Bitfarms Ltd. (Nasdaq/TSX: BITF) (“Bitfarms” or the “Company”), a

global vertically integrated Bitcoin data center company, today

announced the following enhancements to its Operations teams.

Effective immediately, Alex Brammer has been appointed Senior Vice

President of Global Mining Operations and Benoit Gobeil, currently

serving as Executive Vice President of Operation &

Infrastructures, has been promoted to Chief Infrastructure Officer.

In conjunction with these appointments, Bitfarms Mining Operations

will now be split into two divisions, Mining Operations and

Infrastructure, with Mr. Brammer and Mr. Gobeil heading up the

divisions, respectively.

The Mining Operations and Infrastructure

divisions will deliver greater scalability and accountability in

data center construction, maintenance and operations and lay the

foundation for the establishment of HPC/AI operations. Mr. Brammer

will lead the Mining Operations team, responsible for miner

performance, upgrades and hashrate. He will be responsible for

leading all operational aspects of Bitfarms' rapidly expanding

global portfolio of mining assets spanning four countries across

two continents. In close partnership with Mr. Brammer, Mr. Gobeil

will lead the Infrastructure team, responsible for construction,

expansion, upgrades, and maintenance. Both will report directly to

Ben Gagnon, Chief Executive Officer of Bitfarms.

Mr. Brammer brings 20 years of international

operations expertise and deep mining industry relationships to

Bitfarms. He most recently led a premier U.S. independent power

producer’s entry into Bitcoin mining. In this role, he conducted

fleet-wide asset feasibility studies for mining and led the

technical project management and commissioning of the world’s first

and only hyperscale Bitcoin mine powered entirely by nuclear

energy. Prior to this, Mr. Brammer led business development efforts

at Luxor Technology Corporation, where he played a key role in

building several managed services offerings, establishing an ASIC

trading desk, and contributed to the early ideation of the

company's firmware and hashrate derivatives product suites. Since

2022, Alex has also served as a Board Director and Treasurer for

the Bitcoin Today Coalition, a U.S. Internal Revenue Code 501(c)(4)

non-profit focused on Bitcoin policy advocacy and education at the

federal level.

Prior to entering the mining industry, Mr.

Brammer served for 16 years in the U.S. Army. His military career

began as an operator in the 75th Ranger Regiment, where he deployed

three times to Iraq during the Surge. He later deployed to

counter-ISIS in Mosul, Iraq as a platoon leader, served as Chief of

Plans for a Brigade Combat Team of 3,700 personnel, and ultimately

retired as a company commander of a 151-member Stryker Rifle

Company.

Mr. Brammer holds a Bachelor of Science in

Economics from the United States Military Academy at West Point. He

completed a Ph.D. in the politics of counterinsurgency and civil

conflict from Queen’s University in Belfast, Ireland as a 2014

Marshall Scholar and is nearing completion of his MBA from the

University of Chicago Booth School of Business.

“I am confident that Alex’s mining and power

expertise in Pennsylvania and PJM as well as his extensive

leadership and management experience will be instrumental in

driving the continued growth and success of the Company's global

mining operations,” stated Ben Gagnon, Bitfarms CEO. “We are on a

path to double our operating capacity next year and Alex’s proven

management abilities will be integral to leading the mining

operations team to bring online 35 EH/s+ in 2025.”

Mr. Brammer’s responsibilities will include

spearheading post-M&A asset development and integration,

technological innovation, systems integration and standardization,

employee safety and optimizing operational costs across all

Bitfarms data centers. Additionally, Alex will play a critical role

in scaling Bitfarms' IT and operations teams to enhance global

efficiency.

“I am excited to be joining the Bitfarms team at

such a pivotal time for the Company,” stated Alex Brammer.

“Bitfarms is poised to deliver record hashrate growth and

efficiency improvements in 2024, and I look forward to working with

the operational teams to ensure this impressive growth continues

into 2025 and beyond.”

Additionally, Bitfarms is pleased to announce

the promotion of Benoit Gobeil to Chief Infrastructure Officer. Mr.

Gobeil has been with the Company since 2018 and has played an

important role in executing Bitfarms’ transformational growth plan,

contributing cutting-edge industrial, electrical, and operational

experience that enables Bitfarms to stay at the forefront of

next-generation technologies and hardware.

About Bitfarms Ltd. Founded in

2017, Bitfarms is a global Bitcoin data center company that

contributes its computational power to one or more mining pools

from which it receives payment in Bitcoin. Bitfarms develops, owns,

and operates vertically integrated mining farms with in-house

management and company-owned electrical engineering, installation

service, and multiple onsite technical repair centers. Bitfarms’

proprietary data analytics system delivers best-in-class

operational performance and uptime.

