United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K/A

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

February 2025

Vale S.A.

Praia de Botafogo nº 186, 18º andar,

Botafogo

22250-145 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One)

Form 20-F x Form 40-F ¨

Explanatory note

Vale is amending its report on Form 6-K furnished to the Securities and Exchange Commission on February 20, 2025 (Accession No. 0001292814-25-000454)

(the “Original 6-K”) to insert conformed signatures on the Management’s Report on Internal Control over Financial Reporting

and on the Report of Independent Registered Public Accounting Firm. These reports were signed prior to the submission of the Original

6-K, but the conformed signatures were inadvertently omitted from the version filed via EDGAR. Except as described above, this amendment

does not amend any information in the Original 6-K.

Contents

Management’s Report on Internal Control over

Financial Reporting

The management of Vale S.A (Vale) is responsible for

establishing and maintaining adequate internal control over financial reporting.

Vale’s internal control over financial reporting

is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial

statements for external purposes in accordance with generally accepted accounting principles. The company’s internal control over

financial reporting includes those policies and procedures that: (i) pertain to the maintenance of records that, in reasonable detail,

accurately and fairly reflect the transactions and dispositions of the assets of the company; (ii) provide reasonable assurance that transactions

are recorded to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts

and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and

(iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s

assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control

over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of the effectiveness to future periods

are subject to the risk that controls may become inadequate because of changes in conditions, and that the degree of compliance with the

policies or procedures may deteriorate.

Vale’s management has assessed the effectiveness

of the company’s internal control over financial reporting as of December 31, 2024, based on the criteria established in Internal

Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Based

on such assessment and criteria, Vale’s management has concluded that the company’s internal control over financial reporting

is effective as of December 31, 2024.

The effectiveness of the company’s internal control

over financial reporting as of December 31, 2024, has been audited by PricewaterhouseCoopers Auditores Independentes Ltda., an independent

registered public accounting firm, as stated in their unqualified report which appears herein.

February 19th, 2025.

/s/ Gustavo Duarte Pimenta

Chief Executive Officer

/s/ Marcelo Feriozzi Bacci

Chief Financial Officer and Investors Relations

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders

Vale S.A.

Opinions on the Financial Statements and Internal Control over

Financial Reporting

We have audited the accompanying consolidated statement of financial

position of Vale S.A. and its subsidiaries (the “Company”) as of December 31, 2024 and 2023, and the related consolidated

income statement, statement of comprehensive income, statement of changes in equity and statements of cash flows for each of the three

years in the period ended December 31, 2024, including the related notes (collectively referred to as the “consolidated financial

statements”). We also have audited the Company’s internal control over financial reporting as of December 31, 2024, based

on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of

the Treadway Commission (COSO).

In our opinion, the consolidated financial statements referred to above

present fairly, in all material respects, the financial position of the Company as of December 31, 2024 and 2023, and the results of its

operations and its cash flows for each of the three years in the period ended December 31, 2024 in conformity with International Financial

Reporting Standards as issued by the International Accounting Standards Board. Also in our opinion, the Company maintained, in all material

respects, effective internal control over financial reporting as of December 31, 2024, based on criteria established in Internal Control

- Integrated Framework (2013) issued by the COSO.

Basis for Opinions

The Company's management is responsible for these consolidated financial

statements, for maintaining effective internal control over financial reporting, and for its assessment of the effectiveness of internal

control over financial reporting, included in the accompanying Management's Report on Internal Control over Financial Reporting. Our responsibility

is to express opinions on the Company’s consolidated financial statements and on the Company's internal control over financial reporting

based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB)

and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable

rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB.

Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements

are free of material misstatement, whether due to error or fraud, and whether effective internal control over financial reporting was

maintained in all material respects.

Our audits of the consolidated financial statements included performing

procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing

procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures

in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates

made by management, as well as evaluating the overall presentation of the consolidated financial statements. Our audit of internal control

over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material

weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our

audits also included performing such other procedures as we considered necessary in the circumstances. We believe that our audits provide

a reasonable basis for our opinions.

Definition and Limitations of Internal Control over Financial

Reporting

A company’s internal control over financial reporting is a process

designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements

for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting

includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and

fairly reflect the transactions and dispositions of the assets of the company; (ii) provide reasonable assurance that transactions

are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and

that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the

company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition

of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial

reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject

to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or

procedures may deteriorate.

Critical Audit Matters

The critical audit matters communicated below are matters arising from

the current period audit of the consolidated financial statements that were communicated or required to be communicated to the audit committee

and that (i) relate to accounts or disclosures that are material to the consolidated financial statements and (ii) involved our especially

challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the

consolidated financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate

opinions on the critical audit matters or on the accounts or disclosures to which they relate.

Provisions for de-characterization of dam structures

As described in Note 28(a) to the consolidated financial statements,

the Company's provision for de-characterization of all its tailings dams built under the upstream method located in Brazil amounted to

US$ 2,213 million as of December 31, 2024. Management applies significant judgment in developing the estimates for de-characterization

of the dams structures including (i) volume of the waste to be removed based on historical data available and interpretation of the enacted

laws and regulations; (ii) location availability for the tailings disposal; (iii) engineering methods and solutions; (iv) security levels;

(v) productivity of the equipment used; (vi) advances in geological studies and new hydrological information; and (vii) discount rate

update. In addition, as management has further disclosed, given the nature and uncertainties inherent in this type of provision, the amounts

recognized and disclosed will be reassessed by the Company at each reporting period and may be adjusted significantly in future periods,

as new facts and circumstances become known.

The principal considerations for our determination that performing

procedures relating to the provisions for de-characterization of the dam structures is a critical audit matter are (i) the significant

judgment by management, including the use of specialists, when developing the estimates of the total expected costs to carry out all de-characterization

projects related to the dams, which in turn led to (ii) a high degree of auditor judgment, subjectivity, and effort in performing procedures

and evaluating management's significant assumptions related to volume of the waste to be removed and engineering methods and solutions,

and (iii) the audit effort involved the use of professionals with specialized skill and knowledge.

Addressing the matter involved performing procedures and evaluating

audit evidence in connection with forming our overall opinion on the consolidated financial statements. These procedures included testing

the effectiveness of controls relating to management's estimates of the provision for de-characterization of the dams structures. The

work of management's specialists was used in performing the procedures to evaluate the reasonableness of the engineering solutions and

significant assumptions used by management related to volume of the waste to be removed and engineering methods to execute this removal.

As a basis for using this work, the specialists' qualifications were understood and the Company's relationship with these specialists

was assessed. The procedures performed also included evaluation of the methods and assumptions used by specialists and procedures to assess

whether these were consistent with internal and external references, as well as evidence available or obtained in other areas of the audit.

Additionally, these procedures included evaluating whether the assumptions related to volume of the waste to be removed, and engineering

methods and solutions were reasonable considering the information available according to the engineering phase of each project and the

historic information gathered from the ongoing de-characterization projects of the Company.

