UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Dated February 8, 2024

Commission

File Number: 001-35788

ARCELORMITTAL

(Translation

of registrant’s name into English)

24-26,

Boulevard d’Avranches

L-1160

Luxembourg

Grand

Duchy of Luxembourg

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

On February 8, 2024, ArcelorMittal published the press release attached hereto as Exhibit 99.1 and hereby incorporated by reference into this report on Form 6-K.

Exhibit

Index

| Exhibit No. |

Description |

| |

|

| Exhibit 99.1 |

Press release dated February 8, 2024, ArcelorMittal reports fourth quarter

and full year 2023 results. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

ARCELORMITTAL

Date:

8 February 2024

| By: | /s/ Henk Scheffer |

|

|

| Name: | Henk

Scheffer |

|

| Title: | Company Secretary & Group Compliance & Data Protection Officer |

|

ARCELORMITTAL

6-K

Exhibit 99.1

ArcelorMittal reports fourth

quarter and full year 2023 results

Luxembourg, February 8,

2024 - ArcelorMittal (referred to as “ArcelorMittal”

or the “Company” or the "Group") (MT (New York, Amsterdam, Paris, Luxembourg), MTS (Madrid)), the world’s

leading integrated steel and mining company, today announced results1 for the

three-month and twelve-month periods ended December 31, 2023.

2023

key highlights:

Health and safety focus: Protecting employee health and wellbeing

remains an overarching priority of the Company; LTIF2 rate of 0.92x in FY 2023 and 0.70x in FY 2022. Performance in

2023 was severely impacted by the tragic Kostenko mine accident on October 28, 2023. The Company has commissioned dss+ to conduct a comprehensive

independent Company-wide safety audit of its operations, to identify gaps and strengthen safety actions, processes and culture to help

prevent serious accidents. Key recommendations to be published in September 2024

Healthy EBITDA and Free Cashflow: FY 2023 EBITDA of $7.6bn and

EBITDA/tonne of $136/t, reflecting structural improvements to profitability. FY 2023 free cash flow (FCF) of $2.9bn7 ($7.6bn

net cash provided by operating activities less $4.6bn capex (which includes $1.4bn strategic growth capex) and $0.2bn minority dividends)

with 4Q 2023 FCF of $1.8bn ($3.3bn net cash provided by operating activities less $1.5bn capex)

Net income impacted by non-cash non-recurring items: Net income

of $0.9bn includes a negative $2.4bn impact related to the disposal of the Kazakhstan operations6 and a $1.4bn impairment of

Acciaierie d'Italia (ADI) in Italy16. Adjusting for these items, FY 2023 adjusted net income9 is $4.9bn. FY 2023

basic EPS of $1.09 (adjusted basic EPS9 of $5.78)

Financial strength: Net debt of $2.9bn at the end of 2023 (gross

debt of $10.7bn, and cash and cash equivalents of $7.8bn) as compared to $2.2bn at the end of 2022. As of December 31, 2023, the Company

had liquidity of $13.2 billion consisting of cash and cash equivalents of $7.8 billion and $5.4 billion of available credit lines13

Share repurchases driving enhanced value: Repurchased 45.4m shares

in 202311, bringing the total reduction in fully diluted shares outstanding to 33% since the end of September 20208.

Book value per share4 increased to $66 over the last 12 months ROE3 of 8.9%

Priorities:

Growth: following a period of optimization and strategic investment,

the Company is on the cusp of a step change in profitability:

| • | Strategic investments are estimated to add approximately

$1.8bn to EBITDA14,15 growth by the end of 2026. New projects expected to be commissioned in 2024 include: the cold rolling

mill complex at Vega, additional capacity at Serra Azul mine and Barra Mansa (all in Brazil); the first phase of new Electrical Steels

capacity in Europe; the first iron ore concentrate in Liberia; 1GW of renewable power capacity in India; and the new EAF at AMNS Calvert

(US). In addition, the expansion of the AMNS India Hazira plant to ~15Mt capacity (Phase 1A) is progressing well and on track for completion

in 2026 with Phase 1B Hazira capacity expansion to 20Mt planned; plans for expansion to 24Mt (including 1.5Mt long capacity) under preparation |

| • | Decarbonized steel solutions: Existing capabilities

in low-carbon metallics and EAF steel-making provide a unique competitive advantage as we offer an increasingly broad range of low-carbon

intensity steel products to our customers. Our XCarb® recycled and renewably12 produced steel continues to resonate

with our customers, most recently exemplified by contracts to supply Vestas and Schneider Electric. Our DRI/EAF projects are progressing

through FEED; we have signed contracts for a new 1.1Mt EAF at Gijon which will decarbonize the Long business in Spain, allowing for production

of rails and quality wire rods; and a signed Letter of Intent with EDF for a long-term agreement to supply low carbon emissions power

for our key French operations |

| • | Progressive capital allocation: The Company’s

defined capital allocation and return policy is working well, allowing the Company to develop and significantly grow its earnings capacity

whilst consistently rewarding shareholders. The Board proposes to increase the annual base dividend to shareholders from $0.44/sh in FY

2023 to $0.50/sh (to be paid in 2 equal installments in June 2024 and December 2024), subject to the approval of shareholders at the 2024

AGM. In addition, the Company will continue to return a minimum 50% of post-dividend FCF to shareholders through its share buyback programs |

Financial highlights

(on the basis of IFRS1):

| (USDm) unless otherwise shown |

4Q 23 |

3Q 23 |

4Q 22 |

12M 23 |

12M 22 |

| Sales |

14,552 |

16,616 |

16,891 |

68,275 |

79,844 |

| Operating (loss)/income |

(1,980) |

1,203 |

(306) |

2,340 |

10,272 |

| Net (loss)/income attributable to equity holders of the parent |

(2,966) |

929 |

261 |

919 |

9,302 |

| Adjusted net income attributable to equity holders of the parent9 |

982 |

929 |

1,189 |

4,867 |

10,611 |

| Basic (loss)/earnings per common share (US$) |

(3.57) |

1.11 |

0.30 |

1.09 |

10.21 |

| Adjusted basic earnings per common share (US$)9 |

1.18 |

1.11 |

1.37 |

5.78 |

11.65 |

| |

|

|

|

|

|

| Operating (loss)/income/tonne (US$/t) |

(149) |

88 |

(24) |

42 |

184 |

| EBITDA |

1,266 |

1,865 |

1,258 |

7,558 |

14,161 |

| EBITDA /tonne (US$/t) |

95 |

136 |

100 |

136 |

253 |

| |

|

|

|

|

|

| Crude steel production (Mt) |

13.7 |

15.2 |

13.2 |

58.1 |

59.0 |

| Steel shipments (Mt) |

13.3 |

13.7 |

12.6 |

55.6 |

55.9 |

| Total Group iron ore production (Mt) |

10.0 |

10.7 |

10.7 |

42.0 |

45.3 |

| Iron ore production (Mt) (AMMC and Liberia only) |

6.2 |

6.7 |

7.5 |

26.0 |

28.6 |

| Iron ore shipment (Mt) (AMMC and Liberia only) |

6.1 |

6.3 |

6.9 |

26.4 |

28.0 |

| |

|

|

|

|

|

| Weighted average common shares outstanding (in millions) |

830 |

838 |

865 |

842 |

911 |

Commenting, Aditya Mittal, ArcelorMittal

Chief Executive Officer, said:

“In October last year we committed to commissioning an independent

3rd party global audit of all our safety related practices and actions. This audit is now underway and I am determined its

findings and recommendations, combined with the considerable efforts we are already implementing across the Group, will make us a safer

and ultimately accident free company. Every employee in ArcelorMittal is aligned in this goal.

“Turning to our financial performance, our results for the full

year reflect the benefits of the structural improvements we have made to our cost base, asset portfolio and balance sheet in recent years.

Despite the operating environment becoming increasingly challenging as the year progressed, our profitability per tonne is healthy and

well above long-term averages. This highlights the enhanced sustainability we have built into the business, enabling us to generate healthy

cash flow to invest for future growth and return attractive levels of capital to our shareholders.

