Turmalina Metals Corp. (“

Turmalina”, or the

“

Company”; TBX-TSXV, TBXXF-OTCQX, 3RI-FSE) is

pleased to announce the discovery of a high-grade gold vein system

and a new copper-gold mineralized breccia pipe following the

successful completion of 2,984 m of diamond drilling at the

Company’s 403 km2 San Francisco project located in the prolific

mining province of San Juan, Argentina (the

“Project” or

“San Francisco”).

The recently completed 22-hole program included maiden drilling at

5 targets over the extensive project area (Figure 3).

Initial mapping and sampling at Veta Rica

defined a low-sulfidation epithermal quartz vein, 1 to 6 m wide,

outcropping over 300 meters of strike length that returned rock

chip assays of up to 56 g/t Au (Figures 1 & 5). Two holes were

drilled from the same drill pad with both intersecting high-grade

gold at depth (see core photos in Figure 4) including:

- 4.4 m @

6.4 g/t Au; SFDH-078 from 36.6 m.

- Including

0.5 m @28.6 g/t Au from 36.6 m.

- And

0.45 m @ 14.12 g/t Au from 38.85 m.

- 8.75 m

@ 3.5 g/t Au; SFDH-079 from 42 m.

-

Including 6.0 m @ 4.6 g/t Au from 42 m.

-

Including 1.18 m @ 17.9 g/t Au from 42 m.

Follow up mapping has defined a series of

epithermal veins extending for up to 1.5 km, both along strike, and

parallel with, the drilled Veta Rica vein, with assay results

pending (Figure 5). Mapping is ongoing and the system remains open

along strike and at depth. The Project area is located within a

known epithermal gold belt: The nearest such epithermal system is

located at Austral Gold’s Casposo mine, 70 km south of the Veta

Rica discovery. Casposo produced, between 2011 and 2015, 283,000 oz

of gold and 9.6M oz of silver with average grades of 4.8 g/t Au and

183 g/t Ag. Between 2017 and 2019 another 32,000 oz of gold and 3 M

oz of silver were produced before the mill was placed back into

care and maintenance.

Figure 1: Veta Rica Surface map

and sections showing drill holes. Rock chip sampling of the Veta

Rica vein 300m west of the drill target returned grades of up to 27

g/t Au.

The drilling program also tested the Ethan

breccia pipe, a large (~ 200 m long by 100 m wide; Figure 7)

tourmaline breccia pipe that returned strong surface trench assays

(i.e. 30m @ 0.8 % Cu). Two reverse circulation (RC) and three

diamond holes were drilled at the Ethan Breccia. These scout holes

intercepted the strongest tourmaline breccia mineralization

discovered to date at the Project outside of the high-grade San

Francisco breccia, with intercepts including:

- 31 m @

0.42 % Cu, 0.31 g/t Au & 2 g/t Ag (0.66 % CuEq);

SFRC-061 from 3 m.

- Including

10 m @ 0.72 % Cu, 0.53 g/t Au & 5 g/t Ag (1.2 %

CuEq) from 6 m.

- 8 m @

0.71 % Cu, 0.68 g/t Au & 1 g/t Ag (1.2 % CuEq);

SFDH-062 from 27 m.

- 33.8 m

@ 0.45 % Cu, 0.18 g/t Au & 5 g/t Ag (0.63 % CuEq);

SFDH-063 from surface.

-

Including 14 m @ 0.72 % Cu, 0.16 g/t Au & 9 g/t Ag

(0.93 % CuEq) from surface

Mr James Rogers, Chief Executive Officer,

states:

“We are very pleased to announce that the San

Francisco project has delivered Turmalina an exciting development

with the discovery of high-grade gold in the extensive Veta Rica

epithermal vein system. This mineralization is similar to that of

several epithermal mines located along-strike of our project,

including Austral Gold’s Casposo Mine, located 70 km to the

south. Ony two holes have been drilled into this new

discovery, and both holes have returned grades of over 17 g/t Au.

Ongoing surface work has already extended the strike length of the

vein system from 300 m to over 1.5 km. To have intercepted

high-grade gold veins in such a prolific epithermal gold district

continues to demonstrate the value of our large land package in San

Juan: the largest gold producer and most mining-friendly state in

Argentina.