Tax litigation and uncertain tax positions

As described in Note 29 to the consolidated financial statements, the

Company has recognized provisions for tax litigations (other than income taxes) in the amount of US$ 201 million as of December 31, 2024,

and disclosed contingent liabilities related to tax litigation in the amount of US$ 5,995 million. The Company recognizes a provision

for tax litigation (other than income taxes) in the consolidated financial statements for the resolution of pending litigation when the

Company has a present obligation as a result of a past event and management determines that a loss is probable, and the amount of the

loss can be reasonably estimated, with the support of Company's specialists. No provision for tax litigation is recognized in the consolidated

financial statements for unfavorable outcomes when, after assessing the information available, (i) management concludes that it is not

probable that a loss has been incurred in any of the pending litigation; or (ii) management is unable to estimate the loss or range of

loss for any of the pending matters. The Company discloses information on contingent liabilities when management concludes that the risk

of loss is possible or it cannot reasonably estimate the amounts involved, but it is reasonably possible that a loss may be incurred.

Also, as described in Note 9(e) the Company disclosed the amount of

US$ 6,535 million related to uncertain income tax position which tax treatments acceptability will depend on taxation authorities’

decision in the future. In the case of uncertain income tax positions, management determines whether it is probable or not that taxation

authorities will accept the uncertain tax treatment. If management concludes it is not probable that taxation authorities will accept

the uncertain income tax treatment, a provision for income tax is recognized. The provision recognized for uncertain income tax positions

amounted to US$ 154 million as of December 31, 2024.

The principal considerations for our determination that performing

procedures relating to tax litigation and uncertain income tax position are a critical audit matter are (i) the significant judgments

by management when assessing the likelihood of a loss, when determining whether a reasonable estimate of the loss or range of loss and

possible outcomes for each tax litigation claim can be made and when assessing whether it is probable that a taxation authority will accept

an uncertain income tax treatment, which in turn led to a high degree of auditor judgment, subjectivity and effort in evaluating management's

assessment of the loss contingencies associated with litigation claims and acceptability of uncertain income tax positions; and (ii) the

audit effort involved the use of professionals with specialized skill and knowledge.

Addressing the matter involved performing procedures and evaluating

audit evidence in connection with forming our overall opinion on the consolidated financial statements. These procedures included testing

the effectiveness of controls relating to management's evaluation of tax litigation claims and uncertain income tax positions, including

controls over determining whether a loss is probable and whether the amount of loss can be reasonably estimated, or whether it is probable

the taxation authority will accept the uncertain income tax position, as well as financial statement disclosures. These procedures also

included, among others, obtaining and evaluating the letters of audit inquiry with internal and external legal counsel, evaluating the

reasonableness of management's assessment regarding whether unfavorable outcomes is reasonably possible or probable and reasonably estimable

and evaluating the sufficiency of the Company's tax litigation contingencies and uncertain income tax positions disclosures. The work

of Company's specialists was used in performing the procedures to evaluate the reasonableness of the estimates related to the tax litigation

claims and uncertain income tax positions. As a basis for using this work, the specialists' qualifications and objectivity were evaluated,

as well as the methods and assumptions used by them. The procedures also included an evaluation of the specialists' findings. In addition,

professionals with specialized skills and knowledge were used to assist in the evaluation of the reasonableness of the estimate or range

of loss and possible outcomes of the main tax litigation claims and uncertain tax positions.

Liabilities related to associates and joint ventures

As described in Note 27 to the consolidated financial statements, the

Company has recognized a provision related to the Samarco Mineração S.A. ("Samarco") dam failure in the amount

of US$ 3,663 million as of December 31, 2024, including additions to the provision for the year ended December 31, 2024, in the amount

of US$ 956 million. The Fundão tailings dam (the “Fundão Dam”) is owned by Samarco, a joint venture between

Vale S.A. and BHP Billiton Brasil Ltda. ("BHPB"), where the failure was experienced in November 2015. The Company and BHPB have

assumed responsibility in a proportion of fifty percent each for the obligations generated that cannot be financially fulfilled by Samarco

itself, the primary responsible party. In October 2024, Vale, Samarco, and BHPB, together with the Federal Government of Brazil, the State

Governments of Minas Gerais and Espírito Santo, the Federal and State Public Prosecutors’ and Public Defenders’ Offices

and other Brazilian public entities, signed a definitive agreement regarding claims related to the failure of the Fundão Dam (“Definitive

Agreement”). On December 31, 2024, the Company revised the estimates used to measure and recognize the provision related to the

Fundão Dam failure, considering the updated terms of the Definitive Agreement. As a result, the updated amount of the provision

recognized is based on the net present value of estimated cash outflows to be incurred and it requires the use of assumptions that can

significantly change its value due to: (i) the scope and costs to complete the commitments assumed in the context of the Definitive Agreement;

(ii) the extent to which Samarco will be able to directly fulfill the agreed future obligations; (iii) the resolution of existing and

potential future legal claims; and (iv) the updates to the discount rates. In addition, as management has further disclosed, given the

nature and uncertainties inherent in this type of provision, future expenditures may differ from the amounts currently provided for and

changes to key assumptions could result in a material impact to the amount of the provision in future reporting periods.

The principal considerations for our determination that performing

procedures relating to the provisions related to the Samarco Fundão Dam failure is a critical audit matter are (i) the significant

judgment by management, including the use of legal advisors, when developing the estimates of the total expected cash outflows, which

in turn led to (ii) a high degree of auditor judgment, subjectivity, and effort in performing procedures and evaluating management's significant

assumptions, and (iii) the audit effort involved the use of professionals with specialized skill and knowledge.

Addressing the matter involved performing procedures and evaluating

audit evidence in connection with forming our overall opinion on the consolidated financial statements. These procedures included testing

the effectiveness of controls relating to management's estimates of the provision related to the Samarco Fundão Dam failure. The

procedures also included, among others, the assessment of the information contained in the Definitive Agreement, which resulted in the

additional amount of provision recognized in the year ended December 31, 2024. In addition, the procedures included evaluating the reasonableness

of the models, the data, the application of discount rate and other assumptions used to form the provision estimate, with the involvement

of our internal experts with specialized skills and knowledge, which also included sensitivity analysis of the main assumptions used and

the impacts of their possible changes on the calculated provision. The procedures also included evaluating the accounting treatment adopted

by the Company to recognize the provision and its movements in the year ended December 31, 2024, as well as financial statements disclosures.

Impairment of goodwill and other long lived non-financial assets

As described in Note 20 to the consolidated financial statements, the

Company's goodwill balance totaled US$ 3,038 million as of December 31, 2024. As described in Note 20, management tests impairment of

goodwill at least on an annual basis, or more frequently if events or circumstances indicate that the carrying value of goodwill may be

impaired. Management also evaluates impairment indicators for the other long- lived non-financial assets, such as intangible and property

plant and equipment. An impairment loss is recognized when the recoverable amount of an asset or cash generating unit (CGU), determined

at its fair value less costs to disposal (FVLCD), is above its carrying amount. Fair value is generally estimated by management using

discounted cash flow models. Management's cash flow projections used to estimate the recoverable amount of assets or CGUs included significant

judgments and assumptions relating to (i) long-term future metal prices; and (ii) discount rates. During the year ended December 31, 2024,

the Company recognized impairment losses of US$ 2,210 million, mainly related to nickel operations in Thompson and Newfoundland and Labrador,

both located in Canada.

