PHX Energy Services Corp. ("PHX Energy") (TSX:PHX) achieved record levels of

revenue, operating days, EBITDA, and funds from operations for a second quarter.

For the three-month period ended June 30, 2014, the Corporation generated

consolidated revenue of $100.5 million as compared to $65.5 million in the

2013-period; a 53 percent increase. In addition, despite the usual effects of

spring break-up in Canada, the level of the Corporation's profitability

increased. EBITDA of $7.8 million was achieved in the second quarter of 2014

compared to $0.4 million in the 2013-period. As a percentage of revenue, EBITDA

was 8 percent in the 2014-quarter compared to 1 percent in the corresponding

2013-quarter. This level of EBITDA was primarily the result of solid activity

growth and improved profitability realized in the US. In addition, margins were

positively impacted by the ongoing strategy to implement cost reduction

initiatives, continuously improve reliability, and gain operational efficiencies

related to the utilization of PHX Energy's technologies.

All-time record quarterly revenue and operating days were attained in the US and

as a percentage of the 2014-quarter's consolidated revenue, this segment

represented 66 percent as compared to 62 percent in the 2013-quarter. Albania

also achieved the highest level of quarterly revenue and operating days in its

history, and the international segment represented 13 percent of consolidated

revenue in the second quarter of 2014 (2013 - 20 percent). The Canadian segment

in the second quarter of 2014 achieved new quarterly revenue and operating day

milestones.

PHX Energy has increased its 2014 capital expenditure budget from $63.3 million

to $76.4 million, in light of strong growth realized and anticipated future

activity levels. During the second quarter of 2014, $11.1 million in capital

expenditures were incurred, and an additional $26.1 million is currently on

order and is expected to be received within the remainder of 2014.

In the 2014-quarter, the Corporation paid dividends of $7.3 million or $0.21 per

share. As at June 30, 2014, PHX Energy had long-term debt of $90.3 million and

working capital of $77.8 million.

During the second quarter of 2014, PHX Energy's job capacity increased by 5

concurrent jobs to 212 through the addition of 5 E-360 electromagnetic ("EM")

measurement while drilling ("MWD") systems. As at June 30, 2014, the

Corporation's MWD fleet consisted of 140 P-360 positive pulse MWD systems and 72

E-360 EM MWD systems. Of these, 100 MWD systems were deployed in Canada, 94 in

the US, 9 in Russia, 6 in Albania, and 3 in Peru. The process of closing the

Peruvian operations is still in progress and assets are being re-allocated to

other locations. In addition, during the second quarter of 2014, the Corporation

ceased all activities in Colombia and initiated the closure of its Colombian

entity. All assets have been transferred to North America to support the

increased drilling activities.

During the remainder of the year, the Corporation expects to add 12 P-360 and 2

E-360 MWD systems. As a result, by the end of 2014 the Corporation expects to

have a fleet of 226 MWD systems, which would be comprised of 152 P-360 MWD

systems and 74 E-360 MWD systems. In addition, the Corporation expects to

increase its worldwide resistivity while drilling ("RWD") job capacity from 17

at the end of the second quarter to 18 by the end of 2014.

Financial Highlights

(Stated in thousands of dollars except per share amounts, percentages and shares

outstanding)

Three-month periods ended June Six-month periods ended June

30, 30,

% %

2014 2013 Change 2014 2013 Change

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Operating

Results (unaudited) (unaudited) (unaudited) (unaudited)

Revenue 100,484 65,483 53 229,615 158,150 45

Net earnings

(loss) (1,062) (4,735) 78 7,751 3,571 117

Earnings

(Loss) per

share -

diluted (0.03) (0.16) 81 0.22 0.13 69

EBITDA (1) 7,809 367 n.m. 29,080 18,696 56

EBITDA per

share -

diluted (1) 0.22 0.01 n.m. 0.83 0.66 26

---------------------------------------------------------------------------

Cash Flow

Cash flows

from

operating

activities 11,629 11,942 (3) 19,400 25,244 (23)

Funds from

operations

(1) 6,504 872 646 27,019 17,606 53

Funds from

operations

per share -

diluted (1) 0.18 0.03 500 0.77 0.62 24

Dividends

paid 7,258 5,120 42 14,452 10,206 42

Dividends per

share (2) 0.21 0.18 17 0.42 0.36 17

Capital

expenditures 11,069 8,134 36 24,525 21,629 13

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Financial

Position June 30, Dec 31,

(unaudited) '14 '13

Working

capital 77,771 66,580 17

Long-term

debt 90,273 70,208 29

Shareholders'

equity 198,999 198,477 -

Common shares

outstanding 34,978,646 34,218,974 2

---------------------------------------------------------------------------

---------------------------------------------------------------------------

n.m. - not meaningful

(1) Refer to non-GAAP measures section.

(2) Dividends paid by the Corporation on a per share basis in the period.

Non-GAAP Measures

PHX Energy uses certain performance measures throughout this document that are

not recognizable under Canadian generally accepted accounting principles

("GAAP"). These performance measures include earnings before interest, taxes,

depreciation and amortization ("EBITDA"), EBITDA per share, funds from

operations, funds from operations per share and senior debt to EBITDA ratio.

Management believes that these measures provide supplemental financial

information that is useful in the evaluation of the Corporation's operations and

are commonly used by other oil and natural gas service companies. Investors

should be cautioned, however, that these measures should not be construed as

alternatives to measures determined in accordance with GAAP as an indicator of

PHX Energy's performance. The Corporation's method of calculating these measures

may differ from that of other organizations, and accordingly, these may not be

comparable. Please refer to the non-GAAP measures section.

Cautionary Statement Regarding Forward-Looking Information and Statements

This document contains certain forward-looking information and statements within

the meaning of applicable securities laws. The use of "expect", "anticipate",

"continue", "estimate", "objective", "ongoing", "may", "will", "project",

"could", "should", "can", "believe", "plans", "intends", "strategy" and similar

expressions are intended to identify forward-looking information or statements.

The forward-looking information and statements included in this document are not

guarantees of future performance and should not be unduly relied upon. These

statements and information involve known and unknown risks, uncertainties and

other factors that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements and information. The

Corporation believes the expectations reflected in such forward-looking

statements and information are reasonable, but no assurance can be given that

these expectations will prove to be correct. Such forward-looking statements and

information included in this document should not be unduly relied upon. These

forward-looking statements and information speak only as of the date of this

document.

