Itafos Inc. (TSX-V: IFOS) (the “Company”) reported today its Q2 and

H1 2022 financial and operational highlights. The Company’s

financial statements and management’s discussion and analysis and

annual information form for the three and six months ended June 30,

2022 are available under the Company’s profile at www.sedar.com and

on the Company’s website at www.itafos.com. All figures are in

thousands of US Dollars except as otherwise noted.

Q2 and H1 Market Highlights

DAP NOLA prices averaged $860/short ton (“st”)

in Q2 2022 compared to $571/st in Q2 2021, up 51% year-over-year

driven by strong agriculture and phosphate fertilizer market supply

and demand dynamics. Similarly, DAP NOLA prices averaged $827/st in

H1 2022 compared to $536/st in H1 2021, up 54% year-over-year.

Specific factors driving the year-over-year improvements in DAP

NOLA were as follows:

Specific factors driving the year-over-year

improvements in DAP NOLA were as follows:

- limited supply additions;

- global coarse grains and oilseeds

at multi-year low stocks-to-use ratios supporting fertilizer

relative affordability;

- continued drawdown of inventory

levels;

- increased restrictions and controls

on exports from China; and

- disruptions to fertilizer and raw

materials supply from Russia due to sanctions imposed by certain

countries following Russia’s invasion of Ukraine.

Q2 2022 Financial

Highlights

The Company’s revenues, adjusted EBITDA, net

income, basic earnings per share and free cash flow were all up in

Q2 2022 compared to Q2 2021 as follows:

- revenues of $155.0 million in Q2

2022 compared to $103.3 million in Q2 2021;

- adjusted EBITDA of $63.6 million in

Q2 2022 compared to $33.7 million in Q2 2021;

- net income of $44.3 million in Q2

2022 compared to $9.6 million in Q2 2021;

- basic earnings of C$0.30/share in

Q2 2022 compared to C$0.06/share in Q2 2021; and

- free cash flow of $41.3 million in

Q2 2022 compared to $25.4 million in Q2 2021.

The increase in the Company’s Q2 2022 financial

performance compared to Q2 2021 was primarily due to higher

realized prices at Conda, which were partially offset by higher

input costs, and the restart of the sulfuric acid plant at

Arraias.

The Company’s total capex spend in Q2 2022 was

$16.0 million compared to $18.2 million in Q2 2021 with the

decrease primarily due to a shorter turnaround at Conda in 2022

compared to 2021, which was partially offset by activities related

to the initiative to produce and sell HFSA at Conda and maintenance

activities at Arraias related to the restart of the sulfuric acid

plant.

H1 2022 Financial

Highlights

The Company’s revenues, adjusted EBITDA, net

income, basic earnings per share and free cash flow were all up in

H1 2022 compared to H1 2021 as follows:

- revenues of $304.9 million in H1

2022 compared to $193.5 million in H1 2021;

- adjusted EBITDA of $124.0 million

in H1 2022 compared to $54.3 million in H1 2021;

- net income of $77.3 million in H1

2022 compared to $11.5 million in H1 2021;

- basic earnings of C$0.52/share in

H1 2022 compared to C$0.08/share in H1 2021; and

- free cash flow of $95.7 million in

H1 2022 compared to $40.1 million in H1 2021.

The increase in the Company’s H1 2022 financial

performance compared to H1 2021 was primarily due to higher

realized prices at Conda, which were partially offset by higher

input costs, and the restart of the sulfuric acid plant at

Arraias.

The Company’s total capex spend in H1 2022 was

$21.3 million compared to $21.0 million in H1 2021 with the

increase primarily due to activities related to the initiative to

produce and sell HFSA at Conda and maintenance activities at

Arraias related to the restart of the sulfuric acid plant, which

were partially offset by a shorter turnaround at Conda in 2022

compared to 2021.

June 30, 2022 Highlights

As at June 30, 2022, the Company had trailing 12

months adjusted EBITDA of $213.1 million compared to $143.4 million

at the end of 2021 with the increase primarily due to the same

factors that resulted in higher adjusted EBITDA in H1 2022.