The principal considerations for our determination that performing

procedures relating to impairment tests for goodwill and other long lived non-financial assets is a critical audit matter are due to the

significant judgments applied by management when developing the fair value measurement of assets and CGUs. This led to a high degree of

auditor judgment, subjectivity, and effort in performing procedures and evaluating management's cash flow projections and significant

assumptions, related to long-term future metal prices and discount rates. In addition, the audit effort involved the use of professionals

with specialized skills and knowledge.

Addressing the matter, involved performing procedures and evaluating

audit evidence in connection with forming our overall opinion on the consolidated financial statements. These procedures included testing

the effectiveness of the controls related to management's impairment assessment of goodwill and other long lived non-financial assets,

including controls over the valuation of assets and CGUs. These procedures also considered, among others (i) testing management's process

for developing the fair value estimates; (ii) evaluating the appropriateness of the discounted cash flow models; (iii) testing the completeness

and accuracy of the underlying data used in the models; and (iv) evaluating the reasonableness of the significant assumptions used by

management related to the long-term future metal prices and discount rates. Assessing these management's significant assumptions involved

evaluating whether the assumptions used by management were reasonable considering (i) the current and past performance of assets and CGUs;

(ii) the consistency with external market and industry data; and (iii) whether these assumptions were consistent with evidence obtained

in other areas of the audit. Professionals with specialized skills and knowledge were used to assist in the evaluation of the Company's

discounted cash flow models, and the long-term future metal prices and the discount rate assumptions.

/s/ PricewaterhouseCoopers Auditores Independentes Ltda.

Rio de Janeiro, Brazil

February 19, 2025

We have served as the Company’s auditor since 2019.

Consolidated Income Statement

In millions of United States dollars, except earnings per share

| |

|

Year ended December 31, |

| |

Notes |

2024 |

2023 |

2022 |

| Continuing operations |

|

|

|

|

| Net operating revenue |

5(b) |

38,056 |

41,784 |

43,839 |

| Cost of goods sold and services rendered |

6(a) |

(24,265) |

(24,089) |

(24,028) |

| Gross profit |

|

13,791 |

17,695 |

19,811 |

| |

|

|

|

|

| Operating expenses |

|

|

|

|

| Selling and administrative |

6(b) |

(622) |

(553) |

(515) |

| Research and development |

|

(790) |

(723) |

(660) |

| Pre-operating and operational stoppage |

28 |

(403) |

(450) |

(479) |

| (Impairment), reversal of impairment and gains (losses) on disposal of non-current assets, net |

18, 19 and 20 |

301 |

(266) |

773 |

| Other operating revenues (expenses), net |

6(c) |

(1,489) |

(1,498) |

(1,722) |

| Operating income |

|

10,788 |

14,205 |

17,208 |

| |

|

|

|

|

| Financial income |

7 |

422 |

432 |

520 |

| Financial expenses |

7 |

(1,473) |

(1,459) |

(1,179) |

| Other financial items, net |

7 |

(2,772) |

(919) |

2,927 |

| Equity results and other results in associates and joint ventures |

16 and 27 |

(269) |

(1,108) |

305 |

| Income before income taxes |

|

6,696 |

11,151 |

19,781 |

| |

|

|

|

|

| Income taxes |

9(a) |

(721) |

(3,046) |

(2,971) |

| |

|

|

|

|

| Net income from continuing operations |

|

5,975 |

8,105 |

16,810 |

| (Loss) net income from continuing operations attributable to noncontrolling interests |

|

(191) |

122 |

82 |

| Net income from continuing operations attributable to Vale S.A.'s shareholders |

|

6,166 |

7,983 |

16,728 |

| |

|

|

|

|

| Discontinued operations |

|

|

|

|

| Net income from discontinued operations attributable to Vale S.A.'s shareholders |

17(l) |

- |

- |

2,060 |

| |

|

|

|

|

| Net income |

|

5,975 |

8,105 |

18,870 |

| (Loss) net income attributable to noncontrolling interests |

|

(191) |

122 |

82 |

| Net income attributable to Vale S.A.'s shareholders |

|

6,166 |

7,983 |

18,788 |

| |

|

|

|

|

| Basic and diluted earnings per share from continuing operations |

10 |

|

|

|

| Common share (US$) |

|

1.44 |

1.83 |

3.61 |

| |

|

|

|

|

| Basic and diluted earnings per share attributable to Vale's shareholders |

10 |

|

|

|

| Common share (US$) |

|

1.44 |

1.83 |

4.05 |

The accompanying notes are an integral part of these consolidated

financial statements.

Consolidated Statement of Comprehensive

Income

In millions of United States dollars

| |

|

Year ended December 31, |

| |

Notes |

2024 |

2023 |

2022 |

| Net income |

|

5,975 |

8,105 |

18,870 |

| Other

comprehensive income (loss): |

|

|

|

|

| Items that will not be reclassified to income statement |

|

|

|

|

| Translation adjustments of the Parent Company |

|

(9,172) |

2,966 |

2,259 |

| Retirement benefit obligations |

|

102 |

(68) |

269 |

| Adjustments to fair value in equity interests measured at fair value through other comprehensive income |

|

- |

13 |

- |

| |

|

(9,070) |

2,911 |

2,528 |

| |

|

|

|

|

| Items that may be reclassified to income statement |

|

|

|

|

| Translation adjustments of foreign operations |

|

2,237 |

(522) |

(1,306) |

| Net investment hedge |

21(a.iv) |

(500) |

139 |

81 |

| Cash flow hedge |

21(a.iv) |

- |

(19) |

19 |

| Reclassification of cumulative translation adjustment to income statement (i) |

17(b) and 17(d) |

(1,115) |

- |

(4,830) |

| |

|

622 |

(402) |

(6,036) |

| Comprehensive income (loss) |

|

(2,473) |

10,614 |

15,362 |

| |

|

|

|

|

| Comprehensive income (loss) attributable to noncontrolling interests |

|

(284) |

125 |

80 |

| Comprehensive income attributable to Vale S.A.'s shareholders |

|

(2,189) |

10,489 |

15,282 |

| (i) | | For the year ended December 31, 2024, mainly related to the effect of the reclassification

of cumulative translation adjustments to the consolidated income statement, as a consequence of the divestiture and loss of control over

of Vale Oman Distribution Center and PT Vale Indonesia Tbk in the amounts of US$112 and US$1,063, respectively (notes 17b and 17d). |

Items above are stated net of tax, when applicable, and the

related taxes effects are disclosed in note 9.

The accompanying notes are an integral part of these consolidated

financial statements.

