

Selling, general, and administrative

expenses

38.7

40.0

127.3

140.3

Research and technical expenses

6.7

7.8

20.8

24.6

Restructuring and other (income) charges,

net

86.9

24.6

162.8

49.4

Goodwill impairment charge

—

—

349.1

—

Acquisition-related costs

(0.1

)

0.1

—

3.8

Other (income) expense, net

111.8

1.3

167.9

(13.9

)

Interest expense, net

23.8

23.1

69.3

64.3

Income (loss) before income taxes

(137.9

)

32.1

(544.4

)

143.9

Provision (benefit) for income taxes

(30.7

)

6.9

(97.5

)

32.5

Net income (loss)

$

(107.2

)

$

25.2

$

(446.9

)

$

111.4

Per share data

Basic earnings (loss) per share

$

(2.95

)

$

0.70

$

(12.31

)

$

3.05

Diluted earnings (loss) per share

(2.95

)

0.69

(12.31

)

3.03

Weighted average shares outstanding

Basic

36.3

36.2

36.3

36.6

Diluted

36.3

36.4

36.3

36.8

INGEVITY CORPORATION

Segment Operating Results

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

In millions

2024

2023

2024

2023

Net sales

Performance Materials

$

151.1

$

147.2

$

453.4

$

433.2

Road Technologies product line

119.0

129.7

293.8

316.4

Industrial Specialties product line

58.0

126.3

215.7

409.2

Performance Chemicals

$

177.0

$

256.0

$

509.5

$

725.6

Advanced Polymer Technologies

$

48.8

$

42.8

$

144.7

$

161.6

Total net sales

$

376.9

$

446.0

$

1,107.6

$

1,320.4

Segment EBITDA (1)

Performance Materials

$

80.6

$

74.5

$

240.8

$

208.5

Performance Chemicals

19.8

24.7

18.5

89.9

Advanced Polymer Technologies

9.8

11.2

29.1

36.6

Total segment EBITDA (1)

$

110.2

$

110.4

$

288.4

$

335.0

Interest expense, net

(23.8

)

(23.1

)

(69.3

)

(64.3

)

(Provision) benefit for income taxes

30.7

(6.9

)

97.5

(32.5

)

Depreciation and amortization -

Performance Materials

(9.7

)

(9.5

)

(29.0

)

(28.7

)

Depreciation and amortization -

Performance Chemicals

(8.6

)

(13.2

)

(31.1

)

(40.0

)

Depreciation and amortization - Advanced

Polymer Technologies

(7.9

)

(7.9

)

(23.0

)

(23.4

)

Restructuring and other income (charges),

net (2) (3)

(86.9

)

(24.6

)

(162.8

)

(49.4

)

Goodwill impairment charge (2)(4)

—

—

(349.1

)

—

Acquisition and other-related costs (2)

(5)

0.1

(0.1

)

—

(4.6

)

Inventory charges (6)

(3.8

)

—

(6.3

)

—

Loss on CTO resales (2) (4)

(0.8

)

—

(50.8

)

—

CTO supply contract termination charges

(2) (4)

(100.0

)

—

(100.0

)

—

Gain (loss) on strategic investments (2)

(7)

(6.7

)

0.1

(11.4

)

19.3

Net income (loss)

$

(107.2

)

$

25.2

$

(446.9

)

$

111.4

_______________

(1)

Segment EBITDA is the primary measure used

by our chief operating decision maker ("CODM") to evaluate the

performance of and allocate resources among our operating segments.

Segment EBITDA is defined as segment net sales less segment

operating expenses (segment operating expenses consist of costs of

sales, selling, general and administrative expenses, research and

technical expenses, other (income) expense, net, excluding

depreciation and amortization). We have excluded the following

items from segment EBITDA: interest expense associated with

corporate debt facilities, interest income, income taxes,

depreciation, amortization, restructuring and other income

(charges), net, inventory lower of cost or market charges

associated with restructuring actions, goodwill impairment charge,

acquisition and other-related income (costs), litigation verdict

charges, gain (loss) on strategic investments, loss on CTO resales,

CTO supply contract termination charges, pension and postretirement

settlement and curtailment income (charges), net.