In particular, forward-looking information and statements contained in this

document include, without limitation, the projected capital expenditure budget

and how this budget will be funded, the anticipated equipment additions, the

expected combined Canadian federal and provincial tax rate, the efforts underway

to expand the European business, the expected deployment of EDR technologies in

Russia, and the Corporation' assessment of outstanding litigation in the United

States.

The above are stated under the headings: "Overall Performance.", "Operating

Costs and Expenses", "Segmented Information", "Capital Resources", and

"Contingent Liability". Furthermore, all information contained within the

Outlook section of this document contains forward-looking statements.

In addition to other material factors, expectations and assumptions which may be

identified in this document and other continuous disclosure documents of the

Corporation referenced herein, assumptions have been made in respect of such

forward-looking statements and information regarding, among other things: the

Corporation will continue to conduct its operations in a manner consistent with

past operations; the general continuance of current industry conditions;

anticipated financial performance, business prospects, impact of competition,

strategies, the general stability of the economic and political environment in

which the Corporation operates; exchange and interest rates; tax laws; the

sufficiency of budgeted capital expenditures in carrying out planned activities;

the availability and cost of labour and services and the adequacy of cash flow;

debt and ability to obtain financing on acceptable terms to fund its planned

expenditures, which are subject to change based on commodity prices; market

conditions and future oil and natural gas prices; and potential timing delays.

Although Management considers these material factors, expectations and

assumptions to be reasonable based on information currently available to it, no

assurance can be given that they will prove to be correct.

Readers are cautioned that the foregoing lists of factors are not exhaustive.

Additional information on these and other factors that could affect the

Corporation's operations and financial results are included in reports on file

with the Canadian Securities Regulatory Authorities and may be accessed through

the SEDAR website (www.sedar.com) or at the Corporation's website. The

forward-looking statements and information contained in this document are

expressly qualified by this cautionary statement. The Corporation does not

undertake any obligation to publicly update or revise any forward-looking

statements or information, whether as a result of new information, future events

or otherwise, except as may be required by applicable securities laws.

Revenue

(Stated in thousands of dollars)

Three-month periods ended Six-month periods ended

June 30, June 30,

2014 2013 % Change 2014 2013 % Change

---------------------------------------------------------------------

---------------------------------------------------------------------

Revenue 100,484 65,483 53 229,615 158,150 45

---------------------------------------------------------------------

---------------------------------------------------------------------

Due primarily to remarkable growth realized in Canada and the US, PHX Energy

generated a record level of consolidated revenue for a second quarter. This also

represented the fourth highest level of quarterly revenue that the Corporation

has achieved in its history. Consolidated revenue for the three-month period

ended June 30, 2014 was $100.5 million compared to $65.5 million in the

comparable 2013-quarter; an increase of 53 percent. US and international revenue

as a percentage of total consolidated revenue were 66 and 13 percent,

respectively, for the 2014-quarter as compared to 62 and 20 percent in 2013.

Consolidated operating days increased by 36 percent to a second quarter record

of 7,100 days in 2014 as compared to 5,236 days in the 2013-quarter. Average

consolidated day rates for the three-month period ended June 30, 2014, excluding

the motor rental division in the US and the electronic drilling recorder ("EDR")

business, increased to $13,501, which is 11 percent higher than the day rates of

$12,169 in the second quarter of 2013.

During the 2014-quarter, the Canadian industry continued to predominantly

utilize horizontal and directional drilling technologies, which represented

approximately 96 percent of total industry drilling days in the second quarter

of 2014 (2013 - 95 percent). In the US, horizontal and directional activity

levels increased to represent 79 percent of the rigs running per day in the

2014-quarter (2013 - 74 percent). (Sources: Daily Oil Bulletin and Baker Hughes)

The utilization of pad drilling is increasing in the North American market and

this trend adds to the greater demand for horizontal and directional drilling

services.

For the six-month period ended June 30, 2014, consolidated revenue increased by

45 percent to $229.6 million from $158.2 million for the comparable 2013-period.

There were 17,268 consolidated operating days in the six-month period ended June

30, 2014, which is 31 percent higher than the 13,216 days reported in 2013.

Operating Costs and Expenses

(Stated in thousands of dollars except percentages)

Three-month periods ended Six-month periods ended

June 30, June 30,

% %

2014 2013 Change 2014 2013 Change

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Direct costs 86,333 62,051 39 186,977 133,017 41

Depreciation &

amortization (included

in direct costs) 7,480 6,024 24 14,931 11,854 26

Gross profit as

percentage of revenue

excluding depreciation &

amortization 22 14 25 23

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Direct costs are comprised of field and shop expenses, and include depreciation

and amortization on the Corporation's equipment. Excluding depreciation and

amortization, gross profit as a percentage of revenue increased to 22 percent

for the three-month period ended June 30, 2014 as compared to 14 percent in the

comparable 2013-period. For the six-month period ended June 30, 2014, gross

profit as a percentage of revenue, excluding depreciation and amortization, was

25 percent as compared to 23 percent in 2013.

Margins improved in the three and six-month periods ended June 30, 2014 mainly

due to:

-- higher activity levels and average day rates in the US during the 2014-

quarter, and

-- the strategies put in place to implement cost reduction initiatives,

continuously improve reliability, and gain operational efficiencies in

the utilization of PHX Energy's technologies.

For the three-month period ended June 30, 2014, the Corporation's third party

equipment rentals were 4 percent of consolidated revenue, which is the same

percentage as in the corresponding 2013-quarter.

Depreciation and amortization for the three-month period ended June 30, 2014

increased by 24 percent to $7.5 million as compared to $6.0 million in the

2013-quarter. The increase is the result of the Corporation's high level of

capital expenditures in 2013 and 2014.

