Generation Mining Limited (TSX: GENM) (OTCQB: GENMF) (“Gen

Mining” or the “Company”) has executed a mandate letter

to arrange a senior secured project finance facility of up to

US$400 million (the “Mandate”) to fund the construction and

development of its Marathon Palladium-Copper Project, located on

the north shore of Lake Superior in the Province of Ontario, Canada

(the “Marathon Project”).

A syndicate including Export Development Canada (“EDC”),

together with ING Capital LLC (“ING”) and Societe Generale

S.A. (“Societe Generale”) will act as the Mandated Lead

Arrangers (“MLAs”). The formal Mandate includes a

non-binding indicative term sheet (the “Term Sheet”) for a

senior debt facility of up to US$400 million (the

“Facility”).

The execution of the Mandate is a key milestone in the project

financing process for the development of the Marathon Project. EDC,

ING, and Societe Generale were chosen as MLAs due to their

extensive experience providing project finance to greenfield mining

projects and the strength of their mining teams.

Closing of the Facility, targeted for the third quarter of 2023,

remains subject to completion of final due diligence in form and

substance satisfactory to the MLAs, final credit approvals and

execution of definitive Facility documentation.

The definitive Facility documentation will include customary

project finance terms and conditions, as well as a comprehensive

intercreditor agreement. Drawdowns under the Facility would be

subject to customary conditions precedent.

Jamie Levy, President and CEO, commenting on these arrangements

said, “We are very pleased to have mandated these three financial

institutions, all of whom have a strong mining and metals track

record. The US$400 million senior debt facility (CDN $540 million)

combined with the undrawn Wheaton Precious Metals Stream of CDN

$200 million, or a total of CDN $740 million represents a

significant portion of the initial capital required to develop the

Marathon Project. The Company will now focus on finalizing the

definitive documentation, together with arranging equipment leases

and sourcing the balance of the capital required to fully finance

construction.

Mr. Levy went on to say, “The interest of EDC, ING, Societe

Generale, and Wheaton Precious Metals further validates the

Marathon Project’s status as an economic, sustainable,

environmentally sensitive, low-cost producer of critical metals

that are needed to support emissions controls and the transition to

a greener economy. This has never been more urgent particularly in

the wake of the IPCC Report, published March 20, 2023, by the UN

Intergovernmental Panel on Climate Change, which provides

governments, at all levels, with scientific information they can

use to develop climate policies. We look forward to updating the

market throughout the rest of this year on our progress.”

Endeavour Financial is acting as financial advisor to the

Company. Shearman & Sterling LLP and Cassels Brock &

Blackwell LLP are acting as legal counsel to the Company.

About the Company

Gen Mining’s focus is the development of the Marathon Project, a

large undeveloped palladium-copper deposit in Northwestern Ontario,

Canada. The Company released the results of the Feasibility Study

Update on March 31, 2023.

The Feasibility Study Update estimated a Net Present Value

(using a 6% discount rate) of C$1.16 billion, an Internal Rate of

Return of 25.8%, and a 2.3-year payback. The mine is expected to

produce an average of 166,000 ounces of payable palladium and 41

million pounds of payable copper per year over a 13-year mine life

(“LOM”). Over the LOM, the Marathon Project is anticipated to

produce 2,122,000 ounces of palladium, 517 million lbs of copper,

485,000 ounces of platinum, 158,000 ounces of gold and 3,156,000

ounces of silver in payable metals. For more information, please

review the Feasibility Study Update dated March 31, 2023, filed

under the Company’s profile at SEDAR.com or on the Company’s

website at https://genmining.com/projects/feasibility-study/.

The Marathon Property covers a land package of approximately

22,000 hectares, or 220 square kilometres. Gen Mining owns a 100%

interest in the Marathon Project.

Qualified Person

The scientific and technical content of this news release was

reviewed, verified, and approved by Drew Anwyll, P.Eng., M.Eng,

Chief Operating Officer of the Company, and a Qualified Person as

defined by Canadian Securities Administrators National Instrument

43-101 - Standards of Disclosure for Mineral Projects.

