- Third quarter revenue of $97.4 million, up 24%

year-over-year

- ARR of $401 million, up 24% year-over-year

- Third quarter net cash provided by operating activities of $8.1

million

- Company raises full year 2024 revenue and non-GAAP operating

margin guidance

Semrush Holdings, Inc. (NYSE: SEMR), a leading online visibility

management SaaS platform, today reported financial results for the

third quarter ended September 30, 2024.

“We reported a strong quarter, exceeding our guidance and

positioning us to raise our full year 2024 guidance. Revenue growth

accelerated, rising 24% year-over-year to $97.4 million, and ARR

also grew 24% year-over-year, as we focused on growing our core

business, while upselling and cross selling our additional

offerings. Our portfolio of products is expanding, and we are

seeing continued strong initial uptake in the market for our

Enterprise SEO solution. We are expanding our leadership position

in online visibility and we are succeeding in combining strong

durable growth with profitability and free cash flow generation,”

said Oleg Shchegolev, CEO and Co-Founder of Semrush.

Third Quarter 2024 Financial Highlights

- Third quarter revenue of $97.4 million, up 24%

year-over-year.

- Income from operations of $1.7 million for the third quarter,

compared to income from operations of $2.7 million in the prior

year period.

- Operating margin of 1.8% for the third quarter, compared to

operating margin of 3.5% in the prior year period.

- Non-GAAP income from operations of $12.1 million for the third

quarter, compared to a non-GAAP income from operations of $7.5

million in the prior year period.

- Non-GAAP operating margin of 12.4% for the third quarter,

compared to non-GAAP operating margin of 9.5% in the prior year

period.

- Q3 free cash flow of $6.2 million and free cash flow margin of

6.3%.

- ARR of $401 million as of September 30, 2024, up 24%

year-over-year.

- Over 117,000 paying customers as of September 30, 2024, up 10%

from a year ago.

- Dollar-based net revenue retention of 107% as of September 30,

2024, consistent with the previous quarter.

See “Non-GAAP Financial Measures & Definitions of Key

Metrics” below for how Semrush defines ARR, dollar-based net

revenue retention, non-GAAP income (loss) from operations, non-GAAP

operating margin, free cash flow, and free cash flow margin, and

the financial tables that accompany this release for

reconciliations of each non-GAAP financial measure to its closest

comparable GAAP financial measure.

Third Quarter 2024 Business Highlights

We are committed to empowering our customers with the

best-in-class platform needed to boost their online presence and

gain an edge in the market. In the third quarter, we advanced and

expanded many of our offerings:

- Semrush Enterprise SEO Platform is receiving strong demand; new

deals were signed with large multinational corporations including

Salesforce, HSBC, LG, Samsung, Alibaba, Sony, DoorDash, TikTok, and

Square.

- Expanded AI Overview tracking to Semrush's Organic Research,

Domain Overview, Keyword Overview, and Keyword Magic Tool, helping

customers better understand AI Overviews as a key SERP feature and

enhancing their chances of being featured.

- Improved Semrush Social, including Content AI, and added TikTok

integration, allowing users to schedule and post videos, track

engagement metrics, and analyze content performance.

- Continued investments in Generative AI to provide enhanced,

more efficient content creation and marketing capabilities through

Semrush's platform and App Center:

- Introduced AdCreative.ai's AdLLM Spark, a smart AI tool that

empowers businesses to create optimized ad texts to improve

engagement and enhance conversion rates.

- Daily insights allow for faster reactions and more precise

decision-making. Now, .Trends users can spot trends early,

understand ongoing market dynamics fast, strategize immediately,

and execute with lower risk.

- Integrated Klaviyo with My Reports, enabling marketers to pull

email performance data and create dashboards alongside Semrush and

other external marketing tools to easily showcase campaign

performance.

- Released AlgoPix's Product Research Pulse in the App Center,

providing e-commerce sellers with insightful product research data

from various marketplaces to inform product development and enhance

marketing strategies.

- Strengthened customer focus with appointment of Veronique

Montreuil as Chief Customer and Data Officer.

