NICO optimizations and refinery site

negotiations advancing for Project Finance study

Fortune Minerals Limited (TSX: FT) (OTCQB: FTMDF)

(“Fortune” or the “Company”)

(www.fortuneminerals.com) is pleased to report the results of its

Annual Meeting of Shareholders held on June 22, 2021 (the

“Meeting”), and provide a summary of work on its 100% owned

NICO Cobalt-Gold-Bismuth-Copper project (‘NICO Project”) in

Canada. The NICO Project is a planned vertically integrated

Critical Minerals development comprised of a mine and concentrator

in the Northwest Territories (“NWT”) and a

hydrometallurgical refinery at a site in Alberta or Saskatchewan,

producing cobalt sulphate, gold, bismuth ingots and oxide, and

copper cement. The NICO Project is one of the most advanced cobalt

development assets outside of the Democratic Republic of Congo

(“Congo”) to meet the growing demand in lithium-ion

batteries powering electric vehicles, portable electronics and

stationary storage cells, and mitigate supply issues from

geographic concentration of production and policy risks associated

with the current supply sources. The unique metal assemblage of the

NICO Deposit includes primary cobalt, a 1.1 million ounce in-situ

gold co-product, 12% of global bismuth reserves, and by-product

copper. Fortune also owns a 100% interest in the nearby Sue-Dianne

Copper-Silver-Gold satellite deposit (“Sue-Dianne

Deposit”).

Like our news? Click-to-Tweet.

NICO Project Development: The focus of NICO Project work

has been directed at development activities, assessing various

optimizations and refinery sites to produce a more financially

robust project since the completion of the Micon International

Limited (“Micon”) Feasibility Study in 2014. The NICO

Project has received environmental assessment approval and the

major mine permits for the facilities in the NWT and the Company

has completed a Socio-Economic Agreement with the NWT Government.

The preferred refinery site is also permitted and has existing

facilities to materially reduce capital costs for the planned

vertically integrated development. The NICO Project work is

summarized as follows:

NWT Mine Infrastructure The C$200

million, government funded Tlicho Highway to the community of Whati

is nearing completion and is expected to open to the public later

this year. The NICO Project includes construction of a 50-kilometre

spur road from Whati to the mine to allow metal concentrates to be

trucked to the railway at Hay River or Enterprise, NWT for delivery

to the refinery by train. Fortune has completed an Access Agreement

with the Tlicho Government, setting out the terms and conditions

for construction of this road. With the completion schedule of the

Tlicho Highway certain, construction of the mine and concentrator

can now be planned with all-season road access, reducing equipment

redundancy and the costs for facilities that are no longer

required, and mitigate supply chain risks.

A new transload facility is under construction at Enterprise,

NWT, providing Fortune with a second railway loading option. This

would also eliminate 80 km of round trip trucking of metal

concentrates, and reduce the transportation costs for other

materials delivered to the mine during construction and

operations.

The NWT Government is proposing to connect the Yellowknife grid

to the Talston grid south of Great Slave Lake where there is

surplus hydro power. If this is completed, Fortune could construct

a 25-km powerline to Snare Hydro instead of building its own power

plant using liquid natural gas-fueled generators.

Mineral Resource Optimization The

NICO Deposit contains Proven and Probable Open Pit and Underground

Mineral Reserves totaling 33 million tonnes containing 1.1 million

ounces of gold, 82.3 million pounds of cobalt, 102.1 million pounds

of bismuth, and 27.2 million pounds of copper. In 2020, Fortune and

P&E Mining Consultants Inc. completed an updated Mineral

Resource model with more constrained mineralization boundaries to

reduce grade smearing from internal and external modelling dilution

and providing better differentiation between high and low grade

Mineral Resource blocks for mine planning. In addition, the Mineral

Resource model was extended to surface where the NICO Deposit is

known to outcrop and also now includes some higher grade drill

intersections that were previously omitted.

Mine Plan and Scheduling In 2020,

Fortune prepared a new Mine Plan and Schedule focused on earlier

access and processing of higher margin ores. The 2014 Micon

Feasibility Study contemplated combined open pit and underground

mining during the first two years of the 20-year mine life to

augment lower grade open pit ores with processing of gold-rich,

higher grade ores mined by underground methods close to the

existing decline ramp. With better differentiation between high and

low grade resource blocks the underground part of the mine has been

expanded from two years to three to accelerate processing of higher

grade ores.

