High Arctic Energy Services Inc. (TSX: HWO) (the

“Corporation” or “High Arctic”) has released its’ second quarter

financial and operating results. The unaudited consolidated

financial statements, management discussion & analysis

(“MD&A”), for the three and six months ended June 30, 2024 will

be available on SEDAR+ at www.sedarplus.ca, and on High Arctic’s

website at www.haes.ca. All amounts are denominated in Canadian

dollars (“CAD”), unless otherwise indicated.

Completion of

Reorganization

On June 17, 2024, the Corporation held its

Annual and Special General Meeting where the Corporation’s

shareholders approved, amongst other things, a special resolution

approving a reorganization of the Corporation by way of a plan of

arrangement (the “Arrangement”) and a return of capital of up to

$0.76 per common share of High Arctic (the “Return of Capital”).

Pursuant to the reorganization of the Corporation, the PNG business

was spun out to the current High Arctic shareholders through a new

publicly listed entity High Arctic Overseas Holdings Corp.

(“SpinCo”) that will trade on the TSX Venture Exchange under the

trading symbol HOH.

On June 27, 2024, the Corporation received a

final order approving the Arrangement from the Alberta Court of

King’s Bench, and the Return of Capital was distributed to

shareholders on July 17, 2024. On August 1, 2024, the Corporation

was able to fulfill the last major condition in the Arrangement

which was the receipt of conditional approval from the TSX Venture

Exchange to have the SpinCo shares trade on its exchange. All other

terms and conditions to the Arrangement were satisfied subsequent

to receipt of conditional approval from the TSX Venture Exchange

and the Arrangement was completed on August 12, 2024 and the

final approval from the TSX and TSX Venture exchange was received

on August 14, 2024. The shares of SpinCo are expected to commence

trading on the TSX Venture Exchange on or about August 16,

2024.

Pursuant to the Arrangement, each shareholder of

High Arctic received one-quarter of one (1/4) common share of

SpinCo and one-quarter of one (1/4) common share of

post-Arrangement High Arctic for each common share of High Arctic

held. As a result of the Arrangement, each shareholder continues to

own its pro rata portion of both SpinCo and post-Arrangement High

Arctic.

SpinCo’s now stand-alone PNG business begins

with intact senior leadership and management, a new and independent

Board of Directors, a separate stock exchange listing, a strong

capital structure, no long-term debt and positive working capital

of approximately US$19 million, including US$13 million in

cash.

Mike Maguire, Chief Executive Officer commented:

“Our businesses in both Canada and PNG have

performed well in the first half of 2024, setting up both High

Arctic and SpinCo with strong financial positions for the

commencement of trading as independently listed companies. I am

very pleased to have completed the strategic re-organization of the

Corporation and excited to be on the precipice of a new chapter in

the High Arctic story as the two entities commence separate trading

later this week.

Both High Arctic and SpinCo have no net debt and

access to cash at bank to finance budgeted activities and provide a

platform for growth for each business to realize its potential and

maximize value for their shareholders.

In Canada the performance of our rental business

in the first half of 2024 is in-line with our pre-transaction

expectations following the acquisition and integration of Delta

Rental Services. Having a cash positive business, when adjusted for

re-organization costs, positions High Arctic as an attractive

vehicle for future growth and transactions.

In PNG Rig 103 completed services and was

stacked at the forward base in the Southern Highlands, as expected.

We anticipate a period of modest activity, through our rentals and

manpower provision, as we await significant strategic decisions on

major project advancement now expected in 2025.”

Additional Information Pertaining to the

ReorganizationThe Corporation has received final approval

today to list the post-Arrangement common shares of High Arctic

(the “New High Arctic Common Shares”) on the Toronto Stock Exchange

(“TSX”). The existing common shares are expected to be delisted

from the TSX as of the close of business on August 15, 2024. The

New High Arctic Common Shares are expected to commence trading on

the TSX at the market opening on August 16, 2024 and the CUSIP

number for the New High Arctic Shares will be "42964L109".

Pursuant to the completion of the Reorganization

the Corporation has today terminated its normal course issuer bid

arrangement which has been in place since December 13, 2023.

With the completion of the reorganization and in

accordance with the Arrangement, the Corporation is obliged for

Canadian taxation compliance purposes to determine the fair market

value of the SpinCo shares. The Corporation and SpinCo have begun

the valuation process to determine the fair market value for SpinCo

and expects to provide the fair market value of the SpinCo shares

to shareholders prior to November 2024.