(Stated in thousands of dollars except percentages)

Three-month periods ended Six-month periods ended

June 30, June 30,

2014 2013 % Change 2014 2013 % Change

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Selling, general &

administrative

("SG&A") costs 14,523 8,444 72 29,128 18,929 54

Equity-settled

share-based

payments (included

in SG&A costs) 204 203 - 414 530 (22)

SG&A costs excluding

equity-settled

share-based

payments as a

percentage of

revenue 14 13 13 12

---------------------------------------------------------------------------

---------------------------------------------------------------------------

SG&A costs for the three-month period ended June 30, 2014 increased by 72

percent to $14.5 million as compared to $8.4 million in 2013. Included in SG&A

costs for both the 2014 and 2013-quarter are share-based payments of $0.2

million. Excluding these costs, SG&A costs as a percentage of consolidated

revenue for the three-month periods ended June 30, 2014 and 2013 were 14 percent

and 13 percent, respectively.

For the six-month period ended June 30, 2014, SG&A costs increased by 54 percent

to $29.1 million as compared to $18.9 million in 2013. Excluding share-based

payments of $0.4 million in the 2014 six-month period and $0.5 million in the

corresponding 2013-period, SG&A costs as a percentage of consolidated revenue

were 13 percent and 12 percent, respectively.

The increase in SG&A costs in both 2014-periods is mainly due to higher payroll

and marketing related costs associated with overall increased activity, costs

related to closing the Colombian operations, and increased compensation expenses

relating to the re-valuation of share-based cash-settled retention awards.

Share-based payments relate to the amortization of the fair values of issued

options of the Corporation using the Black-Scholes model. In the three-month

period ended June 30, 2014, share-based payments were relatively the same as

those in the corresponding 2013-quarter, however, share-based payments decreased

by 22 percent in the six-month period ending June 30, 2014 as compared to the

corresponding 2013-period. The decrease is mainly due to the Corporation's

increased utilization of retention awards in rewarding employees. Share-based

cash-settled retention awards are measured at fair value, and in the

2014-quarter, the related compensation expense recognized by PHX Energy

increased to $2.0 million as compared to $0.7 million in the 2013-quarter. The

increase is primarily due to the greater number of retention awards granted in

2014 and the second half of 2013, and the re-valuation of the retention awards

based on the increase in PHX Energy's stock price from $13.23 as at March 31,

2014 to $16.58 as at June 30, 2014.

(Stated in thousands of dollars)

Three-month periods ended Six-month periods ended

June 30, June 30,

2014 2013 % Change 2014 2013 % Change

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Research &

development expense 660 456 45 1,497 992 51

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Research and development (R&D) expenditures charged to net earnings during the

three-month periods ended June 30, 2014 and 2013 were $0.7 million and $0.5

million, respectively. During both the 2014 and 2013-quarter, none of the R&D

expenditures were capitalized as development costs.

For the six-month period ended June 30, 2014 and 2013, R&D expenditures of $1.5

million and $1.0 million, respectively, were incurred. During both periods, no

R&D expenditures were capitalized as development costs.

The increase in R&D expenditures in both 2014-periods is mainly attributable to

initiatives in the Stream Services division.

(Stated in thousands of dollars)

Three-month periods ended Six-month periods ended

June 30, June 30,

2014 2013 % Change 2014 2013 % Change

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Finance expense 862 1,181 (27) 1,892 2,275 (17)

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Finance expenses relate to interest charges on the Corporation's long-term and

short-term bank facilities. Finance charges decreased to $0.9 million in the

second quarter of 2014 from $1.2 million in the 2013-quarter, and in the

six-month period ended June 30, 2014 decreased to $1.9 million from $2.3 million

in 2013. The decrease in both periods was primarily due to the lower amount of

borrowings outstanding during the three and six-month periods ended June 30,

2014.

(Stated in thousands of dollars)

Three-month periods ended Six-month periods ended

June 30, June 30,

2014 2013 % Change 2014 2013 % Change

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Gains on disposition

of drilling

equipment 1,599 292 448 3,263 2,633 24

Provision for bad

debts (256) - n.m. (735) - n.m.

Foreign exchange

gains (losses) 18 (34) 153 (392) (337) 16

---------------------------------------------------------------------------

Other income 1,361 258 2,136 2,296

---------------------------------------------------------------------------

---------------------------------------------------------------------------

n.m. - not meaningful

For the three and six-month periods ended June 30, 2014, other income is mainly

represented by gains on disposition of drilling equipment of $1.6 million (2013

- $292,000) and $3.3 million (2013 - $2.6 million), respectively. The

dispositions of drilling equipment relate primarily to equipment lost in well

bores that are uncontrollable in nature. The gain reported is net of any asset

retirements that are made before the end of the equipment's useful life and

self-insured down hole equipment losses, if any. Gains typically result from

insurance programs undertaken whereby proceeds for the lost equipment are at

current replacement values, which are higher than the respective equipment's

book value. In both 2014-periods, there was a higher occurrence of losses

compared to the corresponding 2013-periods.

Offsetting other income for the three and six-month periods ended June 30, 2014

is a provision for bad debts of $0.3 million (2013 - nil) and $0.7 million (2013

- nil), respectively, that relate primarily to Russian receivables. Foreign

exchange losses of $0.4 million in the six-month period ended June 30, 2014

resulted mainly from re-valuation losses on US-denominated payables in Canada

and the devaluation of Albania LEK against the Canadian currency.

(Stated in thousands of dollars, except percentages)

Three-month periods ended Six-month periods ended

June 30, June 30,

2014 2013 2014 2013

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Provision for

(Recovery of) income

taxes 529 (2,103) 4,506 996

Effective tax rates n.m. 31% 37% 22%

-------------------------------------------------------------------------

-------------------------------------------------------------------------

n.m. - not meaningful

The provision for income taxes for the three-month period ended June 30, 2014

was $0.5 million as compared to a recovery of income taxes of $2.1 million in

the 2013-quarter. For the six-month period ended June 30, 2014, the provision

for income taxes was $4.5 million as compared to $1.0 million in 2013. The

expected combined Canadian federal and provincial tax rate for 2014 is 25

percent. The effective tax rate in the 2014 six-month period is higher than the

expected rate mainly due to profitability in the US where the Corporation is

subject to higher tax rates and non-recognition of deferred tax assets for

foreign losses.