The open pit Mine Plan has been re-optimized to provide earlier

access to ores with higher cobalt and gold content, lower bismuth,

and targeting sulphide ores that produce higher cobalt concentrate

grades. A grade control and stockpiling strategy has also been

developed to defer processing of ores with lower cash flow margins.

The identification of additional near-surface ores will reduce

waste rock pre-stripping in the initial years of the mine life.

Mining operating costs were also updated to incorporate the new

open pit design with shorter cycle times reducing equipment

operating costs.

Capital Cost Review Fortune is

reviewing capital cost estimates from earlier engineering studies

and investigating strategies for reducing initial and sustaining

capital costs. The availability of the Tlicho Highway during

construction will allow the Company to eliminate some facilities

that are no longer required for winter ice road construction. The

all-season road is also expected to allow the construction

timelines to be reduced from three to two years. Equipment

selection is being reviewed and changes planned where there are

practical options requiring lower installation costs or, more

modest facilities. Capital costs associated with construction of

parts of the combined tailings and waste rock storage area have

also been deferred by two years to reduce initial capital

costs.

New Refinery Site Significant

efforts have been directed toward evaluation of various sites in

western Canada to construct the NICO Project hydrometallurgical

refinery. The priorities were focused on permitted brownfield

locations with existing facilities and personnel to materially

reduce the capital and operating costs for the refinery and to

accelerate development. Negotiations are in progress with the owner

of the preferred site and an announcement will be made if, and when

an agreement is completed. NICO concentrates are contemplated to

provide the base load feed for the new refinery circuit with

production augmented with feeds from other mines, waste residues

from chemical plants, and scrap metals. The future vision for this

facility is to diversify the business plan to also include the

collection and recycling of spent batteries to recover the

contained metals.

Process Residue Disposal A process

residue disposal solution was needed to accelerate development and

mitigate permitting risks for the preferred refinery site. Fortune

has received indicative terms from a large waste disposal and

environmental services company in western Canada to dispose of the

refinery process residue. This will also mitigate long-term legacy

issues associated with a Company-owned facility.

Critical Minerals: The cobalt and bismuth contained in

the NICO Deposit are identified as Critical Minerals by the United

States (“US”) and European Union (“EU”) governments,

having essential use in new technologies and defense, and concerns

about supply chains due to geographic concentration of production,

political uncertainty, and policy risks with the current supply

sources. In 2021, Natural Resources Canada released the Canadian

Critical Minerals list, which in addition to cobalt and bismuth,

also includes copper.

The cobalt market is about 150,000 tonnes per annum and

consumption is expected to more than double this decade from

accelerating demand in lithium-ion rechargeable batteries, enabling

the transformation to electric vehicles and stationary storage of

electricity. Cobalt is also used in aerospace alloys, cutting tools

and permanent magnets, as well as chemicals to make pigments and

catalysts for plastics, rubber and to refine petroleum.

Approximately 71% of global cobalt production is mined in the Congo

and more than half of this is controlled by Chinese companies.

China also controls 80% of the world’s refined cobalt chemical

supply.

Bismuth is used primarily in the automotive industry for

windshield and glass frits, anti-corrosion coatings and paints, and

it is also used to make pharmaceuticals and alloys and compounds

where dimensional stability or expansion during cooling is

required. Consumption of bismuth is also growing as a non-toxic and

environmentally safe replacement for lead in plumbing brasses and

solders used in potable drinking water sources, electronic solders,

free-machining steel and aluminum, paint pigments, ceramic glazes,

photovoltaics, ammunition and fishing weights. The bismuth market

is approximately 20,000 tonnes per annum and 80% of the supply is

controlled by China.

Canada and the US have announced a Joint Action Plan on Critical

Mineral Collaboration advancing both countries’ interest in

securing supply chains for the minerals needed in new technologies

and to promote more North American production. Following the G7

summit in June, 2021, Canada and the EU launched a new partnership

to secure supply chains for Critical Minerals and reduce dependence

on China, while also improving transparency of raw material

supply.

Government Engagement and Financing

Fortune is engaged with the Canadian and US governments, provincial

and territorial governments, and municipalities to accelerate

development of important near-term Critical Minerals projects. The

Company is interested in securing financial support for the

Feasibility Study update assessing the new refinery site and

optimizations. Governments are also being solicited to participate

in the project finance for the NICO project through various

programs and capital pools designed to promote economic growth,

western Canada diversification, process and product innovation, and

Critical Minerals supply. Fortune was recently invited by the US

Embassy in Ottawa to present at a virtual seminar later this month

to Tier 1 US manufactures involved in defense, mining, aerospace,

automotive, energy and technology, and to strengthen opportunities

for vertical supply chain integration with Canada.

