ValOre Metals Corp. (“ValOre”;

TSX‐V: VO; OTCQB: KVLQF;

Frankfurt: KEQ0) today provided an update on developments

concerning Hatchet Uranium Corp. (“HUC”), in which ValOre currently

holds a 67.5% ownership interest (CLICK HERE for ValOre news

release on May 29, 2024, for HUC incorporation transaction

details).

Hatchet Uranium Corp. has entered into

agreements with Skyharbour Resources Ltd. (“Skyharbour”), whereby

HUC may acquire an 80% interest in Skyharbour’s 9,339 ha Highway

Uranium Property (the “Optioned Highway Property”) and a 100%

interest, subject to a “claw-back” provision for Skyharbour, in

Skyharbour’s Genie, Usam and CBX/Shoe Uranium Projects (the

“Purchased Properties”) totalling 66,358 ha, all located peripheral

to the Athabasca Basin, in northern Saskatchewan, Canada.

Jim Paterson, Chairman and CEO of ValOre

commented: “With this transaction, ValOre shareholders gain growing

exposure to the exciting Canadian uranium exploration sector

through ValOre’s 67.5% ownership interest in Hatchet Uranium Corp.

(“HUC”). We are excited that HUC has formed a partnership with

Skyharbour Resources Ltd., a recognized leader in Canadian uranium

exploration, and HUC has strong support from the Canadian

investment community to advance a growing portfolio of projects in

one of the best places in the world to conduct mineral

exploration.”

HUC and Skyharbour Properties Summary table

|

Company |

Project |

Option / Purchase |

Claims |

Hectare |

| Hatchet Uranium Corp. |

Hatchet Lake |

|

6 |

13,711 |

|

|

|

|

|

|

| Skyharbour Resources Ltd. |

Usam |

Purchase |

12 |

40,041 |

| Skyharbour Resources Ltd. |

CBX |

Purchase |

7 |

8,777 |

| Skyharbour Resources Ltd. |

Shoe |

Purchase |

1 |

609 |

| Skyharbour Resources Ltd. |

Genie |

Purchase |

5 |

16,930 |

| Skyharbour Resources Ltd. |

Highway |

Option |

4 |

9,339 |

|

|

|

|

|

|

| Total |

|

|

35 |

89,407 |

| |

|

|

|

|

Figure 1: Location Map of Hatchet Lake and

Skyharbour’s optioned and purchased properties

Terms of the Optioned Highway

Property

HUC may acquire an 80% interest in the Highway

Property by (i) issuing common shares in the capital of HUC

(“Shares”) having an aggregate value of CAD $1,050,000; (ii) making

cash payments totaling CAD $245,000; and (iii) incurring an

aggregate of CAD $2,050,000 in exploration expenditures over a

three-year period, as follows:

|

Date |

Cash Payments |

Exploration Expenditures |

Value of Shares Issued |

|

On or before the first anniversary of Closing |

$25,000 |

$250,000 |

$25,000(1) |

|

On or before the second anniversary of Closing |

$20,000 |

$300,000 |

$25,000(1) |

|

On or before the third anniversary of Closing |

$200,000 |

$1,500,000 |

$1,000,000(1) |

|

TOTAL |

$245,000 |

$2,050,000 |

$1,050,000 |

(1) Deemed pricing of the Shares is based on the

twenty (20) day volume-weighted average price on either the TSX

Venture Exchange or the Canadian Securities Exchange if HUC shall

list its Shares for trading, being the (“Deemed Price”) or the last

sale price, if not listed on a stock exchange at the time of

issuance.

If the issuance of Shares result in Skyharbour

holding 10% or more of the outstanding common shares of HUC, HUC

will only issue that number of Shares that would result in

Skyharbour receiving 9.9% of the post-issuance issued and

outstanding HUC share capital, and HUC will pay cash in lieu for

Shares not issued.

The obligations of HUC under the option

agreement are subject to the following conditions (i) HUC

completing a financing for minimum gross proceeds of $1,500,000,

(ii) the sale of the Genie, Usam and CBX/Shoe Uranium Projects by

Skyharbour to HUC, and (iii) HUC having listed the HUC Shares on

the TSX Venture Exchange or the Canadian Securities Exchange or

having sold its interest to or combined with a similarly listed

issuer.

