Bitfarms Ltd. (Nasdaq/TSX: BITF), a global Bitcoin vertically

integrated company, reported its financial results for the fourth

quarter and year ended December 31, 2023. All financial

references are in U.S. dollars.

“In 2023, we set the foundation to drive

significant growth through our transformational fleet upgrade and

mining facility expansion,” said Geoff Morphy, President and

Chief Executive Officer of Bitfarms. “To that end, we secured

35,888 ultra-efficient Bitmain T21 miners to be installed in the

first half of 2024 and signed an option to purchase up to an

additional 28,000 T21s for delivery in the second half 2024. Our

2024 plan targets tripling our hashrate to 21 EH/s, at least a 63%

increase in operating capacity to 391 MW, and improving our fleet

efficiency by 34% to 23 w/TH.”

“New farm development in Paraguay will

drive much of this growth. In Yguazu, we purchased land for our 100

MW project in January 2024. In Paso Pe, the infrastructure and

electrical equipment are nearly ready for us to begin installing

Bitmain T21 and new hydro-miners at our 70 MW project, which we

expect to begin energizing in March. In addition, we are actively

evaluating the best use of capital to secure further low-cost

production growth opportunities via miner redeployment,

acquisitions, and farm development,” added Morphy.

Bitfarms’ Chief Financial Officer Jeff Lucas

said, “In 2023, we strengthened our balance sheet and improved our

liquidity, lowering our debt obligations from a peak of $165

million in June 2022 to fully debt free two weeks ago, except for

our lease obligations. By further enhancing financial flexibility

and liquidity, we can better support our aggressive growth plans

for 2024.”

“Following a highly disciplined capital

allocation strategy, we have locked in lower-cost electricity –

fundamental to our long-term success – and eliminated debt to

prepare for active business development in new and low-cost

locations,” concluded Lucas.

Q4 2023 and Recent 2024 Operating

Highlights

- Increased hashrate by 7% to 6.5

EH/s at December 31, 2023, through the installation of 2,300

miners, compared to 6.1 EH/s at the end of Q3 2023.

- Installed 12 Bitmain T21 miners for

testing in mid-February 2024 which outperformed the manufacturer’s

specifications in both normal and high-energy modes.

- At Rio Cuarto, Argentina:

- Installed ~ 600 MicroBT M50

WhatsMiners and 200 Bitmain S19j Pro+ Antminers, which increased

capacity to 54 MW and added 0.1 EH/s, bringing the farm’s total

hashrate to approximately 1.6 EH/s.

- At Paso Pe, Paraguay:

- Amended the energy contract, adding

20 MW to the air-cooled warehouse portion of the project,

increasing its operating capacity to 50 MW and the farm’s total

capacity to 70 MW.

- At Yguazu, Paraguay:

- In January, purchased land for

development of an up to 100 MW hydro-powered facility.

- In February, signed the

engineering, procurement and construction contract for the

substation and transmission line to energize the facility.

- At Baie-Comeau, Québec:

- Cleared the site to house the 11 MW

expansion planned for H2 2024 and poured the building’s concrete

footings ahead of schedule.

Q4 2023 Financial Highlights

(2022 comparisons as restated)

- Total revenue was $46 million, an

increase of 34% compared to $35 million in Q3 2023, as a 5%

increase in BTC earned and 30% higher average BTC prices

contributed to higher revenue.

- Gross mining profit* and gross

mining margin* were $23 million and 52%, respectively, compared to

$13 million and 38% in Q3 2023, respectively.

- General and administrative expenses

were $13 million, up 12% from Q4 2022 and up 60% from Q3 2023. The

increase from the third quarter reflects higher headcount to

support the targeted infrastructure growth as well as one-time and

recurring performance achievement payments, merit and market-based

adjustments, and $4 million non-cash share-based payment

expense.

- Operating loss of $13 million,

which included a $1 million non-cash reversal of revaluation loss

on digital assets and a $2 million non-cash impairment on

impairment on PPE equipment. In Q4 2022, incurred a $20 million

operating loss which included a $9 million non-cash impairment

reversal, a $29 million realized loss on disposition of digital

assets, and a $23 million non-cash reversal of revaluation loss on

digital assets.

- Net loss of $57 million, or ($0.19)

per basic and diluted share, which included a $38 million non-cash

expense for revaluation of warrant liability issued in connection

with 2021 and 2023 financing activities. This compares to a net

loss of $13 million, or ($0.06) per basic and diluted share, in Q4

2022 which included $4 million of non-cash gain on revaluation of

warrant liability.