- Semrush customers who pay more than $10,000 annually grew by

44% year-over-year.

- Ended the quarter with approximately 1.0 million registered

free active customers.

Business Outlook

“We are pleased with our performance this quarter and have

executed well to overachieve on our top line growth and

profitability guidance,” said Brian Mulroy, CFO of Semrush. “We

posted another quarter of strong growth and profitability, with

positive non-GAAP operating income of $12.1 million, non-GAAP

operating margin of 12.4%, which was up nearly 300 basis points

year-over-year, and cash flow from operations of $8.1 million.

Looking ahead, we have a disciplined capital allocation strategy

and expect to continue gaining efficiencies across the organization

while also investing in our future growth.”

Based on information as of today, November 7, 2024, we are

issuing the following financial guidance:

Fourth Quarter 2024 Financial Outlook

- For the fourth quarter, we expect revenue in a range of $100.8

to $101.8 million, which at the mid-point would represent growth of

approximately 21% year-over-year.

- We expect fourth quarter non-GAAP operating margin to be

approximately 11%.

Raised Full-Year 2024 Financial Outlook

- For the full year, we expect revenue in a range of $375 to $376

million, which represents growth of 22% year-over-year.

- We expect a full year non-GAAP operating margin of

approximately 12%.

- We expect the full year free cash flow margin to be

approximately 8%.

As previously disclosed, we are no longer providing guidance for

non-GAAP net income, and instead are guiding both non-GAAP

operating margin and free cash flow margin. Also as previously

disclosed, we have also updated our definitions of non-GAAP income

(loss) from operations to exclude Amortization of Acquired

Intangible Assets, Acquisition Related Costs, Restructuring Costs

and other one-time expenses outside the ordinary course of business

in addition to the prior exclusion of Stock Based Compensation. Our

guidance for the fourth quarter 2024 and full year 2024, as well as

actual results presented herein, reflect this change.

Reconciliations of non-GAAP operating margin and free cash flow

margin guidance to the most directly comparable GAAP measures are

not available without unreasonable efforts on a forward-looking

basis due to the high variability, complexity and low visibility

with respect to the charges excluded from these non-GAAP measures,

in particular the measures and effects of share-based compensation

expense, employer taxes and tax deductions specific to equity

compensation awards that are directly impacted by future hiring,

turnover and retention needs. We expect the variability of the

above charges to have a significant, and potentially unpredictable,

impact on our future GAAP financial results.

Conference Call Details

Semrush will host a conference call and webcast to discuss its

financial results, business highlights, outlook and other matters,

the details for which are provided below.

Date: Friday, November 8th, 2024 Time: 8:30 a.m. ET Hosts: Oleg

Shchegolev, CEO, Eugene Levin, President, and Brian Mulroy, CFO

Conference ID: 866040 Participant Toll Free Dial-In Number: +1

833 470 1428 Participant International Dial-In Number: +1 929 526

1599

Registration:

The live webcast of the conference call as well as the replay

can be accessed for a limited time from the Semrush investor

relations website at http://investors.semrush.com/.

About Semrush

Semrush is a leading online visibility management SaaS platform

that enables businesses globally to run search engine optimization,

advertising, content, social media and competitive research

campaigns and get measurable results from online marketing. Semrush

offers insights and solutions for companies to build, manage, and

measure campaigns across various marketing channels. Semrush is

headquartered in Boston and has offices in Trevose, Austin, Dallas,

Miami, Amsterdam, Barcelona, Belgrade, Berlin, Limassol, Prague,

Warsaw, and Yerevan.

