- Revenue of $2.1 billion, up 1% on a reported and organic

basis

- Earnings per share of $0.89, up 41%; $1.11 on an adjusted

basis, up 12%

- Updated full-year revenue guidance of $8.5 billion, up

approximately 15% YoY, with organic revenue growth of ~5%

- Narrowing full-year adjusted EPS guidance to $4.22 to $4.24,

from $4.18 to $4.28

Xylem Inc. (NYSE: XYL), a leading global water technology

company that empowers customers and communities to build a more

water-secure world, today reported third-quarter results. The

Company’s total revenue was $2.1 billion, up one percent on a

reported and organic basis, and third-quarter earnings per share

were up 41 percent on a reported basis and 12 percent on an

adjusted basis. Orders grew 8 percent on a reported and organic

basis.

“The team delivered strong results in the quarter, with earnings

at the high end of guidance, and margin expansion beating our

expectations,” said Matthew Pine, Xylem’s President and CEO.

“Demand remained resilient, reflected in robust orders growth in

all segments, and a healthy book-to-bill. Moderated organic revenue

growth in the quarter was driven largely by project timing.”

“Outperformance on margin and earnings was further reinforced by

momentum in our integration of Evoqua and by initial impacts from

our broader simplification efforts,” Pine continued. “Evoqua

integration is ahead of schedule and synergy capture continues to

accelerate, giving us confidence in closing the year above target.

As a result, we are narrowing our full-year earnings guidance, with

continuing focus on sustainable, high-quality earnings and

profitable growth.”

Net income was $217 million, or $0.89 per share. Net income

margin increased 300 basis points to 10.3 percent. These results

are driven by strong operational performance. Adjusted net income

was $269 million, or $1.11 per share, which excludes the impacts of

amortization of acquired intangible assets, restructuring and

realignment costs, gain/loss from sale of businesses, special

charges, and tax-related special items.

Third-quarter adjusted earnings before interest, tax,

depreciation, and amortization (EBITDA) margin was 21.2 percent,

reflecting a year-over-year increase of 140 basis points.

Productivity savings and price drove the margin expansion,

exceeding the impact of inflation, strategic investments and

mix.

Outlook

Xylem expects full-year 2024 revenue of $8.5 billion, up

approximately 15 percent on a reported basis and up approximately 5

percent on an organic basis.

Full-year 2024 adjusted EBITDA margin is expected to be

approximately 20.5 percent. This results in adjusted earnings per

share of $4.22 to $4.24 from the previous range of $4.18 to $4.28.

Full-year free cash flow conversion to net income is expected to be

at least 120 percent.

Further 2024 planning assumptions are included in Xylem’s

third-quarter earnings materials posted at www.xylem.com/investors.

Excluding revenue, Xylem provides guidance only on a non-GAAP basis

due to the inherent difficulty in forecasting certain amounts that

would be included in GAAP earnings, such as discrete tax items,

without unreasonable effort.

Supplemental information on Xylem’s third-quarter earnings and

reconciliations for certain non-GAAP items is posted at

www.xylem.com/investors.

About Xylem

Xylem (XYL) is a Fortune 500 global water solutions company that

empowers customers and communities to build a more water-secure

world. Our 23,000 diverse employees delivered combined pro forma

revenue of $8.1 billion in 2023, optimizing water and resource

management with innovation and expertise. Join us at www.xylem.com

and Let’s Solve Water.

Forward-Looking Statements

This press release contains “forward-looking statements" within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Generally, the words “anticipate,” “estimate,” “expect,”

“project,” “intend,” “plan,” "contemplate," "predict," “forecast,”

“likely,” “believe,” “target,” “will,” “could,” “would,” “should,”

"potential," "may" and similar expressions or their negative, may,

but are not necessary to, identify forward-looking statements. By

their nature, forward-looking statements address uncertain matters

and include any statements that: are not historical, such as

statements about our strategy, financial plans, outlook,

objectives, plans, intentions or goals (including those related to

our social, environmental and other sustainability goals); or

address possible or future results of operations or financial

performance, including statements relating to orders, revenues,

operating margins and earnings per share growth.