Second Quarter Results

In the following discussion, the three months

ended June 30, 2024 may be referred to as the “quarter” or “Q2

2024” and the comparative three months ended June 30, 2023 may be

referred to as “Q2 2023”. References to other quarters may be

presented as “QX 20XX” with X/XX being the quarter/year to which

the commentary relates. Additionally, the six-months ended June 30,

2024 may be referred to as “YTD” or “YTD-2024”. References to other

six-month periods ended June 30 may be presented as “YTD-20XX” with

XX being the year to which the six-month period ended June 30

commentary relates.

2024 SECOND QUARTER

HIGHLIGHTS

- Transformational developments from

shareholder approvals on June 17, 2024:

- $37.8 million return of capital to

shareholders completed on July 17, 2024 funded through sale

proceeds on 2022 disposal of Canadian well servicing assets,

and

- Reorganization of capital structure

to provide shareholders separate holdings in two publicly-traded

entities, with dedicated leadership, governance structure and solid

financial positioning.

- The continuing Canadian business

and listing on the TSX (ticker HWO), and

- The spinoff of the PNG business and

new listing on the TSX Venture Exchange (ticker HOH).

- Continued integration of the Delta

Acquisition with the legacy High Arctic rental business that now

operates under the Delta Rental Services banner with deployment of

additional underutilized assets into our expanded geographical

coverage in Alberta.

- Increased revenue from continuing

operations by $1,869 or 281% in the quarter when compared to

revenue of $664 from Q2 2023 as a result of the impact of the Delta

Acquisition on the 2024 results.

- Achieved positive Adjusted EBITDA

from continuing operations of $187 in the quarter versus negative

Adjusted EBITDA for Q2 2023 of ($934).

- Narrowed the operating loss from

continuing operations from $1,400 in Q2 2023 to $1,363 in Q2 2024

as a result of the contribution from the Delta Acquisition which

was mostly offset by $763 of additional G&A expenses incurred

relating to the corporate reorganization.

2024 YEAR TO DATE HIGHLIGHTS

- Similar to the discrete quarter

results, High Arctic’s revenue from continuing operations increased

314% to $5,521 compared to revenue of $1,332 achieved in the first

six months of 2023 as a result of the Delta Acquisition on 2024

results.

- Achieved strong oilfield services

operating margins from continuing operations of 49.4% for the first

half of 2024.

- Narrowed the use of funds flow from

operations from continuing operating activities as the YTD-2024 saw

a use of $96 compared to a use of $747 for the first six months of

2023 driven by strong operational performance from the Delta

Acquisition offset by the significant additional G&A expenses

incurred in 2024 due to the corporate reorganization

initiatives.

- Working capital at the end of the

quarter totaled $4,368, including cash of $3.3 million (after

giving affect to the Return of Capital distribution). This

positioning stands to support organic growth and be an initial

basis for acquisition growth through selective and opportunistic

investments.

Q1 2024 Investor Conference CallA High Arctic

investor conference call is schedule to begin at 3:00 pm MT (5:00

pm ET) on Thursday, August 15, 2024. The conference call dial-in

numbers are 1-800-898-3989 or 416-340-2217 and the participant

passcode is 7163931#.

An archived recording of the conference call

will be available approximately two hours after the call ends by

dialing 1-800-408-3053 and entering passcode 8446938# will remain

available until September 15, 2024. An audio recording of the

conference call will also be available within 24 hours on High

Arctic’s website.

RESULTS OVERVIEW

The following is a summary of select financial

information of the Corporation:

|

|

Three months ended June 30 |

Six months ended June 30 |

|

(thousands of Canadian Dollars, except per share amounts) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

