First Colombia Gold Signs Letter of Intent to Acquire Oil and Gas Assets

25 June 2014 - 1:18AM

Business Wire

First Colombia Gold (OTCQB: FCGD) (“First Colombia” or “The

Company”) is pleased to announce it has signed a Letter of Intent

(“LOI”) to acquire a nineteen and a half percent (19.5%) interest

in three private oil companies located in south central

Kentucky.

The signed LOI outlines the structure of the transaction, which

will give First Colombia a working interest in over 50 active

producing wells, ownership in 39 active oil and gas leases covering

5,322 acres, as well as full title and ownership to six acres of

real estate, which includes a 6800 sq. ft. office complex and

maintenance facility. The LOI also includes drilling and operating

equipment including two drilling rigs and six completion rigs.

This acquisition will add numerous revenue opportunities and

provide cash-flow for operations. The wells being acquired have

produced in excess of 8,000 barrels of crude within the last year.

The acquisition of the interest in these wells will allow First

Columbia to offer a wide variety of contract services including

drilling, well completion, pump installation, complete oilfield

roustabout services, permitting services, salt water disposal, acid

treatments, as well as hauling and logistics services to transport

the crude from the customer to the refinery. All of these services

are currently being offering by the companies we are acquiring an

interest in.

First Columbia’s CEO, Dr. Robert Gates commented, “Acquiring an

interest in these wells, along with the real estate and other

assets included in the transaction, will prove to be a cornerstone

in building our oil and gas portfolio. The wells we are acquiring

have a solid track record of production, producing already 8,000

barrels of crude over the last year which we believe can be

increased. This is a transaction that has a history of being a

performing commercial property, so adding this to our portfolio

should prove to be beneficial to our shareholders.”

Gates continued, “Our goal is to be self-reliant and create a

vertical business model. Over the last decade, oil and gas

production in the U.S. has skyrocketed, especially since the

initiative to reduce America's dependence on foreign oil. With U.S.

crude oil prices over $100 per barrel, many larger oil companies

are looking at Kentucky and exploration activity is rising.

Acquiring an interest in oil and gas properties ,and the service

capabilities for vertical integration meets our corporate strategy.

We are amassing the best properties we can find and assembling the

best management team for our stockholders.”

First Columbia’s board and leadership believe that by providing

the necessary working capital, and by creating an owner/operator

mentality, we can expedite the rework of existing wells and begin

new leasing and drilling programs. Preliminary numbers indicate an

opportunity to add an additional 22 wells that are already

permitted and drilled that can be brought online within the next

sixty days.

"We recently announced our plans to acquire a pipeline of oil

and gas projects, which we believe have solid potential for

building shareholder value. The acquisition of this interest meets

that criteria,” commented VP of Merger and Acquisitions Randy Ross.

“The companies we are acquiring an interest in have been limited on

their oil and gas production, due to lack of capital. Our

management and staff have experience in financing public and

private companies, and expertise in the extractive industries to

build growth in the energy sector through select acquisitions, and

improving operating capability.”

About First Colombia Gold

First Colombia Gold Corp. is a capital company focused on

acquiring, developing and advancing natural resource, energy, and

real estate projects in Europe, North America, and South America.

Our business model is to acquire undervalued assets combining

potential for building assets values and cash flow through leverage

to improved operational efficiencies and development.

Our current activity focus is on precious metal exploration in

Montana in addition to planned initial activities of our energy

division.

Investor Inquiries:

David Kugelman, Investor RelationsPhone: (404) 856-9157 / (866)

692-6847Website: www.firstcolombiagold.comEmail:

info@firstcolombiagold.com

Disclaimer

This release contains forward-looking statements that are based

on beliefs of First Colombia Gold Corp. management and reflect

First Colombia Gold Corp.'s current expectations as contemplated

under section 27A of the Securities Act of 1933, as amended, and

section 21E of the Securities and Exchange Act of 1934, as amended.

When we use in this release, the words "estimate," "project,"

"believe," "anticipate," "intend," "expect," "plan," "predict,"

"may," "should," "will," "can," the negative of these words, or

such other variations thereon, or comparable terminology, are all

intended to identify forward looking statements. Such statements

reflect the current views of First Colombia Gold Corp. with respect

to future events based on currently available information and are

subject to numerous assumptions, risks and uncertainties, including

but not limited to, risks and uncertainties pertaining to

development of mining properties, changes in economic conditions

and other risks, uncertainties and factors, which may cause the

actual results, performance, or achievement expressed or implied by

such forward looking statements to differ materially from the

forward looking statements. The information contained in this press

release is historical in nature, has not been updated, and is

current only to the date shown in this press release. This

information may no longer be accurate and therefore you should not

rely on the information contained in this press release. To the

extent permitted by law, First Colombia Gold Corp. and its

employees, agents and consultants exclude all liability for any

loss or damage arising from the use of, or reliance on, any such

information, whether or not caused by any negligent act or

omission. This press release incorporates by reference the

Company's filings with the SEC including 10k, 10Q, 8K reports and

other filings. Investors are encouraged to review all filings.

There is no assurance First Colombia Gold Corp. will identify

projects of merit or if it will have sufficient financing to

implement its business plan. There is no assurance that the

Company’s due diligence on the potential acquisition of oil and gas

assets will be favorable nor that definitive terms can be

negotiated. Information in this release includes representations

form the private companies referred to which has not been

independently verified by the company. A downturn in oilprices

would affect the potential profitability of the proposed

acquisition negatively.

First Colombia GoldDavid Kugelman, 404-856-9157Investor

Relations866-692-6847www.firstcolombiagold.cominfo@firstcolombiagold.com

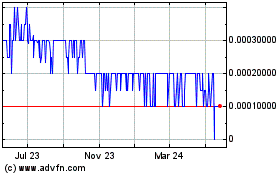

First Colombia Gold (PK) (USOTC:FCGD)

Historical Stock Chart

From Nov 2024 to Dec 2024

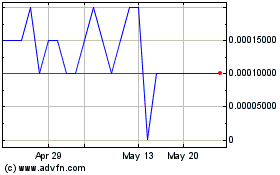

First Colombia Gold (PK) (USOTC:FCGD)

Historical Stock Chart

From Dec 2023 to Dec 2024