Skyharbour shall retain a 2% net smelter returns

royalty from minerals mined and removed from the Highway Property,

of which HUC may purchase one-half, being 1%, at any time for

CAD$1,000,000.

Highway Property Summary

The Highway Property comprises four (4) mineral

claims covering approximately 9,339 hectares located approximately

41 km south of Cameco Corporation’s formerly-producing Rabbit Lake

Mine and 11 km southwest of Uranium Energy Corp.’s West Bear U and

Co-Ni Deposits. Highway 905 transects the property, providing

excellent access for exploration.

There has been limited recent exploration

carried out on the project, but there is the potential for

high-grade basement-hosted uranium mineralization. The Highway

Property is underlain by Wollaston Supergroup metasedimentary

gneisses (pelitic to psammopelitic and psammitic to meta-arkosic)

folded around and overlying an Archean felsic gneiss dome, which

outcrops in the southwestern portion of the property and covers a

northeast trending antiformal fold nose. The Highway Property is

located approximately 7 km east of the present-day margin of the

Athabasca Basin, but the area is believed to have been covered by

Athabasca sandstone in the past.

Figure 2: Highway Property Location Map

Terms of the Purchased

Properties

The Purchased Properties comprise twenty-five

(25) mineral claims covering approximately 66,358 hectares. HUC may

acquire a 100% interest in the Purchased Properties by, on the date

of closing (the “Closing Date”), paying Skyharbour $25,000 and

issuing to Skyharbour such number of units in the capital of HUC

(“HUC Units”) equal to 9.9% of the issued and outstanding Shares

immediately following issuance. Each HUC Unit shall be comprised of

one Share and one share purchase warrant, entitling Skyharbour to

purchase one additional Share for a period of three years at a

price that is a 25% premium to the deemed value of the Shares in

both years 1 and 2, and then increases to a 50% premium to the

issuance value of the Shares in year 3.

Skyharbour shall retain a claw-back provision

whereby, within 90 days after the 3rd anniversary of the Closing

Date. Skyharbour may elect by written notice to HUC of its

intention to purchase back a twenty-five percent (25%) interest in

the Purchased Property by, within 90 days of delivery of such

notice, incurring exploration expenditures or paying cash in lieu

of to fund future exploration, equivalent to fifty percent (50%) of

the total amount that HUC had spent during the term that is three

years from the Closing Date in exploration expenditures on the

Purchased Property. If HUC has not incurred any exploration

expenditures during the three years following the closing date,

then Skyharbour shall automatically receive the 25% interest in the

Property.

The obligation of HUC to acquire the Purchased

Properties is subject to the following conditions (i) HUC

completing a financing for minimum gross proceeds of $1,500,000,

(ii) the closing of the Option of the Highway Uranium Property from

Skyharbour to HUC, and (iii) HUC having listed the HUC Shares on

the TSX Venture Exchange or the Canadian Securities Exchange or

having sold its interest to or combined with a similarly listed

issuer. If the conditions listed in items (i) and (iii) above are

not completed within 18 months, HUC’s right to acquire the

Purchased Property will terminate. If, after 12 months, the

conditions listed in items (i) and (iii) above are not satisfied,

HUC shall pay Skyharbour a monthly fee of $10,000 until such

conditions are satisfied or an aggregate of $60,000 has been paid,

whichever occurs first.

Skyharbour shall also retain a 2% net smelter

returns royalty from minerals mined and removed from the Purchased

Property, of which HUC may purchase one-half, being 1%, at any time

for $2,000,000.

Genie Property Summary

The Genie property consists of five (5) claims

totalling 16,930 ha, located approximately 48 km northeast of

Cameco’s formerly-producing Eagle Point Uranium Mine (Rabbit Lake

Operation) and 40 km north of Wollaston Lake Post. The project is

underlain by Wollaston Supergroup metasedimentary gneisses and

Archean granitoids, with prospective pelitic to psammopelitic

gneisses (including graphitic varieties) and several north-trending

faults related to the Tabbernor fault system being mapped on the

property. The project lies outside the current extent of the

Athabasca Basin but is believed to have been overlain by now-eroded

Athabasca sandstones in the past and has the potential for

high-grade basement-hosted and unconformity-related uranium

mineralization. The property is underlain by a series of linear

magnetic highs (interpreted as granitoids) and magnetic lows

(interpreted as metasedimentary gneisses), cross-cut by a highly

magnetic northwest-trending Mackenzie Diabase dyke.