| Operating results from

continuing operations: |

|

|

|

|

| Revenue – continuing

operations |

2,533 |

|

664 |

|

5,521 |

|

1,332 |

|

| Net loss - continuing

operations |

(1,709 |

) |

(1,546 |

) |

(1,527 |

) |

(1,706 |

) |

|

Per share (basic & diluted)(1) |

(0.04 |

) |

(0.03 |

) |

(0.03 |

) |

(0.03 |

) |

| Oilfield services operating

margin - continuing operations(2) |

1,204 |

|

309 |

|

2,729 |

|

760 |

|

|

Oilfield services operating margin as a % of revenue(2) |

47.5 |

% |

46.5 |

% |

49.4 |

% |

57.1 |

% |

| EBITDA - continuing

operations(2) |

(1,465 |

) |

(1,613 |

) |

(1,233 |

) |

(1,755 |

) |

| Adjusted EBITDA - continuing

operations(2) |

187 |

|

(934 |

) |

280 |

|

(1,331 |

) |

|

Operating loss - continuing operations(2) |

(1,363 |

) |

(1,400 |

) |

(2,433 |

) |

(2,438 |

) |

| Cash flow from continuing

operations: |

|

|

|

|

| Cash flow from continuing

operating activities |

(761 |

) |

626 |

|

(490 |

) |

33 |

|

|

Per share (basic & diluted)(1) |

(0.02 |

) |

0.01 |

|

(0.01 |

) |

0.00 |

|

| Funds flow from (used in)

continuing operating activities(2) |

(293 |

) |

(659 |

) |

(96 |

) |

(747 |

) |

|

Per share (basic & diluted)(1) |

(0.01 |

) |

(0.01 |

) |

(0.00 |

) |

(0.02 |

) |

| Return of Capital,

declared(4) |

37,842 |

|

730 |

|

37,842 |

|

1,460 |

|

|

Per share (basic) |

0.77 |

|

0.015 |

|

0.77 |

|

0.030 |

|

|

Per share (diluted) |

0.751 |

|

0.014 |

|

0.750 |

|

0.028 |

|

|

Capital expenditures |

507 |

|

317 |

|

815 |

|

425 |

|

|

|

|

As at |

|

(thousands of Canadian Dollars, except per share amounts and common

shares outstanding) |

|

|

June 30, 2024 |

Dec 31,2023 |

| Financial

position: |

|

|

|

|

| Working capital(2) |

|

|

4,368 |

|

62,985 |

|

| Cash and cash equivalents(3) |

|

|

41,087 |

|

50,331 |

|

| Total assets |

|

|

120,993 |

|

123,137 |

|

| Long-term debt (non-current) |

|

|

3,265 |

|

3,352 |

|

| |

|

|

|

|

| Shareholders’ equity |

|

|

64,160 |

|

99,332 |

|

|

Per share (basic)(1) |

|

|

1.31 |

|

2.04 |

|

|

Per share (fully diluted)(1) |

|

|

1.27 |

|

1.94 |

|

|

Common shares outstanding |

|

|

49,792,700 |

|

49,122,302 |

|

(1) The number of common shares used

in calculating net loss per share, cash flow from (used in)

operating activities, funds flow from operating activities per

share, dividend payments per share, and shareholders’ equity per

share is determined as explained in Note 13 of the Financial

Statements (continuing operations). (2) Readers are

cautioned that Oilfield services operating margin, EBITDA (Earnings

before interest, tax, depreciation, and amortization), Adjusted

EBITDA, Operating loss, Funds flow from operating activities and

Working capital do not have standardized meanings prescribed by

IFRS – see the “Non IFRS Measures” section in this MD&A for

calculations of these measures.(3) Cash and cash

equivalents includes $37,842 distributed to High Arctic

shareholders on July 17, 2024 as a return of capital

distribution.(4) 2023 figures are cash dividends

declared.

|

Operating Results

Ancillary services segment |

|

|

Three months ended June 30 |

Six months ended June 30 |

|

(thousands of Canadian Dollars, unless otherwise noted) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

| Revenue |

2,533 |

|

664 |

|

5,521 |

|

1,332 |

|

|

Oilfield services expense |

(1,329 |

) |

(355 |

) |

(2,792 |

) |

(572 |

) |

|

Oilfield services operating margin(1) |

1,204 |

|

309 |

|

2,729 |

|

760 |

|

|

Operating margin (%) |

47.5 |

% |

46.5 |

% |

49.5 |

% |

57.1 |

% |

(1) See “Non-IFRS Measures”

The Ancillary Services segment consists of High

Arctic’s oilfield rental equipment in Canada centered upon pressure

control equipment and equipment supporting the high-pressure

stimulation of oil and gas wells in the WCSB.

Production services segmentThe Production

Services segment operations consist of High Arctic’s idled snubbing

units in Colorado, U.S., and its equity investments in the Seh’

Chene Partnership and Team Snubbing Services Inc. in Canada. Though

the Seh’ Chene Partnership has experienced limited business

activity since the 2022 Canadian sales transactions, the

partnership is still active and the Corporation together with its

partner look to re-position its customer offerings and explore

other avenues for business activity.