Although we believe that the expectations reflected in any of

our forward-looking statements are reasonable, actual results could

differ materially from those projected or assumed in any of our

forward-looking statements. Our future financial condition and

results of operations, as well as any forward-looking statements,

are subject to change and to inherent risks and uncertainties, many

of which are beyond our control. Important factors that could cause

our actual results, performance and achievements, or industry

results to differ materially from estimates or projections

contained in or implied by our forward-looking statements include,

among others, the following: the impact of overall industry and

general economic conditions, including industrial, governmental,

and public and private sector spending, interest rates, inflation

and related monetary policy by governments in response to

inflation, and the strength of the residential and commercial real

estate markets, on economic activity and our operations;

geopolitical events, including the ongoing and possible escalation

of the conflicts involving Russia and Ukraine, and the Middle East,

as well as regulatory, economic and other risks associated with our

global sales and operations, including those related to domestic

content requirements applicable to projects receiving governmental

funding; manufacturing and operating cost increases due to

macroeconomic conditions, including inflation, energy supply,

supply chain shortages, logistics challenges, tight labor markets,

prevailing price changes, tariffs and other factors; demand for our

products, disruption, competition or pricing pressures in the

markets we serve; cybersecurity incidents or other disruptions of

information technology systems on which we rely, or involving our

connected products and services; lack of availability or delays in

receiving parts and raw materials from our supply chain, including

electronic components (in particular, semiconductors); disruptions

in operations at our facilities or that of third parties upon which

we rely; uncertainty related to the realization of the benefits and

synergies from our acquisition of Evoqua Water Technologies Corp.;

safe and compliant treatment and handling of water, wastewater and

hazardous materials; failure to successfully execute large

projects, including with respect to meeting performance guarantees

and customers’ budgets, timelines and safety requirements; our

ability to retain and attract leadership and other diverse and key

talent, as well as competition for overall talent and labor;

defects, security, warranty and liability claims, and recalls

related to our products; uncertainty around restructuring and

realignment actions and related costs and savings; our ability to

execute strategic investments for growth, including related to

acquisitions and divestitures; availability, regulation or

interference with radio spectrum used by certain of our products;

volatility in served markets or impacts on our business and

operations due to weather conditions, including the effects of

climate change; risks related to our sustainability commitments and

related disclosures; fluctuations in foreign currency exchange

rates; difficulty predicting our financial results; risk of future

impairments to goodwill and other intangible assets; changes in our

effective tax rates or tax expenses; financial market risks related

to our pension and other defined benefit plans; failure to comply

with, or changes in, laws or regulations, including those

pertaining to our business conduct, operations, products and

services, including anti-corruption, data privacy and security,

trade, competition, the environment, climate change and health and

safety; legal, governmental or regulatory claims, investigations or

proceedings and associated contingent liabilities; matters related

to intellectual property infringement or expiration of rights; and

other factors set forth under “Item 1A. Risk Factors” in our Annual

Report on Form 10-K for the year ended December 31, 2023 ("2023

Annual Report") and in subsequent filings we make with the

Securities and Exchange Commission (“SEC”).

Forward-looking and other statements in this press release

regarding our environmental and other sustainability plans and

goals are not an indication that these statements are necessarily

material to investors, to our business, operating results,

financial condition, outlook, or strategy, to our impacts on

sustainability matters or other parties, or are required to be

disclosed in our filings with the SEC. In addition, historical,

current, and forward-looking social, environmental and

sustainability-related statements may be based on standards for

measuring progress that are still developing, internal controls and

processes that continue to evolve, and assumptions that are subject

to change in the future. All forward-looking statements made herein

are based on information currently available to us as of the date

of this press release. We undertake no obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by law.

XYLEM INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED INCOME

STATEMENTS (Unaudited) (in millions, except per share data)

Three Months

Nine Months

For the periods ended September

30,

2024

2023

2024

2023

Revenue from products

$

1,744

$

1,720

$

5,236

$

4,535

Revenue from services

360

356

1,070

711

Revenue

2,104

2,076

6,306

5,246

Cost of revenue from products

1,047

1,043

3,147

2,730

Cost of revenue from services

273

269

804

555

Cost of revenue

1,320

1,312

3,951

3,285

Gross profit

784

764

2,355

1,961

Selling, general and administrative

expenses

445

491

1,404

1,291

Research and development expenses

55

61

172

172

Restructuring and asset impairment

charges

4

21

37

57

Operating income

280

191

742

441

Interest expense

10

14

35

35

Other non-operating income, net

1

8

11

19

(Loss) on sale of businesses

(2

)

—

(6

)