(2)

For more information on these charges,

refer to the Reconciliation of Adjusted Earnings table on page

7.

(3)

The table below provides an allocation of

these charges between our three reportable segments to provide

investors, potential investors, securities analysts and others with

the information, should they choose, to apply such (income) charges

to each respective reportable segment for which the charges

relate.

Three Months Ended September

30,

Nine Months Ended September

30,

In millions

2024

2023

2024

2023

Performance Materials

$

0.6

$

1.3

$

0.7

$

7.5

Performance Chemicals

86.1

22.9

162.0

39.6

Advanced Polymer Technologies

0.2

0.4

0.1

2.3

Restructuring and other (income) charges,

net

$

86.9

$

24.6

$

162.8

$

49.4

(4)

For the three and nine months ended

September 30, 2024, charges relate to the Performance Chemicals

reportable segment.

(5)

For the three and nine months ended

September 30, 2024 and 2023, charges relate to the Performance

Chemicals reportable segment.

(6)

For the three and nine months ended September 30, 2024, inventory

charges represent lower of cost or market charges associated with

the Performance Chemicals’ repositioning. These charges were not

allocated in the measurement of our Performance Chemicals

reportable segment profitability used by our CODM. Amounts are

included in Cost of sales on the condensed consolidated statement

of operations.

(7)

The table below provides an allocation of

these charges between our three reportable segments to provide

investors, potential investors, securities analysts and others with

the information, should they choose, to apply such (income) charges

to each respective reportable segment for which the charges

relate.

Three Months Ended September

30,

Nine Months Ended September

30,

In millions

2024

2023

2024

2023

Performance Materials

$

—

$

(0.1

)

$

(0.1

)

$

(19.3

)

Performance Chemicals

4.5

—

9.3

—

Advanced Polymer Technologies

2.2

—

2.2

—

(Gain) loss on strategic investments

$

6.7

$

(0.1

)

$

11.4

$

(19.3

)

INGEVITY CORPORATION

Condensed Consolidated Balance

Sheets (Unaudited)

In millions

September 30, 2024

December 31, 2023

Assets

Cash and cash equivalents

$

135.5

$

95.9

Accounts receivable, net

189.9

182.0

Inventories, net

261.0

308.8

Prepaid and other current assets

50.4

71.9

Current assets

636.8

658.6

Property, plant, and equipment, net

671.3

762.2

Goodwill

186.9

527.5

Other intangibles, net

298.6

336.1

Restricted investment

81.1

79.1

Strategic investments

87.3

99.2

Other assets

249.6

160.6

Total Assets

$

2,211.6

$

2,623.3

Liabilities

Accounts payable

$

96.5

$

158.4

Accrued expenses

116.8

72.3

Notes payable and current maturities of

long-term debt

100.7

84.4

Other current liabilities

46.8

47.8

Current liabilities

360.8

362.9

Long-term debt including finance lease

obligations

1,397.6

1,382.8

Deferred income taxes

65.7

70.9

Other liabilities

173.0

175.3

Total Liabilities

1,997.1

1,991.9

Equity

214.5

631.4

Total Liabilities and Equity

$

2,211.6

$

2,623.3

INGEVITY CORPORATION

Condensed Consolidated

Statements of Cash Flows (Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

In millions

2024

2023

2024

2023

Cash provided by (used in) operating

activities:

Net income (loss)

$

(107.2

)

$

25.2

$

(446.9

)

$

111.4

Adjustments to reconcile net income (loss)

to cash provided by (used in) operating activities:

