false

0000814926

0000814926

2024-12-20

2024-12-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report: December 23, 2024

(Earliest Event Date requiring this Report: December

20, 2024)

CAPSTONE

COMPANIES, INC.

(EXACT

NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

| Florida |

0-28331 |

84-1047159 |

| (State

of Incorporation or Organization) |

(Commission

File Number) |

(I.R.S.

Employer Identification No.) |

Number

144-V, 10 Fairway Drive Suite

100

Deerfield

Beach, Florida 33441

(Address of principal executive offices)

(954) 570-8889,

ext. 313

(Registrant’s telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instructions A.2. below):

| ☐ |

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter). Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act: None

| Title

of Class of Securities. |

Trading

Symbol(s). |

Name

of exchange on which registered |

| N/A |

N/A |

N/A |

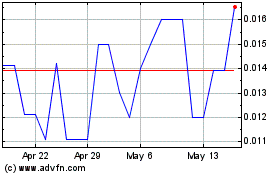

The

Registrant’s Common Stock is quoted on the OTCQB Venture Market of the OTC Markets Group, Inc. under the trading symbol “CAPC.”

Item 1.01. Entry into Material Definitive

Agreement. On December 20, 2024, Capstone Companies Inc. (“Company”) and its wholly owned subsidiary, Capstone Industries,

Inc. (“Sub”) entered into the following agreements to cancel outstanding debts owed by the Company to the other parties to

the agreements:

(1) Cancellation Agreement with Stewart Wallach, former Chief Executive

Officer, current Chair of the Company’s Board of Directors, and a principal shareholder of the Company;

(2) Cancellation Agreement with Group Nexus, LLC, a Florida limited liability

company controlled by Stewart Wallach;

(3) Cancellation Agreement with Jeffrey Postal, a former director and a

principal shareholder of the Company;

(4) Cancellation Agreement with George Wolf, a former director of the Company;

and

(5) Cancellation Agreement with the Estate of E. Fleisig (as successor

in interest to E. Fleisig (deceased)).

The parties to the above cancellation agreements who are creditors

of the Company shall be referred to as “creditor parties”.

The Company issued shares of its Series B-1

Convertible Preferred Stock (“B-1 Stock”) in return for the above parties’ agreement to cancel debts owed by the Company,

which debts had been transferred to the Sub for accounting purposes. The following table states the number of shares of B-1 Stock issued

and the amount of debt cancelled under each of the above agreements:

| Name of Creditor Party |

Amount of Debt owed by the Company (includes accrued interest and deferral of compensation) |

Number of shares of B-1 Stock issuable under cancellation agreement |

|

Stewart Wallach |

$1,392,570

|

284,978 |

|

Group Nexus, LLC |

$657,887

|

134,631

|

|

Jeffrey Postal |

$887,763

|

181,674 |

|

George Wolf |

$336,875 |

68,939 |

|

Estate of E. Fleisig |

$390,208 |

79,853

|

|

Totals |

$3,665,303

|

750,075 |

(1) The Amended and Restated Articles of

Incorporation of the Company provides that in lieu of issuing a fractional share, any fractional share will be paid in an amount equal

to the product of such fraction multiplied by the Common Stock’s fair market value as determined in good faith by the Company’s

Board of Directors as of the date of conversion.

Restricted Securities. The shares of

B-1 Stock issuable under the cancellation agreements listed above are “restricted securities” under Rule 144 of the Securities

Act of 1933 and are also subject to the restrictions on transfer listed below under “Lock-up”. The cancellation agreements

do not grant any registration rights to the shares of B-1 Stock or any shares of Company Common Stock issued upon a conversion of shares

of B-1 Stock.

B-1 Stock. Shares of B-1 Stock have the

following rights and restrictions:

(1) No right to dividend distributions and no

voting rights.

(2) B-1 Stock ranks junior in preferences to

any other class or series of preferred stock authorized and issued by the Company in respect of any distributions of assets.

(3) In the event of any liquidation, dissolution

or winding up of the affairs of the Company, whether voluntary or involuntary, the holders of full and fractional shares of B-1 Stock

shall be entitled, before any distribution or payment is made on any date to the holders of the Common Stock, but after all distributions

are made in full to all other series of issued and outstanding shares of preferred stock, to be paid in full an amount per whole share

equal to $1.00.

(4) Each share that is issued and outstanding may be converted into

66.66 shares of Company Common Stock by the holder thereof upon written demand to the Company and upon compliance with any reasonable

administrative requirements of the Company for such conversion.

(5) The number of shares of Company Common Stock issuable upon any

conversion of the shares of B-1 Stock is subject to usual and customary proportional adjustment of the number of shares of Company Common

Stock issuable in the event of a recapitalization, exchange or substitution of shares.

Lock-up. Under each of the above Cancellation Agreements,

each of the creditor parties is subject to the following lock-up for transfer and conversion of shares of B-1 Stock:

Commencing December 20, 2024 and until the

earlier to occur of: (1) December 20, 2025; (2) the date that the creditor party ceases to be beneficial owner of the shares of B-1

Stock (“Shares”) and any shares of Common Stock issued in a conversion of the Shares (“Conversion Shares”)

because of an exchange or cancellation in connection with a merger or other business combination that is approved by a majority of

the disinterested directors of the Company (being referred to as an “Approved Transaction”); (3) death or dissolution of

the creditor party, as the case may be; (4) the termination of the Management Transition Agreement, signed as of October 31, 2024,

and amended on November 6, 2024, by the Company and Coppermine Ventures, LLC (“CVEN”) (the Management Transition

Agreement, as amended, being referred to as the “MTA”) in accordance with MTA’s terms and conditions and prior to

MTA’s stated expiration date; (5) the date that the Company or Sub files for protection from creditor under any chapter of the

U.S. Bankruptcy Code or the date that an involuntary bankruptcy proceeding is commenced for the Company or Sub under the U.S.

Bankruptcy Code; or (6) disinterested directors of the board of directors of the Company approves a plan of complete dissolution

under applicable domicile laws, the creditor party will not, directly or indirectly, do any of the following acts: (a) tender any

Shares or Conversion Shares to any tender or exchange offer, except in connection with an Approved Transaction; or (b) offer,

pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option,

right or warrant to purchase, or otherwise transfer or dispose of, directly or indirectly, any Shares or Conversion Shares, except

as permitted in next paragraph below; or (c) convert any Shares into Conversion Shares.

The lock-up restriction provides for the following

exceptions to any of the following sales, assignments or transfers of any of the Shares by the creditor party:

(1) the sale of 10% or fewer of the Shares in any

three (3) month period in a private sale of the Shares to an Accredited Investor (as defined in 17 C.F.R. §230.501(a)) who is pre-approved

by the disinterested directors of the Company’s Board of Directors as a buyer of the Shares, which private sale qualifies for an

exemption from registration under federal and applicable state securities laws and regulations; or

(2) if the creditor party is a natural person, to

the creditor party’s estate following the death of the creditor party, by will, intestacy or other operation of applicable laws;

or

(3) if the creditor party is a natural person, by

operation of law, such as pursuant to a qualified domestic order or in connection with a divorce settlement; or

(4) in any public securities offering registered

under the Securities Act of 1933 on Form S-1 or Form S-3 registration statement, or on any successor registration statement form,

filed prior to the first annual anniversary of December 20, 2024, with the SEC by the Company for registration of shares of Common

Stock being sold by CVEN or its affiliates and for which the Company grants piggyback registration rights to the creditor party,

which piggyback registration rights will have terms and conditions as favorable as the piggyback registration rights granted to CVEN

or its affiliates, and which registration rights will only granted by the Company in its sole discretion.

