The Delicate Task of Dealing With China's Most Debt-Burdened Property Giants -- Heard on the Street

01 September 2020 - 9:54PM

Dow Jones News

By Mike Bird

Two of China's most heavily leveraged developers are struggling

in the stock market, and new attention from Beijing on their

towering debt levels will put them under more pressure. But the

central government's efforts don't address a key problem in the

country's economic model: Cash-starved local governments need

indebted property developers to buy their land.

Shares in China Evergrande Group and Sunac China Holdings Ltd.

are down 19% and 30% respectively this year. That partly reflects

poor half-year results. In the first half of 2020, Evergrande's net

profits were cut nearly in half relative to the first six months of

2019, while Sunac's grew by 6.5%, down from 57.1% year-over-year

growth in 2019.

But the dismal stock performances also reflect new, unwelcome

attention from Beijing: China's central bank and housing ministry

last month corralled developers to discuss lofty debt levels.

According to state media, the meeting highlighted three "red lines"

for developers to avoid: a liability to asset ratio of more than

70%, a net debt to equity ratio of over 100%, and cash to short

term debt ratio of less than 100%.

Evergrande and Sunac are the largest developers where debt

metrics are worse than the reported redline level on every

count.

What is perhaps most notable is that these poor debt metrics

persisted this year even in the context of slowly growing or

declining land banks. Evergrande's land reserves declined by more

than 50 million square meters in the first six months of the year,

reaching a 3 1/2 year low.

Sunac's land bank is still growing, but at a far slower pace:

The company's land bank has increased by less than 6% since the end

of 2019, to just shy of 250 million square meters. Between the end

of 2015 and the end of 2019, the company bought land at a rapacious

pace, growing its reserves of land by 750%.

On the one hand of course, that sounds like a positive thing.

The companies are heavily indebted, so borrowing less to buy land

seems like a good idea on the face of it.

But what's good for the longer-term health of the companies may

not be good for the system in general. Somebody needs to buy land

from China's local governments, with such sales making up around a

third of their revenue. Since those municipalities shoulder most of

China's domestic government spending and remit taxes to Beijing,

they cannot simply be starved of funds.

Sunac and Evergrande had been some of the largest purchasers of

land in recent years. Without major changes to the Chinese fiscal

framework, that burden will simply be shuffled to other

players.

Beijing's focus on real estate makes it clear that the central

government understands the threat that the sector's leverage poses

to China's prosperity and stability. But it has yet to offer any

meaningful incentives to improve the system: Simply telling Chinese

developers they are too heavily indebted, when their rapacious land

purchases have been crucial to funding local governments, won't

work.

Write to Mike Bird at Mike.Bird@wsj.com

(END) Dow Jones Newswires

September 01, 2020 07:39 ET (11:39 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

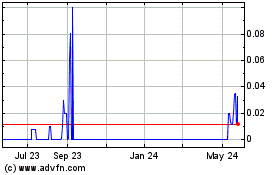

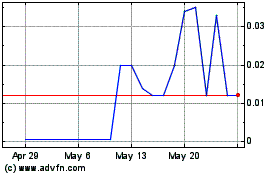

China Evergrande (CE) (USOTC:EGRNF)

Historical Stock Chart

From Jan 2025 to Feb 2025

China Evergrande (CE) (USOTC:EGRNF)

Historical Stock Chart

From Feb 2024 to Feb 2025