Bitfarms currently has 12 operating Bitcoin data

centers and two under development situated in four countries:

Canada, the United States, Paraguay, and Argentina. Powered

predominantly by environmentally friendly hydro-electric and

long-term power contracts, Bitfarms is committed to using

sustainable and often underutilized energy infrastructure.

To learn more about Bitfarms’ events,

developments, and online communities:

www.bitfarms.com https://www.facebook.com/bitfarms/

https://twitter.com/Bitfarms_io https://www.instagram.com/bitfarms/

https://www.linkedin.com/company/bitfarms/

Glossary of Terms

- HPC = High-performance computing

- AI = Artificial intelligence

- EH or EH/s = Exahash or exahash per second

- MW or MWh = Megawatts or megawatt hour

Forward-Looking Statements

This news release contains certain

“forward-looking information” and “forward-looking statements”

(collectively, “forward-looking information”) that are based on

expectations, estimates and projections as at the date of this news

release and are covered by safe harbors under Canadian and United

States securities laws. The statements and information in this

release regarding the benefits of recent leadership changes made by

the Company and the qualities of those candidates, the potential

for enhanced performance as a result of organizational changes,

projected growth, target hashrate, M&A growth opportunities and

prospects, , the benefits of merging HPC/AI with Bitcoin mining

operations, the advantages of PJM offerings and programs, and other

statements regarding future growth, and plans and objectives of the

Company are forward-looking information. Any statements that

involve discussions with respect to predictions, expectations,

beliefs, plans, projections, objectives, assumptions, future events

or performance (often but not always using phrases such as

“expects”, or “does not expect”, “is expected”, “anticipates” or

“does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”,

“estimates”, “prospects”, “believes” or “intends” or variations of

such words and phrases or stating that certain actions, events or

results “may” or “could”, “would”, “might” or “will” be taken to

occur or be achieved) are not statements of historical fact and may

be forward-looking information.

This forward-looking information is based on

assumptions and estimates of management of Bitfarms at the time

they were made, and involves known and unknown risks, uncertainties

and other factors which may cause the actual results, performance,

or achievements of Bitfarms to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking information. Such factors include, among

