Trican Well Service Ltd. (“Trican” or the “Company”) is pleased to

announce its first quarter results for 2018 and announces its

second half 2018 capital program. The following news release should

be read in conjunction with Management’s Discussion and Analysis,

the unaudited interim consolidated financial statements and related

notes of Trican for the three months ended March 31, 2018, as well

as the Annual Information Form for the year ended December 31,

2017. The documents described above are available on SEDAR at

www.sedar.com.

HIGHLIGHTS

- Consolidated revenue from

continuing operations for Q1 2018 was $306.7 million, an increase

of 105% compared to Q1 2017.

- Adjusted EBITDA1 for the quarter

was $54.9 million, which is net of $8.6 million expenses for

stainless steel fluid ends1, compared to $26.0 million in Q1 2017,

which had no charges for fluid ends1.

- Net loss from continuing operations

for the quarter was $28.4 million (Q1 2017 – net loss of $48.9

million).

- Loss in the quarter on the

Company's Investments in Keane of $54.4 million (Q1 2017 – loss of

$52 million) primarily due to the decrease in Keane’s share price

to US$14.80 per share at March 31, 2018 (December 31, 2017 –

US$19.01 per share).

- The acquisition of Canyon, combined

with an increase in fracturing intensity led to significant growth

in the volume of proppant pumped this quarter, increasing 106% when

compared to Q1 2017.

- In Q1 2018, approximately 83% of

Trican’s revenue came from customers focused on oil or liquids rich

gas plays, whereas 17% came from customers focused on dry gas

plays. (Q1 2017 - oil and liquids rich gas plays: 70% of revenue;

dry gas wells: 30% of revenue).

- During Q1 2018, the Company

purchased and cancelled 7,781,100 common shares at a weighted

average price per share of $3.69 under the Normal Course Issuer Bid

(“NCIB”). Since the inception of the NCIB, the Company has

purchased and cancelled 18,593,589 common shares at a weighted

average price per share of $3.89.

First quarter financial results improved

dramatically from the same period in 2017. Some of the key factors

positively affecting the first quarter 2018 results include higher

activity levels, as evidenced by the volume of proppant pumped, the

acquisition of Canyon, and significantly improved services

pricing.

CONTINUING OPERATIONS – FINANCIAL REVIEW

|

|

Three months ended |

| ($

millions, except per share amounts; total proppant pumped1

(thousands); internally sourced proppant pumped1 (thousands); total

job count1; and HHP1 (thousands); (unaudited) |

|

March 31, 2018 |

|

March 31, 2017 |

|

December 31, 2017 |

| Revenue |

$306.7 |

$149.4 |

$280.5 |

| Gross profit |

|

38.9 |

|

17.8 |

|

30.7 |

| Adjusted EBITDA1 |

|

54.9 |

|

26.0 |

|

47.0 |

| Net income /

(loss) |

|

(28.4) |

|

(48.9) |

|

17.2 |

| Per share –

basic |

($0.08) |

($0.25) |

$0.05 |

| Per share –

diluted |

($0.08) |

($0.25) |

$0.05 |

| Total proppant pumped

(tonnes)1 |

|

484 |

|

235 |

|

397 |

| Internally sourced

proppant pumped (tonnes)1 |

|

263 |

|

130 |

|

281 |

| Total job count1 |

|

3,943 |

|

3,554 |

|

2,909 |

| Hydraulic Pumping

Capacity: |

|

672 |

|

424 |

|

680 |

| Active crewed

HHP1 |

|

433 |

|

254 |

|

455 |

| Active,

maintenance/not crewed HHP1 |

|

162 |

|

59 |

|

114 |

|

Parked HHP1 |

|

77 |

|

111 |

|

111 |

| ($

millions) |

As at March 31, 2018 |

As at December 31, 2017 |

| Cash and cash

equivalents |

$4.6 |

$12.7 |

| Working capital1 |

$212.6 |

$148.8 |

| Current portion of

loans and borrowings |

$21.0 |

$20.4 |

| Long-term loans and

borrowings |

$84.8 |

$83.3 |

| Total

assets |

$1,441.6 |

$1,506.2 |

OUTLOOK

Despite weak AECO1 natural gas prices, strong oil and NGL

pricing could result in incremental oilfield services activity

during the second half of 2018. In the short term we anticipate

customers will continue to exercise caution before they increase

their capital expenditure plans. We are encouraged by the increase

in most of our customers’ cash flows and are positioning the

Company to increase our active fleet if our customers increase

their capital programs.