—

Income before taxes

269

185

712

425

Income tax expense

52

33

148

82

Net income

$

217

$

152

$

564

$

343

Earnings per share:

Basic

$

0.89

$

0.63

$

2.33

$

1.64

Diluted

$

0.89

$

0.63

$

2.32

$

1.63

Weighted average number of shares:

Basic

242.9

240.9

242.5

208.9

Diluted

243.8

242.2

243.4

210.1

XYLEM INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED

BALANCE SHEETS (Unaudited) (in millions, except per share

amounts)

September 30,

2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

989

$

1,019

Receivables, less allowances for

discounts, returns and credit losses of $60 and $56 in 2024 and

2023, respectively

1,707

1,617

Inventories

1,091

1,018

Prepaid and other current assets

226

230

Total current assets

4,013

3,884

Property, plant and equipment, net

1,158

1,169

Goodwill

7,593

7,587

Other intangible assets, net

2,326

2,529

Other non-current assets

956

943

Total assets

$

16,046

$

16,112

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

930

$

968

Accrued and other current liabilities

1,105

1,221

Short-term borrowings and current

maturities of long-term debt

17

16

Total current liabilities

2,052

2,205

Long-term debt

1,977

2,268

Accrued post-retirement benefits

332

344

Deferred income tax liabilities

535

557

Other non-current accrued liabilities

550

562

Total liabilities

5,446

5,936

Stockholders’ equity:

Common stock – par value $0.01 per

share:

Authorized 750.0 shares, issued 259.2

shares and 257.6 shares in 2024 and 2023, respectively

3

3

Capital in excess of par value

8,673

8,564

Retained earnings

2,902

2,601

Treasury stock – at cost 16.2 shares and

16.0 shares in 2024 and 2023, respectively

(753

)

(733

)

Accumulated other comprehensive loss

(232

)

(269

)

Total stockholders’ equity

10,593

10,166

Non-controlling interests

7

10

Total equity

10,600

10,176

Total liabilities and stockholders’

equity

$

16,046

$

16,112

XYLEM INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (Unaudited) (in millions)

For the nine months ended September

30,

2024

2023

Operating Activities

Net income

$

564

$

343

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation

191

132

Amortization

229

167

Share-based compensation

43

45

Restructuring and asset impairment

charges

37

57

Loss from sale of business

6

—

Other, net

(4

)

(20

)

Payments for restructuring

(24

)

(12

)

Changes in assets and liabilities (net of

acquisitions):

Changes in receivables

(101

)

(142

)

Changes in inventories

(88

)

(41

)

Changes in accounts payable

(31

)

15

Changes in accrued and deferred taxes

(11

)

(77

)

Other, net

(123

)

(85

)

Net Cash – Operating activities

688

382

Investing Activities

Capital expenditures

(221

)

(177

)

Acquisitions of businesses, net of cash

acquired

(5

)

(476

)

Proceeds from sale of business

11

103

Proceeds from the sale of property, plant

and equipment

3

2

Cash received from investments

5

1

Cash paid for investments

(8

)

(1

)

Cash paid for equity investments

(4

)

(58

)

Cash received from interest rate swaps

—

38

Cash received from cross-currency

swaps

25

25

Other, net

1

4

Net Cash – Investing activities

(193

)

(539

)

Financing Activities

Short-term debt issued, net

—

1

Short-term debt repaid

(268

)

—

Long-term debt issued, net

—

275

Long-term debt repaid

(13

)

(155

)

Repurchase of common stock

(19

)

(10

)

Proceeds from exercise of employee stock

options

66

45

Dividends paid

(263

)

(219

)

Other, net

(23

)

(8

)

Net Cash – Financing activities

(520

)

(71

)

Effect of exchange rate changes on

cash

(5

)

(11

)

Net change in cash and cash

equivalents

(30

)

(239

)

Cash and cash equivalents at beginning of

year

1,019

944

Cash and cash equivalents at end of

period

$

989

$

705

Supplemental disclosure of cash flow

information:

Cash paid during the period for:

Interest

$

49

$

43

Income taxes (net of refunds received)

$

160

$

159

Xylem Inc. Non-GAAP Measures Management

reviews key performance indicators including revenue, gross

margins, segment operating income and margins, orders growth,

working capital and backlog, among others. In addition, we consider

certain non-GAAP (or "adjusted") measures to be useful to

management and investors evaluating our operating performance for

the periods presented, and to provide a tool for evaluating our

ongoing operations, liquidity and management of assets. This

information can assist investors in assessing our financial

performance and measures our ability to generate capital for

deployment among competing strategic alternatives and initiatives,

including but not limited to, dividends, acquisitions, share

repurchases and debt repayment. Excluding revenue, Xylem provides

guidance only on a non-GAAP basis due to the inherent difficulty in

forecasting certain amounts that would be included in GAAP

earnings, such as discrete tax items, without unreasonable effort.