Liquidity and capital resources

|

|

Three months ended June 30 |

Six months ended June 30 |

|

(thousands of Canadian Dollars) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

| Cash provided by (used in)

continued operations: |

|

|

|

|

|

Operating activities |

(761 |

) |

626 |

|

(490 |

) |

33 |

|

|

Investing activities |

(507 |

) |

(317 |

) |

(815 |

) |

27,676 |

|

|

Financing activities |

(127 |

) |

(812 |

) |

(258 |

) |

(1,676 |

) |

| Effect

of exchange rate changes on cash |

415 |

|

(5 |

) |

1,080 |

|

4 |

|

|

Increase (decrease) in cash from continuing operations |

(980 |

) |

(508 |

) |

(483 |

) |

26,037 |

|

|

(thousands of Canadian Dollars, unless otherwise noted) |

|

|

As at June 30, 2024 (2) |

As at Dec 31, 2023 |

|

Current assets (excluding assets held for distribution) |

|

|

45,785 |

79,438 |

| Working capital(1) |

|

|

4,368 |

62,985 |

| Working capital ratio(1) |

|

|

1.1:1 |

4.8:1 |

| Cash and cash equivalents |

|

|

41,087 |

50,331 |

|

Net cash(1) |

|

|

37,647 |

46,804 |

(1) See “Non-IFRS

Measures”(2) Continuing operations

Operating ActivitiesIn Q2 2024, cash used in

operating activities from continuing operations was ($761), as

compared with $626 of cash generated from operating activities from

continuing operations in Q2 2023. Funds used in operating

activities from continuing operations totaled ($293) in the

quarter, versus ($659) for Q2 2023 (see “Non-IFRS Measures”). In Q2

2024, changes in non-cash operating working capital from continuing

operations totaled ($468) versus $1,285 in Q2 2023.

For the six months ended June 30, 2024, cash

used in operating activities from continuing operations was ($490),

as compared with $33 of cash generated from operating activities

from continuing operations in Q2 2023. Funds used in operating

activities from continuing operations totaled ($96) for the six

months ended June 30, 2024, versus ($747) for the same period in

2023. Over the six months ended June 30, 2024, changes in non-cash

operating working capital from continuing operations totaled ($394)

versus $780 for the comparable period in 2023.

The comparative period decrease in cash from

operating activities from continuing operations for both the three

and six months ended June 30, 2023 and 2024 was largely the result

of higher G&A costs, substantially related to the Corporation’s

reorganization initiative more than offsetting increased rental

business margins.

Investing ActivitiesDuring the quarter, the

Corporation’s cash spent on investing activities from continuing

operations totaled $507, compared to $317 for the same period the

year prior. In addition to sustaining and growth capital spending

related to its rental business, the Corporation’s Q2 2024 investing

activity also included spending on new information systems and

information technology infrastructure necessary to support two

separate entities after the completion of the Arrangement. Year to

date spending through June 30, 2024 totaled $815 on these same

projects. During the first six months of 2023, the Corporation

received $27,676 net, primarily as a result of the receipt of the

final cash proceeds of $28,000 from the 2022 sale of the

Corporation’s Canadian well servicing assets.

Financing ActivitiesDuring the quarter, the

Corporation’s cash used in financing activities was $127,

significantly lower when compared to Q2 2023 at $812. During Q2

2024, the Corporation paid $42 (Q2 2023: $43) towards principal

payments on its mortgage financing (see “Mortgage Financing” below)

and $85 against lease liability payments (Q2 2023: $39). The

largest contributor to the decline in cash used in financing

activities in the quarter was due to the $730 returned to

shareholders in the form of cash dividends in Q2 2023 compared to

nil in Q2 2024. In Q2 2024, the Corporation declared the reduction

of stated capital and the Return of Capital which was paid

subsequent to quarter end.

For the six months ended 2024, the Corporation’s

cash used in financing activities was $258, compared to $1,676 for

the same period in 2023. During the first half of 2024, the

Corporation paid $87 (2023: $99) towards principal payments on its

mortgage financing, and $171 (2023: $92) against lease liability

payments. The comparative period decrease in cash used in financing

activities year to date through June 30, 2023 was largely due to

the $1,460 cash dividend payments made during the first half of

2023 and the $25 spent to purchase the Corporation’s common shares

for cancellation.

