Current Report Filing (8-k)

15 September 2015 - 1:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): Sept. 4, 2015

_______________________________

Hannover House, Inc.

(Exact name of registrant as specified

in its charter)

_________________

| Wyoming |

000-28723 |

91-1906973 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation or Organization) |

File Number) |

Identification No.) |

1428 Chester Street, Springdale,

AR 72764

(Address of Principal Executive Offices) (Zip Code)

479-751-4500

(Registrant’s telephone number, including area code)

f/k/a "Target Development Group,

Inc."

f/k/a "Mindset Interactive Corp."

330 Clematis Street, Suite 217, West

Palm Beach, Florida 33401 (561) 514-0936

(Former name or former address and former fiscal year, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

SECTION

1 — REGISTRANT'S BUSINESS AND OPERATIONS

| Item 1.01 |

Entry into a Material Definitive Agreement.

a). Hannover House, Inc. (“Company”) and Medallion

Releasing, Inc. (“Medallion”) have entered into an agreement with East Side Story, LLC (“ESS”) for the

release of the feature film, “Dancin’ It’s On” (the “Film”) to theatres, video and other applicable

media formats in the territory of the United States and Canada. Under the terms of the agreement, ESS shall be responsible to fund

the releasing costs for Film, with Company and Medallion earning customary servicing and distribution fees. Company plans to release

the film to approximately six-hundred (600) theatres on or about October 16, 2015.

b). Hannover House, Inc. ("Company") has agreed

to make monthly installment payments to TCA Global Master Fund (“TCA”) in lieu of ongoing debt-conversion transactions

utilizing Rule 144 exemptions for qualifying, and aged debts into stock. Effective as of September 4, 2015, Company will make monthly

installments of $25,000 to TCA and TCA shall defer or otherwise “stay” from pursuing other collection-enforcement actions

and remedies until the entire TCA debt balance is retired and / or until a new agreement is reached regarding an acceleration of

the debt payments. TCA shall continue to hold the certificate for 10-mm restricted shares in HHSE as collateral until the debt

is retired or otherwise deemed as satisfied.

c). Additional Board of Directors Actions – The Company’s

Board has authorized the hiring of additional support staff and middle-managers in the areas of marketing, advertising, promotions

and technical services, to better handle the additional workload requirements of the growing slate of films and growing revenues

from orders, contacts and licenses. The Company’s Board has further authorized management to proceed with the negotiation

of a significant financing for the Company which would be structured primarily as an Accounts Receivable based facility (allowing

for the acceleration of payments due from Netflix and long-term receivables from Cable Licensors), in order to create a significant

cash resource from which leveraged debt reductions could occur.

|

|

| |

|

|

| |

|

|

SECTION 2 — FINANCIAL INFORMATION

| Item 2.01 |

Completion of Acquisition or Disposition of Assets. Not Applicable. |

|

| Item 2.02 |

Results of Operations and Financial Condition. As a management review tool, and for the purposes of assisting with the pursuit of Accounts Receivable financing as described above in Item 1.01-c, Company management has generated a report itemizing current sales, contracts and existing orders for Company’s products, along with projected revenues for certain items and months leading to year-end 12/31/2015, and attached that report to this Form 8 as an Exhibit. The Company wishes to acknowledge that projections are forward-looking statements and that many factors may impact the actual results and recognition of such results, including, but not limited to, changes in release dates, changes in products, and competitive factors affecting the number of theatres, video placements or video-on-demand platforms supporting Company’s titles. As indicated on the Exhibit, the Company is anticipating year-end revenues of approximately $6.4-mm, with earnings of approximately $2.23-mm, which is based on a revenue recognition of fifty percent (50%) of 80% of the actual revenue forecasts by title and media source for the final four months of 2015, added to the previously reported Q1 and Q2 results, as well as the pending Q3 results for the completed months of July and August, and the current month-in-progress, September, 2015. |

|

SECTION 9 — FINANCIAL STATEMENTS

AND EXHIBITS

| Item 9.01 |

Financial Statements and Exhibits. |

|

| |

|

|

| |

|

|

| |

|

|

| |

(d) Exhibits.

1) - 2015 Sales Analysis & Forecast for the last

four months of the year; and

2) - 4-year Analysis of the growing disparity between

actual revenue and earnings results for Company and declining share price. |

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| Date: September 14, 2015 |

Hannover House, Inc. |

| |

By |

/s/ Eric F. Parkinson |

| |

|

Name: Eric F. Parkinson

Title: C.E.O. |

INDEX TO EXHIBITS

| Exhibit No. |

|

Description |

| 1 |

|

2015 Sales Analysis & Forecast for the last four months of the year. |

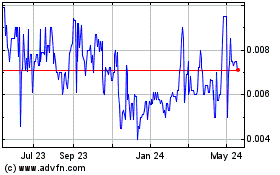

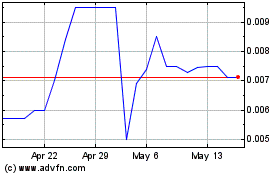

| 2 |

|

4-year Analysis of the growing disparity between actual results for Company and share price. |

EXHIBIT 1 – 2015 Sales Analysis & Forecast

for the last four months of the year.

EXHIBIT 2 - 4-year Analysis of the growing disparity

between actual revenue and earnings results for Company and declining share price.

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Feb 2025 to Mar 2025

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Mar 2024 to Mar 2025