These adjusted metrics are consistent with how management views our

business and are used to make financial, operating and planning

decisions. These metrics, however, are not measures of financial

performance under GAAP and should not be considered a substitute

for revenue, operating income, net income, earnings per share

(basic and diluted) or net cash from operating activities as

determined in accordance with GAAP. We consider the following items

to represent the non-GAAP measures that we consider to be key

performance indicators, as well as the related reconciling items to

the most directly comparable measure calculated and presented in

accordance with GAAP. The non-GAAP measures may not be comparable

to similarly titled measures reported by other companies.

“Organic revenue" and "Organic orders” defined as revenue

and orders, respectively, excluding the impact of fluctuations in

foreign currency translation and contributions from acquisitions

and divestitures. Divestitures include sales or discontinuance of

insignificant portions of our business that did not meet the

criteria for classification as a discontinued operation. The

period-over-period change resulting from foreign currency

translation impacts is determined by translating current period and

prior period activity using the same currency conversion rate.

“Constant currency” defined as financial results

adjusted for foreign currency translation impacts by translating

current period and prior period activity using the same currency

conversion rate. This approach is used for countries whose

functional currency is not the U.S. dollar.

“EBITDA”

defined as earnings before interest, taxes, depreciation and

amortization expense.

“Adjusted EBITDA” and

"Adjusted

Segment EBITDA" reflect the adjustments to EBITDA and segment

EBITDA, respectively, to exclude share-based compensation charges,

restructuring and realignment costs, gain or loss from sale of

businesses and special charges.

"Adjusted EBITDA

Margin" and

"Adjusted Segment EBITDA Margin" defined as

adjusted EBITDA and adjusted segment EBITDA divided by total

revenue and segment revenue, respectively.

"Adjusted

Operating Income", "Adjusted Segment Operating Income", "Adjusted

Net Income" and “Adjusted EPS” defined as operating income,

segment operating income, net income and earnings per share,

adjusted to exclude restructuring and realignment costs,

amortization of acquired intangible assets, gain or loss from sale

of businesses, special charges and tax-related special items, as

applicable.

"Adjusted Operating Margin" and

"Adjusted Segment Operating Margin" defined as adjusted

operating income and adjusted segment operating income divided by

total revenue and segment revenue, respectively.

“Free

Cash Flow” defined as net cash from operating activities, as

reported in the Statement of Cash Flows, less capital expenditures,

and "Free Cash Flow Conversion" defined as Free Cash Flows divided

by net income, excluding the gain on sale of businesses and other

non-recurring, significant non-cash impacts, such as non-cash

impairment charges and significant deferred tax items. Our

definitions of "free cash flow" and "free cash flow conversion" do

not consider certain non-discretionary cash payments, such as debt.

"Adjusted Free Cash Flow" defined as free cash flow

adjusted for significant cash items for which the corresponding

income statement impact does not occur within the same fiscal year.

“Realignment costs” defined as costs not included in

restructuring costs that are incurred as part of actions taken to

reposition our business, including items such as professional fees,

severance, relocation, travel, facility set-up and other costs.

“Special charges" defined as non-recurring costs

incurred by the Company, such as those related to acquisitions and

integrations, divestitures and non-cash impairment charges.

“Tax-related special items" defined as tax items, such as

tax return versus tax provision adjustments, tax exam impacts, tax

law change impacts, excess tax benefits/losses and other discrete

tax adjustments.

Xylem Inc. Non-GAAP Reconciliation Reported

vs. Organic and Constant Currency Orders ($ Millions)

(As

Reported - GAAP) (As Adjusted - Organic) Constant

Currency (A) (B) (C) (D) (E) = B+C+D (F) = E/A (G) = (E - C) /

A Change % Change Acquisitions /Divestitures Change % Change Orders

Orders 2024 v. 2023 2024 v. 2023 Book-to-Bill FX Impact Adj. 2024

v. 2023 Adj. 2024 v. 2023

2024

2023

Nine Months Ended September 30 Xylem Inc.