Consolidated Statement of Cash

Flows

In millions of United States dollars

| |

|

Year ended December 31, |

| |

Notes |

2024 |

2023 |

2022 |

| Cash flow from operations |

11(a) |

13,767 |

17,252 |

18,762 |

| Interest on loans and borrowings paid |

11(c) |

(868) |

(743) |

(785) |

| Cash received (paid) on settlement of derivatives, net |

21 |

11 |

567 |

(83) |

| Payments related to Brumadinho event |

26 |

(909) |

(1,330) |

(1,093) |

| Payments related to de-characterization of dams |

28 |

(533) |

(458) |

(349) |

| Interest on participative shareholders' debentures paid |

23 |

(243) |

(233) |

(371) |

| Income taxes (including settlement programs) paid |

|

(1,859) |

(1,890) |

(4,637) |

| Net cash generated by operating activities from continuing operations |

|

9,366 |

13,165 |

11,444 |

| Net cash generated by operating activities from discontinued operations |

17(l) |

- |

- |

41 |

| Net cash generated by operating activities |

|

9,366 |

13,165 |

11,485 |

| |

|

|

|

|

| Cash flow from investing activities: |

|

|

|

|

| Acquisition of property, plant and equipment and intangible assets |

|

(6,447) |

(5,920) |

(5,446) |

| Payments related to the Samarco dam failure |

27 |

(808) |

(553) |

(338) |

| Advanced payment related to renegotiation of railway concession contracts |

15 |

(656) |

- |

- |

| Cash received (paid) from disposal and acquisition of investments, net |

11(b) |

2,687 |

(139) |

577 |

| Dividends received from associates and joint ventures |

|

81 |

204 |

219 |

| Short-term investment |

|

(85) |

127 |

260 |

| Other investing activities, net |

|

(140) |

(38) |

145 |

| Net cash used in investing activities from continuing operations |

|

(5,368) |

(6,319) |

(4,583) |

| Net cash used in investing activities from discontinued operations |

17(l) |

- |

- |

(103) |

| Net cash used in investing activities |

|

(5,368) |

(6,319) |

(4,686) |

| |

|

|

|

|

| Cash flow from financing activities: |

|

|

|

|

| Loans and borrowings from third parties |

11(c) |

4,855 |

1,950 |

1,275 |

| Payments of loans and borrowings to third parties |

11(c) |

(2,605) |

(658) |

(2,300) |

| Payments of leasing |

25 |

(202) |

(233) |

(224) |

| Dividends and interest on capital paid to Vale’s shareholders |

31(e) |

(3,914) |

(5,513) |

(6,603) |

| Dividends and interest on capital paid to noncontrolling interest |

|

- |

(41) |

(12) |

| Shares buyback program |

31(c) |

(409) |

(2,714) |

(6,036) |

| Acquisition of additional stake in VOPC |

17(g) |

- |

(130) |

- |

| Net cash used in financing activities from continuing operations |

|

(2,275) |

(7,339) |

(13,900) |

| Net cash used in financing activities from discontinued operations |

17(l) |

- |

- |

(11) |

| Net cash used in financing activities |

|

(2,275) |

(7,339) |

(13,911) |

| |

|

|

|

|

| Net increase (decrease) in cash and cash equivalents |

|

1,723 |

(493) |

(7,112) |

| Cash and cash equivalents in the beginning of the year |

|

3,609 |

4,736 |

11,721 |

| Effect of exchange rate changes on cash and cash equivalents |

|

(454) |

69 |

138 |

| Effect of transfer PTVI to non-current assets held for sale |

17(d) |

- |

(703) |

- |

| Cash and cash equivalents from subsidiaries acquired and sold, net |

|

75 |

- |

(11) |

| Cash and cash equivalents at end of the year |

|

4,953 |

3,609 |

4,736 |

The accompanying notes are an integral part of these consolidated

financial statements.

Consolidated Statement of Financial

Position

In millions of United States dollars

| |

Notes |

December 31, 2024 |

December 31, 2023 |

| Assets |

|

|

|

| Current assets |

|

|

|

| Cash and cash equivalents |

22 |

4,953 |

3,609 |

| Short-term investments |

22 |

53 |

51 |

| Accounts receivable |

12 |

2,358 |

4,197 |

| Other financial assets |

15 |

53 |

271 |

| Inventories |

13 |

4,605 |

4,684 |

| Recoverable taxes |

9(f) |

1,100 |

900 |

| Judicial deposits |

29(c) |

- |

611 |

| Other |

|

359 |

444 |

| |

|

13,481 |

14,767 |

| Non-current assets held for sale |

17(d) |

- |

3,933 |

| |

|

13,481 |

18,700 |

| Non-current assets |

|

|

|

| Judicial deposits |

29(c) |

537 |

798 |

| Other financial assets |

15 |

82 |

593 |

| Recoverable taxes |

9(f) |

1,297 |

1,374 |

| Deferred income taxes |

9(b) |

8,244 |

9,565 |

| Other |

|

1,466 |

1,257 |

| |

|

11,626 |

13,587 |

| |

|

|

|

| Investments in associates and joint ventures |

16 |

4,547 |

1,872 |

| Intangibles |

18 |

10,514 |

11,631 |

| Property, plant, and equipment |

19 |

39,984 |

48,396 |

| |

|

66,671 |

75,486 |

| Total assets |

|

80,152 |

94,186 |

| Liabilities |

|

|

|

| Current liabilities |

|

|

|

| Suppliers and contractors |

14 |

4,234 |

5,272 |

| Loans and borrowings |

24 |

1,020 |

824 |

| Leases |

25 |

147 |

197 |

| Other financial liabilities |

15 |

1,543 |

1,676 |

| Taxes payable |

9(f) |

574 |

1,314 |

| Settlement programs ("REFIS") |

9(d) |

353 |

428 |

| Liabilities related to Brumadinho |

26 |

714 |

1,057 |

| Liabilities related to associates and joint ventures |

27 |

1,844 |

837 |

| De-characterization of dams and asset retirement obligations |

28 |

833 |

1,035 |

| Provisions for litigation |

29 |

119 |

114 |

| Employee benefits |

30 |

1,012 |

964 |

| Dividends payable |

|

330 |

- |

| Other |

|

367 |

376 |

| |

|

13,090 |

14,094 |

| Liabilities associated with non-current assets held for sale |

17(d) |

- |

561 |

| |

|

13,090 |

14,655 |

| Non-current liabilities |

|

|

|

| Loans and borrowings |

24 |

13,772 |

11,647 |

| Leases |

25 |

566 |

1,255 |

| Participative shareholders' debentures |

23 |

2,217 |

2,874 |

| Other financial liabilities |

15 |

2,347 |

3,373 |

| Settlement programs ("REFIS") |

9(d) |

1,007 |

1,723 |

| Deferred income taxes |

9(b) |

445 |

870 |

| Liabilities related to Brumadinho |

26 |

1,256 |

2,003 |

| Liabilities related to associates and joint ventures |

27 |

1,819 |

3,590 |

| De-characterization of dams and asset retirement obligations |

28 |

4,930 |

6,694 |

| Provisions for litigation |

29 |

894 |

885 |

| Employee benefits |

30 |

1,118 |

1,381 |

| Streaming transactions |

8 |

1,882 |

1,962 |

| Other |

|

281 |

293 |

| |

|

32,534 |

38,550 |

| Total liabilities |

|

45,624 |

53,205 |

| |

|

|

|

| Equity |

31 |

|

|

| |

|

|

|

| Equity attributable to Vale S.A.'s shareholders |

|

33,406 |

39,461 |

| Equity attributable to noncontrolling interests |

|

1,122 |

1,520 |

| Total equity |

|

34,528 |

40,981 |

| Total liabilities and equity |

|

80,152 |

94,186 |

The accompanying notes are an integral part of these consolidated

financial statements.