(Stated in thousands of dollars except per share amounts and percentages)

Three-month periods ended Six-month periods ended

June 30, June 30,

2014 2013 % Change 2014 2013 % Change

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Net earnings (loss) (1,062) (4,735) 78 7,751 3,571 117

Earnings (Loss) per

share - diluted (0.03) (0.16) 81 0.22 0.13 69

EBITDA 7,809 367 n.m. 29,080 18,696 56

EBITDA per share -

diluted 0.22 0.01 n.m. 0.83 0.66 26

EBITDA as a

percentage of

revenue 8 1 13 12

---------------------------------------------------------------------------

---------------------------------------------------------------------------

n.m. - not meaningful

The Corporation's level of net earnings and EBITDA for the three and six-month

periods ended June 30, 2014 have both increased primarily due to strong activity

levels realized in Canada and the US and improved profitability achieved

particularly in the US. EBITDA as a percentage of revenue for the three and

six-month periods ended June 30, 2014 was 8 and 13 percent, respectively (2013 -

1 percent and 12 percent). Included in the earnings for the 2014-quarter and

2014 six-month period were losses of $1.2 million and $1.9 million,

respectively, from the EDR division (2013 - losses of $0.4 million and $0.7

million).

Segmented Information:

The Corporation reports three operating segments on a geographical basis

throughout the Canadian provinces of Alberta, Saskatchewan, British Columbia,

and Manitoba; throughout the Gulf Coast, Northeast and Rocky Mountain regions of

the US; and internationally, mainly in Albania and Russia.

Canada

(Stated in thousands of dollars, except percentages)

Three-month periods ended Six-month periods ended

June 30, June 30,

2014 2013 % Change 2014 2013 % Change

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Revenue 21,618 12,327 75 80,249 56,675 42

Reportable segment

profit (loss)

before tax (6,701) (4,052) (65) 3,106 8,974 (65)

Reportable segment

profit (loss)

before tax as a

percentage of

revenue n.m. n.m. 4 16

---------------------------------------------------------------------------

---------------------------------------------------------------------------

n.m. - not meaningful

PHX Energy's Canadian operations generated all-time record revenue for a second

quarter. Canadian revenue for the three-month period ended June 30, 2014

increased by 75 percent to $21.6 million from $12.3 million in the corresponding

2013-period. The Corporation's efforts to build and maintain a well-diversified

customer base are continuing to yield successes for the Corporation and as a

result, Canadian activity levels were strong for a second quarter with operating

days increasing by 70 percent to a second quarter record of 1,819 days (2013 -

1,071 days). In comparison, total industry horizontal and directional drilling

activity, as measured by drilling days, increased by 33 percent in the

2014-quarter to 18,381 days, compared to 13,772 days in the 2013-period.

(Source: Daily Oil Bulletin) Average day rates, excluding EDR revenue of $1.5

million, decreased by 5 percent to $11,066 in the 2014-quarter from $11,510 in

the 2013-quarter.

In the second quarter of 2014, PHX Energy's oil well drilling activity (as

measured by operating days) represented approximately 69 percent of its overall

Canadian activity; a slight decrease from the 70 percent represented in the

2013-quarter. During the 2014-quarter, PHX Energy continued to have a very

strong presence in the Montney area, and additionally was active in the

Shaunavon, Lloydminster, and Elkton areas.

For the six-month period ended June 30, 2014, PHX Energy's Canadian revenue

increased by 42 percent to $80.2 million from $56.7 million in the comparable

2013-period. The Corporation's operating days increased by 34 percent to 7,055

days in the 2014 six-month period from 5,268 days in the 2013-period. In

comparison, for the six-month period ended June 30, 2014, the number of

horizontal and directional drilling days realized in the Canadian industry

increased by 11 percent to 56,076 days as compared to 50,710 days in 2013.

In the first half of 2014, PHX Energy experienced increased activity in liquids

rich natural gas as oil well drilling activity (as measured by operating days)

decreased to represent 61 percent of PHX Energy's Canadian activity as compared

to 80 percent in 2013.

Reportable segment loss before tax for the second quarter of 2014 increased to

$6.7 million from $4.1 million in the 2013-quarter. Included in the Canadian

segment's losses in the 2014-quarter was a loss of $1.9 million from the EDR

division. For the six-month period ended June 30, 2014, reportable segment

profit before tax decreased by 65 percent to $3.1 million (4 percent of revenue)

from $9.0 million (16 percent of revenue) in 2013. Lower profitability during

the 2014 six-month period was generally due to increased field personnel costs,

higher MWD system repair costs, and greater third party equipment rentals

experienced in the first quarter of 2014. In addition, included in the Canadian

segment's losses in the 2014 six-month period was a loss of $2.6 million from

the EDR division.

United States

(Stated in thousands of dollars, except percentages)

Three-month periods ended Six-month periods ended

June 30, June 30,

2014 2013 % Change 2014 2013 % Change

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Revenue 65,866 40,295 63 123,308 79,678 55

Reportable segment

profit (loss) before

tax 6,547 (2,526) 359 11,611 (2,562) 553

Reportable segment

profit (loss) before

tax as a percentage

of revenue 10 n.m. 9 n.m.

---------------------------------------------------------------------------

---------------------------------------------------------------------------

n.m. - not meaningful

In the second quarter 2014, PHX Energy's US operations continued to reach new

revenue and profitability milestones. For the three-month period ended June 30,

2014, the segment's revenue was an all-time record at $65.9 million, which is 63

percent higher than the revenue of $40.3 million in the 2013-period. PHX

Energy's US operating days also increased by 35 percent from 3,233 days in the

2013-quarter to 4,375 days in the 2014-quarter, which is the highest quarterly

level of activity the Corporation has achieved in the US. In addition, average

day rates, excluding the motor rental division in Midland, Texas and the Rocky

Mountain region, increased by 20 percent in the 2014-quarter to $14,340 compared

to $11,921 in the 2013-quarter. This increase is partially due to favorable

movements in the US-Canadian currency exchange rates. The strong trend in

activity growth and improved overall day rates generally resulted from ongoing

marketing efforts that helped expand the customer base in all US operating

regions combined with a continued focus on reliability and superior performance.

During the second quarter of 2014, Phoenix USA remained active in the Permian,

Eagle Ford, Bakken, Mississippian/Woodford, Marcellus, Niobrara and Utica

basins. In addition, the motor rental business realized strong growth during the

quarter as it expanded to and gained momentum in the Rocky Mountain region.