Forward-Looking Information

This news release contains certain forward-looking information

and forward-looking statements, as defined in applicable securities

laws (collectively referred to herein as "forward-looking

statements"). Forward-looking statements reflect current

expectations or beliefs regarding future events or the Company’s

future performance. All statements other than statements of

historical fact are forward-looking statements. Often, but not

always, forward-looking statements can be identified by the use of

words such as "plans", "expects", "is expected", "budget",

"scheduled", "estimates", "continues", "forecasts", "Projects",

"predicts", "intends", "anticipates", "targets" or "believes", or

variations of, or the negatives of, such words and phrases or state

that certain actions, events or results "may", "could", "would",

"should", "might" or "will" be taken, occur or be achieved,

including statements related to the anticipated timing for the

execution of definitive financing documentation and the closing of

the financing, government approvals and permitting, and

commencement of construction of the Marathon Project; the timing

and amount of funding required to execute the Company’s development

and business plans related to the Marathon Project; and the life of

mine, mineral production estimates and financial returns from the

Marathon Project. All forward-looking statements, including those

herein, are qualified by this cautionary statement.

Although the Company believes that the expectations expressed in

such statements are based on reasonable assumptions, such

statements are not guarantees of future performance and actual

results or developments may differ materially from those in the

statements. There are certain factors that could cause actual

results to differ materially from those in the forward-looking

information. These include the timing for a construction decision;

the progress of development at the Marathon Project, including

progress of project expenditures and contracting processes, the

Company's plans and expectations with respect to liquidity

management, continued availability of capital and financing, the

future price of palladium and other commodities, permitting

timelines, exchange rates and currency fluctuations, increases in

costs, requirements for additional capital, and the Company's

decisions with respect to capital allocation, and the impact of

COVID-19, inflation, global supply chain disruptions and the war in

Ukraine on the Company, the project schedule for the Marathon

Project, key inputs, staffing and contractors, commodity price

volatility, continued availability of capital and financing,

uncertainties involved in interpreting geological data,

environmental compliance and changes in environmental legislation

and regulation, the Company’s relationships with First Nations

communities, exploration successes, and general economic, market or

business conditions, as well as those risk factors set out in the

Company’s annual information form for the year ended December 31,

2022, and in the continuous disclosure documents filed by the

Company on SEDAR at www.sedar.com. Readers are cautioned that the

foregoing list of factors is not exhaustive of the factors that may

affect forward-looking statements. Accordingly, readers should not

place undue reliance on forward-looking statements. The

forward-looking statements in this news release speak only as of

the date of this news release or as of the date or dates specified

in such statements.

The progress of development at the Marathon Project, including

progress of project expenditures and contracting processes, is

contingent on the continued availability of capital and financing,

permitting timelines, requirements for additional capital, and the

Company's decisions with respect to capital allocation. The Company

has begun submitting the permit applications to start preliminary

construction activities late in the third quarter of 2023 or as

soon as possible thereafter.

Forward-looking statements are based on a number of assumptions

which may prove to be incorrect, including, but not limited to,

assumptions relating to: the availability of financing for the

Company’s operations; operating and capital costs; results of

operations; the mine development and production schedule and

related costs; the supply and demand for, and the level and

volatility of commodity prices; timing of the receipt of regulatory

and governmental approvals for development Projects and other

operations; the accuracy of Mineral Reserve and Mineral Resource

Estimates, production estimates and capital and operating cost

estimates; and general business and economic conditions.

Investors are cautioned that any such statements are not

guarantees of future performance and actual results or developments

may differ materially from those projected in the forward-looking

information. For more information on the Company, investors are

encouraged to review the Company’s public filings on SEDAR at

www.sedar.com. The Company disclaims any intention or obligation to

update or revise any forward- looking information, whether as a

result of new information, future events or otherwise, other than

as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230502005481/en/

Jamie Levy President and Chief Executive Officer (416) 640-2934

(O) (416) 567-2440 (M) jlevy@genmining.com

Ann Wilkinson Vice President, Investor Relations (416) 640-2954

(O) (416) 357-5511 (M) awilkinson@genmining.com

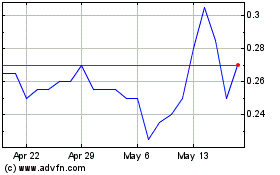

Generation Mining (TSX:GENM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Generation Mining (TSX:GENM)

Historical Stock Chart

From Jan 2024 to Jan 2025