Dilution. The series B-1 Stock is convertible

into shares of Company Common Stock at a conversion ratio of one share of B-1 Stock for 66.66 shares of Company Common Stock. If 50% of

the shares of B-1 Stock issued under the cancellation agreements are converted by the holders after the aforementioned lock-up period,

then the conversion would result in the issuance of an estimated 24,999,997 shares of Common Stock (with fractional shares being paid

in cash), which would represent approximately 34% of the then issued and outstanding shares of Common Stock (assuming that no additional

shares of Common Stock are issued and no purchase or redemption of the shares of B-1 Stock after the date of the filing of this Form 8-K).

If 100% of the shares of B-1 Stock issued under the cancellation agreements are converted by the holders after the aforementioned lock-up

period, then the conversion would result in the issuance of approximately 49,999,994 shares of Common Stock (with fractional shares being

paid in cash), which would represent 50.5% of the then issued and outstanding shares of Common Stock (assuming no additional issuance

of shares of Common Stock and no purchase or redemption of the shares of B-1 Stock after the date of the filing of this Form 8-K. These

percentages are based on an estimated total of 98,826,858 shares of Company Common Stock being issued and outstanding - assuming the conversion

of 100% of the shares of B-1 Stock being converted by all of the holders under the cancellation agreements; and 73,826,864 shares of Company

Common Stock being issued and outstanding – assuming the conversion of 50% of all of the shares of B-1 Stock being converted by

all of the holders under the cancellation agreements). ]

Approval of Cancellation Agreements.

As previously reported in filings with the Commission, the Company has sought since 2023 to develop a new business line internally

(primarily by seeking funding for the production and promotional launch of the Connected Chef tablet product developed by the Company)

or, alternatively, to acquire a new business line through a merger or acquisition. In pursuing those goals, the Company determined that

the debts of the Company, the ones owed to the creditor parties, was adversely affecting the ability of the Company to induce third parties

to consider funding the development of a new business line or to consider a merger or acquisition involving the Company. The Company also

determined that cancellation or settlement of the debts owed the creditor parties would enhance the Company’s prospects for obtaining

funding for developing a new business line or acquiring a new business line for creating revenue generating operations. There is no assurance

that the cancellation or settlement of the debts owed the creditor parties will in fact enhance or enable the development or acquisition

of a new business line, but the existence of those debts was, based on interactions with third parties and in the judgment of the Company,

adversely affecting the Company’s efforts to establish a new business line.

After discussions with the creditor parties,

and in light of the lack of operating revenues or funding, the Company determined that the issuance of shares of capital stock for cancellation

of the debts owed the creditor parties was the only feasible, attainable solution to eliminating those debts. The possible dilution of

holders of Common Stock from any future conversion of the shares of B-1 Stock was determined by the Company to be an acceptable consequence

of elimination of the debts owed to the creditor parties in light of the fact that the Company will be unable to sustain its operations

and continue as a going concern without third party funding or the acquisition of a revenue generating operation. The Company’s

business and financial performance severely limited the Company’s options for resolution of its debts. Funding provided by CVEN

under the MTA and an unsecured promissory note, dated October 31, 2024, (“Note) is only sufficient to cover estimated working capital

needs for paying Company debts essential to maintaining reporting compliance under the Securities Exchange Act of 1934 and corporate compliance

under applicable state law through March 31, 2025. In short, the Company concluded that issuing the shares of B-1 Stock was the only available

option to resolving its debts without filing for liquidation or reorganization under bankruptcy laws, which liquidation or reorganization

would in all likelihood resulted in the loss of the public shareholders of the Company investment in their shares of Company capital stock.

The disinterested directors approved each of

the cancellation agreements prior to execution by the parties. Mr. Wallach recused himself from voting on the cancellation agreement for

himself and the cancellation agreement for Group Nexus, LLC and cancellation agreement for the Estate of E. Fleisig (due to a family relationship

with the certain heirs of the estate). Mr. Postal recused himself from voting on his cancellation agreements and Mr. Wolf did the same

for his cancellation agreement.

The cancellation agreements were reviewed by

Company’s independent director, Jeffrey Guzy, with the assistance of professional advisors of the Company and he reported to the

Company’s Board of Directors that he deemed the cancellation agreements and transactions thereunder fair to the Company’s

public shareholders under the then current business and financial condition and prospects of the Company. The Company needs to develop

or acquire a new business line with revenue generating operations in order to continue as a going concern. The Company currently has no

revenue generating operations and only limited funding under the MTA and Note.

A copy of the above referenced cancellation agreements

are filed as Exhibits 10.1, 10.2, 10.3, 10.4 and 10.5 to this Current Report on Form 8-K (“Form 8-K”) and the summary of those

cancellation agreements in this Item 1.01 is qualified in its entirety by reference to the cancellation agreements filed as Exhibits 10.1,

10.2, 10.3, 10.4 and 10.5 to this Form 8-K. The above summary of the terms of the B-1 Stock is qualified in its entirety by reference

to the Company’s Amended and Restated Articles of Incorporation, as filed as Exhibit 3.1 to the Current Report on Form 8-K, dated

June 8, 2016, as filed by the Company with the Commission.

Item 5.01 Changes in Control of Registrant.

Based on information in filings with the Commission,

and as of the date of the filing of this Form 8-K, Stewart Wallach owns or controls a total of 9,831,745 (representing approximately 20.1%

of the issued and outstanding shares and voting power of the Company Common Stock, as of the date of the filing of this Form 8-K) and

Jeffrey Postal owns or controls a total of 9,034,120 shares of the Company Common Stock (representing approximately 18.5% of the issued

and outstanding shares and voting power of the Company Common Stock, as of the date of the filing of this Form 8-K). The percentages are

based on 48,826,864 shares of Company Common Stock being issued and outstanding. The foregoing share ownership totals do not include conversion

of options or warrants or other convertible securities, including shares of B-1 Stock. Mr. Wallach and Mr. Postal are the two largest

holders of record of shares and voting power of the Company Common Stock.

If Stewart Wallach and Group Nexus, LLC, which is

controlled by Mr. Wallach, convert all of the shares of B-1 Stock received under their cancellation agreements after the lock-up period

described in Item 1.01 above, and assuming no sales or transfers of shares of Common Stock or shares of B-1 Stock, then Mr. Wallach would

control a total of 37,802,926 shares of Common Stock.

If Jeffrey Postal converts all of the shares of B-1

Stock received under his cancellation agreement after the lock-up period described in Item 1.01 above, and assuming no sales or transfers

of shares of Common Stock, then Mr. Postal would own or control a total of approximately 21,144,479 shares of Common Stock.

While there is no agreement between Mr. Wallach and

Mr. Postal to act as a “group” (as defined in Section 13(d)(3) of the Securities Exchange Act of 1934), and no voting agreement

between them, as of the date of the filing of this Form 8-K, then the issuance of shares of B-1 Stock under the cancellations agreements

and subsequent conversion of those shares in to shares of Company Common Stock by Jeffrey Postal, Stewart Wallach and Group Nexus, LLC,

could possibly provide them, if acting jointly or in concert, with sufficient voting control to approve or disapprove corporate actions

requiring a vote of Company Common Stock shareholders. The voting power of Mr. Wallach and affiliates and Mr. Postal would depend on the

number of shares of Company Common Stock issued upon conversion of shares of B-1 Stock by other parties under the cancellation agreements

and issuance of additional shares of Company Common Stock by the Company in transactions other than a conversion of shares of B-1 Stock

under the cancellation agreements, which additional issuances are not readily ascertainable as of the date of the filing of this Form

8-K and may ot occur.