In the 2014-quarter, the utilization of horizontal and directional drilling

techniques in the US industry increased by 12 percent to 1,458 rigs, based on

the average number of horizontal and directional rigs running on a daily basis,

which represented approximately 79 percent of overall industry activity. This

compared to 1,306 horizontal and directional rigs running on a daily basis in

the 2013-quarter, approximately 74 percent of overall industry activity.

(Source: Baker Hughes) This is a positive industry trend that is favorable for

the Corporation. For the three-month period ended June 30, 2014, oil well

drilling, as measured by drilling days, increased to approximately 79 percent of

Phoenix USA's overall activity, compared to 68 percent in the 2013-period.

US revenue for the six-month period ended June 30, 2014 increased by 55 percent

to $123.3 million from $79.7 million in the comparable 2013-period. The

Corporation's US operating days also increased by approximately 30 percent to

8,285 days in the six-month period ended June 30, 2014 from 6,364 days in 2013.

In comparison, US industry activity, as measured by the average number of

horizontal and directional rigs running on a daily basis, increased by 9 percent

in the first half of 2014 to 1,424 rigs as compared to 1,311 rigs in the

comparable 2013-period. (Source: Baker Hughes)

Reportable segment profit before tax for the second quarter of 2014 increased to

$6.5 million (10 percent of revenue) from a loss of $2.5 million in the

2013-quarter. For the six-month period ended June 30, 2014, reportable segment

profit before tax increased to $11.6 million (9 percent of revenue) from a loss

of $2.6 million in 2013. Profitability in both 2014-periods was largely the

result of strong activity growth, improved overall day rates, and ongoing focus

on cost control and operational efficiencies.

International

(Stated in thousands of dollars, except percentages)

Three-month periods ended Six-month periods ended

June 30, June 30,

2014 2013% Change 2014 2013 % Change

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Revenue 13,000 12,861 1 26,058 21,797 20

Reportable segment

profit before tax 2,683 3,322 (19) 5,291 4,376 21

Reportable segment

profit before tax as

a percentage of

revenue 21 26 20 20

---------------------------------------------------------------------------

---------------------------------------------------------------------------

For the three-month period ended June 30, 2014, the Corporation's international

revenue was relatively stable at $13.0 million compared to $12.9 million in the

2013-period. International operating days decreased slightly by 3 percent from

932 days in the 2013-quarter to 906 days in the 2014-quarter. The Corporation

generated 13 percent of its consolidated revenue from international operations

in the 2014-quarter compared to 20 percent in the 2013-quarter.

For the six-month period ended June 30, 2014, revenue increased by 20 percent to

$26.1 million as compared to $21.8 million in 2013. Operating days for the same

period grew by 22 percent from 1,584 days in 2013 to 1,927 days in 2014.

In the 2014-quarter, Phoenix Albania's operations achieved record revenue and

activity levels for any quarter. For the three-month period ended June 30, 2014,

Phoenix Albania's activity grew by 23 percent while revenue increased by 18

percent compared to the corresponding 2013-period. This growth was primarily

propelled by the addition of a rig in March 2014 for an existing client and a

rig in May 2014 for a new client. With these additional rigs, both the

directional drilling and EDR division are actively providing services on 7 rigs

in the country. The Corporation continues to expand its local content as

operation grows and presently has a 7 job capacity in Albania. Efforts are

underway to build on the strong foundation in this region by expanding the

European business beyond the Albanian borders.

In the second quarter of 2014, Phoenix Russia's operating days decreased by 10

percent and revenue decreased by 12 percent as compared to the 2013-period.

During the quarter, the Corporation's activities in Russia were negatively

affected by a major client's efforts to re-organize their operations, however,

the impact of this was eased by Phoenix Russia's ability to add new clients to

diversify its operations. In addition, the Corporation opened a satellite office

in Ufa, Southern Russia, to expand operations in the Orenburg, Samara, and

Buzluk regions, which offer improved pricing and high levels of drilling

activity with key target clients. The Corporation has a job capacity of 17 in

Russia and expects to deploy EDR systems in the country during the 2014-year.

PHX Energy continues to monitor the geopolitical situation with respect to

existing Russian sanctions. No disruptions to the business have occurred to

date, and efforts to mitigate the risk of sanctions include a continued focus on

local content, which currently represents 98 percent of total number of staff.

In May 2014, PHX Energy ceased all activities in Colombia and initiated the

closure of the business. All assets have been transferred out of the country to

support increased drilling activities in North America.

For the three-month period ended June 30, 2014, reportable segment profit before

tax was $2.7 million (21 percent of revenue), a decrease of 19 percent compared

to $3.3 million (26 percent of revenue) in the corresponding 2013-period.

International operations' profitability during the quarter was negatively

affected by weaker activity levels in Russia and costs associated with closing

down the operations in Colombia. Reportable segment profit for the six-month

period ended June 30, 2014 was $5.3 million (20 percent of revenue) as compared

to $4.4 million (20 percent of revenue) in 2013; a 21 percent increase.

Investing Activities

Net cash used in investing activities for the three-month period ended June 30,

2014 was $10.7 million as compared to $20.1 million in 2013. In the second

quarter of 2014, PHX Energy added $6.8 million, net, in capital equipment (2013

- $6.4 million). The capital equipment amounts are net of proceeds from the

involuntary disposal of drilling equipment in well bores of $4.3 million (2013 -

$1.7 million). The quarterly 2014 expenditures included:

-- $5.3 million in MWD systems and spare components;

-- $2.6 million in down hole performance drilling motors;

-- $1.7 million in EDR systems and spare components;

-- $0.6 million in machinery and equipment; and

-- $0.9 million in other assets, including $0.3 million in non-magnetic

drill collars.

The capital expenditure program undertaken in the period was financed mainly

from cash flows from operations.

During the 2014-quarter, the Corporation spent $0.4 million in development

costs. The change in non-cash working capital balances of $3.5 million (use of

cash) for the three-month period ended June 30, 2014, relates to the net change

in the Corporation's trade payables that are associated with the acquisition of

capital assets. This compares to $6.9 million (use of cash) for the three-month

period ended June 30, 2013.

Financing Activities

The Corporation reported cash flows used in financing activities of $1.2 million

in the three-month period ended June 30, 2014 as compared to cash flows from

financing activities of $9.2 million in the 2013-period. In the 2014-quarter:

-- the Corporation paid dividends of $7.3 million to shareholders, or $0.21

per share; and

-- through its option and DRIP program the Corporation received cash

proceeds of $6.1 million from exercised options and reinvested dividends

to acquire 596,846 common shares of the Corporation.

