Procore Technologies, Inc. (NYSE: PCOR), the leading global

provider of construction management software, today announced

financial results for the fourth quarter and full year ended

December 31, 2024.

“Our strong topline performance exceeded expectations,

reinforcing our momentum heading into FY25,” said Tooey

Courtemanche, Founder, President, and CEO of Procore. “The

magnitude of high-quality, large transactions reflects the trust

our customers place in us, and the strength of our market

position.”

“2024 was another year of strong margin expansion delivering 800

basis points of non-GAAP operating margin improvement. Our Q4

results are not indicative of the operating margin you should

expect for FY25,” said Howard Fu, CFO of Procore. “We have

ambitious goals to be a high margin business and we are committed

to making further strides toward those goals in 2025 and

beyond.”

Fourth Quarter 2024 Financial Highlights:

- Revenue was $302 million, an increase of 16%

year-over-year.

- GAAP gross margin was 81% and non-GAAP gross margin was

85%.

- GAAP operating margin was (22%) and non-GAAP operating margin

was (1%).

- Operating cash inflow for the fourth quarter was $29

million.

- Free cash inflow for the fourth quarter was $0.3 million.

Full Year 2024 Financial Highlights:

- Revenue was $1,152 million, an increase of 21%

year-over-year.

- GAAP gross margin was 82% and non-GAAP gross margin was

86%.

- GAAP operating margin was (12%) and non-GAAP operating margin

was 10%.

- Operating cash inflow for 2024 was $196 million.

- Free cash inflow for 2024 was $128 million.

The financial results included in this press release are

preliminary and will not be final until Procore files its Annual

Report on Form 10-K for the period. A reconciliation of GAAP to

non-GAAP financial measures has been provided in the tables

included in this press release. An explanation of these measures is

also included below under the heading “Non-GAAP Financial

Measures.”

Recent Business Highlights:

- Number of organic customers contributing more than $100,000 of

annual recurring revenue totaled 2,333 as of December 31, 2024, an

increase of 16% year-over-year.

- Number of organic customers contributing more than $1,000,000

of annual recurring revenue totaled 86 as of December 31, 2024, an

increase of 39% year-over-year.

- Added 113 net new organic customers in the fourth quarter,

ending with a total of 17,088 organic customers.

- Achieved a gross revenue retention rate of 94% for 2024.

- Achieved a net revenue retention rate of 106% for 2024.

- As of December 31, 2024, 75% of total annual recurring revenue

was generated from customers using four or more products.

- As of December 31, 2024, 48% of total annual recurring revenue

was generated from customers using six or more products.

- Ended 2024 with 4,203 full-time employees, an increase of 14%

year-over-year.

- Announced a series of new product innovations, including the

launches of Procore Artificial Intelligence and AI Agents, Resource

Management, Safety, and Scheduling at Groundbreak 2024, the

construction innovation event of the year.

- Named to Fortune Magazine's Future 50 list, which recognizes

resilient businesses that are built to deliver strong long-term

growth.

First Quarter and Full Year 2025 Outlook:

Procore is providing the following guidance for the first

quarter and full year 2025:

- First Quarter 2025 Outlook:

- Revenue is expected to be in the range of $301 million to $303

million, representing year-over-year growth of 12%.

- Non-GAAP operating margin is expected to be in the range of 7%

to 8%.

- Full Year 2025 Outlook:

- Revenue is expected to be in the range of $1,285 million to

$1,290 million, representing year-over-year growth of 12%.

- Non-GAAP operating margin is expected to be in the range of 13%

to 13.5%.

A reconciliation of non-GAAP guidance measures to corresponding

GAAP measures is not available on a forward-looking basis without

unreasonable effort due to the uncertainty of expenses that may be

incurred in the future and cannot be reasonably determined or

predicted at this time, although it is important to note that these

factors could be material to Procore’s future GAAP financial

results.