Since the Company is seeking to fund the

internal development of a new business line or acquire a new business line or third-party operating company by merger or

acquisition, the issuance of additional shares of Company Common Stock or shares of another class of Company capital stock could

possibly occur in any such corporate action. As of the date of the filing of this Form 8-K, the Company has no legally binding

agreement or commitment to fund the internal development of, or to acquire or merge with, a new business line or third party, or to

issue any securities in an transaction to provide working capital beyond funding under the MTA and Note. No assurances are or

can be given as to the likelihood of the funding of, or acquisition by merger or otherwise of, a new business line or third party

operating company. The MTA referenced in Item 1.01 of this Form 8-K (and previously reported in the Current Report on Form 8-K,

dated November 5, 2024, filed by the Company with the Commission) is an effort by the Company to fund essential corporate compliance

costs through March 31, 2025, and sustain corporate operations, as well as recruit new one or more directors and a senior officer to

lead ongoing management efforts to establish a new business line and revenue generating operations.

FORWARD LOOKING STATEMENTS. Except for

statements of historical fact in this Form 8-K, the information, especially discussions about Company’s efforts to develop or

acquire a new business line and about efforts under the MTA for development or acquisition of a new business line, contained above

may contain forward-looking statements, which statements are characterized by words like “seeking,”

“should,” “may,” “intend,’ “expect,” “hope,” “believe,”

“anticipate” and similar words. Forward looking statements are not guarantees of future performance and undue reliance

should not be placed on them. Forward-looking statements necessarily involve known and unknown risks and uncertainties, which may

cause actual performance and financial results in future periods to differ materially from any statements about future performance

or results expressed or implied by such forward-looking statements. Company is a public shell company without revenue generating

revenues and relies on working capital funding from third parties to sustain its corporate existence and fund meeting the compliance

requirements as an SEC reporting company with its stock quoted on the OTC QB Venture Market. The Company is also a “penny

stock” company with limited public market liquidity and no primary market makers. As such, Company may be unable to develop a

new business line, or acquire or merge with an existing operating company, or, even if a new business line or sustain operations.

revenue generating operation is established, to fund and successfully operate that new business line or operation. Further, the

public auditors of the Company have expressed doubt as to the Company as a going concern. Company may be unable to obtain adequate,

affordable and timely funding to sustain any new business line. There is substantial doubt about the Company’s ability to

establish a new business line or sustain an operation. The business and financial results of another company, including Coppermine

Ventures, LLC or any affiliated company, is not relevant to, and not an indication of the future prospects of any future business,

or the future financial condition or performance of the Company, or future corporate transactions, and should not be relied upon or

regarded as an indication of future business and financial performance of the Company or its future corporate transactions. The risk

factors in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and other filings with the

SEC should be carefully considered prior to any investment decision. The Company undertakes no obligation to update forward-looking

statements if circumstances or management’s estimates or opinions should change except as required by applicable securities

laws. The reader is cautioned not to place undue reliance on forward-looking statements.

Item 9.01. Financials and Exhibits.

(d) Exhibits. The following exhibits are filed with

this Form 8-K:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

CAPSTONE

COMPANIES, INC., A FLORIDA CORPORATION

By: /s/ Stewart Wallach

Stewart Wallach, Chair of Board of Directors

Dated: December 23, 2024

Exhibit 10.1

THE SHARES ISSUED

UNDER THS CANCELLATION AGREEMENT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”),

OR ANY OTHER APPLICABLE SECURITIES LAWS AND HAVE BEEN ISSUED IN RELIANCE UPON AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE

SECURITIES ACT AND SUCH OTHER SECURITIES LAWS. NEITHER THIS SECURITY NOR ANY INTEREST OR PARTICIPATION HEREIN MAY BE REOFFERED, SOLD,

ASSIGNED, TRANSFERRED, PLEDGED, ENCUMBERED, HYPOTHECATED OR OTHERWISE DISPOSED OF (COLLECTIVELY, A “TRANSFER”), EXCEPT PURSUANT

TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO A TRANSACTION WHICH IS EXEMPT FROM, OR NOT SUBJECT TO,

SUCH REGISTRATION, IN EACH CASE IN ACCORDANCE WITH ALL APPLICABLE SECURITIES LAWS. FURTHER, THE RESTRICTIONS ON TRANSFER OF THE SHARES

IN THE CANCELLATION AGREEMENT MUST BE SATISFIED.

CANCELLATION AGREEMENT

THIS CANCELLATION

AGREEMENT (this “Agreement”), dated December 18, 2024, is made by and among Capstone Industries, Inc., a Florida corporation

(the “Company”), Capstone Companies, Inc., a Florida corporation and the parent company of the Company, (“Parent”)

and Stewart Wallach, a natural person, (the “Creditor”). Company, Parent and Creditor will be also referred to individually

as a “party” and collectively, as the “parties”.

BACKGROUND

A. The Company

desires to reduce its debt load in order to improve its balance sheet and to enhance the ability of its Parent, which owns 100% of the

Company’s capital stock and consolidates financial statements of Company into Parent’s financial statements, to secure ongoing

or future funding and to facilitate efforts of Parent’s management to develop or acquire a new business line.

B. The Company and

Parent have no revenue generating operations and rely on third party funding to sustain their operations and corporate existence. Development

of a new business line is essential to Parent and Company continuing as ongoing concerns.

C. The debts owed

to the Creditor by the Parent are set forth in Exhibit One hereto (referred to as the “Debt”) and Creditor agrees to cancel

the Debt in exchange for certain amount of shares of Series B-1 Convertible Preferred Stock (“B-1 Stock”) of the Company,

calculated at the price of $0.07 per share (the “Exchange Price”), on the terms set forth herein, and the Parent is willing

and able to issue shares of B-1 Stock to the Creditor on the terms described herein. The Debt are set forth on the financial statements

of the Company after a transfer of the Debts by the Parent.

D. The Parent is

subject to the reporting requirements of the Securities Exchange Act of 1934 (“Exchange Act”) and files reports under Section

13 of the Exchange Act with the U.S. Securities and Exchange Commission (“SEC”).

E. “Affiliates”

has the meaning set forth in 17 Code of Federal Regulations §230.405, as amended. “Business day” means a weekday on

which the banks in Broward County, Florida are open for business on regular hours.

F. The obligations

of the parties under this Agreement are subject to certain conditions precedent set forth below.

Intending to be legally bound, the

parties agree:

1. Cancellation of

the Debt; Issuance of the Shares. At the “Closing” (as defined in Section 2 below) and subject to the terms and conditions

of this Agreement, the Debt shall be cancelled in return for the issuance of, and the Parent shall issue, an aggregate of 284,978

shares of B-1 Stock (the “Shares”), calculated at the Exchange Price, to the Creditor and do so on behalf of the

Company. Issuance of the Shares will be a full accord and satisfaction of the Debt for the Parent and Company.

2. Closing; Delivery

of Shares. (a) The closing of the cancellation of the Debt and the issuance of the Shares shall occur as soon as practicable after the

execution of this Agreement and satisfaction of the conditions set forth in this Agreement, but in no event later than forty five (45)

calendar days from the execution of this Agreement (the “Outside Date”), at the offices of the Parent, or such other place,

date and time as the parties may otherwise agree (the “Closing”). Issuance of the Shares is expressly subject to conditions

in this Agreement, including, without limitation the conditions set forth in Section 7 below.

