Amerigo Resources Ltd. (TSX:ARG) ("Amerigo" or the "Company") reported today

results for the year ended December 31, 2013.

Amerigo's Chairman and CEO, Dr. Klaus Zeitler, stated "We are pleased to

announce that 2013 was a positive year financially for Amerigo, with revenues in

excess of $143 million and operating cash flow of $19 million. The Company ended

the year with more than $13 million in cash and free of long term debt, and is

now well positioned to proceed with the Cauquenes expansion project.

Negotiations for the formal agreements granting the Company the rights to the

Cauquenes tailings deposit and extending its fresh tailings contract from 2021

to 2037 are in their final stages, we anticipate receiving required

environmental approvals by the end of the current quarter and the due diligence

process in respect of the loan for the majority of the capital cost of the

expansion project is well underway. As a result, we continue to expect to break

ground on the Cauquenes expansion during Q2. The Company's guidance for 2014 is

for production of 45 million pounds of copper and 800,000 pounds of molybdenum,

with cash costs projected to be between $2.15 and $2.25 per pound of copper."

Comparative Annual Overview

----------------------------------------------------------------------------

Years ended December 31,

2013 2012 Change

$ %

----------------------------------------------------------------------------

Copper produced, million pounds 45.7 51.7 (6.0) (12%)

Copper sold, million pounds 45.4 51.6 (6.2) (12%)

Molybdenum produced, pounds 809,057 1,057,717 (248,660) (24%)

Molybdenum sold, pounds 797,444 1,170,703 (373,259) (32%)

Percentage of copper production

from old tailings 40% 47% (7%)

Revenue (thousands) 143,592 181,761 (38,169) (21%)

Cost of sales (1) (thousands) 137,556 182,851 (45,295) (25%)

El Teniente royalty costs

(thousands) 33,815 43,874 (10,059) (23%)

Gross profit (loss) (thousands) 6,036 (1,090) 7,126 654%

Net profit ( loss) (thousands) 993 (8,192) 9,185 112%

Operating cash flow (thousands) 19,136 12,284 6,852 56%

Cash flow paid for plant

expansion (thousands) (2) (13,391) (23,708) 10,317 (44%)

Cash and cash equivalents

(thousands) 13,148 9,250 3,898 42%

Bank debt (thousands) - 1,483 (1,483) (100%)

Average realized copper price

per pound 3.32 3.58 (0.26) (7%)

Cash cost per pound (3) 2.08 2.46 (0.38) (15%)

Total cost per pound (3) 3.22 3.62 (0.40) (11%)

----------------------------------------------------------------------------

(1) Includes El Teniente royalty costs

(2) Excluding working capital changes

(3) Cash and total costs are non-GAAP measures, refer to the

Company's MD&A for a reconciliation to cost of sales .

Financial results

-- Revenue was $143.6 million compared to $181.8 million in 2012. Revenues

decreased 21% due to lower copper and molybdenum sales and lower metal

prices.

-- Cost of sales was $137.6 million, compared to $182.9 million in 2012, a

decrease of 25%, driven by lower production and reduced power costs

mainly as a result of the change in the

Company's power contract from a variable to a lower fixed rate.

-- Gross profit was $6 million, compared to gross loss of $1.1 million in

2012.

-- Net profit was $1 million compared to a net loss of $8.2 million in

2012.

Production

-- The Company produced 45.7 million pounds of copper, 12% lower than the

51.7 million pounds produced in 2012.

-- Molybdenum production was 809,057 pounds, 24% lower than the 1,057,717

pounds produced in 2012.

-- Production was adversely affected by a mine slide and pit wall failure

in the Colihues deposit during April 2013 and by low process plant

recoveries from both fresh tailings and Colihues.

Revenue

-- Revenue decreased to $143.6 million from $181.8 million in 2012. The

Company's selling prices fell from $3.58/lb in 2012 to $3.32/lb for

copper and from $12.64/lb to $10.13/lb for molybdenum, and copper and

molybdenum sales volume decreased 12% and 32%, respectively, from 2012

levels.