Quarterly Conference Call

Procore Technologies, Inc. will hold a conference call to

discuss its fourth quarter and full year results at 2:00 p.m.,

Pacific Time, on Thursday, February 13, 2025. A live audio webcast

will be accessible on Procore's investor relations website at

http://investors.procore.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, about Procore and its industry, including our outlook for

first quarter 2025 and the full fiscal year 2025, that involve

substantial risks and uncertainties. All statements in this press

release, other than statements of historical fact, are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements generally relate to future events or future financial or

operating performance, and may be identified by the use of words

such as “anticipate,” “believe,” “contemplate,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,” or

“would,” or the negative of these words, or other similar terms or

expressions that concern Procore’s expectations, strategy, plans,

or intentions.

Procore has based the forward-looking statements contained in

this press release primarily on its current expectations and

projections about future events and trends that Procore believes

may affect its business, financial condition, and operating

results. The outcome of the events described in these

forward-looking statements is subject to risks, uncertainties, and

other factors that could cause results to differ materially from

Procore’s current expectations, including, but not limited to, our

expectations regarding our financial performance (including

revenues, expenses, and margins, and our ability to achieve or

maintain future profitability), our ability to effectively manage

our growth, anticipated performance, trends, growth rates, and

challenges in our business and in the markets in which we operate

or anticipate entering into, economic and industry trends (in

particular, the rate of adoption of construction management

software and digitization of the construction industry, inflation,

interest rates, tariffs, and challenging geopolitical conditions),

our progress with respect to our go-to-market transition and our

ability to realize the expected benefits of the transition, our

ability to attract new customers and retain and increase sales to

existing customers, our ability to expand internationally, the

effects of increased competition in our markets and our ability to

compete effectively, our estimated total addressable market, our

ability to execute, and realize benefits from, our stock repurchase

program, and as set forth in Procore’s filings with the Securities

and Exchange Commission. You should not rely on Procore’s

forward-looking statements. Procore assumes no obligation to update

any forward-looking statements to reflect events or circumstances

that exist or change after the date on which they were made, except

as required by law.

Non-GAAP Financial Measures

In addition to Procore’s results determined in accordance with

U.S. generally accepted accounting principles, or GAAP, Procore

believes certain non-GAAP measures, as described below, are useful

in evaluating Procore’s operating performance. Procore uses this

non-GAAP financial information, collectively, to evaluate its

ongoing operations as well as for internal planning and forecasting

purposes. Procore believes that non-GAAP financial information,

when taken collectively, is helpful to investors because it

provides consistency and comparability with past financial

performance, and may assist in comparisons with other companies,

some of which use similar non-GAAP financial information to

supplement their GAAP results. These non-GAAP financial measures

are not prepared in accordance with GAAP, and are presented for

supplemental purposes only.

Non-GAAP Gross Profit, Non-GAAP Gross Margin, Non-GAAP

Operating Expenses, Non-GAAP Income from Operations, Non-GAAP

Operating Margin, Non-GAAP Net Income, and Non-GAAP Net Income per

Share: Procore defines these non-GAAP financial measures as the

respective GAAP measures, excluding stock-based compensation

expense, amortization of acquired intangible assets, employer

payroll tax related to employee stock transactions, and

acquisition-related expenses. Non-GAAP gross margin is the ratio

calculated by dividing non-GAAP gross profit by total revenue.

Non-GAAP operating margin is the ratio calculated by dividing

non-GAAP income from operations by total revenue. Basic earnings

(loss) per share is computed by dividing net income (loss) by the

weighted average number of common shares outstanding for the

period. Non-GAAP diluted earnings per share is computed by giving

effect to all potential weighted average dilutive common stock

equivalents outstanding for the period, including options to

purchase common stock, restricted stock units, and shares to be

issued pursuant to the employee stock purchase plan. The dilutive

effect of outstanding awards is reflected in non-GAAP diluted

earnings per share by application of the treasury stock method.

Stock-based compensation expense includes the net effects of

capitalization and amortization of stock-based compensation expense

related to capitalized software and cloud-computing arrangement

implementation costs. Stock-based compensation expense has been,

and will continue to be for the foreseeable future, a significant

recurring expense in our business and an important part of the

compensation provided to our employees. Because of varying

available valuation methodologies, subjective assumptions, and the

variety of equity instruments that can impact a company’s non-cash

expenses, we believe that providing non-GAAP financial measures

that exclude stock-based compensation expense allows for meaningful

comparisons between its operating results from period to period.