"Looking ahead, there are early signs of a more constructive industry

backdrop. This, alongside the progress we are making with our portfolio of strategic growth projects - several of which will complete

this year - means the Company will continue to take important steps forward in its drive to be a stronger, more profitable, and of course

safer, Company."

Safety and sustainable development

Health and safety

Performance

in 2023 was severely impacted by the tragic Kostenko mine accident on October 28, 2023.

In December

2023, ArcelorMittal launched an independent 3rd party global audit that will look at every aspect of the Company’s health and safety

practices across the Group. ArcelorMittal's employees are united in their determination to become a zero fatality workplace and this audit

will complement the considerable effort already being implemented across the organization to achieve this aim.

The Company-wide

audit of safety practices by dss+ has now commenced and will support our pathway to zero serious injuries and fatalities. Recommendations

are due to be published in September 2024 and the audit will cover:

| • | A comprehensive Fatality Prevention Standards audit for the

3 main occupational risks (crushed by vehicle, crushed by moving machinery & fall from height) leading to serious injuries and fatalities. |

| • | Expert input into the CTO-led process risk management safety

system that will include audits of its highest priority countries and assets (including strategic JVs). |

| • | Assessment of all health and safety systems, processes, structures,

capabilities, governance and assurance processes. |

Own personnel and contractors – Lost Time Injury Frequency

rate

| Lost time injury frequency rate |

4Q 23 |

3Q 23 |

4Q 22 |

12M 23 |

12M 22 |

| NAFTA |

0.40 |

0.09 |

0.18 |

0.22 |

0.25 |

| Brazil |

0.18 |

0.22 |

0.14 |

0.26 |

0.10 |

| Europe |

1.45 |

1.25 |

1.14 |

1.30 |

1.11 |

| ACIS |

3.22 |

1.49 |

1.07 |

1.43 |

0.74 |

| Mining |

— |

0.19 |

0.61 |

0.10 |

0.84 |

| Total |

1.34 |

0.94 |

0.86 |

0.92 |

0.70 |

Sustainable

development highlights:

| • | In Spain, on November 28, 2023, ArcelorMittal announced that

contracts have been signed to build a new 1.1Mt EAF in Gijon. Once the EAF is operational (1H 2026), the site will be able to switch to

producing low carbon-emissions steel for the long products sector, rails and wire rods, making the site highly competitive, in particular

for sectors with stringent carbon criteria for public procurement contracts. |

| • | In France, on January 15, 2024, a Letter of Intent was signed

with EDF for the long-term supply of low carbon electricity to its French steelmaking sites in Dunkirk and Fos-sur-Mer (subject to final

approvals for the DRI/EAF project in Dunkirk). |

| • | ArcelorMittal has seen increasing demand for its low carbon

steel – XCarb® recycled

and responsibly produced steel. |

| ◦ | On November 15, 2023, Schneider Electric and ArcelorMittal

announced a partnership to supply XCarb®

recycled and renewably produced steel for Schneider Electric’s

electrical cabinets and enclosures. |

| ◦ | On January 16, 2024, Vestas and ArcelorMittal announced a

low carbon partnership and the first project will use XCarb®

recycled and renewably produced heavy plate steel for an offshore

wind farm, built by Baltic Power in Poland. |

| • | In India, AM/NS India published their Climate Action report

and are targeting a reduction in their emissions intensity of 20% by 2030 (from 2021 levels). |

| • | Over the course of 2023, ArcelorMittal has also progressed

renewable projects in Argentina, India and Brazil, announced plans to build an industrial- scale direct electrolysis plant (Volteron™)

and has been advancing smart carbon projects in Ghent and Dunkirk (Carbon Capture and Storage pilots and the Steelanol plant). |

| • | Following the sale of the Company's assets in Kazakhstan (which

represented approximately 16.5% of the Group's scope 1 and scope 2 carbon emissions), the Company no longer owns and operates coal mines.

|

Analysis of results for the twelve

months ended December 31, 2023 versus results for the twelve months ended December 31, 2022

Sales for 12M 2023 decreased by -14.5% to $68.3 billion as compared

with $79.8 billion for 12M 2022, primarily due to -13.5% lower average steel selling prices as shipments were relatively stable.

Impairment charges (other than related to the sale of operations

in Kazakhstan) for 12M 2023 amounted to $0.1 billion, relating to the Long business of ArcelorMittal South Africa as compared to an impairment

charge of $1.0 billion in 12M 2022 related to ArcelorMittal Kryvyi Rih (Ukraine).

Following the sale of the Company's steel and mining operations in

Kazakhstan, the Company recorded a $0.9 billion non-cash impairment charge (including $0.2 billion goodwill), and recorded $1.5 billion

cumulative translation losses (previously recorded against equity) through the profit and loss.

Operating income for 12M 2023 of $2.3 billion was lower as compared

to $10.3 billion in 12M 2022 primarily driven by negative price-cost effect (predominantly on account of -13.5% lower average steel selling

prices), impairment charges and impact on disposal of Kazakhstan operations as discussed above.

Income from associates, joint ventures and other investments (excluding

impairment) for 12M 2023 was stable at $1.2 billion as compared to $1.3 billion for 12M 2022 supported by higher contributions from AMNS

India and Chinese investees.

Impairment of associates, joint ventures and other investments amounted

to $1.4 billion for 12M 2023, and related to the impairment of the Company’s investment in Acciaierie d'Italia (ADI) following downward

revisions to the expected future cash flows.

ArcelorMittal’s net income for 12M 2023 was $919 million as

compared to $9,302 million for 12M 2022. Adjusted net income9 for 12M 2023 was $4.9 billion as compared to $10.6 billion for

12M 2022.

ArcelorMittal’s basic earnings per common share for 12M 2023

was $1.09, as compared to $10.21 for 12M 2022. Adjusted basic earnings per common share (excluding impairment charges and impact on disposal

of Kazakhstan operations)9 for 12M 2023 was $5.78 as compared to $11.65 for 12M 2022.

Analysis of results for 4Q 2023

versus 3Q 2023

Sales in 4Q 2023 were -12.4% lower at $14.6 billion as compared to

$16.6 billion in 3Q 2023 impacted by lower average steel selling prices (-5.1%) and lower steel shipment volumes (-3.0%).

Impairment charges (other than related to the sale of operations

in Kazakhstan) for 4Q 2023 amounted to $0.1 billion related to the Long business of ArcelorMittal South Africa.

Following the sale of the Company's steel and mining operations in

Kazakhstan the Company recorded a $0.9 billion non-cash impairment charge (including $0.2 billion goodwill) and recorded $1.5 billion

cumulative translation losses (previously recorded against equity) through the profit and loss.

Operating loss for 4Q 2023 was $2.0 billion as compared to an operating

income of $1.2 billion in 3Q 2023. The operating loss in 4Q 2023 was impacted by the impairment and impact on disposal of Kazakhstan operations

(as discussed above), and also reflected a decline in steel spreads (primarily due to a decline in steel prices) and lower steel shipments.

Income from associates, joint ventures and other investments (excluding

impairments) for 4Q 2023 was lower at $188 million as compared to $285 million in 3Q 2023, primarily due to lower contributions from European

investees.

Impairments of associates, joint ventures and other investments were

$1.4 billion for 4Q 2023, and related to the impairment of the Company’s investment in Acciaierie d'Italia (ADI) following downward

revisions to the expected future cash flows.

ArcelorMittal recorded net loss in 4Q 2023 of $2,966 million as compared

to a net income of $929 million in 3Q 2023. Adjusted net income9 in 4Q 2023 was $982 million as compared to $929 million in

3Q 2023.

ArcelorMittal's basic loss per common share for 4Q 2023 was $3.57

as compared to an earnings per common share of $1.11 in 3Q 2023. Adjusted basic earnings per common share9 for 4Q 2023 was

higher at $1.18 as compared to $1.11 in 3Q 2023.