“While the San Francisco breccia pipe is an

outstanding high-grade asset, we are pleased to add the Ethan

Breccia to our portfolio of mineralized breccias. It’s encouraging

to see the strong copper mineralization in shallow drilling at

Ethan, a breccia pipe that is nearly four times the width of the

San Francisco pipe, and our team is currently reviewing and

modelling the results.”

Figure 2: Veta Rica discovery hole drill core

being examined by CEO James Rogers.

Three other prospects were tested during the

program. Eight holes were drilled to test intrusion-hosted

stockwork veining at Tres Magos, returning multiple short intervals

of Ag-Pb-Zn±Cu-Au mineralization (i.e. 1.3m of 0.5% Cu, 13 g/t Ag,

0.3 % Pb & 0.4 % Zn; 0.9 % CuEq, SFDH-076 from 51.8 m). Three

holes were drilled to test intermediate sulfidation epithermal

veins at Veta Amarilla, which returned short intervals of

Ag-Au-Pb-Zn mineralization (i.e. 1 m @ 18 g/t Ag, 0.3 g/t Au, 0.5 %

Pb & 0.2 % Zn; 0.5 % CuEq, SFDH-071 from 28 m). Three holes

testing low sulfidation epithermal quartz veins at Veta Alumbrera

did not return any significant results. Intersections for all

prospects are listed in Table 2.

Figure 3: Map showing the block of properties

controlled by Turmalina Metals with the drill targets locations

drilled in this campaign and the San Francisco Breccia.

Current Work

Initial exploration efforts at San Francisco

were focussed on breccia mineralization. Through the Company’s

extensive exploration work, led by Chico Azevedo, the project has

greatly expanded into highly prospective areas containing a number

of vein, intrusion-related, porphyry and breccia targets.

While the San Francisco breccia pipe remains one

of the highest-grade tourmaline Cu-Au breccia pipes ever discovered

(see select results in Table 1) the Company is most excited about

the exploration potential for high-grade gold-silver and

polymetallic vein types and other mineralization styles. The Veta

Rica discovery exemplifies the style of epithermal mineralization

commonly found in the district.

The Turmalina technical team is currently in the

field continuing surface work on the new Veta Rica discovery along

with other nearby targets. A follow up diamond drilling program is

currently being planned to further test the Veta Rica target along

strike and at depth. Our team is also currently modelling the Ethan

Breccia discovery with an aim of designing follow-up drill holes in

this large breccia system.

Grant of Stock Options and RSUs

The Company announces that it has granted

options to acquire a total of 1,225,000 common shares of the

Company to officers, directors, employees, and consultants,

pursuant to the Company's Stock Option Plan, at the exercise price

of $0.35 per share for a period of five years.

Additionally, the Company has granted 5,400,000

restricted stock units (“RSUs”) to officers, directors, employees,

and consultants of the Company under the terms of the Company’s

restricted share unit plan (the “RSU Plan”) and which have a

two-year vesting period.

About The San Francisco

Project

The 40,340 ha San Francisco project is located

in the pro-mining province of San Juan, Argentina, a country where

there are currently 12 operating mines, 5 in construction and 20 in

pre-feasibility/feasibility stage. The project benefits from

well-developed infrastructure and is 130 km northeast of the

regional capital San Juan.

The San Francisco Project was assembled around,

and includes, one of the highest-grade tourmaline breccias of the

same name. The land position at San Francisco was expanded in 2022

and now includes multiple mineralized targets including more than

60 breccias, intrusion-related gold and epithermal vein-type

targets.

Turmalina has developed an operational centre in

the town of Villa Nueva, where the local community welcomes new

exploration efforts in the region.

Turmalina has several option agreements to acquire 100% of

certain titles of the SFDLA project and a right to explore and

exploit other titles from the government of San Juan.