The expense related to amortization of acquired intangible assets

is a non-cash expense and is dependent upon estimates and

assumptions, which can vary significantly and are unique to each

asset acquired; therefore, Procore believes non-GAAP measures that

adjust for the amortization of acquired intangible assets provide

investors a consistent basis for comparison across accounting

periods. The amount of employer payroll tax-related items on

employee stock transactions is dependent on restricted stock unit

settlements, option exercises, related stock price, and other

factors that are beyond Procore’s control and that do not correlate

to the operation of the business. When evaluating the performance

of its business and making operating plans, Procore does not

consider these items (for example, when considering the impact of

equity award grants, the company places a greater emphasis on

overall stockholder dilution than the accounting charges associated

with such grants). Since the amount of employer payroll tax-related

items on employee stock transactions is highly variable due to

factors outside our control, and unrelated to Procore’s core

operations, operating results, revenue-generating activities,

business strategy, industry, or regulatory environment, management

does not consider employer payroll tax on employee stock

transactions in the evaluation of the business or in making

operating plans. Accordingly, Procore believes this adjustment in

arriving at our non-GAAP measures provides investors with a better

understanding of the performance of its core business in a manner

that is consistent with management’s view of the business.

Acquisition-related expenses include external and incremental

transaction costs, such as legal and due diligence costs and

retention payments. These expenses are unpredictable and generally

would not have otherwise been incurred in the periods presented as

part of our continuing operations. In addition, the size and

complexity of an acquisition, which often drives the magnitude of

acquisition-related expenses, may not be indicative of such future

costs. Procore believes that excluding acquisition-related expenses

facilitates the comparison of its financial results to its

historical operating results and to other companies in its

industry. Overall, Procore believes it is useful to exclude these

expenses in order to better understand the long-term performance of

its core business and to facilitate comparison of its results

period-over-period and to those of peer companies. All of these

non-GAAP financial measures are important tools for financial and

operational decision-making and for evaluating Procore's own

operating results over different periods of time.

Non-GAAP financial measures may not provide information that is

directly comparable to information provided by other companies in

Procore's industry, as other companies in the industry may

calculate non-GAAP financial measures differently. In addition,

there are limitations in using non-GAAP financial measures because

non-GAAP financial measures are not prepared in accordance with

GAAP, may be different from non-GAAP financial measures used by

other companies, and exclude expenses that may have a material

impact on Procore's reported financial results. Unlike stock-based

compensation expense, employer payroll tax related to employee

stock transactions is a cash expense that we will continue to incur

in the future. The presentation of non-GAAP financial information

is not meant to be considered in isolation or as a substitute for

the directly comparable financial measures prepared in accordance

with GAAP. Investors should review the reconciliation of non-GAAP

financial measures to the comparable GAAP financial measures

included below, and not rely on any single financial measure to

evaluate Procore's business.

Free Cash Flow: Procore defines free cash flow as net

cash provided by operating activities, less purchases of property

and equipment and capitalized software development costs. Procore

believes free cash flow is an important liquidity measure of the

cash (if any) that is available, after our operating activities and

capital expenditures. Procore uses free cash flow in conjunction

with traditional GAAP measures to assess its liquidity and evaluate

the effectiveness of its business strategies. Once Procore’s

business needs and obligations are met, cash can be used to

maintain a strong balance sheet, invest in future growth, and

execute our stock repurchase program.

Other Metrics

Customer Count: The aforementioned customer count

excludes customers acquired from business combinations that do not

have standard Procore annual contracts.

About Procore

Procore Technologies, Inc. (NYSE: PCOR) creates software for

people who build the world. With a focus on providing timely and

accurate data for all, Procore transforms the construction industry

one project at a time - from hospitals and skyscrapers to airports

and stadiums. Beyond its connected, innovative technology, Procore

empowers the industry and its communities through Procore.org. For

more information, visit www.procore.com.