Analysis

of segment operations

NAFTA

| (USDm) unless otherwise shown |

4Q 23 |

3Q 23 |

4Q 22 |

12M 23 |

12M 22 |

| Sales |

2,942 |

3,188 |

2,923 |

12,978 |

13,774 |

| Operating income |

280 |

520 |

331 |

1,917 |

2,818 |

| Depreciation |

(157) |

(125) |

(127) |

(535) |

(427) |

| Exceptional items |

— |

— |

98 |

— |

190 |

| EBITDA |

437 |

645 |

360 |

2,452 |

3,055 |

| Crude steel production (kt) |

2,185 |

2,122 |

2,025 |

8,727 |

8,271 |

| Steel shipments* (kt) |

2,590 |

2,527 |

2,338 |

10,564 |

9,586 |

| Average steel selling price (US$/t) |

948 |

1,043 |

1,021 |

1,024 |

1,215 |

* NAFTA steel shipments include slabs sourced

by the segment from Group companies (mainly the Brazil segment) and sold to the Calvert JV (eliminated in the Group consolidation). These

shipments can vary between periods due to slab sourcing mix and timing of vessels. 4Q'23 432kt, 3Q'23 393kt, 4Q'22 272kt, 12M'23 1,660kt

and 12M'22 1,173kt

Sales in 4Q 2023 decreased by -7.7% to $2.9 billion,

as compared to $3.2 billion in 3Q 2023 primarily on account of lower average steel selling prices (-9.1%) offset in part by higher steel

shipments (+2.5%).

Operating income in 4Q 2023 decreased by -46.3% to $280 million as compared

to $520 million in 3Q 2023, due to a negative price-cost effect, primarily due to lower average steel selling prices.

EBITDA in 4Q 2023 of $437 million was -32.2% lower as compared to $645

million in 3Q 2023, primarily due to a negative price-cost effect, resulting primarily from lower average steel selling prices.

Brazil10

| (USDm) unless otherwise shown |

4Q 23 |

3Q 23 |

4Q 22 |

12M 23 |

12M 22 |

| Sales |

2,709 |

3,560 |

2,894 |

13,163 |

13,732 |

| Operating income |

171 |

414 |

302 |

1,461 |

2,775 |

| Depreciation |

(77) |

(87) |

(60) |

(341) |

(246) |

| EBITDA |

248 |

501 |

362 |

1,802 |

3,021 |

| Crude steel production (kt) |

3,533 |

3,669 |

2,783 |

13,986 |

11,877 |

| Steel shipments (kt) |

3,562 |

3,599 |

2,639 |

13,681 |

11,516 |

| Average steel selling price (US$/t) |

852 |

932 |

1,036 |

939 |

1,114 |

Since its consolidation on March 9, 2023, ArcelorMittal Pecém

has performed strongly, achieving full nameplate production and capturing synergies of ~$0.1 billion, double the pre-acquisition forecast.

Sales in 4Q 2023 decreased by -23.9% to $2.7 billion as compared to $3.6

billion in 3Q 2023, primarily due to a -8.6% decrease in average steel selling prices and translation impacts from the devaluation of

the Argentinian peso.

Operating income in 4Q 2023 of $171 million was -58.6% lower as compared

to $414 million in 3Q 2023 primarily due to a negative price-cost effect and the devaluation of the Argentinian peso as discussed above.

EBITDA in 4Q 2023 decreased by -50.4% to $248 million as compared to

$501 million in 3Q 2023 due to negative price-cost effect and the negative impact of Argentinian peso devaluation (approximately $80 million).

Europe

| (USDm) unless otherwise shown |

4Q 23 |

3Q 23 |

4Q 22 |

12M 23 |

12M 22 |

| Sales |

7,990 |

8,894 |

10,077 |

38,305 |

47,263 |

| Operating income/ (loss) |

11 |

160 |

(10) |

1,104 |

4,292 |

| Depreciation |

(325) |

(313) |

(316) |

(1,241) |

(1,268) |

| Exceptional items |

— |

— |

— |

— |

(473) |

| EBITDA |

336 |

473 |

306 |

2,345 |

6,033 |

| Crude steel production (kt) |

6,630 |

7,475 |

6,956 |

28,827 |

31,904 |

| Steel shipments (kt) |

6,507 |

6,538 |

6,802 |

28,071 |

30,182 |

| Average steel selling price (US$/t) |

975 |

1,020 |

1,085 |

1,039 |

1,191 |

Europe segment crude steel production decreased by -11.3% to 6.6Mt in

4Q 2023 as compared to 7.5Mt in 3Q 2023 impacted by a reline of BF#A at Gent (Belgium) and planned maintenance of BF#2 at Bremen (Germany)

both of which restarted in early December 2023 and coupled with production cuts at BF1 in Fos (France). Steel shipments were stable in

4Q 2023 as compared to 3Q 2023 primarily due to continued weak apparent demand driven by destocking and construction-related demand.

Sales in 4Q 2023 declined by -10.2% to $8.0 billion, as compared to $8.9

billion in 3Q 2023, primarily due to -4.4% decrease in average steel selling prices.

Operating income in 4Q 2023 of $11 million as compared to operating income

of $160 million in 3Q 2023 mainly due to a negative price-cost effect.

EBITDA in 4Q 2023 of $336 million decreased by -28.9% as compared to

$473 million in 3Q 2023, mainly due to a negative price-cost effect.

ACIS

| (USDm) unless otherwise shown |

4Q 23 |

3Q 23 |

4Q 22 |

12M 23 |

12M 22 |

| Sales |

1,199 |

1,389 |

1,229 |

5,422 |

6,368 |

| Operating loss |

(2,689) |

(92) |

(1,198) |

(3,021) |

(930) |

| Depreciation |

(62) |

(71) |

(65) |

(278) |

(369) |

| Impairment items |

(112) |

— |

(1,026) |

(112) |

(1,026) |

| Impact on disposal of Kazakhstan operations |

(2,431) |

— |

— |

(2,431) |

— |

| EBITDA |

(84) |

(21) |

(107) |

(200) |

465 |

| Crude steel production (kt) |

1,351 |

1,925 |

1,394 |

6,527 |

6,949 |

| Steel shipments (kt) |

1,323 |

1,698 |

1,414 |

6,018 |

6,378 |

| Average steel selling price (US$/t) |

677 |

681 |

720 |

706 |

817 |

On December 7, 2023, the Company completed the sale

of its Kazakhstan operations.

On a scope adjusted basis, i.e. excluding Kazakhstan,

crude steel production in 4Q 2023 was 0.9Mt, a decrease of -23.1% as compared 3Q 2023 due to maintenance work at ArcelorMittal South Africa.

On a scope adjusted basis steel shipments in 4Q 2023 were 0.9Mt, a decrease of -8.1% as compared to 3Q 2023.

Sales in 4Q 2023 declined by -13.7% to $1.2 billion

as compared to $1.4 billion in 3Q 2023, primarily due to lower steel shipments, resulting primarily from the disposal of the Kazakhstan

operations on December 7, 2023 as mentioned above.

Impairment charges for 4Q 2023 (other than related to the sale of Kazakhstan

operations) amounted to $0.1 billion, relating to the Long business of ArcelorMittal South Africa and the impact on disposal of Kazakhstan

operations was a loss of $2.4 billion6. The Company is to receive $1.0 billion aggregate proceeds from the sale; consideration

of $536 million has been received and a further $450 million is to be received in four equal installments starting 2Q 2024 (with sovereign

fund guarantees).

Operating loss in 4Q 2023 of $2,689 million (impacted by impairment and

the impact on disposal of Kazakhstan operations) compared to $92 million in 3Q 2023.

EBITDA loss was $84 million in 4Q 2023 as compared to $21 million in

3Q 2023 primarily due to lower steel shipments and average steel selling prices.

Mining

| (USDm) unless otherwise shown |

4Q 23 |

3Q 23 |

4Q 22 |

12M 23 |

12M 22 |

| Sales |

764 |

729 |

716 |

3,077 |

3,396 |

| Operating income |

270 |

275 |

255 |

1,144 |

1,483 |

| Depreciation |

(69) |

(57) |

(57) |

(238) |

(234) |

| EBITDA |

339 |

332 |

312 |

1,382 |

1,717 |

| |

|

|

|

|

|

| Iron ore production (Mt) |

6.2 |

6.7 |

7.5 |

26.0 |

28.6 |

| Iron ore shipment (Mt) |

6.1 |

6.3 |

6.9 |

26.4 |

28.0 |

Note: Mining segment comprises iron ore operations of ArcelorMittal

Mines Canada (AMMC) and ArcelorMittal Liberia.

