Solar Alliance announces shares for debt transaction

02 March 2024 - 9:00AM

Solar Alliance Energy Inc. (‘Solar Alliance’ or the

‘Company’) (TSX-V: SOLR), a leading solar energy solutions

provider focused on the commercial and industrial solar sector,

announces that it intends to settle a total of $165,000 (the

“

Debt”) of accrued liabilities for directors' fees

owed to certain current directors of the Company (the “

Debt

Settlement”). The Debt began accruing in 2021.

The Company expects to settle the Debt by

issuing a total of 3,000,000 common shares of the Company (the

“Shares”) at a price of $0.055 per Share to these

individuals.

The board of directors and management of the

Company believe that the proposed shares for debt transaction is in

the best interests of the Company as it allows the Company to

preserve its funds for operations and continued growth

opportunities.

As the directors are insiders of the Company,

the issuance of the Shares in connection with the Debt Settlement

will be considered a “related party transaction” within the meaning

of Multilateral Instrument 61-101 – Protection of Minority Security

Holders in Special Transaction (“MI 61-101”). The

Company is relying on the exemption from the requirement for a

formal valuation and minority shareholder approval under MI 61-101

on the basis of the exemptions contained in section 5.5(1)(a) and

section 5.7(1)(a) of MI 61-101, as the fair market value of the

consideration of the Shares to be issued to the directors in

connection with the Debt Settlement is not expected to exceed 25%

of the Company’s market capitalization.

The Debt Settlement is subject to TSX Venture

Exchange approval.

The Shares will be subject to a statutory

four-month hold period from the date of issuance.

Myke Clark, CEO

|

For more information: |

|

Investor RelationsMyke Clark,

CEO416-848-7744mclark@solaralliance.com |

About Solar Alliance Energy Inc.

(www.solaralliance.com)Solar

Alliance is an energy solutions provider focused on the commercial,

utility and community solar sectors. Our experienced team of solar

professionals reduces or eliminates customers' vulnerability to

rising energy costs, offers an environmentally friendly source of

electricity generation, and provides affordable, turnkey clean

energy solutions. Solar Alliance’s strategy is to build, own and

operate our own solar assets while also generating stable revenue

through the sale and installation of solar projects to commercial

and utility customers. The Company currently owns two operating

solar projects in New York and actively pursuing opportunities to

grow its ownership pipeline. The technical and operational

synergies from this combined business model supports sustained

growth across the solar project value chain from design,

engineering, installation, ownership and

operations/maintenance.

Statements in this news release, other than

purely historical information, including statements relating to the

Company's future plans and objectives or expected results,

constitute Forward-looking statements. The words “would”, “will”,

“expected” and “estimated” or other similar words and phrases are

intended to identify forward-looking information. Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the Company’s actual results,

level of activity, performance or achievements to be materially

different than those expressed or implied by such forward-looking

information. Such factors include but are not limited to:

uncertainties related to the ability to raise sufficient capital;

changes in economic conditions or financial markets; litigation,

legislative or other judicial, regulatory, legislative and

political competitive developments; technological or operational

difficulties; the ability to maintain revenue growth; the ability

to execute on the Company’s strategies; the ability to complete the

Company’s current and backlog of solar projects; the ability to

grow the Company’s market share; the high growth US solar industry;

the ability to convert the backlog of projects into revenue; the

expected timing of the construction and completion of the 872 KW

Tennessee solar project; the targeting of larger customers; the

ability to predict and counteract the effects of COVID-19 on the

business of the Company, including but not limited to the effects

of COVID-19 on the construction sector, capital market conditions,

restriction on labour and international travel and supply chains;

potential corporate growth opportunities and the ability to execute

on the key objectives in 2023. Consequently, actual results may

vary materially from those described in the forward-looking

statements.

“Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release."

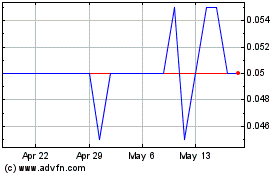

Solar Alliance Energy (TSXV:SOLR)

Historical Stock Chart

From Oct 2024 to Nov 2024

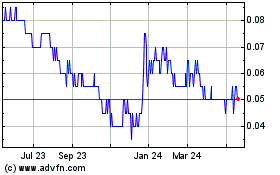

Solar Alliance Energy (TSXV:SOLR)

Historical Stock Chart

From Nov 2023 to Nov 2024