Stack Capital Group Inc. Announces Normal Course Issuer Bid

14 November 2024 - 11:45PM

Stack Capital Group Inc. (TSX:STCK) (“Stack Capital”) announced

today that the Toronto Stock Exchange (the “TSX”) has accepted a

notice filed by Stack Capital of its intention to make a normal

course issuer bid (the “NCIB”) with respect to its outstanding

common shares. Stack Capital management believes its share price is

undervalued compared to its recently announced Book Value per Share

of $11.05.

The notice provides that Stack Capital may,

during the 12-month period commencing November 18, 2024, and ending

no later than November 17, 2025, purchase through the facilities of

the TSX and/or alternative Canadian Trading Systems up to 531,000

common shares in total, being 5.0% of the issued and outstanding

common shares as of November 11, 2024. The price which Stack

Capital will pay for any common shares will be the market price at

the time of acquisition. During the period of this NCIB, Stack

Capital may make purchases under the NCIB by means of open market

transactions. The actual number of common shares which may be

purchased pursuant to the NCIB and the timing of any such purchases

will be determined by senior management of Stack Capital. The

average daily trading volume from May 1, 2024 to October 31, 2024

was of 4,613 common shares. Daily purchases under the NCIB will be

generally limited to 1,153 common shares, other than block

purchases. All shares purchased by Stack Capital under the NCIB

will be cancelled.

As of November 11, 2024, there were 10,636,908

common shares of Stack Capital outstanding, and the public float

was 8,213,866 common shares.

Stack Capital may purchase its common shares,

from time to time, if it believes that the market price of its

common shares is attractive and that the purchase would be an

appropriate use of corporate funds and in the best interests of

Stack Capital.

In connection with the NCIB, Stack Capital has

entered into an automatic share purchase plan (“ASPP”) with a

designated broker to facilitate the purchase of common shares under

the NCIB, including at times when Stack Capital would ordinarily

not be permitted to purchase its common shares due to regulatory

restrictions or self-imposed blackout periods. During restricted or

blackout periods, purchases under the ASPP will be determined by

the designated broker in its sole discretion based on the

purchasing parameters set by Stack Capital in accordance with the

rules of the TSX, applicable securities laws and the terms of the

ASPP. Outside of the restricted and blackout periods, the timing

and amount of purchases under the NCIB will be determined by senior

management of Stack Capital. The ASPP has been pre-cleared by the

TSX and will become effective on November 18, 2024, concurrently

with the commencement of the NCIB. All purchases made under the

ASPP will be included in computing the number of common shares

purchased under the NCIB.

Pursuant to a previous notice of intention to

conduct a NCIB, under which Stack Capital sought and received

approval from the TSX to purchase up to 449,000 common shares for

the period of November 17, 2023 to November 16, 2024, Stack Capital

purchased 59,400 common shares through the facilities of the TSX

and alternative Canadian Trading Systems for cancellation as of

November 11, 2024 at a weighted average price of $8.73 per share.

Stack Capital’s previous NCIB expires on November 16, 2024.

About Stack Capital

Stack Capital is an investment holding company

and its business objective is to invest in equity, debt and/or

other securities of growth-to-late-stage private businesses.

Through Stack Capital, shareholders have the opportunity to gain

exposure to a diversified private investment portfolio; participate

in the private market; and have liquidity due to the listing of the

Common Shares and Warrants on the TSX. At the same time, the public

structure also allows the Company to focus its efforts on

maximizing long-term performance through a portfolio of high growth

businesses, which are not widely available to most Canadian

investors. SC Partners Ltd. has taken the initiative in creating

the Company and acts as the Company's administrator and is

responsible to source and advise with respect to all investments

for the Company.

For more information, please visit our

website at www.stackcapitalgroup.com

or contact:

Brian ViveirosVP, Corporate Development, and

Investor Relations647.280.3307brian@stackcapitalgroup.com

Non-IFRS Financial Measures

This press release may make reference to the

following financial measures which are not recognized under

International Financial Reporting Standards (“IFRS”), and which do

not have a standard meaning prescribed by IFRS:

- Book Value - the

aggregate fair value of the assets of the Company on the referenced

date, less the aggregate carrying value of the liabilities,

excluding any deferred taxes or unrealized deferred gains or losses

if applicable, of the Company; and

- Book Value per Share

(BVPS) - the Book Value on the referenced day divided by

the aggregate number of Common Shares that are outstanding on such

day.

The Company’s Book Value and Book Value per

Share is a measure of the performance of the Company as a whole.

The Company’s method of determining this financial measure may

differ from other issuers’ methods and, accordingly, this amount

may not be comparable to measures used by other issuers. This

financial measure is not a performance measure as defined under

IFRS and should not be considered either in isolation of, or as a

substitute for, net earnings per share prepared in accordance with

IFRS.

Cautionary Note Regarding

Forward-Looking Information

This press release contains statements that

constitute “forward-looking statements” within the meaning of

applicable securities legislation, including, but not limited to,

statements relating to future purchases of common shares under the

NCIB, including pursuant to the ASPP. Much of this information can

be identified by words such as “expect to,” “expected,” “will,”

“estimated” or similar expressions suggesting future outcomes or

events. Stack Capital believes the expectations reflected in such

forward-looking statements are reasonable but no assurance can be

given that these expectations will prove to be correct and such

forward-looking statements should not be unduly relied upon.

Forward-looking statements are based on current

information and expectations that involve a number of risks and

uncertainties, which could cause actual results or events to differ

materially from those anticipated. These risks include, but are not

limited to, risks associated with Stack Capital’ financial

condition and prospects; the stability of general economic and

market conditions; interest rates; the availability of cash for

repurchases of outstanding common shares under the NCIB; the

existence of alternative uses for Stack Capital’s cash resources

which may be superior to effecting repurchases under the NCIB;

compliance by third parties with their contractual obligations;

compliance with applicable laws and regulations pertaining to the

NCIB and ASPP; and other risks related to Stack Capital’s business,

including those identified in Stack Capital’s annual information

form for the year ended December 31, 2023 under the heading “Risk

Factors” (a copy of which may be obtained at www.sedarplus.ca) and

subsequent filings. Forward-looking statements contained in this

press release are made as of the date hereof and are subject to

change. All forward-looking statements in this press release are

qualified by these cautionary statements. Unless otherwise required

by applicable securities laws, we do not intend, nor do we

undertake any obligation, to update or revise any forward-looking

statements contained in this press release to reflect subsequent

information, events, results or circumstances or otherwise.

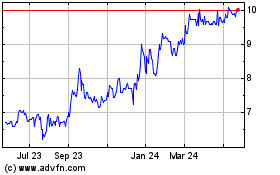

Stack Capital (TSX:STCK)

Historical Stock Chart

From Nov 2024 to Dec 2024

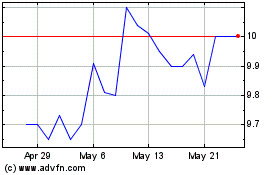

Stack Capital (TSX:STCK)

Historical Stock Chart

From Dec 2023 to Dec 2024