LEADING EDGE

MATERIALS REPORTS QUARTERLY

RESULTS TO APRIL 30,

2023

Vancouver, June 21,

2023 – Leading Edge Materials

Corp. (“Leading Edge Materials” or the

“Company”) (TSXV: LEM)

(Nasdaq First North: LEMSE)

(OTCQB: LEMIF) (FRA:

7FL) second quarter results for the period ending April

30, 2023. All references to dollar amounts in this release are in

Canadian dollars.

Highlights During and After the

Quarter

During the three months ended April 30,

2023:

- On March 1, 2023, the Company

announced it identified extensive Co-Ni-mineralization 50 metres

above the previously reported Gallery 7 at its Bihor Sud project in

Romania.

Subsequent to April 30, 2023:

- On June 1, 2023, the Company

announced in-situ assay results at over 30% Nickel and 4.7% Cobalt

at Bihor Sud. Additionally, surface trench assay results indicate a

zone of Pb-Zn-Ag mineralisation.

Results of Operations

Three Months Ended April 30, 2023, Compared to

Three Months Ended January 31, 2023

During the three months ended April 30,2023 (“Q2

2023”) the Company reported a net loss of $1,235,603 compared to a

reported net loss of $637,135 for the three months ended January

31,2023 (“Q1 2023”), an increase in loss by $598,468, the increase

in loss mainly due to share-based compensation related to granting

of stock options under the Company’s stock option plan of $710,563

in Q2 2023 compared to share-based compensation of $97,029 in Q1

2023.

Three Months Ended April 30, 2023, Compared to

Three Months Ended April 30, 2022

During the three months ended April 30, 2023

(“2023 period”), the Company reported a net loss of $1,235,603

compared to a net loss of $790,120 for the three months ended April

30, 2022 (“2022 period”), an increase in loss of $445,483, the

increase in loss mainly due to share-based compensation of $710,563

(2022 period-$Nil), foreign exchange loss of $187,455 (2022 period

-$4,483), mark to market loss of $22,178 (2022 period

-$357,800).

Selected Financial Data

The following selected

financial information is derived from the unaudited condensed

consolidated interim financial statements of the Company prepared

in accordance with IFRS.

|

|

Fiscal 2023 |

Fiscal 2022 |

Fiscal 2021 |

|

Three Months Ended |

April 30, 2023$ |

January 31,2023$ |

October 31,2022$ |

July 31,2022$ |

April 30,2022$ |

January 31,2022$ |

October 31,2021$ |

July 31,2021$ |

|

Operations |

|

|

|

|

|

|

|

|

|

Expenses |

(1,048,182) |

(570,549) |

(425,075) |

(419,050) |

(433,894) |

(1,874,407) |

(583,391) |

(600,531) |

|

Other items |

(187,421) |

(66,586) |

308,721 |

(190,659) |

(356,226) |

(219,942) |

28,466 |

(477,057) |

|

Comprehensive profit/(loss) |

(1,235,603) |

(637,135) |

(116,354) |

(609,709) |

(790,120) |

(2,094,349) |

(554,925) |

(1,077,588) |

|

Basic Profit/(loss) per share |

(0.01) |

(0.00) |

(0.00) |

(0.00) |

(0.01) |

(0.01) |

(0.00) |

(0.01) |

|

Diluted profit/(loss) per share |

(0.01) |

(0.00) |

(0.00) |

(0.00) |

(0.01) |

(0.01) |

(0.00) |

(0.01) |

|

Financial Position |

|

|

|

|

|

|

|

|

|

Working capital |

1,344,044 |

2,124,643 |

1,365,657 |

1,686,095 |

2,396,484 |

3,236,870 |

2,350,166 |

2,803,903 |

|

Total assets |

24,181,654 |

24,845,430 |

23,832,418 |

24,827,062 |

25,000,847 |

30,597,341 |

28,756,406 |

28,455,148 |

|

Total non-current liabilities |

(5,404,808) |

(5,556,603) |

(5,292,618) |

(6,159,922) |

(6,045,964) |

(10,812,012) |

(9,946,686) |

(9,054,376) |

Financial Condition / Capital Resources

During the three months ended April 30, 2023, the Company

recorded a net loss of $1,235,603 as of April 30, 2023, the Company

had an accumulated deficit of $46,587,540 and working capital of

$1,344,044. The Company is maintaining its Woxna Graphite Mine on a

“production-ready” basis to minimize costs and is conducting

ongoing research and development to produce higher value specialty

products. The Company is also evaluating a potential restart of

production at the Woxna Graphite Mine. The Company anticipates that

it has sufficient funding to meet anticipated levels of corporate

administration and overheads for the ensuing twelve months however,

it will need additional capital to provide working capital and

recommence operations at the Woxna Graphite Mine, establish a

production facility for the Anode Project, to fund future

development of the Norra Karr Property or to complete exploration

activities in Romania. There is no assurance such additional

capital will be available to the Company on acceptable terms or at

all. In the longer term the recoverability of the carrying value of

the Company’s long-lived assets is dependent upon the Company’s

ability to preserve its interest in the underlying mineral property

interests, the discovery of economically recoverable reserves, the

achievement of profitable operations and the ability of the Company

to obtain financing to support its ongoing exploration programs and

mining operations. See also “COVID-19”.

