Canadian Premium Sand Completes Non-Brokered Private Placement of Secured Convertible Debentures

27 February 2020 - 12:00AM

Canadian Premium Sand Inc. (“

CPS”

or the “

Company”) (TSXV: CPS) is pleased to

announce that it has completed its previously announced

non-brokered private placement (the "

Offering") of

secured convertible debentures (the "

Convertible

Debentures"). Pursuant to the Offering, the

Company accepted subscriptions for Debentures totaling

approximately $2 million.

The net proceeds of the Offering will be used

for the continued development of the Company's Wanipigow Sand

Resource and for general working capital purposes.

The Convertible Debentures bear interest at a

rate of 12% per annum and mature on February 26, 2024 (the

"Maturity Date"). The Convertible Debentures and

accrued interest thereon are convertible into common shares

("Common Shares"), at the holder's option, at a

price of $0.75 per Common Share, subject to adjustment in certain

events, at any time prior to the Maturity Date. On or after

February 26, 2022 if the daily volume weighted average trading

price of the Common Shares is $1.20 per Common Share or more for

each trading day over a 30 consecutive trading day period, the

Company may, at any time and from time to time thereafter (the

"Redemption Date"), at its option, redeem all, or

any portion of the Convertible Debentures for either: (i) a cash

payment that is equal to all outstanding principal and accrued

interest under each Convertible Debenture up to the Redemption

Date; or (ii) by issuing and delivering Common Shares to the

holders of Convertible Debentures at a deemed price of $0.75 per

Common Share that is equal to all outstanding principal and accrued

interest under each Convertible Debenture up to the Redemption

Date, or any combination of (i) or (ii), upon not less than 30 days

and not more than 60 days prior written notice to the holder of

Convertible Debentures. The Convertible Debentures are a secured

obligation of the Company which will rank senior to all present and

future indebtedness that is not senior indebtedness which will

involve the grant by the Company of a fixed and floating charge

over all of its present and after acquired property. If a change of

control of the Company occurs prior to the Maturity Date, unless

the holder elects in writing to convert the Convertible Debentures

into Common Shares, the Company will repay in cash upon the closing

of such change of control all outstanding principal and accrued

interest under each Convertible Debenture plus a change of control

premium equal to an additional 3% of the outstanding principal sum

under such Convertible Debenture.

Certain directors of the Company, being Lowell

Jackson, John Assman and Glenn Leroux, and each of its two

significant shareholders being Paramount Resources Ltd. and David

Wilson, directly or indirectly participated in the Offering in the

aggregate amount of $1.975 million, thereby making the Offering a

"related party transaction" as defined under Multilateral

Instrument 61-101 ("MI 61-101"). The Offering is

exempt from the need to obtain minority shareholder and a formal

valuation as required by MI 61-101 as the Company is listed on the

TSX Venture Exchange and at the time the transaction was agreed to

the fair market value of the Debentures to insiders or the

consideration paid by insiders of the Company did not exceed 25% of

the Company's market capitalization. The Company did not file a

material change report more than 21 days before the expected

closing date of the Offering as the details of the Offering,

including the amount to be raised pursuant to the Offering, had not

been confirmed at that time and the Company wished to close the

Offering on an expedited basis for sound business reasons and in a

timeframe consistent with usual market practices for transactions

of this nature.

The Offering remains subject to the final

acceptance of the TSX Venture Exchange. The Debentures and the

Common Shares issuable upon conversion of the Debentures are

subject to a statutory hold period expiring on June 27, 2020.

The securities of the Company have not

been, and will not be, registered under the U.S. Securities Act of

1933, as amended (the "U.S. Securities Act") or any U.S. state

securities laws and may not be offered or sold in the United States

absent registration or an available exemption from the registration

requirement of the U.S. Securities Act and applicable U.S. state

securities laws. This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of these securities, in any jurisdiction in which such

offer, solicitation or sale would be unlawful.

About Canadian Premium Sand

Inc.

The Company is an exploration stage company

which is developing its Wanipigow Sand Resource in Manitoba, and a

reporting issuer in Ontario, Alberta and British Columbia. Its

shares trade on the TSX Venture Exchange under the symbol

"CPS".

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

CONTACT

INFORMATION:

Canadian Premium Sand

Inc. Glenn Leroux President and Chief Executive

Officer 587.350.5772glenn.leroux@cpsmail.com

Investor

RelationsIR@cpsmail.com

www.canadianpremiumsand.com

Disclaimer for Forward-Looking

Information

Certain statements in this press release related

to the business prospects of the Company and the Offering and the

securities issuable thereunder are forward-looking statements and

are prospective in nature. Forward-looking statements are not based

on historical facts, but rather on current expectations and

projections about future events, and are therefore subject to risks

and uncertainties which could cause actual results to differ

materially from the future results expressed or implied by the

forward-looking statements. These statements generally can be

identified by the use of forward-looking words such as “may”,

“should”, “will”, “could”, “intend”, “estimate”, “plan”,

“anticipate”, “expect”, “believe” or “continue”, or the negative

thereof or similar variations. Forward-looking statements in this

news release include statements regarding the use of proceeds of

Offering and receipt of the final approval of the TSX Venture

Exchange. Such statements are qualified in their entirety by the

inherent risks and uncertainties that the proceeds of the Offering

may be used other than as set out in this news release, that the

TSX Venture Exchange may not approve the Offering and such other

factors beyond the control of the Company. Such forward-looking

statements should therefore be construed in light of such factors,

and the Company is not under any obligation, and expressly

disclaims any intention or obligation, to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

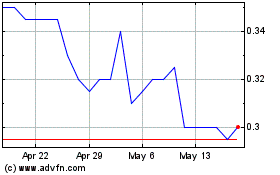

Canadian Premium Sands (TSXV:CPS)

Historical Stock Chart

From Jan 2025 to Feb 2025

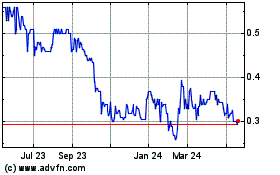

Canadian Premium Sands (TSXV:CPS)

Historical Stock Chart

From Feb 2024 to Feb 2025