Consolidated Statement of Changes in Equity

In millions of United States dollars

| |

Notes |

Share

capital |

Capital

reserve |

Profit

reserves |

Treasury

shares |

Other

reserves |

Cumulative

translation adjustments |

Retained

earnings |

Equity

attributable to Vale S.A.’s shareholders |

Equity

attributable to noncontrolling interests |

Consolidated equity |

| Balance

as of December 31, 2021 |

|

61,614 |

1,139 |

15,702 |

(5,579) |

(1,960) |

(36,444) |

- |

34,472 |

834 |

35,306 |

| Net

income |

|

- |

- |

- |

- |

- |

- |

18,788 |

18,788 |

82 |

18,870 |

| Other

comprehensive income |

|

- |

- |

756 |

- |

269 |

(4,531) |

- |

(3,506) |

(2) |

(3,508) |

| Dividends

and interest on capital of Vale S.A.'s shareholders |

31(d) |

- |

- |

(3,500) |

- |

- |

- |

(4,386) |

(7,886) |

- |

(7,886) |

| Dividends

of noncontrolling interest |

|

- |

- |

- |

- |

- |

- |

- |

- |

(7) |

(7) |

| Transaction

with noncontrolling interests |

17

(l) |

- |

- |

- |

- |

- |

- |

- |

- |

584 |

584 |

| Appropriation

to undistributed retained earnings |

|

- |

- |

14,402 |

- |

- |

- |

(14,402) |

- |

- |

- |

| Shares

buyback program |

31(c) |

- |

- |

- |

(6,036) |

- |

- |

- |

(6,036) |

- |

(6,036) |

| Share-based

payment program |

30(b) |

- |

- |

- |

- |

16 |

- |

- |

16 |

- |

16 |

| Treasury

shares used and canceled |

31(b) |

- |

- |

(6,616) |

6,635 |

- |

- |

- |

19 |

- |

19 |

| Balance

as of December 31, 2022 |

|

61,614 |

1,139 |

20,744 |

(4,980) |

(1,675) |

(40,975) |

- |

35,867 |

1,491 |

37,358 |

| Net

income |

|

- |

- |

- |

- |

- |

- |

7,983 |

7,983 |

122 |

8,105 |

| Other

comprehensive income |

|

- |

- |

1,495 |

- |

(73) |

1,084 |

- |

2,506 |

3 |

2,509 |

| Dividends

and interest on capital of Vale S.A.’s shareholders |

31(d) |

- |

- |

(437) |

- |

- |

- |

(3,744) |

(4,181) |

- |

(4,181) |

| Dividends

of noncontrolling interest |

|

- |

- |

- |

- |

- |

- |

- |

- |

(37) |

(37) |

| Transaction

with noncontrolling interests |

17(g) |

- |

- |

- |

- |

3 |

- |

- |

3 |

(59) |

(56) |

| Appropriation

to undistributed retained earnings |

|

- |

- |

4,239 |

- |

- |

- |

(4,239) |

- |

- |

- |

| Shares

buyback program |

31(c) |

- |

- |

- |

(2,714) |

- |

- |

- |

(2,714) |

- |

(2,714) |

| Share-based

payment program |

30(b) |

- |

- |

- |

26 |

(29) |

- |

- |

(3) |

- |

(3) |

| Treasury

shares used and canceled |

31(b) |

- |

- |

(4,164) |

4,164 |

- |

- |

- |

- |

- |

- |

| Balance

as of December 31, 2023 |

|

61,614 |

1,139 |

21,877 |

(3,504) |

(1,774) |

(39,891) |

- |

39,461 |

1,520 |

40,981 |

| Net

income |

|

- |

- |

- |

- |

- |

- |

6,166 |

6,166 |

(191) |

5,975 |

| Other

comprehensive income |

|

- |

- |

(5,007) |

- |

144 |

(3,492) |

-

|

(8,355) |

(93) |

(8,448) |

| Dividends

and interest on capital of Vale S.A.'s shareholders |

31(d) |

- |

- |

(2,364) |

- |

- |

- |

(1,996) |

(4,360) |

- |

(4,360) |

| Transaction

with noncontrolling interests (i) |

17(d)

and 17(e) |

- |

- |

- |

- |

895 |

- |

- |

895 |

(114) |

781 |

| Appropriation

to undistributed retained earnings |

|

- |

- |

4,170 |

- |

- |

- |

(4,170) |

- |

- |

- |

| Shares

buyback program |

31(c) |

- |

- |

- |

(409) |

- |

- |

- |

(409) |

- |

(409) |

| Share-based

payment programs |

30(b) |

- |

- |

- |

2 |

6 |

- |

- |

8 |

- |

8 |

| Balance

as of December 31, 2024 |

|

61,614 |

1,139 |

18,676 |

(3,911) |

(729) |

(43,383) |

- |

33,406 |

1,122 |

34,528 |

| |

|

|

|

|

|

|

|

|

|

|

|

| (i) | | The effect on equity attributable to noncontrolling interests includes the derecognition

of noncontrolling shareholders of PT Vale Indonesia Tbk in the amount of US$1,628 (note 17d) and the recognition of noncontrolling shareholders

of Vale Base Metals Limited in the amount of US$1,514 (note 17e). |

The accompanying notes are an integral part of these consolidated

financial statements.

Notes to the Consolidated Financial Statements Expressed in millions of United States dollar, unless otherwise stated |

1. Corporate information

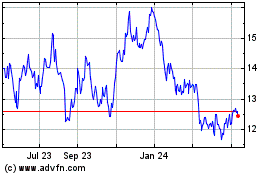

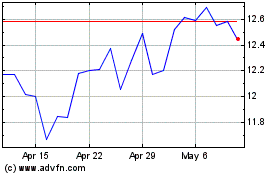

Vale S.A. (the “Parent Company”) is a public company

headquartered in the city of Rio de Janeiro, Brazil. Vale’s share capital consists of common shares, traded on the stock exchange.

In Brazil, Vale's common shares are listed on B3 under the

code VALE3. The Company also has American Depositary Receipts (ADRs), with each representing one common share, traded on the New York

Stock Exchange (NYSE) under the code VALE. Additionally, the shares are traded on LATIBEX under the code XVALO, which is an unregulated

electronic market established by the Madrid Stock Exchange for the trading of Latin American securities. The Company's shareholding structure

is disclosed in note 31.

Vale, together with its subsidiaries (“Vale” or

the “Company”), is one of the world's largest producers of iron ore and nickel. The Company also produces iron ore pellets

and copper. Nickel and copper concentrates contain by-products such as platinum group metals (PGM), gold, silver, and cobalt. Most of

the Company’s products are sold to international markets, through the Company's main trading Company, Vale International S.A. (“VISA”),

a wholly owned subsidiary located in Switzerland.

The Company is engaged in greenfield mineral exploration in

six countries, including Brazil, USA, Canada, Chile, Peru and Indonesia. It also operates extensive logistics systems in Brazil and other

regions worldwide, including railways, maritime terminals, and ports integrated with mining operations. Additionally, the Company has

distribution centers to support its iron ore shipments globally.

Vale also holds investments in energy businesses to meet energy consumption

needs through renewable sources.

The Company's operations are organized into two operational

segments: "Iron Solutions" and "Energy Transition Metals" (note 5).

