Third quarter revenue increased 9% year over

year to $119 million

Ending ARR grew 10% year over year to $483

million

Third quarter loss from operations was $10

million; non-GAAP operating income was $25 million

PagerDuty, Inc. (NYSE:PD), a leader in digital operations

management, today announced financial results for the third quarter

of fiscal 2025, ended October 31, 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241126811639/en/

(Graphic: Business Wire)

“PagerDuty delivered a solid quarter with revenue and non-GAAP

operating income results well above third quarter guidance ranges

with annual recurring revenue increasing to $483 million, growing

10% year-over-year,” said Chairperson and CEO, Jennifer Tejada.

“Consistent performance over the past four quarters has led to

stabilization across all business segments, and along with

improving leading indicators, positions the business on a strong

upward trajectory.”

Third Quarter Fiscal 2025 Financial Highlights

- Revenue was $118.9 million, an increase of 9.4% year over

year.

- Loss from operations was $10.3 million; operating margin was

negative 8.7%.

- Non-GAAP operating income was $25.0 million; non-GAAP operating

margin was 21.0%.

- Net loss per share attributable to PagerDuty, Inc. common

stockholders was $0.07.

- Non-GAAP net income per diluted share attributable to

PagerDuty, Inc. common stockholders was $0.25.

- Net cash provided by operating activities was $22.1 million,

with free cash flow of $19.4 million.

- Cash, cash equivalents, and investments were $542.2 million as

of October 31, 2024.

The section titled “Non-GAAP Financial Measures” below contains

a description of the non-GAAP financial measures and

reconciliations between GAAP and non-GAAP financial

information.

Third Quarter and Recent Highlights

- Customers with annual recurring revenue over $100 thousand grew

6% to 825 as of October 31, 2024, compared to 778 a year ago.

- Dollar-based net retention rate was 107% as of October 31,

2024, compared to 110% a year ago.

- Free and paid customers totaled more than 30,000 as of October

31, 2024, representing approximately 11% growth year over

year.

- Total paid customers were 15,050 as of October 31, 2024,

compared to 15,049 a year ago.

- Remaining performance obligations were $405 million as of

October 31, 2024. Of this amount, the Company expects to recognize

revenue of approximately $278 million, or 69%, over the next 12

months with the balance to be recognized as revenue

thereafter.(1)

- Lands and expands include: Alphonso Inc,, CFP Energy Limited,

Cloudflare, Infosys, NVIDIA Corporation, Waste Management Inc., and

Zscaler.

- Announced Jennifer Tejada as guest speaker during the 2024 AWS

re:Invent keynote.

- Introduced enterprise-grade, AI-powered innovations.

- Released Total Economic Impact Study revealing a 249% return on

investment over three years using the PagerDuty Operations

Cloud.

- Recognized as a Leader in 2024 GigaOm Radar for AIOps.

- Showcased PagerDuty customer - Anaplan.

- Recognized by Fortune's Best Workplaces as one of the top 25

companies for women in their small and medium designation.

(1)Beginning in the first quarter of

fiscal 2025, the Company began to include contracts with an

original term of less than 12 months in this disclosure which

comprised $116 million of remaining non-cancelable performance

obligations as of October 31, 2024.

Financial Outlook

For the fourth quarter of fiscal 2025, PagerDuty currently

expects:

- Total revenue of $118.5 million - $120.5 million, representing

a growth rate of 7% - 8% year over year.

- Non-GAAP net income per diluted share attributable to

PagerDuty, Inc. common stockholders of $0.15 - $0.16 assuming

approximately 93 million diluted shares and a non-GAAP tax rate of

23%.

For the full fiscal year 2025, PagerDuty currently expects:

- Total revenue of $464.5 million - $466.5 million (compared to

the previous guidance of $463.0 million - $467.0 million),

representing a growth rate of 8% year over year.

- Non-GAAP net income per diluted share attributable to

PagerDuty, Inc. common stockholders of $0.78 - $0.79 (up from $0.67

- $0.72) assuming approximately 95 million diluted shares and a

non-GAAP tax rate of 23%.

These statements are forward-looking and actual results may

differ materially. Please refer to the section titled

"Forward-Looking Statements" below for information on the factors

that could cause our actual results to differ materially from these

forward-looking statements.