Previous work on the Genie project includes

limited diamond drilling (three historical drill holes, of which

one was abandoned in overburden) and a variety of airborne and

ground geophysical surveys, prospecting, geological mapping, lake

sediment and overburden sampling, and soil sampling. Most of this

exploration work took place between 1966 to 1980, prior to the

advent of modern geophysical methods and geological models, but in

2014 part of the Genie property was covered by a helicopter-borne

DIGHEM magnetic, electromagnetic, and radiometric survey. The

survey showed a strong central EM conductor following a

magnetically inferred contact on the two northeastern most claims,

which is locally disrupted by several moderately conductive N-S

trending structural breaks, inferred to be faults. This strong

conductor is highly prospective for uranium mineralization, and

drilling done in 1969 and 1971 has confirmed the presence of

graphitic and sulfide-containing pelitic gneisses on the property.

Lake sediment samples, also collected at Genie during the 2014

exploration program, contained up to 63.3 ppm U, further showcasing

the prospectivity of the property.

Figure 3: Genie Property Location Map

Usam Property Summary

The Usam Project consists of twelve (12) claims

totalling 40,041 ha located approximately 16 km northeast of

Cameco’s Eagle Point Mine (Rabbit Lake Operation). The project has

numerous EM conductors that are associated with significant

magnetic lows of the Wollaston Domain. While the project is outside

the current confines of the Athabasca Basin, the area was overlain

by Athabasca sandstones historically. Basement rocks on the

property include Wollaston Supergroup metasediments and Archean

granitoid gneisses, with highly prospective pelitic to

psammopelitic gneisses (including graphitic varieties) making up

the largest proportion of the basement rocks. Several

north-trending faults related to the Tabbernor fault system

cross-cut the property.

Previous work on the project includes diamond

drilling (12 holes), lake sediment sampling, soil sampling,

geological mapping, ground and airborne geophysics, marine seismic,

prospecting, and other geochemical sampling, the majority of which

was done in the 1980's and 1970's. Modern exploration of the

property has been limited to geophysics and ground prospecting. As

such there is a significant untested potential on the project.

Trenching on Cleveland Island uncovered up to 0.31% U3O8 in

mineralized pegmatite, and diamond drilling on Gilles Island

intersected anomalous uranium, indicating that the basement rocks

underling the Usam property are fertile sources of uranium in

addition to containing pegmatite- and granite-hosted U-Th-REE

mineralization. There are also several sedimentary-hosted base

metals (i.e. Cu and Zn) showings on the project and in the

surrounding area, which show similarities to the sedimentary-hosted

Cu mineralization previously discovered by Rio Tinto and its

partners at the Janice Lake Project further southwest in the

Wollaston Domain.

Figure 4 – Usam Property Location Map

CBX/Shoe Property Summary

The CBX property has been recently expanded

through staking to include five (5) additional claims adjoining the

previously staked CBX and Shoe properties, which have been combined

to include a total of seven (7) claims covering 8,777 hectares. The

609 ha Shoe property has remained unchanged, with both CBX and Shoe

now consisting of eight non-contiguous claims totalling 9,386

hectares.

The new claims lie approximately 6.5 km to 25 km

northeast of the Eagle Point uranium mine and cover the northern

shore of Wollaston Lake including parts of Cunning Bay. Outcrop

exposure on the property is poor, but historical mapping and

drilling shows that the newly expanded CBX project is underlain by

a mixture of Wollaston Supergroup metasedimentary gneisses,

Hudsonian intrusives, and Archean felsic gneisses of the Western

Wollaston Domain. Similar lithologies host uranium mineralization

at the Rabbit Lake operation, including the Eagle Point deposit,

and other uranium deposits in the Athabasca Basin and surrounding

regions. The CBX and Shoe properties have had historical

exploration, including airborne and ground geophysical surveys,

lake sediment, soil, and spruce geochemical surveys, till sampling,

prospecting, geological mapping, and a marine seismic survey, but

the majority of this work took place in the 1960's to 1980's, with

limited modern exploration work being carried out on a small

portion of the CBX and Shoe properties.

Figure 5: CBX/Shoe Property Location Map

Quality Assurance/Quality Control

(“QA/QC”)

CLICK HERE for a summary of ValOre’s policies

and procedures related to QA/QC and grade interval reporting.

