- Delivered Revenue and Earnings Ahead of the Company’s

Outlook led by Growth at Coach

- Achieved Diluted EPS of $0.79 and Record non-GAAP Diluted

EPS of $1.02

- Fueled 280 Basis Points of Gross Margin Expansion and Strong

Operating and Free Cash Flow

Link to Download Tapestry’s Q1 Earnings Presentation, Including

Brand Highlights

Tapestry, Inc. (NYSE: TPR), a house of iconic accessories and

lifestyle brands consisting of Coach, Kate Spade, and Stuart

Weitzman, today reported results for the fiscal first quarter ended

September 28, 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241107011142/en/

(Photo: Business Wire)

Joanne Crevoiserat, Chief Executive Officer of Tapestry, Inc.,

said, “Our first quarter results outperformed expectations,

showcasing the brand magic and operational excellence that fuel our

strategic growth agenda. Our talented global teams fostered

consumer connections through innovative products, experiences, and

storytelling, while managing our business with focus and discipline

against a dynamic backdrop. We remain in a position of strength,

with distinctive brands, an agile platform, and robust cash flow

that provide us with strategic and financial flexibility to deliver

accelerated organic growth and enhanced value creation in FY25 and

for years to come.”

Tapestry, Inc. Strategic &

Financial Highlights

The Company advanced its strategic priorities throughout the

quarter, resulting in double-digit adjusted EPS growth and strong

cash flow generation despite the complex global economic and

consumer environment. Highlights included:

Build Lasting Customer Relationships

- Drove customer engagement across brands, acquiring

approximately 1.4 million new customers in North America alone, of

which over half were Gen Z and Millennials.

Power Global Growth

- Delivered revenue approximately in-line with prior year on a

reported and constant currency basis, ahead of the Company’s

outlook; drove topline growth at Coach, which continued

to outpace expectations at increasing profitability;

- Achieved International topline gains of 2% at constant

currency, which included strength in Europe (+27%), partially

offset, as expected, by a decrease in revenue in total APAC

(-2%);

- Realized a 1% sales decline in North America, which

included the planned decrease in wholesale; delivered higher

operating margin and profit dollars in the region compared to last

year driven by gross margin expansion;

- Drove double-digit adjusted earnings per diluted share

growth, ahead of expectations, while making ongoing strategic

investments in brand-building, notably through marketing;

- Generated strong cash flow from operating activities of

$120 million and free cash flow of $94 million, fueling the

Company’s long-term growth agenda and shareholder return program

via its dividend.

Deliver Compelling Omni-Channel Experiences

- Provided unique and seamless omni-channel experiences, with

a focus on driving brand desire, consumer connections, and cultural

relevance, underpinned by Tapestry’s data-driven, customer

engagement platform;

- Achieved direct-to-consumer sales in-line with prior

year on a constant currency basis, which included a high-single

digit increase in Digital revenue and a low-single digit decline in

global brick and mortar sales.

Fuel Fashion Innovation and Product Excellence

- Delivered strong innovation to consumers, highlighted by

Coach, which drove handbag revenue growth and AUR gains;

- Remained disciplined brand-builders and operators,

underscored by significant gross margin expansion of 280 basis

points, which included operational outperformance, lower

freight expense, and FX tailwinds;

- Leveraged Tapestry’s agile supply chain to deliver

creativity, value, and craftsmanship globally, while enabling

diligent inventory management against a rapidly shifting

landscape.

Overview of Fiscal 2025 First Quarter

Financial Results

- Net sales totaled $1.51 billion, approximately in-line

with prior year on both a reported and constant currency basis. FX

represented a 40-basis point headwind in the quarter due to the

appreciation of the U.S. Dollar.

- Gross profit totaled $1.13 billion, while gross margin

was 75.3%, driven by operational improvements of 180 basis points,

as well as a benefit of 60 basis points from lower freight expense,

as well as FX tailwinds. This compared to prior year gross profit

of $1.10 billion, representing a gross margin of 72.5%.

- SG&A expenses totaled $883 million and represented

58.6% of sales on a reported basis. On a non-GAAP basis, SG&A

expenses totaled $850 million and represented 56.4% of sales. In

the prior year period, SG&A expenses totaled $845 million and

represented 55.8% of sales on a reported basis and totaled $825

million and represented 54.5% of sales on a non-GAAP basis.