6,534

5,457

1,077

20

%

104

%

(886

)

6

197

4

%

20

%

Water Infrastructure

2,036

1,680

356

21

%

111

%

(243

)

(1

)

112

7

%

21

%

Applied Water

1,382

1,350

32

2

%

103

%

-

3

35

3

%

3

%

Measurement and Control Solutions

1,199

1,228

(29

)

(2

%)

86

%

-

(1

)

(30

)

(2

%)

(2

%)

Water Solutions and Services

1,917

1,199

718

60

%

110

%

(643

)

5

80

7

%

60

%

Quarter Ended September 30 Xylem Inc.

2,201

2,031

170

8

%

105

%

-

(4

)

166

8

%

8

%

Water Infrastructure

700

656

44

7

%

112

%

-

(4

)

40

6

%

6

%

Applied Water

437

422

15

4

%

98

%

-

-

15

4

%

4

%

Measurement and Control Solutions

386

343

43

13

%

84

%

-

(2

)

41

12

%

12

%

Water Solutions and Services

678

610

68

11

%

118

%

-

2

70

11

%

11

%

Quarter Ended June 30 Xylem Inc.

2,087

1,856

231

12

%

96

%

(265

)

11

(23

)

(1

%)

13

%

Water Infrastructure

690

563

127

23

%

109

%

(89

)

5

43

8

%

23

%

Applied Water

465

445

20

4

%

102

%

-

3

23

5

%

5

%

Measurement and Control Solutions

384

470

(86

)

(18

%)

80

%

-

1

(85

)

(18

%)

(18

%)

Water Solutions and Services

548

378

170

45

%

91

%

(176

)

2

(4

)

(1

%)

46

%

Quarter Ended March 31 Xylem Inc.

2,246

1,570

676

43

%

110

%

(621

)

(1

)

54

3

%

43

%

Water Infrastructure

646

461

185

40

%

113

%

(154

)

(2

)

29

6

%

40

%

Applied Water

480

483

(3

)

(1

%)

110

%

-

-

(3

)

(1

%)

(1

%)

Measurement and Control Solutions

429

415

14

3

%

93

%

-

-

14

3

%

3

%

Water Solutions and Services

691

211

480

227

%

123

%

(467

)

1

14

7

%

228

%

Xylem Inc. Non-GAAP Reconciliation Reported vs. Organic and

Constant Currency Revenue ($ Millions)

(As Reported -

GAAP) (As Adjusted - Organic) Constant Currency

(A) (B) (C) (D) (E) = B+C+D (F) = E/A (G) = (E - C) / A Change

% Change

Acquisitions /Divestitures Change % Change Revenue Revenue 2024 v.

2023

2024 v. 2023

FX Impact Adj. 2024 v. 2023 Adj. 2024 v. 2023

2024

2023

Nine Months Ended September 30 Xylem Inc.

6,306

5,246

1,060

20

%

(782

)

5

283

5

%

20

%

Water Infrastructure

1,828

1,541

287

19

%

(221

)

-

66

4

%

19

%

Applied Water

1,339

1,396

(57

)

(4

%)

-

1

(56

)

(4

%)

(4

%)

Measurement and Control Solutions

1,402

1,175

227

19

%

-

-

227

19

%

19

%

Water Solutions and Services

1,737

1,134

603

53

%

(561

)

4

46

4

%

54

%

Quarter Ended September 30 Xylem Inc.

2,104

2,076

28

1

%

-

(6

)

22

1

%

1

%

Water Infrastructure

623

612

11

2

%

-

(5

)

6

1

%

1

%

Applied Water

447

465

(18

)

(4

%)

-

(2

)

(20

)

(4

%)

(4

%)

Measurement and Control Solutions

458

413

45

11

%

-

(1

)

44

11

%

11

%

Water Solutions and Services

576

586

(10

)

(2

%)

-

2

(8

)

(1

%)

(1

%)

Quarter Ended June 30 Xylem Inc.

2,169

1,722

447

26

%

(302

)

13

158

9

%

27

%

Water Infrastructure

631

519

112

22

%

(84

)

6

34

7

%

23

%

Applied Water

456

478

(22

)

(5

%)

-

4

(18

)

(4

%)

(4

%)

Measurement and Control Solutions

482

384

98

26

%

-

2

100

26

%

26

%

Water Solutions and Services

600

341

259

76

%

(218

)

1

42

12

%

76

%

Quarter Ended March 31 Xylem Inc.