Outlook

Since our last

quarterly update, we are pleased to see additional momentum on

political and legislative levels in the European Union. These

initiatives are of course all tied to themes around climate change,

risk assessment of supply chains, dependance on other countries,

etc. All of which are directly relevant to our activities, and

where we feel we have an important role to play. Our decision to

focus the Company on critical raw materials within the EU feels

opportune.

Regarding the EU

Critical Raw Materials Act, which was proposed this spring, we hear

informal feedback from various sources that it is largely

considered a sensible proposal. We can only agree, preferring free

market mechanisms rather than making companies dependent on direct

subsidies and such. As a reminder, the proposed legislation will

require at least 10% of such designated critical raw materials to

have been mined in the EU, and for member states to guarantee 24

months permitting process for projects deemed of strategic

importance, all within very tight timelines.

Additionally, there

are numerous other initiatives also highly relevant to us, for

example:

- The EU Parliament has adopted new

rules for the design, manufacture and recycling of all types of

batteries sold in the EU.[1] The background to the content of the

regulation, are the proposals for mandatory sustainability criteria

for batteries. This is relevant to our Woxna graphite mine (only

one in the EU), where we conducted a life cycle analysis to

demonstrate its capacity to be an order of magnitude lower GHG

emitter as a Swedish anode producer compared to most current Asian

alternatives, presented in our 2021 PEA.[2]

- Proposals to beef up the European

Net-Zero Industry Act.[3] This is relevant to the European wind

power industry. Our Norra Karr project potentially plays a vital

role in possibly making Europe self sufficient for some of the

critical rare earth elements without which one can not manufacture

the permanent magnets which go into wind turbine generators and

electric motors. China has a near full control of these materials

today.

- The German government plans to set

up a state fund worth up to €2 billion ($2.2 billion) that will

support mining of raw materials critical to the nation’s green

transition, with the aim of securing access and cutting reliance on

China.[4]

- Along with the multi-billion France

2030[5] plan we have to conclude that there appears to be several

alternatives emerging for European companies like ours to access

funding to develop and build projects.

Politicians, supported

by European citizens, certainly appear to walk the talk in terms of

aligning with stated policy aims. What has surprised us is the

speed with which these proposals are suggested and rapidly debated

to get implemented in short order. It seems everyone is aware and

committed to deal with the multiple crises we find ourselves in the

middle of: climate change, war in Europe, energy crisis, dependance

on Asian supply chains, etc.

We are pleased that we

have managed to position the Company at the point where these

trends converge providing a convex exposure to events taking place

around us.

Our built and

permitted Woxna graphite mine and plant continues to be

meticulously kept on care and maintenance. As reported, we are

evaluating a restart of the mine to initially produce graphite

concentrate, as the first step to developing a downstream anode

business. Market signals are obviously important to guide us as to

when to restart.

The massive forecast

demand-supply imbalance of graphite appears one of the most

attractive investment cases of any of the battery materials.[6]

However, natural flake graphite prices have so far (along with many

other commodities) come down over 20% this year.[7] This suggests

that we are not yet at the point where relatively inelastic demand

from nascent giga factories meets the tight current supply. With

economic slowdown in China, graphite demand as refractory material

has also decreased. We are of course monitoring this with interest,

bearing in mind price action in Cobalt a few years ago, or Lithium

last year.

We believe having a

built and permitted graphite mine, in an excellent jurisdiction

with proximity to infrastructure and the many new giga factories

gradually coming on line is the most compelling exposure one can

have set to benefit from this imbalance. Given the EU Critical Raw

Materials Act and the numerous other initiatives, the strategic

importance, value and scarcity of Woxna is enhanced in our

opinion.

For the Norra Karr

project, we took the decision to initiate a Natura 2000 permit

application process. By doing this based on the new design of the

Norra Karr project we will benefit from authorities and other

stakeholders evaluating the merits of the project based on the most

recent plans that substantially reduce the potential for

environmental risk. In parallel, through the various environmental

and metallurgical studies that may be required to support the

Natura 2000 permit application the Company can further progress the

Norra Karr project towards its next stages of feasibility

development. We will continue to adapt our path should the legal

framework evolve going forward. Aspects of the proposed EUCRMA

appear particularly relevant to this project.