- Operating income was $252 million on a reported basis,

while operating margin was 16.7%. On a non-GAAP basis, operating

income was $285 million, while operating margin was 18.9%. This

compares to reported operating income of $253 million and a 16.7%

operating margin and non-GAAP operating income of $273 million and

an 18.0% operating margin in the prior year period.

- Net interest was an expense of $31 million on a reported

basis and income of $7 million on a non-GAAP basis. This compared

to net interest expense in the prior year of $13 million on a

reported basis and $7 million on a non-GAAP basis.

- Other income was $4 million as compared to other expense

of $1 million in the prior year period.

- Net income was $187 million, with earnings per diluted

share of $0.79. On a non-GAAP basis, net income was $242 million,

with earnings per diluted share of $1.02. In the prior year period,

net income was $195 million, with earnings per diluted share of

$0.84. On a non-GAAP basis, net income in the prior year was $216

million, with earnings per diluted share of $0.93. On a reported

basis, the tax rate for the quarter was 17.3% or 18.5% on a

non-GAAP basis. In the prior year period, the tax rate was 18.2% or

18.3% on a non-GAAP basis.

Summary of Revenue Information

(Unaudited) – in USD millions

% Change

Quarter EndedSeptember 28, 2024

Reported Constant Currency Brand (in

millions) Coach

$

1,170.6

1

%

2

%

Kate Spade

283.2

-7

%

-6

%

Stuart Weitzman

53.7

2

%

2

%

Region North America

948.2

-1

%

-1

%

Greater China (1)

234.1

-4

%

-5

%

Japan

117.1

-8

%

-4

%

Other Asia (2)

86.8

11

%

10

%

Europe

94.3

27

%

27

%

Other (3)

27.0

2

%

2

%

Tapestry

$

1,507.5

0

%

0

%

(1) Greater China includes mainland China, Taiwan,

and Hong Kong SAR and Macao SAR. (2) Other Asia includes Malaysia,

Australia, New Zealand, South Korea, Singapore, and other countries

within Asia. (3) Other primarily represents royalties earned from

the Company's licensing partners and sales in the Middle East.

Balance Sheet and Cash Flow

Highlights

- Cash, cash equivalents and short-term investments

totaled $7.31 billion and total borrowings outstanding were

$7.31 billion, reflecting $6.1 billion in senior notes issued in

November 2023 to fund the proposed acquisition of Capri Holdings

Limited.

- Inventory was $1.03 billion compared to the prior year’s

ending inventory of $943 million, reflecting a higher level of

in-transits, consistent with expectations.

- Cash flow from operating activities for the first fiscal

quarter was an inflow of $120 million compared to an inflow $75

million in the prior year. Free cash flow was an inflow of

$94 million compared to an inflow of $54 million in the prior year.

This included CapEx and implementation costs related to

Cloud Computing of $30 million versus $29 million a year

ago.

Dividend

The Company’s Board of Directors declared a quarterly cash

dividend of $0.35 per common share payable on December 23, 2024 to

shareholders of record as of the close of business on December 6,

2024.

In Fiscal 2025, Tapestry continues to expect to return

approximately $325 million to shareholders through dividend

payments for an anticipated annual dividend rate of $1.40 per

share.

Non-GAAP Reconciliation

During the first fiscal quarter of 2025, Tapestry recorded

certain items that decreased the Company’s pre-tax income by $71

million, net income by $55 million, and earnings per diluted share

by $0.23. These items relate to acquisition costs, primarily

associated with financing and professional fees.

Please refer to Financial Schedules 3 and 4 included herein for

a detailed reconciliation of the Company’s reported GAAP to

non-GAAP results.

Financial Outlook

Tapestry is raising its Fiscal 2025 outlook, which is provided

on a non-GAAP basis. The Company now expects:

- Revenue of over $6.75 billion, representing growth of

approximately 1% to 2% versus prior year on a reported and constant

currency basis, and ahead of prior guidance for slight growth on

reported basis and approximately 1% on a constant currency

basis;

- Operating margin expansion over 50 basis points compared

to prior year;

- Net interest income of approximately $20 million;

- Tax rate of approximately 19%;

- Weighted average diluted share count of approximately

238 million shares;

- Earnings per diluted share of $4.50 to $4.55,

representing mid-single digit growth compared to the prior year,

and an increase from the Company’s prior guidance of $4.45 to

$4.50;

- Free cash flow of approximately $1.1 billion, excluding

deal-related costs.