Forward-looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws, which are statements

that involve substantial risks and uncertainties. Forward-looking

statements generally relate to future events or our future

financial or operating performance. In some cases, you can identify

forward-looking statements because they contain words such as

“may,” “will,” “shall,” “should,” “expects,” “plans,”

“anticipates,” “could,” “intends,” “target,” “projects,”

“contemplates,” “believes,” “estimates,” “predicts,” “potential” or

“continue” or the negative of these words or other similar terms or

expressions that concern our expectations, strategy, plans or

intentions. Forward-looking statements include, but are not limited

to, guidance on financial results for the fourth quarter and full

year of 2024 (including revenue, non-GAAP operating margin, and

free cash flow margin); statements regarding the expectations of

demand for our products and cash flow generation; acquisition

activity, integration and results of recent acquisitions;

statements about improvements to and expansion of our products and

platform, and launching new products; the contributions of our

officers; statements about future operating results, including

revenue, growth opportunities, variability of expenses, ability to

realize efficiencies, future spending and incremental investments,

business trends, our ability to deliver profits, and growth and

value for shareholders.

The forward-looking statements contained in this release are

also subject to other risks and uncertainties, including those more

fully described in our filings with the Securities and Exchange

Commission (“SEC”), including in the sections entitled “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” in our filings with the SEC,

including our most recent annual report on form 10-K, and our

subsequently filed quarterly reports and other SEC filings.

Although we believe that our plans, intentions, expectations,

strategies and prospects as reflected in or suggested by those

forward-looking statements are reasonable, we can give no assurance

that the plans, intentions, expectations or strategies will be

attained or achieved. The forward-looking statements in this

release are based on information available to us as of the date

hereof, and we disclaim any obligation to update any

forward-looking statements, except as required by law. These

forward-looking statements should not be relied upon as

representing our views as of any date subsequent to the date of

this press release.

Additional information regarding these and other factors that

could affect our results is included in our SEC filings, which may

be obtained by visiting our Investor Relations page on its website

at investors.semrush.com or the SEC's website at www.sec.gov.

Non-GAAP Financial Measures & Definitions of Key

Metrics

We believe that providing non-GAAP information to investors, in

addition to the GAAP presentation, allows investors to view the

financial results in the way management views the operating

results. We further believe that providing this information allows

investors to not only better understand our financial performance,

but also to evaluate the efficacy of the methodology and

information used by management to evaluate and measure such

performance. We also believe that the use of non-GAAP financial

measures provides an additional tool for investors to use in

evaluating ongoing operating results and trends and in comparing

our financial results with other companies in our industry, many of

which present similar non-GAAP financial measures to investors. We

also believe free cash flow margin is useful to investors as we

monitor it as a measure of our overall business performance, which

enables us to analyze our future performance without the effects of

non-cash items and allows us to better understand the cash needs of

our business. The non-GAAP information included in this press

release should not be considered superior to, or a substitute for,

financial statements prepared in accordance with GAAP and may be

different from non-GAAP financial measures presented by other

companies. Investors are encouraged to review the reconciliation of

non-GAAP measures to their most directly comparable GAAP financial

measures provided in the financial statement tables included below

in this press release.

Annual Recurring Revenue (ARR) is defined as of a given

date as the monthly recurring revenue that we expect to

contractually receive from all paid subscription agreements that

are actively generating revenue as of that date multiplied by 12.

We include both monthly recurring paid subscriptions, which renew

automatically unless canceled, as well as the annual recurring paid

subscriptions so long as we do not have any indication that a

customer has canceled or intends to cancel its subscription and we

continue to generate revenue from them.

Dollar-based net revenue retention is defined as (a) the

revenue from our customers during the twelve-month period ending

one year prior to such period as the denominator and (b) the

revenue from those same customers during the twelve months ending

as of the end of such period as the numerator. This calculation

excludes revenue from new customers and any non-recurring

revenue.

Free cash flow and free cash flow margin. We define free

cash flow, a non-GAAP financial measure, as net cash provided by

(used in) operating activities less purchases of property and

equipment and capitalized software development costs. We define

free cash flow margin as free cash flow divided by GAAP

revenue.