Also as at June 30, 2022, the Company had net

debt of $146.2 million compared to $217.7 million at the end of

2021 with the decrease primarily due to principal payments under

the Company’s secured term loan (the “Term Loan”) and Conda’s

secured working capital facility (the “Conda ABL”) higher cash and

cash equivalents. The Company’s net debt as at June 30, 2022 was

comprised of $61.5 million in cash and $207.7 million in debt

(gross of deferred financing costs). For the six months ended June

30, 2022, the Company repaid $47.6 million of debt, including $42.3

million of principal under the Term Loan and $5.0 million cash

drawn under the Conda ABL. As at June 30, 2022, the Company’s net

leverage ratio was 0.7x compared to 1.5x at the end of 2021.

As at June 30, 2022, the Company had liquidity

of $68.7 million comprised of $61.5 million in cash and $7.2

million in Conda ABL undrawn borrowing capacity.

Q2 2022 Operational

Highlights

EHS

- continued corporate-wide risk

mitigation measures to address potential impacts to employees,

contractors and operations as a result of the COVID-19 pandemic,

which resulted in no material impact to operations;

- sustained EHS excellence, including

no reportable environmental releases and no recordable incidents,

which resulted in a consolidated TRIFR of 0.26, representing a new

Company record; and

- received a notice of violation

(“NOV”) at Conda from the from the Idaho Department of

Environmental Quality (“DEQ”) related to a failed air stack

emissions test in May 2021. Conda investigated and corrected the

issues during 2021. The NOV was formally received from the DEQ in

May 2022 and resolved in July 2022.

Conda

- completed a scheduled plant

turnaround at Conda and returned to full production capacity;

- produced 80,297 tonnes P2O5 at

Conda in Q2 2022 compared to 67,835 tonnes P2O5 in Q2 2021 with the

increase primarily due to a shorter turnaround in 2022 compared to

2021;

- generated revenues of $148,940 at

Conda in Q2 2022 compared to $103,316 in Q2 2021 with the increase

primarily due to higher realized prices;

- generated adjusted EBITDA at Conda

of $66,716 in Q2 2022 compared to $37,747 in Q2 2021 with the

increase primarily due to the same factors that resulted in higher

revenues, which were partially offset by higher input costs;

- reached a settlement agreement

related to shared environmental and asset retirement obligations at

Conda's Lanes Creek mine;

- purchased mining equipment at Conda

in exchange for a note payable of $3,930;

- advanced activities related to the

extension of Conda's mine life through permitting and development

of H1/NDR, including progression of the NEPA EIS preparation and

public engagement process; and

- advanced activities related to the

optimization of Conda's EBITDA generation, including beginning

production and sales of HFSA.

H1 2022 Operational

Highlights

EHS

- continued corporate-wide risk

mitigation measures to address potential impacts to employees,

contractors and operations as a result of the COVID-19 pandemic,

which resulted in no material impact to operations;

- sustained EHS excellence, including

no reportable environmental releases and one recordable incident,

which resulted in a consolidated TRIFR of 0.26, representing a new

Company record;

- received national recognition

during the 87th North American Wildlife and Natural Resources

Conference as the BLM awarded the Conservation Leadership Partner

Award to the Southeast Idaho Habitat Mitigation Fund, which was

developed and funded by Conda; and

- received a NOV at Conda from the

DEQ related to a failed air stack emissions test in May 2021. Conda

investigated and corrected the issues during 2021. The NOV was

formally received from the DEQ in May 2022 and resolved in July

2022.

Conda

- completed a scheduled plant

turnaround at Conda and returned to full production capacity;

- produced 169,393 tonnes P2O5 at

Conda in H1 2022 compared to 157,191 tonnes P2O5 in H1 2021 with

the increase primarily due to a shorter turnaround in 2022 compared

to 2021;

- generated revenues of $296,470 at

Conda in H1 2022 compared to $193,458 in H1 2021 primarily due to

higher realized prices;

- generated adjusted EBITDA at Conda

of $131,104 in H1 2022 compared to $61,869 in H1 2021 primarily due

to the same factors that resulted in higher revenues, which were

partially offset by higher input costs;

- reached a settlement with insurers

on a business interruption claim related to the 2020 disruption in

sulfuric acid supply to Conda, which resulted in receipt of net

insurance proceeds of $8,675;

- reached a settlement agreement

related to shared environmental and asset retirement obligations at

Conda's Lanes Creek mine;

- posted incremental letters of

credit of $3,663 under the Conda ABL as collateral for Conda's

surety bonds that guarantee Conda's obligations under existing

operating and environmental permits;

- purchased mining equipment at Conda

in exchange for a note payable of $3,930;

- advanced activities related to the

extension of Conda's mine life through permitting and development

of H1/NDR, including progression of the NEPA EIS preparation and

public engagement process; and

- advanced activities related to the

optimization of Conda's EBITDA generation, including beginning

production and sales of HFSA.

