Park Lawn Corporation Announces $125 Million Bought Deal Offering and Successful Completion of Cress Funeral Service Acquisit...

02 April 2019 - 6:37AM

Expands U.S. operations into Wisconsin with

acquisition of 8 funeral homes and 2 crematoria

Park Lawn Corporation (TSX: PLC) (“

PLC” or the

“

Company”) is pleased to announce that it has

entered into an agreement with a syndicate of underwriters (the

“

Underwriters”) co-led by National Bank Financial

Inc., CIBC Capital Markets and Cormark Securities Inc. to issue

4,874,000 common shares (the “

Common Shares”) at a

price of $25.65 per Common Share, on a bought deal basis, for

gross proceeds of approximately $125 million. (the

“

Offering”). The Company has also granted the

Underwriters an option to purchase up to an additional 731,100

Common Shares on the same terms and conditions, exercisable at any

time, in whole or in part, up to 30 days after the closing of the

Offering (the “

Over-Allotment Option”).

The net proceeds from the Offering will be used

to repay the Company’s outstanding indebtedness under its credit

facility, to fund the Company’s ongoing growth initiatives, and for

general corporate purposes.

The Common Shares will be offered pursuant to a

short-form prospectus to be filed in each of the provinces of

Canada, which will describe the terms of the Offering. The Offering

is expected to close on or about April 23, 2019 and is subject to

certain conditions including, but not limited to, the receipt of

all regulatory approvals including the approval of the Toronto

Stock Exchange.

Concurrently with the announcement of the

Offering, PLC is also pleased to announce that it has completed its

previously announced acquisition of all the outstanding equity of

Cress Funeral Service, Inc. (“Cress Funeral

Service”), an 8-location funeral business in Madison,

Wisconsin for a purchase price of approximately US$20.3 million,

subject to customary working capital adjustments (the

“Acquisition”).

The securities offered pursuant to the Offering

have not been, nor will they be, registered under the United States

Securities Act of 1933, as amended, (the “1933

Act”) and may not be offered, sold or delivered, directly

or indirectly, in the United States, or to, or for the account or

benefit of, “U.S. persons” (as defined in Regulation S under the

1933 Act), except pursuant to an exemption from the registration

requirements of the 1933 Act. This press release does not

constitute an offer to sell or a solicitation of an offer to buy

any securities in the United States or to, or for the account or

benefit of, U.S. persons.

About Park Lawn CorporationPLC

provides goods and services associated with the disposition and

memorialization of human remains. Products and services are sold on

a pre-planned basis (pre-need) or at the time of a death (at-need).

PLC and its subsidiaries own and operate businesses including

cemeteries, crematoria, funeral homes, chapels, planning offices

and a transfer service. PLC has a North American wide platform with

operations in five Canadian provinces and thirteen U.S. states.

Cautionary Statement Regarding Forward-Looking

Information

This news release may contain forward-looking

statements (within the meaning of applicable securities laws)

relating to the business of PLC and the environment in which it

operates. Forward-looking statements are identified by words such

as “believe”, “anticipate”, “project”, “expect”, “intend”, “plan”,

“will”, “may”, “estimate”, “pro-forma” and other similar

expressions. These statements are based on PLC’s expectations,

estimates, forecasts and projections and include, without

limitation, statements regarding the completion of the Offering,

the proposed use of proceeds of the Offering, PLC’s continued

growth strategy, the anticipated effect of the Offering on the

performance of PLC, the expected purchase price multiple of the

Acquisition and the impact of the Acquisition on PLC’s business.

The forward-looking statements in this news release are based on

certain assumptions, including without limitation that all

conditions to completion of the Offering will be satisfied or

waived, those regarding present and future business strategies, the

environment in which PLC will operate in the future, expected

revenues, expansion plans, the impact of the Acquisition on PLC’s

business, and PLC’s ability to achieve its goals. Forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties that are difficult to control or predict. A

number of factors could cause actual results to differ materially

from the results discussed in the forward-looking statements,

including, but not limited to, the risk that the Offering will not

be completed and the factors discussed under the heading “Risk

Factors” in PLC’s Annual Information Form available at

www.sedar.com. There can be no assurance that forward-looking

statements will prove to be accurate as actual outcomes and results

may differ materially from those expressed in these forward-looking

statements. Readers, therefore, should not place undue reliance on

any such forward-looking statements. Further, these forward-looking

statements are made as of the date of this news release and, except

as expressly required by applicable law, PLC assumes no obligation

to publicly update or revise any forward-looking statement, whether

as a result of new information, future events or otherwise.

Contact Information

Andrew ClarkChairman & Chief Executive

Officer(416) 231-1462

Joseph LeederChief Financial Officer &

Director(416) 231-1462

Suzanne Cowan VP, Business Development &

Corporate Affairs scowan@parklawncorp.com(416) 231-1462

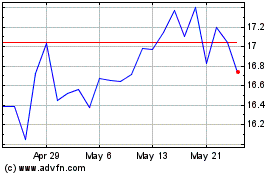

Park Lawn (TSX:PLC)

Historical Stock Chart

From Oct 2024 to Nov 2024

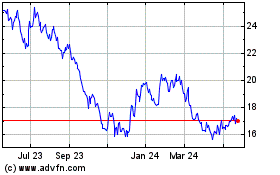

Park Lawn (TSX:PLC)

Historical Stock Chart

From Nov 2023 to Nov 2024