Iron Solutions –

Comprise iron ore extraction and iron ore pellets and briquettes production, as well as the North, South, and Southeast transportation corridors in Brazil,

including railways, ports and terminals linked to mining operations.

| · | Iron ore:

Currently, Vale operates three systems in Brazil for the production and

distribution of iron ore. The Northern System (Carajás, State of Pará, Brazil) is fully integrated and comprises three mining

complexes, a railway and a maritime terminal. The Southeast System (Quadrilátero Ferrífero, Minas Gerais, Brazil) is fully

integrated, consisting of three mining complexes, a railway, a maritime terminal, and a port. The Southern System (Quadrilátero

Ferrífero, Minas Gerais, Brazil) consists of two mining complexes and two maritime terminals. |

| · | Iron ore pellets and

other ferrous products: Currently, Vale has a diversified

portfolio of agglomerates, which includes iron ore pellets and briquettes. Vale operates eight pelletizing plants in Brazil and two in

Oman. |

Energy Transition Metals

– Includes the production of nickel, copper and its by-products.

| · | Nickel:

The Company's primary nickel operations are conducted by Vale Canada

Limited ("Vale Canada"), which owns mines and processing plants in Canada and Brazil and nickel refining facilities in the United

Kingdom and Japan. Vale also holds investments in nickel operations in Indonesia. |

| · | Copper:

In Brazil, Vale produces copper concentrates at Sossego and Salobo in

Carajás, State of Pará. In Canada, Vale produces copper concentrates and copper cathodes associated with its nickel mining

operations in Sudbury (located in Ontario), Voisey’s Bay (located in Newfoundland and Labrador), and Thompson (located in Manitoba). |

| · | Cobalt, PGM, and other

precious metals: The ore extracted by Vale Canada in Sudbury

yields cobalt, PGMs (Platinum Group Metals), silver, and gold as by-products, which are processed at refining facilities in Port Colborne,

Ontario. In Canada, Vale also produces refined cobalt at its Long Harbour facilities in Newfoundland and Labrador. The copper operations

in Sossego and Salobo in Brazil also yield silver and gold as by-products. |

Notes to the Consolidated Financial Statements Expressed in millions of United States dollar, unless otherwise stated |

2. Basis of preparation of the consolidated

financial statements

The consolidated financial

statements of the Company (“financial statements”) have been prepared and are presented in accordance with the International

Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards”).

All material information for the preparation of these financial statements, and only this information,

are presented and correspond to those used by the Company's Management.

The financial statements

have been prepared on a historical cost basis and adjusted to reflect: (i) the fair value of certain financial assets and liabilities

(including derivative instruments), as well as pension plans assets and (ii) assets impairment, when applicable.

These

financial statements were authorized for issue by the Board of Directors on February 19, 2025.

a) New and amended standards

Amendments to IAS 7 - Statement of Cash Flows

and IFRS 7 - Financial Instruments: Disclosures

In May 2023, the International

Accounting Standards Board (“IASB”) amended the standards IAS 7- Statement of Cash Flows and IFRS 7 - Financial Instruments:

Disclosures, to establish new disclosure requirements on supplier finance arrangements. The amendments are effective for annual periods

beginning on or after January 1, 2024, and, therefore, the Company started to apply these amendments from these financial statements,

as shown in note 14.

Amendments to IAS 1 – Non-current liabilities

with covenants

In October 2022, the IASB

amended the standard IAS 1 – Presentation of Financial Statements, to improve the disclosure requirements related to long-term debt

subject to compliance with covenants. The amendments are effective for January 1, 2024, and, therefore, the Company started to apply these

amendments from these financial statements, as shown in note 24(c).

IFRIC Agenda decision on IFRS 8 Operating

Segments

In July 2024, the IASB published

a agenda decision on IFRS 8– Information by segment, clarifying the requirements on the disclosure of specific items of income and

expenses by operating segment. As a result of this agenda decision, the Company added the disclosure of the cost of goods sold and services

provided by operating segment in note 5 of these financial statements, including the disclosure of the comparative information.

IFRS 18 - Presentation and Disclosure in

Financial Statements

In April 2024, the IASB issued

IFRS 18 - Presentation and Disclosure in Financial Statements, which replaces IAS 1 –Presentation of Financial Statements. IFRS

18 introduces new requirements on presentation within the statement of income statement, requires disclosure of ‘management-defined

performance measures’ and includes new requirements for

aggregation and disaggregation

of financial information of the primary financial statements and the notes. IFRS 18 will be effective for annual reporting periods beginning

on or after January 1, 2027, and the Company is currently assessing the potential impacts arising from the standard.

Amendments to IFRS 9 - Financial Instruments

and IFRS 7 - Financial Instruments: Disclosure

In December 2024, the IASB

amended IFRS 9 – Financial Instruments and IFRS 7 – Financial Instruments: Disclosure to clarify and provide additional guidance,

including new disclosures requirements, related to certain power purchase agreements. These amendments will be effective for annual reporting

periods beginning on or after January 1, 2026, and the Company does not expect material impacts on financial statements.

Other recently issued or amended accounting

standards

Certain other new accounting

standards, amendments and interpretations have been published recently, however, have not materially impacted these financial statements.

The Company did not early adopt any standards and does not expect that other standards already issued and not yet mandatory will have

a material impact in future reporting periods.

Notes to the Consolidated Financial Statements Expressed in millions of United States dollar, unless otherwise stated |

b) Principles of Consolidation

The Company's financial statements

reflect the assets, liabilities and transactions of the Parent Company and its direct and indirect subsidiaries (“subsidiaries”).

Intercompany balances and transactions, which include unrealized profits, are eliminated. A list of the most relevant companies, including

associates and joint ventures, and the financial policies applied in preparing the consolidated financial projections are described in

note 16.

c) Functional currency and presentation currency

The financial statements of the Company and its subsidiaries,

associates and joint ventures are measured using the currency of the primary economic environment in which each entity operates (“functional

currency”), in the case of the Parent Company it is the Brazilian real (“R$”). For presentation purposes, these financial

statements are presented in United States dollars (“US$”) as the Company believes that this is how international investors

analyze the financial statements.

The income statement and cash flows statements of the

Parent Company and its investees which have a functional currency other than US$ are translated into US$ at the average monthly exchange

rate, the assets and liabilities are translated at the final rate and the other equity items are translated at the historical rate. All

monetary exchange differences are recognized in comprehensive income as “Translation adjustments”.

When a foreign operation is totally or partially disposed,

the monetary exchange differences that were recorded in the equity are recognized in the income statement for the year, see accounting

policy in note 16 of these financial statements.

The main exchange rates used by the Company to translate

its foreign operations are as follows:

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Closing rate |

|

Average rate |

| |

|

2024 |

|

2023 |

|

2022 |

|

2024 |

|

2023 |

|

2022 |

| US Dollar ("US$") |

|

6.1923 |

|

4.8413 |

|

5.2177 |

|

5.3920 |

|

4.9954 |

|

5.1655 |

| Canadian dollar ("CAD") |

|

4.3047 |

|

3.6522 |

|

3.8550 |

|

3.9342 |

|

3.7026 |

|

3.9705 |

| Euro ("EUR") |

|

6.4363 |

|

5.3516 |

|

5.5694 |

|

5.8340 |

|

5.4023 |

|

5.4420 |

d) Critical accounting estimates

and judgments

The preparation of financial statements requires the

use of critical accounting estimates and Management also needs to exercise judgement in applying the Company’s accounting policies.