Please note this outlook assumes the following:

- No revenue, net interest, or earnings impact related to the

proposed acquisition of Capri Holdings Limited;

- No impact from any potential future share repurchase activity

in the Fiscal Year;

- No further appreciation of the U.S. Dollar; information

provided based on spot rates at the time of forecast;

- No material worsening of inflationary pressures or consumer

confidence;

- No benefit from the potential reinstatement of the Generalized

System of Preferences (“GSP”); and

- No impact related to any potential policy changes resulting

from the outcome of U.S. Presidential election in November

2024.

Given the dynamic nature of these and other external factors,

financial results could differ materially from the outlook

provided.

Financial Outlook - Non-GAAP Adjustments: The Company is not

able to provide a full reconciliation of the non-GAAP financial

measures to GAAP presented in this release and on the Company’s

conference call because certain material items that impact these

measures, such as the timing and exact amount of acquisition,

financing, purchase accounting and integration-related charges and

Company costs associated with the acquisition of Capri Holdings

Limited have not yet occurred and cannot be reasonably estimated at

this time. Accordingly, a reconciliation of the Company’s non-GAAP

financial measure guidance to the corresponding GAAP measure is not

available without unreasonable effort.

Conference Call Details

The Company will host a conference call to review these results

at 8:00 a.m. (ET) today, November 7, 2024. Interested parties may

listen to the conference call via live webcast by accessing

www.tapestry.com/investors or calling 1-866-847-4217 or

1-203-518-9845 and providing the Conference ID 4306173. A telephone

replay will be available starting at 12:00 p.m. (ET) today for a

period of five business days. To access the telephone replay, call

1-800-283-4641 or 1-402-220-0851. A webcast replay of the earnings

conference call will also be available for five business days on

the Tapestry website. In addition, presentation slides have been

posted to the Company’s website at www.tapestry.com/investors.

Upcoming Events

The Company expects to report Fiscal 2025 second quarter results

on Thursday, February 6, 2025.

To receive notification of future announcements, please register

at www.tapestry.com/investors ("Subscribe to E-Mail Alerts").

About Tapestry, Inc.

Our global house of brands unites the magic of Coach, kate spade

new york and Stuart Weitzman. Each of our brands are unique and

independent, while sharing a commitment to innovation and

authenticity defined by distinctive products and differentiated

customer experiences across channels and geographies. We use our

collective strengths to move our customers and empower our

communities, to make the fashion industry more sustainable, and to

build a company that’s equitable, inclusive, and diverse.

Individually, our brands are iconic. Together, we can stretch

what’s possible. To learn more about Tapestry, please visit

www.tapestry.com. For important news and information regarding

Tapestry, visit the Investor Relations section of our website at

www.tapestry.com/investors. In addition, investors should continue

to review our news releases and filings with the SEC. We use each

of these channels of distribution as primary channels for

publishing key information to our investors, some of which may

contain material and previously non-public information. The

Company’s common stock is traded on the New York Stock Exchange

under the symbol TPR.

This information to be made available in this press release may

contain forward-looking statements based on management's current

expectations. Forward-looking statements include, but are not

limited to, the statements under “Financial Outlook,” statements

regarding long term performance, statements regarding the Company’s

capital deployment plans, including anticipated annual dividend

rates and share repurchase plans, and statements that can be

identified by the use of forward-looking terminology such as "may,"

“can,” “if,” "continue," “assume,” "should," "expect,"

“confidence,” “goals,” “trends,” “anticipate,” "intend,"

"estimate," “on track,” “future,” “plan,” “deliver,” “potential,”

“position,” “believe,” “will,” “target,” "guidance," "forecast,"

“outlook,” “commit,” “leverage,” “generate,” “enhance,”

“innovation,” “drive,” “effort,” “progress,” “confident,”