While our fracturing equipment is fully committed from June

until September, we do not anticipate third quarter fracturing

utilization levels to reach those experienced in the third quarter

of 2017. Weak AECO pricing has shifted customer spending away from

natural gas completions, and towards oil and NGL completions

activity such as the East Duvernay and other more exploratory

liquids rich plays. This shift will result in more single well

hydraulic fracturing jobs in Q3 2018 relative to Q3 2017, which

activity was weighted to high intensity multi-well pad hydraulic

fracturing jobs.

Third quarter demand for our fracturing fleets exceeds our

capacity of active crewed fracturing equipment and we are in the

process of adding one more fracturing fleet to meet this demand.

Improving fundamentals for oil and NGLs has resulted in early stage

customer interest beyond this additional crew. Therefore, we

intend to activate all of our idled fracturing equipment during the

second half of 2018. Activating all of our idled fracturing

equipment in advance of hiring crews will allow the Company to more

efficiently service our existing customers by having additional

equipment rotating through our fleet. Additionally, we will have

the flexibility to increase the number of fleets more rapidly

should customer demand materialize. The cost related to these

reactivations was previously planned in our first half 2018 capital

program and remains at $3 to $4 million dollars for all parked

fracturing equipment.

For Q4 2018, one half of our fracturing fleets remain hard

committed with long-term customers. The remaining fleets are soft

committed to customers based on their Q4 2018 well completion

plans. We anticipate these soft committed arrangements will be

firmed up due to the aforementioned improving customers’ cash

flows.

2018 second half activity for our cementing service line will

remain strong and similar to last year. Strong demand for our

coil services should result in the Company activating two

additional coiled tubing units from our existing available idled

equipment.

Second quarter activity levels are usually difficult to predict

given the nature of operational challenges that result during

spring break-up1. Predicting our activity levels during Q2 2018

will be even more challenging given the high snow fall levels1 in a

number of our operating regions, which could prolong road bans and

other seasonal operating challenges. Notwithstanding potential

second quarter seasonal challenges, the Company has customers

assigned for each of its hydraulic fracturing crews starting in

June and approximately 25% of its hydraulic fracturing crews will

work through April and May. We do not anticipate Q2 2018

activity to be as strong as last year due to a weaker spot market,

which is primarily a result of the aforementioned Q2 2018 weather

challenges.

Pricing for the remainder of 2018 is expected to remain

comparable to first quarter pricing levels. We have

seen some inflation on transportation charges for sand delivery,

trucking, fuel, and certain chemicals. We will work with our

clients to pass on cost increases during the second half of the

year.

Capital Expenditures

The Company’s 2018 capital expenditure program is now projected

to be $70 million for the full year, an increase of $37 million

from the previously disclosed $33 million first half of 2018

capital program. The incremental capital program for the full

year is comprised of the following:

- Additional Growth Capital1: $19 million

- Additional Maintenance Capital1: $17 million

- Additional Infrastructure and other Capital1: $1 million

Growth capital primarily relates to the addition of sand storage

equipment and other equipment required to service our clients as

the type of work moves to larger completion activities.

Maintenance capital expenditures are anticipated to be consistent

in the second half of 2018 relative to the first half. The Company

has seen an increase in maintenance capital expenditures as the

intensity of hydraulic fracturing increases; however, this increase

was anticipated and reflected in our current pricing levels.