2,033

1,448

585

40

%

(480

)

(2

)

103

7

%

40

%

Water Infrastructure

574

410

164

40

%

(137

)

(1

)

26

6

%

40

%

Applied Water

436

453

(17

)

(4

%)

-

(1

)

(18

)

(4

%)

(4

%)

Measurement and Control Solutions

462

378

84

22

%

-

(1

)

83

22

%

22

%

Water Solutions and Services

561

207

354

171

%

(343

)

1

12

6

%

171

%

Xylem Inc. Non-GAAP Reconciliation Adjusted Diluted EPS ($

Millions, except per share amounts)

Q3 2024 Q3

2023 As Reported Adjustments Adjusted

As Reported Adjustments Adjusted

Total Revenue

2,104

-

2,104

2,076

-

2,076

Operating Income

280

70

a

350

191

124

a

315

Operating Margin

13.3

%

16.6

%

9.2

%

15.2

%

Interest Expense

(10

)

-

(10

)

(14

)

-

(14

)

Other Non-Operating Income (Expense)

1

-

1

8

-

8

Gain/(Loss) From Sale of Business

(2

)

2

b

-

-

-

-

Income before Taxes

269

72

341

185

124

309

Provision for Income Taxes

(52

)

(20

)

c

(72

)

(33

)

(36

)

c

(69

)

Net Income

217

52

269

152

88

240

Diluted Shares

243.8

243.8

242.2

242.2

Diluted EPS

$

0.89

$

0.22

$

1.11

$

0.63

$

0.36

$

0.99

Q3 YTD 2024 Q3 YTD 2023

As Reported Adjustments Adjusted

As Reported Adjustments Adjusted

Total Revenue

6,306

-

6,306

5,246

-

5,246

Operating Income

742

254

a

996

441

318

a

759

Operating Margin

11.8

%

15.8

%

8.4

%

14.5

%

Interest Expense

(35

)

-

(35

)

(35

)

-

(35

)

Other Non-Operating Income (Expense)

11

-

11

19

-

19

Gain/(Loss) From Sale of Business

(6

)

6

b

-

-

-

-

Income before Taxes

712

260

972

425

318

743

Provision for Income Taxes

(148

)

(70

)

c

(218

)

(82

)

(75

)

c

(157

)

Net Income

564

190

754

343

243

586

Diluted Shares

243.4

243.4

210.1

210.1

Diluted EPS

$

2.32

$

0.78

$

3.10

$

1.63

$

1.16

$

2.79

a

Quarter-to-date:

Restructuring & realignment

costs: 2024 - $11 million and 2023 - $34 million

Special charges: 2024 - $6

million of acquisition & integration cost and $1 million of

other special charges; 2023 - $23 million of acquisition &

integration related costs and $1 million of asset impairment

charges

Purchase accounting intangible

amortization: 2024 - $52 million and 2023 - $66 million

Year-to-date:

Restructuring & realignment

costs: 2024 - $55 million and 2023 - $82 million

Special charges: 2024 - $31

million of acquisition & integration related costs, $4 million

of other special charges and $1 million of asset impairment

charges; 2023 - $107 million of acquisition & integration

related costs, $6 million of other special charges and $3 million

of intangible asset impairment charges

Purchase Accounting Intangible

Amortization: 2024 - $163 million and 2023 - $120 million

b

Gain/Loss from sale of business

as per income statement for all periods presented

c

Quarter-to-date: 2024 -

Net tax impact on pre-tax adjustments (note a and b) of $17 million

and other tax special items of $3 million; 2023 - Net tax impact on

pre-tax adjustments (note a) of $28 million and other tax special

items of $8 million

Year-to-date: 2024 - Net

tax impact on pre-tax adjustments (note a and b) of $59 million and

other tax special items of $11 million; 2023 - Net tax impact on

pre-tax adjustments (note a) of $67 million and other tax special

items of $8 million

Xylem Inc. Non-GAAP Reconciliation Net Cash - Operating

Activities vs. Free Cash Flow ($ Millions)

Q1

Q2

Q3

Year-to-Date

2024

2023

2024

2023

2024

2023

2024

2023

Net Cash - Operating Activities

$89

($19

)