Capital Resources

As at June 30, 2014, the Corporation has access to a $10.0 million operating

facility. The facility bears interest based primarily on the Corporation's

senior debt to EBITDA ratio, as defined in the agreement. At the Corporation's

option, interest is at the bank's prime rate plus a margin that ranges from a

minimum of 0.75 percent to a maximum of 2 percent, or the bank's bankers'

acceptance rate plus a margin that ranges from a minimum of 1.75 percent to a

maximum of 3 percent. As of June 30, 2014, the Corporation had nil drawn on this

facility.

As at June 30, 2014, the Corporation also has access to a $95.0 million

syndicated facility and a US$25.0 million operating facility in the US. The

facilities bear interest at the same rates disclosed above. The syndicated

facility and the US operating facility mature on September 5, 2016. As at June

30, 2014, $70.0 million was drawn on the syndicated facility and US$19.0 million

was drawn on the US operating facility.

All credit facilities are secured by a general security agreement over all

assets of the Corporation located in Canada and the US. As at June 30, 2014, the

Corporation was in compliance with all of its bank debt covenants.

Cash Requirements for Capital Expenditures

Historically, the Corporation has financed its capital expenditures and

acquisitions through cash flows from operating activities, debt and equity. The

2014 capital budget was increased to $76.4 million from the $63.3 million

announced in the first quarter of 2014, subject to further quarterly review of

the Board of Directors. These planned expenditures are expected to be financed

from a combination of one or more of the following, cash flow from operations,

the Corporation's unused credit facilities or equity, if necessary. However, if

a sustained period of market uncertainty and financial market volatility

persists in 2014, the Corporation's activity levels, cash flows and access to

credit may be negatively impacted, and the expenditure level would be reduced

accordingly. Conversely, if future growth opportunities present themselves, the

Corporation would look at expanding this planned capital expenditure amount.

Contingent Liability

The Corporation's wholly-owned subsidiary, Phoenix Technology Services USA Inc.

("Phoenix USA"), has been named in a legal action in Houston, Texas commenced by

a former employee (the "Claimant") alleging that he was improperly classified as

exempt under the Fair Labour Standards Act and therefore entitled to unpaid

overtime. Legal actions involving similar alleged violations have been filed in

the United States against a number of other drilling companies. The Claimant

asserts that he will seek to have the action certified as a collective action

which may result in additional employees or former employees of Phoenix USA

joining the action. Phoenix USA has filed a defense to the action and intends to

vigorously defend the same including, without limitation, any motion which may

be brought for certification. Based upon a preliminary assessment of information

available and certain assumptions the Corporation believes to be reasonable at

this time, PHX Energy believes it has a number of defenses to the claims

asserted and the action is not currently believed to be material to the

Corporation. The Corporation does not undertake any obligation to update

publicly the status of the action whether as a result of new information, future

events or otherwise, except as may be expressly required by applicable

securities laws or the situation otherwise warrants.

Outlook

In the second quarter of 2014, PHX Energy set quarter-over-quarter records for

consolidated revenue, operating days, funds from operations and EBITDA and as a

result of increased activity levels the Corporation's team of personnel,

operational resources and asset base also expanded. The Corporation is extremely

proud of these new milestones despite an expected slower activity period due to

spring break-up in Canada.

The industry has experienced many positive technical changes in the last year

and PHX Energy believes these are just the beginning of numerous step changes

that will transform operators' demands and drilling practices. PHX Energy is

currently equipping itself to be at the forefront as a service leader by

expanding its optimization services and developing advanced technologies that

offer greater performance.

Spring break-up in Canada reduced activity in April and May and through the

majority of June, however, the increased utilization of pad drilling was a

positive trend during this slower period. Pad drilling presents numerous

advantages to both operators and service providers, such as PHX Energy,

including a shorter time required to move the rig which improves equipment

utilization. PHX Energy was a direct benefactor of this trend in the second

quarter and expects pad drilling to create a positive upside in future quarters

and break-up periods.

Activity levels in all key operating basins in the US market experienced growth,

including the Marcellus in the Northeast region where improved natural gas

prices made drilling more economical for PHX Energy's clients. As it was spring

break-up in Canada, many of the Corporation's assets, including guidance systems

and performance drilling motors, were transferred to the Corporation's key

operating areas in the US to meet demands.

Internationally, PHX Energy's client base is diversifying in both Albania and

Russia. In Albania this diversification lead to new records being achieved and

the Corporation believes this upward trend will continue. The Corporation's

outlook for Russia is also positive, despite a decline in an existing client's

activity during the second quarter. Many of the newly awarded contracts are set

to commence in the later part of the year and PHX Energy plans to expand its

service offering to a new drilling region in Russia.

With each of its geographical operating regions expanding, PHX Energy has once

again increased its capital expenditure budget. These expenditures in the

remainder of 2014 will be dedicated to replenishing the Canadian fleet in

addition to adding new capacity to support forecasted growth. Due to delivery

timelines for this equipment, it is likely that third party rental costs will be

incurred in upcoming quarters.

The Corporation has established an impressive track record for growth, which can

be attributed to the efforts of its over 1,100 employees. Since the first

quarter of 2010, record revenues quarter-over-quarter have been achieved and

operating days have continued to set quarterly records since the fourth quarter

of 2012; often boasting double digit growth percentages. PHX Energy has

implemented strategies to improve margins, such as increasing the number of

value added technologies in its service offering, diversifying its lines of

business into higher margin services like the data management sector, and

undertaking numerous internal efficiency initiatives, all of which are beginning

to make an impact on our results.

PHX Energy believes that operational and financial records will continue to be

achieved in the future and that the remainder of 2014 will be defined by robust

growth.

John Hooks, Chairman of the Board, President and Chief Executive Officer

July 30, 2014

Non-GAAP Measures

1) EBITDA

EBITDA, defined as earnings before interest, taxes, depreciation and

amortization, is not a financial measure that is recognized under GAAP. However,

Management believes that EBITDA provides supplemental information to net

earnings that is useful in evaluating the Corporation's operations before

considering how it was financed or taxed in various countries. Investors should

be cautioned, however, that EBITDA should not be construed as an alternative

measure to net earnings determined in accordance with GAAP. PHX Energy's method

of calculating EBITDA may differ from that of other organizations and,

accordingly, its EBITDA may not be comparable to that of other companies.