CONTINUING OPERATIONS – COMPARATIVE QUARTERLY INCOME

STATEMENTS

| ($ thousands, except total job count1, and

revenue per job, unaudited) |

|

|

|

|

|

|

|

| |

|

March 31, |

% of |

March 31, |

% of |

December 31, |

% of |

| Three months ended |

|

2018 |

Revenue |

|

2017 |

Revenue |

|

2017 |

Revenue |

| |

|

|

|

|

|

|

|

|

Revenue |

$306,719 |

100% |

$149,403 |

100% |

$280,495 |

100% |

|

Cost of sales |

|

|

|

|

|

|

| |

Cost of

sales – other |

|

238,111 |

78% |

|

117,212 |

78% |

|

218,420 |

78% |

| |

Cost of sales – depreciation and amortization |

|

29,729 |

10% |

|

14,366 |

10% |

|

31,330 |

11% |

| |

Gross

profit |

|

38,879 |

13% |

|

17,825 |

12% |

|

30,743 |

11% |

| |

Administrative expenses – other |

|

15,834 |

5% |

|

9,519 |

6% |

|

17,874 |

6% |

| |

Administrative expenses - depreciation |

|

814 |

-% |

|

888 |

1% |

|

371 |

-% |

| |

Asset

impairment |

|

- |

-% |

|

- |

-% |

|

6,523 |

2% |

| |

Other

(income)/expenses |

|

357 |

-% |

|

(1,935) |

(1%) |

|

- |

|

| Results from operating activities |

|

21,874 |

7% |

|

9,359 |

6% |

|

5,975 |

2% |

| |

Finance

income |

|

- |

-% |

|

(926) |

(2%) |

|

(2,148) |

(1%) |

| |

Finance

costs |

|

2,771 |

1% |

|

3,728 |

2% |

|

4,212 |

2% |

| |

Loss/(gain)

on investments in Keane |

|

54,446 |

18% |

|

51,997 |

35% |

|

(20,651) |

(7%) |

| |

Foreign

exchange (gain)/loss |

|

(5,377) |

(2%) |

|

(1,231) |

(1%) |

|

399 |

-% |

|

(Loss)/profit before income tax |

|

(29,966) |

(10%) |

|

(44,215) |

(30%) |

|

24,163 |

9% |

| Income tax

expense / (recovery) |

|

(1,554) |

(1%) |

|

4,637 |

3% |

|

10,161 |

4% |

| (Loss)/profit from continuing

operations |

($28,412) |

(9%) |

($48,852) |

(33%) |

$14,002 |

5% |

| Adjusted EBITDA1 |

$54,850 |

18% |

$26,030 |

17% |

$46,990 |

17% |

| Total job

count1 |

|

3,943 |

|

|

3,554 |

|

|

2,909 |

|

| Revenue per

job1 |

|

77,247 |

|

|

41,601 |

|

|

96,354 |

|

| Total proppant pumped (tonnes)1 |

|

484,000 |

|

|

235,000 |

|

|

397,000 |

|

1 Certain financial measures in this news

release – namely adjusted EBITDA, adjusted EBITDA percentage and

working capital are not prescribed by IFRS and are considered

non-GAAP measures. These measures may not be comparable to similar

measures presented by other issuers and should not be viewed as a

substitute for measures reported under IFRS. These financial

measures are reconciled to IFRS measures in the Non-GAAP

Disclosures section of this news release. Other non-standard

measures and common industry terms are also described in the

Non-Standard Measures section of the this news release.

NON-GAAP DISCLOSURE

Certain terms in this news release, including

adjusted EBITDA, adjusted EBITDA percentage and working capital, do

not have any standardized meaning as prescribed by IFRS and,

therefore, are considered non-GAAP measures and may not be

comparable to similar measures presented by other issuers.