PagerDuty has not reconciled forward-looking net loss per share

attributable to PagerDuty, Inc. common stock holders to

forward-looking non-GAAP net income per share attributable to

PagerDuty, Inc. common stockholders because certain items are out

of PagerDuty's control or cannot be reasonably predicted.

Accordingly, such reconciliation is not available without

unreasonable effort.

Conference Call Information

PagerDuty will host a conference call and live webcast (Zoom

meeting ID 975 4160 6140) for analysts and investors at 2:00 p.m.

Pacific Time on November 26, 2024. For audio only, the dial-in

number 1-312-626-6799 may be used. This news release with the

financial results will be accessible from PagerDuty’s website at

investor.pagerduty.com prior to the conference call. A live webcast

of the conference call will be accessible from the PagerDuty

investor relations website at investor.pagerduty.com.

Supplemental Financial and Other Information

Supplemental financial and other information can be accessed

through PagerDuty’s investor relations website at

investor.pagerduty.com. PagerDuty uses the investor relations

section on its website as the means of complying with its

disclosure obligations under Regulation FD. Accordingly, we

recommend that investors monitor PagerDuty’s investor relations

website in addition to following PagerDuty’s press releases, SEC

filings, social media, including PagerDuty’s LinkedIn account

(https://www.linkedin.com/company/482819), X (formerly Twitter)

account @pagerduty, the X account @jenntejada and Facebook page

(facebook.com/pagerduty), and public conference calls and

webcasts.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, including but not limited

to, statements regarding our future financial performance and

outlook, and market positioning. Words such as “expect,” “extend,”

“anticipate,” “should,” “believe,” “hope,” “target,” “project,”

“accelerate,” “goals,” “estimate,” “potential,” “predict,” “may,”

“will,” “might,” “could,” “intend,” “shall,” and variations of

these terms or the negative of these terms and similar expressions

are intended to identify these forward-looking statements.

Forward-looking statements are subject to a number of risks and

uncertainties, many of which involve factors or circumstances that

are beyond our control. Our actual results could differ materially

from those stated or implied in forward-looking statements due to a

number of factors, including but not limited to, risks and other

factors detailed in our Annual Report on Form 10-K/A filed with the

Securities and Exchange Commission (SEC) on March 18, 2024.

Additional information will be made available in our Quarterly

Report on Form 10-Q for the quarter ended October 31, 2024 and

other filings and reports that we may file from time to time with

the SEC. In particular, the following risks and uncertainties,

among others, could cause results to differ materially from those

expressed or implied by such forward-looking statements: the effect

of unfavorable conditions in our industry or the global economy, or

reductions in information technology spending on our business and

results of operations; our ability to achieve and maintain future

profitability; our ability to attract new customers and retain and

sell additional functionality and services to our existing

customers; our ability to sustain and manage our growth; our

dependence on revenue from a single product; our ability to compete

effectively in an increasingly competitive market; and general

global market, political, economic, and business conditions.

Past performance is not necessarily indicative of future

results. The forward-looking statements included in this press

release represent our views as of the date of this press release.

We anticipate that subsequent events and developments will cause

our views to change. We undertake no intention or obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. These

forward-looking statements should not be relied upon as

representing our views as of any date subsequent to the date of

this press release.

About PagerDuty, Inc.

PagerDuty, Inc. (NYSE:PD) is a global leader in digital

operations management, enabling customers to achieve operational

efficiency at scale with the PagerDuty Operations Cloud. The

PagerDuty Operations Cloud combines AIOps, Automation, Customer

Service Operations and Incident Management with a powerful

generative AI assistant to create a flexible, resilient and

scalable platform to increase innovation velocity, grow revenue,

reduce cost, and mitigate the risk of operational failure. Half of

the Fortune 500 and nearly 70% of the Fortune 100 rely on PagerDuty

as essential infrastructure for the modern enterprise. To learn

more and try PagerDuty for free, visit www.pagerduty.com.

The PagerDuty Operations Cloud

The PagerDuty Operations Cloud is the platform for

mission-critical, time-critical operations work in the modern

enterprise. Through the power of AI and automation, it detects and

diagnoses disruptive events, mobilizes the right team members to

respond, and streamlines infrastructure and workflows across your

digital operations. The Operations Cloud is essential

infrastructure for revolutionizing digital operations to compete

and win as a modern digital business.

