Oncologix Posts Solid Revenue Growth and Continued Financial Improvements

22 April 2014 - 2:37AM

Marketwired

Oncologix Posts Solid Revenue Growth and Continued Financial

Improvements

ALEXANDRIA, LA--(Marketwired - Apr 21, 2014) - Oncologix Tech

Inc. (OTCQB: OCLG), a medical device and healthcare service holding

company announced today its Second Quarter and YTD Fiscal 2014

results.

Wayne Erwin, CEO of Oncologix, stated, "Our progress and hard

work are evidenced by the company's fiscal year 2014 second quarter

and year-to-date financial results. Revenues during the

periods were $983,758 and $1,708,391, respectively. When

compared to the company posting zero revenues for the comparable

periods in fiscal 2013, we think it's an important milestone that

revenues are continuing to build for the year. Also, during

the six months ending February 28, 2014, the company repaid over

$400,000 of debt. It's evident from these results that we are

executing our two-prong strategy that focuses on acquisitions and

debt reduction; both of which have significantly enhanced

Oncologix's market value. Other key indicators of our six

month February 28, 2014 financials are:

Mid-Year 2014 Key Company Activities:

- Revenues for the three and six months were $983,758 and

$1,708,391, respectively.

- Acquired Amian Health Services -- adding $1,000,000 in annual

revenues

- Executed a $4,000,000 line of credit facility with $300,000,000

TCA Global Fund to augment our acquisition strategy

- Repaid over $400,000 in debt

- Reduced annualized rents by $50,000

- Reduced non-essential FTE employees by $148,000 per year

- Began new product development for Dotolo Research Toxygen-II

hardware system

- Relocated Dotolo Research Corporation manufacturing facilities

to Tempe, AZ

- Increased our authorized stock to 750mm shares

Erwin also noted, "To continue our mid-year success, we'll

execute further our acquisition strategy. We are currently in

due diligence with two additional healthcare service companies with

revenues exceeding $5,000,000 and generating $800,000 in annualized

earnings. Overall, our company objective is to reach

$10,000,000 in annualized revenues by fiscal year end. We believe

that our stock price is currently undervalued and the debt

reduction effort and strategic acquisitions will increase our stock

values in the near term."

Oncologix operates and manufactures Class II medical device

products and delivers Personal Healthcare Services nationally. For

its clients, Oncologix provides FDA approved medical devices and

State licensed healthcare services. For its shareholders, Oncologix

operates profitable business divisions that build, maintain and

nourish shareholder value. The Company's corporate mission is to be

the best small cap medical device and healthcare services holding

company in North America.

Forward Looking Statement This press release may contain

forward-looking statements, made in reliance upon Section 21D of

the Exchange Act of 1934, which involve known and unknown risks,

uncertainties or other factors that could cause actual results to

differ materially from the results, performance, or expectations

implied by these forward-looking statements. The Company's

expectations, among other things, are dependent upon economic

conditions, continued demand for its products, the availability of

raw materials, retention of its key management and operating

personnel, its ability to operate its subsidiary companies

effectively, need for and availability of more capital as well as

other uncontrollable or unknown factors which are more fully

disclosed in the Company's filings with the Securities and Exchange

Commission.

CONTACT

INFORMATION Wayne Erwin Chairman and CEO Email Contact (318)

451-9543 INVESTOR

RELATIONS Jack Eversull President The Eversull Group, Inc.

972-571-1624 214-469-2361 fax Email Contact

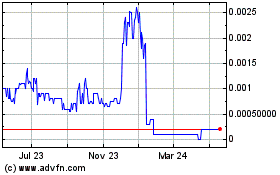

Oncologix Tech (CE) (USOTC:OCLG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Oncologix Tech (CE) (USOTC:OCLG)

Historical Stock Chart

From Dec 2023 to Dec 2024