“uncertain,” “achieve,” “strategic,” “growth,” “proposed

acquisition,” “we can stretch what’s possible,” similar

expressions, and variations or negatives of these words. Future

results may differ materially from management's current

expectations, based upon a number of important factors, including

risks and uncertainties such as the impact of economic conditions,

recession and inflationary measures, risks associated with

operating in international markets and our global sourcing

activities, the ability to anticipate consumer preferences and

retain the value of our brands, including our ability to execute on

our e-commerce and digital strategies, the ability to successfully

implement the initiatives under our 2025 growth strategy, the

effect of existing and new competition in the marketplace, the

satisfaction of the conditions precedent to consummation of the

proposed acquisition of Capri Holdings Limited (“Capri”), including

the ability to secure regulatory approval in the United States on

the terms expected, at all or in a timely manner, our ability to

achieve intended benefits, cost savings and synergies from

acquisitions including our proposed acquisition of Capri, the

outcome of the antitrust lawsuit by the Federal Trade Commission

against us and Capri related to the consummation of the proposed

acquisition, our ability to control costs, the effect of seasonal

and quarterly fluctuations on our sales or operating results; the

risk of cybersecurity threats and privacy or data security

breaches, our ability to satisfy our outstanding debt obligations

or incur additional indebtedness, the risks associated with climate

change and other corporate responsibility issues, the impact of tax

and other legislation, the risks associated with potential changes

to international trade agreements and the imposition of additional

duties on importing our products, our ability to protect against

infringement of our trademarks and other proprietary rights, and

the impact of pending and potential future legal proceedings, etc.

In addition, purchases of shares of the Company’s common stock will

be made subject to market conditions and at prevailing market

prices. Please refer to the Company’s latest Annual Report on Form

10-K and its other filings with the Securities and Exchange

Commission for a complete list of risks and important factors. The

Company assumes no obligation to revise or update any such

forward-looking statements for any reason, except as required by

law.

Schedule 1: Consolidated Statements of Operations

TAPESTRY, INC. CONSOLIDATED STATEMENTS OF OPERATIONS

For the Quarter Ended September 28, 2024

and September 30, 2023 (in

millions, except per share data)

(unaudited) QUARTER ENDED September 28, 2024

September 30, 2023 Net sales

$

1,507.5

$

1,513.2

Cost of sales

372.6

415.5

Gross profit

1,134.9

1,097.7

Selling, general and administrative expenses

882.9

844.5

Operating income (loss)

252.0

253.2

Interest expense, net

30.7

13.3

Other expense (income)

(4.4

)

1.4

Income (loss) before provision for income taxes

225.7

238.5

Provision (benefit) for income taxes

39.1

43.5

Net income (loss)

$

186.6

$

195.0

Net income (loss) per share: Basic

$

0.81

$

0.85

Diluted

$

0.79

$

0.84

Shares used in computing net income (loss) per share: Basic

231.5

228.3

Diluted

235.9

232.5

Schedule 2: Detail to Net Sales

TAPESTRY, INC. DETAIL TO NET SALES For the Quarter Ended September 28, 2024 and September

30, 2023 (in

millions) (unaudited) QUARTER ENDED

September 28, 2024 September 30, 2023 % Change

Constant Currency % Change Coach

$

1,170.6

$

1,157.4

1

%

2

%

Kate Spade

283.2

303.2

(7

)%

(6

)%

Stuart Weitzman

53.7

52.6

2

%

2

%

Total Tapestry

$

1,507.5

$

1,513.2

—

%

—

%

Schedules 3 & 4: Consolidated Segment Data and GAAP to

Non-GAAP Reconciliation

TAPESTRY, INC. GAAP TO NON-GAAP RECONCILIATION

(in millions, except per share

data) (unaudited)

For the Quarter Ended September 28, 2024 Items

Affecting Comparability GAAP Basis(As Reported)

Acquisition Costs Non-GAAP Basis(Excluding Items)

Gross Profit Coach

916.1

—

916.1

Kate Spade

189.6

—

189.6

Stuart Weitzman

29.2

—

29.2

Gross profit

$

1,134.9

$

—

$

1,134.9

SG&A expenses Coach

529.5

—

529.5

Kate Spade

162.6

—

162.6

Stuart Weitzman

36.6

—

36.6

Corporate

154.2

33.4

120.8

SG&A expenses

$

882.9

$

33.4

$

849.5

Operating income (loss) Coach

386.6

—

386.6

Kate Spade

27.0

—

27.0

Stuart Weitzman

(7.4

)

—

(7.4

)

Corporate

(154.2

)

(33.4

)

(120.8

)

Operating income (loss)

$

252.0

$

(33.4

)

$

285.4

Interest expense, net

30.7

37.4

(6.7

)