As reported, continued

work at our Bihor Sud Ni-Co exploration project in Romania has been

progressing very encouragingly. Since having received permission to

enter underground galleries in January, this has been advancing

rapidly. Results have been encouraging: in the first target gallery

G7 we have encountered visual Co-Ni mineralisation over 135 m.

Additionally, further extensive Co-Ni mineralisation has been

identified in G4, 50 m above and in the cross cut and raise

connecting these two galleries. This indicates that we are

potentially encountering sizeable systems with good potential.

High levels of radon

gas readings resulted in time needing to be taken to design, order

and have a ventilation system installed. While this was done, we

took the opportunity to dig and sample five exploration trenches.As

communicated, in situ samples from gallery walls reported 30% Ni

and 4.7% Co. And the trenches have yielded very encouraging results

with apparently important Pb-Zn-Ag mineralization continuously over

1 km strike. Basically, we are reassured that these latest results

continue to confirm our prior stated beliefs and that this truly is

an incredible exploration project with scale and high grade

potential.

Now that ventilation

has been successful installed in G4, additional ventilation will be

added to G7. The company can now engage in its planned underground

channel sampling program and follow up on planning an underground

drilling program.

________________________________________________________________________________________________________________________________

-

https://www.electrive.com/2023/06/14/eu-parliament-approves-comprehensive-battery-market-regulation/

- See National Instrument 43-101

report entitled “NI 43-101 Technical Report – Woxna Graphite”

prepared for Woxna Graphite AB with effective date June 9, 2021 and

issue date July 23, 2021. See Leading Edge Materials Corp.’s SEDAR

profile on www.sedar.com or www.leadingedgematerials.com for report

and more information. The PEA is preliminary in nature, it includes

inferred mineral resources that are considered too speculative

geologically to have the economic considerations applied to them

that would enable them to be categorized as mineral reserves, and

there is no certainty that the PEA will be realized.

-

https://windeurope.org/newsroom/press-releases/nzia-act-now-or-europes-wind-turbines-will-be-made-in-china/?ref=mainbanner

-

https://financialpost.com/pmn/business-pmn/germany-draws-up-e2-billion-state-fund-to-secure-key-commodities

-

https://www.economie.gouv.fr/france-2030

- [6]

https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions/executive-summary

- [7]

https://www.fastmarkets.com/commodity-price/graphite-flake-94-c-100-mesh-fob-china-mb-gra-0042

Financial Information

The report for three

months ending July 31, 2023, is expected to be published on or

about September 20, 2023.

On behalf of the Board of

Directors,Leading Edge Materials

Corp.

Eric Krafft, Interim CEO

For further information, please contact the Company

at:info@leadingedgematerials.com

www.leadingedgematerials.com

Follow usTwitter:

https://twitter.com/LeadingEdgeMtlsLinkedin:

https://www.linkedin.com/company/leading-edge-materials-corp/

About Leading Edge Materials

Leading Edge Materials is a Canadian public company focused on

developing a portfolio of critical raw material projects located in

the European Union. Critical raw materials are determined as such

by the European Union based on their economic importance and supply

risk. They are directly linked to high growth technologies such as

batteries for electromobility and energy storage and permanent

magnets for electric motors and wind power that underpin the clean

energy transition towards climate neutrality. The portfolio of

projects includes the 100% owned Woxna Graphite mine (Sweden),

Norra Karr HREE project (Sweden) and the 51% owned Bihor Sud Nickel

Cobalt exploration alliance (Romania).

Additional Information

The Company’s unaudited consolidated financial statements for

the six months ended April 30, 2023 and related management’s

discussion and analysis are available on the Company’s website at

www.leadingedgematerials.com or under its profile on SEDAR at

www.sedar.com

The information was submitted for publication through the agency

of the contact person set out above, on June 21, 2023, at 10:00 am

Vancouver time.

Leading Edge Materials is listed on the TSXV under the symbol

“LEM”, OTCQB under the symbol “LEMIF” and Nasdaq First North

Stockholm under the symbol "LEMSE". Mangold Fondkommission AB is

the Company’s Certified Adviser on Nasdaq First North and may be

contacted via email CA@mangold.se or by phone +46 (0) 8 5030

1550.