others, risks relating to: receipt of the approval of the

shareholders of Stronghold Digital Mining, Inc. (“Stronghold”) and

the Toronto Stock Exchange for the Stronghold acquisition as well

as other applicable regulatory approvals; that the Stronghold

acquisition may not close within the timeframe anticipated or at

all or may not close on the terms and conditions currently

anticipated by the parties for a number of reasons including,

without limitation, as a result of a failure to satisfy the

conditions to closing of the Stronghold acquisition; the letter of

intent on the 10 MW is subject to entering into a definitive lease

agreement and TSX approval, none of which is assured; the power

purchase agreements and economics thereof may not be as

advantageous as expected; the inability of Bitfarms to operate the

plants as anticipated following consummation of the Stronghold

acquisition and assumption of operations at the Sharon mega-site

with access to up to 120 MW; the construction and operation of new

facilities may not occur as currently planned, or at all; expansion

of existing facilities may not materialize as currently

anticipated, or at all; new miners may not perform up to

expectations; revenue may not increase as currently anticipated, or

at all; the ongoing ability to successfully mine digital currency

is not assured; failure of the equipment upgrades to be installed

and operated as planned; the availability of additional power may

not occur as currently planned, or at all; expansion may not

materialize as currently anticipated, or at all; the power purchase

agreements and economics thereof may not be as advantageous as

expected; potential environmental cost and regulatory penalties due

to the operation of the Stronghold plants which entail

environmental risk and certain additional risk factors particular

to the business of Stronghold including, land reclamation

requirements may be burdensome and expensive, changes in tax

credits related to coal refuse power generation could have a

material adverse effect on the business, financial condition,

results of operations and future development efforts, competition

in power markets may have a material adverse effect on the results

of operations, cash flows and the market value of the assets, the

business is subject to substantial energy regulation and may be

adversely affected by legislative or regulatory changes, as well as

liability under, or any future inability to comply with, existing

or future energy regulations or requirements, the operations are

subject to a number of risks arising out of the threat of climate

change, and environmental laws, energy transitions policies and

initiatives and regulations relating to emissions and coal residue

management, which could result in increased operating and capital

costs and reduce the extent of business activities, operation of

power generation facilities involves significant risks and hazards

customary to the power industry that could have a material adverse

effect on our revenues and results of operations, and there may not

have adequate insurance to cover these risks and hazards,

employees, contractors, customers and the general public may be

exposed to a risk of injury due to the nature of the operations,

limited experience with carbon capture programs and initiatives and

dependence on third-parties, including consultants, contractors and

suppliers to develop and advance carbon capture programs and

initiatives, and failure to properly manage these relationships, or

the failure of these consultants, contractors and suppliers to

perform as expected, could have a material adverse effect on the

business, prospects or operations; the digital currency market; the

ability to successfully mine digital currency; revenue may not

increase as currently anticipated, or at all; it may not be

possible to profitably liquidate the current digital currency

inventory, or at all; a decline in digital currency prices may have

a significant negative impact on operations; an increase in network

difficulty may have a significant negative impact on operations;

the volatility of digital currency prices; the anticipated growth

and sustainability of hydroelectricity for the purposes of

cryptocurrency mining in the applicable jurisdictions; the

inability to maintain reliable and economical sources of power to

operate cryptocurrency mining assets; the risks of an increase in

electricity costs, cost of natural gas, changes in currency

exchange rates, energy curtailment or regulatory changes in the

energy regimes in the jurisdictions in which Bitfarms and

Stronghold operate and the potential adverse impact on

profitability; future capital needs and the ability to complete

current and future financings, including each of Bitfarms’,

Stronghold’s or the combined company’s ability to utilize an

at-the-market offering program (each, an “ATM Program”) and the

prices at which securities may be sold in each such ATM Program, as

well as capital market conditions in general; share dilution

resulting from an ATM Program and from other equity issuances;

volatile securities markets impacting security pricing unrelated to

operating performance; the risk that a material weakness in

internal control over financial reporting could result in a

misstatement of financial position that may lead to a material

misstatement of the annual or interim consolidated financial

statements if not prevented or detected on a timely basis;

historical prices of digital currencies and the ability to mine

digital currencies that will be consistent with historical prices;

and the adoption or expansion of any regulation or law that will

prevent any of Bitfarms, Stronghold or the combined company from

operating its business, or make it more costly to do so. For

further information concerning these and other risks and

uncertainties, refer to Bitfarms’ filings

on www.sedarplus.ca (which are also available on the

website of the U.S. Securities and Exchange Commission (the “SEC")

at www.sec.gov), including the MD&A for the year-ended

December 31, 2023, filed on March 7, 2024 and the MD&A for the

three and six months ended June 30, 2024 filed on August 8, 2024

and Stronghold’s filings on www.sec.gov, including the Annual

Report on Form 10-K for the fiscal year ended 2023, filed on March

8, 2024, the Quarterly Report on Form 10-Q for the fiscal quarter

ended March 31, 2024, filed on May 8, 2024, the Quarterly Report on

Form 10-Q for the fiscal quarter ended June 30, 2024, filed on

August 14, 2024, and subsequent reports on Forms 10-Q and 8-K.

Although each of Bitfarms and Stronghold has attempted to identify

important factors that could cause actual results to differ

materially from those expressed in forward-looking statements,

there may be other factors that cause results not to be as

anticipated, estimated or intended, including factors that are

currently unknown to or deemed immaterial by Bitfarms or

Stronghold, as applicable. There can be no assurance that such

statements will prove to be accurate as actual results, and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

any forward-looking information. Neither Bitfarms nor Stronghold

undertakes any obligation to revise or update any forward-looking

information other than as required by law.

Investor Relations Contacts:

BitfarmsTracy KrummeSVP, Head of IR & Corp. Comms. +1

786-671-5638tkrumme@bitfarms.com

Innisfree M&A IncorporatedGabrielle Wolf / Scott Winter+1

212-750-5833

Laurel Hill Advisory

Group1-877-452-7184416-304-0211assistance@laurelhill.com

Media Contacts:

U.S.: Joele Frank, Wilkinson Brimmer KatcherDan Katcher or

Joseph Sala212-355-4449

Québec:Tact Louis-Martin Leclerc+1

418-693-2425lmleclerc@tactconseil.ca

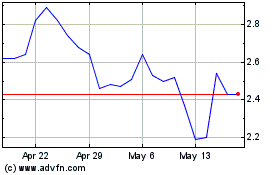

Bitfarms (TSX:BITF)

Historical Stock Chart

From Jan 2025 to Feb 2025

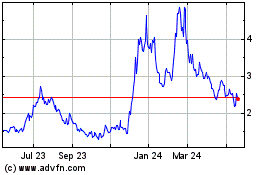

Bitfarms (TSX:BITF)

Historical Stock Chart

From Feb 2024 to Feb 2025