TDCX Inc. (“TDCX” or the “Company”) (NYSE: TDCX), an

award-winning digital customer experience (CX) solutions provider

for technology and blue-chip companies, today announced the

completion of the merger (the “Merger”) contemplated by the

Agreement and Plan of Merger (the “Merger Agreement”), dated March

1, 2024, by and among the Company, Transformative Investments Pte

Ltd, an exempted company incorporated with limited liability under

the laws of the Cayman Islands (“Parent”), and Helium, an exempted

company incorporated with limited liability under the laws of the

Cayman Islands and a wholly-owned subsidiary of Parent (“Merger

Sub”), pursuant to which the Company was acquired by Mr. Laurent

Junique, Founder, Executive Chairman, Director, CEO of the Company

and his affiliates (the “Buyer Group”). Merger Sub merged with and

into the Company, effective as of June 18, 2024 (the “Effective

Time”), with the Company being the surviving company. As a result

of the Merger, TDCX became a private company wholly owned by Parent

and will cease to be a publicly traded company.

Pursuant to the terms of the Merger Agreement, at the Effective

Time, (i) each Class A ordinary share, par value US$0.0001 per

share, of the Company (each a “Class A Share”) and each Class B

ordinary share, par value US$0.0001 per share, of the Company (each

a “Class B Share”, and together with each Class A Share,

collectively, the “Shares”) issued and outstanding immediately

prior to the Effective Time (other than the Excluded Shares (as

defined in the Merger Agreement), the Dissenting Shares (as defined

in the Merger Agreement) and Shares represented by ADSs (as defined

below), shall be cancelled and cease to exist in exchange for the

right to receive US$7.20 in cash per Share without interest (the

“Per Share Merger Consideration”); (ii) each American Depositary

Share, representing one (1) Class A Share (each, an “ADS” or,

collectively, the “ADSs”), issued and outstanding immediately prior

to the Effective Time (other than ADSs representing the Excluded

Shares), and each Share represented by such ADSs, shall be

cancelled and cease to exist in exchange for the right to receive

US$7.20 in cash per ADS without interest (the “Per ADS Merger

Consideration”) (less applicable fees, charges and expenses payable

by ADS holders pursuant to the deposit agreement, dated September

30, 2021, entered into by and among the Company, JPMorgan Chase

Bank, N.A. and the holders and beneficial owners of the ADSs, and

any applicable taxes and other governmental charges); and (iii)

each warrant granted and vested pursuant to the Warrant Agreement

to Purchase American Depositary Shares of TDCX Inc. dated September

2, 2022 between the Company and a certain shareholder, issued and

outstanding immediately prior to the Effective Time shall be

cancelled and cease to exist in exchange for the right to receive

US$7.19 in cash per vested warrant without interest (the “Per

Warrant Merger Consideration”, together with the Per Share Merger

Consideration and the Per ADS Merger Consideration, the “Merger

Consideration”), in each case, net of any applicable withholding

taxes.

Each registered holder of Shares or ADSs immediately prior to

the Effective Time who is entitled to the Merger Consideration will

receive a letter of transmittal and instructions from the paying

agent on how to surrender their Shares or ADSs in exchange for the

Merger Consideration in respect of each Share or ADS held thereby,

and should wait to receive the letter of transmittal before

surrendering their Shares or ADSs.

Because Merger Sub owned over 90% of the voting power

represented by all issued and outstanding shares of TDCX prior to

the effectiveness of the Merger and the Merger was in the form of a

short-form merger in accordance with Section 233(7) of the Cayman

Islands Companies Act, the Merger was not subject to a vote of the

shareholders of TDCX.

TDCX requested that trading of its ADSs on the New York Stock

Exchange (the “NYSE”) be suspended prior to the opening of trading

on June 20, 2024. The Company requested that the NYSE file a Form

25 with the U.S. Securities and Exchange Commission (the “SEC”)

notifying the SEC of the delisting of the ADSs on the NYSE and the

deregistration of the Company’s registered securities.

