AsiaBaseMetals Inc. Closes Private Placement

20 November 2019 - 12:30AM

AsiaBaseMetals Inc. (the "Company") (TSX-V: "ABZ")

is pleased to announce that it has closed its non-brokered private

placement for gross proceeds of $350,100 through the sale of

1,945,000 units ("

Units") at a price of $0.18 per

Unit (the "

Private Placement"). Each Unit is

comprised of one common share of the Company (a

"

Share") and one transferable common share

purchase warrant (each, a "

Warrant"). Each Warrant

entitles the holder to purchase an additional Share at a price of

$0.25 per Share for a period of two years.

The proceeds from the sale of the Units are

intended to be used for general working capital. No finders fees

were issued under the Private Placement.

The Private Placement is subject to acceptance

by the TSX Venture Exchange. All securities issued pursuant to the

Private Placement will be subject to a four month hold period from

the date of issue.

For more information please email

info@asiabasemetals.com.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Multilateral Instrument 61-101

Under the Private Placement, the following

insiders of the Company purchased common shares: Raj Chowdhry,

President, CEO and a director of the Company, purchased 1,390,500

Units under the Private Placement; Henry Park, a director of the

Company, purchased 278,000 Units through a company controlled by

Mr. Park; and Terrylene Penstock, a director of the Company,

purchased 110,000 Units under the Private Placement. Their

participation is considered to be a "related party transaction" as

defined under Multilateral Instrument 61-101 ("MI

61-101"). The transaction is exempt from the formal

valuation and minority shareholder approval requirements of

MI 61-101 as neither the fair market value of the securities

to be distributed in the Private Placement nor the consideration to

be received for those securities, in so far as the Private

Placement involves the insiders, exceeds 25% of the Company’s

market capitalization. The Company did not file a material change

report more than 21 days before the expected closing of the Private

Placement as the details of the Private Placement and the

participation therein by related parties of the Company were not

settled until shortly prior to closing and the Company wished to

close on an expedited basis for sound business reasons.

Early Warning Disclosure

Mr. Chowdhry acquired ownership of 1,390,500

Units under the Private Placement. Prior to the Private Placement,

Mr. Chowdhry held 19,444,749 Shares, which represented

approximately 48.50% of the issued and outstanding Shares. After

giving effect to the Private Placement, Mr. Chowdhry beneficially

owns and controls a total of 20,835,249 Shares, 2,607,404 Warrants

and 1,050,000 Options. These securities represent 49.50% of the

Company's issued and outstanding Shares on a non-diluted basis or

53.54% of the Company's issued and outstanding Shares on a

partially diluted basis assuming exercise of Mr. Chowdhry’s

Warrants and Options only. Mr. Chowdhry acquired the Units for

investment purposes. Mr. Chowdhry intends to evaluate his

investment in the Company and to increase or decrease his

shareholdings from time to time as he may determine appropriate. A

copy of the early warning report being filed by Mr. Chowdhry may be

obtained by contacting Mr. Chowdhry at

(604) 765 - 2030.

Cautionary Note Regarding

Forward-Looking Statements: Certain disclosure in this

release, including statements regarding the Company's intention to

carry out the Private Placement and the use of proceeds from the

Private Placement constitute “forward-looking information” within

the meaning of Canadian securities legislation. In making the

forward-looking statements in this release, the Company has applied

certain factors and assumptions that the Company believes are

reasonable, including that the Company will be able to use the

proceeds of the Private Placement as anticipated. However, the

forward-looking statements in this release are subject to numerous

risks, uncertainties and other factors that may cause future

results to differ materially from those expressed or implied in

such forward-looking statements. Such uncertainties and risks

include, among others, inability to use the proceeds from the

Private Placement as anticipated. There can be no assurance that

such statements will prove to be accurate, and actual results and

future events could differ materially from those anticipated in

such statements. Readers are cautioned not to place undue reliance

on forward-looking statements. The Company does not intend, and

expressly disclaims any intention or obligation to, update or

revise any forward-looking statements whether as a result of new

information, future events or otherwise, except as required by

law.

Contact Information

AsiaBaseMetals Inc.

Raj Chowdhry, Chief Executive Officer

Email: info@asiabasemetals.com

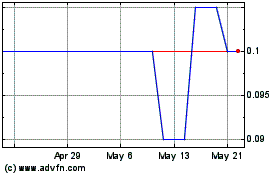

AsiaBaseMetals (TSXV:ABZ)

Historical Stock Chart

From Jan 2025 to Feb 2025

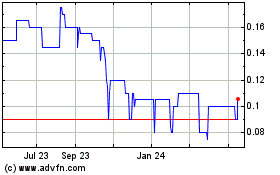

AsiaBaseMetals (TSXV:ABZ)

Historical Stock Chart

From Feb 2024 to Feb 2025