“We remain steadfast in our commitment to the safety and

reliability of our operations as we continue to navigate the impact

of the COVID19 pandemic,” said Mark Little, president and

chief executive officer. “Although the pandemic continues to have

adverse impacts on our industry, we remain focused on items within

our control, including the safety of our workforce and communities,

and structural changes that lower our cost base, preserve the

financial resiliency of the company and set the foundation for

longterm value creation.”

- Funds from operations increased to

$1.166 billion ($0.76 per common share) in the third quarter

of 2020, from $488 million ($0.32 per common share) in the

second quarter of 2020. Funds from operations were

$2.675 billion ($1.72 per common share) in the prior year

quarter. Cash flow provided by operating activities, which includes

changes in non-cash working capital, was $1.245 billion ($0.82

per common share) in the third quarter of 2020, compared to

$3.136 billion ($2.02 per common share) in the prior

year quarter.

- The company recorded an operating

loss of $302 million ($0.20 per common share) in the third

quarter of 2020, compared to $1.489 billion ($0.98 per common

share) in the second quarter of 2020 and operating earnings of

$1.114 billion ($0.72 per common share) in the prior year

quarter. The company had a net loss of $12 million ($0.01 per

common share) in the third quarter of 2020, compared to net

earnings of $1.035 billion ($0.67 per common share) in the

prior year quarter.

- The company continued to reduce

operating and capital costs in the third quarter of 2020 relative

to the prior year quarter and remains on track to achieve its

previously announced $1 billion operating cost reduction

target and $1.9 billion capital cost reduction target.

- The company undertook significant

maintenance activities across its upstream and downstream assets in

the third quarter of 2020, which resulted in lower production

volumes and refinery utilization. Total upstream production

decreased to 616,200 barrels of oil equivalent per day (boe/d)

during the third quarter of 2020, from 762,300 boe/d in the

prior year quarter, and refinery utilization averaged 87% in the

third quarter of 2020 compared to 100% in the prior year quarter.

Substantially all maintenance activities were completed during or

subsequent to the third quarter of 2020, including repairs at Oil

Sands Base Plant, enabling all assets to return to normal operating

rates by early November 2020.

- The company’s ability to react

rapidly to changing market conditions enabled the company to exit

the quarter with refinery utilization of

approximately 97%.

- During the third quarter of 2020,

Suncor began the restart of the second primary extraction train at

Fort Hills. In October 2020, the restart was completed with

Fort Hills now on track to achieve its updated gross

production guidance of between 120,000 and 130,000 barrels per

day (bbls/d) in the fourth quarter of 2020.

- The accelerated maintenance at

Firebag, which allows the company to integrate and fully utilize

the additional steam and water treatment assets has been

substantially completed subsequent to the third quarter of 2020.

Firebag is in the process of commissioning and ramping up the

facility to its new nameplate capacity of 215,000 bbls/d.

- The interconnecting pipelines

between Suncor’s Oil Sands Base Plant and Syncrude are nearing

completion of construction, and will be commissioned in the fourth

quarter of 2020. The bidirectional pipelines are expected to

enhance integration between these assets and provide increased

operational flexibility.

Financial Results

Operating (Loss) Earnings

Suncor’s third quarter 2020 operating loss was $302 million

($0.20 per common share), compared to operating earnings of

$1.114 billion ($0.72 per common share) in the prior year

quarter. In the third quarter of 2020, crude oil and refined

product realizations decreased significantly from the prior year

quarter, with crude oil and crack spread benchmarks declining by

more than 25%, primarily due to the impacts of the

COVID19 pandemic. Upstream production decreased as the company

experienced an operational incident at Oil Sands Base Plant and

Fort Hills continued operating on one primary extraction train.

Refinery crude throughput decreased compared to the prior year

quarter due to planned maintenance activities and lower demand for

transportation fuels as a result of the COVID19 pandemic.

Operating losses in the third quarter of 2020 were minimized by the

decrease in operating, selling and general expenses associated with

lower production and the continued execution of the company’s cost

reduction initiatives.

Net (Loss) Earnings

Suncor’s net loss was $12 million ($0.01 per common share)

in the third quarter of 2020, compared to net earnings of

$1.035 billion ($0.67 per common share) in the prior year

quarter. In addition to the factors impacting operating (loss)

earnings discussed above, the net loss for the third quarter of

2020 included a $290 million unrealized after-tax foreign

exchange gain on the revaluation of U.S. dollar denominated

debt. Net earnings in the prior year quarter included a

$127 million unrealized after-tax foreign exchange loss on the

revaluation of U.S. dollar denominated debt and an after-tax

gain of $48 million in the Exploration and Production

(E&P) segment related to the sale of certain non-core

assets.