$288

$28

$311

$373

$688

$382

Capital Expenditures - PPE

(59

)

(33

)

(59

)

(42

)

(60

)

(57

)

(178

)

(132

)

Capital Expenditures - Software

(15

)

(16

)

(14

)

(12

)

(14

)

(17

)

(43

)

(45

)

Capital Expenditures

(74

)

(49

)

(73

)

(54

)

(74

)

(74

)

(221

)

(177

)

Free Cash Flow

$15

($68

)

$215

($26

)

$237

$299

$467

$205

Cash paid in excess of tax provision for R&D law

change adoption

-

33

-

-

-

-

-

33

Cash paid by Xylem for Evoqua's pre-close transaction costs

-

-

-

70

-

-

-

70

Cash paid for Idrica distribution agreement

-

-

-

60

-

-

-

60

Adjusted Free Cash Flow

$15

($35

)

$215

$104

$237

$299

$467

$368

Net Income

$153

$99

$194

$92

$217

$152

$564

$343

Gain/(Loss) from sale of business

(5

)

-

1

-

(2

)

-

(6

)

-

Restructuring Charges - non-cash stock acceleration and

asset impairment

(2

)

-

(16

)

(14

)

(3

)

(11

)

(21

)

(25

)

Special Charges - Inventory step-up

-

-

-

(15

)

-

(5

)

-

(20

)

Special Charges - non-cash impairment

(1

)

(2

)

-

-

-

(1

)

(1

)

(3

)

Net Income, excluding gain/(loss) on sale of businesses,

non-cash restructuring and special charges

$161

$101

$209

$121

$222

$169

$592

$391

Operating Cash Flow Conversion

58

%

(19

%)

148

%

30

%

143

%

245

%

122

%

111

%

Free Cash Flow Conversion

9

%

(35

%)

103

%

86

%

107

%

177

%

79

%

94

%

Xylem Inc. Non-GAAP Reconciliation EBITDA and Adjusted

EBITDA by Quarter ($ Millions)

2024

Q1 Q2 Q3 Q4 Total Net Income

153

194

217

564

Net Income margin

7.5

%

8.9

%

10.3

%

8.9

%

Depreciation

61

62

68

191

Amortization

73

83

73

229

Interest Expense (Income), net

7

6

5

18

Income Tax Expense

43

53

52

148

EBITDA

337

398

415

-

1,150

Share-based Compensation

18

13

12

43

Restructuring & Realignment

15

29

11

55

Special Charges

16

13

7

36

Loss/(Gain) from sale of business

5

(1

)

2

6

Adjusted EBITDA

391

452

447

-

1,290

Revenue

2,033

2,169

2,104

6,306

Adjusted EBITDA Margin

19.2

%

20.8

%

21.2

%

20.5

%

2023

Q1 Q2 Q3 Q4 Total Net Income

99

92

152

266

609

Net Income margin

6.8

%

5.3

%

7.3

%

12.6

%

8.3

%

Depreciation

28

41

63

61

193

Amortization

32

51

84

76

243

Interest Expense (Income), net

2

5

6

8

21

Income Tax Expense

27

22

33

(56

)

26

EBITDA

188

211

338

355

1,092

Share-based Compensation

12

15

18

15

60

Restructuring & Realignment

11

36

33

23

103

Special Charges

25

67

22

22

136

Loss/(Gain) from sale of business

-

-

-

1

1

Adjusted EBITDA

236

329

411

416

1,392

Revenue

1,448

1,722

2,076

2,118

7,364

Adjusted EBITDA Margin

16.3

%

19.1

%

19.8

%

19.6

%

18.9

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030450000/en/

Media Houston Spencer +1 (914) 240-3046

Houston.Spencer@xylem.com

Investors Keith Buettner +1 (724) 772-1531

Keith.Buettner@xylem.com

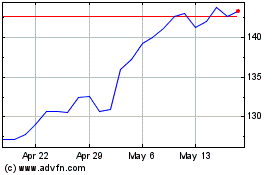

Xylem (NYSE:XYL)

Historical Stock Chart

From Oct 2024 to Nov 2024

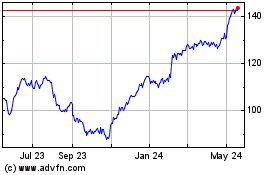

Xylem (NYSE:XYL)

Historical Stock Chart

From Nov 2023 to Nov 2024