PAGERDUTY, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per share

data)

(unaudited)

Three months ended October

31,

Nine months ended October 31,

2024

2023

2024

2023

Revenue

$

118,946

$

108,720

$

346,053

$

319,582

Cost of revenue(1)

20,268

19,705

59,691

57,474

Gross profit

98,678

89,015

286,362

262,108

Operating expenses:

Research and development(1)

34,267

34,272

106,878

104,221

Sales and marketing(1)

49,272

49,630

148,737

143,155

General and administrative(1)

25,432

25,955

78,800

77,547

Total operating expenses

108,971

109,857

334,415

324,923

Loss from operations

(10,293

)

(20,842

)

(48,053

)

(62,815

)

Interest income(2)

6,912

6,029

21,408

15,242

Interest expense

(2,377

)

(1,454

)

(6,888

)

(4,184

)

Gain on partial extinguishment of

convertible senior notes

—

3,970

—

3,970

Other income (expense), net(2)

346

(834

)

212

(960

)

Loss before (provision for) benefit from

income taxes

(5,412

)

(13,131

)

(33,321

)

(48,747

)

(Provision for) benefit from income

taxes

(715

)

41

(1,335

)

197

Net loss

$

(6,127

)

$

(13,090

)

$

(34,656

)

$

(48,550

)

Net loss attributable to redeemable

non-controlling interest

(203

)

(324

)

(681

)

(1,513

)

Net loss attributable to PagerDuty,

Inc.

$

(5,924

)

$

(12,766

)

$

(33,975

)

$

(47,037

)

Less: Adjustment attributable to

redeemable non-controlling interest

634

2,359

9,881

4,088

Net loss attributable to PagerDuty, Inc.

common stockholders

$

(6,558

)

$

(15,125

)

$

(43,856

)

$

(51,125

)

Weighted average shares used in

calculating net loss per share, basic and diluted

91,438

93,104

92,530

92,257

Net loss per share, basic and diluted,

attributable to PagerDuty, Inc. common stockholders

$

(0.07

)

$

(0.16

)

$

(0.47

)

$

(0.55

)

(1) Includes stock-based compensation

expense as follows:

Three months ended October

31,

Nine months ended October 31,

2024

2023

2024

2023

Cost of revenue

$

1,432

$

1,820

$

4,696

$

5,860

Research and development

11,576

11,128

34,640

34,002

Sales and marketing

7,639

8,094

23,702

22,362

General and administrative

11,126

10,786

34,041

32,686

Total

$

31,773

$

31,828

$

97,079

$

94,910

(2) Includes a reclassification for the

three and nine months ended October 31, 2023 for a portion of other

income to the interest income line item to conform to current

period presentation.

PAGERDUTY, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

(unaudited)

October 31, 2024

January 31, 2024

Assets

Current assets:

Cash and cash equivalents

$

326,440

$

363,011

Investments

215,722

208,178

Accounts receivable, net of allowance for

credit losses of $803 and $1,382 as of October 31, 2024 and January

31, 2024, respectively

75,182

100,413

Deferred contract costs, current

19,632

19,502

Prepaid expenses and other current

assets

17,157

12,094

Total current assets

654,133

703,198

Property and equipment, net

19,573

17,632

Deferred contract costs, non-current

24,167

25,118

Lease right-of-use assets

2,436

3,789

Goodwill

137,401

137,401

Intangible assets, net

23,698

32,616

Other assets

5,346

5,552

Total assets

$

866,754

$

925,306

Liabilities, redeemable non-controlling

interest, and stockholders’ equity

Current liabilities:

Accounts payable

$

7,116

$

6,242

Accrued expenses and other current

liabilities

15,801

15,472

Accrued compensation

34,474

30,239

Deferred revenue, current

214,058

223,522

Lease liabilities, current

3,550

6,180

Convertible senior notes, net, current

57,332

—

Total current liabilities

332,331

281,655

Convertible senior notes, net,

non-current

392,697

448,030

Deferred revenue, non-current

2,659

4,639

Lease liabilities, non-current

6,119

6,809

Other liabilities

4,859

5,280

Total liabilities

738,665

746,413

Redeemable non-controlling interest

16,493

7,293

Stockholders' equity

Common stock

—

—

Additional paid-in capital

699,633

774,768

Accumulated other comprehensive loss

(502

)