PROCORE-IR

Category: Earnings

Procore Technologies,

Inc.

Condensed Consolidated

Statements of Operations (unaudited)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

(in thousands, except share

and per share amounts)

Revenue

$

302,048

$

260,041

$

1,151,708

$

950,010

Cost of revenue(1)(2)(3)

56,834

47,831

205,612

174,462

Gross profit

245,214

212,210

946,096

775,548

Operating expenses

Sales and marketing(1)(2)(3)(4)

161,733

122,511

552,019

494,908

Research and development(1)(2)(3)(4)

89,289

74,611

312,987

300,571

General and administrative(1)(3)(4)

60,436

52,422

217,513

195,746

Total operating expenses

311,458

249,544

1,082,519

991,225

Loss from operations

(66,244

)

(37,334

)

(136,423

)

(215,677

)

Interest income

5,980

5,167

23,694

19,779

Interest expense

(460

)

(480

)

(1,899

)

(1,957

)

Accretion income, net

2,918

3,179

13,583

9,794

Other income (expense), net

(3,110

)

649

(3,136

)

(360

)

Loss before provision for income taxes

(60,916

)

(28,819

)

(104,181

)

(188,421

)

Provision for income taxes

1,375

700

1,775

1,273

Net loss

$

(62,291

)

$

(29,519

)

$

(105,956

)

$

(189,694

)

Net loss per share attributable to common

stockholders, basic and diluted

$

(0.42

)

$

(0.20

)

$

(0.72

)

$

(1.34

)

Weighted-average shares used in computing

net loss per share attributable to common stockholders, basic and

diluted

149,202,684

144,074,303

147,444,772

141,961,467

(1)

Includes stock-based compensation expense

and amortization of capitalized stock-based compensation as

follows:

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

(in thousands)

Cost of revenue

$

4,422

$

3,134

$

15,478

$

11,491

Sales and marketing

15,333

13,198

58,058

55,162

Research and development

18,277

15,874

67,961

68,275

General and administrative

13,734

11,769

53,336

44,406

Total stock-based compensation

expense*

$

51,766

$

43,975

$

194,833

$

179,334

*Includes amortization of capitalized

stock-based compensation of $2.5 million and $1.4 million,

respectively, for the three months ended December 31, 2024 and

2023; and $8.0 million and $4.5 million, respectively, for the

years ended December 31, 2024 and 2023, which was initially

capitalized as capitalized software and cloud-computing arrangement

implementation costs, and was primarily amortized in cost of

revenue.

(2)

Includes amortization of acquired

intangible assets as follows:

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

(in thousands)

Cost of revenue

$

6,698

$

5,904

$

25,437

$

22,396

Sales and marketing

3,224

3,106

12,700

12,425

Research and development

650

670

2,657

2,757

Total amortization of acquired intangible

assets

$

10,572

$

9,680

$

40,794

$

37,578

(3)

Includes employer payroll tax on employee

stock transactions as follows:

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

(in thousands)

Cost of revenue

$

126

$

101

$

612

$

540

Sales and marketing

360

383

3,227

2,766

Research and development

446

332

3,535

3,217

General and administrative

266

274

2,086

1,910

Total employer payroll tax on employee

stock transactions

$

1,198

$

1,090

$

9,460

$

8,433

(4)

Includes acquisition-related expenses as

follows:

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

(in thousands)

Sales and marketing

$

—

$

481

$

1,448

$

2,483

Research and development

32

46

32

6,370

General and administrative

194

16

808

35

Total acquisition-related expenses

$

226

$

543

$

2,288

$

8,888

Procore Technologies,

Inc.

