High Arctic Energy Services Inc. (TSX: HWO) ("High Arctic" or the

"Corporation") is pleased to announce the results from its 2024

annual general and special meeting of shareholders held on June

17, 2024 in Calgary, Alberta (the "Meeting"). Each of the matters

voted upon at the Meeting was approved by the shareholders at the

Meeting. Details of each matter are included in the Corporation's

Management Information Circular dated May 9, 2024 (“Circular”), a

copy of which is available on the Corporation’s profile on SEDAR+

at www.sedarplus.ca. The voting results for each matter voted on

by the shareholders at the Meeting are provided below.

1. Arrangement

The shareholders passed a special resolution

approving the plan of arrangement under Section 193 of the

Business Corporations Act (Alberta) (“Arrangement”) among High

Arctic, its shareholders and High Arctic Overseas Holdings Corp.

(“SpinCo”). The Arrangement is described in detail in the Circular

and its appendices. The vote in respect of the Arrangement was

carried out by ballot, with 98.994% of votes cast being in favour

of the resolution approving the Arrangement. Excluding the votes

of interested parties as required by Multilateral Instrument 61-101

- Protection of Minority Security Holders in Special Transactions

(“MI 61-101”), 98.92% of votes were cast in favour of the

Arrangement.

The Corporation will apply for a final order

approving the Arrangement from the Alberta Court of King’s Bench

on Thursday, June 27, 2024 at 2:00 p.m. Assuming all other terms

and conditions to the Arrangement are satisfied, it is expected

that the Arrangement will be completed on July 31, 2024.

2. Return of

Capital

The shareholders passed a special resolution

approving the distribution of surplus cash to shareholders by way

of a return of capital of up to $0.76 per common share of High

Arctic (the “Return of Capital”). The vote in respect of the Return

of Capital was carried out by ballot, with 99.085% of votes cast

being in favour of the resolution approving the Return of Capital.

The amount of the Return of Capital remains subject to

determination by the Board of Directors of High Arctic. The

Corporation expects that the Return of Capital will be completed

and paid to shareholders on or around July 17, 2024.

3. Deferred

Share Unit Plan

The shareholders passed an ordinary resolution

approving the redemption of all outstanding deferred share units

(“DSUs”) under the Corporation’s deferred share unit plan. The vote

in respect of the DSUs was carried out by ballot, with 98.431% of

votes cast being in favour of the resolution. Excluding the votes

of shareholders who currently hold DSUs, as required pursuant to

the rules of the Toronto Stock Exchange (an aggregate of 2,275,567

shares), 98.297% of votes were cast in favour of the

resolution.

4. SpinCo Equity

Compensation Plan

The shareholders passed an ordinary resolution

approving an omnibus equity compensation plan for SpinCo. The vote

in respect of the SpinCo equity compensation plan was carried out

by ballot, with 98.631% of votes cast being in favour of the

resolution.

5. Fixing the

Number of Directors

The shareholders passed a resolution fixing the

number of directors to be elected at the Meeting at four (4). The

vote in respect of this matter carried out by show of hands, with

94.473% of votes cast being in favour of the resolution.

6. Election of

Directors

All of the nominees named in the Circular were

elected as directors of the Corporation. The vote in respect of

this matter carried out by ballot. The detailed results of voting

are as follows:

|

Nominee |

# Votes For |

% Votes For |

# Votes Withheld |

% Votes Withheld |

|

Michael R. Binnion |

28,524,297 |

97.996 |

583,432 |

2.004 |

|

Simon P.D. Batcup |

28,540,756 |

98.052 |

566,973 |

1.948 |

|

Douglas J. Strong |

28,540,459 |

98.051 |

567,270 |

1.949 |

|

Craig F. Nieboer |

28,867,556 |

99.175 |

240,173 |

0.825 |

|

|

7. Appointment

of Auditor

The shareholders approved the reappointment of

KPMG LLP, as the auditors of the Corporation to hold office until

the close of the next annual meeting of shareholders of the

Corporation, with their remuneration to be fixed by the directors.

The vote in respect of this matter carried out by show of hands,

with 99.374% of votes cast being in favour of the resolution.

CEO of High Arctic, Mike Maguire stated “The

resounding shareholder support for the Arrangement, the Return of

Capital and the other resolutions key to our reorganization

confirms our thesis that separating the Canadian and Papua New

Guinean businesses is the best pathway for each business to realize

its potential and maximize value for our current shareholders.”