Table 1: Selected highlight of

previous Company drilling at the San Francisco Breccia Pipe

|

Hole ID |

Target |

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Ag (g/t) |

Cu (%) |

Pb (%) |

Zn (%) |

AuEq g/t |

CuEq % |

|

SFDH-012 |

SF BX |

12 |

121 |

109 |

4.94 |

109 |

1.13 |

0.23 |

0.06 |

8.00 |

5.49 |

|

SFDH-039 |

SF BX |

397.7 |

470 |

72.3 |

0.71 |

100 |

3.47 |

0.31 |

0.69 |

7.07 |

4.85 |

|

SFDH-038 |

SF BX |

0 |

81 |

81 |

2.33 |

63.94 |

0.23 |

0.23 |

0.38 |

3.50 |

2.40 |

|

SFDH-011 |

SF BX |

25 |

108 |

83 |

4.4 |

82 |

0.43 |

0.74 |

0.52 |

6.09 |

4.18 |

|

SFDH-011 |

SF BX |

27 |

68 |

41 |

7.03 |

91 |

0.51 |

0.23 |

0.02 |

8.96 |

6.14 |

*Intersections are not true widths and

additional drilling and geological modelling of the mineralized

zones in the breccia pipes is required to determine the true widths

of the drill hole intersections. Intersections are selected based

on a 0.5 g/t Au or 0.3% Cu cut-off grade, a minimum downhole length

of 2m and a maximum waste inclusion of 2 consecutive meters.

Equivalent gold (AuEq) and equivalent copper (CuEq) values are

calculated assuming 100% recovery using USD$ 1770 oz Au, $23 oz Ag

and $8300/t Cu (~$3.8/lb). Results from the drilling on this

project can be found in Company News releases with the following

dates: March 23, August 28, October 5 & December 7, 2020 and

January 25, March 30, June 8 & August 30 2021.

On Behalf of the Company,

Mr James Rogers Chief Executive Officer and Director.

Website: turmalinametals.comAddress: #1507 - 1030 West Georgia

St, Vancouver, BC V6E 3V7.

For Investor Relations enquiries, please contact Highland

Contact at +1 833 923 3334 (toll free) or via

info@turmalinametals.com.

Statements

About Turmalina Metals and our

projects: Turmalina Metals is a TSXV-listed exploration

company focused on developing our portfolio of high-grade

gold-copper-silver projects in South America. Our focus is on

tourmaline breccias, a deposit style overlooked by many explorers.

Turmalina Metals is led by a team responsible for multiple

gold-copper-silver discoveries who are highly experienced in this

deposit style. Our projects are characterised by open high-grade

mineralization on established mining licenses that present

compelling drill targets. The principal project held by Turmalina

is the San Francisco project in San Juan, Argentina. For further

information on the San Francisco Project, refer to the technical

report entitled “NI43-101 Technical Report San Francisco Copper

Gold Project, San Juan Province, Argentina” dated November 17, 2019

under the Corporation’s profile at www.sedar.com. Turmalina is also

exploring the Chanape project in Peru. For further information on

Chanape please refer to the technical report “National Instrument

43-101 Technical Report on the Chanape Gold-Silver-Copper Project”

dated July 5, 2022 under the Corporation’s profile at

www.sedar.com.

Sampling and Analytic

procedure: Turmalina Metals follows systematic sampling

and analytical protocols which exceed industry standards and are

summarized below.

All drill holes are PQ, HQ or NQ diameter

diamond core holes. At San Francisco, drill core is collected at

the drill site and transported by vehicle to the Turmalina core

logging facility in Villa Nueva where recovery measurements are

taken before the core is photographed and geologically logged. The

core is then cut in half with a diamond saw blade with half the

sample retained in the core box for future reference and the other

half placed into a pre-labelled plastic bag, sealed with a plastic

zip tie, and identified with a unique sample number. The core is

typically sampled over a 0.5 to 1.5 meter sample interval unless

the geologist determines the presence of an important geological

contact. In this case, the samples can have a minimum of 20

centimetres length. The bagged samples are then stored in a secure

area pending shipment to the ALS laboratory in Lima where they are

dried, crushed and pulverized. Following sample preparation the

prepared pulps are then analysed using a 50g digested sample and

fire assay-AA finish analysis for gold and four acid digestion with

ICP-MS analysis for 53 other elements. Samples with results that

exceed maximum detection values for gold are re-analysed by fire

assay with a gravimetric finish and other elements of interest are

re-analysed using precise ore-grade ICP analytical techniques.