Mortgage financing

|

(thousands of Canadian Dollars) |

|

|

As at June 30, 2024 |

As at Dec 31, 2023 |

|

Current |

|

|

175 |

175 |

|

Non-current |

|

|

3,265 |

3,352 |

|

Total |

|

|

3,440 |

3,527 |

The Corporation has mortgage financing secured

by lands and buildings owned by High Arctic located within Alberta,

Canada. The mortgage has a remaining initial term of under three

years with a fixed interest rate of 4.30% with payments occurring

monthly. The Corporation’s mortgage financing contains certain

non-financial covenants requiring lenders’ consent including

changes to the underlying business. At June 30, 2024, the

Corporation was compliant with all covenants associated with the

mortgage financing.

Outlook

For some time, the Corporation has both pursued

or entertained potential business combination transactions. The

distinctly different profiles of the North American and PNG

businesses have proven to be the main impediment to unearthing

transactions acceptable to all parties and in the best interests of

High Arctic Shareholders. Finding unique companies desirous of

being linked to both distinct businesses has proven futile.

Companies to whom association with our North American Business may

be attractive are a distinctly broader group and do not overlap

with the international companies with whom the PNG business and its

risk profile may fit well.

An example of this type of business combination

was achieved in the Canadian market amidst reorganization

deliberations with the Delta Acquisition in December of 2023. Its

integration with our legacy rentals business in Canada has enabled

the Corporation to increase scale at the operating margin level

through the first half of 2024. Delta has performed in line with

our pre-transaction expectations during this first half year and we

expect a strong performance through the balance of 2024 as we

continue to market and deploy our underutilized assets into our

expanded geographical coverage.

Over the past two years, the Corporation has

divested underperforming and non-core assets and business. Now the

Corporation’s Canadian business consists of a high-margin

equipment rental business centered upon pressure control and well

stimulation, a minority interest in Canada’s largest oilfield

snubbing services business, Team Snubbing Services Inc., (“Team

Snubbing”) and industrial properties at Clairmont and Whitecourt in

Alberta, Canada. With the recent completion of the Arrangement,

High Arctic is now poised to execute on an exciting new chapter in

its corporate history and looks to grow the Canadian business

through selective and opportunistic investments as well as consider

accretive acquisitions in Canada.

As Team Snubbing moves into the second half of

2024, we are looking forward to developments from the changes made

in Q2 2024 after their acquisition of control of Team Snubbing

International Inc. (“Team International”) that took place on April

1, 2024. The changes made in the quarter include the restructuring

of the management and operational teams and the deployment of

additional purpose-built assets to meet market needs of their

customers and the environment they operate in. The navigation

through this initiative in such a short period has proven the

capability and depths of the Team Snubbing management team and the

‘Team Culture’. Team Snubbing and High Arctic are very proud of

what has been accomplished in a short time frame and are excited to

build on the larger geographical foundation that has been

established.

Post the Arrangement, coupling the outlook for

Team Snubbing and our integrated rentals business along with the

industry macro developments around pipeline projects that will

finally access tidewater markets and expand oil and gas takeaway

for Canada in 2024, the Corporation anticipates strong demand for

its equipment. Our Canadian business will be well positioned to

deliver upon a growth strategy that creates value for our

shareholders.

Post the Arrangement, the PNG business, High

Arctic Overseas Holding Corp., begins with intact senior leadership

and management, a new and independent Board of Directors, its own

public listing on the TSX Venture exchange, a strong capital

structure, no long-term debt and positive working capital of

approximately US$19 million, including US$13 million in cash.

Having successfully completed its current drilling program in PNG

during the second quarter, drilling operations will be idle and are

expected to remain idle to close out 2024. Ancillary services for

rental equipment and manpower solutions remain active and are

expected to provide meaningful cash flow to partially cover

regional fixed infrastructure and personnel support costs. Near

term priorities include sustainment of safety culture and people

expertise, a deep and productive national workforce, and

positioning for significant business development around world-class

LNG projects.

NON-IFRS MEASURES

This press release contains references to

certain financial measures that do not have a standardized meaning

prescribed by International Financial Reporting Standards (“IFRS”)

and may not be comparable to the same or similar measures used by

other companies. High Arctic uses these financial measures to

assess performance and believes these measures provide useful

supplemental information to shareholders and investors. These

financial measures are computed on a consistent basis for each

reporting period and include Oilfield services operating margin,

EBITDA (Earnings before interest, tax, depreciation and

amortization), Adjusted EBITDA, Operating loss, Funds flow from

operating activities, Working capital and Net cash. These do not

have standardized meanings.

