IC Potash Announces Filing of Feasibility Study for the Ochoa

Sulphate of Potash Project

TORONTO, ON--(Marketwired -

March 10, 2014) - IC Potash Corp. (TSX: ICP) (OTCQX:

ICPTF) ("ICP" or the "Company") is pleased to announce the

filing of the "NI 43-101 Technical Report, Ochoa Project

Feasibility Study, Lea County, New Mexico, USA" (the "Report") on

SEDAR (www.sedar.com). The Report is also filed on the Company

website (www.icpotash.com). The date of the Report is March 7,

2014, with an effective date of January 9, 2014. It was prepared by

Qualified Persons from Agapito Associates Inc. and SNC-Lavalin Inc.

All dollar amounts in this press release are U.S. dollars and all

tons are short tons.

The Report includes a summary of the Ochoa Project (the

"Project"), including geology and mineralization, exploration and

drilling, resources and reserves, mining methods, mineral

processing and metallurgical testing, infrastructure, hydrology,

environmental permitting, marketing, capital costs, operating

costs, project economics, and conclusions and recommendations.

The Report recommends that ICP immediately seek funding for

bridge engineering while also seeking full funding of the Ochoa

Project. The Report also recommends that the Company move to

implementation by commencing engineering, procurement, and

construction management ("EPCM") activities and completing the

environmental permitting.

Mr. Sidney Himmel, CEO of ICP, stated: "The completion and

filing of this report, and the recommendations of its authors,

allows the Company to progress to obtain financing and project

partners to advance towards construction and production."

Highlights from the Report include:

- The financial model covers approximately three years of

construction and commissioning beginning in Q2 2014 and continuing

through Q2 2017, followed by 50 years of operation. Sulphate

of Potash ("SOP") production in 2017 is estimated at 48% of annual

capacity, with full capacity expected in 2018.

- The Company remains on schedule to receive a record of decision

on its environmental impact statement in Q2 2014, which will allow

construction to commence as planned.

- The ore bed will be accessed via a 25-foot diameter, two

compartment mine ventilation and service shaft, and a 12,000-foot

long slope.

- Room-and-pillar mining and dual split super section mining

methods are expected to be used to extract ore from the deposit at

a nominal rate of 3.7 million tons per year.

- The plant is designed to operate 7,912 hours annually and

employ approximately 400 people at full production.

- The Company has full right to appropriate non-potable water

from the Capitan Reef aquifer for mining and industrial use.

- Average K2O process recovery is estimated to be 82%.

- Steady-state annual production at full capacity is expected to

be 714,400 tons of SOP. The product mix is projected to be 229,400

tons of standard SOP, 385,000 tons of granular SOP, and 100,000

tons of soluble SOP.

- Steady-state operating production cost is estimated to be $195

per ton of SOP.

- The capital cost of the Project is estimated to be $1,018

million, with an accuracy of +/-15%.

- The after-tax Net Present Value ("NPV") is US$612 million using

an after tax discount rate of 10% and no debt. The after-tax

internal rate of return is 16%. The after-tax NPV is US$1.019

billion, using an after-tax discount rate of 8% and no debt.

- Payback period from the commencement of production is expected

to be 5.4 years after tax.

The Report identifies Measured and Indicated Resources of

1,017.8 million tons at an average grade of 83.9% by weight

polyhalite. Mineral Resources that are not Mineral Reserves do not

have demonstrated economic viability. Mineral Resources are

summarized in the table below:

Ochoa Project Mineral Resources, (effective date May 31,

2013)

| |

|

|

|

Average Thickness(ft) |

|

ResourceArea(acres) |

|

In-Place Tons1,2,3 (millions) |

|

Polyhalite(wt %) |

|

Equivalent K2SO4(wt %) |

|

Anhydrite(wt %) |

|

Halite(wt %) |

|

Magnesite (wt %) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEASURED4 |

|

5.2 |

|

26,166 |

|

511.7 |

|

84.5 |

|

24.4 |

|

4.02 |

|

3.27 |

|

7.94 |

|

INDICATED5 |

|

5.0 |

|

26,698 |

|

506.0 |

|

83.3 |

|

24.1 |

|

4.00 |

|

3.30 |

|

8.61 |

| TOTAL

M&I |

|

5.1 |

|

52,865 |

|

1,017.8 |

|

83.9 |

|

24.2 |

|

4.01 |

|

3.28 |

|

8.27 |

|

INFERRED6 |

|

4.8 |

|

15,634 |

|

284.0 |

|

82.6 |

|

23.9 |

|

4.11 |

|

3.37 |

|

8.82 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1 Average in-situ bulk density of 173.5

pounds per cubic foot (pcf). |

| 2 Bed thickness cutoff 4.0 ft, composite

grade cutoff 65.0% polyhalite, excludes out-of-seam

dilution. |

| 3 Mineral Resource includes Mineral

Reserves. |

| 4 Measured Resource located within 0.75-mile

radius from an exploration core hole. |

| 5 Indicated Resource located between

0.75-mile and 1.5-mile radius from an exploration core

hole. |

| 6 Inferred Resource located between 1.5-mile

and 3.0-mile radius from an exploration core hole. |

| Note: Gypsum

weight percent negligible for all resource classifications. |

| |

The Company released the details of a feasibility study on

January 23, 2014. The Report outlines a detailed 50-year mine plan

as well as calculated Proven and Probable Mineral Reserves based on

the Project's Measured and Indicated Mineral Resources. Contained

within the mine plan are approximately 182.4 million tons of Proven

and Probable Reserves grading 78.05% by weight polyhalite. Measured

and Indicated mineral resources become Proven and Probable Mineral

Reserves once it has been determined that the resources are

economic for extraction. These Reserves are shown below:

Ochoa Project Mineral Reserves, (effective date January 9,

2014)

|

|

|

AverageMinedThickness1 (ft) |

|

50 Year Mine Plan Mined Area(million ft2 ) |

|

ROM Mined Tons 2,3 (millions) |

|

Mining Recovery4 (%) |

|

Polyhalite(wt %) |

|

EquivalentK2S04 (wt %) |

|

Anhydrite(wt %) |

|

Halite(wt %) |

|

Magnesite(wt %) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PROVEN |

|

5.9 |

|

246 |

|

125.0 |

|

47.1% |

|

78.42 |

|

22.66 |

|

11.29 |

|

3.66 |

|

7.79 |

|

PROBABLE |

|

5.9 |

|

113 |

|

57.4 |

|

64.8% |

|

77.20 |

|

22.31 |

|

11.60 |

|

3.65 |

|

8.30 |

| TOTAL

P&P |

|

5.9 |

|

359 |

|

182.4 |

|

51.5% |

|

78.05 |

|

22.55 |

|

11.39 |

|

3.66 |

|

8.08 |

| 1 Bed thickness cutoff 4.0 ft,

composite grade cutoff 66.0% polyhalite, includes out-of-seam

dilution. |

| 2 Average in-situ bulk density of 173.5

pcf. |

| 3 No inferred tons mined |

| 4 Areal recovery (mined area) inside 50

Year Mine Plan boundary |

| Note: Gypsum weight percent negligible

for all resource classifications. |

| Mineral

Reserves are included in Mineral Resources |

| |

Measured and Indicated Mineral Resources exist to the north,

east, and west of the 50-year mine plan boundary and there is a

reasonable expectation that those resources will be economically

mineable, which would allow for an extension of mining operations

beyond 50 years.

Qualified Persons Report:

All scientific and technical disclosures in this press release

have been prepared under the supervision of and approved by Deepak

Malhotra, Ph.D. and registered SME member, president of Resource

Development Inc., a Qualified Person within the meaning of National

Instrument 43-101 - Standards of Disclosure for Mineral Projects

("NI 43-101") and an advisor to the Company.

The Report authors are Gary Skaggs, P.E., P.Eng.; Leo Gilbride,

P.E.; Tom Vandergrift, P.E.; Susan Patton, Ph.D., P.E.; Vanessa

Santos, PG; Lawrence Berthelet, P.Eng., MBA; and Jack Nagy, P.

Eng., each an independent Qualified Person within the meaning of NI

43-101.

About IC Potash Corp.

ICP has demonstrated a low-cost method to produce Sulphate of

Potash ("SOP") from its 100%-owned Ochoa polyhalite deposit in

southeast New Mexico. The Company intends to become a primary,

long-term producer of SOP. The global market for SOP is 5.5 million

tons per year, with producers benefiting from substantial price

premiums over regular potash, known as muriate of potash. SOP is a

non-chloride potash fertilizer widely used in the horticultural

industry and for high value crops, such as fruits, vegetables,

tobacco and potatoes. It is applicable for soils where there are

substantial agricultural activity, high soil salinity, and in arid

regions. The Ochoa Project has access to excellent local labor

resources, low-cost electricity and natural gas, water, rail lines,

and the Port of Galveston, Texas. ICP's land holdings consist of

nearly 90,000 acres of federal subsurface potassium prospecting

permits and State of New Mexico potassium mining leases. For more

information, please visit www.icpotash.com.

Forward-Looking Statements

Certain information set forth in this news release may contain

forward-looking statements that involve substantial known and

unknown risks and uncertainties and other factors which may cause

the actual results, performance or achievements of ICP to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Forward-looking statements include statements that use

forward-looking terminology such as "may", "will", "expect",

"anticipate", "believe", "continue", "potential" or the negative

thereof or other variations thereof or comparable terminology. Such

forward-looking statements include, without limitation, reserve

estimates, ICP's expected position as one of the lowest cost

producers of SOP in the world, the timing of receipt and

publication of ICP's environmental permits, the sufficiency of

ICP's cash balances, the timing of production, and other statements

that are not historical facts. These forward-looking statements are

subject to numerous risks and uncertainties, certain of which are

beyond the control of ICP, including, but not limited to, risks

associated with mineral exploration and mining activities, the

impact of general economic conditions, industry conditions,

dependence upon regulatory approvals, the uncertainty of obtaining

additional financing, and risks associated with turning reserves

into product. Readers are cautioned that the assumptions used in

the preparation of such information, although considered reasonable

at the time of preparation, may prove to be imprecise and, as such,

undue reliance should not be placed on forward-looking

statements.

FOR MORE INFORMATION, PLEASE CONTACT: Mr. Mehdi Azodi Investor

Relations Director Phone: 416-779-3268 E-mail:

mazodi@icpotash.com

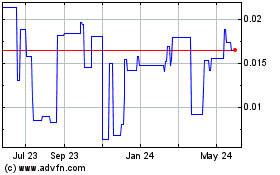

Belgravia Hartford Capital (PK) (USOTC:BLGVF)

Historical Stock Chart

From Feb 2025 to Mar 2025

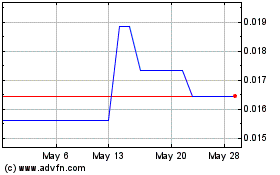

Belgravia Hartford Capital (PK) (USOTC:BLGVF)

Historical Stock Chart

From Mar 2024 to Mar 2025