Turmalina Metals independently inserts certified

control standards, coarse field blanks and duplicates into the

sample stream to monitor data quality (‘QA/QC’ samples). These

QA/QC samples are inserted “blindly” to the laboratory in the

sample sequence prior to departure from the Turmalina Metals core

storage facilities. For drill core samples 8 QA/QC samples are

inserted into each 70-sample dispatch: 1 blank sample, 5

commercially-prepared standards, 1 core duplicate sample and 1

control sample from the SF mine.

The assay results for the QA/QC samples are

checked and verified by the project geologist and the Qualified

Person. All such QA/QC assay results from sample dispatches

reported in this news release have been found to be within

acceptable industry limits, and the Qualified Person is not aware

of any sampling, recovery or any other factors that could

materially affect the accuracy or reliability of the data.

Qualified Person: The

scientific, technical and analytical data contained in this news

release pertaining to the San Francisco and Chanape projects has

been reviewed and approved by Dr. Rohan Wolfe, Technical Advisor,

MAIG, who serves as the Qualified Person (QP) under the definition

of National Instrument 43-101.

Forward Looking Statement: This

news release contains certain "forward-looking statements" within

the meaning of such statements under applicable securities law.

Forward-looking statements are frequently characterized by words

such as "anticipates", "plan", "continue", "expect", "project",

"intend", "believe", "anticipate", "estimate", "may", "will",

"potential", "proposed", "positioned" and other similar words, or

statements that certain events or conditions "may" or "will" occur.

These statements are only predictions. Various assumptions were

used in drawing the conclusions or making the projections contained

in the forward-looking statements throughout this news release.

Forward-looking statements are based on the opinions and estimates

of management at the date the statements are made and are subject

to a variety of risks (including those risk factors identified in

the Corporation’s prospectus dated November 21, 2019) and

uncertainties and other factors that could cause actual events or

results to differ materially from those projected in the

forward-looking statements. The Corporation is under no obligation,

and expressly disclaims any intention or obligation, to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as expressly

required by applicable law.

Figure 4: Veta Rica drill core from drill hole

SFDH-079 with gold grades (g/t).

Figure 5: Follow up mapping and sampling at

Veta Rica area has already defined a series of quartz veins

along-strike and in parallel to the drilled outcrop. This low

sulfidation epithermal system has been mapped up to 1.5km from the

drill site, and remains open along-strike and at depth. Detailed

sampling of all veins is underway, with assays pending. Numbers

refer to photos in Figure 6.

Figure 6: Photographs from the current Veta

Rica sampling program (locations in Figure 4): (1) low sulphidation

epithermal quartz vein hosted in strongly sericite-altered

granodiorite. (2) ) Quartz vein displaying strong boxwork texture

(hematite and jarosite) after weathered sulphides. Assays for both

sites pending.

Figure 7: Geological map of the Ethan breccia

with samples and drill hole locations. Drilling has shown that the

two lobes mapped at surface represent one breccia body measuring

200m by 100 m at the surface.

Figure 8: Cross section at the Ethan Breccia.

Hole SFDH-63 was drilled parallel to hole SFRC-061, which was lost

at 69m and had intersected 31m @ 0.66% of CuEq. The Company is

currently modelling the distribution of grade in this large breccia

body.

Figure 9: Cu-Au breccia mineralization at

Breccia Ethan (A) Typical

quartz-tourmaline-pyrite-chalcopyrite-chalcocite breccia (SFDH-063,

13 to 40 m). (B) Strong malachite staining of a quartz-tourmaline

breccia. From a 0.9m long sample that returned 0.79 g/t Au, 5.8 g/t

Ag & 0.66 % Cu (SFDH-063, 21.75-22.65m). Photographs are of a

selected interval and is not necessarily representative of

mineralisation hosted throughout the property.

