Chakana Acquires 1.0% NSR Royalty on Soledad Project, Peru

19 March 2019 - 11:30PM

Chakana Copper Corp. (TSX-V: PERU; OTC: CHKKF; FWB: 1ZX) (the

“

Company” or “

Chakana”),

announces that it has purchased a 1.0% Net Smelter Returns (NSR)

royalty (the “Royalty”) on the Soledad project from Minera

Vertiente Del Sol S.A.C, the registered owner of the Soledad

Property and a subsidiary of Condor Resources Inc. The Royalty is

independent of the Company’s 100% option agreement with Condor (see

Condor news release dated April 25, 2017). Exploration by Chakana

has highlighted the property’s gold, copper and silver potential,

and the royalty acquisition is in anticipation of continuing

success, simplifying the royalty structure and unburdening the

Company’s ultimate financial obligations.

The purchase price for the Royalty is US$565,000

comprised of US$275,000 in cash and 900,000 Chakana shares. The

Royalty covers Condor’s mining concessions and a 2-kilometer area

of interest.

Chakana previously had the right to re-purchase

50% of the 2% NSR royalty (or a 1% NSR) that would be granted to

Condor (the “Condor NSR”) for US$2,000,000 if Chakana exercises its

option to purchase Condor’s Soledad concessions. As a result of

Chakana purchasing the Royalty now, the option agreement between

the parties will be amended to reflect a reduction of the Condor

NSR royalty from 2% to 1%, with Chakana having the right to

re-purchase 50% of the Condor NSR royalty (or 0.5% NSR) for

US$1,000,000 subsequent to exercising the option agreement. If

Chakana does not exercise the option agreement to acquire Condor’s

Soledad concessions, Condor has the right to purchase 50% of the

Royalty (or 0.5% NSR) for US$1,000,000. The amendment to the option

agreement also eliminates Chakana’s pre-royalty payment

obligations. Chakana’s purchase of the Royalty is subject to TSX

Venture Exchange approval.

“The purchase of a 1% NSR royalty on a large

portion of the Soledad project where twelve of seventeen confirmed

breccia pipes occur captures significant value for Chakana

shareholders at a 70% discount to the original option agreement.

Purchasing the Royalty also increases Chakana’s flexibility to

raise future capital and reduces a financial burden on the project

that should enhance the project economics if mineral resources are

defined. The Royalty purchase affirms our confidence in the Soledad

project based on the initial drilling of four breccia pipes and the

extensive surface sampling and geophysical work completed to date,”

stated President and CEO David Kelley.

About the Soledad Project

The Soledad project is located in the Ancash

Province of central Peru, 35 kilometers south of Barrick’s Pierina

mine. The project has been subject to an aggressive exploration

program by Chakana since an initial 100% purchase option agreement

was established with Condor in April, 2017. Two subsequent

agreements expanded the land position to 3,085 hectares (see news

releases dated May 23, 2018 and July 16, 2018 on www.sedar.com).

The focus of exploration has been on high grade copper-gold-silver

mineralized tourmaline breccia pipes that crop out at surface. A

total of 25,211m of diamond drilling has been completed to date on

four of the seventeen known breccia pipes. Over sixty targets have

been defined on the property that have yet to be tested. A 20,000m

drill program planned for 2019 will commence immediately upon

approval of drill permits.

A table accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/fdd4edd1-1a61-4a7e-8711-6e194c499b72

* Reported mineralized intervals are not true

widths given the vertical nature of the breccia pipe and the steep

inclination of the holes. Cu_eq and Au_eq values were calculated

using copper, gold, and silver. Metal prices utilized for the

calculations are Cu – US$2.90/lb, Au – US$1,300/oz, and Ag –

US$17/oz. No adjustments were made for recovery as the project is

an early stage exploration project and metallurgical data to allow

for estimation of recoveries are not yet available. The formulas

utilized to calculate equivalent values are Cu_eq (%) = Cu% + (Au

g/t * 0.6556) + (Ag g/t * 0.00857) and Au_eq (g/t) = Au g/t + (Cu%

* 1.5296) + (Ag g/t * 0.01307).

Sampling and Analytical

Procedures

Chakana follows rigorous sampling and analytical

protocols that meet or exceed industry standards. Core samples are

stored in a secured area until transport in batches to the ALS

facility in Callao, Lima, Peru. Sample batches include

certified reference materials, blank, and duplicate samples that

are then processed under the control of ALS. All samples are

analyzed using the ME-MS41 (ICP technique that provides a

comprehensive multi-element overview of the rock geochemistry),

while gold is analyzed by AA24 and GRA22 when values exceed 10

g/t. Over limit silver, copper, lead and zinc are analyzed

using the OG-46 procedure. Soil samples are analyzed by 4-acid

(ME-MS61) and for gold by Fire Assay on a 30g sample

(Au-ICP21).

Qualified Person

David Kelley, an officer and a director of

Chakana, and a Qualified Person as defined by NI 43-101, reviewed

and approved the technical information in this news release.

ON BEHALF OF THE BOARD

(signed) “David Kelley” David Kelley President and CEO

For further information contact:Michelle Borromeo, Manager –

Corporate CommunicationsPhone: 604-715-6845 Email:

mborromeo@chakanacopper.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

Forward-looking Statement Advisory: This release

may contain forward-looking statements. Forward-looking statements

involve known and unknown risks, uncertainties, and other factors

which may cause the actual results, performance, or achievements of

Chakana to be materially different from any future results,

performance, or achievements expressed or implied by the

forward-looking statements. Forward looking statements or

information relates to, among other things, the interpretation of

the nature of the mineralization at the Soledad

copper-gold-silver project (the “Project”), the potential

to expand the mineralization, and to develop and grow a

resource within the Project, the planning for

further exploration work, the ability to de-risk the potential

exploration targets, and our belief in the potential

for mineralization within unexplored parts of the

Project. These forward-looking statements are based on management’s

current expectations and beliefs but given the uncertainties,

assumptions and risks, readers are cautioned not to place undue

reliance on such forward- looking statements or information. The

Company disclaims any obligation to update, or to publicly

announce, any such statements, events or developments except as

required by law.

A photo accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/ff092d05-897e-466e-869b-d0c2d3af37ed

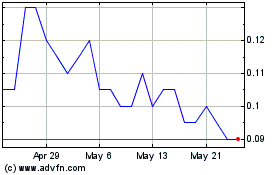

Chakana Copper (TSXV:PERU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Chakana Copper (TSXV:PERU)

Historical Stock Chart

From Jan 2024 to Jan 2025