Depreciation and amortization

26.2

30.6

83.1

92.1

Restructuring and other (income) charges,

net

86.9

24.6

162.8

49.4

Loss on CTO resales

0.8

—

50.8

—

(Gain) loss on strategic investment

6.7

(0.1

)

11.4

(19.3

)

Goodwill impairment charge

—

—

349.1

—

CTO supply contract termination

charges

100.0

—

100.0

—

Other non-cash items

(24.7

)

39.3

(88.5

)

115.9

Changes in operating assets and

liabilities, net of effect of acquisitions:

Restructuring and other cash outflow,

net

(21.0

)

(21.9

)

(43.9

)

(46.7

)

CTO resales cash inflow (outflow), net

0.3

—

(45.0

)

—

CTO supply contract termination cash

outflow

(50.0

)

—

(50.0

)

—

Changes in other operating assets and

liabilities, net

28.5

7.5

(18.8

)

(143.9

)

Net cash provided by (used in) operating

activities

$

46.5

$

105.2

$

64.1

$

158.9

Cash provided by (used in) investing

activities:

Capital expenditures

$

(18.0

)

$

(33.5

)

$

(52.7

)

$

(80.6

)

Proceeds from sale of strategic

investment

—

0.1

—

31.5

Purchase of strategic investment

—

(2.4

)

—

(2.4

)

Other investing activities, net

0.6

3.5

1.2

(1.1

)

Net cash provided by (used in) investing

activities

$

(17.4

)

$

(32.3

)

$

(51.5

)

$

(52.6

)

Cash provided by (used in) financing

activities:

Proceeds from revolving credit facility

and other borrowings

$

38.2

$

41.7

$

150.5

$

239.5

Payments on revolving credit facility and

other borrowings

(44.1

)

(95.3

)

(119.3

)

(240.1

)

Finance lease obligations, net

(0.3

)

(0.1

)

(0.9

)

(0.6

)

Tax payments related to withholdings on

vested equity awards

(0.1

)

(0.3

)

(2.9

)

(4.8

)

Proceeds and withholdings from share-based

compensation plans, net

—

0.7

—

4.7

Repurchases of common stock under

publicly-announced plan

—

—

—

(92.1

)

Net cash provided by (used in) financing

activities

$

(6.3

)

$

(53.3

)

$

27.4

$

(93.4

)

Increase (decrease) in cash, cash

equivalents, and restricted cash

22.8

19.6

40.0

12.9

Effect of exchange rate changes on

cash

5.4

(2.3

)

1.6

(3.0

)

Change in cash, cash equivalents, and

restricted cash(1)

28.2

17.3

41.6

9.9

Cash, cash equivalents, and restricted

cash at beginning of period

125.3

76.9

111.9

84.3

Cash, cash equivalents, and restricted

cash at end of period (1)

$

153.5

$

94.2

$

153.5

$

94.2

(1) Includes restricted cash of $18.0

million and $9.7 million and cash and cash equivalents of $135.5

million and $84.5 million at September 30, 2024 and 2023,

respectively. Restricted cash is included within "Prepaid and other

current assets" and "Restricted investment" within the condensed

consolidated balance sheets.

Supplemental cash flow

information:

Cash paid for interest, net of capitalized

interest

$

18.7

$

17.9

$

61.0

$

57.9

Cash paid for income taxes, net of

refunds

1.8

4.3

24.0

27.9

Purchases of property, plant, and

equipment in accounts payable

0.4

0.8

2.2

6.1

Leased assets obtained in exchange for new

finance lease liabilities

—

0.2

—

0.2

Leased assets obtained in exchange for new

operating lease liabilities

3.6

7.2

5.5

26.0

Ingevity Corporation

Non-GAAP Financial Measures

Ingevity has presented certain financial measures, defined

below, which have not been prepared in accordance with U.S.

generally accepted accounting principles (“GAAP”) and has provided

a reconciliation to the most directly comparable financial measure

calculated in accordance with GAAP on the following pages. These

financial measures are not meant to be considered in isolation nor

as a substitute for the most directly comparable financial measure

calculated in accordance with GAAP. Investors should consider the

limitations associated with these non-GAAP measures, including the

potential lack of comparability of these measures from one company

to another.