(733

)

Accumulated deficit

(586,410

)

(552,435

)

Treasury stock

(1,125

)

(50,000

)

Total stockholders’ equity

111,596

171,600

Total liabilities, redeemable

non-controlling interest, and stockholders' equity

$

866,754

$

925,306

PAGERDUTY, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Three months ended October

31,

Nine months ended October 31,

2024

2023

2024

2023

Cash flows from operating

activities:

Net loss attributable to PagerDuty, Inc.

common stockholders

$

(6,558

)

$

(15,125

)

$

(43,856

)

$

(51,125

)

Net loss and adjustment attributable to

redeemable non-controlling interest

431

2,035

9,200

2,575

Net loss

(6,127

)

(13,090

)

(34,656

)

(48,550

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization

5,071

5,025

15,526

15,016

Amortization of deferred contract

costs

5,555

5,123

16,261

15,286

Amortization of debt issuance costs

671

523

1,950

1,456

Gain on extinguishment of convertible

senior notes

—

(3,970

)

—

(3,970

)

Stock-based compensation

31,773

31,828

97,079

94,910

Non-cash lease expense

903

1,106

2,538

3,425

Other

(1,387

)

(1,524

)

(3,852

)

(1,426

)

Changes in operating assets and

liabilities:

Accounts receivable

(8,406

)

(5,420

)

24,751

18,983

Deferred contract costs

(5,311

)

(5,520

)

(15,441

)

(12,285

)

Prepaid expenses and other assets

(2,217

)

(1,289

)

(5,079

)

(2,674

)

Accounts payable

(176

)

(757

)

603

(1,002

)

Accrued expenses and other liabilities

(473

)

781

(1,302

)

767

Accrued compensation

4,823

5,706

4,002

(13,086

)

Deferred revenue

(1,070

)

(119

)

(11,386

)

(12,547

)

Lease liabilities

(1,556

)

(1,486

)

(4,505

)

(4,484

)

Net cash provided by operating

activities

22,073

16,917

86,489

49,819

Cash flows from investing

activities:

Purchases of property and equipment

(552

)

(245

)

(1,646

)

(1,193

)

Capitalized internal-use software

costs

(2,078

)

(1,441

)

(5,019

)

(3,812

)

Purchases of available-for-sale

investments

(54,721

)

(43,927

)

(153,121

)

(151,984

)

Proceeds from maturities of

available-for-sale investments

54,250

56,500

147,827

164,064

Proceeds from sales of available-for-sale

investments

—

—

2,237

—

Purchases of non-marketable equity

investments

—

—

—

(200

)

Net cash (used in) provided by investing

activities

(3,101

)

10,887

(9,722

)

6,875

Cash flows from financing

activities:

Proceeds from issuance of convertible

senior notes, net of issuance costs

—

391,543

(403

)

391,543

Purchases of capped calls related to

convertible senior notes

—

(55,102

)

—

(55,102

)

Repurchases of convertible senior

notes

—

(223,471

)

—

(223,471

)

Investment from redeemable non-controlling

interest holder

—

—

—

1,781

Repurchases of common stock

(70,310

)

(50,000

)

(97,523

)

(50,000

)

Proceeds from employee stock purchase

plan

—

—

5,735

6,292

Proceeds from issuance of common stock

upon exercise of stock options

723

973

1,527

8,390

Employee payroll taxes paid related to net

share settlement of restricted stock units

(8,531

)

(9,786

)

(22,659

)

(25,772

)

Net cash (used in) provided by financing

activities

(78,118

)

54,157

(113,323

)

53,661

Effects of foreign currency exchange rates

on cash, cash equivalents, and restricted cash

(86

)

(177

)

(109

)

(451

)

Net change in cash, cash equivalents, and

restricted cash

(59,232

)

81,784

(36,665

)

109,904

Cash, cash equivalents, and restricted

cash at beginning of period

389,234

302,139

366,667

274,019

Cash, cash equivalents, and restricted

cash at end of period

$

330,002

$

383,923

$

330,002

$

383,923

Non-GAAP Financial Measures

This press release and the accompanying tables contain the

following non-GAAP financial measures: non-GAAP gross profit,

non-GAAP gross margin, non-GAAP research and development, non-GAAP

sales and marketing, non-GAAP general and administrative, non-GAAP

operating income, non-GAAP operating margin, non-GAAP net income

attributable to PagerDuty, Inc. common stockholders, non-GAAP net

income per share attributable to PagerDuty, Inc. common

stockholders, free cash flow, and free cash flow margin.