(b) At the Closing,

and if the Parent has engaged a stock transfer agent to record transactions in the B-1 Stock, the Parent shall use its best efforts to

cause the Parent’s transfer agent to deliver to the Creditor, by courier or FedEx, a stock certificate registered in the name of

Creditor and representing the amount of Shares as is set forth above. If the Parent acts as its stock transfer agent, then the Parent

will issue the stock certificates for the Shares within ten (10) business days after the Closing. The Creditor may elect to have the

Shares registered on the Parent’s stock transfer and registrar records and receive a written certification of ownership of the

Shares rather than a physical stock certificate.

(c) Legends. Creditor

understands that, until such time as the Shares may be sold pursuant to an effective registration statement or any available, applicable

exemption from the registration requirements under the Securities Act (including, if the Parent is eligible under Rule 144 of the Securities

Act, Rule 144 of the Securities Act), any certificates representing the Shares or Conversion Shares, whether maintained in a book entry

system or otherwise, will bear a legend in substantially the following form and substance:

“THE SHARES

EVIDENCED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”),

OR ANY OTHER APPLICABLE SECURITIES LAWS AND HAVE BEEN ISSUED IN RELIANCE UPON AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE

SECURITIES ACT AND SUCH OTHER SECURITIES LAWS. NEITHER THIS SECURITY NOR ANY INTEREST OR PARTICIPATION HEREIN MAY BE REOFFERED, SOLD,

ASSIGNED, TRANSFERRED, PLEDGED, ENCUMBERED, HYPOTHECATED OR OTHERWISE DISPOSED OF, EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OR PURSUANT TO A TRANSACTION WHICH IS EXEMPT FROM, OR NOT SUBJECT TO, SUCH REGISTRATION, IN EACH CASE IN ACCORDANCE

WITH ALL APPLICABLE SECURITIES LAWS. FURTHER, A CERTAIN CANCELLATION AGREEMENT BETWEEN THE ISSUER AND INITIAL HOLDER OF THESE SHARES,

RESTRICTS TRANSFER OF THESE SHARES BY THE INITIAL HOLDER OF THE SHARES. A COPY OF THE CANCELLATION AGREEMENT IS AVAILABLE AT NO CHARGE

FROM THE ISSUER OF THE SHARES.”

3. Representations

and Warranties of Creditor. The Creditor represents and warrants to the Company and Parent with respect to only himself that, as of the

date first written above, and as of the date of the Closing, as follows:

(a). Qualification,

Authorization and Enforcement. This Agreement has been duly executed by the (i) Creditor, and when delivered by the Creditor in accordance

with the terms hereof, this Agreement will constitute the valid and legally binding obligation of the Creditor, enforceable against him

in accordance with its terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium,

liquidation or similar laws relating to, or affecting generally the enforcement of, creditors’ rights and remedies or by other

equitable principles of general application.

(b). No Conflict.

The execution, delivery, and performance of this Agreement do not and will not: (i) conflict with or violate any law or governmental

order applicable to the Creditor; or (ii) conflict with, result in any breach of, constitute a default (or event which with the giving

of notice or lapse of time or both would become a default) under, require any consent under, or give to others any rights of termination,

amendment, acceleration, suspension, revocation or cancellation of, or result in the creation of any encumbrance on any of the assets

or properties of the Creditor pursuant to, any contract to which the Creditor is a party or by which any of such assets or properties

are bound or affected.

(c). Governmental

Consents and Approvals. The execution, delivery, and performance of this Agreement by the Creditor does not and will not require any

consent, approval, authorization, or other order of, action by, filing with, or notification to, any governmental authority, except:

(i) the filing of a Form D with the U.S. Securities and Exchange Commission (“SEC”) and then the filing of that Form D with

states that require the filing of that Form D (as filed with the SEC); and (ii) the possible need to file a Form 4 and amended Schedule

13D with the SEC by the Creditor. Creditor agrees and understands that the transaction contemplated herein may obligate the Creditor

to make these SEC and states’ filings and those filings would be the sole responsibility and obligation of the Creditor, not the

Company or Parent.

(d). Purchase Entirely

for Own Account. Creditor is acquiring the Shares for Creditor’s own account for investment purposes only, not as nominee or agent,

and not with a view to, or for sale in connection with, a distribution of the Shares within the meaning of the Securities Act of 1933,

as amended (the “Securities Act”), and Creditor has no present intention of selling, granting any participation in, or otherwise

distributing the same in violation of the Securities Act or applicable state securities laws and regulations. Except as provided by and

other than as required under below, nothing contained herein shall be deemed a representation or warranty by Creditor to hold Shares

for any period of time, other than any period required under applicable laws or court order.

(e). Investor Status.

Creditor is not a registered broker-dealer under Section 15 of the Exchange Act, or a person engaged in a business that would require

him to be so registered. Creditor has such experience in business and financial matters that he is capable of evaluating the merits and

risks of an investment in the Shares. Creditor acknowledges that an investment in the Shares is speculative and involves a high degree

of risk. At the time the Creditor was offered the Shares, he was, at the time of the date first written above and the date on which the

Closing occurs, an “accredited investor” as defined in Rule 501(a) under the Securities Act. Timely completion, signing and

tender of the investor questionnaire is a condition precedent to the obligation of the Parent to issue the Shares to the Creditor.

(g). Access to Information.

Creditor is a former senior officer (as of December 4, 2024) and a current director of the Parent, and a current director and senior

officer of the Company, and he has access to, and has been afforded access to, the business and financial records of the Parent and Company.

Further, the Creditor has reviewed the Parent’s SEC filings since 2020, which contain consolidated financials incorporating financial

results of Company. In addition, the Creditor has had (i) the opportunity to ask such questions as he has deemed necessary of, and to

receive answers from, representatives of the Company and Parent concerning the terms and conditions of the issuance of the Shares and

the merits and risks of investing in the Shares; (ii) access to information about the Parent and Company and their respective financial

condition, results of operations, business, properties, management and prospects sufficient to enable him to evaluate his investment

in the Shares and Conversion Shares; and (iii) the opportunity to obtain such additional information that the Parent or Company possesses

or can acquire without unreasonable effort or expense that is necessary to make an informed investment decision with respect to the investment

in the Shares and Conversion Shares.

(h). Independent

Investment Decision. Creditor has independently evaluated the merits of his decision to acquire the Shares and Conversion Shares pursuant

to this Agreement, and the Creditor confirms that he has not relied on the advice of anyone other than the Creditor’s own business,

financial and legal advisors and his independent investigation of the Parent and Company in making his investment decision. Creditor

understands that nothing in the Agreement or any other materials presented to Creditor in connection with the purchase and sale of the

Shares constitutes legal, tax, financial or investment advice. Creditor has consulted such financial, legal, tax and investment advisors

as he, in his sole discretion, has deemed necessary or appropriate in connection with his acquisition of the Shares. Creditor has not

relied upon any representations by the Parent or Company that are not expressly contained in this Agreement in deciding to enter into

this Agreement.

(i). Restricted Securities.

Creditor understands and acknowledges that: (i) the Shares and shares of Parent Common Stock issuable upon conversion of the Shares (“Conversion

Shares”) are “restricted securities” under Rule 144 under the Securities Act and will bear a customary restrictive

legend inasmuch as they are being acquired from the Parent in a transaction not involving a public offering and that under such laws

and applicable regulations such securities may be resold without registration under the Securities Act only in certain limited circumstances

or qualification for an exemption from registration under the Securities Act.

(ii). No Registration.

The Shares have not been registered under the Securities Act or any state securities laws and are being offered and sold in reliance

upon specific exemptions from the registration requirements of the Securities Act and state securities laws, and the Parent is relying

upon the truth and accuracy of, and Creditor’s compliance with, the representations, warranties, covenants, agreements, acknowledgments

and understandings of Creditor contained in this Agreement and in the investor questionnaire in order to determine the availability of

such exemptions and the eligibility of Creditor to acquire the Shares; and

(iii). Hold Investment.