Qualified Person (“QP”)

The technical information in this news release

has been prepared in accordance with Canadian regulatory

requirements set out in NI 43-101 and reviewed and approved by

Thiago Diniz, P.Geo., ValOre’s QP and Vice President of

Exploration.

About Hatchet Uranium Corp.

Hatchet Uranium Corp. was incorporated by ValOre

on February 7, 2024. Jim Paterson, ValOre’s Chairman and Chief

Executive Officer, serves as HUC’s Chief Executive Officer and sole

director. HUC’s head and registered office is located at Suite 1020

- 800 West Pender Street, Vancouver, BC V6C 2V6.

About Skyharbour Resources

Ltd.

Skyharbour holds an extensive portfolio of

uranium exploration projects in Canada's Athabasca Basin and is

well positioned to benefit from improving uranium market

fundamentals with interest in twenty-nine projects, ten of which

are drill-ready, covering over 580,000 hectares (over 1.4 million

acres) of land. Skyharbour has acquired from Denison Mines, a large

strategic shareholder of Skyharbour, a 100% interest in the Moore

Uranium Project, which is located 15 kilometres east of Denison's

Wheeler River project and 39 kilometres south of Cameco's McArthur

River uranium mine. Moore is an advanced-stage uranium exploration

property with high-grade uranium mineralization at the Maverick

Zone that returned drill results of up to 6.0% U3O8 over 5.9

metres, including 20.8% U3O8 over 1.5 metres at a vertical

depth of 265 metres (see news release dated February 27th, 2017,

titled: “Skyharbour Intersects 20.8% U3O8 over 1.5 Metres in First

Drill Hole at Maverick Zone and Discovers New High-Grade Uranium

Lens on Moore Lake Uranium Project”). Adjacent to the Moore Project

is the Russell Lake Uranium Project, in which Skyharbour is an

operator with joint-venture partner RTEC. The project hosts several

high-grade uranium drill intercepts over a large property area with

robust exploration upside potential. Skyharbour is actively

advancing these projects through exploration and drill

programs.

Skyharbour also has joint ventures with industry

leader Orano Canada Inc., Azincourt Energy, and Thunderbird

Resources (previously Valor) at the Preston, East Preston, and Hook

Lake Projects respectively. Skyharbour also has several active

earn-in option partners, including CSE-listed Basin Uranium Corp.

at the Mann Lake Uranium Project; CSE-listed Medaro Mining Corp. at

the Yurchison Project; TSX-V listed North Shore Uranium at the

Falcon Project; UraEx Resources at the South Dufferin and Bolt

Projects; Hatchet Uranium at the Highway Project and TSX-V listed

Terra Clean Energy (previously Tisdale) at the South Falcon East

Project which hosts the Fraser Lakes Zone B uranium and thorium

deposit. In aggregate, Skyharbour has now signed earn-in option

agreements with partners that total over $40 million in

partner-funded exploration expenditures, over $30 million worth of

shares being issued, and over $21 million in cash payments coming

into Skyharbour, assuming that these partner companies complete

their entire earn-ins at the respective projects.

Skyharbour's goal is to maximize shareholder

value through new mineral discoveries, committed long-term

partnerships, and the advancement of exploration projects in

geopolitically favourable jurisdictions.

Skyharbour’s Uranium Project Map in the Athabasca

Basin:

https://www.skyharbourltd.com/_resources/images/SKY_SaskProject_Locator_2024-02-14_V2.jpg

To find out more about Skyharbour Resources Ltd.

(TSX-V: SYH) visit Skyharbour’s website

at www.skyharbourltd.com.

About ValOre Metals Corp.

ValOre Metals Corp.

(TSX‐V: VO) is a

Canadian company with a team aiming to deploy capital and knowledge

on projects which benefit from substantial prior investment by

previous owners, existence of high-value mineralization on a large

scale, and the possibility of adding tangible value through

exploration and innovation.

ValOre’s Pedra Branca Platinum Group Elements

Project comprises 45 exploration licenses covering a total area of

51,096 hectares (126,260 acres) in northeastern Brazil. At Pedra

Branca, 7 distinct PGE+Au deposit areas host, in aggregate, a 2022

NI 43-101 inferred resource of 2.198 Moz 2PGE+Au contained in 63.6

Mt grading 1.08 g/t 2PGE+Au. ValOre’s team believes the Pedra

Branca project has significant exploration discovery and resource

expansion potential. (CLICK HERE to download 2022 technical report*

and CLICK HERE for news release dated March 24, 2022).