Funds from Operations and Cash Flow Provided By

Operating Activities

Funds from operations were $1.166 billion ($0.76 per common

share) in the third quarter of 2020, compared to

$2.675 billion ($1.72 per common share) in the third quarter

of 2019, and were influenced by the same factors impacting

operating (loss) earnings noted above.

Cash flow provided by operating activities, which includes

changes in non-cash working capital, was $1.245 billion ($0.82

per common share) for the third quarter of 2020, compared to

$3.136 billion ($2.02 per common share) in the prior year

quarter. In addition to the factors noted above, cash flow provided

by operating activities was further impacted by a lower source of

cash associated with the company’s working capital balances in the

third quarter of 2020 compared to the prior year quarter. The

source of cash was primarily due to an increase in accrued

liabilities relative to the second quarter of 2020, partially

offset by an increase in income taxes receivable due to tax losses

incurred, which are expected to be received in 2021.

Operating Results

Suncor’s total upstream production was 616,200 boe/d during

the third quarter of 2020, compared to 762,300 boe/d in the

prior year quarter. Synthetic crude oil (SCO) production decreased

to 410,800 bbls/d in the third quarter of 2020 from

479,300 bbls/d in the third quarter of 2019, resulting in

combined upgrader utilization rates of 75% and 87%, respectively,

with both periods impacted by planned maintenance at Oil Sands

operations and Syncrude and, in the third quarter of 2020, by an

operational incident at the secondary extraction facilities at Oil

Sands Base Plant. Production was restored to 165,000 bbls/d of

mined bitumen, within approximately two weeks of the incident, as

production was restricted to manage bitumen quality into the

upgraders. Subsequent to the third quarter of 2020, repairs were

substantially completed and production is anticipated to ramp up to

full rates by early November 2020. To mitigate the impact of this

event, the company diverted bitumen production from Firebag to the

upgraders to maximize the production of higher value SCO barrels.

As a result, overall Oil Sands production was also reduced by the

yield loss associated with upgrading In Situ bitumen

to SCO.

Non-upgraded bitumen production decreased to 108,200 bbls/d

in the third quarter of 2020 from 190,700 bbls/d in the third

quarter of 2019, as bitumen production from Firebag was diverted to

the upgrader to maximize value over volume and as Fort Hills

continued operating on one primary extraction train throughout the

third quarter of 2020. At the end of the third quarter of 2020, the

company also accelerated a portion of Firebag maintenance

originally scheduled for 2022, to expand the capacity of the

facility through the installation of new incremental emulsion

handling and steam infrastructure and also address plant

restrictions that developed during the quarter. This maintenance

was substantially completed subsequent to the third quarter of

2020.

At Fort Hills, the second primary extraction train was restarted

in the third quarter of 2020. Subsequent to the third quarter of

2020, the restart was completed with Fort Hills now on track to

achieve its updated gross production guidance of between 120,000

and 130,000 bbls/d in the fourth quarter of 2020. This lays

the foundation for improved cost effectiveness through optimization

of the mine fleet and includes the completion of the full

deployment of autonomous haul trucks by the end of 2020. At this

initial production level, Suncor expects to retain approximately

90% of the estimated cost reductions.

“We are disappointed with our recent operational performance so

we are strengthening our focus on the company’s commitment to

reliability,” said Little. “We remain focused on operational

excellence and on continuing to make the right longterm decisions

to advance our asset sustainment and strategic initiatives aimed at

improving reliability, increasing margins and reducing operating

costs across our assets.”

E&P production during the third quarter of 2020 increased to

97,200 boe/d from 92,300 boe/d in the prior year quarter,

primarily due to improved reliability at Hibernia, and increased

production at Hebron as six new production wells have come online

since the third quarter of 2019, partially offset by Terra Nova,

which remained offline, and natural declines in the

United Kingdom.

Refinery crude throughput was 399,700 bbls/d and refinery

utilization was 87% in the third quarter of 2020, compared to

refinery crude throughput of 463,700 bbls/d and refinery

utilization of 100% in the prior year quarter, with the decline due

to the completion of the eight-week planned maintenance event at

the Edmonton refinery and lower demand for refined products during

the third quarter of 2020. Refined product sales decreased in the

third quarter of 2020 to 534,000 bbls/d, compared to

572,000 bbls/d in the prior year quarter, as a result of the

COVID19 pandemic.