Reader Advisory

Certain information in this news release may

constitute forward-looking statements or forward-looking

information within the meaning of applicable Canadian securities

laws (collectively, “Forward-Looking Statements”). All statements,

other than statements of historical fact, addressing activities,

events or developments that the Company believes, expects or

anticipates will or may occur in the future are Forward-Looking

Statements. Forward-Looking Statements are often, but not always,

identified by the use of words such as “seek,” “anticipate,”

“believe,” “plan,” “estimate,” “expect,” and “intend” and

statements that an event or result “may,” “will,” “can,” “should,”

“could,” or “might” occur or be achieved and other similar

expressions. Forward-Looking Statements are based upon the opinions

and expectations of the Company based on information currently

available to the Company. Forward-Looking Statements are subject to

a number of factors, risks and uncertainties that may cause the

actual results of the Company to differ materially from those

discussed in the Forward-Looking Statements including, among other

things, the Company has yet to generate a profit from its

activities; there can be no guarantee that the estimates of

quantities or qualities of minerals disclosed in the Company’s

public record will be economically recoverable; uncertainties

relating to the availability and costs of financing needed in the

future; competition with other companies within the mining

industry; the success of the Company is largely dependent upon the

performance of its directors and officers and the Company’s ability

to attract and train key personnel; changes in world metal markets

and equity markets beyond the Company’s control; the possibility of

write-downs and impairments; the risks associated with uninsurable

risks arising during the course of exploration; development and

production; the risks associated with changes in the mining

regulatory regime governing the Company; the risks associated with

tenure to the Norra Karr property; the risks associated with the

various environmental regulations the Company is subject to;

rehabilitation and restitution costs; the Woxna project has never

defined a mineral reserve or a feasibility study and the associated

increased risk of technical and economic failure in case of

restarting production; risks relating to the preliminary and

non-binding nature of the MOU with Sicona. On June 9, 2021, Leading

Edge announced the results of an independent preliminary economic

assessment for the development of Woxna (the "2021 Woxna PEA"), the

full details of which are included in a technical report entitled

"NI 43-101 Technical Report – Woxna Graphite" prepared for Woxna

Graphite AB with effective date June 9, 2021 and issue date July

23, 2021, available on Leading Edge's website

www.leadingedgematerials.com and under its SEDAR profile

www.sedar.ca. The 2021 Woxna PEA is preliminary in nature, it

includes inferred mineral resources that are considered too

speculative geologically to have the economic considerations

applied to them that would enable them to be categorized as mineral

reserves, and there is no certainty that the preliminary economic

assessment will be realized. Mineral resources that are not mineral

reserves do not have demonstrated economic viability. On July 22,

2021, Leading Edge announced the results of an independent

preliminary economic assessment for the development of Norra Karr

(the "2021 Norra Karr PEA"), the full details of which are included

in a technical report titled “PRELIMINARY ECONOMIC ASSESSMENT OF

NORRA KARR RARE EARTH DEPOSIT AND POTENTIAL BY-PRODUCTS, SWEDEN"

prepared for Leading Edge Materials Corp. with effective date

August 18, 2021 and issue date August 19, 2021, available on

Leading Edge's website www.leadingedgematerials.com and under its

SEDAR profile www.sedar.ca. The 2021 Norra Karr PEA is preliminary

in nature, it includes inferred mineral resources that are

considered too speculative geologically to have the economic

considerations applied to them that would enable them to be

categorized as mineral reserves, and there is no certainty that the

preliminary economic assessment will be realized. Mineral resources

that are not mineral reserves do not have demonstrated economic

viability. On March 11, 2020, the World Health Organization (“WHO”)

declared the novel coronavirus outbreak identified as “COVID-19”,

as a global pandemic. In order to combat the spread of COVID-19

governments worldwide have enacted emergency measures including

travel bans, legally enforced or self-imposed quarantine periods,

social distancing and business and organization closures. These

measures have caused material disruptions to businesses,

governments and other organizations resulting in an economic

slowdown and increased volatility in national and global equity and

commodity markets. The Company has implemented safety and physical

distancing procedures, including working from home where possible

and ceased all travel, as recommended by the various governments.

The Company will continue to monitor the impact of the COVID-19

outbreak, the duration and impact which is unknown at this time, as

is the efficacy of any intervention. It is not possible to reliably

estimate the length and severity of these developments and the

impact on the financial results and condition of the Company and

its operations in future periods.

- 20230621 LEM 2023Q2 press release

- Financial Report Q2

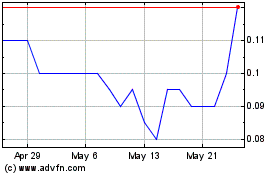

Leading Edge Materials (TSXV:LEM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Leading Edge Materials (TSXV:LEM)

Historical Stock Chart

From Dec 2023 to Dec 2024