By Jing Yang and Trefor Moss

One of China's largest car makers, Zhejiang Geely Holding Group

Co., is making plans to tap into the surging market for SPACs.

The multinational company, which owns Geely Automobile Holdings

Ltd., Volvo Car Group and several other electric-vehicle brands, is

in talks to sponsor a special-purpose acquisition company that

could raise $300 million in a Nasdaq initial public offering,

according to people familiar with the matter.

In addition, the Hangzhou-based group is considering taking one

of its European electric-vehicle subsidiaries public by merging it

with another SPAC and boosting its valuation sharply, to as much as

$40 billion, the people said.

SPACs, also known as blank-check companies, raise money by

selling stock publicly and listing on exchanges before finding

private businesses to merge with. They have surged in popularity

and drawn record sums of money from global investors, Many startups

also see mergers with SPACs as a faster and easier way to go

public.

More of Asia's tycoons and investment firms have capitalized on

the boom in SPACs on U.S. exchanges this year.

Geely, which is controlled by its billionaire chairman and

founder Li Shufu, is considering doing the same. The group is

discussing creating a SPAC with its Hong Kong-based venture arm,

GLY Capital Management, according to people familiar with the

matter. Under the plan being discussed, Mr. Li would sit on the new

company's board with two other Geely representatives and one from

Volvo, a person familiar with the talks said.

The funds raised by the new company could give Geely a war chest

as it ramps up investments in new technology such as

electrification and artificial intelligence. The plan is under

deliberation internally and may not go ahead, people familiar with

the matter said. GLY Capital, meanwhile, is raising a new venture

fund that will invest in "companies that seek to redefine the

transportation industry," the firm said last month. Geely and South

Korea's SK Holdings are anchor investors in the fund, which is

targeting a year-end close of $300 million.

Separately, Polestar, a Swedish electric-vehicle maker owned by

Volvo Cars and Geely, is considering going public in the U.S.

through a different SPAC in a transaction that could value the

business at as much as $40 billion, the people familiar with the

matter said. If achieved, it would be one of the most valuable SPAC

mergers.

Polestar has been a stand-alone brand since 2017 and focuses on

high-performance electric cars. The company is wrapping up a Series

A fundraising round that will value it at $7 billion, the people

said.

Polestar, which runs its day-to-day management and governance

independent of Geely and Volvo, is aiming for a Series B

fundraising that could boost its valuation to $20 billion by the

end of June, before merging with a SPAC to go public, the people

said.

Geely and Polestar are discussing the pros and cons of Polestar

going public through a SPAC, and a final decision hasn't been made,

people familiar with the matter said.

Geely has begun overhauling its strategy in recognition that it

has fallen behind in the transition to electric vehicles, now

widely viewed as a critical shift for all global auto makers. Its

various electric brands have sold poorly in China, while Tesla

Inc., BYD Co. and others have taken a commanding lead in the

segment. Last month, Geely said it would set up a China-based

company called Zeekr Co. to serve the premium electric-vehicle

space in which Polestar and Volvo operate.

Meanwhile, the values of U.S.-listed Chinese electric-vehicle

companies Li Auto Inc., Nio Inc. and XPeng Inc. have skyrocketed in

recent months, giving them valuations far in excess of Geely's.

Combining with a SPAC can be a fast track to a high valuation.

In February, Lucid Motors Inc., a fledgling electric-vehicle maker

based in Newark, Calif., agreed to merge with a SPAC in a deal that

valued Lucid at $24 billion.

Grab Holdings Inc., a Southeast Asian ride-sharing and delivery

company, is in talks to go public through a SPAC that could value

it as much as $40 billion, The Wall Street Journal reported.

Polestar vehicles are built in China, and the country's

electric-vehicle market is among the world's biggest. An October

recall of all global Polestar vehicles over faulty components that

caused some vehicles to lose power, however, has dented the brand's

reputation.

Despite positive reviews, the company's main production model,

the Polestar 2--which was positioned as a direct competitor to

Tesla's Model 3--has been a commercial flop in China.

It is now priced at the equivalent of about $41,000 before

subsidies, and around 400 units have sold since August, according

to the website D1EV, which tracks Chinese electric-vehicle sales.

Tesla, in contrast, sold 69,280 Shanghai-built Model 3 and Model Y

cars in the March quarter alone in China. The Model 3 sells for

around $38,000 in the country.

The Polestar 2 has had a better reception in Europe, where it

has sold more than 8,700 units since launching in July, according

to the website Car Sales Base. Its sales there are still dwarfed by

Tesla's Model 3 sedan, which sold more than 46,000 units in Europe

during the same period. U.S. deliveries of the Polestar 2, priced

locally at $59,900, began in December.

Raffaele Huang contributed to this article.

Write to Jing Yang at Jing.Yang@wsj.com and Trefor Moss at

Trefor.Moss@wsj.com

(END) Dow Jones Newswires

April 13, 2021 05:40 ET (09:40 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

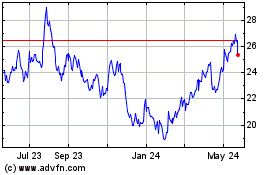

Geely Automobile (PK) (USOTC:GELYY)

Historical Stock Chart

From Dec 2024 to Jan 2025

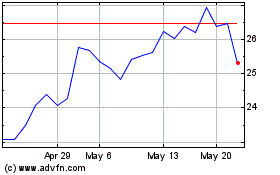

Geely Automobile (PK) (USOTC:GELYY)

Historical Stock Chart

From Jan 2024 to Jan 2025