*The 2022 Technical Report entitled “Independent

Technical Report –Mineral Resource Update on the Pedra Branca PGE

Project, Ceará State, Brazil” was prepared as a National Instrument

43-101 Technical Report on behalf of ValOre Metals Corp. with an

effective date of March 08, 2022. The 2022 Technical Report by

independent qualified persons, Fábio Valério (P.Geo.) and Porfirio

Cabaleiro (P.Eng.), of GE21, commissioned to complete the mineral

resource estimate while Chris Kaye of Mine and Quarry Engineering

Services Inc. (MQes), was commissioned to review the metallurgical

information. The Mineral Resource estimates were prepared in

accordance with the CIM Standards, and the CIM Guidelines, using

geostatistical, plus economic and mining parameters appropriate to

the deposit. Mineral Resources, which are not mineral reserves, do

not have demonstrated economic viability, and may be materially

affected by environmental, permitting, legal, marketing, and other

relevant issues. Mineral Resources are based upon a cut-off grade

of 0.4 g/t PGE+Au, correlated to Pd_eq grade of 0.35 g/t, and were

limited by an economic pit built in Geovia Whittle 4.3 software and

following the geometric and economic parameters as disclosed in the

2022 NI 43-101 Technical Report.

On behalf of the Board of Directors,

“Jim Paterson”

James R. Paterson, Chairman and CEO

ValOre Metals Corp.

For further information about ValOre Metals

Corp. or this news release, please visit our website at

www.valoremetals.com or contact Investor Relations at 604.646.4527,

or by email at contact@valoremetals.com.

ValOre Metals Corp. is a proud member of

Discovery Group. For more information, please visit:

http://www.discoverygroup.ca/

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release contains “forward-looking

statements” within the meaning of applicable securities laws.

Although ValOre believes that the expectations reflected in its

forward-looking statements are reasonable, such statements have

been based on factors and assumptions concerning future events that

may prove to be inaccurate. These factors and assumptions are based

upon currently available information to ValOre. Such statements are

subject to known and unknown risks, uncertainties and other factors

that could influence actual results or events and cause actual

results or events to differ materially from those stated,

anticipated or implied in the forward-looking statements. A number

of important factors including those set forth in other public

filings could cause actual outcomes and results to differ

materially from those expressed in these forward-looking

statements. Factors that could cause the actual results to differ

materially from those in forward-looking statements include the

future operations of ValOre and economic factors. Readers are

cautioned to not place undue reliance on forward-looking

statements. The statements in this press release are made as of the

date of this release and, except as required by applicable law,

ValOre does not undertake any obligation to publicly update or to

revise any of the included forward-looking statements, whether as a

result of new information, future events or otherwise. ValOre

undertakes no obligation to comment on analyses, expectations or

statements made by third parties in respect of ValOre, or its

financial or operating results or (as applicable), their

securities.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/7b3f7222-c9ee-4f36-b975-992fa5506544

https://www.globenewswire.com/NewsRoom/AttachmentNg/d458b3b7-d1a5-4a1b-901a-0504c86c7c3f

https://www.globenewswire.com/NewsRoom/AttachmentNg/ff11d84a-a771-4d8f-b2fc-719e2d2d1253

https://www.globenewswire.com/NewsRoom/AttachmentNg/276399d4-1146-49b4-a462-7045bbe340ae

https://www.globenewswire.com/NewsRoom/AttachmentNg/4c31f893-5f8c-4b49-9581-82007d3941c9

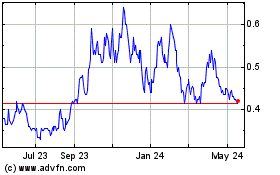

Skyharbour Resources (TSXV:SYH)

Historical Stock Chart

From Dec 2024 to Jan 2025

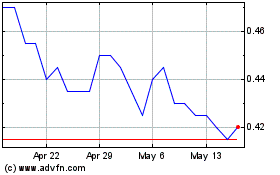

Skyharbour Resources (TSXV:SYH)

Historical Stock Chart

From Jan 2024 to Jan 2025