- Adjusted EBITDA* of $14 million, or

30% of revenue, compared to $2 million, or 7% of revenue, in Q4

2022, with the increase driven largely by the average BTC price

approximately doubling the average BTC price in the prior year

quarter.

- The Company earned 1,236 BTC at an

average direct cost of production per BTC* of $16,200 compared to

$16,900 in Q3 2023.

- Total cash cost of production per

BTC* was $25,200 in Q4 2023, up from $22,700 in Q3 2023, reflecting

one-time and non-recurring fixed operating expenses including

infrastructure enhancement and compensation.

Liquidity** At December 31,

2023, the Company held $84 million in cash and 804 BTC valued at

approximately $34 million based upon a BTC price at that time of

approximately $42,300 for total liquidity** of $118 million.

Q4 2023 and Recent 2024 Financing

Activities

- Raised $41 million in net proceeds

through a private placement in November 2023.

- Received $11 million in proceeds

during December 2023 and $6 million in proceeds during 2024 from

exercise of warrants issued in the November 2023 private

placement.

- Eliminated debt as of February 29,

2024, paying down $6 million in equipment-related indebtedness in

Q4 2023 and another $4 million in Q1 2024.

- Initiated the Synthetic HODL™

strategy with the purchase of 135 long-dated BTC call options held

by the Company as of December 31, 2023.

Quarterly Operating

Performance

|

Key Performance Indicators |

Q4 2023 |

Q4 2022 |

Q3 2023 |

|

Total BTC Earned |

1,236 |

1,434 |

1,172 |

|

Quarter End Operating Hashrate |

6.5 |

4.5 |

6.1 |

|

Operating Capacity (MW) |

240 |

188 |

234 |

|

Hydropower (MW) |

186 |

178 |

183 |

|

Watts/TH Efficiency*** |

35 |

38 |

36 |

| BTC

Sold |

1,135 |

3,093 |

1,018 |

| |

|

|

|

Quarterly Operating

Production

|

Quarter |

BTC Earned 2023 |

BTC Earned 2022 |

|

Q1 |

1,297 |

961 |

|

Q2 |

1,223 |

1,257 |

|

Q3 |

1,172 |

1,515 |

|

Q4 |

1,236 |

1,434 |

|

Totals |

4,928 |

5,167 |

|

|

|

|

Quarterly Average Revenue**** and Cost

of Production per BTC*

|

|

Q4 2023 |

Q3 2023 |

Q2 2023 |

Q1 2023 |

Q4 2022 |

|

Avg. Rev/BTC**** |

$36,400 |

$28,100 |

$28,000 |

$22,500 |

$18,100 |

|

Direct Cost/BTC* |

$16,200 |

$16,900 |

$15,700 |

$12,500 |

$11,000 |

|

Cash Cost/BTC* |

$25,200 |

$22,700 |

$21,800 |

$17,600 |

$16,400 |

Financial Results for the Year-ended December 31:

2023 vs 2022(2022 comparisons as restated)

In 2023, the Company generated revenue of $146

million, compared to $142 million in 2022. 2023 gross loss was $22

million, or negative 15% gross margin*, compared to gross profit of

$11 million, or 7% gross margin*, in 2022. Non-cash depreciation

and amortization expense was $85 million and $72 million,

respectively, for 2023 and 2022.

The Company earned 4,928 BTC for an average

direct cost of production per BTC* of $15,200 in 2023 compared to

5,167 BTC earned for an average direct cost of production per BTC*

of $10,000 in 2022, largely reflecting an approximate 74% increase

in average network difficulty over the prior year.

Operating loss was $72 million in 2023, compared

to an operating loss of $284 million in 2022. 2023 net loss was

$104 million, or $(0.40) per basic and diluted share, compared to a

net loss of $176 million, or $(0.85) per basic and diluted share,

in 2022. Adjusted EBITDA* was $35 million, with 24% Adjusted EBITDA

margin*, compared to $55 million of Adjusted EBITDA*, with 38%

Adjusted EBITDA margin* in 2022.

* Gross mining profit, gross mining margin,

EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, direct cost per

BTC and total cash cost per BTC are non-IFRS financial measures or

ratios and should be read in conjunction with and should

not be viewed as alternatives to or replacements of measures of

operating results and liquidity presented in accordance with IFRS.

Readers are referred to the reconciliations of non-IFRS measures

included in the Company’s MD&A and at the end of this press

release.** Liquidity represents cash and balance of digital assets

including digital assets pledged as collateral.*** Average Watts

represents the energy consumption of Miners.**** Average revenue

per BTC is based on revenue from mining operations only and

excludes Volta revenue.