This news release does not discuss previously used non-GAAP

measures Operating Income and Adjusted Operating Income. The

non-GAAP measures used in this news release, combined with IFRS

measures, are currently the most appropriate measures for reviewing

and understanding the Company’s financial results.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP term and has been

reconciled to profit / (loss) for the financial periods, being the

most directly comparable measure calculated in accordance with

IFRS. Management relies on adjusted EBITDA to better translate

historical variability in our principal business activities into

future forecasts. By isolating incremental items from net

income, including income / expense items related to how the Company

chooses to manage financing elements of the business, management

can better predict future financial results from our principal

business activities. The items included in this calculation have

been specifically identified as they are either non-cash in nature,

subject to significant volatility between periods, and / or not

relevant to our principle business activities. Items adjusted in

the non-GAAP calculation of adjusted EBITDA, are as follows:

- non-cash expenditures, including

depreciation, amortization, and impairment expenses; and

equity-settled stock based compensation;

- consideration as to how we chose to

generate financial income and incur financial expenses, including

foreign exchange expenses, and gains/losses on Investments in

Keane;

- taxation in various

jurisdictions;

- transaction costs, as this cost is

subject to significant volatility between periods and is dependent

on the Company making significant acquisitions and divestitures

which may be less reflective, and/or useful in segregating, for the

purposes of evaluating the Company’s ongoing financial

results;

- Costs resulting for payment of the

legal claims made against the Company as they can give rise to

significant volatility between periods that are less likely to

correlate with changes in the Company’s activity levels; and

- Costs that result from the

significant changes in employee levels. This is particularly

prevalent from January 1, 2015 to December 31, 2017 due to the

decrease in the employee count from 6,741 employees on January 1,

2015 to 2,067 employees on December 31, 2017.

| ($ thousands; unaudited) |

Three months ended |

| |

March 31, 2018 |

March 31, 2017 |

December 31, 2017 |

| Profit/ (loss) from continuing operations (IFRS

financial measure) |

($28,412) |

($48,852) |

$14,002 |

| Adjustments: |

|

|

|

|

|

Cost

of sales - depreciation and amortization |

|

29,729 |

|

14,366 |

|

31,330 |

|

|

Administrative expenses - depreciation |

|

814 |

|

888 |

|

371 |

|

|

Income tax expense/(recovery) |

|

(1,554) |

|

4,637 |

|

10,161 |

|

|

Loss/(gain) on Investments in Keane |

|

54,446 |

|

51,997 |

|

(20,651) |

|

|

Finance loss/(income) |

|

- |

|

(926) |

|

(13) |

|

|

Finance costs |

|

2,771 |

|

3,728 |

|

4,212 |

|

|

Asset

impairment |

|

- |

|

11 |

|

6,512 |

|

|

Foreign exchange (gain)/loss |

|

(5,377) |

|

(1,231) |

|

399 |

|

|

Other

expense/(income) |

|

357 |

|

(1,935) |

|

(2,148) |

| Administrative expenses - transaction costs |

|

- |

|

1,862 |

|

747 |

| Administrative expenses - amortization of debt

issuance costs |

|

683 |

|

652 |

|

677 |

| Administrative expenses - equity-settled

share-based compensation |

|

1,393 |

|

843 |

|

1,365 |

| Adjusted EBITDA |

$54,850 |

$26,030 |

$46,990 |

Adjusted EBITDA %

Adjusted EBITDA % is determined by dividing

adjusted EBITDA by revenue from continuing operations. The

components of the calculation are presented below:

|

($ thousands; unaudited) |

Three months ended |

|

|

March 31,2018 |

March 31,2017 |

December 31,2017 |

| Adjusted

EBITDA |

$54,850 |

$26,030 |

$46,990 |

|

Revenue |

$306,719 |

$149,403 |

$280,495 |

| Adjusted

EBITDA % |

|

18% |

|

17% |

|

17% |

Working Capital

Working capital is calculated as current assets

minus current liabilities, excluding cash and current portion of

loans and borrowings. Management believes working capital is a

useful supplemental measure as it aligns items that are adjustments

to operating activities in the statement of cash flows which aids

users in understanding changes in cash flows from operating

activities. By calculating working capital, and changes in working

capital, the Company is able to better monitor its ability to meet

its short term obligations.

| ($ thousands; unaudited) |

March 31,2018 |

December 31,2017 |

| Current assets |

$339,769 |

$292,082 |

| Less: cash and cash equivalents |

|

(4,565) |

|

(12,739) |

| Current liabilities |

|

(143,615) |

|

(150,942) |

|

Less: current portion of loans and borrowings |

|

|

20,976 |

|

20,408 |

| Working capital |

$212,565 |

$148,809 |

Other Non-Standard Financial

Terms

In addition to the above non-GAAP financial

measures, this news release makes reference to the following

non-standard financial terms. These terms may differ and may

not be comparable from similar terms used by other companies.