Costs

-- Cash cost (a non-GAAP measure equal to the aggregate of smelting,

refining and other charges, production costs net of molybdenum-related

net benefits, administration and transportation costs, see the Company's

MD&A) before El Teniente royalty was $2.08/lb, compared to $2.46/lb in

2012. Cash costs decreased mostly as a result of lower power costs.

-- Total cost (a non-GAAP measure equal to the aggregate of cash cost, El

Teniente royalty, depreciation and accretion, see the Company's MD&A)

was $3.22/lb compared to $3.62/lb in 2012, as a result of lower cash

cost and El Teniente royalties.

-- Power costs in 2013 were $23.8 million ($0.0939/kwh) compared to $50.7

million ($0.1895/kwh) in 2012, Similar lower power costs are expected at

least to December 31, 2017, the end of the term of MVC's current power

contract

-- Total El Teniente royalties were $33.8 million in 2013, compared to

$43.9 million in 2012, due to lower production and metal prices.

Cash and Financing Activities

-- Cash balance was $13.1 million at December 31, 2013 compared to $9.2

million at December 31, 2012.

Investments

-- Cash payments for capital expenditures ("Capex") were $13.4 million

compared to $23.7 million in 2012. Capex payments have been funded from

operating cash flow and cash at hand.

-- Capex incurred in 2013 totaled $10.4 million (2012: $22.2 million) and

included project investments in connection with Cauquenes engineering

and permitting ($3.6 million) and sustaining Capex projects ($6.8

million).

-- The Company's investments in Candente Copper Corp. and Los Andes Copper

Ltd. had an aggregate fair value of $3.2 million at December 31, 2013

(December 31, 2012: $4.1 million).

Outlook

-- In 2014 MVC is expected to produce approximately 45 million pounds of

copper and 800,000 pounds of molybdenum, not accounting for the

Company's Cauquenes expansion. In addition, the tolling contract with

Minera Maricunga is expected to contribute a further 2 million pounds of

copper. The 2014 production budget anticipates continued low grades in

Colihues as the area to be mined contains recent DET tailings deposited

in 2006.

-- Cash cost is projected to be between $2.15/lb and $2.25/lb in 2014.

-- 2014 Sustaining Capex at MVC is estimated to be approximately $3.8

million. Capex for the Cauquenes expansion project is estimated to be

approximately $140 million (see the

Company's MD&A).

The information in this news release and the Selected Financial Information

contained in the following page should be read in conjunction with the Audited

Consolidated Financial Statements and Management's Discussion and Analysis for

the years ended December 31, 2013 and 2012, which will be available at the

Company's website at www.amerigoresources.com and at www.sedar.com.

Amerigo Resources Ltd. produces copper and molybdenum under a long term

partnership with the world's largest copper producer, Codelco, by means of

processing fresh and old tailings from the world's largest underground copper

mine, El Teniente near Santiago, Chile. Tel: (604) 681-2802; Fax: (604)

682-2802; Web: www.amerigoresources.com; Listing: ARG:TSX

Certain of the information and statements contained herein that are not

historical facts, constitute "forward-looking information" within the meaning of

the Securities Act (British Columbia), Securities Act (Ontario) and the

Securities Act (Alberta) ("Forward-Looking Information"). Forward-Looking

Information is often, but not always, identified by the use of words such as

"seek", "anticipate", "believe", "plan", "estimate", "expect" and "intend";

statements that an event or result is "due" on or "may", "will", "should",

"could", or might" occur or be achieved; and, other similar expressions. More

specifically, Forward-Looking Information contained herein includes, without

limitation, information concerning future tailings production volumes and the

Company's copper and molybdenum production, all of which involve known and

unknown risks, uncertainties and other factors which may cause the actual

results, performance or achievements of the Company, or industry results, to be

materially different from any future results, performance or achievements

expressed or implied by such Forward-Looking Information; including, without

limitation, material factors and assumptions relating to, and risks and

uncertainties associated with, the supply of tailings from El Teniente and

extraction of tailings from the Colihues tailings impoundment, the achievement

and maintenance of planned production rates, the evolving legal and political

policies of Chile, the volatility in the Chilean economy, military unrest or

terrorist actions, metal price fluctuations, governmental relations, the

availability of financing for activities when required and on acceptable terms,

the estimation of mineral resources and reserves, current and future

environmental and regulatory requirements, the availability and timely receipt

of permits, approvals and licenses, industrial or environmental accidents,

equipment breakdowns, availability of and competition for future mineral

acquisition opportunities, availability and cost of insurance, labour disputes,

land claims, the inherent uncertainty of production and cost estimates, currency

fluctuations, expectations and beliefs of management and other risks and

uncertainties, including those described under Risk Factors in the Company's

Annual Information Form and in Management's Discussion and Analysis in the

Company's financial statements.