The Shares and Conversion Shares may have to be held indefinitely unless the Shares and Conversion Shares are registered under the Securities

Act or applicable state securities laws, or an exemption from registration is available for the Shares and Conversion Shares. Further,

there is no public market for the Shares and the public market for the Conversion Shares may have limited liquidity from time to time.

The Parent has no intention or plans to create a public market for the Shares.

(j). No Registration

Rights. Creditor further understands that there is no registration rights granted for the Shares or Conversion Shares being acquired

pursuant to this Agreement.

(k) Shell Company.

As of the date first written above, Rule 144 under the Securities Act is not available for resale of the Shares or Conversion Shares

and will not be available for resale of the Shares or Conversion Shares, until such time as the Parent has satisfied the information

requirements under Rule 144(i) of the Securities Act. There is no assurance that the Parent will satisfy the requirements under Rule

144(i) of the Securities Act to permit use of Rule 144 or that the Parent will become eligible to use Form S-8 registration statement

for registration of securities granted or issued under an incentive compensation plan. Further, neither the Company nor Parent have revenue

generating operations and no significant tangible assets other nominal amount of cash received from a loan or other third-party funding,

which sums are only sufficient to pay overhead costs essential to maintain the Parent as a public company under federal securities laws

and the Company’s existence under Florida laws.

4. Representations

and Warranties of the Company. The Company hereby represents and warrants to the Creditor that, as of the date hereof and as of the date

of Closing, as follows:

(a). Qualification,

Authorization and Enforcement. The Company is duly incorporated or otherwise organized, validly existing and in good standing under the

laws of the jurisdiction of its incorporation, with the requisite power and authority to own and use its properties and assets and to

carry on its business as currently conducted. The Company has the requisite corporate power and authority to enter into and to consummate

the transactions contemplated by this Agreement and otherwise to carry out its obligations there under. The execution and delivery of

this Agreement by the Company and the consummation by it of the transactions contemplated hereby and thereby have been duly authorized

by all necessary action on the part of the Company and no further action is required by the Company in connection therewith. This Agreement

has been duly executed by the Company and, when delivered in accordance with the terms hereof, will constitute the valid and binding

obligation of the Company enforceable against the Company in accordance with its terms, except as such enforceability may be limited

by applicable bankruptcy, insolvency, reorganization, moratorium, liquidation or similar laws relating to, or affecting generally the

enforcement of, creditors’ rights and remedies or by other equitable principles of general application.

(b). No Conflicts.

The execution, delivery and performance of this Agreement by the Company and the consummation by the Company of the transactions contemplated

hereby and thereby do not and will not (i) conflict with or violate any provision of the Company’s articles of incorporation, bylaws

or other organizational or charter documents as in effect on the date hereof, or (ii) conflict with, or constitute a default (or an event

that with notice or lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration

or cancellation (with or without notice, lapse of time or both) of, any agreement, credit facility, debt or other instrument (evidencing

a Company debt or otherwise) or other understanding to which the Company is a party or by which any property or asset of the Company

is bound or affected, or (iii) result in a violation of any law, rule, regulation, order, judgment, injunction, decree or other restriction

of any court or governmental authority to which the Company is subject (including federal and state securities laws and regulations),

or by which any property or asset of the Company is bound or affected; except in the case of each of clauses (ii) and (iii), such as

could not, individually or in the aggregate, have or reasonably be expected to result in a material adverse effect. For purposes of this

Agreement, “material adverse effect” means an adverse financial, business or legal impact that a reasonable investor would

consider important in making a decision to buy, sell, hold the Parent’s securities.

(c). Filings, Consents

and Approvals. The Company is not required to obtain any consent, waiver, authorization or order of, give any notice to, or make any

filing or registration with any United States court or other federal, state, local or other governmental authority or other

person in connection with the execution, delivery and performance by the Company of this Agreement, other than (i) filings if required

by federal and state securities laws, and (ii) those that have been made or obtained prior to the date of this Agreement. Parties agree

and understand that Parent will have to file a Form 8-K with the SEC and file a copy of this Agreement as an exhibit to that Form 8-K

as well as disclose this Agreement, the Creditor and the transaction contemplated herein in filings with the SEC and possibly other regulators

and those filings and disclosures will be available to the public.

5. Representations

and Warranties of the Parent. The Parent hereby represents and warrants to the Creditor that, as of the date hereof and as of the date

of Closing, as follows:

(a). Qualification,

Authorization and Enforcement. The Parent is duly incorporated or otherwise organized, validly existing and in good standing under the

laws of the jurisdiction of its incorporation, with the requisite power and authority to own and use its properties and assets and to

carry on its business as currently conducted. The Parent has the requisite corporate power and authority to enter into and to consummate

the transactions contemplated by this Agreement and otherwise to carry out its obligations there under. The execution and delivery of

this Agreement by the Parent and the consummation by it of the transactions contemplated hereby and thereby have been duly authorized

by all necessary action on the part of the Parent

and no further action is required by the Parent in connection therewith. This Agreement has been duly executed by the Parent and, when

delivered in accordance with the terms hereof, will constitute the valid and binding obligation of the Parent enforceable against the

Parent in accordance with its terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization,

moratorium, liquidation or similar laws relating to, or affecting generally the enforcement of, creditors’ rights and remedies

or by other equitable principles of general application.

(b). No Conflicts.

The execution, delivery and performance of this Agreement by the Parent and the consummation by the Parent of the transactions contemplated

hereby and thereby do not and will not (i) conflict with or violate any provision of the Parent’s articles of incorporation, bylaws

or other organizational or charter documents as in effect on the date hereof, or (ii) conflict with, or constitute a default (or an event

that with notice or lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration

or cancellation (with or without notice, lapse of time or both) of, any agreement, credit facility, debt or other instrument (evidencing

a Parent debt or otherwise) or other understanding to which the Parent is a party or by which any property or asset of the Parent is

bound or affected, or (iii) result in a violation of any law, rule, regulation, order, judgment, injunction, decree or other restriction

of any court or governmental authority to which the Parent is subject (including federal and state securities laws and regulations),

or by which any property or asset of the Parent is bound or affected; except in the case of each of clauses (ii) and (iii), such as could

not, individually or in the aggregate, have or reasonably be expected to result in a material adverse effect.

(c) Filings, Consents

and Approvals. The Parent is not required to obtain any consent, waiver, authorization or order of, give any notice to, or make any filing

or registration with any United States court or other federal, state, local or other governmental authority or other person in connection

with the execution, delivery and performance by the Parent of this Agreement, other than (i) filings if required by state securities

laws, (ii) if required, the filing of a Notice of Sale of Securities on Form D with the SEC under Regulation D of the Securities Act

and with any states requiring the filing of the Form D, (iii) the filings required in accordance with the Exchange Act and (iv) those

filings and consents that have been made or obtained prior to the date of this Agreement.

(d). Issuance of

Shares. The Shares are duly authorized and, when issued and paid for in accordance with the terms and conditions of this Agreement, will

be validly issued, fully paid and non- assessable, free and clear of all liens imposed by the Parent or Company. There are no subscriptions,

warrants, rights of first refusal or other restrictions on transfer relative to, or options exercisable with respect to, the Shares.

The Shares are not the subject of any present or, to the Parent’s knowledge, threatened suit, action, arbitration, administrative

or other proceeding, and the Parent and Company each knows of no reasonable grounds for the institution of any such proceedings.