Condensed Consolidated Balance

Sheets (unaudited)

December 31,

2024

2023

(in thousands)

Assets

Current assets

Cash and cash equivalents

$

437,722

$

357,790

Marketable securities, current

337,673

320,161

Accounts receivable, net

246,472

206,644

Contract cost asset, current

33,922

28,718

Prepaid expenses and other current

assets

47,013

42,421

Total current assets

1,102,802

955,734

Marketable securities, non-current

46,042

—

Capitalized software development costs,

net

112,321

83,045

Property and equipment, net

43,592

36,258

Right of use assets - finance leases

31,727

34,375

Right of use assets - operating leases

28,790

44,141

Contract cost asset, non-current

47,505

44,564

Intangible assets, net

120,946

137,546

Goodwill

549,651

539,354

Other assets

20,918

18,551

Total assets

$

2,104,294

$

1,893,568

Liabilities and Stockholders’

Equity

Current liabilities

Accounts payable

$

36,069

$

13,177

Accrued expenses

88,740

100,075

Deferred revenue, current

584,719

501,903

Other current liabilities

21,427

27,275

Total current liabilities

730,955

642,430

Deferred revenue, non-current

5,815

7,692

Finance lease liabilities, non-current

41,352

43,581

Operating lease liabilities,

non-current

32,697

37,923

Other liabilities, non-current

5,122

6,332

Total liabilities

815,941

737,958

Stockholders’ equity

Common stock

15

15

Additional paid-in capital

2,535,868

2,295,807

Accumulated other comprehensive loss

(2,737

)

(1,375

)

Accumulated deficit

(1,244,793

)

(1,138,837

)

Total stockholders’ equity

1,288,353

1,155,610

Total liabilities and stockholders’

equity

$

2,104,294

$

1,893,568

Remaining performance obligation:

The following table presents our current and non-current RPO at

the end of each period:

December 31,

Change

2024

2023

Dollar

Percent

(dollars in thousands)

Remaining performance

obligations

Current

$

829,666

$

698,284

$

131,382

19

%

Non-current

456,801

302,215

154,586

51

%

Total remaining performance

obligations

$

1,286,467

$

1,000,499

$

285,968

29

%

Procore Technologies,

Inc.

Condensed Consolidated

Statements of Cash Flows (unaudited)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

(in thousands)

Operating activities

Net loss

$

(62,291

)

$

(29,519

)

$

(105,956

)

$

(189,694

)

Adjustments to reconcile net loss to net

cash provided by operating activities

Stock-based compensation

49,348

42,601

186,880

174,835

Depreciation and amortization

24,626

19,690

89,753

71,633

Accretion of discounts on marketable debt

securities, net

(2,699

)

(3,175

)

(12,830

)

(9,790

)

Abandonment of long-lived assets

610

676

1,428

1,488

Noncash operating lease expense

3,196

5,160

11,102

13,092

Unrealized foreign currency loss (gain),

net

2,009

(1,263

)

2,304

(524

)

Deferred income taxes

(885

)

(776

)

(881

)

(769

)

Provision for credit losses

(57

)

1,170

591

8,052

Decrease (increase) in fair value of

strategic investments

3

132

(454

)

287

Changes in operating assets and

liabilities, net of effect of asset acquisitions and business

combinations

Accounts receivable

(73,797

)

(60,636

)

(39,501

)

(57,492

)

Deferred contract cost assets

(5,776

)

(4,207

)

(8,993

)

(9,306

)

Prepaid expenses and other assets

5,880

(4,490

)

(6,241

)

(6,368

)

Accounts payable

11,623

(3,196

)

22,652

(938

)

Accrued expenses and other liabilities

(7,026

)

6,734

(15,501

)

4,759

Deferred revenue

85,359

77,510

79,091

106,590

Operating lease liabilities

(1,067

)

(5,668

)

(7,272

)

(13,840

)

Net cash provided by operating

activities

29,056

40,743

196,172

92,015

Investing activities

Purchases of property and equipment

(11,633

)

(2,252

)

(19,143

)

(10,325

)

Capitalized software development costs

(17,076

)

(9,498

)

(49,529

)

(34,685

)

Purchases of strategic investments

(450

)

(238

)

(2,367

)

(764

)

Purchases of marketable securities

(80,856

)

(93,142

)

(491,475

)

(402,424

)

Maturities of marketable securities

68,819

84,620

440,537

372,240

Sales of marketable securities

—

—

—

5,452

Originations of materials financing

—

(387

)

—

(23,972

)

Customer repayments of materials

financing

34

5,189

1,605

26,242

Asset acquisitions, net of cash

acquired

—

(1,814

)

(3,792

)

(7,825

)

Acquisition of businesses, net of cash

acquired

—

—

(25,945

)

—

Net cash used in investing activities

$

(41,162

)

$

(17,522

)

$

(150,109

)

$

(76,061

)

Procore Technologies,

Inc.