Such Forward-Looking Information is based upon the Company's assumptions

regarding global and Chilean economic, political and market conditions and the

price of metals, including copper and molybdenum, and future tailings production

volumes and the Company's copper and molybdenum production. Among the factors

that have a direct bearing on the Company's future results of operations and

financial conditions are changes in project parameters as plans continue to be

refined, interruptions in the supply of fresh tailings from El Teniente, further

delays in the extraction of tailings from the Colihues tailings impoundment, a

change in government policies, competition, currency fluctuations and

restrictions and technological changes, among other things. Should one or more

of any of the aforementioned risks and uncertainties materialize, or should

underlying assumptions prove incorrect, actual results may vary materially from

any conclusions, forecasts or projections described in the Forward-Looking

Information. Accordingly, readers are advised not to place undue reliance on

Forward-Looking Information. Except as required under applicable securities

legislation, the Company undertakes no obligation to publicly update or revise

Forward-Looking Information, whether as a result of new information, future

events or otherwise.

AMERIGO RESOURCES LTD. SELECTED FINANCIAL INFORMATION

YEARS ENDED DECEMBER 31, 2013 AND 2012

All figures expressed in US Dollars and presented under IFRS

Consolidated Statements of Financial Position

December 31, December 31,

2013 2012

$ $

----------------------------

Cash and cash equivalents 13,148 9,250

Property, plant and equipment 116,601 138,337

Other assets 56,360 56,829

----------------------------

Total assets 186,109 204,416

----------------------------

Total liabilities 64,370 72,218

Shareholders' equity 121,739 132,198

----------------------------

Total liabilities and shareholders' equity 186,109 204,416

----------------------------

Consolidated Statements of Comprehensive Income

(Loss)

Year ended Year ended

December 31, December 31,

2013 2012

$ $

----------------------------

Total revenue, net of smelter and refinery

charges 143,592 181,761

Cost of sales (137,556) (182,851)

Other expenses (4,236) (3,751)

Finance expense (626) (1,056)

Income tax expense (181) (2,295)

----------------------------

Profit (loss) for the year 993 (8,192)

Other comprehensive (loss) income (11,504) 7,214

----------------------------

Comprehensive loss (10,511) (978)

----------------------------

EPS (LPS) - Basic and Diluted 0.01 (0.05)

Consolidated Statements of Cash Flows

December 31, December 31,

2013 2012

$ $

----------------------------

Net cash provided by operating activities 19,523 22,726

Net cash used in investing activities (13,391) (23,708)

Net cash (used in) financing activities (1,497) (10,193)

----------------------------

Net cash inflow (outflow) 4,635 (11,175)

----------------------------

FOR FURTHER INFORMATION PLEASE CONTACT:

Amerigo Resources Ltd.

Dr. Klaus Zeitler

Chairman & CEO

(604) 218-7013 or (604) 697-6201

Amerigo Resources Ltd.

(604) 681-2802

(604) 682-2802 (FAX)

www.amerigoresources.com

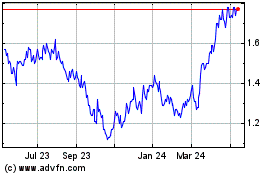

Amerigo Resources (TSX:ARG)

Historical Stock Chart

From Dec 2024 to Jan 2025

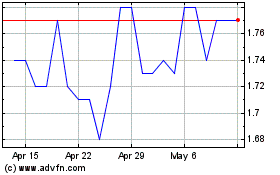

Amerigo Resources (TSX:ARG)

Historical Stock Chart

From Jan 2024 to Jan 2025