Conference CallManagement will host a

conference call today at 8:00am EST. A presentation of the Q4 2023

results will be accessible before the call on the Investor website

and can be accessed here.

Participants are asked to pre-register for the

event through the following link: Q4 2023 Conference

Call. Please note that registered participants will receive

their dial-in number upon registration and will dial directly into

the call without delay. Those unable to pre-register may dial in by

calling: 1-866-777-2509 (domestic), or 1-412-317-5413

(international), and should do so 10 minutes prior to the start

time.

The conference call will also be available through a live

webcast found here.

The webcast replay will be available one hour

after the end of the call and can be accessed in the Events section

of our Investor website. An audio replay will be available through

March 14, 2024, and can be accessed at 1-877-344-7529 (domestic),

1-412-317-0088 (international), or Canada (toll free) 855-669-9658

using access code 4390159.

Non-IFRS Measures*As a Canadian

company, Bitfarms follows International Financial Reporting

Standards (IFRS) which are issued by the International Accounting

Standard Board (IASB). Under IFRS rules, the Company does not

reflect the revaluation gains on the mark-to-market of its Bitcoin

holdings in its income statement. It also does not include the

revaluation losses on the mark-to-market of its Bitcoin holdings in

Adjusted EBITDA, which is a measure of the cash profitability of

its operations and does not reflect the change in value of its

assets and liabilities.

The Company uses Adjusted EBITDA to measure its

operating activities' financial performance and cash generating

capability.

2022 Restatement During the

preparation of the Company's financial statements for the year

ended December 31, 2023, the Company reassessed the application of

IFRS Accounting Standards on the accounting for warrants issued in

connection with private placement financings conducted in 2021 and,

as such, restated (the “Restatement”) its consolidated statements

of financial position as of December 31, 2022 and January 1, 2022,

its consolidated statements of profit or loss and comprehensive

profit or loss for the year ended December 31, 2022 and its

consolidated statements of cash flows for the year ended December

31, 2022, which were previously filed on SEDAR+ and EDGAR. For

further details, consult Note 3e of the audited consolidated

financial statements for the year ended December 31, 2023,

available on SEDAR+ and EDGAR. As described in the Annual MD&A

for the year ended December 31, 2023, available on SEDAR+ and

EDGAR, the Company is undertaking remediation efforts in light of

the Restatement and in order to improve the overall effectiveness

of its internal control over financial reporting for the accounting

of complex financial instruments.

About Bitfarms Ltd.Founded in

2017, Bitfarms is a global Bitcoin mining company that contributes

its computational power to one or more mining pools from which it

receives payment in Bitcoin. Bitfarms develops, owns, and operates

vertically integrated mining farms with in-house management and

company-owned electrical engineering, installation service, and

multiple onsite technical repair centers. The Company’s proprietary

data analytics system delivers best-in-class operational

performance and uptime.

Bitfarms currently has 11 operating Bitcoin

mining facilities and two under development situated in four

countries: Canada, the United States, Paraguay, and Argentina.

Powered predominantly by environmentally friendly hydro-electric

and long-term power contracts, Bitfarms is committed to using

sustainable and often underutilized energy infrastructure.

To learn more about Bitfarms’ events,

developments, and online communities:

Website: Website: www.bitfarms.com

https://www.facebook.com/bitfarms/https://twitter.com/Bitfarms_iohttps://www.instagram.com/bitfarms/https://www.linkedin.com/company/bitfarms/

Glossary of Terms

- BTC BTC/day = Bitcoin or Bitcoin per day

- EH or EH/s = Exahash or exahash per second

- MW or MWh = Megawatts or megawatt hour

- w/TH = Watts/Terahash efficiency (includes cost of powering

supplementary equipment

- Synthetic HODL™ = the use of instruments that create Bitcoin

equivalent exposure

Cautionary Statement

Trading in the securities of the Company should

be considered highly speculative. No stock exchange, securities

commission or other regulatory authority has approved or

disapproved the information contained herein. Neither the Toronto

Stock Exchange, Nasdaq, or any other securities exchange or

regulatory authority accepts responsibility for the adequacy or

accuracy of this release.