Non-GAAP income (loss) from operations, and non-GAAP

operating margin. As described above, we have updated our

definitions for non-GAAP income (loss) from operations and have

introduced non-GAAP operating margin; the updated definitions,

which apply to our guidance for the fourth quarter and full year

2024, are as follows. We define non-GAAP income (loss) from

operations as GAAP income (loss) from operations, excluding

Stock Based Compensation, Amortization of Acquired Intangible

Assets, Acquisition Related Costs, Restructuring Costs and other

one-time expenses outside the ordinary course of business (for

example, our Exit Costs incurred primarily in 2022). We define

non-GAAP operating margin as non-GAAP income (loss) from

operations divided by GAAP revenue. We believe investors may want

to consider our results with and without the effects of these items

in order to compare our financial performance with that of other

companies that exclude such items and to compare our results to

prior periods.

Stock-based compensation. Stock-based compensation is a

non-cash expense accounted for in accordance with FASB ASC Topic

718. We believe that the exclusion of stock-based compensation

expense allows for financial results that are more indicative of

our operational performance and provide for a useful comparison of

our operating results to prior periods and to our peer companies

because stock-based compensation expense varies from period to

period and company to company due to such things as differing

valuation methodologies, timing of awards and changes in stock

price.

Amortization of acquired intangible assets. Excluding

amortization of acquired intangible assets from non-GAAP expense

and income measures allows management and investors to evaluate

results “as-if” the acquired intangible assets had been developed

internally rather than acquired and, therefore, provides a

supplemental measure of performance in which our acquired

intellectual property is treated in a comparable manner to our

internally developed intellectual property. These amounts are

inconsistent in amount and frequency and are significantly impacted

by the timing and size of acquisitions. Although we exclude

amortization of acquired intangible assets from our non-GAAP

expenses, we believe that it is important for investors to

understand that such intangible assets contribute to revenue

generation.

Restructuring and other costs. Restructuring and other

costs include restructuring expenses as well as other charges that

are unusual in nature, are the result of unplanned events, and

arise outside the ordinary course of our business. Restructuring

expenses consist of employee severance costs, charges for the

closure of excess facilities and other contract termination costs.

Other costs include litigation contingency reserves, asset

impairment charges, relocation expenses associated with the

migration of employees in 2022 that occurred throughout 2022 and

early 2023, and gains or losses on the sale or disposition of

certain non-strategic assets or product lines.

Acquisition-related costs, net. In recent years, we have

completed a number of acquisitions, which result in transition,

integration and other acquisition-related expense which would not

otherwise have been incurred, are unpredictable and dependent on a

significant number of factors that are deal-specific or outside of

our control, are not indicative of our operational performance (or

that of the acquired businesses or assets) and are likely to

fluctuate as our acquisition activity increases or decreases in

future periods. By excluding acquisition-related costs and

adjustments from our non-GAAP measures, management is better able

to evaluate our ability to utilize our existing assets and estimate

the long-term value that acquired assets will generate for us.

Semrush Holdings, Inc.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in

thousands, except per share data)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Revenue

$

97,410

$

78,718

$

274,173

$

224,281

Cost of revenue (1)

17,063

13,032

46,665

38,643

Gross profit

80,347

65,686

227,508

185,638

Operating expenses

Sales and marketing (1)

35,689

30,094

104,610

95,827

Research and development (1)

22,183

14,075

58,775

42,071

General and administrative (1)

20,770

18,769

57,556

56,797

Exit costs

—

—

—

1,292

Total operating expenses

78,642

62,938

220,941

195,987

Income (loss) from operations

1,705

2,748

6,567

(10,349

)

Other income, net

2,912

2,104

9,167

6,728

Income (loss) before income taxes

4,617

4,852

15,734

(3,621

)

Provision for income taxes

3,899

637

11,652

2,303

Net income (loss)

718

4,215

4,082

(5,924

)

Net loss attributable to noncontrolling

interest in consolidated subsidiaries

(376

)

—

(809

)

—

Net income (loss) attributable to Semrush

Holdings, Inc.

$

1,094

$

4,215

$

4,891

$

(5,924

)

.