For more information on the Arrangement and the

Return of Capital and the other matters approved at the Meeting,

please see the Circular and the Corporation's news releases dated

May 11, 2024, May 21, 2024, May 29, 2024, and June 12, 2024

available on the Corporation’s SEDAR+ profile at

www.sedarplus.com

About High Arctic

High Arctic is an energy services provider. High

Arctic is a market leader in Papua New Guinea providing drilling

and specialized well completion services and supplies rental

equipment including rig matting, camps, material handling and

drilling support equipment. In western Canada, High Arctic provides

pressure control and other oilfield equipment on a rental basis to

exploration and production companies, from its bases in Whitecourt

and Red Deer, Alberta.

For further information, please contact:

Lonn BateInterim Chief Financial

Officer1.587.318.22181.800.668.7143

High Arctic Energy Services Inc.Suite 2350, 330–5th Avenue

SWCalgary, Alberta, Canada T2P 0L4website: www.haes.caEmail:

info@haes.ca

Forward-Looking Statements

Forward-Looking Statements. Certain statements

contained in this press release may constitute forward-looking

statements. These statements relate to future events or High

Arctic's and SpinCo's future performance. All statements other than

statements of historical fact may be forward-looking statements.

Forward-looking statements are often, but not always, identified

by the use of words such as "seek", "anticipate", "plan",

"continue", "estimate", "expect", "may", "will", "project",

"predict", "potential", "targeting", "intend", "could", "might",

"should", "believe" and similar expressions. These statements

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements. High Arctic

believes that the expectations reflected in those forward-looking

statements are reasonable, but no assurance can be given that

these expectations will prove to be correct and such

forward-looking statements included in this press release should

not be unduly relied upon by investors. These statements speak

only as of the date of this press release and are expressly

qualified, in their entirety, by this cautionary statement.

In particular, this press release contains

forward-looking statements, pertaining to the following: the

timing and anticipated receipt of required regulatory (including

stock exchange) and court approvals for the Arrangement; the

ability of High Arctic to satisfy the other conditions to, and to

complete, the Arrangement; the anticipated timing of the Return of

Capital; the closing of the Arrangement; and the approval by the

Board and the amount and payment of the Return of Capital.

In respect of the forward-looking statements and

information concerning the anticipated completion of the proposed

Arrangement, the anticipated timing for completion of the

Arrangement and related transactions, High Arctic has provided

them in reliance on certain assumptions that it believe are

reasonable at this time, including assumptions as to the ability

of the parties to receive, in a timely manner, the necessary

regulatory (including stock exchange) court and other third party

approvals; and the ability of the parties to satisfy, in a timely

manner, the other conditions to the closing of the Arrangement.

These dates may change for a number of reasons, including inability

to secure necessary shareholder, regulatory, court or other third

party approvals in the time assumed or the need for additional

time to satisfy the other conditions to the completion of the

Arrangement. Accordingly, readers should not place undue reliance

on the forward-looking statements and information contained in

this news release concerning these times.

This forward-looking information represents High

Arctic’s views as of the date of this document and such

information should not be relied upon as representing its views as

of any date subsequent to the date of this document. High Arctic

has attempted to identify important factors that could cause

actual results, performance or achievements to vary from those

current expectations or estimates expressed or implied by the

forward-looking information. However, there may be other factors

that cause results, performance or achievements not to be as

expected or estimated and that could cause actual results,

performance or achievements to differ materially from current

expectations. There can be no assurance that forward-looking

information will prove to be accurate, as results and future events

could differ materially from those expected or estimated in such

statements. Accordingly, readers should not place undue reliance

on forward-looking information. Except as required by law, High

Arctic undertakes no obligation to publicly update or revise any

forward-looking statements.

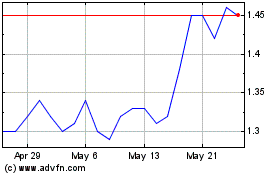

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

From Feb 2025 to Mar 2025

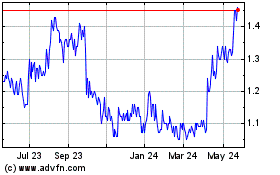

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

From Mar 2024 to Mar 2025