The following is a reconciliation of net earnings to EBITDA:

(Stated in thousands of dollars)

Three-month periods Six-month periods

ended June 30, ended June 30,

2014 2013 2014 2013

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net earnings (loss) (1,062) (4,735) 7,751 3,571

Add:

Depreciation and amortization 7,480 6,024 14,931 11,854

Provision for (Recovery of)

income taxes 529 (2,103) 4,506 996

Finance expense 862 1,181 1,892 2,275

----------------------------------------------------------------------------

EBITDA as reported 7,809 367 29,080 18,696

----------------------------------------------------------------------------

----------------------------------------------------------------------------

EBITDA per share - diluted is calculated using the treasury stock method whereby

deemed proceeds on the exercise of the share options are used to reacquire

common shares at an average share price. The calculation of EBITDA per share on

a dilutive basis does not include anti-dilutive options.

2) Funds from Operations

Funds from operations is defined as cash flows generated from operating

activities before changes in non-cash working capital. This is not a measure

recognized under GAAP. Management uses funds from operations as an indication of

the Corporation's ability to generate funds from its operations before

considering changes in working capital balances. Investors should be cautioned,

however, that this financial measure should not be construed as an alternative

measure to cash flows from operating activities determined in accordance with

GAAP. PHX Energy's method of calculating funds from operations may differ from

that of other organizations and, accordingly, it may not be comparable to that

of other companies.

The following is a reconciliation of cash flows from operating activities to

funds from operations:

(Stated in thousands of dollars)

Three-month periods Six-month periods

ended June 30, ended June 30,

2014 2013 2014 2013

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Cash flows from operating

activities 11,629 11,942 19,400 25,244

Add:

Changes in non-cash working

capital (6,505) (12,216) 5,118 (10,237)

Interest paid 893 606 1,628 1,878

Income taxes paid 487 540 873 721

----------------------------------------------------------------------------

Funds from operations 6,504 872 27,019 17,606

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Funds from operations per share - diluted is calculated using the treasury stock

method whereby deemed proceeds on the exercise of the share options are used to

reacquire common shares at an average share price. The calculation of funds from

operations per share on a dilutive basis does not include anti-dilutive options.

3) Senior Debt to EBITDA Ratio

Senior debt is represented by loans and borrowings. EBITDA, for purposes of the

calculation of this covenant ratio, is represented by EBITDA as defined in

Non-GAAP Measures above and adding share-based payments less interest and income

taxes paid.

About PHX Energy Services Corp.

The Corporation, through its directional drilling subsidiary entities, provides

horizontal and directional drilling technology and services to oil and natural

gas producing companies in Canada, the US, Albania, and Russia. PHX Energy

develops and manufactures its E-360 EM and P-360 positive pulse MWD technologies

that are made available for internal operational use. In addition, as the result

of an acquisition completed in November 2013, PHX Energy provides EDR technology

and services, through Stream Services (formerly RigManager Services).

PHX Energy's Canadian directional drilling operations are conducted through

Phoenix Technology Services LP. The Corporation maintains its corporate head

office, research and development, Canadian sales, service and operational

centres in Calgary, Alberta. In addition, PHX Energy has a facility in Estevan,

Saskatchewan. PHX Energy's US operations, conducted through the Corporation's

wholly-owned subsidiary, Phoenix Technology Services USA Inc. ("Phoenix USA"),

is headquartered in Houston, Texas. Phoenix USA has sales and service facilities

in Houston, Texas; Traverse City, Michigan; Casper, Wyoming; Denver, Colorado;

Fort Worth, Texas; Midland, Texas; Buckhannon, West Virginia; Pittsburgh,

Pennsylvania; and Oklahoma City, Oklahoma. Internationally, PHX Energy has sales

offices and service facilities in Albania and Russia, and an administrative

office in Nicosia, Cyprus.

PHX Energy markets its EDR technology and services in Canada through its newly

rebranded division, Stream Services which has offices and an operations center

in Calgary, Alberta. EDR technology is marketed worldwide outside Canada through

its wholly-owned subsidiary Stream Services International Inc. (formerly

RigManager International Inc.); mainly in Albania and Mexico.

Consolidated Statements of Financial Position

(unaudited)

June 30, 2014 December 31, 2013

----------------------------------------------------------------------------

ASSETS

Current assets:

Cash and cash equivalents $ 9,038,538 $ 5,663,880

Trade and other receivables 93,584,779 97,660,559

Inventories 31,115,503 30,024,019

Prepaid expenses 5,353,419 2,913,514

----------------------------------------------------------------------------

Total current assets 139,092,239 136,261,972

Non-current assets:

Drilling and other equipment 170,980,225 165,771,615

Goodwill 31,229,756 31,229,756

Intangible assets 24,394,797 17,113,924

----------------------------------------------------------------------------

Total non-current assets 226,604,778 214,115,295

----------------------------------------------------------------------------

Total assets $ 365,697,017 $ 350,377,267

----------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Trade and other payables $ 56,677,014 $ 64,815,732

Dividends payable 2,448,505 2,239,910

Current tax liabilities 1,871,567 2,410,198

Current portion of finance leases 324,553 215,697

----------------------------------------------------------------------------

Total current liabilities 61,321,639 69,681,537

Non-current liabilities:

Loans and borrowings 90,273,000 70,208,400

Deferred tax liabilities 13,203,859 9,833,710

Deferred income 1,900,001 1,966,667

Finance leases - 209,935

----------------------------------------------------------------------------

Total non-current liabilities 105,376,860 82,218,712

Equity:

Share capital 175,468,608 165,451,599

Contributed surplus 4,454,219 6,361,710

Retained earnings 17,374,567 24,284,690

Accumulated other comprehensive

income 1,701,124 2,379,019

----------------------------------------------------------------------------

Total equity 198,998,518 198,477,018

----------------------------------------------------------------------------

Total liabilities and equity $ 365,697,017$ 350,377,267

----------------------------------------------------------------------------

Consolidated Statements of Comprehensive Income

(unaudited)