PagerDuty believes that non-GAAP financial measures, when taken

collectively, may be helpful to investors because they provide

consistency and comparability with past financial performance and

can assist in comparisons with other companies, some of which use

similar non-GAAP financial measures to supplement their GAAP

results. The non-GAAP financial information is presented for

supplemental informational purposes only, should not be considered

a substitute for financial information presented in accordance with

GAAP, and may be different from similarly-titled non-GAAP measures

used by other companies.

The principal limitation of these non-GAAP financial measures is

that they exclude significant expenses and income that are required

by GAAP to be recorded in PagerDuty’s financial statements. In

addition, they are subject to inherent limitations as they reflect

the exercise of judgment by PagerDuty’s management about which

expenses and income are excluded or included in determining these

non-GAAP financial measures. A reconciliation is provided below for

each historical non-GAAP financial measure to the most directly

comparable financial measure presented in accordance with GAAP.

Specifically, PagerDuty excludes the following from its

historical and prospective non-GAAP financial measures, as

applicable:

Stock-based

compensation: PagerDuty utilizes stock-based compensation to

attract and retain employees. It is principally aimed at aligning

their interests with those of its stockholders and at long-term

retention, rather than to address operational performance for any

particular period. As a result, stock-based compensation expenses

vary for reasons that are generally unrelated to financial and

operational performance in any particular period.

Employer taxes related

to employee stock transactions: PagerDuty views the amount

of employer taxes related to its employee stock transactions as an

expense that is dependent on its stock price, employee exercise and

other award disposition activity, and other factors that are beyond

PagerDuty’s control. As a result, employer taxes related to

employee stock transactions vary for reasons that are generally

unrelated to financial and operational performance in any

particular period.

Amortization of

acquired intangible assets: PagerDuty views amortization of

acquired intangible assets as items arising from pre-acquisition

activities determined at the time of an acquisition. While these

intangible assets are evaluated for impairment regularly,

amortization of the cost of purchased intangibles is an expense

that is not typically affected by operations during any particular

period.

Acquisition-related

expenses: PagerDuty views acquisition-related expenses, such

as transaction costs, acquisition-related retention payments, and

acquisition-related asset impairment, as events that are not

necessarily reflective of operational performance during a period.

In particular, PagerDuty believes the consideration of measures

that exclude such expenses can assist in the comparison of

operational performance in different periods which may or may not

include such expenses.

Amortization of debt

issuance costs: The imputed interest rates of the Company's

convertible senior notes (the "2025 Notes" and the "2028 Notes" or,

collectively, the "Notes") was approximately 1.91% for the 2025

Notes and 2.13% for the 2028 Notes. This is a result of the debt

issuance costs, which reduce the carrying value of the convertible

debt instruments. The debt issuance costs are amortized as interest

expense. The expense for the amortization of the debt issuance

costs is a non-cash item, and we believe the exclusion of this

interest expense will provide for a more useful comparison of our

operational performance in different periods.

Restructuring

costs: PagerDuty views restructuring costs, such as employee

severance-related costs and real estate impairment costs, as events

that are not necessarily reflective of operational performance

during a period. In particular, PagerDuty believes the

consideration of measures that exclude such expenses can assist in

the comparison of operational performance in different periods

which may or may not include such expenses.

Gains (or losses) on

partial extinguishment of convertible senior notes:

PagerDuty views gains (or losses) on partial extinguishment of debt

as events that are not necessarily reflective of operational

performance during a period. PagerDuty believes that the

consideration of measures that exclude such gain (or loss) impact

can assist in the comparison of operational performance in

different periods which may or may not include such gains (or

losses).

Adjustment attributable

to redeemable non-controlling interest: PagerDuty adjusts

the value of redeemable non-controlling interest of its joint

venture PagerDuty K.K. according to the operating agreement.

PagerDuty believes this adjustment is not reflective of operational

performance during a period and exclusion of such adjustments can

assist in comparison of operational performance in different

periods.