Table 2: Significant drillhole

intersections from 2023 drilling at the San Francisco Project

|

Prospect |

Hole_ID |

|

From |

To |

Interval |

Au (g/t) |

Ag (g/t) |

Cu (%) |

Pb (%) |

Zn (%) |

EqAu (g/t) |

EqCu (%) |

|

Breccia Ethan |

SFRC-061 |

|

3 |

34 |

31 |

0.31 |

2.06 |

0.42 |

0.00 |

0.01 |

0.93 |

0.66 |

|

Breccia Ethan |

SFRC-061 |

including |

6 |

16 |

10 |

0.53 |

4.54 |

0.74 |

0.00 |

0.01 |

1.62 |

1.16 |

|

Breccia Ethan |

SFRC-061 |

|

57 |

60 |

3 |

0.36 |

0.68 |

0.27 |

0.00 |

0.00 |

0.75 |

0.54 |

|

Breccia Ethan |

SFRC-062 |

|

2 |

7 |

5 |

0.39 |

0.96 |

0.18 |

0.00 |

0.01 |

0.66 |

0.47 |

|

Breccia Ethan |

SFRC-062 |

|

27 |

35 |

8 |

0.68 |

1.31 |

0.71 |

0.00 |

0.01 |

1.69 |

1.21 |

|

Breccia Ethan |

SFDH-063 |

|

0 |

33.8 |

33.8 |

0.18 |

4.78 |

0.45 |

0.02 |

0.03 |

0.89 |

0.63 |

|

Breccia Ethan |

SFDH-063 |

Including |

0 |

14 |

14 |

0.16 |

9.33 |

0.72 |

0.04 |

0.05 |

1.31 |

0.93 |

|

Breccia Ethan |

SFDH-063 |

Including |

57.12 |

63 |

5.88 |

0.27 |

0.53 |

0.24 |

0.00 |

0.00 |

0.61 |

0.43 |

|

Breccia Ethan |

SFDH-063 |

|

79.32 |

90.15 |

10.83 |

0.28 |

1.07 |

0.34 |

0.00 |

0.00 |

0.76 |

0.54 |

|

Breccia Ethan |

SFDH-064 |

|

25.3 |

29.3 |

4 |

0.25 |

0.91 |

0.37 |

0.00 |

0.01 |

0.78 |

0.56 |

|

Breccia Ethan |

SFDH-064 |

|

48.37 |

54.45 |

6.08 |

0.14 |

0.67 |

0.21 |

0.00 |

0.00 |

0.45 |

0.32 |

|

Breccia Ethan |

SFDH-064 |

|

68.7 |

75 |

5.99 |

0.21 |

0.93 |

0.22 |

0.00 |

0.00 |

0.53 |

0.38 |

|

Breccia Ethan |

SFDH-065 |

|

67.35 |

70.65 |

3.3 |

0.25 |

0.44 |

0.18 |

0.00 |

0.00 |

0.51 |

0.36 |

|

Breccia Ethan |

SFDH-065 |

|

108.25 |

112.7 |

4.45 |

0.14 |

0.67 |

0.19 |

0.00 |

0.00 |

0.41 |

0.30 |

|

Tres Magos |

SFDH-066 |

|

141.4 |

144 |

2.6 |

0.24 |

0.79 |

0.00 |

0.02 |

0.03 |

0.27 |

0.19 |

|

Tres Magos |

SFDH-067 |

|

29.7 |

32.6 |

2.9 |

0.01 |

0.03 |

0.34 |

0.00 |

0.03 |

0.50 |

0.35 |

|

Tres Magos |

SFDH-068 |

|

18.55 |

39.1 |

20.55 |

0.27 |

0.09 |

0.00 |

0.00 |

0.01 |

0.28 |

0.20 |

|

Tres Magos |

SFDH-070 |

|

45.25 |

50.65 |

5.4 |

0.02 |

4.07 |

0.04 |

0.40 |

0.50 |

0.48 |

0.35 |

|

Veta Amarilla |

SFDH-071 |

|

28 |

29 |

1 |

0.25 |

17.90 |

0.02 |

0.50 |

0.17 |

0.75 |

0.54 |

|

Veta Amarilla |

SFDH-072 |

|

20 |

20.65 |