Forward-Looking Statements

This news release contains certain

“forward-looking information” and “forward-looking statements”

(collectively, “forward-looking information”) that are based on

expectations, estimates and projections as at the date of this news

release and are covered by safe harbors under Canadian and United

States securities laws. The statements and information in this

release regarding projected growth, target hashrate, opportunities

relating to the Company’s geographical diversification and

expansion, upgrading and deployment of miners as well as the timing

therefor, improved financial performance and balance sheet

liquidity, other growth opportunities and prospects, and other

statements regarding future growth, plans and objectives of the

Company are forward-looking information. Any statements that

involve discussions with respect to predictions, expectations,

beliefs, plans, projections, objectives, assumptions, future events

or performance (often but not always using phrases such as

“expects”, or “does not expect”, “is expected”, “anticipates” or

“does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”,

“estimates”, “prospects”, “believes” or “intends” or variations of

such words and phrases or stating that certain actions, events or

results “may” or “could”, “would”, “might” or “will” be taken to

occur or be achieved) are not statements of historical fact and may

be forward-looking information and are intended to identify

forward-looking information.

This forward-looking information is based on

assumptions and estimates of management of the Company at the time

they were made, and involves known and unknown risks, uncertainties

and other factors which may cause the actual results, performance,

or achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking information. Such factors include, among

others, risks relating to: the construction and operation of the

Company’s facilities may not occur as currently planned, or at all;

expansion may not materialize as currently anticipated, or at all;

the digital currency market; the ability to successfully mine

digital currency; revenue may not increase as currently

anticipated, or at all; it may not be possible to profitably

liquidate the current digital currency inventory, or at all; a

decline in digital currency prices may have a significant negative

impact on operations; an increase in network difficulty may have a

significant negative impact on operations; the volatility of

digital currency prices; the anticipated growth and sustainability

of hydroelectricity for the purposes of cryptocurrency mining in

the applicable jurisdictions; the inability to maintain reliable

and economical sources of power for the Company to operate

cryptocurrency mining assets; the risks of an increase in the

Company’s electricity costs, cost of natural gas, changes in

currency exchange rates, energy curtailment or regulatory changes

in the energy regimes in the jurisdictions in which the Company

operates and the adverse impact on the Company’s profitability; the

ability to complete current and future financings; the impact of

the Restatement on the price of the Company’s common shares,

financial condition and results of operations; the risk that a

material weakness in internal control over financial reporting

could result in a misstatement of the Company’s financial position

that may lead to a material misstatement of the annual or interim

consolidated financial statements if not prevented or detected on a

timely basis; any regulations or laws that will prevent Bitfarms

from operating its business; historical prices of digital

currencies and the ability to mine digital currencies that will be

consistent with historical prices; and the adoption or expansion of

any regulation or law that will prevent Bitfarms from operating its

business, or make it more costly to do so. For further information

concerning these and other risks and uncertainties, refer to the

Company’s filings on www.SEDAR.com (which are also available on the

website of the U.S. Securities and Exchange Commission at

www.sec.gov), including the MD&A for the year-ended December

31, 2023, filed on March 7, 2024. Although the Company has

attempted to identify important factors that could cause actual

results to differ materially from those expressed in

forward-looking statements, there may be other factors that cause

results not to be as anticipated, estimated or intended, including

factors that are currently unknown to or deemed immaterial by the

Company. There can be no assurance that such statements will prove

to be accurate as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on any forward-looking

information. The Company undertakes no obligation to revise or

update any forward-looking information other than as required by

law.

Investor Relations Contacts:

Tracy Krumme (Bitfarms)+1

786-671-5638tkrumme@bitfarms.com

David Barnard (LHA)+1

415-433-3777Investors@bitfarms.com

Media Contacts:

