Norway Oil Fund Puts Bombardier on Watch List for Possible Exclusion

08 March 2022 - 11:01PM

Dow Jones News

By Dominic Chopping

Norway's $1.3 trillion sovereign wealth fund has placed Canadian

aircraft manufacturer Bombardier Inc. under observation for

possible exclusion from the fund over ethical concerns, along with

Indian port and logistics company Adani Ports & Special

Economic Zone Ltd. and South Korean logistics firm Hyundai Glovis

Co. Ltd.

The fund is managed by Norway's central bank, but decisions to

exclude or place companies on observation are made based on

recommendations from an ethics council of appointed by the Ministry

of Finance.

The fund adheres to guidelines that mean it doesn't invest in

certain weapons manufacturers, thermal coal miners, tobacco

producers or companies responsible for environmental damage or

which violate human rights, for example.

Norges Bank said in a statement late on Monday that it has

placed Bombardier under observation due to "unacceptable risk that

the company contributes to or is responsible for gross

corruption."

According to the ethics council, investigations revealed that

Bombardier or its subsidiaries can be linked to allegations or

suspicions of corruption in six countries spanning over ten years,

with the cases relating to bribes or suspicious transactions

amounting to over $100 million used to win contracts for

Bombardier's subsidiaries.

However, it said that the majority of allegations and suspicions

of corruption were linked to Bombardier's transportation division,

which was sold in 2021.

The fund held a 0.91% stake in Bombardier at the end of 2021,

worth $29.6 million.

Adani Ports & Special Economic Zone is placed under

observation due to "unacceptable risk that the company contributes

to or is responsible for serious violations of individuals' rights

in situations of war or conflict," Norges Bank said.

An Adani Ports subsidiary had signed a deal with a Myanmar

military-owned company to build a port terminal in the country,

prior to last year's coup.

The company has since said it plans to exit the project but the

ethics council noted significant uncertainty about when such a

withdrawal will be possible to implement.

The fund held a 0.26% stake in Adani Ports at the end of 2021,

worth $53 million.

Norges Bank has also decided to place Hyundai Glovis under

observation due to "unacceptable risk that the company contributes

to gross or systematic human rights violations and serious

environmental damage."

The ethics council said the company has disposed of

decommissioned vessels by sending them to be broken up for scrap on

beaches in Pakistan and Bangladesh, a process that causes severe

environmental damage and where working conditions are extremely

poor.

The fund held a 0.81% stake in Hyundai Glovis at the end of

2021, worth $42.9 million.

Meanwhile, Chinese sportswear manufacturer Li Ning Co. Ltd. has

been excluded from the fund due to unacceptable risk that the

company contributes to serious human rights violations in Xinjiang,

China.

"Producing in or purchasing certain products from this region,

including textiles and cotton, are associated with a particular

risk of becoming involved in forced labour," the ethics council

said.

The fund held 0.59% in Li Ning at the end of 2021, worth $168

million.

Norges Bank added that it has revoked the exclusion of

U.K.-listed oil and gas company San Leon Energy PLC. The company

has been excluded since 2016 due to risk of violating ethical norms

by engaging in petroleum prospecting in Western Sahara, but these

activities have now stopped, it said.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

March 08, 2022 06:46 ET (11:46 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

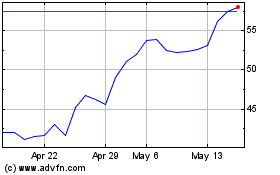

Bombardier (QX) (USOTC:BDRBF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Bombardier (QX) (USOTC:BDRBF)

Historical Stock Chart

From Jan 2024 to Jan 2025