Transaction costs

Transaction costs and/or Trican acquisition costs are costs

incurred to complete a transaction in subsequent integration,

including costs to assist in evaluating and completing the

acquisition of Canyon, including legal, advisory, accounting

related fees, and severance costs that directly relate to the

transaction.

Revenue per job

Calculation is determined based on total revenue

from continuing operations divided by total job count. This

calculation may fluctuate based on both pricing, sales mix and

method with which the customer requests its invoices.

Common Industry

Terms

Common Business Terms:

|

AECO |

|

The CDN$

Alberta natural gas price traded on the Natural Gas Exchange. The

price is generally quoted per thousand cubic feet of natural gas

(MCF). |

| WTI |

|

The US$

quoted price on the New York Stock Exchange for West Texas

Intermediate crude oil is a trading classification of crude oil and

a benchmark in oil prices. The price is generally quoted per barrel

(bbl). |

| Rig

count |

|

The

estimated average number of drilling rigs operating in the WCSB at

a specified time reported in this news release as annual and

quarterly averages, sourced from Nickles Daily Oil Bulletin. |

| Spring

break-up |

|

In the

WCSB during the spring season, provincial governments and rural

municipalities (or counties) ban heavy equipment from roads to

prevent damage. It becomes difficult, and in some cases impossible,

to continue to work during this period and therefore activity in

the oilfield is often reduced. |

| High

snowfall levels |

|

High

snowfall levels are measured by comparing November through April

snow fall levels in Grande Prairie compared to the average for that

time frame (source: Data compiled by management from information

included on The Weather Network, shows snow levels approximately

20% above historical average). The ultimate effect of the

high seasonal snowfall levels on Q2 activity levels will be

dependent on a number of incremental factors which cannot be

predicted as of the date of this news release. |

| Fluid

end |

|

Hydraulic fracturing pumpers have a multiplex pump that pressurizes

fracturing fluid for transfer down the wellbore. The

multiplex pump consists of a power end and a fluid end. The

power end houses a crankshaft that is connected to a spacer block

that contains connecting rods that drive the individual plungers

contained in the fluid end. The abrasive sand and fluid

mixture is pumped through the fluid end at pressures of up to

15,000 pound-force per square inch (PSI), or 103 megapascals (MPA),

which will cause wear on the fluid end. It is a modular unit

that can be replaced independent of the power end and spacer

block. As a result of the change in estimated useful life,

effective December 2017, fluid ends were no longer capitalized to

property plant and equipment or expensed as cost of sales -

depreciation. Expenses related to fluid ends are now expensed as

part of cost of sales – other. |

| Company

Specific Industry Terms: |

|

|

|

Proppant |

|

A solid

material, typically sand, treated sand or man-made ceramic

materials, designed to keep an induced hydraulic fracture open

during and following a fracturing treatment. |

| Total

Proppant Pumped |

|

The

Company uses this as one measure of activity levels of hydraulic

fracturing activity. The correlation of proppant pumped to

Pressure Pumping activity may vary in the future depending upon

changes in fracturing intensity, weight of proppant used, and job

mix. |

|

Internally Sourced Proppant Pumped |

|

Certain

of the Company’s customers purchase proppant directly from third

party suppliers. As the Company does not generate revenue

from selling proppant to these customers, this metric assists in

evaluating changing job mix with changing revenue levels. |

| Total

Job count |

|

A job is

essentially represented by an invoice. The frequency of

invoices may differ as to how often the customer requests to be

billed during a project. Additionally, the size and scope of a job

can impact the length of time and cost on a job. Therefore, a job

can vary greatly in time and expense. |

| HHP |

|

Hydraulic horse power which is generally the measure of an

individual hydraulic fracturing pump and a company’s hydraulic

fracturing fleet size. |

|

Hydraulic Pumping Capacity |

|

Refers