Income tax effects and

adjustments: Based on PagerDuty's financial outlook for

fiscal 2025, PagerDuty is utilizing a projected non-GAAP tax rate

of 23% in order to provide better consistency across the interim

reporting periods by eliminating the impact of non-recurring and

period specific items, which can vary in size and frequency.

PagerDuty's estimated tax rate on non-GAAP income is determined

annually and may be adjusted during the year to take into account

events or trends that PagerDuty believes materially impact the

estimated annual rate including, but not limited to, significant

changes resulting from tax legislation, material changes in the

geographic mix of revenue and expenses and other significant

events.

Non-GAAP gross profit and non-GAAP gross margin

We define non-GAAP gross profit as gross profit excluding the

following expenses typically included in cost of revenue:

stock-based compensation expense, employer taxes related to

employee stock transactions, amortization of acquired intangible

assets, and restructuring costs. We define non-GAAP gross margin as

non-GAAP gross profit as a percentage of revenue.

Non-GAAP operating expenses

We define non-GAAP operating expenses as operating expenses

excluding stock-based compensation expense, employer taxes related

to employee stock transactions, amortization of acquired intangible

assets, acquisition-related expenses, which include transaction

costs, acquisition-related retention payments, and asset

impairment, and restructuring costs which are not necessarily

reflective of operational performance during a given period.

Non-GAAP operating income and non-GAAP operating margin

We define non-GAAP operating income as loss from operations

excluding stock-based compensation expense, employer taxes related

to employee stock transactions, amortization of acquired intangible

assets, acquisition-related expenses, which include transaction

costs, acquisition-related retention payments, and asset

impairment, and restructuring costs which are not necessarily

reflective of operational performance during a given period. We

define non-GAAP operating margin as non-GAAP operating income as a

percentage of revenue.

Non-GAAP net income attributable to PagerDuty, Inc. common

stockholders

We define non-GAAP net income attributable to PagerDuty, Inc.

common stockholders as net loss attributable to PagerDuty, Inc.

common stockholders excluding stock-based compensation expense,

employer taxes related to employee stock transactions, amortization

of debt issuance costs, amortization of acquired intangible assets,

acquisition-related expenses, which include transaction costs,

acquisition-related retention payments and asset impairment,

restructuring costs, adjustment attributable to redeemable

non-controlling interest, and income tax adjustments, which are not

necessarily reflective of operational performance during a given

period.

Non-GAAP net income per share, basic and diluted

We define non-GAAP net income per share, basic as non-GAAP net

income attributable to PagerDuty, Inc. common stockholders divided

by weighted average shares outstanding at the end of the reporting

period. We define non-GAAP net income per share, diluted as

non-GAAP net income attributable to PagerDuty, Inc. common

stockholders divided by weighted average diluted shares outstanding

at the end of the reporting period.

Free cash flow and free cash flow margin

We define free cash flow as net cash provided by operating

activities, less cash used for purchases of property and equipment

and capitalization of internal-use software costs. We define free

cash flow margin as free cash flow as a percentage of revenue. In

addition to the reasons stated above, we believe that free cash

flow is useful to investors as a liquidity measure because it

measures our ability to generate or use cash in excess of our

capital investments in property and equipment in order to enhance

the strength of our balance sheet and further invest in our

business and potential strategic initiatives. A limitation of the

utility of free cash flow as a measure of our liquidity is that it

does not represent the total increase or decrease in our cash

balance for the period. We use free cash flow in conjunction with

traditional U.S. GAAP measures as part of our overall assessment of

our liquidity, including the preparation of our annual operating

budget and quarterly forecasts and to evaluate the effectiveness of

our business strategies. There are a number of limitations related

to the use of free cash flow as compared to net cash provided by

operating activities, including that free cash flow includes

capital expenditures, the benefits of which are realized in periods

subsequent to those when expenditures are made.

PagerDuty encourages investors to review the related GAAP

financial measures and the reconciliation of these non-GAAP

financial measures to their most directly comparable GAAP financial

measures, which it includes in press releases announcing quarterly

financial results, including this press release, and not to rely on

any single financial measure to evaluate PagerDuty’s business.

Please see the reconciliation tables at the end of this release

for the reconciliation of non-GAAP financial measures to their

most-comparable GAAP financial measures.