TDCX intends to file with the SEC a Form 15 suspending TDCX’s

reporting obligations under the Securities Exchange Act of 1934.

TDCX’s obligations to file with or furnish to the SEC certain

reports and forms, including Form 20-F and Form 6-K, will be

suspended immediately as of the filing date of the Form 15 and will

terminate once the deregistration becomes effective.

In connection with the Merger, Houlihan Lokey (China) Limited is

serving as financial advisor to the committee of independent and

disinterested directors established by TDCX’s board of directors

(the “Special Committee”). Hogan Lovells is serving as U.S. legal

counsel to the Special Committee. Maples and Calder (Hong Kong) LLP

is serving as Cayman Islands legal counsel to the Special

Committee.

Goldman Sachs (Singapore) Pte. is serving as financial advisor

to the Buyer Group. Skadden, Arps, Slate, Meagher & Flom LLP is

serving as U.S. legal counsel to the Buyer Group. Travers Thorp

Alberga is serving as Cayman Islands legal counsel to the Buyer

Group.

Safe Harbor Statement

This announcement contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. In some cases,

you can identify these forward-looking statements by the use of

words such as “outlook,” “believes,” “expects,” “potential,”

“continues,” “may,” “will,” “should,” “could,” “seeks,” “predicts,”

“intends,” “trends,” “plans,” “estimates,” “anticipates” or the

negative version of these words or other comparable words. The

Company may also make written or oral forward-looking statements in

its periodic reports to the SEC, in its annual report to

shareholders, in press releases and other written materials and in

oral statements made by its officers, directors or employees to

third parties. Statements that are not historical facts, including

statements about the Company’s beliefs and expectations, are

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties, including the possibility that

the Merger will not occur as planned if events arise that result in

the termination of the Merger Agreement, if the expected financing

for the Merger is not available for any reason, or if one or more

of the various closing conditions to the Merger are not satisfied

or waived, and other risks and uncertainties regarding the Merger

Agreement and the Merger that will be discussed in the Schedule

13E-3 to be filed with the SEC. All information provided in this

press release is as of the date of this press release, and the

Company undertakes no obligation to update any forward-looking

statement, except as required under applicable law. You should not

rely upon these forward-looking statements as predictions of future

events.

About TDCX Inc.

Singapore-headquartered TDCX provides transformative digital CX

solutions, enabling world-leading and disruptive brands to acquire

new customers, to build customer loyalty and to protect their

online communities.

TDCX helps clients achieve their customer experience aspirations

by harnessing technology, human intelligence and its global

footprint. It serves clients in fintech, gaming, technology, travel

and hospitality, digital advertising and social media, streaming

and e-commerce. TDCX’s expertise and strong footprint in Asia has

made it a trusted partner for clients, particularly high-growth,

new economy companies, looking to tap the region’s growth

potential.

TDCX’s commitment to delivering positive outcomes for our

clients extends to its role as a responsible corporate citizen. Its

Corporate Social Responsibility program focuses on positively

transforming the lives of its people, its communities and the

environment.

TDCX employs more than 17,800 employees across 30 campuses

globally, specifically in Brazil, Colombia, Hong Kong, India,

Indonesia, Japan, Malaysia, Mainland China, Philippines, Romania,

Singapore, South Korea, Spain, Thailand, Türkiye, and Vietnam. For

more information, please visit www.tdcx.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240618921244/en/

For enquiries:

Investors / Analysts: Joana Cheong investors@tdcx.com

Media: Eunice Seow media@tdcx.com

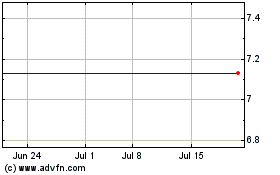

TDCX (NYSE:TDCX)

Historical Stock Chart

From Nov 2024 to Dec 2024

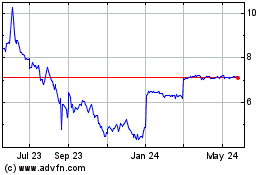

TDCX (NYSE:TDCX)

Historical Stock Chart

From Dec 2023 to Dec 2024