The company’s total operating, selling and general expenses

decreased to $2.275 billion in the third quarter of 2020 from

$2.793 billion in the prior year quarter, primarily due to

lower overall upstream and downstream sales volumes, continued cost

reduction initiatives executed in 2020, as well as a share-based

compensation recovery incurred in the third quarter of 2020, as

compared to a share-based compensation expense in the prior year

quarter. Operating, selling and general expenses for the nine

months ended September 30, 2020 decreased by approximately

$1 billion compared to the prior year period.

“Suncor continues to reduce operating and capital costs across

our business,” said Little. “Building on our commitment to

reliability, the work at our Oil Sands Base Plant, Firebag and Fort

Hills operations is substantially complete and the facilities are

in the process of ramping up to normal operating rates by early

November. With our full complement of refinery assets back on

stream after planned maintenance, the company is positioned for

strong performance exiting 2020.”

Strategy Update

In response to the COVID19 pandemic and global supply

imbalances, the company took decisive action to lower production to

meet demand, lower operating costs and capital, and preserve its

financial strength while laying the foundation to deliver longterm

value in support of increasing shareholder returns. This approach

is underpinned by Suncor’s commitment to operational excellence,

including its unwavering commitment to operate in a safe, reliable,

cost-efficient and environmentally responsible manner.

Suncor has made progress in reducing operating costs across the

company and remains on track to achieve the previously announced

$1 billion operating cost reduction target by the end of 2020.

In 2020, the company has achieved savings through base business

reductions, enhancements to our supply chain model and reductions

in costs as Fort Hills temporarily transitioned to one primary

extraction train. In addition to the progress Suncor has made thus

far on reducing operating and capital costs, the company has made

the decision to accelerate structural reductions to its workforce

over the next 18 months by approximately 10 to 15%, which were

anticipated as part of the company’s transformation and

$2 billion incremental free funds flow target.

The company also remains on track to achieve its

$1.9 billion capital reduction target by the end of 2020,

shifting the focus to sustaining projects designed to maintain safe

and reliable operations, while advancing select projects in the

core of our business that are expected to provide near-term returns

and result in structural reductions to operating costs. Suncor

continues to exercise capital discipline, carefully evaluating

future projects and being disciplined in the deployment of capital

in a constrained environment. This includes reducing spending

across various E&P assets, including at Terra Nova, West White

Rose and Fenja. The operator of the West White Rose Project has

announced the cancellation of the 2021 construction season and is

moving the project into safekeeping mode. The company is exercising

capital discipline by undertaking activities to safely preserve the

Terra Nova floating production storage and offloading unit quayside

and deferring the asset life extension (ALE) project until an

economically viable path forward with a safe and reliable return to

operations can be determined. The ALE project is currently being

evaluated with all stakeholders to determine the best option to

recover remaining resources from the Terra Nova field.

In the third quarter of 2020, the company continued to advance

the transition to its Autonomous Haulage System (AHS) at Fort

Hills, which is expected to result in enhanced safety,

environmental and operating performance, and lower operating costs.

The company anticipates that the AHS truck fleet at Fort Hills will

be fully operational in the fourth quarter of 2020. Starting late

in the third quarter of 2020, Firebag In-Situ production rates were

reduced to 110,000 bbls/d to enable Suncor to expand the

capacity of the facility by fully integrating the new incremental

emulsion handling and steam infrastructure. Following completion of

this work, Firebag nameplate capacity will increase by

12,000 bbls/d to 215,000 bbls/d. The interconnecting

pipelines between Suncor’s Oil Sands Base Plant and Syncrude are

nearing completion of construction, and will be commissioned in the

fourth quarter of 2020. The bidirectional pipelines are expected to

enhance integration between these assets and provide increased

operational flexibility.

These initiatives are anticipated to deliver structural,

sustained free funds flow growth through margin improvements,

operating and sustaining capital cost reductions, and production

growth from existing assets, which will contribute to Suncor’s

$2 billion free funds flow target. Technology investments in

the company’s marketing and trading business and the advancement of

supply chain optimization initiatives are also expected to

contribute towards this target while unlocking value that is

largely independent of commodity prices. These projects will be

underscored by digital technology adoption as the company continues

to accelerate its digital transformation strategy aimed at

improving the reliability, safety and environmental performance of

its operations and which the company anticipates will enable

operational efficiencies that will provide further structural

cost savings.