Three-month periods ended Six-month periods ended

June 30, June 30,

2014 2013 2014 2013

----------------------------------------------------------------------------

Revenue $100,484,150 $ 65,482,975 $229,614,660 $158,149,790

Direct costs 86,333,058 62,051,464 186,976,870 133,017,023

----------------------------------------------------------------------------

Gross profit 14,151,092 3,431,511 42,637,790 25,132,767

----------------------------------------------------------------------------

Expenses:

Selling, general

and administrative

expenses 14,523,261 8,443,769 29,127,887 18,928,599

Research and

development

expenses 660,226 456,068 1,497,470 991,981

Finance expense 861,744 1,181,287 1,892,041 2,274,914

Other income (1,360,839) (257,647) (2,136,085) (2,296,483)

----------------------------------------------------------------------------

14,684,392 9,823,477 30,381,313 19,899,011

Share of loss of

equity-accounted

investee (net of

tax) - 446,514 - 666,568

----------------------------------------------------------------------------

Earnings (Loss)

before income taxes (533,300) (6,838,480) 12,256,477 4,567,188

----------------------------------------------------------------------------

Provision for

(Recovery of)

income taxes

Current 1,926,514 833,711 2,586,179 2,628,702

Deferred (1,397,394) (2,937,048) 1,919,616 (1,632,216)

----------------------------------------------------------------------------

529,120 (2,103,337) 4,505,795 996,486

----------------------------------------------------------------------------

Net earnings (loss) (1,062,420) (4,735,143) 7,750,682 3,570,702

----------------------------------------------------------------------------

Other comprehensive

income

Foreign currency

translation (2,103,649) 830,863 (677,895) 2,295,633

----------------------------------------------------------------------------

Total comprehensive

income (loss) for

the period $ (3,166,069) $ (3,904,280) $ 7,072,787 $ 5,866,335

----------------------------------------------------------------------------

Earnings (Loss) per

share - basic $ (0.03) $ (0.16) $ 0.22 $ 0.13

Earnings (Loss) per

share - diluted $ (0.03) $ (0.16) $ 0.22 $ 0.13

----------------------------------------------------------------------------

Consolidated Statements of Cash Flows

(unaudited)

Three-month periods ended Six-month periods ended

June 30, June 30,

2014 2013 2014 2013

----------------------------------------------------------------------------

Cash flows from

operating

activities:

Net earnings (loss) $ (1,062,420) $ (4,735,143) $ 7,750,682 $ 3,570,702

Adjustments for:

Depreciation and

amortization 7,480,099 6,024,210 14,931,171 11,853,819

Provision for

(Recovery of)

income taxes 529,120 (2,103,337) 4,505,795 996,486

Unrealized foreign

exchange loss

(gain) (131,792) 148,237 120,041 346,690

Gain on disposition

of drilling

equipment (1,599,176) (292,163) (3,263,325) (2,632,698)

Equity-settled

share-based

payments 204,092 202,730 414,084 529,767

Finance expense 861,744 1,181,287 1,892,041 2,274,914

Provision for bad

debts 255,559 - 735,098 -

Amortization of

deferred income (33,333) - (66,666) -

Share of loss of

equity-accounted

investee - 446,514 - 666,568

Change in non-cash

working capital 6,504,853 12,215,708 (5,118,215) 10,236,550

----------------------------------------------------------------------------

Cash generated from

operating

activities 13,008,746 13,088,043 21,900,706 27,842,798

Interest paid (892,311) (605,918) (1,627,474) (1,877,732)

Income taxes paid (487,112) (540,107) (873,433) (720,859)

----------------------------------------------------------------------------

Net cash from

operating

activities 11,629,323 11,942,018 19,399,799 25,244,207

----------------------------------------------------------------------------

Cash flows from

investing

activities:

Proceeds on

disposition of

drilling equipment 4,293,890 1,686,595 7,405,486 5,283,563

Acquisition of

drilling and other

equipment (11,069,061) (8,133,626) (24,525,334) (21,628,872)

Acquisition of

intangible assets (436,544) (3,759,200) (7,884,816) (3,759,200)

Investment in

equity-accounted

investee - (3,000,000) - (3,200,000)

Change in non-cash

working capital (3,451,293) (6,925,943) (4,162,605) (10,926,303)

----------------------------------------------------------------------------

Net cash used in

investing

activities (10,663,008) (20,132,174) (29,167,269) (34,230,812)

----------------------------------------------------------------------------

Cash flows from

financing

activities:

Proceeds from

issuance of share

capital 6,072,119 2,270,116 7,695,434 3,331,992

Dividends paid to

shareholders (7,257,519) (5,120,280) (14,452,227) (10,205,718)

Proceeds on loans

and borrowings - 10,221,500 20,000,000 15,208,000

Payments under

finance leases (49,047) - (101,079) -

Proceeds on

operating facility - 1,860,518 - 3,627,704

----------------------------------------------------------------------------

Net cash from (used

in) financing

activities (1,234,447) 9,231,854 13,142,128 11,961,978

----------------------------------------------------------------------------

Net increase

(decrease) in cash

and cash

equivalents (268,132) 1,041,698 3,374,658 2,975,373

Cash and cash

equivalents,

beginning of period 9,306,670 6,263,644 5,663,880 4,329,969

----------------------------------------------------------------------------

Cash and cash

equivalents, end of

period $ 9,038,538 $ 7,305,342 $ 9,038,538 $ 7,305,342

----------------------------------------------------------------------------

FOR FURTHER INFORMATION PLEASE CONTACT:

PHX Energy Services Corp.

John Hooks

President and CEO

403-543-4466

PHX Energy Services Corp.

Cameron Ritchie

Senior Vice President Finance and CFO

403-543-4466

www.phxtech.com

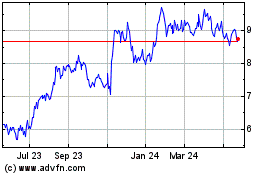

PHX Energy Services (TSX:PHX)

Historical Stock Chart

From Jan 2025 to Feb 2025

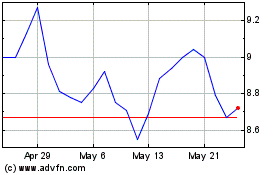

PHX Energy Services (TSX:PHX)

Historical Stock Chart

From Feb 2024 to Feb 2025