We believe these non-GAAP financial measures provide management

as well as investors, potential investors, securities analysts, and

others with useful information to evaluate the performance of the

business, because such measures, when viewed together with our

financial results computed in accordance with GAAP, provide a more

complete understanding of the factors and trends affecting our

historical financial performance, liquidity measures, and projected

future results.

Ingevity uses the following non-GAAP measures:

Adjusted earnings (loss) is defined as

net income (loss) plus restructuring and other (income) charges,

net, goodwill impairment charge, acquisition and other-related

(income) costs, pension and postretirement settlement and

curtailment (income) charges, loss on CTO resales, CTO supply

contract termination charges, (gain) loss on strategic investments,

debt refinancing fees, litigation verdict charges, and the income

tax expense (benefit) on those items, less the provision (benefit)

from certain discrete tax items.

Diluted adjusted earnings (loss) per

share is defined as diluted earnings (loss) per common share plus

restructuring and other (income) charges, net, per share, goodwill

impairment charge per share, acquisition and other-related (income)

costs per share, pension and postretirement settlement and

curtailment (income) charges per share, loss on CTO resales per

share, CTO supply contract termination charges per share, (gain)

loss on strategic investments per share, debt refinancing fees per

share, litigation verdict charge per share, and the income tax

expense (benefit) per share on those items, less the provision

(benefit) from certain discrete tax items per share.

Adjusted EBITDA is defined as net

income (loss) plus interest expense, net, provision (benefit) for

income taxes, depreciation, amortization, restructuring and other

(income) charges, net, goodwill impairment charge, acquisition and

other-related (income) costs, litigation verdict charges, (gain)

loss on strategic investments, loss on CTO resales, CTO supply

contract termination charges, and pension and postretirement

settlement and curtailment (income) charges, net.

Adjusted EBITDA Margin is defined as

Adjusted EBITDA divided by Net sales.

Free Cash Flow is defined as the sum

of net cash provided by (used in) the following items: operating

activities less capital expenditures.

Net Debt is defined as the sum of

notes payable, short-term debt, current maturities of long-term

debt and long-term debt including finance lease obligations less

the sum of cash and cash equivalents, restricted cash associated

with our new market tax credit financing arrangement, and

restricted investment associated with certain finance lease

obligations, excluding the allowance for credit losses on

held-to-maturity debt securities held within the restricted

investment.

Net Debt Ratio is defined as Net Debt

divided by the last twelve months Adjusted EBITDA, inclusive of

acquisition-related pro forma adjustments.

Ingevity's management also uses the above financial measures as

the primary measures of profitability and liquidity of the

business. In addition, Ingevity believes Adjusted EBITDA and

Adjusted EBITDA Margin are useful measures because they exclude the

effects of financing and investment activities as well as

non-operating activities.

GAAP Reconciliation of 2024 Adjusted EBITDA

Guidance

A reconciliation of net income to adjusted EBITDA as projected

for 2024 is not provided. Ingevity does not forecast net income as

it cannot, without unreasonable effort, estimate or predict with

certainty various components of net income. These components, net

of tax, include further restructuring and other income (charges),

net; additional acquisition and other-related (income) costs;

litigation verdict charges; additional pension and postretirement

settlement and curtailment (income) charges; and revisions due to

legislative tax rate changes. Additionally, discrete tax items

could drive variability in our projected effective tax rate. All of

these components could significantly impact such financial

measures. Further, in the future, other items with similar

characteristics to those currently included in adjusted EBITDA,

that have a similar impact on the comparability of periods, and

which are not known at this time, may exist and impact adjusted

EBITDA.