Fortune continues to advance discussions with potential private

sector strategic partners that want a reliable, transparent and

sustainable supply of Critical Minerals for their business or, for

investment purposes.

Field Activities: The Covid-19 pandemic has presented

companies with a 15-month challenge for advancing mineral projects

due to lockdowns, travel restrictions, and employees working

primarily from home. Fortune was able to complete a geophysical

program in 2020 between lockdowns consisting of induced

polarization and magnetometer surveys over the east end of the NICO

Deposit, which identified five high-priority targets for follow-up

drilling and potential resource expansion. The 2020 program was

supported in part by a NWT Government Mineral Incentive Program

grant of C$144,000, and the Company was awarded the same amount for

work planned in 2021.

The NICO Deposit and the Sue-Dianne Deposit are classified as

iron oxide copper-gold (“IOCG”)-type mineral deposits where

global analogues typically occur in clusters of very large ore

bodies. They include the ‘super giant’ Olympic Dam Mine in South

Australia, the Carajas, Brazil deposits, and the Candelaria

District deposits in Chile, which indicate the significant

exploration potential of the NICO leases and surrounding areas.

Next Steps: Fortune’s near-term priorities are to

complete the site selection and negotiations for the NICO Project

refinery collaboration. Engagement with governments are continuing

to secure financial support for the updated feasibility study and

project finance. Discussions are also continuing with potential

strategic partners and are expected to accelerate once the refinery

site is finalized.

Fortune is now looking at options to reprocess NICO mill

tailings to recover a portion of the gold that is not already

captured in the gravity and flotation circuits. A drill program is

also planned for later this year to test the high priority targets

identified in the 2020 geophysics program.

Annual Meeting Results: Fortune reports that the nominees

listed in the management information circular for the Meeting were

elected as directors. Detailed results of the vote based on proxies

received are set out below:

Nominee

Votes For

% For

Votes Withheld

% Withheld

Carl Clouter

72,906,551

91.09%

7,135,747

8.91%

Robin E. Goad

73,602,797

91.95%

6,439,501

8.05%

Glen Koropchuk

73,204,256

91.46%

6,838,042

8.54%

John McVey

74,935,597

93.62%

5,106,701

6.38%

Mahendra Naik

73,567,097

91.91%

6,475,201

8.09%

David Ramsay

73,459,818

91.78%

6,582,480

8.22%

Edward Yurkowski

74,092,447

92.57%

5,949,851

7.43%

Shareholders also approved the appointment of Fortune’s

auditors.

Due to Ontario government restrictions on the size of group

gatherings to reduce the risk of spreading the Coronavirus, there

was no corporate presentation provided at the Meeting. Shareholders

wishing to speak with management can contact the Company through

Troy Nazarewicz, Fortune’s Investor Relations Manager at

info@fortuneminerals.com .

For more detailed information about the NICO Mineral Reserves

and certain technical information in this news release, please

refer to the Technical Report on the NICO Project, entitled

"Technical Report on the Feasibility Study for the

NICO-Gold-Cobalt-Bismuth-Copper Project, Northwest Territories,

Canada", dated April 2, 2014 and prepared by Micon International

Limited which has been filed on SEDAR and is available under the

Company's profile at www.sedar.com.

The disclosure of scientific and technical information contained in

this news release has been approved by Robin Goad, M.Sc., P.Geo.,

President and Chief Executive Officer of Fortune who is a

"Qualified Person" under National Instrument 43-101.

About Fortune Minerals: Fortune is a Canadian mining

company focused on developing the NICO Cobalt-Gold-Bismuth-Copper

Project in the NWT. The Company has an option to purchase lands in

Saskatchewan where it may build the hydrometallurgical plant to

process NICO metal concentrates and is also evaluating other

brownfield locations with existing facilities to reduce project

capital and operating costs. In addition, Fortune owns the

satellite Sue-Dianne Copper-Silver-Gold Deposit located 25 km north

of the NICO Project mine site and is a potential future source of

incremental mill feed to extend the life of the NICO mill and

concentrator.

Follow Fortune Minerals:

Click here to subscribe to Fortune’s email list.

Click here to follow Fortune on LinkedIn.

@FortuneMineral on Twitter.