Operating income in 4Q 2023 was -1.7% lower at $270 million as compared

to $275 million in 3Q 2023.

EBITDA in 4Q 2023 of $339 million was +2.1% higher as compared to $332

million in 3Q 2023, due to higher iron ore reference prices (+12.8%) offset in part by lower iron ore shipments (-4.1% due in part to

the impact of a rail bridge failure in Liberia in early November 2023 as well as lower production at AMMC due to maintenance), higher

freight costs and lower quality premia.

Joint

ventures

ArcelorMittal has investments in various joint ventures and associate

entities globally. The Company considers the Calvert (50% equity interest) and AMNS India (60% equity interest) joint ventures to be of

particular strategic importance, warranting more detailed disclosures to improve the understanding of their operational performance and

value to the Company.

Calvert

| (USDm) unless otherwise shown |

4Q 23 |

3Q 23 |

4Q 22 |

12M 23 |

12M 22 |

| Production (100% basis) (kt)17 |

1,052 |

1,178 |

1,014 |

4,654 |

4,320 |

| Steel shipments (100% basis) (kt)17 |

1,079 |

1,063 |

905 |

4,469 |

4,229 |

| EBITDA (100% basis)17 |

90 |

105 |

(1) |

374 |

589 |

Calvert EBITDA during 4Q 2023 of $90 million represented a -14.6% decline

as compared to $105 million in 3Q 2023 primarily due to a weaker mix with a lower percentage of higher margin automotive shipments and

higher maintenance costs.

AMNS India

| (USDm) unless otherwise shown |

4Q 23 |

3Q 23 |

4Q 22 |

12M 23 |

12M 22 |

| Crude steel production (100% basis) (kt) |

1,964 |

1,942 |

1,624 |

7,463 |

6,685 |

| Steel shipments (100% basis) (kt) |

1,868 |

1,874 |

1,593 |

7,251 |

6,470 |

| EBITDA (100% basis) |

499 |

533 |

162 |

1,936 |

1,201 |

AMNS India achieved record crude steel production

in December 2023 reaching 8.1Mt run-rate (close to 8.6Mt capacity debottlenecking target).

The CGL4 line was commissioned in 4Q 2023 which allowed for the launch

of the Magnelis product (renewables and solar products) into the market.

EBITDA during 4Q 2023 of $499 million was -6.4% lower as compared to

$533 million in 3Q 2023, including a lower impact from natural gas hedges.

Outlook

As anticipated, apparent demand conditions are now

showing signs of improvement as the destocking phase reaches maturity. Despite continued headwinds to real demand, World ex-China apparent

steel consumption ("ASC") in 2024 is expected to grow by +3.0% to +4.0% as compared to 2023.

ArcelorMittal expects the following demand dynamics by key region:

| • | In the US, although real demand growth is expected to remain

lackluster due to the lagged impact of higher interest rates, the destocking that impacted apparent demand in 2023 is not expected to

continue in 2024. As a result, apparent steel consumption of flat products is expected to grow by +1.5% to +3.5%; |

| • | In Europe, whilst the Company assumes a marginal decline in

real demand, mainly construction, the destocking that impacted apparent demand in 2023 is not expected to continue in 2024. As a result,

apparent demand for flat products is expected to improve, with growth within a range of +2.0% to +4.0%; |

| • | In Brazil, the Company expects a gradual rebound in real steel

consumption to support an ASC growth within a range of +0.5% to +2.5%; |

| • | In India, the Company expects another strong year with apparent

steel consumption growth within the range of +6.5% to +8.5%; |

| • | In China, economic growth is expected to weaken. Despite continued

weakness in real estate, the impact of announced stimulus is expected to support offsetting demand growth from infrastructure spending.

As a result, steel consumption is expected to be relatively stable/slightly positive (+0% to +2%). |

The Company remains positive on the medium/long-term

steel demand outlook and, supported by its strong position remains focused on executing its strategy of growth with capital returns.

Capex in 2024 is expected to remain within the $4.5-$5.0

billion range (of which $1.4-$1.5 billion is expected as strategic growth capex).

New segmentation and incorporating the result

from investments in associates, joint ventures and other investments into EBITDA from January 1, 2024

Going forward we will report EBITDA including our share of JV and associates

net income in order to more fully reflect our growth exposures. EBITDA will be defined as operating income (loss) plus depreciation, impairment

charges, exceptional items and income from associates, JV and other investments (excluding impairment charges and exceptional items, if

any, of such associates, joint ventures and other investments). The following changes will be made to the Company's segment reporting:

| • | The NAFTA segment will be renamed

"North America", a core growth region for the ArcelorMittal Group; |

| • | "India and JVs” will be reported separately as

a segment, reflecting the share of net income of AMNS India, VAMA and Calvert as well as the other associates, joint ventures and other

investments. India is a high growth vector of the Group and our assets have strategic advantages to grow in line with the market and increase

profitability; |

| • | "Sustainable Solutions" segment will be composed

of a number of high-growth, niche, capital light businesses playing an important role in supporting climate action (including renewables,

special projects and construction business) which are currently reported within the Europe segment, which will be reported separately;

|

| • | Following the sale of the Company’s operations in Kazakhstan,

the remaining parts of the former ACIS segment will be assigned to an “Others” segment; and |

| • | No changes to the "Brazil" and "Mining"

segments. |

These changes will be applied as from January

1, 2024, and will be presented with the earnings release for the first quarter of 2024. The Company will in due course publish historical

comparative information for modelling purposes.

ArcelorMittal Condensed

Consolidated Statements of Financial Position1

| In millions of U.S. dollars |

Dec 31, 2023 |

Sept 30, 2023 |

Dec 31, 2022 |

| ASSETS |

|

|

|

| Cash and cash equivalents |

7,783 |

6,289 |

9,414 |

| Trade accounts receivable and other |

3,661 |

4,479 |

3,839 |

| Inventories |

18,759 |

18,852 |

20,087 |

| Prepaid expenses and other current assets |

3,037 |

3,505 |

3,778 |

| Total Current Assets |

33,240 |

33,125 |

37,118 |

| |

|

|

|

| Goodwill and intangible assets |

5,102 |

4,885 |

4,903 |

| Property, plant and equipment |

33,656 |

33,494 |

30,167 |

| Investments in associates and joint ventures |

10,078 |

11,171 |

10,765 |

| Deferred tax assets |

9,469 |

8,884 |

8,554 |

| Other assets |

2,372 |

2,180 |

3,040 |

| Total Assets |

93,917 |

93,739 |

94,547 |

| |

|

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

| Short-term debt and current portion of long-term debt |

2,312 |

2,310 |

2,583 |

| Trade accounts payable and other |

13,605 |

12,315 |

13,532 |

| Accrued expenses and other current liabilities |

5,852 |

5,826 |

6,283 |

| Total Current Liabilities |

21,769 |

20,451 |

22,398 |

| |

|

|

|

| Long-term debt, net of current portion |

8,369 |

8,233 |

9,067 |

| Deferred tax liabilities |

2,432 |

2,573 |

2,666 |

| Other long-term liabilities |

5,279 |

4,943 |

4,826 |

| Total Liabilities |

37,849 |

36,200 |

38,957 |

| |

|

|

|

| Equity attributable to the equity holders of the parent |

53,961 |

55,406 |

53,152 |

| Non-controlling interests |

2,107 |

2,133 |

2,438 |

| Total Equity |

56,068 |

57,539 |

55,590 |

| Total Liabilities and Shareholders’ Equity |

93,917 |

93,739 |

94,547 |

ArcelorMittal

Condensed Consolidated Statements of Operations1

| |

Three months ended |

Twelve months ended |

| In millions of U.S. dollars unless otherwise shown |

Dec 31, 2023 |

Sept 30, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

| Sales |

14,552 |

16,616 |

16,891 |

68,275 |

79,844 |

| Depreciation (B) |

(703) |

(662) |

(636) |

(2,675) |

(2,580) |

| Impairment items9. 19 (B) |

(112) |

— |

(1,026) |

(112) |

(1,026) |

| Exceptional items9, 19 (B) |

— |

— |

98 |

— |

(283) |

| Impact on disposal of Kazakhstan operations (B) |

(2,431) |

— |

— |

(2,431) |

— |

| Operating (loss)income (A) |

(1,980) |

1,203 |

(306) |

2,340 |

10,272 |

| Operating margin % |

(13.6) % |

7.2 % |

(1.8) % |

3.4 % |

12.9 % |

| |

|

|

|

|

|

| Income from associates, joint ventures and other investments (excluding impairments) |