Q2 Other Highlights

- produced 20,549 tonnes of sulfuric

acid at Arraias in Q2 2022 compared to no production in Q2

2021;

- generated adjusted EBITDA at

Arraias of $405 in Q2 2022 compared to $(938) in Q2 2021 with the

increase due to the restart of the sulfuric acid plant;

- continued evaluation of strategic

alternatives for non-North American assets; and

- announced the appointment of

Stephen Shapiro and Isaiah Toback to the Company’s Board of

Directors. Mr. Toback replaced Rory O’Neill as a nominee to the

Company’s Board of Directors by its principal shareholder,

CLF.

H1 2022 Other Highlights

- produced 30,200 tonnes of sulfuric

acid at Arraias in H1 2022 compared to no production in H1

2021;

- generated adjusted EBITDA at

Arraias of $(248) in H1 2022 compared to $(1,772) in H1 2021 with

the reduced deficit due to the restart of the sulfuric acid

plant;

- continued evaluation of strategic

alternatives for non-North American assets; and

- announced the appointment of

Stephen Shapiro and Isaiah Toback to the Company's Board of

Directors. Mr. Toback replaced Rory O'Neill as a nominee to the

Company's Board of Directors by its principal shareholder,

CLF.

Subsequent Events

Subsequent to June 30, 2022, the Company:

- announced the appointment of

Matthew O’Neill as CFO. Mr. O’Neill succeeds George Burdette who

served as CFO since April 2018; and

- granted 82,230 restricted share

unites (“RSUs”) to management under its RSU plan.

Market Outlook

The Company expects the current strength in the

global agriculture and phosphate fertilizer fundamentals to

continue. Accordingly, the Company expects continued strength in

pricing and volume fundamentals in the phosphate fertilizer markets

with a moderate softening of prices during H2 2022 relative to H1

2022.

Specific factors the Company expects to support

the continued strength in the global phosphate fertilizer markets

during H2 2022 are as follows:

- no significant supply capacity

additions; and

- reduced exports from China.

Specific factors the Company expects to

influence the moderate softening of the global phosphate fertilizer

markets during H2 2022 relative to H1 2022 are as follows:

- higher inventory levels;

- softening crop prices;

- moderated demand; and

- increased supply from maximizing

existing capacity run-rates.

The Company expects sulfur and sulfuric acid

prices to decrease globally due to increased refinery activity and

softer demand from phosphates and metals consumers.

Financial Outlook

The Company’s revised guidance for 2022 is as

follows:

|

(in millions of US Dollars |

|

|

|

Actual |

|

|

|

Projected |

|

|

Projected |

|

except as otherwise noted) |

|

|

|

H1 2022 |

|

|

|

H2 2022 |

|

|

FY 2022 |

|

Adjusted EBITDAi |

|

|

|

$ |

124 |

|

|

$ |

86-106 |

|

$ |

210-230 |

|

Net income |

|

|

|

|

77 |

|

|

|

23-28 |

|

|

100-105 |

|

Basic earnings (C$/share) |

|

|

|

|

0.52 |

|

|

|

0.16-0.19 |

|

|

0.69-0.72 |

|

Maintenance capexi |

|

|

|

|

13 |

|

|

|

5-9 |

|

|

18-22 |

|

Growth capexi |

|

|

|

|

8 |

|

|

|

10-14 |

|

|

18-21 |

|

Free cash flowi |

|

|

|

|

96 |

|

|

|

54-69 |

|

|

150-165 |

The Company revised its guidance for 2022 as

follows:

- adjusted EBITDA guidance of

$210-230 million (maintained) to reflect the Company’s view of H2

2021 prices and input costs at Conda, including the current DAP

NOLA prices (100% of Conda’s MAP is sold under a long-term offtake

agreement with pricing indexed to DAP NOLA on an average

three-month trailing basis) and continued production and sales of

sulfuric acid at Arraias;

- net income guidance of $100-105

million (increased from previous guidance of $80-95 million) to

reflect tax efficiencies resulting from the Company’s

redomiciliation from the Cayman Islands to the US;

- basic earnings guidance of

C$0.69-0.72/share (increased from previous guidance of

C$/0.55-0.65/share) to reflect the revised net income

guidance;

- maintenance capex guidance of

$18-22 million (tightened from previous guidance of $15-23

million);

- growth capex guidance of $18-21

million (tightened from previous guidance of $15-22 million);

and

- free cash flow guidance of $150-165

million (maintained).

