Current Report Filing (8-k)

16 September 2014 - 11:46PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to

Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported): September 15, 2014

_______________________________

Hannover House,

Inc.

(Exact name of

registrant as specified in its charter)

_________________

| Wyoming |

000-28723 |

91-1906973 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation or Organization) |

File Number) |

Identification No.) |

1428 Chester

Street, Springdale, AR 72764

(Address of Principal Executive Offices) (Zip Code)

479-751-4500

(Registrant’s telephone number, including area code)

f/k/a "Target

Development Group, Inc."

f/k/a "Mindset

Interactive Corp."

330 Clematis

Street, Suite 217, West Palm Beach, Florida 33401 (561) 514-0936

(Former name or former address and former fiscal year, if changed since last report)

_______________________________

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION 1 —

REGISTRANT'S BUSINESS AND OPERATIONS

| Item 1.01 |

Entry into a Material Definitive Agreement. Hannover

House, Inc. (“Company”) has entered into a theatrical releasing and home video venture with Redbull Media

House (“Redbull”) for the motorsports feature film documentary “On Any Sunday: The Next Chapter.”

Under the terms of the agreement, Redbull shall finance the theatrical releasing costs to enable Hannover House to open

the film on approximately 260 screens beginning November 7, 2014. Company shall also release the film to DVD and Blu-Ray

home video on February 10, 2015 under terms and conditions that are customary and consistent with other acquisitions of this caliber.

The Company expects to benefit significantly with enhanced awareness and consumer demand to see the movie, which is expected to

be driven by the media exposure, advertising and publicity activities being funded by Redbull’s promotional and

marketing teams. The film was rated by the MPAA on Friday, Sept. 12, and earned a “PG” rating. Theatre

circuits that have offered to support the release include AMC, Carmike, Cinemark, Malco and Regal Entertainment Group.

A promotional website for the film has been published at: www.OnAnySundayFilm.com

|

|

| Item 1.02 |

Termination of a Material Definitive Agreement. Hannover

House, Inc. ("Company") has terminated a corporate financing agreement that had been previously entered into in

May, 2013 with TCA Global Master Fund. Per the terms of the mutually agreed dissolution, TCA will return to Hannover House

ten-million (10,000,000) collateral shares of common stock, and will be paid three-hundred-thousand dollars (USD $300,000) by Hannover

House over the next six months. An additional, initial payment of approximately one-hundred-fifty-thousand dollars (USD $150,000)

shall be paid by Redwood Management, under a debt-purchase structure calling for the release of 18,270,543 shares of common stock.

Hannover House management feels that the dissolution and resolution

of the credit facility from TCA is in the company’s best interest. The revolving structure and credit caps were impeding

the company from pursuing other (more traditional) forms of operating financing.

The net result to the Company's current share structure resulting

from both the termination of the TCA credit facility is as follows:

Current Total Shares In Issue (June 30, 2014): 598,338,905

Collateral Shares to be surrendered by T.C.A.:

<10,000,000>

Shares to Redwood for Settlement Payment:

18,270,543

Revised Total O.S After Both Transactions:

606,609,448

|

|

| Item 1.03 |

Bankruptcy or Receivership. Not Applicable. |

|

SECTION 2 —

FINANCIAL INFORMATION

| Item 2.01 |

Completion of Acquisition or Disposition of Assets. Not Applicable. |

|

| Item 2.02 |

Results of Operations and Financial Condition. Not Applicable.

|

|

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. Not Applicable. |

|

| Item 2.04 |

Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement. Not Applicable. |

|

| Item 2.05 |

Costs Associated with Exit or Disposal Activities. Not Applicable. |

|

| Item 2.06 |

Material Impairments. Not Applicable. |

|

SECTION 3 —

SECURITIES AND TRADING MARKETS

| Item 3.01 |

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. Not Applicable. |

|

| Item 3.02 |

Unregistered Sales of Equity Securities. Not Applicable. |

|

| Item 3.03 |

Material Modification to Rights of Security Holders.

Not Applicable.

|

|

SECTION 4 —

MATTERS RELATED TO ACCOUNTANTS AND FINANCIAL STATEMENTS

| Item 4.01 |

Changes in Registrant’s Certifying Accountant. Not Applicable. |

|

| Item 4.02 |

Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review. Not Applicable. |

|

SECTION 5 —

CORPORATE GOVERNANCE AND MANAGEMENT

| Item 5.01 |

Changes in Control of Registrant. Not Applicable. |

|

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors;

Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. Not Applicable.

|

|

| Item 5.03 |

Amendments to Articles of Incorporation or Bylaws; Change in

Fiscal Year. Not Applicable.

|

|

| Item 5.04 |

Temporary Suspension of Trading Under Registrant's Employee Benefit Plans. Not Applicable. |

|

| Item 5.05 |

Amendments to the Registrant’s Code of Ethics, or Waiver of a Provision of the Code of Ethics. Not Applicable. |

|

| Item 5.06 |

Change in Shell Company Status. Not Applicable. |

|

SECTION 6 —

ASSET-BACKED SECURITIES

| Item 6.01 |

ABS Informational and Computational Material. Not Applicable. |

|

| Item 6.02 |

Changes in Servicer or Trustee. Not Applicable. |

|

| Item 6.03 |

Change in Credit Enhancement or Other External Support. Not Applicable. |

|

| Item 6.04 |

Failure to Make a Required Distribution. Not Applicable. |

|

| Item 6.05 |

Securities Act Updating Disclosure. Not Applicable. |

|

SECTION 7 —

REGULATION FD

| Item 7.01 |

Regulation FD Disclosure. Not Applicable. |

|

SECTION 8 —

OTHER EVENTS

| Item 8.01 |

Other Events. Notification of Annual Meeting of

Shareholders. Notice is hereby made

|

|

SECTION 9 —

FINANCIAL STATEMENTS AND EXHIBITS

| Item 9.01 |

Financial Statements and Exhibits. |

|

| |

(a) Financial statements of businesses acquired. Not Applicable. |

|

| |

(b) Pro forma financial information. Not Applicable. |

|

| |

(c) Shell company transactions. Not Applicable. |

|

| |

(d) Exhibits. Not Applicable. |

|

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| Date: September 15, 2014 |

Hannover House, Inc. |

|

| |

By |

/s/ Eric F. Parkinson |

|

| |

|

Name: Eric F. Parkinson

Title: C.E.O. |

|

INDEX TO EXHIBITS

| Exhibit No. |

|

Description |

| 1 |

|

Not Applicable. |

| |

|

|

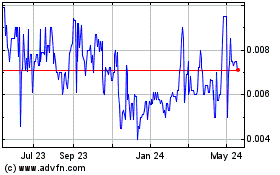

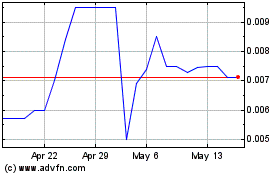

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Dec 2023 to Dec 2024