188 |

285 |

121 |

1,184 |

1,317 |

| Impairments of associates, joint ventures and other investments |

(1,405) |

— |

— |

(1,405) |

— |

| Net interest expense |

(3) |

(31) |

(72) |

(145) |

(213) |

| Foreign exchange and other net financing (loss)/gain |

(240) |

(224) |

449 |

(714) |

(121) |

| (Loss)income before taxes and non-controlling interests |

(3,440) |

1,233 |

192 |

1,260 |

11,255 |

| Current tax expense |

(128) |

(282) |

(91) |

(1,008) |

(2,080) |

| Deferred tax benefit |

582 |

10 |

126 |

770 |

363 |

| Income tax benefit/(expense) (net) |

454 |

(272) |

35 |

(238) |

(1,717) |

| (Loss)income including non-controlling interests |

(2,986) |

961 |

227 |

1,022 |

9,538 |

| Non-controlling interests loss(income) |

20 |

(32) |

34 |

(103) |

(236) |

| Net (loss)/income attributable to equity holders of the parent |

(2,966) |

929 |

261 |

919 |

9,302 |

| |

|

|

|

|

|

| Basic (loss)earnings per common share ($) |

(3.57) |

1.11 |

0.30 |

1.09 |

10.21 |

| Diluted (loss)earnings per common share ($) |

(3.57) |

1.10 |

0.30 |

1.09 |

10.18 |

| |

|

|

|

|

|

| Weighted average common shares outstanding (in millions) |

830 |

838 |

865 |

842 |

911 |

| Diluted weighted average common shares outstanding (in millions) |

830 |

841 |

868 |

845 |

914 |

| |

|

|

|

|

|

| OTHER INFORMATION |

|

|

|

|

|

| EBITDA (C = A-B) |

1,266 |

1,865 |

1,258 |

7,558 |

14,161 |

| EBITDA Margin % |

8.7 % |

11.2 % |

7.4 % |

11.1 % |

17.7 % |

| |

|

|

|

|

|

| Total Group iron ore production (Mt) |

10.0 |

10.7 |

10.7 |

42.0 |

45.3 |

| Crude steel production (Mt) |

13.7 |

15.2 |

13.2 |

58.1 |

59.0 |

| Steel shipments (Mt) |

13.3 |

13.7 |

12.6 |

55.6 |

55.9 |

ArcelorMittal

Condensed Consolidated Statements of Cash flows1

| |

Three months ended |

Twelve months ended |

| In millions of U.S. dollars |

Dec 31, 2023 |

Sept 30, 2023 |

Dec 31, 2022 |

Dec 31, 2023 |

Dec 31, 2022 |

| Operating activities: |

|

|

|

|

|

| (Loss)/income attributable to equity holders of the parent |

(2,966) |

929 |

261 |

919 |

9,302 |

| Adjustments to reconcile net income to net cash provided by operations: |

|

|

|

|

|

| Non-controlling interests (loss)income |

(20) |

32 |

(34) |

103 |

236 |

| Depreciation and impairment19 |

815 |

662 |

1,662 |

2,787 |

3,606 |

| Exceptional items19 |

— |

— |

(98) |

— |

283 |

| Impact on disposal of Kazakhstan operations |

2,431 |

— |

— |

2,431 |

— |

| Income from associates, joint ventures and other investments |

(188) |

(285) |

(121) |

(1,184) |

(1,317) |

| Impairment of associates, joint ventures and other investments |

1,405 |

— |

— |

1,405 |

— |

| Deferred tax benefit |

(582) |

(10) |

(126) |

(770) |

(363) |

| Change in working capital18 |

2,470 |

(269) |

2,412 |

1,604 |

(1,223) |

| Other operating activities (net) |

(37) |

222 |

(322) |

350 |

(321) |

| Net cash provided by operating activities (A) |

3,328 |

1,281 |

3,634 |

7,645 |

10,203 |

| Investing activities: |

|

|

|

|

|

| Purchase of property, plant and equipment and intangibles (B) |

(1,450) |

(1,165) |

(1,500) |

(4,613) |

(3,468) |

| Other investing activities (net) |

464 |

187 |

(33) |

(1,235) |

(1,015) |

| Net cash used in investing activities |

(986) |

(978) |

(1,533) |

(5,848) |

(4,483) |

| Financing activities: |

|

|

|

|

|

| Net (payments)proceeds relating to payable to banks and long-term debt |

(195) |

262 |

1,923 |

(1,334) |

3,283 |

| Dividends paid to ArcelorMittal shareholders |

(184) |

— |

— |

(369) |

(332) |

| Dividends paid to minorities (C) |

(31) |

(66) |

(29) |

(162) |

(331) |

| Share buyback |

(466) |

(38) |

(288) |

(1,208) |

(2,937) |

| Lease payments and other financing activities (net) |

(53) |

(56) |

(28) |

(593) |

(160) |

| Net cash (used in) provided by financing activities |

(929) |

102 |

1,578 |

(3,666) |

(477) |

| Net increase(decrease) in cash and cash equivalents |

1,413 |

405 |

3,679 |

(1,869) |

5,243 |

| Effect of exchange rate changes on cash |

128 |

(85) |

656 |

255 |

(158) |

| Change in cash and cash equivalents |

1,541 |

320 |

4,335 |

(1,614) |

5,085 |

| |

|

|

|

|

|

| Free cash flow (D=A+B+C) |

1,847 |

50 |

2,105 |

2,870 |

6,404 |

Appendix 1: Product shipments

by region1

| (000'kt) |

4Q 23 |

3Q 23 |

4Q 22 |

12M 23 |

12M 22 |

| Flat |

2,028 |

1,938 |

1,767 |

8,220 |

7,121 |

| Long |

709 |

667 |

658 |

2,734 |

2,739 |

| NAFTA |

2,590 |

2,527 |

2,338 |

10,564 |

9,586 |

| Flat |

2,402 |

2,328 |

1,514 |

8,833 |

6,423 |

| Long |

1,171 |

1,283 |

1,145 |

4,905 |

5,179 |

| Brazil |

3,562 |

3,599 |

2,639 |

13,681 |

11,516 |

| Flat |

4,570 |

4,483 |

4,751 |

19,570 |

21,387 |

| Long |

1,840 |

1,945 |

1,933 |

8,001 |

8,321 |

| Europe |

6,507 |

6,538 |

6,802 |

28,071 |

30,182 |

| CIS |

757 |

1,052 |

916 |

3,615 |

4,221 |

| Africa |

570 |

649 |

498 |

2,412 |

2,160 |

| ACIS |

1,323 |

1,698 |

1,414 |

6,018 |

6,378 |

Note: “Others and eliminations” are not presented in the

table

Appendix 2a: Capital expenditures1

| (USDm) |

4Q 23 |

3Q 23 |

4Q 22 |

12M 23 |

12M 22 |

| NAFTA |

117 |

72 |

201 |

426 |

500 |

| Brazil |

292 |

243 |

341 |

917 |

708 |

| Europe |

502 |

409 |

564 |

1,612 |

1,204 |

| ACIS |

80 |

103 |

151 |

406 |

483 |

| Mining |

205 |

207 |

198 |

784 |

488 |

| Others |

254 |

131 |

45 |

468 |

85 |

| Total |

1,450 |

1,165 |

1,500 |

4,613 |

3,468 |

Appendix 2b: Capital expenditure

projects

| Segment |

Site / unit |

Capacity / details |

Impact on EBITDA * |

Key date / forecast completion |

| Brazil |

ArcelorMittal Vega Do Sul |

Increase hot dipped / cold rolled coil capacity and construction of a new 700kt continuous annealing line (CAL) and continuous galvanizing line (CGL) combiline |