PAGERDUTY, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(in thousands, except percentages

and per share data)

(unaudited)

Three months ended October

31,

Nine months ended October 31,

2024

2023

2024

2023

Non-GAAP gross profit and non-GAAP

gross margin

Gross profit

$

98,678

$

89,015

$

286,362

$

262,108

Add:

Stock-based compensation

1,432

1,820

4,696

5,860

Employer taxes related to employee stock

transactions

29

21

112

138

Amortization of acquired intangible

assets

2,200

2,087

6,875

6,260

Restructuring costs

—

—

(2

)

137

Non-GAAP gross profit

$

102,339

$

92,943

$

298,043

$

274,503

Revenue

$

118,946

$

108,720

$

346,053

$

319,582

Gross Margin

83.0

%

81.9

%

82.8

%

82.0

%

Non-GAAP gross margin

86.0

%

85.5

%

86.1

%

85.9

%

Non-GAAP operating expenses

Research and development

$

34,267

$

34,272

$

106,878

$

104,221

Less:

Stock-based compensation

11,576

11,128

34,640

34,002

Employer taxes related to employee stock

transactions

173

210

691

930

Acquisition-related expenses

227

161

750

484

Amortization of acquired intangible

assets

—

88

116

262

Restructuring costs

—

—

(2

)

(5

)

Non-GAAP research and development

$

22,291

$

22,685

$

70,683

$

68,548

Sales and marketing

$

49,272

$

49,630

$

148,737

$

143,155

Less:

Stock-based compensation

7,639

8,094

23,702

22,362

Employer taxes related to employee stock

transactions

128

39

463

589

Amortization of acquired intangible

assets

632

610

1,897

1,830

Restructuring costs

—

(1

)

(10

)

(49

)

Non-GAAP sales and marketing

$

40,873

$

40,888

$

122,685

$

118,423

General and administrative

$

25,432

$

25,955

$

78,800

$

77,547

Less:

Stock-based compensation

11,126

10,786

34,041

32,686

Employer taxes related to employee stock

transactions

122

145

463

658

Acquisition-related expenses

—

530

(1

)

530

Amortization of acquired intangible

assets

—

21

29

65

Restructuring costs

—

133

24

1,451

Non-GAAP general and administrative

$

14,184

$

14,340

$

44,244

$

42,157

Note: Certain figures may not sum due to

rounding.

PAGERDUTY, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES (continued)

(in thousands, except percentages

and per share data)

(unaudited)

Three months ended October

31,

Nine months ended October 31,

2024

2023

2024

2023

Non-GAAP operating income and non-GAAP

operating margin

Loss from operations

$

(10,293

)

$

(20,842

)

$

(48,053

)

$

(62,815

)

Add:

Stock-based compensation

31,773

31,828

97,079

94,910

Employer taxes related to employee stock

transactions

452

415

1,729

2,315

Amortization of acquired intangible

assets

2,832

2,806

8,917

8,417

Acquisition-related expenses

227

691

749

1,014

Restructuring costs

—

132

10

1,534

Non-GAAP operating income

$

24,991

$

15,030

$

60,431

$

45,375

Revenue

$

118,946

$

108,720

$

346,053

$

319,582

Operating margin

(8.7

)%

(19.2

)%

(13.9

)%

(19.7

)%

Non-GAAP operating margin

21.0

%

13.8

%

17.5

%

14.2

%

Non-GAAP net income attributable to

PagerDuty, Inc. common stockholders

Net loss attributable to PagerDuty, Inc.

common stockholders

$

(6,558

)

$

(15,125

)

$

(43,856

)

$

(51,125

)

Add:

Stock-based compensation

31,773

31,828

97,079

94,910

Employer taxes related to employee stock

transactions

452

415

1,729

2,315

Amortization of debt issuance costs

671

523

1,950

1,456

Amortization of acquired intangible

assets

2,832

2,806

8,917

8,417

Acquisition-related expenses

227

691

749

1,014

Restructuring costs

—

132

10

1,534

Gain on extinguishment of convertible

senior notes

—

(3,970

)

—

(3,970

)

Adjustment attributable to redeemable

non-controlling interest

634

2,359

9,881

4,088

Income tax effects and adjustments

(6,310

)

(466

)

(16,402

)