“Through our integrated model and the value-driven projects

we’ve advanced, including the AHS at Fort Hills and the Syncrude

interconnecting pipelines, we believe Suncor is well positioned to

add incremental and sustainable free funds flow in 2021,” said

Little. “We are confident that the steps we have taken this year

will contribute to creating longterm value for our

shareholders.”

While the focus in 2020 has been on maintaining the financial

strength and resiliency of the balance sheet through this period of

volatile market conditions, the company remains committed to

returning value to our shareholders and, in the third quarter of

2020, the company paid $321 million in dividends. As the

company continues to execute on its plan to add sustainable annual

free funds flow, the company plans to follow its capital allocation

framework with a combination of future debt repayments, increasing

shareholder returns and measured investments in economic

projects.

Operating (Loss) Earnings

Reconciliation(1)

|

|

Three months endedSeptember 30 |

Nine months endedSeptember 30 |

|

|

($ millions) |

2020 |

|

2019 |

|

2020 |

|

2019 |

|

|

|

Net (loss) earnings |

(12 |

) |

1 035 |

|

(4 151 |

) |

5 234 |

|

|

|

Unrealized foreign exchange (gain) loss on U.S. dollar

denominated debt |

(290 |

) |

127 |

|

253 |

|

(355 |

) |

|

|

Asset impairment(2) |

— |

|

— |

|

1 798 |

|

— |

|

|

|

Impact of income tax rate adjustment on deferred taxes(3) |

— |

|

— |

|

— |

|

(1 116 |

) |

|

|

Gain on significant disposal(4) |

— |

|

(48 |

) |

— |

|

(187 |

) |

|

|

Operating (loss) earnings(1) |

(302 |

) |

1 114 |

|

(2 100 |

) |

3 576 |

|

|

|

(1) |

Operating (loss) earnings is a non-GAAP financial measure. All

reconciling items are presented on an after-tax basis. See the

Non-GAAP Financial Measures Advisory section of this news

release. |

|

(2) |

During the first quarter of 2020, the company recorded non-cash

after-tax impairment charges of $1.376 billion on its share of

the Fort Hills assets, in the Oil Sands segment, and

$422 million against its share of the White Rose and Terra

Nova assets, in the E&P segment, due to a decline in forecasted

crude oil prices as a result of decreased global demand due to the

COVID19 pandemic and changes to their respective capital,

operating and production plans. Refer to the Segment Results and

Analysis section of the MD&A for further details. |

|

(3) |

In the second quarter of 2019, the company recorded a

$1.116 billion deferred income tax recovery associated with

the Government of Alberta’s substantive enactment of legislation

for the staged reduction of the corporate income tax rate from 12%

to 8% from 2019 to 2022. |

|

(4) |

The third quarter of 2019 included an after-tax gain of

$48 million in the E&P segment related to the sale of

certain non-core assets. In the second quarter of 2019, Suncor sold

its 37% interest in Canbriam Energy Inc. for total proceeds

and an equivalent gain of $151 million ($139 million

after-tax), which had previously been written down to nil in the

fourth quarter of 2018 following the company’s assessment of

forward natural gas prices and the impact on estimated future

cash flows. |

Corporate Guidance

Suncor has updated its Corporate Guidance for the full year

business environment outlook assumptions previously updated on

September 7, 2020 for Brent Sullom Voe from US$43.00/bbl to

US$41.00/bbl, WTI at Cushing from US$40.00/bbl to US$38.00/bbl, WCS

at Hardisty from US$26.00/bbl to US$25.00/bbl and AECOC Spot

from $2.25/GJ to $2.00/GJ, due to declines in key forward curve

pricing for the remainder of the year. As a result of these

updates, the full year current income tax recovery assumptions have

changed from $500 million – $800 million to

$650 million – $950 million.

For further details and advisories regarding Suncor’s 2020

annual guidance, see suncor.com/guidance.