to the total available HHP in the Trican hydraulic fracturing

fleet. The figures are presented in both the average

available during the given period and the HHP available at the end

of a specified period. |

| Active

crewed HHP |

|

Represents the total HHP that Trican has been activated or is

currently operating. This figure is presented as at the end

of a specified period. |

| Active,

maintenance/not crewed HHP |

|

This is

fracturing equipment that is in the periodic maintenance cycle,

which includes equipment that has completed a routine maintenance

period and is ready for work, but no available crew is available to

operate the equipment. |

| Parked

HHP |

|

Fracturing equipment that is not included in the Active Crewed HHP

category or the Active, Maintenance/not crewed HHP category and

would require minimal reactivation costs to move into the Active

Crewed HHP category. |

| Period

average active, crewed HHP |

|

Fracturing equipment that has, on average, been active and crewed

for the period. |

| Growth

capital |

|

Capital

expenditures primarily for items that will expand our revenue

and/or reduce our expenditures through operating efficiencies. |

|

Maintenance capital |

|

Capital

expenditures primarily for the replacement or refurbishment of worn

out equipment. |

|

Infrastructure capital |

|

Capital

expenditures primarily for the improvement of operational and base

infrastructure. |

|

WCSB |

|

Western

Canadian Sedimentary Basin (an oil and natural gas producing area

of Canada generally considered to cover a region from south west

Manitoba to northeast BC). |

FORWARD-LOOKING STATEMENTS

Certain statements contained in this document

constitute forward-looking information and statements (collectively

"forward-looking statements"). These statements relate to future

events or our future performance. All statements other than

statements of historical fact may be forward-looking statements.

Forward-looking statements are often, but not always, identified by

the use of words such as "anticipate", "achieve", "estimate",

"expect", "intend", "plan", "planned", and other similar terms and

phrases. These statements involve known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking statements. We believe the expectations reflected

in these forward-looking statements are reasonable but no assurance

can be given that these expectations will prove to be correct and

such forward-looking statements included in this document should

not be unduly relied upon. These statements speak only as of the

date of this document.

In particular, this document contains

forward-looking statements pertaining to, but not limited to, the

following:

- anticipated industry activity

levels in jurisdictions where the Company operates, as well as

expectations regarding our customers’ work programs, capital

expenditure plans, business plans and equipment utilization

levels;

- expectations regarding proppant

usage and sand loading levels;

- anticipated adjustments to our

active equipment fleet, and related adjustments to cost

structure;

- expectations regarding the

Company’s cost structure;

- expectations regarding future

maintenance costs;

- anticipated pricing and customer

allocation for fracturing services including the timing and extent

to which increased input costs will be passed on to customers;

- expectations regarding the

Company’s equipment utilization levels and demand for our services

for 2018;

- expectations regarding capital

expenditure spending for 2018 and that capital expenditure spending

levels have been reflected in our current pricing levels;

- expectations regarding the

Company’s financial results, working capital levels, liquidity and

profits;

- expectations regarding the quantity

of proppant pumped per well;

- expectations regarding pricing of

the Company’s services;

- expectations that certain items

such as transaction costs will be useful in future predictions of

earnings

- expectations that adjusted EBITDA

will help predict future earnings

- expectations regarding the timing,

value and realized cash flow from the Investments in Keane;

- anticipated ability of the Company

to meet foreseeable funding requirements;

- expectations surrounding weather

and seasonal slowdowns; and

- expectations regarding the impact

of new accounting standards and interpretations not yet

adopted.