6. Restrictions on

Sale. (a) Transfers. Beginning on the date first written above and until the earlier to occur of: (i) the first annual anniversary of

the date first written above; (ii) the date that the Creditor ceases to be beneficial owner of the Shares and Conversion Shares because

of an exchange or cancellation in connection with a merger or other business combination that is approved by a majority of the disinterested

directors of the Parent (being referred to as an “Approved Transaction”); (iii) death or dissolution of the Creditor, as

the case may be; (iv) the termination of the Management Transition Agreement, signed as of October 31, 2024, by Parent and Coppermine

Ventures, LLC (“CVEN”) (the Management Transition Agreement being referred to as the “MTA”) in accordance with

MTA’s terms and conditions and prior to MTA’s stated expiration date; (iv) the date that the Parent or Company files for

protection from creditor under any chapter of the U.S. Bankruptcy Code or the date that an involuntary bankruptcy proceeding is commenced

for the Parent or Company under the U.S. Bankruptcy Code; or (v) disinterested directors of the board of directors of the Parent approves

a plan of complete dissolution under applicable domicile laws, the Creditor will not, directly or indirectly, do any of the following

acts:

(A) tender any Shares

or Conversion Shares to any tender or exchange offer, except in connection with an Approved Transaction; or (B) offer, pledge, sell,

contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant

to purchase, or otherwise transfer or dispose of, directly or indirectly, any Shares or Conversion Shares, except as permitted in Section

6(b) below; or (C) convert any Shares into Conversion Shares.

(b) The restrictions

and obligations contemplated by Section 6(a) above shall not apply to any of the following sales, assignments or transfers of any of

the Shares by the Creditor:

(i) the sale of 10%

or fewer of the Shares in any three (3) month period in a private sale of the Shares to an Accredited Investor (as defined in 17 C.F.R.

§230.501(a)) who is pre-approved by the disinterested directors of the Parent’s Board of Directors as a buyer of the Shares,

which private sale qualifies for an exemption from registration under federal and applicable state securities laws and regulations; or

(ii) if the Creditor

is a natural person, to the Creditor’s estate following the death of the Creditor, by will, intestacy or other operation of applicable

laws; or

(iii) if the Creditor

is a natural person, by operation of law, such as pursuant to a qualified domestic order or in connection with a divorce settlement;

or

(iv) in any public

securities offering registered under the Securities Act on Form S-1 or Form S-3 registration statement, or on any successor registration

statement form, filed prior to the first annual anniversary of the date written above, with the SEC by the Parent for registration of

shares of Common Stock being sold by CVEN or its affiliates and for which the Parent grants piggyback registration rights to the Creditor,

which piggyback registration rights will have terms and conditions as favorable as the piggyback registration rights granted to CVEN

or its affiliates, which registration rights will only granted by the Parent in its sole discretion.

(c) Conversion. If

the Creditor is permitted under this Agreement to convert the Shares into Conversion Shares, then the Creditor will tender a written

request to convert the number of Shares specified in the written request into Conversion Shares (“Conversion Notice”), which

Conversion Notice must be signed by the Creditor’s authorized signatory, and must be sent to the principal executive offices of

the Parent, to the attention of the Chief Executive Officer or Chief Financial Officer, and sent by Federal Express or United Parcel

Service, or other nationally recognized overnight delivery services, with prepaid airbill and adult receipt signature required. For any

conversion of Shares permitted under this Agreement. The Parent will consummate the conversion and issue the Conversion Shares within

fifteen (15) days after receipt of a properly completed and signed Conversion Notice, subject to the requirements of the Parent’s

stock transfer agent for issuance of Conversion Shares being satisfied by the Parent and Creditor.

7. Amounts Repaid

in Full. For and in consideration of the issuance of the Shares to the Creditor, the Debt shall be deemed to be repaid in full, and the

Company and Parent shall have no further obligations in connection with the Debt to the Creditor. Creditor shall mark the original loan

or financing agreement and any underlying original promissory note or other instrument evidencing the Debt as “PAID IN FULL”

and tender those loan or financing agreements and promissory note or other instrument to the Parent within five (5) days after the Closing.

Delivery of these documents in accordance with this Section 7 is an express condition precedent to obligation of the Parent to issue

the Shares to the Creditor.

8. Release by the

Creditor. Upon receipt of the Shares, the Creditor unconditionally and absolutely releases and discharges: the Parent; the Company; their

respective subsidiaries; their respective and their respective subsidiaries’ officers, directors, principals, shareholders, control

persons, past and present employees, insurers, successors, and assigns (collectively, “Parent Parties”) from all actions,

cause of action, suits, debts, dues, sums of money, accounts, reckonings, bonds, bills, specialties, covenants, contracts, controversies,

agreements, promises, variances, trespasses, damages, judgments, extents, executions, claims, and demands of any kind whatsoever, in

law, admiralty or equity, against any of the Parent Parties that

the Creditor ever had, now have or hereafter can assert, or shall or may, have for, upon, or by reason of any matter, cause or thing

whatsoever, whether or not known or unknown, from the beginning of the world to the date of the Closing. The Creditor represents and

warrants that no other person or entity has any interest in the matters released herein, and that it has not assigned or transferred,

or purported to assign or transfer, to any person or entity all or any portion of the matters released herein.

9. Fees, Expenses.

Each party shall pay the fees and expenses of its or his advisers, counsel, accountants and other experts, if any, and all other expenses

incurred by such party incident to the negotiation, preparation, execution, delivery and performance of this Agreement.

10. General Provisions.

(a). Governing Law; Waiver of Jury Trial. This Agreement is governed by and construed in accordance with the laws of the State of Florida

without giving effect to any choice or conflict of law provision or rule (whether of the State of Florida or any other jurisdiction)

that would cause or permit the application of laws of any jurisdictions other than those of the State of Florida. Each of the parties:

(i) hereby irrevocably consents to the exclusive jurisdiction of the “Chosen Courts” (as defined herein) and to service of

the summons and complaint and any other process (whether inside or outside the territorial jurisdiction of the U.S. District Court for

the Southern District of Florida or state courts located in or for Broward County, Florida (the “Chosen Courts“)) in any

legal, arbitration or administrative proceeding of any kind whatsoever in any of the Chosen Courts (individually, a “Proceeding”

and collectively, “Proceedings”) arising out of or relating to or based upon this Agreement, for and on behalf of itself

or any of himself, or its or his properties or assets, or in such other manner as may be permitted by applicable laws. Nothing in this

Section 10(a) will affect the right of any party to serve legal process in any other manner permitted by applicable laws; and (ii) irrevocably

and unconditionally consents and submits itself or himself and its or his properties and assets in any Proceeding to the exclusive general

jurisdiction of the Chosen Courts in the event that any claim, cause of action, dispute or controversy arises out of or relates to or

is based upon this Agreement and any transactions contemplated herein; (iii) irrevocably and unconditionally agrees that it or he will

not attempt to deny or defeat such personal jurisdiction by motion or other request for leave from any Chosen Court; (iv) agrees that

any Proceeding arising out of or relating to this Agreement will be brought, tried and determined only in the Chosen Courts; (v) waives

any objection that it or he may now or hereafter have to the venue of any such Proceeding in the Chosen Courts or that such Proceeding

was brought in an inconvenient court and agrees not to plead or claim the same; and (vi) agrees that it or he will not bring any Proceeding

arising out of or relating to this Agreement in any court other than the Chosen Courts. Each of the parties agrees that a final judgment

in any Proceeding in the Chosen Courts will be conclusive and may be enforced in other jurisdictions by suit on the judgment or in any

other manner provided by applicable law.

