Rio Tinto to invest $2.5 billion to expand Rincon lithium project capacity to 60,000 tonnes per year

12 December 2024 - 11:08PM

Business Wire

Rio Tinto has approved $2.5 billion1 to expand the Rincon

project in Argentina, the company’s first commercial scale lithium

operation, demonstrating its commitment to building a world-class

battery materials portfolio.

Rincon's capacity of 60,000 tonnes of battery grade lithium

carbonate per year is comprised of the 3,000-tonne starter plant

and 57,000-tonne expansion plant. Rincon’s mine life is expected to

be 40 years2, with construction of the expanded plant scheduled to

begin in mid-2025, subject to permitting. First production is

expected in 2028 followed by a three-year ramp up to full capacity,

generating significant job creation and economic opportunities for

local businesses.

Rio Tinto Chief Executive Jakob Stausholm said: “The attractive

long-term outlook for lithium driven by the energy transition

underpins our investment in Rincon. We are dedicated to developing

this tier 1, world-class resource at scale at the low end of the

cost curve. We are equally committed to meeting the highest ESG

standards, leveraging our advanced technology to halve the amount

of water used in processing, while continuing to grow our mutually

beneficial partnerships with local communities and Salta

province.

“Building on Argentina's supportive economic policies, skilled

workforce, and exceptional resources we are positioning ourselves

to become one of the top lithium producers globally. This

investment alongside our proposed Arcadium acquisition ensures that

lithium will become one of the key pillars of our commodity

portfolio for decades to come.”

Located in the heart of the ‘lithium triangle’ in Argentina, the

Rincon project consists of brine extraction using a production

wellfield, processing and waste facilities, as well as associated

infrastructure. The project uses direct lithium extraction (DLE)

technology, a process that supports water conservation, reduces

waste and produces lithium carbonate more consistently than other

methods.

Rincon is a large3, long-life asset with Ore Reserves 60% higher

than we assumed at the time of acquisition. It is expected to be in

the first quartile of the cost curve, demonstrating resilience and

ability to operate profitably through the cycle.

This investment supports Argentina’s ongoing ambitions to become

a world-leading lithium producer. Argentina's economic reforms and

the new Incentive Regime for Large Investments (‘RIGI’) provide a

favourable environment for investment, offering benefits such as

lower tax rates, accelerated depreciation, and regulatory stability

for 30 years, protecting the project from future policy changes, as

well as enhanced investor protections.

This announcement is authorised for release to the market by

Andy Hodges, Rio Tinto’s Group Company Secretary.

1 Included in the Group’s capital expenditure guidance provided

at Rio Tinto’s Investor Seminar on 4 December 2024. 2 The

production target of approximately 53 kt of battery grade lithium

carbonate per year for a period of 40 years was previously reported

in a release to the ASX dated 4 December 2024 titled “Rincon

Project Mineral Resources and Ore Reserves: Table 1”. Rio Tinto

confirms that all material assumptions underpinning that production

target continue to apply and have not materially changed. Plans are

in place to build for a capacity of 60 kt of battery grade lithium

carbonate per year with debottlenecking and improvement programs

scheduled to unlock this additional throughput. 3 See ASX release

dated 4 December 2024 titled “Rincon Project Mineral Resources and

Ore Reserves: Table 1" for details of Mineral Resources and Ore

Reserves.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241212756864/en/

Please direct all enquiries to

media.enquiries@riotinto.com

Media Relations, United Kingdom David

Outhwaite M +44 7787 597 493

Media Relations, Australia Matt Chambers

M +61 433 525 739 Michelle Lee M +61 458 609

322 Rachel Pupazzoni M +61 438 875 469

Media Relations, Canada Simon Letendre

M +1 514 796 4973 Malika Cherry M +1 418 592

7293 Vanessa Damha M +1 514 715 2152

Media Relations, US Jesse Riseborough

M +1 202 394 9480

Investor Relations, United Kingdom David

Ovington M +44 7920 010 978 Laura Brooks M

+44 7826 942 797 Wei Wei Hu M +44 7825 907 230

Investor Relations, Australia Tom Gallop

M +61 439 353 948 Amar Jambaa M +61 472 865

948

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United

Kingdom T +44 20 7781 2000 Registered in England No.

719885

Rio Tinto Limited Level 43, 120 Collins Street Melbourne

3000 Australia T +61 3 9283 3333 Registered in Australia ABN

96 004 458 404

riotinto.com

Category: Rincon

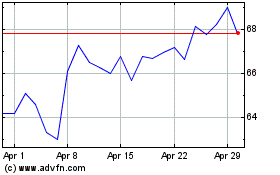

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Nov 2024 to Dec 2024

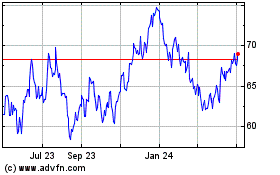

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Dec 2023 to Dec 2024