Net income (loss) attributable to Semrush

Holdings, Inc. per share attributable to common

stockholders—basic:

$

0.01

$

0.03

$

0.03

$

(0.04

)

Net income (loss) attributable to Semrush

Holdings, Inc. per share attributable to common

stockholders—diluted:

$

0.01

$

0.03

$

0.03

$

(0.04

)

Weighted-average number of shares of

common stock used in computing net income (loss) per share

attributable to common stockholders—basic:

146,436

142,837

145,563

142,247

Weighted-average number of shares of

common stock used in computing net income (loss) per share

attributable to common stockholders—diluted:

149,427

146,271

148,653

142,247

1 includes stock-based compensation

expense as follows:

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Cost of revenue

$

71

$

33

$

169

$

82

Sales and marketing

1,228

822

3,207

2,190

Research and development

1,707

579

3,714

1,464

General and administrative

4,569

2,769

12,766

7,028

Total stock-based compensation

$

7,575

$

4,203

$

19,856

$

10,764

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Reconciliation of Non-GAAP income

(loss) from operations

($)

(%)

($)

(%)

($)

(%)

($)

(%)

Income (loss) from operations

$

1,705

1.8

%

$

2,748

3.5

%

$

6,567

2.4

%

$

(10,349

)

(4.6

)%

Stock-based compensation expense

7,575

7.8

%

4,203

5.3

%

19,856

7.2

%

10,764

4.8

%

Non-GAAP income (loss) from operations

(prior definition)

$

9,280

9.6

%

$

6,951

8.8

%

$

26,423

9.6

%

$

415

0.2

%

Amortization of acquired intangibles

1,380

1.4

%

557

0.7

%

2,962

1.1

%

1,631

0.7

%

Restructuring and other costs

207

0.2

%

—

—

%

2,331

0.9

%

1,292

0.6

%

Acquisition-related costs, net

1,190

1.2

%

—

—

%

2,265

0.8

%

—

—

%

Non-GAAP income (loss) from operations

(new definition)

$

12,057

12.4

%

$

7,508

9.5

%

$

33,981

12.4

%

$

3,338

1.5

%

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Reconciliation of Free cash

flow

($)

(%)

($)

(%)

($)

(%)

($)

(%)

Net cash provided by (used in) operating

activities

$

8,141

8.4

%

$

6,356

8.1

%

$

35,063

12.8

%

$

(3,567

)

(1.6

)%

Purchases of property and equipment

(505

)

(0.5

)%

(108

)

(0.1

)%

(3,411

)

(1.2

)%

(1,065

)

(0.5

)%

Capitalization of internal-use software

costs

(1,473

)

(1.5

)%

(1,283

)

(1.6

)%

(5,842

)

(2.1

)%

(3,913

)

(1.7

)%

Free cash flow

$

6,163

6.4

%

$

4,965

6.4

%

$

25,810

9.5

%

$

(8,545

)

(3.8

)%

Semrush Holdings, Inc.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (in

thousands)

As of

September 30, 2024

December 31, 2023

Assets

Current assets

Cash and cash equivalents

$

45,083

$

58,848

Short-term investments

187,796

179,721

Accounts receivable

9,344

7,897

Deferred contract costs, current

portion

9,755

9,074

Prepaid expenses and other current

assets

20,429

10,014

Total current assets

272,407

265,554

Property and equipment, net

7,220

6,686

Operating lease right-of-use assets

11,048

14,069

Intangible assets, net

30,746

16,083

Goodwill

54,299

24,879

Deferred contract costs, net of current

portion

2,722

3,586

Other long-term assets

5,355

633

Total assets

$

383,797

$

331,490

Liabilities, noncontrolling interest,

and stockholders' equity

Current liabilities

Accounts payable

$

11,541

$

9,187

Accrued expenses

20,284

19,891

Deferred revenue

68,996

58,310

Current portion of operating lease

liabilities

4,768

4,274

Other current liabilities

7,462

2,817

Total current liabilities

113,051

94,479

Deferred revenue, net of current

portion

210

331

Deferred tax liability

1,965

839

Operating lease liabilities, net of

current portion

7,315

10,331

Other long-term liabilities

2,261

1,195

Total liabilities

124,802

107,175

Commitments and contingencies

Stockholders' equity

Class A common stock

1

1

Class B common stock

—

—

Additional paid-in capital

313,924

291,898

Accumulated other comprehensive income

(loss)

1,700

(752

)

Accumulated deficit

(67,107

)

(71,998

)

Total stockholders' equity attributable to

Semrush Holdings, Inc.

