Teck Resources Says New Glencore Proposal Remains Largely Unchanged

12 April 2023 - 1:19AM

Dow Jones News

By Adriano Marchese

Teck Resources Ltd. said Tuesday that it will review Glencore

PLC's revised unsolicited offer to effectively buy out shareholders

of their coal exposure, but noted that the new offer isn't much

different.

Earlier on Tuesday, Glencore, a London-listed Anglo-Swiss

commodity mining and trading company, said its new offer would see

Teck shareholders receive 24% of MetalsCo and $8.2 billion in

cash.

Teck Resources said that the revised proposal offers a cash

consideration in lieu of shares in the proposed combined coal

entity, but that it appears to be largely unchanged.

Last week, Glencore came to Teck with a proposal to merge the

two businesses in an all-share deal, with a simultaneous demerger

of their combined coal business.

At the time Glencore said the deal would unlock $4.25 billion to

$5.25 billion of estimated post-tax synergy value and would give

its shareholders 76% of the merged company.

Teck said that it will "carefully and expeditiously" review and

evaluate the new proposal with its financial and legal advisers,

consistent with its fiduciary duties.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

April 11, 2023 11:04 ET (15:04 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

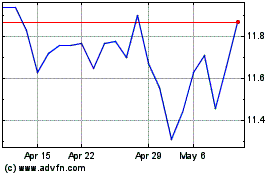

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Oct 2024 to Nov 2024

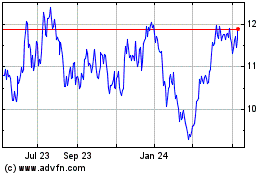

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Nov 2023 to Nov 2024