false

0001407583

0001407583

2024-01-29

2024-01-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 29, 2024

BUNKER

HILL MINING CORP.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

|

333-150028 |

|

32-0196442 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

82

Richmond Street East, Toronto, Ontario, Canada M5C 1P1

(Address

of Principal Executive Offices) (Zip Code)

416-477-7771

(Registrant’s

Telephone Number, Including Area Code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| none |

|

|

|

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

5.02 |

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On

January 29, 2024, Bunker Hill Mining Corp. (the “Company”) entered into an award agreement with Gerbrand van Heerden,

the Chief Financial Officer of the Company, pursuant to which the Company granted 672,450 restricted stock units (the “RSUs”)

to Mr. van Heerden under the Company’s amended and restated restricted stock unit incentive plan. Each RSU represents a right of

Mr. van Heerden to receive one share of common stock of the Company on January 29, 2025.

| Item

7.01 |

Regulation

FD Disclosure. |

On

January 29, 2024, the Company issued a press release regarding the issuance of the RSUs. A copy of the press release is furnished as

Exhibit 99.1 hereto and is incorporated herein by reference.

The

information set forth in this Item 7.01, including the information set forth in Exhibit 99.1, is being furnished and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly

set forth by specific reference in such a filing.

| Item

9.01 |

Financial

Statements and Exhibits. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

BUNKER

HILL MINING CORP. |

| |

|

| Dated:

January 31, 2024 |

By: |

/s/

Sam Ash |

| |

Name: |

Sam

Ash |

| |

Title: |

President

and CEO |

Exhibit

99.1

BUNKER

HILL ANNOUNCES EQUITY COMPENSATION GRANT

TORONTO,

ONT., January 29, 2024 – Bunker Hill Mining Corp. (“Bunker Hill” or the “Company”) (TSX-V:

BNKR) (OTCQB: BHILL) announces that its board of directors has approved the grant of 672,450 restricted stock units (the “RSUs”)

to the Chief Financial Officer of the Company pursuant to the terms of the Company’s amended and restated restricted stock unit

incentive plan (the “RSU Plan”). Each RSU will vest on January 29, 2025 into one share of common stock of the Company

(the “Common Shares”) at a deemed price of C$0.10 based on the closing price of the Common Shares on the TSX Venture

Exchange (the “TSX-V”) on January 26, 2024.

A

copy of the RSU Plan is available under the Company’s profile on SEDAR+.

ABOUT

BUNKER HILL MINING CORP.

Under

new Idaho-based leadership, Bunker Hill intends to sustainably restart and develop the Bunker Hill Mine as the first step in consolidating

and then optimizing a number of mining assets into a high-value portfolio of operations, centered initially in North America. Information

about the Company is available on its website, www.bunkerhillmining.com, or within the SEDAR+ and EDGAR databases.

Cautionary

Statements

Neither

the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the

adequacy or accuracy of this release.

Certain

statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements

are within the meaning of that term in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities

Exchange Act of 1934, as amended, as well as within the meaning of the phrase ‘forward-looking information’ in the Canadian

Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations (collectively, “forward-looking

statements”). Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates

and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or

management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”,

“anticipates”, “expects”, “estimates”, “may”, “could”, “would”,

“will”, “plan” or variations of such words and phrases.

Forward-looking

statements in this news release include, but are not limited to, statements regarding the Company’s objectives, goals or future

plans, including the restart and development of the Bunker Hill Mine, and the achievement of future short-term, medium-term and long-term

operational strategies.

Factors

that could cause actual results to differ materially from such forward-looking statements include, but are not limited to, those risks

and uncertainties identified in public filings made by Bunker Hill with the U.S. Securities and Exchange Commission (the “SEC”)

and with applicable Canadian securities regulatory authorities, and the following: the Company’s inability to raise additional

capital for project activities, including through equity financings, concentrate offtake financings or otherwise; the fluctuating price

of commodities; capital market conditions; restrictions on labor and its effects on international travel and supply chains; failure to

identify mineral resources; failure to convert estimated mineral resources to reserves; the preliminary nature of metallurgical test

results; the Company’s ability to restart and develop the Bunker Hill Mine and the risks of not basing a production decision on

a feasibility study of mineral reserves demonstrating economic and technical viability, resulting in increased uncertainty due to multiple

technical and economic risks of failure which are associated with this production decision including, among others, areas that are analyzed

in more detail in a feasibility study, such as applying economic analysis to resources and reserves, more detailed metallurgy and a number

of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts and, as

a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery,

including increased risks associated with developing a commercially mineable deposit, with no guarantee that production will begin as

anticipated or at all or that anticipated production costs will be achieved; failure to commence production would have a material adverse

impact on the Company’s ability to generate revenue and cash flow to fund operations; failure to achieve the anticipated production

costs would have a material adverse impact on the Company’s cash flow and future profitability; delays in obtaining or failures

to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties

relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity

in light of the failure to obtain additional financing, including the ability of the Company to complete the payments pursuant to the

terms of the agreement to acquire the Bunker Hill Mine complex; inflation; changes in exchange rates; fluctuations in commodity prices;

delays in the development of projects; and capital, operating and reclamation costs varying significantly from estimates and the other

risks involved in the mineral exploration and development industry. Although the Company believes that the assumptions and factors used

in preparing the forward-looking statements in this news release are reasonable, undue reliance should not be placed on such statements

or information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in

the disclosed time frames or at all, including as to whether or when the Company will achieve its project finance initiatives, or as

to the actual size or terms of those financing initiatives. The Company disclaims any intention or obligation to update or revise any

forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. No stock

exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Readers

are cautioned that the foregoing risks and uncertainties are not exhaustive. Additional information on these and other risk factors that

could affect the Company’s operations or financial results are included in the Company’s annual information form or annual

report and may be accessed through the SEDAR+ website (www.sedarplus.ca) or through EDGAR on the SEC website (www.sec.gov),

respectively.

For

additional information contact:

Sam

Ash

President

and Chief Executive Officer

+1

208 627-7586

ir@bunkerhillmining.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

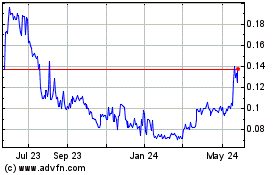

Bunker Hill Mining (QB) (USOTC:BHLL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Bunker Hill Mining (QB) (USOTC:BHLL)

Historical Stock Chart

From Jan 2024 to Jan 2025