false

0001413119

0001413119

2025-01-21

2025-01-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 21, 2025

KRAIG

BIOCRAFT LABORATORIES, INC.

(Exact

name of registrant as specified in its charter)

| Wyoming |

|

333-146316

|

|

83-0458707 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

2723

South State St. Suite 150

Ann

Arbor, Michigan 48104

(Address of principal executive offices, including Zip Code)

(734)

619-8066

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

- |

|

- |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (?230.405 of

this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

Entry

into Standby Equity Purchase Agreement

On

January 21, 2025, Kraig Biocraft Laboratories, Inc., a Wyoming corporation (“Kraig Biocraft Laboratories” or

the “Company”) entered into a Standby Equity Purchase Agreement (the “SEPA”) with

YA II PN, LTD., a Cayman Islands exempt limited company (the “Investor”). Capitalized terms used herein, but

not otherwise defined, have the meaning ascribed to such terms in the SEPA, a copy of which is filed herewith as Exhibit 10.1.

Pursuant

to the SEPA, the Company has the right to sell to the Investor up to $10 million of its shares of common stock, subject to certain limitations

and conditions set forth in the SEPA, from time to time during the term of the SEPA. Sales of the shares of common stock to the Investor

under the SEPA, and the timing of any such sales, are at the Company’s option, and the Company is under no obligation to sell any

shares of common stock to the Investor under the SEPA except in connection with notices that may be submitted by the Investor, in certain

circumstances as described below.

Upon

the satisfaction of the conditions to the Investor’s purchase obligation set forth in the SEPA, including having a registration

statement registering the resale of the shares of common stock issuable under the SEPA declared effective by the SEC, the Company will

have the right, but not the obligation, from time to time at its discretion until the SEPA is terminated to direct the Investor to purchase

a specified number of shares of common stock (“Advance”) by delivering written notice to the Investor (“Advance

Notice”). While there is no mandatory minimum amount for any Advance, it may not exceed an amount equal to 100% of the

average of the daily traded amount during the five consecutive trading days immediately preceding an Advance Notice.

In

addition to the satisfaction of the conditions, the Investor shall not be obligated to purchase or acquire, and shall not purchase or

acquire, any common stock under the SEPA which, when aggregated with all other common stock beneficially owned by the Investor and its

affiliates, would result in the beneficial ownership by the Investor and its affiliates (on an aggregated basis) of a number of shares

of common stock exceeding 4.99% of the then outstanding voting power or number of common shares. In addition, in no event shall an Advance

exceed the number of common shares registered in respect of the transactions contemplated hereby under the registration statement then

in effect.

The

Company shall pay the Investor a structuring fee in an amount of $25,000, of which $10,000 has been paid, and $15,000 shall be paid on

the earlier of (a) the Closing of the first Advance, or (b) the termination of the SEPA. Additionally, within three days of signing the

SEPA (the “Effective Date”), the Company shall pay a commitment fee in an amount equal to 1.00% of the Commitment

Amount (the “Commitment Fee”) consisting of such number of Common Shares that is equal to the Commitment Fee

divided by the average of the daily VWAPs of the Common Shares during the 3 Trading Days immediately prior to the Effective Date (the

“Commitment Shares”). The Commitment Shares issuable hereunder shall be included on the initial Registration

Statement.

The

SEPA will automatically terminate on the earliest to occur of (i) 36-month anniversary of the Effective Date or (ii) the date on which

the Investor shall have made payment of Advances pursuant to the SEPA for shares of common stock equal to the Commitment Amount. The

Company has the right to terminate the SEPA at no cost or penalty upon five (5) trading days’ prior written notice to the Investor,

provided that there are no outstanding Advance Notices for which shares of common stock need to be issued. Neither the Company nor the

Investor may assign or transfer their respective rights and obligations under the SEPA, and no provision of the SEPA may be modified

or waived other than by an instrument in writing signed by both parties.

The

SEPA contains customary representations, warranties, conditions, and indemnification obligations of the parties. The representations,

warranties and covenants contained in such agreements were made only for purposes of such agreements and as of specific dates, were solely

for the benefit of the parties to such agreements and may be subject to limitations agreed upon by the contracting parties.

The

net proceeds received by the Company under the SEPA will depend on the frequency and prices at which the Company sells its shares of

common stock to the Investor. The Company expects that any proceeds received from such sales to the Investor will be used for working

capital and general corporate purposes.

Item

3.02 Unregistered Sales of Equity Securities.

The

disclosure set forth above in Item 1.01 of this Current Report on Form 8-K relating to the issuance of shares of common stock to the

Investor pursuant to the SEPA, including any shares to be issued in connection with an Advance Notice or the Commitment Fee is incorporated

by reference herein in its entirety. The offer and sale of shares of common stock pursuant to the SEPA was and will be made in reliance

upon the exemption from registration contained in Section 4(a)(2) of the Securities Act of 1933, as amended. This Current Report on Form

8-K shall not constitute an offer to sell or the solicitation of any offer to buy the securities discussed herein, nor shall there be

any offer, solicitation, or sale of the securities in any state in which such offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of any such state.