In preparing its revised guidance for 2022, the

Company maintained is prior assumption for expected average DAP

NOLA during H2 2022 of $690-750/st.

Business Outlook

The Company continues to focus on the following

key objectives to drive long-term value and shareholder

returns:

- improving financial and operational

performance;

- deleveraging the balance

sheet;

- extending Conda’s current mine life

through permitting and development of H1/NDR;

- evaluating strategic alternatives

for non-North American assets; and

- maintaining capital-lite investment

approach.

About Itafos

The Company is a phosphate and specialty

fertilizer company. The Company’s businesses and projects are as

follows:

- Conda – a vertically integrated

phosphate fertilizer business located in Idaho, US with production

capacity as follows:

- approximately 550kt per year of

monoammonium phosphate (“MAP”), MAP with micronutrients (“MAP+”),

superphosphoric acid (“SPA”), merchant grade phosphoric acid

(“MGA”) and ammonium polyphosphate (“APP”); and

- approximately 27kt per year of

hydrofluorosilicic acid (“HFSA”);

- Arraias – a vertically integrated

phosphate fertilizer business located in Tocantins, Brazil with

production capacity as follows:

- approximately 500kt per year of

single superphosphate (“SSP”) and SSP with micronutrients (“SSP+”);

and

- approximately 40kt per year of

excess sulfuric acid (220kt per year gross sulfuric acid production

capacity);

- Farim – a high-grade phosphate mine

project located in Farim, Guinea-Bissau;

- Santana – a vertically integrated

high-grade phosphate mine and fertilizer plant project located in

Pará, Brazil; and

- Araxá – a vertically integrated

rare earth elements and niobium mine and extraction plant project

located in Minas Gerais, Brazil.

In addition to the businesses and projects

described above, the Company also owns Paris Hills (Idaho, US) and

Mantaro (Junin, Peru), which are phosphate mine projects that are

in process of being wound down.

The Company is a Delaware corporation that is

headquartered in Houston, TX. The Company’s shares trade on the TSX

Venture Exchange (“TSX-V”) under the ticker symbol “IFOS”. The

Company’s principal shareholder is CL Fertilizers Holding LLC

(“CLF”). CLF is an affiliate of Castlelake, L.P., a global private

investment firm.

For more information, or to join the Company’s

mailing list to receive notification of future news releases,

please visit the Company’s website at www.itafos.com.

Non-IFRS Financial Measures

The Company considers both IFRS and certain

non-IFRS measures to assess performance. Non-IFRS measures are a

numerical measure of a company’s performance, that either include

or exclude amounts that are not normally included or excluded from

the most directly comparable IFRS measures. In evaluating non-IFRS

measures, investors, analysts, lenders and others should consider

that non-IFRS measures do not have any standardized meaning under

IFRS and that the methodology applied by the Company in calculating

such non-IFRS measures may differ among companies and analysts. The

Company believes the non-IFRS measures provide useful supplemental

information to investors, analysts, lenders and others in order to

evaluate the Company’s operational and financial performance. These

non-IFRS financial measures should not be considered as a

substitute for, nor superior to, measures of financial performance

prepared in accordance with IFRS.

Non-IFRS measures included in this news release

are defined as follows:

- “EBITDA” as earnings before

interest, taxes, depreciation, depletion and amortization;

- “Adjusted EBITDA” as EBITDA

adjusted for non-cash, extraordinary, non-recurring and other items

unrelated to the Company’s core operating activities;

- “Trailing 12 months adjusted

EBITDA” as Adjusted EBITDA for the current and preceding three

quarters;

- “Total capex” as additions to

property, plant, and equipment and mineral properties adjusted for

additions to asset retirement obligations, additions to right of

use assets and capitalized interest;

- “Maintenance capex” as portion of

total capex relating to the maintenance of ongoing operations;

- “Growth capex” as portion of total

capex relating to development of growth opportunities;

- “Cash growth capex” as growth capex

less accrued growth capex;

- “Free cash flow” as cash flows from

operating activities, which excludes payment of interest expense,

plus cash flows from investing activities less cash growth

capex;

- “Net debt” as debt less cash and

cash equivalents plus deferred financing costs (does not consider

lease liabilities);

- “Net leverage ratio” as net debt

divided by trailing 12 months adjusted EBITDA; and

- “Liquidity” as cash and cash

equivalents plus undrawn committed borrowing capacity.