Non-GAAP Financial Measures

Operating (loss) earnings is defined in the Non-GAAP Financial

Measures Advisory section of Suncor’s management’s discussion and

analysis dated October 28, 2020 (the MD&A) and reconciled to

the GAAP measure above and in the Consolidated Financial

Information section of the MD&A. Funds from operations and free

funds flow are defined and reconciled, as applicable, to the GAAP

measure in the Non-GAAP Financial Measures Advisory section of the

MD&A. These non-GAAP financial measures are included because

management uses this information to analyze business performance,

leverage and liquidity and it may be useful to investors on the

same basis. These non-GAAP measures do not have any standardized

meaning and therefore are unlikely to be comparable to similar

measures presented by other companies and should not be considered

in isolation or as a substitute for measures of performance

prepared in accordance with GAAP.

Legal Advisory – Forward-Looking

Information

This news release contains certain forward-looking information

and forward-looking statements (collectively referred to herein as

“forward-looking statements”) within the meaning of applicable

Canadian and U.S. securities laws. Forward-looking statements in

this news release include references to: Suncor’s expectation that

its focus on items within its control and structural changes will

lower its cost base, preserve the financial resiliency of the

company and set the foundation for long-term value creation; that

the company remains on track to achieve its $1 billion operating

cost reduction target and its $1.9 billion capital cost reduction

target by the end of 2020; that all assets will return to normal

operating rates by early November 2020 and that Fort Hills is on

track to achieve its updated gross production guidance of between

120,000 and 130,000 bbls/d in the fourth quarter of 2020; the

expectation that the accelerated maintenance at Firebag will allow

the company to integrate and fully utilize the additional steam and

water treatment assets and that Suncor is commissioning and ramping

up the facility to its new nameplate capacity of 215,000 bbls/d;

the expectation that the bi-directional interconnecting pipelines

between Syncrude and Oil Sands Base Plant will be commissioned in

the fourth quarter of 2020 and will enhance integration between

these assets and provide increased operational flexibility;

Suncor’s expectation that its income taxes receivable due to tax

losses will be received in 2021; Suncor’s expectation that the

restart of the second primary extraction train at Fort Hills will

lay the foundation for improved cost effectiveness through

optimization of the mine fleet; statements surrounding AHS,

including that it will be fully deployed at Fort Hills by the end

of 2020, that it will result in enhanced safety, environmental and

operating performance and lower operating costs and that Suncor

will retain approximately 90% of the estimated cost reductions;

Suncor’s commitment to reliability and that it will remain focused

on making the right long-term decisions to advance its asset

sustainment and strategic initiatives aimed at improving

reliability, increasing margins and reducing operating costs across

its assets; Suncor’s belief that it is positioned for a strong

performance exiting 2020, and the basis for such belief; Suncor’s

belief that the actions it took to lower production to meet demand,

lower operating costs and capital and preserve its financial

strength will lay the foundation to deliver long-term value in

support of increasing shareholder returns and that this approach is

underpinned by its commitment to operational excellence, including

its unwavering commitment to operate in a safe, reliable,

cost-efficient and environmentally responsible manner; Suncor’s

expectations regarding the structural reductions to its workforce,

including the timing, scope and expected impacts; Suncor’s

expectation that it will continue to execute on its operating and

capital costs reduction targets by shifting the focus to sustaining

projects designed to maintain safe and reliable operations, while

advancing select projects in the core of its business that are

expected to provide near-term returns and result in structural

reductions to operating costs; statements about Suncor’s free funds

flow target, as well as the initiatives and projects that are

expected to contribute to it; Suncor’s expectations for the

technology investments in its marketing and trading business and

the advancement of supply chain optimization initiatives, the

belief that these projects will be underscored by digital

technology adoption as the company continues to accelerate its

digital transformation strategy aimed at improving the reliability,

safety and environmental performance of its operations and which

the company anticipates will enable operational efficiencies that

will provide further structural cost savings; Suncor’s belief that

it is well positioned to add incremental and sustainable free funds

flow in 2021 and that the steps it has taken in 2020 will

contribute to creating long-term value for its shareholders, and

the basis for such beliefs; Suncor’s plan to follow its capital

allocation framework with a combination of future debt repayments,

increasing shareholder returns and measured investments in economic

projects; and Suncor’s full year outlook range on current income

taxes and business environment outlook assumptions for Brent Sullom

Voe, WTI at Cushing, WCS at Hardisty and AECO-C Spot. In addition,

all other statements and information about Suncor’s strategy for

growth, expected and future expenditures or investment decisions,

commodity prices, costs, schedules, production volumes, operating

and financial results and the expected impact of future commitments

are forward-looking statements. Some of the forward-looking

statements and information may be identified by words like

“expects”, “anticipates”, “will”, “estimates”, “plans”,

“scheduled”, “intends”, “believes”, “projects”, “indicates”,

“could”, “focus”, “vision”, “goal”, “outlook”, “proposed”,

“target”, “objective”, “continue”, “should”, “may” and similar

expressions.