Actual Agency Khushboo Chaudhary+1

646-373-9946mediarelations@bitfarms.com

Québec Media: TactLouis-Martin Leclerc+1

418-693-2425lmleclerc@tactconseil.ca

|

Bitfarms Ltd. Consolidated Financial & Operational

Results |

| |

| |

Three months ended December 31, |

Year ended December 31, |

| (U.S.$ in

thousands except where indicated) |

2023 |

|

2022(3) |

$ Change |

|

% Change |

|

2023 |

|

2022(3) |

$ Change |

|

% Change |

|

|

Revenues |

46,241 |

|

27,037 |

|

19,204 |

|

71 |

% |

146,366 |

|

142,428 |

|

3,938 |

|

3 |

% |

| Cost of

revenues |

44,484 |

|

39,121 |

|

5,363 |

|

14 |

% |

167,868 |

|

131,910 |

|

35,958 |

|

27 |

% |

|

Gross (loss) profit |

1,757 |

|

(12,084 |

) |

13,841 |

|

115 |

% |

(21,502 |

) |

10,518 |

|

(32,020 |

) |

(304 |

)% |

| Gross

margin(1) |

4 |

% |

(45 |

)% |

— |

|

— |

|

(15 |

)% |

7 |

% |

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

General and administrative expenses |

13,405 |

|

11,972 |

|

1,433 |

|

12 |

% |

39,292 |

|

51,506 |

|

(12,214 |

) |

(24 |

)% |

|

Realized loss on disposition of digital assets |

— |

|

28,567 |

|

(28,567 |

) |

(100 |

)% |

— |

|

150,810 |

|

(150,810 |

) |

(100 |

)% |

|

Reversal of revaluation loss on digital assets |

(1,183 |

) |

(23,284 |

) |

22,101 |

|

(95 |

)% |

(2,695 |

) |

(2,166 |

) |

(529 |

) |

24 |

% |

|

Loss on disposition of property, plant and equipment |

2 |

|

(415 |

) |

417 |

|

100 |

% |

1,778 |

|

1,277 |

|

501 |

|

39 |

% |

|

Impairment (reversal) on short-term prepaid deposits, equipment and

construction prepayments, property, plant and equipment and

right-of-use assets |

2,270 |

|

(8,903 |

) |

11,173 |

|

125 |

% |

12,252 |

|

75,213 |

|

(62,961 |

) |

(84 |

)% |

|

Impairment on goodwill |

— |

|

— |

|

— |

|

— |

% |

— |

|

17,900 |

|

(17,900 |

) |

(100 |

)% |

|

Operating loss |

(12,737 |

) |

(20,021 |

) |

7,284 |

|

(36 |

)% |

(72,129 |

) |

(284,022 |

) |

211,893 |

|

(75 |

)% |

|

Operating margin(1) |

(28 |

)% |

(74 |

)% |

— |

|

— |

|

(49 |

)% |

(199 |

)% |

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

| Net

financial (income) expenses |

44,800 |

|

(7,128 |

) |

51,928 |

|

729 |

% |

32,308 |

|

(90,966 |

) |

123,274 |

|

136 |

% |

|

Net loss before income taxes |

(57,537 |

) |

(12,893 |

) |

(44,644 |

) |

346 |

% |

(104,437 |

) |

(193,056 |

) |

88,619 |

|

(46 |

)% |

|

|

|

|

|

|

|

|

|

|

| Income

tax recovery |

(378 |

) |

191 |

|

(569 |

) |

(298 |

)% |

(401 |

) |

(17,412 |

) |

17,011 |

|

(98 |

)% |

|

Net loss |

(57,159 |

) |

(13,084 |

) |

(44,075 |

) |

337 |

% |

(104,036 |

) |

(175,644 |

) |

71,608 |

|

(41 |

)% |

|

|

|

|

|

|

|

|

|

|

| Basic

and diluted loss per share (in U.S. dollars) |

(0.19 |

) |

(0.06 |

) |

— |

|

— |

|

(0.40 |

) |

(0.85 |

) |

— |

|

— |

|

|

Change in revaluation surplus - digital assets, net of tax |

7,675 |

|

— |

|

7,675 |

|

100 |

% |

9,242 |

|

— |

|

9,242 |

|

100 |

% |

|

Total comprehensive loss, net of tax |

(49,484 |

) |

(13,084 |

) |

(36,400 |

) |

278 |

% |

(94,794 |

) |

(175,644 |

) |

80,850 |

|

(46 |

%) |

|

|

|

|

|

|

|

|

|

|

| Gross Mining

profit(2) |

23,357 |

|

8,494 |

|

14,863 |

|

175 |

% |

62,374 |

|

82,584 |

|

(20,210 |

) |

(24 |

)% |

| Gross Mining

margin(2) |

52 |

% |

33 |

% |

— |

|

— |

|

44 |

% |

59 |

% |

— |

|

— |

|

| EBITDA(2) |

(35,656 |

) |

10,955 |

|

(46,611 |

) |

(425 |

)% |

(16,993 |

) |

(106,871 |

) |

89,878 |

|

(84 |

)% |

| EBITDA

margin(2) |

(77 |

)% |

41 |

% |