Item

7.01 Regulation FD Disclosure.

On

January 21, 2025, the Company issued press release announcing its entry into the SEPA. A copy of the press release is furnished as Exhibit

99.1 to this Current Report on Form 8-K and is incorporated by reference in this Item 7.01.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

January 21, 2025

| |

KRAIG BIOCRAFT LABORATORIES, INC. |

| |

|

|

| |

By: |

/s/

Kim Thompson |

| |

|

Kim Thompson |

| |

|

Chief Executive Officer,

Chief Financial Officer and Director |

Exhibit

10.1

Exhibit 99.1

Kraig

Biocraft Laboratories Secures $10 Million SEPA to Support Spider Silk Production Growth and Commercialization

ANN

ARBOR, Mich., – January 21, 2025 –Kraig Biocraft Laboratories, Inc. (OTCQB: KBLB) (“the Company” or “Kraig

Labs”), a leading developer of spider silk-based fibers, announces that it has secured $10 million in a standby equity purchase

agreement (“SEPA”) with YA II PN, Ltd. (“Yorkville”). This agreement will provide the Company with access

to the working capital necessary to continue production expansion for its revolutionary recombinant spider silk fibers and materials.

Kraig

Labs structured the SEPA to allow the Company to access capital over the next 36 months, when and how it determines best for the growth

of spider silk production and end-market development. The Company is under no obligation to utilize this funding, has no minimum use

requirements, and it does not impose any restrictions on the Company’s operations. This agreement gives the Company the flexibility

to access the capital necessary to bridge its transition to revenue generation.

“We

have worked with Yorkville in the past and we are excited to renew and strengthen that relationship. This strategic financial

relationship provides Kraig Labs with the flexibility to support the growth of spider silk commercialization,” said Founder and

CEO, Kim Thompson. “The SEPA provides access to significant growth capital, allowing us to focus on executing our vision for eco-friendly,

cost-effective spider silk production. We will put this capital to work, building out our production capacity and spider silk inventory,

developing new consumer products, and establishing partnerships with market channel sales partners.”

For

details about other recent advancements the Company has made, please see the Company’s investor conference at www.kraiglabs.com/videos

or on the Company’s YouTube Channel https://www.youtube.com/@kraigbiocraftlaboratories2270.

To

view the most recent news from Kraig Labs and/or to sign up for Company alerts, please go to www.KraigLabs.com/news

The

securities described herein have not been registered under the Securities Act of 1933, as amended, and may not be sold in the United

States absent registration or an applicable exemption from the registration requirements. This press release shall not constitute an

offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or other jurisdiction

in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any

such state or other jurisdiction.

About

Kraig Biocraft Laboratories, Inc.

Kraig

Biocraft Laboratories, Inc. (www.KraigLabs.com), a reporting biotechnology company is the leading developer of genetically engineered

spider silk-based fiber technologies.

The

Company has achieved a series of scientific breakthroughs in the area of spider silk technology with implications for the global textile

industry.

Cautionary

Statement Regarding Forward Looking Information

Statements

in this press release about the Company’s future and expectations other than historical facts are “forward-looking statements.”

These statements are made on the basis of management’s current views and assumptions. As a result, there can be no assurance that

management’s expectations will necessarily come to pass. These forward-looking statements generally can be identified by phrases

such as “believes,” “plans,” “expects,” “anticipates,” “foresees,” “estimated,”

“hopes,” “if,” “develops,” “researching,” “research,” “pilot,”

“potential,” “could” or other words or phrases of similar import. Forward looking statements include descriptions

of the Company’s business strategy, outlook, objectives, plans, intentions and goals. All such forward-looking statements are subject

to certain risks and uncertainties that could cause actual results to differ materially from those in forward-looking statements. This

press release does not constitute an offer to sell or the solicitation of an offer to buy any security.

Ben

Hansel, Hansel Capital, LLC

(720)

288-8495

ir@KraigLabs.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

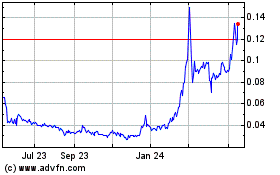

Kraig Biocraft Laborator... (QB) (USOTC:KBLB)

Historical Stock Chart

From Feb 2025 to Mar 2025

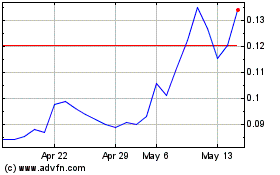

Kraig Biocraft Laborator... (QB) (USOTC:KBLB)

Historical Stock Chart

From Mar 2024 to Mar 2025