248,518

219,149

Noncontrolling interest in consolidated

subsidiaries

10,477

5,166

Total stockholders’ equity

258,995

224,315

Total liabilities, noncontrolling interest

and stockholders' equity

$

383,797

$

331,490

Semrush Holdings, Inc.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in

thousands)

Nine Months Ended September

30,

2024

2023

Operating Activities

Net income (loss)

$

4,082

$

(5,924

)

Adjustments to reconcile net income (loss)

to net cash provided by (used in) operating activities

Depreciation and amortization expense

7,094

4,807

Amortization of deferred contract

costs

9,163

7,510

Amortization (accretion) of premiums and

discounts on investments

(2,551

)

(4,667

)

Non-cash lease expense

3,431

2,828

Stock-based compensation expense

19,856

10,764

Non-cash interest expense

—

158

Change in fair value included in other

income, net

(633

)

(335

)

Deferred taxes

(286

)

12

Other non-cash items

1,457

771

Changes in operating assets and

liabilities

Accounts receivable

(301

)

(2,261

)

Deferred contract costs

(8,980

)

(9,835

)

Prepaid expenses and other current

assets

(3,495

)

(5,411

)

Accounts payable

1,939

(5,570

)

Accrued expenses

1,296

174

Other current liabilities

(527

)

—

Deferred revenue

6,852

6,198

Other long-term liabilities

84

—

Change in operating lease liability

(3,418

)

(2,786

)

Net cash provided by (used in) operating

activities

35,063

(3,567

)

Investing Activities

Purchases of property and equipment

(3,411

)

(1,065

)

Capitalization of internal-use software

costs

(5,842

)

(3,913

)

Purchases of short-term investments

(136,768

)

(182,381

)

Proceeds from sales and maturities of

short-term investments

132,500

154,741

Purchases of convertible debt

securities

(3,650

)

(319

)

Funding of investment loan receivable

(7,757

)

—

Cash paid for acquisition of businesses,

net of cash acquired

(21,082

)

(1,232

)

Purchase of noncontrolling interest

(4,870

)

—

Purchases of other investments

(196

)

(150

)

Net cash used in investing activities

(51,076

)

(34,319

)

Financing Activities

Proceeds from exercise of stock

options

3,700

746

Proceeds from issuance of shares in

connection with employee stock purchase plan

—

264

Payment of acquired debt

(1,114

)

—

Payment of finance leases

(577

)

(1,938

)

Net cash provided by (used in) financing

activities

2,009

(928

)

Effect of exchange rate changes on cash

and cash equivalents

424

238

Increase (decrease) in cash, cash

equivalents and restricted cash

(13,580

)

(38,576

)

Cash, cash equivalents and restricted

cash, beginning of period

58,848

79,765

Cash, cash equivalents and restricted

cash, end of period

$

45,268

$

41,189

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107174340/en/

Investor Brinlea C. Johnson The Blueshirt Group Semrush

Holdings, Inc. ir@semrush.com

Media Jena Sullivan Senior Public Relations Manager

Semrush Holdings, Inc. jena.sullivan@semrush.com

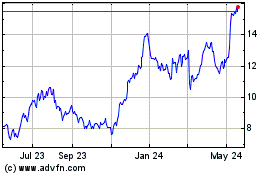

SEMrush (NYSE:SEMR)

Historical Stock Chart

From Nov 2024 to Dec 2024

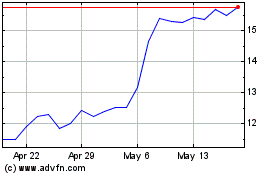

SEMrush (NYSE:SEMR)

Historical Stock Chart

From Dec 2023 to Dec 2024