EACH PARTY ACKNOWLEDGES

AND AGREES THAT ANY CONTROVERSY THAT MAY ARISE PURSUANT TO THIS AGREEMENT IS LIKELY TO INVOLVE COMPLICATED AND DIFFICULT ISSUES, AND

THEREFORE EACH PARTY IRREVOCABLY AND UNCONDITIONALLY WAIVES TO THE FULLEST EXTENT PERMITTED BY LAW ANY RIGHT THAT SUCH PARTY MAY HAVE

TO A TRIAL BY JURY IN RESPECT OF ANY PROCEEDING (WHETHER FOR BREACH OF CONTRACT, TORTIOUS CONDUCT OR OTHERWISE) DIRECTLY OR INDIRECTLY

ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED IN THIS AGREEMENT. EACH PARTY CERTIFIES AND AGREES THAT

(A) NO REPRESENTATIVE, AGENT OR ATTORNEY OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT,

IN THE EVENT OF LITIGATION, SEEK TO ENFORCE THE FOREGOING WAIVER; (B) IT UNDERSTANDS AND HAS CONSIDERED THE IMPLICATIONS OF THIS WAIVER;

(C) IT MAKES THIS WAIVER VOLUNTARILY; AND (D) IT HAS BEEN INDUCED TO GRANT OR ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS,

THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 10(a).

(b). Termination.

This Agreement may be terminated prior to Closing: (a) by written agreement of the parties; or (b) by either the Company or Parent or

the Creditor upon written notice to the other, if the Closing shall not have taken place by 6:30 p.m. Eastern time on the Outside Date;

provided, that the right to terminate this Agreement under this Section 10(b) shall not be available to any party whose failure to comply

with its obligations under this Agreement has been the cause of or resulted in the failure of the Closing to occur on or before such

time. Upon a termination in accordance with this Section 10(b), and except as expressly stated otherwise in this Agreement, the Company

and Parent shall not have any further obligation or liability (including as arising from such termination) to the Creditor.

(c). Disputes. Prior

to commencing any legal proceedings, the parties will seek to resolve any disputes, controversies, claims or causes of action based upon,

arising from or related to this Agreement and the transactions contemplated herein (collectively, a “Claim”) by private negotiations

conducted during the twenty (20) days commencing immediately after a party receives a written notice from another party alleging a Claim

(“Private Resolution Period”). Parties agree that no legal proceedings will be commenced for a Claim during the Private Resolution

Period. The parties discussing any Claim will do so in a good faith, diligent manner.

(d). Notices. All

notices, requests, demands, consents and other communications hereunder to any party shall be in writing and either delivered in person

or sent by U.S. mail, overnight courier or by e-mail or other electronic transmission, addressed to such party at the address set forth

below and shall be effective only upon receipt by such party. A party may change its notice information upon three (3) business days’

prior written notice to the other parties. All deliveries of notices shall require a receipt signature. The notice contact information

is:

Parent and Company

Address: Number 144-V, 10 Fairway Drive

Suite 100, Deerfield Beach, Florida 33441

Telephone: (954) 570-8889, ext. 313

Attn: Chief Executive Officer

Creditor:

Address: 715 1st

Avenue, Delray Beach, Florida 33444

Telephone: 954-646-2307

Attn: Stewart Wallach

(e). Further Assurances.

The parties shall execute and deliver all such further instruments, agreements and documents and take all such other actions as may reasonably

be required to carry out the transactions contemplated hereby and to evidence the fulfillment of the agreements herein contained.

(f). Successors and Assigns. The terms

and conditions of this Agreement shall inure to the benefit of and be binding upon the respective successors and assigns of the parties.

(g). No Third-Party

Beneficiaries. This Agreement is intended for the benefit of the parties and their respective successors and permitted assigns and is

not for the benefit of, nor may any provision hereof be enforced by, any other person, except as otherwise expressly set forth in this

Agreement.

(h). Modification

and Waivers. No provision of this Agreement may be waived or amended except in a written instrument signed by the Company and the Creditor.

No waiver of any default with respect to any provision, condition or requirement of this Agreement shall be deemed to be a continuing

waiver in the future or a waiver

of any subsequent default or a waiver of any other provision, condition or requirement hereof, nor shall any delay or omission of either

party to exercise any right hereunder in any manner impair the exercise of any such right.

(i). Severability.

If any provision of this Agreement is held to be invalid or unenforceable in any respect, the validity and enforceability of the remaining

terms and provisions of this Agreement shall not in any way be affected or impaired thereby and the parties will attempt to agree upon

a valid and enforceable provision that is a reasonable substitute therefor, and upon so agreeing, shall incorporate such substitute provision

in this Agreement.

(j). Entire Agreement.

This Agreement and Exhibit One hereto contain the entire agreement and understanding of the parties with respect to the subject matter

hereof and supersede all prior agreements, understandings, discussions and representations, oral or written, with respect to such matters,

which the parties acknowledge have been cancelled and waived by the parties. Exhibit One hereto is incorporated herein by reference as

if set forth verbatim herein.

(k). Enforcement.

The parties agree that irreparable damage for which monetary damages, even if available, would not be an adequate remedy would occur

in the event that the parties do not perform the provisions of this Agreement (including any party failing to take such actions that

are required of it hereunder in order to consummate this Agreement) in accordance with its specified terms or otherwise breach such provisions.

The parties acknowledge and agree that (i) the parties will be entitled, in addition to any other remedy to which they are entitled at

law or in equity, to an injunction, specific performance and other equitable relief to prevent breaches (or threatened breaches) of this

Agreement or to enforce specifically the terms and provisions hereof, (ii) the parties will not assert that a remedy of monetary damages

would provide an adequate remedy for such breach and (iii) the right of specific enforcement is an integral part of the transactions

contemplated hereby and without that right, none of parties would have entered into this Agreement.

(l). Assignment;

Successors. Other than as provided herein, neither this Agreement nor any of the rights, interests or obligations under this Agreement

may be assigned or delegated, in whole or in part, by operation of law or otherwise, by any party without the prior written consent of

the other parties, and any such assignment without such prior written consent will be null and void. Subject to the preceding sentence,

this Agreement will be binding upon, inure to the benefit of, and be enforceable by, the parties and their respective successors and

assigns.

(m). Headings. The

headings used in this Agreement are for convenience of reference only and shall not be deemed to limit, characterize or in any way affect

the interpretation of any provision of this Agreement.

(n). Survival. The

representations, warranties, agreements and covenants contained herein shall survive the Closing and the delivery of the Shares, until

the second (2nd) anniversary of the date hereof.

(o). Counterparts.

This Agreement may be executed in one or more counterparts, all of which will be considered one and the same agreement and instrument

and will become effective when one or more counterparts have been signed by each of the parties and delivered to the other parties, it

being understood that all parties need not sign the same counterpart. Any such counterpart, to the extent delivered by electronic delivery,

including online services like DocuSign, will be treated in all manners and respects as an original executed counterpart and will be

considered to have the same binding legal effect as if it were the original signed version thereof delivered in person. No party may

raise the use of an electronic delivery to deliver a signature, or the fact that any signature or agreement or instrument was transmitted

or communicated through the use of an electronic delivery, as a defense to the formation of a contract, and each party forever waives

any such defense, except to the extent such defense relates to lack of authenticity.

(p). No Presumption

Against Drafting Party. Each party acknowledges that each party to this Agreement has been represented by its or his own legal counsel

in connection with this Agreement and the transactions contemplated by this Agreement or had reasonable opportunity to consult such legal

counsel prior to signing this Agreement. Accordingly, any rule of law or any legal decision that would require interpretation of any

claimed ambiguities in this Agreement against the drafting party has no application to this Agreement and is expressly waived by each

party.