Provision for income taxes

39.1

(15.8

)

54.9

Net income (loss)

$

186.6

$

(55.0

)

$

241.6

Net income (loss) per diluted common share

$

0.79

$

(0.23

)

$

1.02

TAPESTRY, INC. GAAP TO NON-GAAP RECONCILIATION

(in millions, except per share

data) (unaudited)

For the Quarter Ended September 30, 2023 Items

Affecting Comparability GAAP Basis(As Reported)

Acquisition Costs Non-GAAP Basis(Excluding Items)

Gross Profit Coach

867.6

—

867.6

Kate Spade

198.9

—

198.9

Stuart Weitzman

31.2

—

31.2

Gross profit

$

1,097.7

$

—

$

1,097.7

SG&A expenses Coach

496.3

—

496.3

Kate Spade

172.3

—

172.3

Stuart Weitzman

39.8

—

39.8

Corporate

136.1

19.6

116.5

SG&A expenses

$

844.5

$

19.6

$

824.9

Operating income (loss) Coach

371.3

—

371.3

Kate Spade

26.6

—

26.6

Stuart Weitzman

(8.6

)

—

(8.6

)

Corporate

(136.1

)

(19.6

)

(116.5

)

Operating income (loss)

$

253.2

$

(19.6

)

$

272.8

Interest expense, net

13.3

6.7

6.6

Provision for income taxes

43.5

(5.0

)

48.5

Net income (loss)

$

195.0

$

(21.3

)

$

216.3

Net income (loss) per diluted common share

$

0.84

$

(0.09

)

$

0.93

Management utilizes non-GAAP and constant currency measures to

conduct and evaluate its business during its regular review of

operating results for the periods affected and to make decisions

about Company resources and performance. The Company believes

presenting these non-GAAP measures, which exclude items that are

not comparable from period to period, is useful to investors and

others in evaluating the Company’s ongoing operating and financial

results in a manner that is consistent with management’s evaluation

of business performance and understanding how such results compare

with the Company’s historical performance. Additionally, the

Company believes presenting these metrics on a constant currency

basis will help investors and analysts to understand the effect of

significant year-over-year foreign currency exchange rate

fluctuations on these performance measures and provide a framework

to assess how business is performing and expected to perform

excluding these effects.

The Company reports information in accordance with U.S.

Generally Accepted Accounting Principles ("GAAP"). The Company's

management does not, nor does it suggest that investors should,

consider non-GAAP financial measures in isolation from, or as a

substitute for, financial information prepared in accordance with

GAAP. Further, the non-GAAP measures utilized by the Company may be

unique to the Company, as they may be different from non-GAAP

measures used by other companies.

The Company operates on a global basis and reports financial

results in U.S. dollars in accordance with GAAP. Percentage

increases/decreases in net sales for the Company and each segment

have been presented both including and excluding currency

fluctuation effects from translating foreign-denominated sales into

U.S. dollars and compared to the same periods in the prior quarter

and fiscal year. The Company calculates constant currency net sales

results by translating current period net sales in local currency

using the prior year period’s currency conversion rate.

The segment operating income and supplemental segment SG&A

expenses presented in the Consolidated Segment Data, and GAAP to

non-GAAP Reconciliation Table above, as well as SG&A expense

ratio, and operating margin, are considered non-GAAP measures.

These measures have been presented both including and excluding

acquisition costs for the three months ended September 28, 2024 and

September 30, 2023. In addition, segment Operating Income (loss),

Net income (loss), and Net Income (loss) per diluted common share,

have been presented both including and excluding acquisition costs

for the three months ended September 28, 2024 and September 30,

2023.

The Company also presents free cash flow, which is a non-GAAP

measure, Free cash flow is calculated by taking the “Net cash flows

provided by (used in) operating activities” less “Purchases of

property and equipment” from the Condensed Consolidated Statement

of Cash Flows. The Company believes that free cash flow is an

important liquidity measure of the cash that is available after

capital expenditures for operational expenses and investment in our

business. The Company believes that free cash flow is useful to

investors because it measures the Company’s ability to generate or

use cash. Once our business needs and obligations are met, cash can

be used to maintain a strong balance sheet, invest in future growth

and return capital to stockholders. Adjusted EBITDA is calculated

as Net Income, excluding, Interest expense, Provision for income

taxes, Depreciation and amortization, Cloud computing amortization

costs, Share-based compensation and Items affecting comparability

including Acquisition and Integration costs.