Our actual results could differ materially from

those anticipated in these forward-looking statements as a result

of the risk factors set forth below and in the “Risk Factors”

section of our Annual Information Form dated March 29, 2018:

- volatility in market prices for oil

and natural gas;

- liabilities inherent in oil and

natural gas operations;

- competition from other suppliers of

oil and gas services;

- competition for skilled

personnel;

- changes in income tax laws or

changes in other laws and incentive programs relating to the oil

and gas industry; and

- changes in political, business,

military and economic conditions in key regions of the world.

Readers are cautioned that the foregoing lists

of factors are not exhaustive. Forward-looking statements are based

on a number of factors and assumptions which have been used to

develop such statements and information but which may prove to be

incorrect. Although management of Trican believes that the

expectations reflected in such forward-looking statements or

information are reasonable, undue reliance should not be placed on

forward-looking statements because Trican can give no assurance

that such expectations will prove to be correct. In addition to

other factors and assumptions which may be identified in this

document, assumptions have been made regarding, among other things:

crude oil and natural gas prices; the impact of increasing

competition; the general stability of the economic and political

environment; the timely receipt of any required regulatory

approvals; the Company's ability to continue its operations

for the foreseeable future and to realize its assets and discharge

its liabilities and commitments in the normal course of business;

industry activity levels; Trican's policies with respect to

acquisitions; the ability of Trican to obtain qualified staff,

equipment and services in a timely and cost efficient manner; the

ability to operate our business in a safe, efficient and effective

manner; the ability of Trican to obtain capital resources and

adequate sources of liquidity; the performance and characteristics

of various business segments; the regulatory framework; the timing

and effect of pipeline, storage and facility construction and

expansion; and future commodity, currency, exchange and interest

rates.

The forward-looking statements contained in this

document are expressly qualified by this cautionary statement. We

do not undertake any obligation to publicly update or revise any

forward-looking statements except as required by applicable

law.

Additional information regarding Trican

including Trican’s most recent Annual Information Form is available

under Trican’s profile on SEDAR (www.sedar.com).

CONFERENCE CALL AND WEBCAST

DETAILS

The Company will host a conference call on

Thursday, May 10, 2018 at 10:00 a.m. MT (12:00 p.m. ET) to discuss

the Company’s results for the 2018 First Quarter.

To listen to the webcast of the conference call,

please enter https://edge.media-server.com/m6/p/wce4iod2 in

your web browser or visit the Investors section of our website at

www.tricanwellservice.com/investors and click on “Reports”.

To participate in the Q&A session, please

call the conference call operator at 1-844-358-9180 (North America)

or 478-219-0187 (outside North America) 15 minutes prior to the

call's start time and ask for the “Trican Well Service Ltd. First

Quarter 2018 Earnings Results Conference Call”.

The conference call will be archived on Trican’s

website at www.tricanwellservice.com/investors

Headquartered in Calgary, Alberta, Trican

provides a comprehensive array of specialized products, equipment

and services that are used during the exploration and development

of oil and gas reserves.

Requests for further information should be

directed to:

Dale Dusterhoft President and Chief Executive

OfficerE-mail: ddusterhoft@trican.ca

Michael Baldwin Senior Vice President,

Corporate Development E-mail: mbaldwin@trican.ca

Robert SkilnickChief Financial OfficerE-mail:

robert.skilnick@trican.ca

Phone: (403) 266-0202 Fax: (403) 237-7716 2900, 645 – 7th Avenue

S.W. Calgary, Alberta T2P 4G8

Please visit our website at

www.tricanwellservice.com

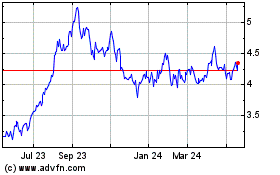

Trican Well Service (TSX:TCW)

Historical Stock Chart

From Oct 2024 to Dec 2024

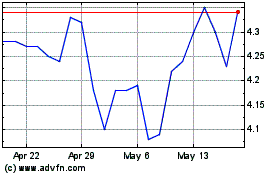

Trican Well Service (TSX:TCW)

Historical Stock Chart

From Dec 2023 to Dec 2024