The Company makes estimates

about the future based on assumptions. Accounting estimates and judgments are continually evaluated and are based on management's experience

and knowledge, information available at the date of the financial statements and other factors, including expectations of future events

that are considered reasonable under the circumstances. Accounting estimates, by definition, will seldom equal the actual results.

The areas involving significant

estimates or judgements or complexity, and of items which are more likely to be materially adjusted due to estimates and assumptions are

presented in the following notes:

| Note |

Significant estimates and judgments |

| 9 |

Deferred income taxes and uncertain tax positions |

| 15 |

Liabilities related to the concession grant |

| 16 |

Consolidation |

| 19 |

Mineral reserves and mines useful life |

| 20 |

Impairment of non-current assets |

| 21 |

Fair values estimate |

| 26 |

Liabilities related to Brumadinho |

| 27 |

Liabilities related to associates and joint ventures |

| 28 |

Provision for de-characterization of dam structures and asset retirement obligations |

| 29 |

Litigation |

| 30 |

Employee post-retirement obligation |

Notes to the Consolidated Financial Statements Expressed in millions of United States dollar, unless otherwise stated |

e) Material accounting policies

The material accounting policies applied in the preparation

of these financial statements have been included in the respective notes and are consistent in all years presented.

3. Significant events and transactions

related to 2024 financial statements

| · | Remuneration to shareholders

– During 2024, the Company approved dividends and interest

on capital to its shareholders in the amount of US$4,360 (R$22,884 million). On February 19, 2025 (subsequent event), the Board of Directors

approved remuneration to shareholders in the total amount of US$1,596 (R$9,143 million). Further details are presented in note 31(e) of

these financial statements. |

| · | Impairment on assets

related to nickel – The Company identified impairment

triggers related to its nickel operations in Thompson and Newfoundland and Labrador, both located in Canada. Therefore, Vale carried out

an impairment test on these assets and recognized impairment losses of US$1,945 in the income statement for the year ended December 31,

2024, as “(Impairment), reversal of impairment and gains (losses) on disposal of non-current assets, net”. Further details

are presented in note 20(a) of these financial statements. |

| · | Renegotiation of railway

concession contracts – In December 2024, the general

basis for the renegotiation of the concession contracts for the Carajás Railway and the Vitória a Minas railway were agreed

between Vale, the Brazilian National Land Transportation Agency and the Brazilian Federal Government. The renegotiation will be performed

under the terms of the concession contracts, which remain in force, aiming to promote their modernization and updating. As a result, Vale

recorded an addition of US$256 (R$1,559 million) in the liability associated with the railway concessions and paid US$656 (R$4 billion)

in advance. Further details are presented in note 15(a) of these financial statements. |

| · | Purchase of a minority

stake in Anglo American Minério de Ferro Brasil S.A. (“Anglo American”) – In

December 2024, the Company completed the purchase of a 15% stake in Anglo American, of which the acquisition cost is substantially composed

by the contribution of Serra da Serpentina assets to Anglo American, whose value was estimated at US$750, in addition to a disbursement

of US$30. As a result, Anglo American became an associate and Vale recognized a gain of US$626 in the income statement as “(Impairment),

reversal of impairment and gains (losses) on disposal of non-current assets, net”. Further details are presented in note 17(a) of

these financial statements. |

| · | Definitive Settlement

related to the Samarco Mineração S.A. (“Samarco”) dam failure – In

October 2024, Vale, Samarco and BHP Billiton Brasil Ltda., together with the Brazilian Federal Government, the State Governments of Minas Gerais and Espírito

Santo, the Federal and State Public Prosecutors’ and Public Defenders’ Offices and other Brazilian public entities, signed

a definitive agreement on claims related to the collapse of the Samarco dam, which was ratified in November 2024. As a result, Vale recognized

an additional provision of US$956, recorded in the income statement as “Equity results and other results in associates and joint

ventures”. Further details are presented in note 27 of these financial statements. |

| · | Debentures public

offering – In October 2024, the Company issued debentures

of US$1 billion (R$6 billion) with maturities in 10, 12, and 15 years. Further details are presented in note 11(d) of these financial

statements. |

| · | Divestment in Vale

Oman Distribution Center (“VODC”) – In

September 2024, the Company completed the sale of 50% equity interest in VODC to AP Oryx Holdings LLC, for US$600. As a result, VODC became

a joint venture, and Vale recognized a gain of US$1,222 in the income statement as “(Impairment), reversal of impairment and gains

(losses) on disposal of non-current assets, net”. Further details are presented in note 17(b) of these financial statements. |

| · | Acquisition of Aliança

Geração de Energia S.A. (“Aliança Energia”) – In

August 2024, the Company completed the acquisition of the entire stake held by Cemig Geração e Transmissão S.A. in

Aliança Energia, for US$493 (R$2,737 million). As a result, Vale holds 100% of the shareholding and consolidates Aliança

Energia. Further details are presented in note 17(c) of these financial statements. |

| · | Bond issuance and

repurchase – In June 2024, Vale issued bonds of US$1

billion, maturing in 2054 with a coupon of 6.40% per year. In July 2024, this amount was substantially used to redeem bonds maturing in

2026, 2036, and 2039, in the total amount of US$970. As a result of the repurchase, the Company paid a premium of US$50, which was recorded

in the income statement as “Financial expenses”. Further details are presented in note 11(c) of these financial statements. |

Notes to the Consolidated Financial Statements Expressed in millions of United States dollar, unless otherwise stated |

| · | Divestment in PT Vale

Indonesia (PTVI) – In June 2024, the Company, together

with Sumitomo Metal Mining Co. Ltd. and PT Mineral Industri Indonesia (“MIND ID”), completed the divestment transaction of

PTVI. As a result, Vale received US$155 and lost control over PTVI, which resulted in a gain of US$1,059 recorded in the income statement

as “(Impairment), reversal of impairment and gains (losses) on disposal of non-current assets, net”. Further details are presented

in note 17(d) of these financial statements. |

| · | Strategic partnership

in the Energy Transition Metals business – In April

2024, the Company completed the transaction in which Manara Minerals acquired a 10% stake in Vale Base Metals Limited, which is the holding

company for the Energy Transition Metals business, for US$2,455. As a result, Vale recognized a gain of US$895 in equity as “Transactions

with noncontrolling shareholders”. Further details are presented in note 17(e) of these financial statements. |

4. Climate-related

financial information

Climate strategy

The Company has been integrating climate strategy into

its business through a comprehensive approach, based on systematic planning and execution, prioritizing risk management and leveraging

opportunities, as well as based on purpose to establish a social, economic and environmental legacy.

The announced investments and the Company's strategy

with climate-related changes, initiatives were evaluated in the context of critical accounting estimates and judgments. Future changes

in this strategy or in the global scenario may affect the Company's main estimates and may result in material impacts on the Company's

results and balances of assets and liabilities in subsequent fiscal years.

| Sphere of influence |

Decarbonization targets |

Description |

Potential Impacts on Financial Statements |

| Operations |

·

Reduce absolute Scope 1 and 2 emissions by 33% by 2030.