Schedule 5: Condensed Consolidated Balance Sheets

TAPESTRY, INC. CONDENSED CONSOLIDATED BALANCE SHEETS

At September 28, 2024 and June 29,

2024 (in millions)

(unaudited) (audited) September 28,

2024 June 29, 2024 ASSETS Cash, cash equivalents

and short-term investments

$

7,305.2

$

7,203.8

Receivables

279.0

228.2

Inventories

1,030.8

824.8

Other current assets

530.5

546.9

Total current assets

9,145.5

8,803.7

Property and equipment, net

513.0

514.7

Operating lease right-of-use assets

1,293.6

1,314.4

Other assets

2,776.8

2,763.5

Total assets

$

13,728.9

$

13,396.3

LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable

$

544.0

$

452.2

Accrued liabilities

708.6

656.3

Current portion of operating lease liabilities

297.8

299.7

Current debt

303.4

303.4

Total current liabilities

1,853.8

1,711.6

Long-term debt

7,008.3

6,937.2

Long-term operating lease liabilities

1,196.0

1,224.2

Other liabilities

688.9

626.4

Stockholders' equity

2,981.9

2,896.9

Total liabilities and stockholders' equity

$

13,728.9

$

13,396.3

Schedule 6: Condensed Consolidated Statement of Cash

Flows

TAPESTRY, INC. CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

At September 28, 2024 and September 30,

2023 (in millions)

(unaudited) (unaudited) September 28,

2024 September 30, 2023 CASH FLOWS PROVIDED BY (USED

IN) OPERATING ACTIVITIES Net income (loss)

$

186.6

$

195.0

Adjustments to reconcile net income to net cash provided by (used

in) operating activities: Depreciation and amortization

40.9

44.3

Amortization of cloud computing arrangements

14.0

13.4

Other non-cash items

0.5

49.7

Changes in operating assets and liabilities

(122.5

)

(227.1

)

Net cash provided by (used in) operating activities

119.5

75.3

CASH FLOWS PROVIDED BY (USED IN) INVESTING ACTIVITIES

Purchases of property and equipment

(25.6

)

(20.9

)

Purchases of investments

(1,479.2

)

(1.9

)

Proceeds from maturities and sales of investments

1,694.9

—

Net cash provided by (used in) investing activities

190.1

(22.8

)

CASH FLOWS PROVIDED BY (USED IN) FINANCING ACTIVITIES

Payment of dividends

(81.4

)

(80.2

)

Other items

6.9

(69.2

)

Net cash provided by (used in) financing activities

(74.5

)

(149.4

)

Effect of exchange rate on cash and cash equivalents

85.8

(7.1

)

Net (decrease) increase in cash and cash equivalents

320.9

(104.0

)

Cash and cash equivalents at beginning of period

$

6,142.0

$

726.1

Cash and cash equivalents at end of period

$

6,462.9

$

622.1

Schedule 7: Store Count by Brand

TAPESTRY, INC. STORE COUNT At June

29, 2024 and September 28, 2024 (unaudited) As ofJune 29, 2024 As ofSeptember 28, 2024 Directly-Operated Store Count: Openings (Closures) Coach North America

324

2

(1)

325

International

606

4

(16)

594

Kate Spade

North America

197

3

(3)

197

International

181

3

(6)

178

Stuart Weitzman

North America

34

—

—

34

International

60

2

(2)

60

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107011142/en/

Tapestry, Inc. Media: Andrea Shaw Resnick Chief Communications

Officer 212/629-2618 aresnick@tapestry.com Analysts and Investors:

Christina Colone Global Head of Investor Relations 212/946-7252

ccolone@tapestry.com

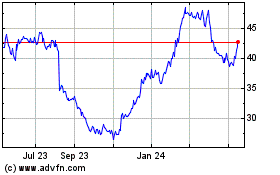

Tapestry (NYSE:TPR)

Historical Stock Chart

From Nov 2024 to Dec 2024

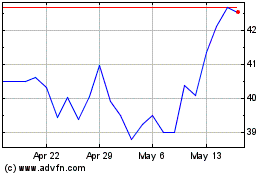

Tapestry (NYSE:TPR)

Historical Stock Chart

From Dec 2023 to Dec 2024