INGEVITY CORPORATION

Reconciliation of Non-GAAP Financial

Measures

Reconciliation of Net Income

(Loss) (GAAP) to Adjusted Earnings (Loss) (Non-GAAP) and

Reconciliation of Diluted Earnings (Loss) per Common Share (GAAP)

to Diluted Adjusted Earnings per Share (Non-GAAP)

Three Months Ended September

30,

Nine Months Ended September

30,

In millions, except per share data

(unaudited)

2024

2023

2024

2023

Net income (loss) (GAAP)

$

(107.2

)

$

25.2

$

(446.9

)

$

111.4

Restructuring and other (income) charges,

net (1)

86.9

24.6

162.8

49.4

Goodwill impairment charge (2)

—

—

349.1

—

Acquisition and other-related costs

(3)

(0.1

)

0.1

—

4.6

Loss on CTO resales (4)

0.8

—

50.8

—

CTO supply contract termination charges

(5)

100.0

—

100.0

—

(Gain) loss on strategic investments

(6)

6.7

(0.1

)

11.4

(19.3

)

Tax effect on items above (7)

(43.3

)

(5.8

)

(158.0

)

(8.1

)

Certain discrete tax provision (benefit)

(8)

(3.6

)

0.2

24.4

(1.1

)

Adjusted earnings (loss)

(Non-GAAP)

$

40.2

$

44.2

$

93.6

$

136.9

Diluted earnings (loss) per common

share (GAAP)

$

(2.95

)

$

0.69

$

(12.31

)

$

3.03

Restructuring and other (income) charges,

net

2.39

0.67

4.48

1.34

Goodwill impairment charge

—

—

9.62

—

Acquisition and other-related costs

—

—

—

0.13

Loss on CTO resales

0.02

—

1.40

—

CTO supply contract termination

charges

2.75

—

2.75

—

(Gain) loss on strategic investments

0.18

—

0.31

(0.52

)

Tax effect on items above

(1.19

)

(0.16

)

(4.36

)

(0.23

)

Certain discrete tax provision

(benefit)

(0.10

)

0.01

0.67

(0.03

)

Diluted adjusted earnings (loss) per

share (Non-GAAP)

$

1.10

$

1.21

$

2.56

$

3.72

Weighted average common shares outstanding

- Diluted (9)

36.5

36.4

36.5

36.8

_______________

(1)

We regularly perform strategic reviews and

assess the return on our operations, which sometimes results in a

plan to restructure the business. These costs are excluded from our

reportable segment results; details of which are included in the

table below. For the details of these costs between our reportable

segments, see Segment Operating Results on page 2.

Three Months Ended September

30,

Nine Months Ended September

30,

In millions

2024

2023

2024

2023

Work force reductions and other

$

—

$

1.5

$

—

$

11.6

Performance Chemicals' repositioning

85.6

—

157.9

—

Restructuring charges (1)

$

85.6

$

1.5

$

157.9

$

11.6

Alternative feedstock transition

—

11.8

—

18.4

North Charleston plant transition

1.3

9.8

4.9

12.7

Business transformation costs

—

1.5

—

6.7

Other (income) charges, net (1)

$

1.3

$

23.1

$

4.9

$

37.8

Restructuring and other (income) charges,

net (2)

$

86.9

$

24.6

$

162.8

$

49.4

_______________

(1)

Amounts are recorded within Restructuring

and other (income) charges, net on the condensed consolidated

statement of operations.

(2)

For information on our Workforce

reductions and other, Performance Chemicals' repositioning,

Alternative feedstock transition, North Charleston plant

transition, and the Business transformation costs please refer to

Note 15, Restructuring and Other (Income) Charges, net, in the

Notes to the Consolidated Financial Statements included in the

Company’s Form 10-K for the year ended December 31, 2023, filed on

February 22, 2024. Updates will be provided in subsequent filings

of the Company's Form 10-Q in 2024.