0.65 |

0.22 |

7.41 |

0.01 |

0.49 |

0.23 |

0.60 |

0.43 |

|

Veta Amarilla |

SFDH-072 |

|

84 |

85.8 |

1.8 |

0.01 |

8.50 |

0.04 |

0.09 |

0.30 |

0.32 |

0.23 |

|

Veta Amarilla |

SFDH-073 |

|

3.65 |

7.35 |

3.7 |

0.01 |

0.01 |

0.00 |

0.02 |

0.35 |

0.17 |

0.12 |

|

Tres Magos |

SFDH-076 |

Including |

51.8 |

53.1 |

1.3 |

0.04 |

13.45 |

0.53 |

0.32 |

0.42 |

1.24 |

0.88 |

|

Tres Magos |

SFDH-076 |

|

91.3 |

95.3 |

4 |

0.46 |

7.46 |

0.07 |

0.07 |

0.06 |

0.70 |

0.50 |

|

Tres Magos |

SFDH-076 |

Including |

93.55 |

95.3 |

1.75 |

0.93 |

9.13 |

0.09 |

0.05 |

0.04 |

1.20 |

0.86 |

|

Tres Magos |

SFDH-077 |

|

99.9 |

100.65 |

0.75 |

0.34 |

10.54 |

0.05 |

0.39 |

0.72 |

0.98 |

0.70 |

|

Tres Magos |

SFDH-077 |

|

106.9 |

107.57 |

0.67 |

1.03 |

4.88 |

0.03 |

0.03 |

0.03 |

1.15 |

0.82 |

|

Veta Rica |

SFDH-078 |

|

36.6 |

41 |

4.4 |

6.36 |

4.97 |

0.00 |

0.07 |

0.00 |

6.45 |

4.61 |

|

Veta Rica |

SFDH-078 |

Including |

36.6 |

37.1 |

0.5 |

28.59 |

12.44 |

0.00 |

0.17 |

0.00 |

28.80 |

20.57 |

|

Veta Rica |

SFDH-078 |

and |

38.85 |

39.3 |

0.45 |

14.12 |

4.93 |

0.00 |

0.01 |

0.00 |

14.19 |

10.13 |

|

Veta Rica |

SFDH-079 |

|

42 |

70.36 |

28.36 |

1.33 |

1.44 |

0.00 |

0.04 |

0.02 |

1.37 |

0.98 |

|

Veta Rica |

SFDH-079 |

Including |

42 |

50.75 |

8.75 |

3.52 |

1.36 |

0.00 |

0.03 |

0.01 |

3.56 |

2.54 |

|

Veta Rica |

SFDH-079 |

Including |

42 |

48 |

6 |

4.53 |

1.54 |

0.00 |

0.03 |

0.01 |

4.57 |

3.26 |

|

Veta Rica |

SFDH-079 |

Including |

42 |

43.18 |

1.18 |

17.94 |

3.32 |

0.00 |

0.05 |

0.01 |

18.00 |

12.86 |

|

Veta Rica |

SFDH-079 |

|

54.45 |

56.6 |

2.15 |

0.89 |

0.84 |

0.00 |

0.04 |

0.02 |

0.93 |

0.66 |

|

Veta Rica |

SFDH-079 |

|

60 |

67.56 |

7.56 |

0.50 |

2.82 |

0.01 |

0.07 |

0.04 |

0.59 |

0.42 |

|

Veta Rica |

SFDH-079 |

Including |

63.15 |

64.23 |

1.08 |

1.26 |

4.74 |

0.01 |

0.17 |

0.06 |

1.43 |

1.02 |

*Intersections are not true widths and

additional drilling and geological modelling of the mineralized

zones in the breccia pipes is required to determine the true widths

of the drill hole intersections. Equivalent gold (AuEq) and

equivalent copper (CuEq) values are calculated assuming 100%

recovery using USD$ 1860 oz Au, $22 oz Ag, $8100/t Cu (~$3.7/lb),

$2130/t Pb & $2510/t Zn.