Condensed Consolidated

Statements of Cash Flows (unaudited)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

(in thousands)

Financing activities

Proceeds from stock option exercises

$

3,366

$

2,524

$

15,737

$

17,618

Proceeds from employee stock purchase

plan

10,882

12,394

24,069

25,400

Payment of deferred business combination

consideration

—

—

(1,470

)

—

Payment of deferred asset acquisition

consideration

—

—

(81

)

—

Principal payments under finance lease

agreements, net of proceeds from lease incentives

(450

)

(403

)

(2,019

)

(1,853

)

Net cash provided by financing

activities

13,798

14,515

36,236

41,165

Net increase in cash, cash equivalents and

restricted cash

1,692

37,736

82,299

57,119

Effect of exchange rate changes on

cash

(3,268

)

1,736

(2,367

)

855

Cash, cash equivalents and restricted

cash, beginning of period

439,298

318,318

357,790

299,816

Cash, cash equivalents and restricted

cash, end of period

$

437,722

$

357,790

$

437,722

$

357,790

Procore Technologies,

Inc.

Reconciliation of GAAP to

Non-GAAP Financial Measures (unaudited)

Reconciliation of gross profit and

gross margin to non-GAAP gross profit and non-GAAP gross

margin:

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

(dollars in thousands)

Revenue

$

302,048

$

260,041

$

1,151,708

$

950,010

Gross profit

245,214

212,210

946,096

775,548

Stock-based compensation expense

4,422

3,134

15,478

11,491

Amortization of acquired technology

intangible assets

6,698

5,904

25,437

22,396

Employer payroll tax on employee stock

transactions

126

101

612

540

Non-GAAP gross profit

$

256,460

$

221,349

$

987,623

$

809,975

Gross margin

81

%

82

%

82

%

82

%

Non-GAAP gross margin

85

%

85

%

86

%

85

%

Reconciliation of operating expenses to

non-GAAP operating expenses:

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

(dollars in thousands)

Revenue

$

302,048

$

260,041

$

1,151,708

$

950,010

GAAP sales and marketing

161,733

122,511

552,019

494,908

Stock-based compensation expense

(15,333

)

(13,198

)

(58,058

)

(55,162

)

Amortization of acquired intangible

assets

(3,224

)

(3,106

)

(12,700

)

(12,425

)

Employer payroll tax on employee stock

transactions

(360

)

(383

)

(3,227

)

(2,766

)

Acquisition-related expenses

—

(481

)

(1,448

)

(2,483

)

Non-GAAP sales and marketing

$

142,816

$

105,343

$

476,586

$

422,072

GAAP sales and marketing as a percentage

of revenue

54

%

47

%

48

%

52

%

Non-GAAP sales and marketing as a

percentage of revenue

47

%

41

%

41

%

44

%

GAAP research and development

$

89,289

$

74,611

$

312,987

$

300,571

Stock-based compensation expense

(18,277

)

(15,874

)

(67,961

)

(68,275

)

Amortization of acquired intangible

assets

(650

)

(670

)

(2,657

)

(2,757

)

Employer payroll tax on employee stock

transactions

(446

)

(332

)

(3,535

)

(3,217

)

Acquisition-related expenses

(32

)

(46

)

(32

)

(6,370

)

Non-GAAP research and development

$

69,884

$

57,689

$

238,802

$

219,952

GAAP research and development as a

percentage of revenue

30

%

29

%

27

%

32

%

Non-GAAP research and development as a

percentage of revenue

23

%

22

%

21

%

23

%

GAAP general and administrative

$

60,436

$

52,422

$

217,513

$

195,746

Stock-based compensation expense

(13,734

)

(11,769

)

(53,336

)

(44,406

)