(2)

During the second quarter of 2024, the

company concluded that the carrying amount of the Performance

Chemicals’ reporting unit exceeded its fair value, resulting in a

non-cash goodwill impairment charge.

(3)

Charges represent (gains) losses incurred

to complete and integrate acquisitions and other strategic

investments. Charges may include the expensing of the inventory

fair value step-up resulting from the application of purchase

accounting for acquisitions and certain legal and professional fees

associated with the completion of acquisitions and strategic

investments. For the details of these costs between our reportable

segments, see Segment Operating Results on page 2.

Three Months Ended September

30,

Nine Months Ended September

30,

In millions

2024

2023

2024

2023

Legal and professional service fees

$

(0.1

)

$

0.1

$

—

$

3.8

Acquisition-related (income) costs

$

(0.1

)

$

0.1

$

—

$

3.8

Inventory fair value step-up amortization

(1)

—

—

—

0.8

Acquisition and other-related (income)

charges

$

(0.1

)

$

0.1

$

—

$

4.6

_______________

(1)

Included in Cost of sales on the condensed

consolidated statement of operations.

(4)

Due to the DeRidder Plant closure and the

corresponding reduced CTO refining capacity, we were obligated,

under an existing CTO supply contract, to purchase CTO through 2025

at amounts in excess of required CTO volumes. As of July 1, 2024,

we have terminated the CTO supply contract that resulted in these

excess CTO volumes. As a result of the termination of this contract

the purchases under the CTO supply contract ended, effective June

30, 2024. Therefore, we are no longer required to purchase this

excess CTO volume through 2025, and as such, we expect to end our

CTO resale activity by the end of 2024. Updates will be provided in

subsequent filings of the Company's Form 10-Q in 2024.

(5)

As consideration for the termination of

the CTO supply contract, we made a cash payment in the amount of

$50.0 million on July 1, 2024 and an additional cash payment in the

amount of $50.0 million on October 8, 2024. Since this contract

termination is directly attributable to the Performance Chemicals’

repositioning, that is, it does not represent normal, recurring

expenses necessary to operate our business, we have excluded the

CTO supply contract termination charges for the purposes of

calculating our non-GAAP financial performance measures. Updates

will be provided in subsequent filings of the Company's Form 10-Q

in 2024.

(6)

We exclude gains and losses from strategic investments from our

segment results, as well as our non-GAAP financial measures,

because we do not consider such gains or losses to be directly

associated with the operational performance of the segment. We

believe that the inclusion of such gains or losses, would impair

the factors and trends affecting the historical financial

performance of our reportable segments. We continue to include

undistributed earnings or loss, distributions, amortization or

accretion of basis differences, and other-than-temporary

impairments for equity method investments that we believe are

directly attributable to the operational performance of such

investments, in our reportable segment results.

(7)

Income tax impact of non-GAAP adjustments is the summation of the

calculated income tax charge related to each pre-tax non-GAAP

adjustment. The non-GAAP adjustments relate primarily to

adjustments in the United States. As such, the income tax effect is

calculated using the statutory tax rates of 21% for the United

States and approximately 2.5% for state and local taxes, applied to

the non-GAAP adjustments.

(8)

Represents certain discrete tax items such

as excess tax benefits on stock compensation and impacts of

legislative tax rate changes.

(9)

The average number of shares outstanding

used in the three and nine months ended September 30, 2024 diluted

adjusted earnings (loss) per share computation (Non-GAAP) includes

0.2 million diluted shares. This number of shares differs from the

average number of shares outstanding used in diluted earnings

(loss) per share computations (GAAP) as we had a net loss on a GAAP

basis.