$0.1bn |

1H 2024 |

| Brazil |

Serra Azul mine |

Facilities to produce 4.5Mt/year DRI quality pellet

feed by exploiting compact itabirite

iron ore |

$100m |

2H 2024 |

| Brazil |

Barra Mansa |

Increase capacity of HAV bars and sections by 0.4Mt/pa |

$70m |

2H 2024 |

| Brazil |

Monlevade |

Increase in liquid steel capacity by 1.0Mt/year; Sinter feed capacity of 2.25Mt/year |

$200m |

2H 2026 |

| Europe |

Mardyck (France) |

New Electrical Steels. Facilities to produce 170kt NGO Electrical Steels (of which 145kt for Auto applications) consisting of annealing and pickling line (APL), reversing mill (REV) and annealing and varnishing (ACL) lines |

$100m |

2H 2024 (ACL) |

| Europe |

Gijon (Spain) |

Construction of a new 1.1Mt EAF to enable the production of low carbon-emissions steel for the long products sector, specifically rails and wire rod |

$50m |

1H 2026 |

| NAFTA |

Las Truchas mine (Mexico) |

Revamping project with 1Mtpa pellet feed capacity increase (to 2.3Mt/year) with DRI concentrate grade capability |

$50m |

2H 2025 |

| AMNS Calvert (US) |

Calvert** |

New 1.5Mt EAF and caster |

$85m (our share of net income) |

2H 2024 |

| AMNS India |

Hazira** |

Debottlenecking existing assets; AMNS India medium-term plans are to expand and grow initially to ~15Mt by early 2026 in Hazira (Phase 1A); ongoing downstream projects; Phase 1B to 20Mt planned; plans for expansion to 24Mt (including 1.5Mt long capacity) under preparation; additional greenfield opportunities under development |

$0.4bn (our share of net income for Phase 1A and ongoing downstream projects) |

1H 2026 |

| Others (India) |

Andhra Pradesh (India) |

Renewable energy project: 975MW of nominal capacity solar and wind power |

$70m |

1H 2024 |

| Mining |

Liberia mine |

Phase 2 premium produce expansion: Increase production capacity to 15Mt/year |

$350m |

4Q 2024 (first concentrate) |

* Estimate of additional EBITDA based on full capacity and assuming

prices/spreads generally in line with the averages of the 2015-2020 period; ** AMNS India and AMNS Calvert are share of net income

Capital expenditure

FY 2023 capex is $4.6 billion included investments in strategic growth

of $1.4 billion. The Company expects strategic projects capex in 2024 of between $1.4-$1.5 billion. Decarbonization capex is expected

to increase to between $0.3-$0.4 billion (vs. $0.2 billion in 2023) and capex outside of strategic growth projects and decarbonization

is expected to be in the range of $2.8-$3.1 billion.

Appendix 3: Debt repayment schedule

as of December 31, 2023

| (USD billion) |

2024 |

2025 |

2026 |

2027 |

2028 |

>2028 |

Total |

| Bonds |

0.9 |

1.0 |

1.1 |

1.2 |

— |

2.6 |

6.8 |

| Commercial paper |

0.7 |

— |

— |

— |

— |

— |

0.7 |

| Other loans |

0.7 |

0.7 |

0.2 |

0.5 |

0.2 |

0.9 |

3.2 |

| Total gross debt |

2.3 |

1.7 |

1.3 |

1.7 |

0.2 |

3.5 |

10.7 |

As of December 31, 2023, the average debt maturity is 5.7 years.

Appendix 4: Reconciliation of

gross debt to net debt

| (USD million) |

Dec 31, 2023 |

Sept 30, 2023 |

Dec 31, 2022 |

| Gross debt |

10,681 |

10,543 |

11,650 |

| Less: Cash and cash equivalents |

(7,783) |

(6,289) |

(9,414) |

| Net debt |

2,898 |

4,254 |

2,236 |

| |

|

|

|

| Net debt / LTM EBITDA |

0.4 |

0.6 |

0.2 |

Appendix 5: Adjusted net income

and adjusted basic EPS

| (USDm) |

4Q 23 |

3Q 23 |

4Q 22 |

12M 23 |

12M 22 |

| Net (loss)income attributable to equity holders of the parent |

(2,966) |

929 |

261 |

919 |

9,302 |

| Impairment items5 |

(112) |

— |

(1,026) |

(112) |

(1,026) |

| Exceptional items6 |

— |

— |

98 |

— |

(283) |

| Impact on disposal of Kazakhstan operations6 |

(2,431) |

— |

— |

(2,431) |

— |

| Impairment of associates, joint ventures and other investments16 |

(1,405) |

— |

— |

(1,405) |

— |

| Adjusted net income |

982 |

929 |

1,189 |

4,867 |

10,611 |

| |

|

|

|

|

|

| Weighted average common shares outstanding (in millions) |

830 |

838 |

865 |

842 |

911 |

| |

|

|

|

|

|

| Adjusted basic EPS $/share |

1.18 |

1.11 |

1.37 |

5.78 |

11.65 |

Appendix

6: Terms and definitions

Unless indicated otherwise, or the context otherwise requires, references

in this earnings release to the following terms have the meanings set out next to them below:

Adjusted basic EPS: refers to adjusted net income divided by

the weighted average common shares outstanding.

Adjusted net income(loss): refers to reported net income/(loss)

excluding impairment charges and exceptional items (including with respect to the income from associates, JV and other investments), and

impact on disposal of Kazakhstan operations.

Apparent steel consumption: calculated as the sum of production

plus imports minus exports.

Average steel selling prices: calculated as steel sales divided

by steel shipments.

Cash and cash equivalents: represents cash and cash equivalents,

restricted cash and short-term investments.

Capex: represents the purchase of property, plant and equipment

and intangibles.

Crude steel production: steel in the first solid state after

melting, suitable for further processing or for sale.

Depreciation: refers to amortization and depreciation.

EPS: refers to basic or diluted earnings per share.

EBITDA: operating results plus depreciation, impairment items

and exceptional items and impact on disposal of Kazakhstan operations. As from January 1, 2024, EBITDA will also include income from associates,

JV and other investments (excluding impairments).

EBITDA/tonne: calculated as EBITDA divided by total steel

shipments.

Exceptional items: income / (charges) relate to transactions

that are significant, infrequent or unusual and are not representative of the normal course of business of the period.

FEED: Front End Engineering Design, or FEED, is an engineering

and project management approach undertaken before detailed engineering, procurement, and construction. This crucial phase helps manage

project risks and thoroughly prepare for the project's execution. It directly follows the pre-feed phase during which the concept is selected,

and the feasibility of available options is studied.

Free cash flow (FCF): refers to net cash provided by operating

activities less capex less dividends paid to minority shareholders.

Foreign exchange and other net financing income(loss): include

foreign currency exchange impact, bank fees, interest on pensions, impairment of financial assets, revaluation of derivative instruments

and other charges that cannot be directly linked to operating results.

Gross debt: long-term debt and short-term

debt.

Impairment items: refers to impairment charges net of reversals.

Income from associates, joint ventures and other investments:

refers to income from associates, joint ventures and other investments (excluding impairments of associates, joint ventures and other

investments)

Iron ore reference prices: refers to iron ore prices for 62%

Fe CFR China.

Kt: refers to thousand metric tonnes.

Liquidity: cash and cash equivalents plus available credit lines

excluding back-up lines for the commercial paper program.

LTIF: refers to lost time injury frequency rate equals

lost time injuries per 1,000,000 worked hours, based on own personnel and contractors.

Mt: refers to million metric tonnes.

Net debt: long-term debt

and short-term debt less cash and cash equivalents.

Net debt/LTM EBITDA: refers

to Net debt divided by EBITDA for the last twelve months.

Net interest expense: includes interest expense less interest

income

On-going projects: refer to projects for which construction

has begun (excluding various projects that are under development), even if such projects have been placed on hold pending improved operating

conditions.

Operating results: refers to operating income(loss).