(1,920

)

Non-GAAP net income attributable to

PagerDuty, Inc. common stockholders

$

23,721

$

19,193

$

60,057

$

56,719

Non-GAAP net income per share,

basic

Net loss per share, basic, attributable to

PagerDuty, Inc. common stockholders

$

(0.07

)

$

(0.16

)

$

(0.47

)

$

(0.55

)

Non-GAAP adjustments to net loss

attributable to PagerDuty, Inc. common stockholders

0.33

0.37

1.12

1.16

Non-GAAP net income per share, basic,

attributable to PagerDuty, Inc. common stockholders

$

0.26

$

0.21

$

0.65

$

0.61

Non-GAAP net income per share,

diluted(1)

Net loss per share, diluted, attributable

to PagerDuty, Inc. common stockholders

$

(0.07

)

$

(0.16

)

$

(0.47

)

$

(0.55

)

Non-GAAP adjustments to net loss

attributable to PagerDuty, Inc. common stockholders

0.32

0.36

1.10

1.13

Non-GAAP net income per share, diluted,

attributable to PagerDuty, Inc. common stockholders

$

0.25

$

0.20

$

0.63

$

0.58

Weighted-average shares used in

calculating net loss per share, basic and diluted

91,438

93,104

92,530

92,257

Weighted-average shares used in

calculating non-GAAP net income per share

Basic

91,438

93,104

92,530

92,257

Diluted

94,036

96,235

95,549

100,834

Note: Certain figures may not sum due to

rounding.

(1) On October 13, 2023, the Company

provided written notice to the trustee and the note holders of the

2025 Notes that it had irrevocably elected to settle the principal

amount of its convertible senior notes in cash and pay or deliver,

as the case may be, cash, shares of common stock or a combination

of cash and shares of common stock, at the Company’s election, in

respect to the remainder, if any, of the Company’s conversion

obligation in excess of the aggregate principal amount of the 2025

Notes being converted. The company uses the if-converted method to

calculate the non-GAAP net income per diluted share attributable to

PagerDuty, Inc. related to the convertible notes due 2025 prior to

the election on October 13, 2023. As such, approximately 5.8

million and 6.7 million shares related to the convertible notes due

2025 were included in the non-GAAP diluted outstanding share number

for the three and nine months ended October 31, 2023, respectively,

related to the period prior to the election on October 13, 2023.

Similarly, for the three and nine months ended October 31, 2023,

the numerator used to compute this measure was increased by $0.7

million and $2.5 million, respectively, for after-tax interest

expense savings related to our convertible notes.

PAGERDUTY, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES (continued)

(in thousands, except

percentages)

(unaudited)

Three months ended October

31,

Nine months ended October 31,

2024

2023

2024

2023

Free cash flow and free cash flow

margin

Net cash provided by investing

activities

$

22,073

$

16,917

$

86,489

$

49,819

Purchases of property and equipment

(552

)

(245

)

(1,646

)

(1,193

)

Capitalization of internal-use software

costs

(2,078

)

(1,441

)

(5,019

)

(3,812

)

Free cash flow

$

19,443

$

15,231

$

79,824

$

44,814

Net cash (used in) provided by investing

activities

$

(3,101

)

$

10,887

$

(9,722

)

$

6,875

Net cash (used in) provided by financing

activities

$

(78,118

)

$

54,157

$

(113,323

)

$

53,661

Revenue

$

118,946

$

108,720

$

346,053

$

319,582

Free cash flow margin

16.3

%

14.0

%

23.1

%

14.0

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241126811639/en/

Investor Relations Contact: Tony Righetti

investor@pagerduty.com

Media Contact: Debbie O'Brien media@pagerduty.com

SOURCE PagerDuty

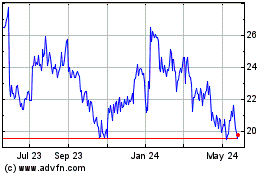

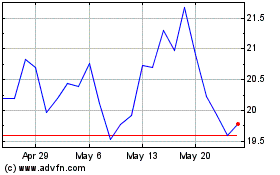

PagerDuty (NYSE:PD)

Historical Stock Chart

From Oct 2024 to Nov 2024

PagerDuty (NYSE:PD)

Historical Stock Chart

From Nov 2023 to Nov 2024