SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

|

Date of Report (Date of earliest event reported):

|

February 19, 2011

|

|

AURI, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

|

0-281617

|

|

33-0619264

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

1200 North Coast Hwy., Laguna Beach, California

|

|

92651

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Registrant’s telephone number, including area code:

|

|

(949) 793-4045

|

|

Wellstone Filter Sciences, Inc.

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

EXPLANATORY NOTE

The purpose of this Amendment No. 2 to Form 8-K (“Amendment”) is to amend certain items contained in the initial filing by Auri, Inc., a Delaware corporation (the “Company”), of a Current Report on Form 8-K for February 19, 2011, filed with the Securities and Exchange Commission (“SEC”) on February 22, 2011 and amended by a Current Report on Form 8-K filed with the SEC on March 10, 2011 (collectively, the “Initial Filing”). Defined terms used in this Amendment but not defined herein have the meanings ascribed to them in the Initial Filing.

The following Items of the Initial Filing are being amended:

|

|

●

|

Item 1.01 of the Initial Filing is amended to incorporate a description of the material terms of an Escrow Agreement entered into by the Company in connection with the Merger Agreement; and

|

|

|

●

|

Item 9.01 of the Initial Filing is amended to revise Item 9.01(d) to include the Escrow Agreement as Exhibit 10.1.

|

Except for the amended disclosure contained herein, this Amendment does not modify or update disclosures contained in the Initial Filing. Unless otherwise specifically stated, the disclosures provided in this document speak as of the date of the Initial Filing and have not been updated for more current information.

This Amendment should be read in conjunction with the Company’s other filings made with the SEC subsequent to the date of the Initial Filing. For updated disclosure regarding the Company’s business and financial condition, please read the Company’s periodic filings for the fiscal year ended December 31, 2010 and the quarterly period ended September 30, 2011.

|

Item 1.01.

|

Entry Into a Material Definitive Agreement.

|

Escrow Agreement

Effective February 14, 2011, the Company entered into an Escrow Agreement (the “Escrow Agreement”) with Learned Jeremiah Hand (“LJH”), Cerami Consulting Corp. (“Cerami”), Carla Hand (“Hand”), Herrington Management (“Herrington”), Advanced Multilevel Concepts, Inc. (“Advanced”) and Corporate Stock Escrow (“Escrow Agent”) covering an aggregate of 74,516,048 shares of the Company’s common stock (the “Escrowed Shares”). Certificates representing the Escrowed Shares were placed into escrow (the “Escrow Account”) with the Escrow Agent by LJH, Cerami, Hand, Herrington and Advanced in contemplation of the

closing of the Merger Agreement.

Under the terms of the Escrow Agreement, upon the closing of the Merger Agreement, (i) certificates representing shares of common stock held by Carla and Cerami (aggregating 9,631,940 shares of common stock) shall be canceled, (ii) of the shares of common stock held by LJH, (A) 4,500,00 shares shall be transferred to Herrington, (B) 1,885,804 shares shall be transferred to Advanced, (C) 56,159,514 shares shall be canceled and (D) 2,338,790 shares shall be retained by LJH, and (iii) 3,500,000 of the shares held by Herrington, together with the 1,885,804 shares held by Advanced (collectively, the “Remaining Escrowed Shares”), shall be retained by the Escrow Agent pursuant to the terms of the

Escrow Agreement.

The Escrow Agreement further provides that following the consummation of the Merger Agreement, the Company shall effect a private placement of shares of its common stock to raise gross proceeds of $2,000,000. To the extent the Company is required to issue more than 6,000,000 shares of common stock in order to receive $2,000,000 in gross proceeds under the contemplated private placement, the Escrow Agent shall cancel one Remaining Escrowed Share for each share of common stock issued by the Company in excess of 6,000,000 to reach the required $2,000,000 of gross proceeds in the offering. In the event the Company raises the $2,000,000 in gross proceeds by issuing more than 6,000,000 shares of

common stock but less than 11,385,804 shares of common stock (i.e., 6,000,000 shares of common stock plus the amount of the Remaining Escrowed Shares), any remaining shares not canceled shall be released from the Escrow Account to Herrington and Advanced. In the event the Company raises the $2,000,000 in gross proceeds by issuing 6,000,000 or fewer shares of common stock, all Escrowed Shares shall be released from the Escrow Account to Herrington and Advanced. The Escrow Agreement also provides that in the event any of the Escrowed Shares must be canceled, shares held by Herrington shall be canceled prior to the cancellation of any shares held by Advanced. The Escrow Agreement will terminate upon the earlier of the following: (i) once no Escrowed Shares remain in the Escrow Account or (ii) as further agreed by the parties.

The closing of the Merger Agreement occurred on February 24, 2011.

Effective June 22, 2011, the parties to the Escrow Agreement agreed to cause the Escrow Agent to transfer 500,000 of the Remaining Escrowed Shares held by Herrington to ML Asset Management, Inc. pursuant to the terms of an agreement between Herrington and ML Asset Management, Inc.

As of the date of the filing of this Amendment, there are an aggregate of 4,885,804 shares of the Company’s common stock held in the Escrow Account under the terms of the Escrow Agreement.

The description of the Escrow Agreement does not purport to be complete and is qualified in its entirety by reference to the Escrow Agreement, which is filed as Exhibit 10.1 to this report and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits

.

|

|

10.1

|

Escrow Agreement dated as of February 14, 2011 by and among Wellstone Filter Sciences, Inc., Learned Jeremiah Hand, Cerami Consulting Corp., Carla Hand, Herrington Management, Advanced Multilevel Concepts, Inc. and Corporate Stock Escrow*

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: November 18

, 2011

|

AURI, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ ORI ROSENBAUM

|

|

|

|

|

Ori Rosenbaum

|

|

|

|

|

President and CEO

|

|

AURI, INC.

EXHIBITS FILED WITH THIS REPORT

|

10.1

|

Escrow Agreement dated as of February 14, 2011 by and among Wellstone Filter Sciences, Inc., Learned Jeremiah Hand, Cerami Consulting Corp., Carla Hand, Herrington Management, Advanced Multilevel Concepts, Inc. and Corporate Stock Escrow

|

-5-

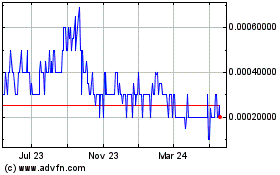

Auri (PK) (USOTC:AURI)

Historical Stock Chart

From Nov 2024 to Dec 2024

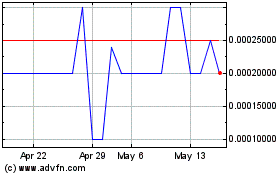

Auri (PK) (USOTC:AURI)

Historical Stock Chart

From Dec 2023 to Dec 2024