Operating segments: NAFTA segment includes the Flat, Long and

Tubular operations of Canada, Mexico; and also includes all Mexico mines. The Brazil segment includes the Flat, Long and Tubular operations

of Brazil and its neighboring countries including Argentina, Costa Rica, Venezuela; and also includes Andrade and Serra Azul captive iron

ore mines. The Europe segment includes the Flat, Long and Tubular operations of the European business, as well as Downstream Solutions,

and also includes Bosnia and Herzegovina captive iron ore mines. The ACIS segment includes the Flat, Long and Tubular operations of Kazakhstan

(till December 7, 2023), Ukraine and South Africa; and also includes the captive iron ore mines in Ukraine and iron ore and coal mines

in Kazakhstan. Mining segment includes iron ore operations of ArcelorMittal Mines Canada and ArcelorMittal Liberia.

Own iron ore production: includes total of all finished production

of fines, concentrate, pellets and lumps and includes share of production.

Price-cost effect: a lack of correlation or a lag in the corollary

relationship between raw material and steel prices, which can either have a positive (i.e. increased spread between steel prices and raw

material costs) or negative effect (i.e. a squeeze or decreased spread between steel prices and raw material costs).

Shares outstanding fully diluted

basis: refers to shares outstanding (shares issued less treasury shares) plus shares underlying Mandatorily Convertible Subordinated

Notes ("MCNs") which were converted into shares in May 2023.

Shipments: information at segment and Group level eliminates

intra-segment shipments (which are primarily between Flat/Long plants and Tubular plants) and inter-segment shipments respectively. Shipments

of Downstream Solutions are excluded.

Working capital change (working capital investment / release): Movement

of change in working capital - trade accounts receivable plus inventories less trade and other accounts payable.

| 1. | The financial information in this press release has been prepared

consistently with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards

Board (“IASB”) and as adopted by the European Union. The interim financial information included in this announcement has also

been prepared in accordance with IFRS applicable to interim periods, however this announcement does not contain sufficient information

to constitute an interim financial report as defined in International Accounting Standard 34, “Interim Financial Reporting”.

The numbers in this press release have not been audited. The financial information and certain other information presented in a number

of tables in this press release have been rounded to the nearest whole number or the nearest decimal. Therefore, the sum of the numbers

in a column may not conform exactly to the total figure given for that column. In addition, certain percentages presented in the tables

in this press release reflect calculations based upon the underlying information prior to rounding and, accordingly, may not conform exactly

to the percentages that would be derived if the relevant calculations were based upon the rounded numbers. Segment information presented

in this press release is prior to inter-segment eliminations and certain adjustments made to operating results of the segments to reflect

corporate costs, income from non-steel operations (e.g. logistics and shipping services) and the elimination of stock margins between

the segments. This press release also includes certain non-GAAP financial/alternative performance measures. ArcelorMittal presents EBITDA

and EBITDA/tonne, free cash flow (FCF) and ratio of net debt/LTM EBITDA which are non-GAAP financial/alternative performance measures,

as additional measures to enhance the understanding of its operating performance. ArcelorMittal also presents Equity book value per share

and ROE as shown in footnotes to this press release. ArcelorMittal believes such indicators are relevant to provide management and investors

with additional information. The definition of EBITDA has been revised in this earnings release to split out the impairment charges and

exceptional items of the Kazakhstan disposal because the Company believes this presentation provides more clarity with respect to the

impacts of this disposal. ArcelorMittal also presents net debt and change in working capital as additional measures to enhance the understanding

of its financial position, changes to its capital structure and its credit assessment. ArcelorMittal also presents adjusted net income(loss)

and adjusted basic earnings per share as it believes these are useful measures for the underlying business performance excluding impairment

items, exceptional items. The definition of adjusted net income has been revised as for EBITDA to split out the impairment charges and

exceptional items of the Kazakhstan disposal for the same reason as for EBITDA and also to clarify that impairment charges and exceptional

items of associates, joint ventures and other investments are excluded from this alternative performance measure. The Company’s

guidance as to additional EBITDA estimated to be generated from certain projects, free cash flow, cash taxes and its working capital release

(or the change in working capital included in net cash provided by operating activities) for 2023 is based on the same accounting policies

as those applied in the Company’s financial statements prepared in accordance with IFRS. ArcelorMittal is unable to reconcile, without

unreasonable effort, such guidance to the most directly comparable IFRS financial measure, due to the uncertainty and inherent difficulty

of predicting the occurrence and the financial impact of items impacting comparability. For the same reasons, ArcelorMittal is unable

to address the significance of the unavailable information. Non-GAAP financial/alternative performance measures should be read in conjunction

with, and not as an alternative to, ArcelorMittal's financial information prepared in accordance with IFRS. |

| 2. | LTIF refers to lost time injury frequency rate equals lost

time injuries per 1,000,000 worked hours, based on own personnel and contractors. LTIF figures: 12M 2023 0.92 and 12M 2022 0.70. |

| 3. | ROE refers to "Return on Equity" which is calculated

as trailing twelve-month adjusted net income (excluding impairment charges and exceptional items) attributable to equity holders of the

parent divided by the average equity attributable to the equity holders of the parent over the period. 2023 ROE of 8.9% ($4.9 billion

/ $54.4 billion). 2022 ROE of 20.3% ($10.6 billion / $52.3 billion). |

| 4. | Equity book value per share is calculated as the Equity attributable

to the equity holders of the parent divided by diluted number of shares at the end of the period. 4Q 2023 total equity of $54.0 billion

divided by 819 million shares outstanding equals $66/sh. 3Q 2023 total equity of $55.4 billion divided by 838 million diluted shares outstanding

equals $66/sh. |

| 5. | Impairment charge for 12M 2023 (excluding that related to

the sale of operations in Kazakhstan) amounted to $0.1 billion, related to the Long business of ArcelorMittal South Africa. Impairment

charge of $1.0 billion in 12M 2022 related to ArcelorMittal Kryvyi Rih (Ukraine). |

| 6. | Exceptional items for 12M 2023 (excluding that related to

the sale of operations in Kazakhstan) were nil. Exceptional items for 12M 2022 of $0.3 billion included non-cash inventory related provisions

partially offset by gains related to the acquisition of the Hot Briquetted Iron (‘HBI’) plant in Texas and the settlement

of a claim by ArcelorMittal for a breach of a supply contract. Following the sale of the Company's steel and mining operations in Kazakhstan

the Company recorded a $0.9 billion non-cash impairment charge (including $0.2 billion goodwill), and recorded $1.5 billion cumulative

translation losses (previously recorded against equity) through the Consolidated Statements of Operations. |

| 7. | FY 2022 FCF of $6.4 billion ($10.2 billion net cash provided

by operating activities less capex of $3.5 billion less minority dividends of $0.3 billion). |

| 8. | September 30, 2020, was the inception date of the ongoing

share buyback programs. |

| 9. | See Appendix 5 for reconciliation of adjusted net income and

adjusted basic EPS. |

| 10. | On March 9, 2023, ArcelorMittal announced that following receipt

of customary regulatory approvals it has completed the acquisition of Companhia Siderúrgica do Pecém (‘CSP’)

in Brazil for an enterprise value of approximately $2.2 billion. CSP has since been renamed ArcelorMittal Pecém and is a world-class

operation, producing high-quality slab at a globally competitive cost. Its facility, located in the state of Ceará in northeast

Brazil was commissioned in 2016. It operates a three million tonne capacity blast furnace and has access via conveyors to the Port of

Pecém, a large-scale, deep-water port located 10 kilometers from the plant. The acquisition offers significant operational and

financial synergies and brings with it the potential for further expansions, such as the option to add primary steelmaking capacity (including

direct reduced iron) and rolling and finishing capacity. Given its location, ArcelorMittal Pecém also presents an opportunity to

create a new low-carbon steelmaking hub, capitalizing on the state of Ceará’s ambition to develop a low-cost green hydrogen

hub in Pecém. |

| 11. | Company has repurchased 45.4 million shares during 12M 2023

including 26.3 million shares from the current 85 million share buy back program. |

| 12. | XCarb® is designed to bring together all of ArcelorMittal’s

reduced, low and zero-carbon products and steelmaking activities, as well as wider initiatives and green innovation projects, into a single

effort focused on achieving demonstrable progress towards carbon neutral steel. Alongside the new XCarb® brand, we have launched three