Reconciliations of non-IFRS measures to the most

directly comparable IFRS measures are included in the Company’s

management’s discussion and analysis available under the Company’s

profile at www.sedar.com and on the Company’s website at

www.itafos.com.

Other Defined Terms

Other defined terms included in this news

release are as follows:

- Bureau of Land Management

("BLM");

- Coronavirus disease 2019

(“COVID-19”);

- Diammonium phosphate (“DAP”) New

Orleans (“NOLA”);

- Environmental, Health and Safety

(“EHS”);

- Environmental Impact Statement

(“EIS”);

- Husky 1/North Dry Ridge

(“H1/NDR”);

- National Environmental Policy Act

(“NEPA”); and

- Total recordable incident frequency

rate (“TRIFR”).

Forward-Looking Information

Certain information contained in this news

release constitutes forward-looking information. All information

other than information of historical fact is forward-looking

information. Statements that address activities, events or

developments that the Company believes, expects or anticipates will

or may occur in the future include, but are not limited to,

statements regarding estimates and/or assumptions in respect of the

Company’s financial and business outlook are forward-looking

information. The use of any of the words “intend”, “anticipate”,

“plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”,

“should”, “would”, “believe”, “predict” and “potential” and similar

expressions are intended to identify forward-looking information.

This information involves known and unknown risks, uncertainties

and other factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

information. No assurance can be given that this information will

prove to be correct and such forward-looking information included

in this news release should not be unduly relied upon.

Forward-looking information is subject to a

number of risks and other factors that could cause actual results

and events to vary materially from that anticipated by such

forward-looking information. Although the Company has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended. Factors that may cause

actual results to differ materially from expected results described

in forward-looking statements include, but are not limited to,

uncertainties of estimates of capital and operating costs and

production estimates; the ability of the Company to meet its

financial obligations and minimum commitments, fund capital

expenditures and comply with covenants contained in the agreements

that govern indebtedness; fluctuations in foreign exchange or

interest rates and stock market volatility; the continued supply of

sulfuric acid to Conda from its primary supplier and those risk

factors set out in the Company’s annual information form and other

disclosure documents available under the Company’s profile on SEDAR

at www.sedar.com and on the Company’s website at www.itafos.com.

Readers are cautioned that the foregoing list of risks,

uncertainties and assumptions are not exhaustive. The

forward-looking information included in this news release is

expressly qualified by this cautionary statement and is made as of

the date of this news release. The Company undertakes no obligation

to publicly update or revise any forward-looking information except

as required by applicable securities laws.

This news release contains future oriented

financial information and financial outlook information (together,

“FOFI”) about the Company’s prospective results of operations,

including statements regarding expected adjusted EBITDA, net

income, basic earnings per share, maintenance capex, growth capex

and free cash flow. FOFI is subject to the same assumptions, risk

factors, limitations and qualifications as set forth in the above

paragraph. The Company has included the FOFI to provide an outlook

of management’s expectations regarding anticipated activities and

results, and such information may not be appropriate for other

purposes. The Company and management believe that the FOFI has been

prepared on a reasonable basis, reflecting management’s reasonable

estimates and judgements; however, actual results of operations and

the resulting financial results may vary from the amounts set forth

herein. Any financial outlook information speaks only as of the

date on which it is made and the Company undertakes no obligation

to publicly update or revise any financial outlook information

except as required by applicable securities laws.

NEITHER THE TSX-V NOR ITS REGULATION SERVICES

PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX-V)

ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS

RELEASE.

For further information, please

contact:

Matthew O’NeillItafos Investor

Relationsinvestor@itafos.com713-242-8446

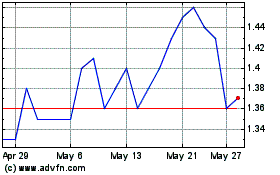

Itafos (TSXV:IFOS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Itafos (TSXV:IFOS)

Historical Stock Chart

From Dec 2023 to Dec 2024