(q). Interpretation.

Where a reference in this Agreement is made to a section or exhibit, such reference will be to a section of or exhibit to this Agreement

unless otherwise indicated. If a term is defined as one part of speech (such as a noun), it will have a corresponding meaning when used

as another part of speech (such as a verb). Unless the context of this Agreement clearly requires otherwise, words importing the masculine

gender will include the feminine and neutral genders and vice versa, and the definitions of terms contained in this Agreement are applicable

to the singular as well as the plural forms of such terms. The words “includes” or “including” will mean “including

without limitation,” the words “hereof,” “hereby,” “herein,” “hereunder” and similar

terms in this Agreement will refer to this Agreement as a whole and not any particular section or article in which such words appear,

the word “extent” in the phrase “to the extent” will mean the degree to which a subject or other thing extends

and such phrase will not mean simply “if,” any reference to a “law” will include any rules and regulations promulgated

thereunder, and any reference to “any law” in this Agreement will mean such law as from time to time amended, modified or

supplemented. Each reference to a “wholly owned subsidiary” or “wholly owned subsidiaries” of a person will be

deemed to include any subsidiary of such person where all of the equity interests of such subsidiary are directly or indirectly owned

by such person (other than directors qualifying shares, nominee shares or other equity interests that are required by law or regulation

to be held by a director or nominee).

(r). Authority. Each

party represents and covenants that the person signing this Agreement for that party has all requisite authority to legally bind the

party under this Agreement by his or her signature below.

IN WITNESS WHEREOF, the parties

have caused this Agreement to be duly executed and delivered on the date and year first above written.

CAPSTONE COMPANIES, INC., a Florida corporation

By: ________________________________________________

Name: ___Alex Jacobs______________________________________

Title: ____CEO______________________________________

CAPSTONE INDUSTRIES, INC., a Florida corporation

By: ______________________________________________

Name: ___Jeffery Guzy______________________________________

Title: ___Director_______________________________________

CREDITOR: Stewart Wallach, a natural person

By: __________________________________________

Name: ______Stewart Walach___________________________________

Title: __________________________________________

Exhibit One: Debt

owed to Creditor

Debt owed to Creditor as of date first

written in the Cancellation Agreement to which this Exhibit One is appended.

Principal: $____1,341,340____________________________

Interest Accrued: $____51,230________________________

Total: $___1,392,570__________________________________

Exhibit 10.2

THE SHARES ISSUED

UNDER THS CANCELLATION AGREEMENT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”),

OR ANY OTHER APPLICABLE SECURITIES LAWS AND HAVE BEEN ISSUED IN RELIANCE UPON AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE

SECURITIES ACT AND SUCH OTHER SECURITIES LAWS. NEITHER THIS SECURITY NOR ANY INTEREST OR PARTICIPATION HEREIN MAY BE REOFFERED, SOLD,

ASSIGNED, TRANSFERRED, PLEDGED, ENCUMBERED, HYPOTHECATED OR OTHERWISE DISPOSED OF (COLLECTIVELY, A “TRANSFER”), EXCEPT PURSUANT

TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO A TRANSACTION WHICH IS EXEMPT FROM, OR NOT SUBJECT TO,

SUCH REGISTRATION, IN EACH CASE IN ACCORDANCE WITH ALL APPLICABLE SECURITIES LAWS. FURTHER, THE RESTRICTIONS ON TRANSFER OF THE SHARES

IN THE CANCELLATION AGREEMENT MUST BE SATISFIED.

CANCELLATION AGREEMENT

THIS CANCELLATION

AGREEMENT (this “Agreement”), dated December 18, 2024, is made by and among Capstone Industries, Inc., a Florida corporation

(the “Company”), Capstone Companies, Inc., a Florida corporation and the parent company of the Company, (“Parent”)

and Group Nexus, LLC, Florida limited liability company owned by an Accredited Investor, (the “Creditor”). Company, Parent

and Creditor will be also referred to individually as a “party” and collectively, as the “parties”.

BACKGROUND

A. The Company

desires to reduce its debt load in order to improve its balance sheet and to enhance the ability of its Parent, which owns 100% of the

Company’s capital stock and consolidates financial statements of Company into Parent’s financial statements, to secure ongoing

or future funding and to facilitate efforts of Parent’s management to develop or acquire a new business line.

B. The Company and

Parent have no revenue generating operations and rely on third party funding to sustain their operations and corporate existence. Development

of a new business line is essential to Parent and Company continuing as ongoing concerns.

C. The debts owed

to the Creditor by the Parent are set forth in Exhibit One hereto (referred to as the “Debt”) and Creditor agrees to cancel

the Debt in exchange for certain amount of shares of Series B-1 Convertible Preferred Stock (“B-1 Stock”) of the Company,

calculated at the price of $0.07 per share (the “Exchange Price”), on the terms set forth herein, and the Parent is willing

and able to issue shares of B-1 Stock to the Creditor on the terms described herein. The Debt are set forth on the financial statements

of the Company after a transfer of the Debts by the Parent.

D. The Parent is

subject to the reporting requirements of the Securities Exchange Act of 1934 (“Exchange Act”) and files reports under Section

13 of the Exchange Act with the U.S. Securities and Exchange Commission (“SEC”).

E. “Accredited

Investor” has the meaning set forth in 17 Code of Federal Regulations §230.501(a). “Affiliates” has the meaning

set forth in 17 Code of Federal Regulations §230.405, as amended. “Business day” means a weekday on which the banks

in Broward County, Florida are open for business on regular hours.

F. The obligations

of the parties under this Agreement are subject to certain conditions precedent set forth below.

Intending to be legally bound, the

parties agree:

1. Cancellation of

the Debt; Issuance of the Shares. At the “Closing” (as defined in Section 2 below) and subject to the terms and conditions

of this Agreement, the Debt shall be cancelled in return for the issuance of, and the Parent shall issue, an aggregate of 134,631

shares of B-1 Stock (the “Shares”), calculated at the Exchange Price, to the Creditor and do so on behalf of the

Company. Issuance of the Shares will be a full accord and satisfaction of the Debt for the Parent and Company.

2. Closing; Delivery

of Shares. (a) The closing of the cancellation of the Debt and the issuance of the Shares shall occur as soon as practicable after the

execution of this Agreement and satisfaction of the conditions set forth in this Agreement, but in no event later than forty five (45)

calendar days from the execution of this Agreement (the “Outside Date”), at the offices of the Parent, or such other place,

date and time as the parties may otherwise agree (the “Closing”). Issuance of the Shares is expressly subject to conditions

in this Agreement, including, without limitation the conditions set forth in Section 7 below.

(b) At the Closing,

and if the Parent has engaged a stock transfer agent to record transactions in the B-1 Stock, the Parent shall use its best efforts to

cause the Parent’s transfer agent to deliver to the Creditor, by courier or FedEx, a stock certificate registered in the name of

Creditor and representing the amount of Shares as is set forth above. If the Parent acts as its stock transfer agent, then the Parent

will issue the stock certificates for the Shares within ten (10) business days after the Closing. The Creditor may elect to have the

Shares registered on the Parent’s stock transfer and registrar records and receive a written certification of ownership of the

Shares rather than a physical stock certificate.

(c) Legends. Creditor

understands that, until such time as the Shares may be sold pursuant to an effective registration statement or any available, applicable

exemption from the registration requirements under the Securities Act (including, if the Parent is eligible under Rule 144 of the Securities

Act, Rule 144 of the Securities Act), any certificates representing the Shares or Conversion Shares, whether maintained in a book entry