NowVertical Group Inc. (TSXV: NOW) (“

NOW” or the

“

Company”) is pleased to announce the closing of

its previously announced marketed public offering (the

“

Public Offering”) of 4,569 senior unsecured

convertible debenture units of the Company (the “

Debenture

Units”) and its concurrent private placement of 500

Debenture Units (the “

Concurrent Private

Placement” and, together with the Public Offering, the

“

Offering”) at a price of $1,000 per Debenture

Unit for total gross proceeds of C$5,069,000. The Offering was

conducted on a “best efforts” agency basis by Echelon Wealth

Partners Inc. (the “

Agent”), as sole agent and

bookrunner.

Each Debenture Unit consists of one 10% senior

unsecured convertible debenture of the Company (each a

“Convertible Debenture”) having a face value of

C$1,000 (the “Principal Amount”) and 715 Class A

subordinate voting share purchase warrants of the Company (each a

“Warrant”, and collectively the

“Warrants”), representing 75% warrant

coverage.

The Convertible Debentures will mature 36 months

from the date hereof (the “Maturity Date”). The

Principal Amount per Convertible Debenture shall be convertible,

for no additional consideration, into Class A subordinate voting

shares of the Company (each a “Subordinate Voting

Share”) at the option of the holder (with the exception of

the Company Conversion as set out below) in whole or in part at any

time and from time to time prior to the earlier of: (i) the close

of business on the Maturity Date, and (ii) the business day

immediately preceding the date specified by the Company for

redemption of the Convertible Debentures upon a change of control

at a conversion price per share equal to C$1.05 subject to

adjustment in certain events (the “Conversion

Price”).

Each Warrant is exercisable for one Subordinate

Voting Share at a price of C$1.25 per Subordinate Voting Share for

a period of 36 months following the date hereof. The Company has

received approval from the TSX Venture Exchange (the

“TSXV”) to list the Warrants issued under the

Public Offering under the symbol “NOW.WT.A”. The Warrants are

expected to commence trading on the TSXV on the date hereof.

The Company will be entitled to force the

conversion (the “Company Conversion”) of the

Principal Amount of the then outstanding Convertible Debentures at

the Conversion Price on not more than 60 days’ and not less than 30

days’ notice (i) in the event that the daily volume weighted

average trading price of the Subordinate Voting Shares on the TSXV

is greater than C$1.60 per share for 10 consecutive trading days of

the Subordinate Voting Shares on the TSXV preceding such notice, or

(ii) in connection with an equity or similar financing (either

qualified by a prospectus or by way of private placement) involving

Subordinate Voting Shares, or warrants exercisable for Subordinate

Voting Shares, resulting in aggregate gross proceeds to the Company

of not less than C$12,500,000 (the “Qualified

Financing”), in each case subject to the Company

Conversion being permitted under the policies of the TSXV for any

trading of the Subordinate Voting Shares at that time. If a

Qualified Financing is completed at a price per security that is

lower than the Conversion Price (with such Conversion Price being

calculated, in the case of warrants, by adding the issue and

exercise price), the Conversion Price will be reduced to equal the

greater of $0.10 and the closing price of the Subordinate Voting

Shares on the TSXV on the day before the press release announcing

the Qualified Financing is disseminated, provided that, among other

things, the conditional approval of the TSXV is obtained.

The Company filed a prospectus supplement dated

September 26, 2022 in respect of the Public Offering, which

supplemented a short form base shelf prospectus of the Company

dated January 21, 2022, each of which was filed with the securities

commissions of each of the Provinces of Canada, except Quebec. The

prospectus supplement and the short form base shelf prospectus are

available on the Company’s SEDAR profile at www.sedar.com. There

have been no changes to the material terms of the Debenture Units

since the press release issued September 22, 2022 disclosing the

pricing terms of the Offering.

The Company intends to use the net proceeds of

the Offering for (i) deferred payments related to acquisitions,

(ii) working capital, and (iii) general corporate purposes.

The Convertible Debentures and Warrants issued

in respect of the Concurrent Private Placement are subject to a

four-month hold period and are therefore not freely tradeable until

February 6, 2023. In connection with the Offering, the Company paid

the Agent an agency fee comprised of a cash fee of $354,830 and the

issuance of 337,933 broker warrants, with $35,000 of such cash fee

and 33,333 of such broker warrants being paid or issued in respect

of the Concurrent Private Placement, as applicable.

This news release does not constitute an offer

to sell or a solicitation of an offer to sell any of securities in

the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”) or any state

securities laws and may not be offered or sold within the United

States or to U.S. persons unless registered under the U.S.

Securities Act and applicable state securities laws or an exemption

from such registration is available.

About NowVertical Group Inc.NOW

is a big data, analytics and Vertical Intelligence

(“VI”) software and solutions company growing

organically and through acquisition. NOW's VI solutions are

organized by industry vertical and are built upon a foundational

set of data technologies that fuse, secure, and mobilize data in a

transformative and compliant way. The NOW product suite enables the

creation of high-value VI solutions that are predictive in nature

and drive automation specific to each high-value industry

vertical.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

For more information about the Company, visit

www.nowvertical.com. For further information, please contact: Daren

Trousdell, Chief Executive Officere: daren@nowvertical.comt: (212)

302-0868

or

Glen Nelson, Investor Relationse: glen@nowvertical.comt: (403)

763-9797

Forward-Looking InformationThis

news release may contain forward–looking statements (within the

meaning of applicable securities laws) which reflect the Company's

current expectations regarding future events. Forward-looking

statements are identified by words such as "believe", "anticipate",

"project", "expect", "intend", "plan", "will", "may", "estimate"

and other similar expressions. These statements are based on the

Company's expectations, estimates, forecasts and projections and

include, without limitation, statements regarding the proposed use

of proceeds from the Offering, and the future success of the

Company's business.

The forward-looking statements in this news

release are based on certain assumptions. The forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties that are difficult to control or predict

(such risks include, among other things, the failure to use the

proceeds of the Offering as set forth herein). A number of factors

could cause actual results to differ materially from the results

discussed in the forward-looking statements. Readers, therefore,

should not place undue reliance on any such forward-looking

statements. Further, these forward-looking statements are made as

of the date of this news release and, except as expressly required

by applicable law, the Company assumes no obligation to publicly

update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise.

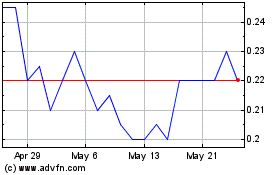

NowVertical (TSXV:NOW)

Historical Stock Chart

From Dec 2024 to Jan 2025

NowVertical (TSXV:NOW)

Historical Stock Chart

From Jan 2024 to Jan 2025