Reconciliation of Net Income

(Loss) (GAAP) to Adjusted EBITDA (Non-GAAP)

Three Months Ended September

30,

Nine Months Ended September

30,

In millions, except percentages

(unaudited)

2024

2023

2024

2023

Net income (loss) (GAAP)

$

(107.2

)

$

25.2

$

(446.9

)

$

111.4

Provision (benefit) for income taxes

(30.7

)

6.9

(97.5

)

32.5

Interest expense, net

23.8

23.1

69.3

64.3

Depreciation and amortization

26.2

30.6

83.1

92.1

Restructuring and other (income) charges,

net (1)

86.9

24.6

162.8

49.4

Goodwill impairment charge (1)

—

—

349.1

—

Acquisition and other-related (income)

costs (1)

(0.1

)

0.1

—

4.6

Loss on CTO resales (1)

0.8

—

50.8

—

CTO supply contract termination charges

(1)

100.0

—

100.0

—

(Gain) loss on strategic investments

(1)

6.7

(0.1

)

11.4

(19.3

)

Adjusted EBITDA (Non-GAAP)

$

106.4

$

110.4

$

282.1

$

335.0

Net sales

$

376.9

$

446.0

$

1,107.6

$

1,320.4

Net income (loss) margin

(28.4

)%

5.7

%

(40.3

)%

8.4

%

Adjusted EBITDA margin

28.2

%

24.8

%

25.5

%

25.4

%

_______________

(1)

For more information on these charges,

refer to the Reconciliation of Adjusted Earnings table on page

7.

Calculation of Free Cash Flow

(Non-GAAP)

Three Months Ended September

30,

Nine Months Ended September

30,

In millions (unaudited)

2024

2023

2024

2023

Net cash provided by (used in) operating

activities

$

46.5

$

105.2

$

64.1

$

158.9

Less: Capital expenditures

18.0

33.5

52.7

80.6

Free Cash Flow (Non-GAAP)

$

28.5

$

71.7

$

11.4

$

78.3

Calculation of Net Debt Ratio

(Non-GAAP)

In millions, except ratios

(unaudited)

September 30, 2024

Notes payable and current maturities of

long-term debt

$

100.7

Long-term debt including finance lease

obligations

1,397.6

Debt issuance costs

4.5

Total Debt

1,502.8

Less:

Cash and cash equivalents (1)

135.7

Restricted investment (2)

81.3

Net Debt

$

1,285.8

Net Debt Ratio (Non GAAP)

Adjusted EBITDA

Twelve months ended December 31, 2023

$

377.1

Nine months ended September 30, 2023

(3)

(335.0

)

Nine months ended September 30, 2024

(3)

282.1

Adjusted EBITDA - last twelve months (LTM)

as of September 30, 2024

$

324.2

Net debt ratio (Non GAAP)

4.0x

_______________

(1)

Includes $0.2 million of Restricted Cash

related to the New Market Tax Credit arrangement.

(2)

Our restricted investment is a trust managed in order to secure

repayment of the finance lease obligation associated with

Performance Materials' Wickliffe, Kentucky, manufacturing site at

maturity. The trust, presented as Restricted investment on our

condensed consolidated balance sheets, originally purchased

long-term bonds that mature through 2026. The principal received at

maturity of the bonds, along with interest income that is

reinvested in the trust, are expected to be equal to or more than

the $80.0 million finance lease obligation that is due in 2027.

Excludes $0.2 million allowance for credit losses on

held-to-maturity debt securities.

(3)

Refer to the Reconciliation of Net Income (GAAP) to Adjusted EBITDA

(Non-GAAP) schedule on page 9 for the reconciliation to the most

comparable GAAP financial measure.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029418496/en/

Caroline Monahan 843-740-2068 media@ingevity.com

Investors: John E. Nypaver, Jr. 843-740-2002

investors@ingevity.com

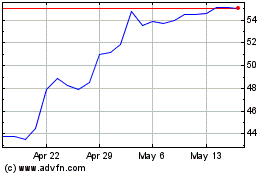

Ingevity (NYSE:NGVT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ingevity (NYSE:NGVT)

Historical Stock Chart

From Feb 2024 to Feb 2025