— |

|

— |

|

(12 |

)% |

(75 |

)% |

— |

|

— |

|

| Adjusted

EBITDA(2) |

14,048 |

|

1,982 |

|

12,066 |

|

609 |

% |

35,085 |

|

54,686 |

|

(19,601 |

) |

(36 |

)% |

|

Adjusted EBITDA margin(2) |

30 |

% |

7 |

% |

— |

|

— |

|

24 |

% |

38 |

% |

— |

|

— |

|

|

|

|

|

|

1 Gross margin and Operating margin are supplemental financial

ratios; refer to section 10 -Non-IFRS and Other Financial Measures

and Ratiosof the Company's MD&A. |

|

2 Gross Mining profit, Gross Mining margin, EBITDA, EBITDA margin,

Adjusted EBITDA and Adjusted EBITDA margin are non-IFRS measures or

ratios; refer to section 10 -Non-IFRS and Other Financial Measures

and Ratios of the Company's MD&A. |

|

3 Prior year figures are derived from restated financial

statements. Refer to the 2023 annual financial statements Note 3e

-Basis of Presentation and Material Accounting Policy

Information-2022 Restatement. |

|

Bitfarms Ltd.Reconciliation of

Consolidated Net Income (loss) to EBITDA and Adjusted

EBITDA |

| |

|

|

Three months ended December 31, |

Year ended December 31, |

|

(U.S.$ in thousands except where indicated) |

2023 |

|

2022(1) |

$ Change |

|

% Change |

|

2023 |

|

2022(1) |

$ Change |

|

% Change |

|

|

Revenues |

46,241 |

|

27,037 |

|

19,204 |

|

71% |

|

146,366 |

|

142,428 |

|

3,938 |

|

3% |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss before income taxes |

(57,537) |

|

(12,893) |

|

(44,644) |

|

346% |

|

(104,437) |

|

(193,056) |

|

88,619 |

|

(46)% |

|

|

Interest expense and income |

91 |

|

3,071 |

|

(2,980) |

|

(97)% |

|

2,659 |

|

13,765 |

|

(11,106) |

|

(81)% |

|

|

Depreciation and amortization |

21,790 |

|

20,777 |

|

1,013 |

|

5% |

|

84,785 |

|

72,420 |

|

12,365 |

|

17% |

|

|

EBITDA |

(35,656) |

|

10,955 |

|

(46,611) |

|

(425)% |

|

(16,993) |

|

(106,871) |

|

89,878 |

|

(84)% |

|

|

EBITDA margin |

(77)% |

|

41% |

|

— |

|

— |

|

(12)% |

|

(75)% |

|

— |

|

— |

|

|

Share-based payment |

3,906 |

|

3,795 |

|

111 |

|

3% |

|

10,915 |

|

21,788 |

|

(10,873) |

|

(50)% |

|

| Realized loss on disposition of

digital assets |

— |

|

28,567 |

|

(28,567) |

|

(100)% |

|

— |

|

150,810 |

|

(150,810) |

|

(100)% |

|

| Impairment (reversal) on

short-term prepaid deposits, equipment and construction

prepayments, property, plant and equipment and right-of-use

assets |

2,270 |

|

(8,903) |

|

11,173 |

|

125% |

|

12,252 |

|

75,213 |

|

(62,961) |

|

(84)% |

|

| Reversal of revaluation loss on

digital assets |

(1,183) |

|

(23,284) |

|

22,101 |

|

(95)% |

|

(2,695) |

|

(2,166) |

|

(529) |

|

24% |

|

| Impairment on goodwill |

— |

|

— |

|

— |

|

—% |

|

— |

|

17,900 |

|

(17,900) |

|

(100)% |

|

| Gain on extinguishment of

long-term debt and lease liabilities |

— |

|

— |

|

— |

|

—% |

|

(12,835) |

|

— |

|

(12,835) |

|

(100)% |

|

| Loss (gain) on revaluation of

warrants |

37,874 |

|

(3,759) |

|

41,633 |

|

nm |

|

38,088 |

|

(63,406) |

|

101,494 |

|

160% |

|

| Gain on disposition of marketable

securities |

(999) |

|

(7,317) |

|

6,318 |

|

(86)% |

|

(12,245) |

|

(51,649) |

|

39,404 |

|

(76)% |

|

|

Net financial expenses and other |

7,836 |

|

1,928 |

|

5,908 |

|

306% |

|

18,598 |

|

13,067 |

|

5,531 |

|

42% |

|

|

Adjusted EBITDA |

14,048 |

|

1,982 |

|

12,066 |

|

609% |

|

35,085 |

|

54,686 |

|

(19,601) |

|

(36)% |

|

|

Adjusted EBITDA margin |

30% |

|

7% |

|

— |

|

— |

|

24% |

|

38% |

|

— |

|

— |

|

nm: not meaningful

|

|

|

|

1 |

Prior year figures are derived from restated financial statements.