This press release contains forward-looking information and

forward-looking statements within the meaning of applicable

securities legislation. This forward-looking information includes

statements with respect to, among other things, the potential for

expansion of the NICO Deposit, the Company’s plans to conduct a

drill program during 2021, the planned opening of the Tlicho

Highway, the construction of a new transload facility at

Enterprise, NWT, the possible connection of the Yellowknife

electrical grid to the Talston grid south of Great Slave Lake, the

planned update to the 2014 Feasibility Study, the possibility of

obtaining financial support for the NICO Project through various

government capital pools, the Company’s plans to develop the NICO

Project and the potential for the Sue-Dianne property to provide

incremental mill feed to the NICO Project. Forward-looking

information is based on the opinions and estimates of management as

well as certain assumptions at the date the information is given

(including, in respect of the forward-looking information contained

in this press release, assumptions regarding: the Company’s ability

to conduct and complete the planned drill program; the timing of

the opening of the Tlicho Highway, the Company’s ability to secure

a site in southern Canada for the construction of a NICO Project

refinery; the Company’s ability to arrange the necessary financing

to continue operations and develop the NICO Project; the receipt of

all necessary regulatory approvals for the construction and

operation of the NICO Project and the related hydrometallurgical

refinery and the timing thereof; growth in the demand for cobalt;

the time required to construct the NICO Project; and the economic

environment in which the Company will operate in the future,

including the price of gold, cobalt and other by-product metals,

anticipated costs and the volumes of metals to be produced at the

NICO Project). However, such forward-looking information is subject

to a variety of risks and uncertainties and other factors that

could cause actual events or results to differ materially from

those projected in the forward-looking information. These factors

include the risks that the planned 2021 drill program may not

result in a meaningful expansion of the NICO Deposit, the new

transload facility at Enterprise, NWT may not be completed when

anticipated, , the Yellowknife electrical grid may not be connected

to the Talston grid south of Great Slave Lake, the planned update

to the 2014 Feasibility Study may take longer than anticipated to

be completed and the economic benefits to be reflected in such

update may be less than anticipated, the COVID-19 pandemic may

interfere with the Company’s ability to conduct the drill program,

the NICO Project may not receive the benefit of any financing under

the published initiatives of the United States and European Union

with respect to critical minerals or from any other government

sources, the Company may not be able to secure a site for the

construction of a refinery, the Company may not be able to finance

and develop NICO on favourable terms or at all, uncertainties with

respect to the receipt or timing of required permits, approvals and

agreements for the development of the NICO Project, including the

related hydrometallurgical refinery, the construction of the NICO

Project may take longer than anticipated, the Company may not be

able to secure offtake agreements for the metals to be produced at

the NICO Project, the Sue-Dianne Property may not be developed to

the point where it can provide mill feed to the NICO Project, the

inherent risks involved in the exploration and development of

mineral properties and in the mining industry in general, the

market for products that use cobalt or bismuth may not grow to the

extent anticipated, the future supply of cobalt and bismuth may not

be as limited as anticipated, the risk of decreases in the market

prices of cobalt, bismuth and other metals to be produced by the

NICO Project, discrepancies between actual and estimated Mineral

Resources or between actual and estimated metallurgical recoveries,

uncertainties associated with estimating Mineral Resources and

Reserves and the risk that even if such Mineral Resources prove

accurate the risk that such Mineral Resources may not be converted

into Mineral Reserves once economic conditions are applied, the

Company’s production of cobalt, bismuth and other metals may be

less than anticipated and other operational and development risks,

market risks and regulatory risks. Readers are cautioned to not

place undue reliance on forward-looking information because it is

possible that predictions, forecasts, projections and other forms

of forward-looking information will not be achieved by the Company.

The forward-looking information contained herein is made as of the

date hereof and the Company assumes no responsibility to update or

revise it to reflect new events or circumstances, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210623005482/en/

For further information please contact: Fortune Minerals

Limited Troy Nazarewicz Investor Relations Manager

info@fortuneminerals.com Tel: (519) 858-8188

www.fortuneminerals.com

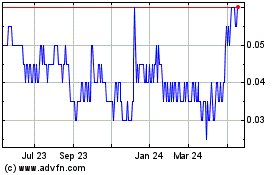

Fortune Minerals (TSX:FT)

Historical Stock Chart

From Nov 2024 to Dec 2024

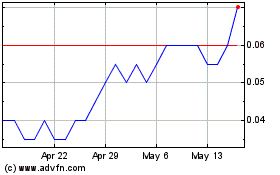

Fortune Minerals (TSX:FT)

Historical Stock Chart

From Dec 2023 to Dec 2024