XCarb® initiatives: the XCarb® innovation fund, XCarb® green steel certificates and XCarb® recycled and renewably produced

for products made via the Electric Arc Furnace route using scrap. The Company is offering green steel using a system of certificates (XCarb®

green certificates). These will be issued by an independent auditor to certify tonnes of CO2 savings achieved through the Company’s

investment in decarbonization technologies in Europe. Net-zero equivalence is determined by assigning CO2 savings certificates equivalent

to CO2 per tonne of steel produced in 2018 as baseline. The certificates will relate to the tonnes of CO2 saved in total, as a direct

result of the decarbonization projects being implemented across a number of its European sites. |

| 13. | On December 19, 2018, ArcelorMittal signed a $5.5 billion

Revolving Credit Facility ("RCF"), with a five-year maturity plus two one-year extension options. During the fourth quarter

of 2019, ArcelorMittal executed the option to extend the facility to December 19, 2024 for an available amount of $5.4 billion. After

the extension the remaining $0.1 billion remained with a maturity of December 19, 2023 and has hence expired. In December 2020, ArcelorMittal

executed the second option to extend the facility, and the new maturity is now extended to December 19, 2025. On April 30, 2021, ArcelorMittal

amended its $5.5 billion RCF to align with its sustainability and climate action strategy. On December 20, 2022, the RCF was amended as

part of the transition from Libor to risk free rates. Loans in USD are now based on Term SOFR instead of Libor. As of December 31, 2023,

the $5.4 billion revolving credit facility was fully available. |

| 14. | Estimate of additional contribution

to EBITDA, based on assumptions once ramped up to capacity and assuming prices/spreads generally in line with the averages of the 2015-2020

period. The $1.8 billion total also includes the expected share of net income from key strategic growth projects in AMNS India and Calvert

(US). |

| 15. | New segmentation from January 1, 2024: In order to better

reflect the business profile and external understanding of its geographical and market exposures, the Company will going forward refer

to EBITDA (defined as operating income (loss) plus depreciation, impairment items and exceptional items and income from associates, joint

ventures and other investments (excluding impairments and exceptional items if any, of associates, joint ventures and other investments).

The following changes will be made to the Company's reporting: a) The NAFTA segment will be renamed "North America", a core

growth region for the ArcelorMittal Group; b) "India and JVs” will be reported separately as a segment, reflecting the share

of net income (excluding impairment charges) of AMNS India, VAMA and Calvert as well as the other associates, joint ventures and other

investments. India is a high growth vector of the Group and we believe our assets have strategic advantages to grow in line with the market

and increase profitability; c) "Sustainable Solutions" segment will be composed of a number of high-growth, niche, capital light

businesses playing an important role in supporting climate action (including renewables, special projects and construction business) which

are currently reported within the Europe segment, will be reported separately; d) Following the sale of the Company’s operations

in Kazakhstan, the remaining parts of the former ACIS segment will be assigned to an “Others” segment; and e) No changes to

the "Brazil" and "Mining" segments. These changes will be applied as from January 1, 2024 and will be presented with

the earnings release for the first quarter of 2024. The Company will in due course publish historical comparative information for modelling

purposes. |

| 16. | Impairments of associates, joint ventures and other investments

were $1.4 billion for 12M 2023, and relate to the impairment of the Company’s investment in Acciaierie d'Italia (ADI) following

downward revisions to the expected future cash flows. |

| 17. | Production: all production of the hot strip mill including

processing of slabs on a hire work basis for ArcelorMittal Group entities and third parties, including stainless steel slabs. Shipments:

including shipments of finished products processed on a hire work basis for ArcelorMittal Group entities and third parties, including

stainless steel products. EBITDA of Calvert presented here on a 100% basis as a stand-alone business and in accordance with the Company's

policy, applying the weighted average method of accounting for inventory. |

| 18. | Net cash provided by operating activities in 4Q 2023 was $3,328

million, and includes a working capital release of $2,470 million as compared to an investment of $269 million, driven primarily by lower

accounts receivable (due to lower prices and lower volumes, including the impact of normal seasonality at year end), and lower inventories

(primarily due to reduced inventory volumes). The Company released a total of $1,604 million in working capital in the calendar year 2023. |

| 19. | Excluding impact on disposal of Kazakhstan operations. |

Fourth

quarter 2023 earnings analyst conference call

Mr. Lakshmi Mittal and Aditya Mittal will host a conference call for

members of the investment community to present and comment on the three-month period and twelve month periods ended December 31, 2023

on: Thursday February 8, 2024, at 9.30am US Eastern time; 14.30pm London time and 15.30pm CET.

Webcast

link: https://interface.eviscomedia.com/player/1154/

VIP Connect Conference Call:

Participants may pre-register and will receive dedicated dial-in details

to easily and quickly access the call:

https://services.choruscall.it/DiamondPassRegistration/register?confirmationNumber=2729640&linkSecurityString=59ba86ec0

Please visit the results section on our website to listen to the reply

once the event has finished https://corporate.arcelormittal.com/investors/results

Forward-Looking

Statements

This document contains forward-looking information and statements about

ArcelorMittal and its subsidiaries. These statements include financial projections and estimates and their underlying assumptions, statements

regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future

performance. Forward-looking statements may be identified by the words “believe”, “expect”, “anticipate”,

“target” or similar expressions. Although ArcelorMittal’s management believes that the expectations reflected in such

forward-looking statements are reasonable, investors and holders of ArcelorMittal’s securities are cautioned that forward-looking

information and statements are subject to numerous risks and uncertainties, many of which are difficult to predict and generally beyond

the control of ArcelorMittal, that could cause actual results and developments to differ materially and adversely from those expressed

in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed

or identified in the filings with the Luxembourg Stock Market Authority for the Financial Markets (Commission de Surveillance du Secteur

Financier) and the United States Securities and Exchange Commission (the “SEC”) made or to be made by ArcelorMittal, including

ArcelorMittal’s latest Annual Report on Form 20-F on file with the SEC. ArcelorMittal undertakes no obligation to publicly update

its forward-looking statements, whether as a result of new information, future events, or otherwise.

About ArcelorMittal

ArcelorMittal is one of the world's leading steel and mining companies,

with a presence in 60 countries and primary steelmaking facilities in 15 countries. In 2023, ArcelorMittal had revenues of $68.3 billion

and crude steel production of 58.1 million metric tonnes, while iron ore production reached 42.0 million metric tonnes.

Our goal is to help build a better world with smarter steels. Steels

made using innovative processes which use less energy, emit significantly less carbon and reduce costs. Steels that are cleaner, stronger

and reusable. Steels for electric vehicles and renewable energy infrastructure that will support societies as they transform through this

century. With steel at our core, our inventive people and an entrepreneurial culture at heart, we will support the world in making that

change. This is what we believe it takes to be the steel company of the future.

ArcelorMittal is listed on the stock exchanges of New York (MT), Amsterdam

(MT), Paris (MT), Luxembourg (MT) and on the Spanish stock exchanges of Barcelona, Bilbao, Madrid and Valencia (MTS). For more information

about ArcelorMittal please visit: https://corporate.arcelormittal.com/

ArcelorMittal investor relations: +44 207 543 1128; Retail: +44 207

543 1156; SRI: +44 207 543 1156 and Bonds/credit: +33 1 71 92 10 26.

ArcelorMittal corporate communications (e-mail: press@arcelormittal.com)

+44 207 629 7988. Contact: Paul Weigh +44 203 214 2419

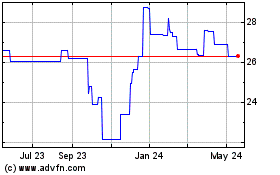

Arcelormittal (PK) (USOTC:AMSYF)

Historical Stock Chart

From Jan 2025 to Feb 2025

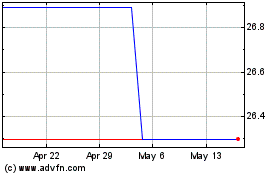

Arcelormittal (PK) (USOTC:AMSYF)

Historical Stock Chart

From Feb 2024 to Feb 2025