Refer to the 2023 annual financial statements Note 3e - Basis of

Presentation and Material Accounting Policy Information - 2022

Restatement. |

| Bitfarms

Ltd. Calculation of Gross Mining

Profit and Gross Mining Margin |

| |

|

|

Three months ended December 31, |

Year ended December 31, |

|

(U.S.$ in thousands except where indicated) |

2023 |

|

2022 |

|

$ Change |

|

% Change |

|

2023 |

|

2022 |

|

$ Change |

|

% Change |

|

|

Gross (loss) profit |

1,757 |

|

(12,084 |

) |

13,841 |

|

115 |

% |

(21,502 |

) |

10,518 |

|

(32,020 |

) |

(304 |

)% |

|

Non-Mining revenues (1) |

(1,285 |

) |

(1,101 |

) |

(184 |

) |

17 |

% |

(5,060 |

) |

(3,443 |

) |

(1,617 |

) |

47 |

% |

| Depreciation and

amortization |

21,790 |

|

20,777 |

|

1,013 |

|

5 |

% |

84,785 |

|

72,420 |

|

12,365 |

|

17 |

% |

| Purchases of electrical

components and other |

754 |

|

510 |

|

244 |

|

48 |

% |

2,590 |

|

1,773 |

|

817 |

|

46 |

% |

|

Electrician salaries and payroll taxes |

341 |

|

392 |

|

(51 |

) |

(13 |

)% |

1,561 |

|

1,316 |

|

245 |

|

19 |

% |

|

Gross Mining profit |

23,357 |

|

8,494 |

|

14,863 |

|

175 |

% |

62,374 |

|

82,584 |

|

(20,210 |

) |

(24 |

)% |

|

Gross Mining margin |

52 |

% |

33 |

% |

— |

|

— |

|

44 |

% |

59 |

% |

— |

|

— |

|

|

(1) |

Non-Mining revenues reconciliation: |

|

|

Three months ended December 31, |

Year ended December 31, |

|

(U.S.$ in thousands except where indicated) |

2023 |

|

2022 |

|

$ Change |

|

% Change |

|

2023 |

|

2022 |

|

$ Change |

|

% Change |

|

|

Revenues |

46,241 |

|

27,037 |

|

19,204 |

|

71 |

% |

146,366 |

|

142,428 |

|

3,938 |

|

3 |

% |

|

Less Mining related revenues for the purpose of calculating gross

Mining margin: |

|

|

|

|

|

|

|

|

|

Mining revenues |

(44,956 |

) |

(25,936 |

) |

(19,020 |

) |

73 |

% |

(141,306 |

) |

(138,985 |

) |

(2,321 |

) |

2 |

% |

|

Non-Mining revenues |

1,285 |

|

1,101 |

|

184 |

|

17 |

% |

5,060 |

|

3,443 |

|

1,617 |

|

47 |

% |

|

Bitfarms Ltd. Calculation of Direct Cost and Direct Cost

per BTC |

| |

|

|

Three months ended December 31, |

Year ended December 31, |

|

(U.S.$ in thousands except where indicated) |

2023 |

|

2022 |

|

$ Change |

|

% Change |

|

2023 |

|

2022 |

|

$ Change |

|

% Change |

|

|

Cost of revenues |

44,484 |

|

39,121 |

|

5,363 |

|

14 |

% |

167,868 |

|

131,910 |

|

35,958 |

|

27 |

% |

|

Depreciation and amortization |

(21,790 |

) |

(20,777 |

) |

(1,013 |

) |

5 |

% |

(84,785 |

) |

(72,420 |

) |

(12,365 |

) |

17 |

% |

| Purchases of electrical

components |

(750 |

) |

(507 |

) |

(243 |

) |

48 |

% |

(2,580 |

) |

(1,759 |

) |

(821 |

) |

47 |

% |

| Electrician salaries and

payroll taxes |

(341 |

) |

(392 |

) |

51 |

|

(13 |

)% |

(1,561 |

) |

(1,316 |

) |

(245 |

) |

19 |

% |

| Infrastructure |

(1,607 |

) |

(1,030 |

) |

(577 |

) |

56 |

% |

(3,909 |

) |

(4,871 |

) |

962 |

|

(20 |

)% |

|

Other |

— |

|

(658 |

) |

658 |

|

100 |

% |

82 |

|

(82 |

) |

164 |

|

200 |

% |

|

Direct Cost |

19,996 |

|

15,757 |

|

4,239 |

|

27 |

% |

75,115 |

|

51,462 |

|

23,653 |

|

46 |

% |

|

Quantity of BTC earned |