Table 3: San Francisco RC and diamond drill

hole locations and targets included in this release. Holes listed

but not reported in Table 2 returned no significant results.

|

Hole ID |

E(WGS84 - 19S) |

N(WGS84 - 19S) |

Elevation (m) |

Azimuth |

Dip |

Depth (m) |

Target |

|

SFRC-061RC |

444973 |

6603690 |

3398 |

161 |

-60 |

69 |

Breccia Ethan |

|

SFRC-062RC |

444972 |

6603691 |

3398 |

316 |

-60 |

47 |

Breccia Ethan |

|

SFDH-063 |

444971 |

6603690 |

3398 |

161 |

-61 |

206 |

Breccia Ethan |

|

SFDH-064 |

444973 |

6603692 |

3395 |

316 |

-60 |

161 |

Breccia Ethan |

|

SFDH-065 |

441189 |

6599844 |

3398 |

29 |

-60 |

147.4 |

Breccia Ethan |

|

SFDH-066 |

441093 |

6600004 |

3301 |

280 |

-62 |

167.4 |

Tres Magos |

|

SFDH-067 |

441418 |

6599987 |

3499 |

6 |

-58 |

134 |

Tres Magos |

|

SFDH-068 |

441279 |

6600016 |

3318 |

102 |

-61 |

50.8 |

Tres Magos |

|

SFDH-069 |

441188 |

6599845 |

3259 |

281 |

-62 |

76.5 |

Tres Magos |

|

SFDH-070 |

441288 |

6600402 |

3279 |

105 |

-60 |

156 |

Tres Magos |

|

SFDH-071 |

440035 |

6604044 |

3382 |

165 |

-60 |

125 |

Veta Amarilla |

|

SFDH-072 |

440035 |

6604044 |

3381 |

165 |

-80 |

224 |

Veta Amarilla |

|

SFDH-073 |

440202 |

6604214 |

3387 |

166 |

-60 |

119 |

Veta Amarilla |

|

SFDH-074 |

439896 |

6603771 |

3383 |

329 |

- 60 |

116 |

Veta Amarilla |

|

SFDH-075 |

441421 |

6600000 |

3485 |

189 |

-62 |

83 |

Tres Magos |

|

SFDH-076 |

441072 |

6600697 |

3542 |

304 |

-61 |

119 |

Tres Magos |

|

SFDH-077 |

441126 |

6600524 |

3541 |

345 |

-60 |

134 |

Tres Magos |

|

SFDH-078 |

446351 |

6594462 |

2879 |

194 |

-60 |

63.5 |

Veta Rica |

|

SFDH-079 |

446347 |

6594467 |

2875 |

219 |

-60 |

84.8 |

Veta Rica |

|

SFDH-080 |

446271 |

6567555 |

1837 |

74 |

-59 |

269 |

Veta Alumbrera |

|

SFDH-081 |

446130 |

6567975 |

1921 |

82 |

-60 |

131 |

Veta Alumbrera |

|

SFDH-082 |

445967 |

6567852 |

1935 |

60 |

-65 |

416 |

Veta Alumbrera |

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d5a5cbfc-4276-44db-a26e-6adeb8b3e707

https://www.globenewswire.com/NewsRoom/AttachmentNg/b395b642-f77e-41ce-9356-e67f510087bc

https://www.globenewswire.com/NewsRoom/AttachmentNg/4ab4266d-512d-4596-b4ec-12b8c2b7f27c

https://www.globenewswire.com/NewsRoom/AttachmentNg/5d03bd30-9138-42f8-90db-ff7d489b9f98

https://www.globenewswire.com/NewsRoom/AttachmentNg/a1ca2960-23c1-4d44-ba7a-27f01440864a

https://www.globenewswire.com/NewsRoom/AttachmentNg/53748dbc-288a-4109-9c6e-8d688f45d93f

https://www.globenewswire.com/NewsRoom/AttachmentNg/a696be12-be2e-484a-9d4a-33fa3fa3c91c

https://www.globenewswire.com/NewsRoom/AttachmentNg/001c83a4-efb7-4f6e-bd2f-c28202742391

https://www.globenewswire.com/NewsRoom/AttachmentNg/4ee8cad2-4065-4733-b3e8-2dea36362895

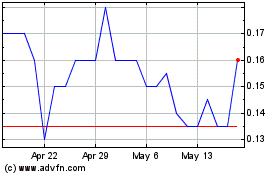

Turmalina Metals (TSXV:TBX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Turmalina Metals (TSXV:TBX)

Historical Stock Chart

From Jan 2024 to Jan 2025