These financial measures should not be

considered as an alternative to, or more meaningful than, net

income (loss), cash from operating activities, current assets or

current liabilities, cash and/or other measures of financial

performance as determined in accordance with IFRS.

For additional information regarding non-IFRS

measures, including their use to management and investors and

reconciliations to measures recognized by IFRS, please refer to the

Corporation’s MD&A, which is available online at

www.sedarplus.ca and through High Arctic’s website at www.haes.ca.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking

statements. When used in this document, the words “may”, “would”,

“could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “seek”,

“propose”, “estimate”, “expect”, and similar expressions are

intended to identify forward-looking statements. Such statements

reflect the Corporation’s current views with respect to future

events and are subject to certain risks, uncertainties, and

assumptions. Many factors could cause the Corporation’s actual

results, performance, or achievements to vary from those described

in this press release.

Should one or more of these risks or

uncertainties materialize, or should assumptions underlying

forward-looking statements prove incorrect, actual results may vary

materially from those described in this press release as intended,

planned, anticipated, believed, estimated or expected. Specific

forward-looking statements in this press release include, among

others, statements pertaining to: listing of the SpinCo common

shares and new High Arctic common shares following the

reorganization; right sizing of the general and administrative

infrastructure to align with the new corporate structure; the

performance of the Corporation’s investment in Team Snubbing, and

whether Team Snubbing can realize high utilization in its Canadian

operations and for its snubbing packages in Alaska in 2024; strong

demand for the Corporation’s Canadian rental equipment in 2024,

scaling the Canadian business, executing on one or more corporate

transactions; estimated credit risks and the utilization of tax

losses; and timing of the provision to shareholders of the fair

market value of the SpinCo shares.

With respect to forward-looking statements

contained in this press release, the Corporation has made

assumptions regarding, among other things, general economic and

business conditions which will include, among other things, the

outlook for energy services; continued impact of Russia-Ukraine

conflict; the impact of conflict in the middle east; market

fluctuations in interest rates, commodity prices, and foreign

currency exchange rates; expectations regarding the Corporation’s

ability to manage its liquidity risk, raise capital and manage its

debt finance agreements; projections of market prices and costs;

factors upon which the Corporation will decide whether or not to

undertake a specific course of operational action or expansion; the

Corporation’s ability to: maintain its ongoing relationship with

major customers; successfully market its services to current and

new customers; devise methods for, and achieve its primary

objectives; source and obtain equipment from suppliers;

successfully manage, operate, and thrive in an environment which is

facing much uncertainty; remain competitive in all its operations;

attract and retain skilled employees; and obtain equity and debt

financing on satisfactory terms.

The Corporation’s actual results could differ

materially from those anticipated in these forward-looking

statements as a result of the risk factors set forth above and

elsewhere in this press release, along with the risk factors set

out in the most recent Annual Information Form filed on SEDAR+ at

www.sedarplus.ca.

The forward-looking statements contained in this

press release are expressly qualified in their entirety by this

cautionary statement. These statements are given only as of the

date of this press release. The Corporation does not assume any

obligation to update these forward-looking statements to reflect

new information, subsequent events or otherwise, except as required

by law.

About High Arctic Energy

ServicesHigh Arctic is an energy services provider. High

Arctic provides pressure control equipment and equipment supporting

the high-pressure stimulation of oil and gas wells and other

oilfield equipment on a rental basis to exploration and production

companies, from its bases in Whitecourt and Red Deer, Alberta.

For further information, please contact:

Lonn BateChief Financial

Officer P:

587-318-2218P: +1 (800) 688

7143 High

Arctic Energy Services Inc.Suite 2350, 330 – 5th Ave SWCalgary,

Alberta, Canada T2P 0L4website: www.haes.caEmail: info@haes.ca

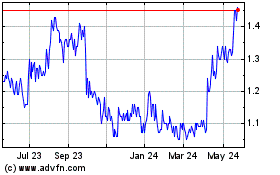

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

From Feb 2025 to Mar 2025

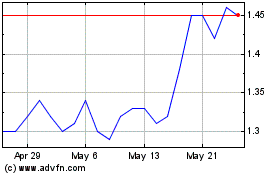

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

From Mar 2024 to Mar 2025