1,236 |

|

1,434 |

|

(198 |

) |

(14 |

)% |

4,928 |

|

5,167 |

|

(239 |

) |

(5 |

)% |

|

Direct Cost per BTC (in U.S. dollars) |

16,200 |

|

11,000 |

|

5,200 |

|

47 |

% |

15,200 |

|

10,000 |

|

5,200 |

|

52 |

% |

|

Bitfarms Ltd. of Total Cash Cost and Total Cost per

BTC |

| |

|

|

Three months ended December 31, |

Year ended December 31, |

|

(U.S.$ in thousands except where indicated) |

2023 |

|

2022(1) |

$ Change |

|

% Change |

|

2023 |

|

2022(1) |

$ Change |

|

% Change |

|

|

Net loss before income taxes |

57,537 |

|

12,893 |

|

44,644 |

|

346 |

% |

104,437 |

|

193,056 |

|

(88,619 |

) |

(46 |

)% |

| Revenues |

46,241 |

|

27,037 |

|

19,204 |

|

71 |

% |

146,366 |

|

142,428 |

|

3,938 |

|

3 |

% |

| Depreciation and

amortization |

(21,790 |

) |

(20,777 |

) |

(1,013 |

) |

5 |

% |

(84,785 |

) |

(72,420 |

) |

(12,365 |

) |

17 |

% |

| Purchases of electrical

components |

(750 |

) |

(507 |

) |

(243 |

) |

48 |

% |

(2,580 |

) |

(1,759 |

) |

(821 |

) |

47 |

% |

| Electrician salaries and

payroll taxes |

(341 |

) |

(392 |

) |

51 |

|

(13 |

)% |

(1,561 |

) |

(1,316 |

) |

(245 |

) |

19 |

% |

| Share-based payment |

(3,906 |

) |

(3,795 |

) |

(111 |

) |

3 |

% |

(10,915 |

) |

(21,788 |

) |

10,873 |

|

(50 |

)% |

| Realized loss on disposition

of digital assets |

— |

|

(28,567 |

) |

28,567 |

|

100 |

% |

— |

|

(150,810 |

) |

150,810 |

|

100 |

% |

| Reversal of revaluation loss

on digital assets |

1,183 |

|

23,284 |

|

(22,101 |

) |

(95 |

)% |

2,695 |

|

2,166 |

|

529 |

|

24 |

% |

| (Loss) gain on disposition of

property, plant and equipment |

(2 |

) |

415 |

|

(417 |

) |

(100 |

)% |

(1,778 |

) |

(1,277 |

) |

(501 |

) |

39 |

% |

| Impairment (charge) reversal

on short-term prepaid deposits, equipment and construction

prepayments, property, plant and equipment and right-of-use

assets |

(2,270 |

) |

8,903 |

|

(11,173 |

) |

(125 |

)% |

(12,252 |

) |

(75,213 |

) |

62,961 |

|

(84 |

)% |

| Impairment on goodwill |

— |

|

— |

|

— |

|

— |

% |

— |

|

(17,900 |

) |

17,900 |

|

100 |

% |

| Net financial income

(expenses) |

(44,800 |

) |

7,128 |

|

(51,928 |

) |

(729 |

)% |

(32,308 |

) |

90,966 |

|

(123,274 |

) |

(136 |

)% |

|

Other |

— |

|

(2,124 |

) |

2,124 |

|

100 |

% |

(97 |

) |

(1,548 |

) |

1,451 |

|

(94 |

)% |

|

Total Cash Cost |

31,102 |

|

23,498 |

|

7,604 |

|

32 |

% |

107,222 |

|

84,585 |

|

22,637 |

|

27 |

% |

|

Quantity of BTC earned |

1,236 |

|

1,434 |

|

(198 |

) |

(14 |

)% |

4,928 |

|

5,167 |

|

(239 |

) |

(5 |

)% |

|

Total Cash Cost per BTC (in U.S. dollars) |

25,200 |

|

16,400 |

|

8,800 |

|

54 |

% |

21,800 |

|

16,400 |

|

5,400 |

|

33 |

% |

|

|

|

|

1 |

Prior year figures are derived from restated financial statements.

Refer to the 2023 annual financial statements Note 3e - Basis of

Presentation and Material Accounting Policy Information - 2022

Restatement. |

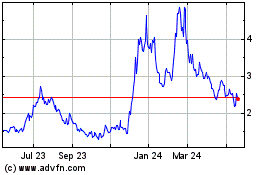

Bitfarms (TSX:BITF)

Historical Stock Chart

From Jan 2025 to Feb 2025

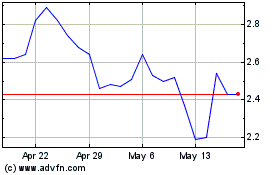

Bitfarms (TSX:BITF)

Historical Stock Chart

From Feb 2024 to Feb 2025