Employer payroll tax on employee stock

transactions

(266

)

(274

)

(2,086

)

(1,910

)

Acquisition-related expenses

(194

)

(16

)

(808

)

(35

)

Non-GAAP general and administrative

$

46,242

$

40,363

$

161,283

$

149,395

GAAP general and administrative as a

percentage of revenue

20

%

20

%

19

%

21

%

Non-GAAP general and administrative as a

percentage of revenue

15

%

16

%

14

%

16

%

Reconciliation of loss from operations

and operating margin to non-GAAP income (loss) from operations and

non-GAAP operating margin:

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

(dollars in thousands)

Revenue

$

302,048

$

260,041

$

1,151,708

$

950,010

Loss from operations

(66,244

)

(37,334

)

(136,423

)

(215,677

)

Stock-based compensation expense

51,766

43,975

194,833

179,334

Amortization of acquired intangible

assets

10,572

9,680

40,794

37,578

Employer payroll tax on employee stock

transactions

1,198

1,090

9,460

8,433

Acquisition-related expenses

226

543

2,288

8,888

Non-GAAP income (loss) from operations

$

(2,482

)

$

17,954

$

110,952

$

18,556

Operating margin

(22

%)

(14

%)

(12

%)

(23

%)

Non-GAAP operating margin

(1

%)

7

%

10

%

2

%

Reconciliation of net loss and net loss

per share to non-GAAP net income and non-GAAP net income per

share:

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

(in thousands, except share

and per share amounts)

Revenue

$

302,048

$

260,041

$

1,151,708

$

950,010

Net loss

(62,291

)

(29,519

)

(105,956

)

(189,694

)

Stock-based compensation expense

51,766

43,975

194,833

179,334

Amortization of acquired intangible

assets

10,572

9,680

40,794

37,578

Employer payroll tax on employee stock

transactions

1,198

1,090

9,460

8,433

Acquisition-related expenses

226

543

2,288

8,888

Non-GAAP net income

$

1,471

$

25,769

$

141,419

$

44,539

Numerator:

Non-GAAP net income

$

1,471

$

25,769

$

141,419

$

44,539

Denominator:

Weighted-average shares used in computing

net loss per share attributable to common stockholders, basic

149,202,684

144,074,303

147,444,772

141,961,467

Effect of dilutive securities: Employee

stock awards

4,192,863

5,329,311

5,004,643

6,591,783

Weighted-average shares used in computing

net income per share attributable to common stockholders,

diluted

153,395,547

149,403,614

152,449,415

148,553,250

GAAP net loss per share, basic

$

(0.42

)

$

(0.20

)

$

(0.72

)

$

(1.34

)

GAAP net loss per share, diluted

$

(0.42

)

$

(0.20

)

$

(0.72

)

$

(1.34

)

Non-GAAP net income per share, basic

$

0.01

$

0.18

$

0.96

$

0.31

Non-GAAP net income per share, diluted

$

0.01

$

0.17

$

0.93

$

0.30

Computation of free cash flow:

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

(in thousands)

Net cash provided by operating

activities

$

29,056

$

40,743

$

196,172

$

92,015

Purchases of property, plant, and

equipment

(11,633

)

(2,252

)

(19,143

)

(10,325

)

Capitalized software development costs

(17,076

)

(9,498

)

(49,529

)

(34,685

)

Non-GAAP free cash flow

$

347

$

28,993

$

127,500

$

47,005

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213134245/en/

Media Contact press@procore.com

Investor Contact ir@procore.com

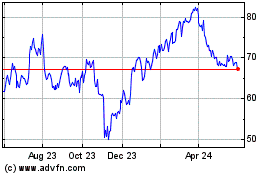

Procore Technologies (NYSE:PCOR)

Historical Stock Chart

From Jan 2025 to Feb 2025

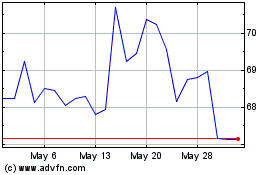

Procore Technologies (NYSE:PCOR)

Historical Stock Chart

From Feb 2024 to Feb 2025