·

Achieve net-zero Scope 1 and 2 emissions by 2050.

|

Investment in solutions that increase the energy efficiency of processes

and solutions that replace fossil energy raw materials with renewable sources or those with lower greenhouse gas (“GHG”) emission

intensity of Scope 1. |

·

Investments in affiliates and joint ventures

·

Value chain operational costs and expenses to support decarbonization

·

Impairment and asset useful lives

·

Property, plant and equipaments

·

Intangibles

|

|

Investment in solutions for the consumption of electricity from renewable

sources, aiming to reduce Scope 2 GHG emissions. |

·

Commitments related to electricity from renewable sources supply

contracts

·

Property, plant and equipaments

·

Value chain operational costs and expenses to support decarbonization

·

Lease of properties linked to the generation of electricity from

renewable sources

·

Financial Instruments

|

| Value Chain |

·

Reduce net Scope 3 emissions by 15% by 2035.

·

Contribute to the International Maritime Organization's ("IMO")

2023 strategy to achieve net-zero greenhouse gas emissions by or around 2050. |

Limited use of high-integrity carbon credits for eventual offsetting of

Scope 3 GHG emissions. |

·

Intangible

·

Retirement expense from the credit of

·

carbon

·

Investments in subsidiaries, affiliates and joint ventures

·

Provisions |

|

Investment in solutions and technologies to reduce greenhouse gas emissions

from international shipping. |

·

Research and development expenses for navigation solution

·

Value chain operational costs and expenses to support decarbonization |

Notes to the Consolidated Financial Statements Expressed in millions of United States dollar, unless otherwise stated |

The Company evaluated its decarbonization targets by

analyzing the criteria for recognition of provision according to IAS 37 - Provisions, Contingent Liabilities and Contingent Assets. There

is no provision as of December 31, 2024 because the target does not represent a present obligation for the Company.

Impact of transition risks related to climate change on the

Company's assets

In the development of the strategic plan, the Company

qualitatively evaluates scenarios related to climate change and defines the base case to guide the positioning of its business, as well

as test resilience against other exploratory scenarios. The Company's approach to climate change is shaped by an analysis of global megatrends

through a scenario-building tool. These scenarios offer insights associated to global temperatures increasing into the future of mining,

that influence commodity price forecasts, capital allocation, portfolio decisions, and business strategies.

In this context, the Company observes the persistence

of the characteristic cycles of the mining industry over the coming decades, driven by an energy transition that occurs asynchronously

and unevenly between different sectors and regions. Vale carried out an analysis of the resilience of its portfolio in the face of climate

change scenarios, based on the scenarios of the International Energy Agency.

The potential financial impacts of climate change and

the transition to a low-carbon economy were considered in the evaluation of the Company's critical accounting estimates, including impairment

indicators, such as possible reductions in demand for commodities due to changes in policies, regulatory environment (including carbon

pricing mechanisms), legal, technological, market or reputational changes.

The Company did not identify any impairment of assets

due to this topic. However, given the complexity of modeling, identifying additional risks and planning and executing actions in response

to the identified risks, transition risks may result in material impacts on the Company's income and balance of assets and liabilities

in subsequent fiscal years.

Impacts of physical risks related

to climate change on the book values of assets

The Company's operations are also exposed to events

resulting from climate change. Therefore, the Company is currently assessing the potential impacts of physical risks related to climate

change in the models used in the asset impairment test, such as potential operational disruptions caused by increased frequency and/or

severity of extreme and chronic weather events resulting from long-term changes in weather patterns.

The Company did not identify any impairment of assets

in the financial statements of 2024 due to the physical risks considered in the valuation. However, due to the complexity of physical

risk modeling, the continuous evolution of the ongoing nature of the Company's physical risk assessment process, the identification of

additional risks may result in material impacts on the Company's income and balance of assets and liabilities in subsequent fiscal years.

Carbon pricing in Strategic Planning

Carbon pricing is one of the main strategic tools used

by the Company for decision-making, allowing it to assess the global and geographically dispersed distribution of operating and customer

markets. Incorporated into the cycle of scenario analysis and strategic planning, carbon pricing makes it possible to assess the financial

impacts on business value over time. In the 2024 cycle, three main effects were analyzed: (i) the direct costs avoided through decarbonization,

(ii) the net capital expenditures and operational expenses impacts associated with the Scope 1 and 2 reduction targets for 2030, and (iii)

the potential increase in demand for agglomerated iron ore products, such as pellets and briquettes, driven by emission limit regulations

and the search for lower-emission raw materials in the steel industry.

Carbon prices are integrated into the Marginal Abatement

Cost Curve (MACC) as a shadow price, used for prioritization of investments and analysis of the net present value of projects. This approach

ensures that the costs and risks associated with climate change are incorporated into the capital allocation and decarbonization strategy.

Decarbonization initiatives

The Company, in line with its strategy to decarbonization

in its value chain, allocates resources to projects to reduce greenhouse gas emissions and meet climate goals. These efforts include technological

upgrades, modification of production processes, as well as strategic partnerships.

Below are the main projects related to Vale's strategy

to promote economic development in line with environmental preservation and sustainability, followed by financial effects.

Notes to the Consolidated Financial Statements Expressed in millions of United States dollar, unless otherwise stated |

Production of Iron Ore

Briquette: In 2023, the first briquette plant was inaugurated at the Tubarão Complex, in Vitória, Espírito

Santo. Iron ore briquette is one of the strategies implemented by the Company to increase the exploration of high-quality ores and offer

new products in line with the demands for decarbonization of the steel industry. Currently, Vale has two iron ore briquette plants in

the Tubarão Complex. The two briquette plants come from the conversion of pelletizing plants. As of December 31, 2024, the Company

had a balance of US$257 (2023: US$259) in property, plant and equipment associated with the briquette plants.

Gelado Project:

In March 2023, the Company started operations of the Gelado Project in Carajás (PA), which will produce pellet feed (iron

ore for pelletizing) from the reuse of iron ore tailings, which have been deposited at the site for approximately four decades. In addition

to destinate sustainably disposing of the tailings, the project will use 100% electric dredges to extract the material, avoiding greenhouse

gas emissions. The final product is sent to the pelletizing plant in São Luiz (MA) due to the high quality of the pellets manufactured

on site, steel customers are able to reduce their carbon emissions – compared to using lower quality products. As of December 31,

2024, the Company had a balance of US$308 (2023: US$390) in fixed assets related to the Gelado Project.

Sustainable sand: In

October 2022, the Company created the company Co-log logística de coprodutos S.A ("Agera") to develop and expand its

Sustainable Sand business. Agera receives the sand produced from the treatment of tailings generated by Vale's iron ore operations and

promotes its commercialization and distribution. The new company also invests in research and development of new solutions for the product.

In the year ended December 31, 2024, the Company recognized US$1 (2023: US$1 and 2022: US$0) in income statement as research and development

expenses.

Purchase of electricity

from renewable sources: The Company also has Power Purchase Agreements ("PPAs") with suppliers of electricity

based on renewable sources, which enables the reduction of scope 2 emissions. These contracts have been entered into and continue to be

held for their own use purposes and are therefore outside the scope of IFRS 9 - Financial Instruments. PPAs are treated as executory

contracts, and expenditures are recorded as incurred.

Vale Ventures:

The Company announced the creation of a Corporate Venture Capital operation ("Vale Ventures"), whose objective is to invest