Forward-looking statements are based on Suncor’s current

expectations, estimates, projections and assumptions that were made

by the company in light of its information available at the time

the statement was made and consider Suncor’s experience and its

perception of historical trends, including expectations and

assumptions concerning: the accuracy of reserves estimates; the

current and potential adverse impacts of the COVID-19 pandemic,

including the status of the pandemic and future waves and any

associated policies around current business restrictions,

shelter-in-place orders or gatherings of individuals; commodity

prices and interest and foreign exchange rates; the performance of

assets and equipment; capital efficiencies and cost savings;

applicable laws and government policies; future production rates;

the sufficiency of budgeted capital expenditures in carrying out

planned activities; the availability and cost of labour, services

and infrastructure; the satisfaction by third parties of their

obligations to Suncor; the development and execution of projects;

and the receipt, in a timely manner, of regulatory and third-party

approvals.

Forward-looking statements are not guarantees of future

performance and involve a number of risks and uncertainties, some

that are similar to other oil and gas companies and some that are

unique to Suncor. Suncor’s actual results may differ materially

from those expressed or implied by its forward-looking statements,

so readers are cautioned not to place undue reliance on them.

Suncor’s Annual Information Form and Annual Report to

Shareholders, each dated February 26, 2020, Form 40-F dated

February 27, 2020, the MD&A, and other documents Suncor files

from time to time with securities regulatory authorities describe

the risks, uncertainties, material assumptions and other factors

that could influence actual results and such factors are

incorporated herein by reference. Copies of these documents are

available without charge from Suncor at 150 6th Avenue S.W.,

Calgary, Alberta T2P 3E3, by calling 1-800-558-9071, or by email

request to invest@suncor.com or by referring to the company’s

profile on SEDAR at sedar.com or EDGAR at sec.gov. Except as

required by applicable securities laws, Suncor disclaims any

intention or obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Legal Advisory – BOEs

Certain natural gas volumes have been converted to barrels of

oil equivalent (boe) on the basis of one barrel to six thousand

cubic feet. Any figure presented in boe may be misleading,

particularly if used in isolation. A conversion ratio of one bbl of

crude oil or natural gas liquids to six thousand cubic feet of

natural gas is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead. Given that the value ratio based

on the current price of crude oil as compared to natural gas is

significantly different from the energy equivalency of 6:1,

utilizing a conversion on a 6:1 basis may be misleading as an

indication of value.

Suncor Energy is Canada's leading integrated energy company.

Suncor's operations include oil sands development and upgrading,

offshore oil and gas production, petroleum refining, and product

marketing under the Petro-Canada brand. A member of Dow Jones

Sustainability indexes, FTSE4Good and CDP, Suncor is working to

responsibly develop petroleum resources while also growing a

renewable energy portfolio. Suncor is listed on the UN Global

Compact 100 stock index. Suncor's common shares (symbol: SU) are

listed on the Toronto and New York stock exchanges.

For more information about Suncor, visit our website at

suncor.com or follow us on Twitter @Suncor.

A full copy of Suncor's third quarter 2020 Report to

Shareholders and the financial statements and notes (unaudited) can

be downloaded at suncor.com/investor-centre/financial-reports.

Suncor’s updated Investor Relations presentation is available

online, visit suncor.com/investor-centre.

To listen to the webcast discussing Suncor's third quarter

results, visit suncor.com/webcasts.

Media inquiries:1-833-296-4570media@suncor.com

Investor inquiries:1-800-558-9071invest@suncor.com

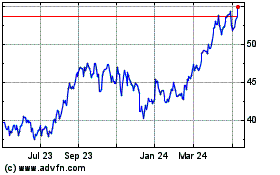

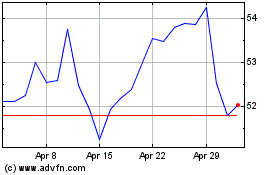

Suncor Energy (TSX:SU)

Historical Stock Chart

From Jan 2025 to Feb 2025

Suncor Energy (TSX:SU)

Historical Stock Chart

From Feb 2024 to Feb 2025