Indicate by check mark if the registrant is

a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

¨

No

x

Indicate by check mark if the registrant is

not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes

¨

No

x

Indicate by check mark whether the issuer (1)

filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the last 12 months (or for such shorter

period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past

90 days. Yes

x

No

¨

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files). Yes

x

No

¨

Indicate by check mark if disclosure of delinquent

filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained,

to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III

of this Form 10-K or any amendment to this Form 10-K.

x

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act.

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act).

As of June 10, 2016, the registrant had 178,239,536 outstanding

shares of Common Stock.

PART I

ITEM 1. BUSINESS.

Plandaí Biotechnology, Inc. (the “Company”)

and its subsidiaries is a bio-pharmaceutical business that focuses on the production of proprietary botanical extracts for the

nutraceutical and pharmaceutical industries. The Company grows the green tea used in its Phytofare® Catechin production a 3,000-hectare

estate it operates under a 49-year notarial lease in the Mpumalanga province of South Africa. Plandaí uses a proprietary

extraction process that is engineered to yield highly bioavailable products of pharmaceutical-grade purity. Phytofare

®

Catechin Complex, a green-tea derived extract, is the first commercial product in the Phytofare

®

brand and has supporting

clinical data supporting its use in multiple potential wellness applications. The Company’s principle holdings consist of

land, farms and infrastructure in South Africa.

The Company was originally incorporated as

Jerry's Inc., in the State of Florida on November 30, 1942. The Company catered airline flights and operated coffee shops, lounges

and gift shops at airports and other facilities located in Florida, Alabama and Georgia. The company's airline catering services

included the preparation of meals in kitchens located at, or adjacent to, airports and the distribution of meals and beverages

for service on commercial airline flights. The Company also provided certain ancillary services, including, among others, the preparation

of beverage service carts, the unloading and cleaning of plates, utensils and other accessories arriving on incoming aircraft,

and the inventory management and storage of airline-owned dining service equipment. In March of 2004 we moved our domicile to Nevada

and changed our name to Diamond Ranch Foods, Ltd. Diamond Ranch Foods, Ltd. was engaged in the meat processing and distribution

industry focusing on the eastern seaboard of the United States. Operations consisted of packing, processing, custom meat cutting,

portion controlled meats, private labeling, and distribution of our products to a diversified customer base, including, but not

limited to; in-home food service businesses, retailers, hotels, restaurants and institutions, deli and catering operators, and

industry suppliers. On November 17, 2011, the Company, through its wholly owned subsidiary, Plandaí Biotechnologies, Inc.

consummated a share exchange with Global Energy Solutions Corporation Limited, an Irish corporation. Under the terms of the Share

Exchange, GES received 76,000,000 shares of Diamond Ranch that had been previously issued to Plandaí Biotechnologies, Inc.

in exchange for 100% of the issued and outstanding capital of GES. On November 21, 2011, the Company filed an amendment

to the Articles of Incorporation to change the name of the Company to Plandaí Biotechnology, Inc. GES was subsequently

folded up into Plandaí and the legal status terminated, leaving Plandaí Biotechnology, Inc. as the surviving entity.

During the fourth quarter of fiscal 2015, the

Company began shipping product to customers and recording sales. However, a hailstorm during the quarter destroyed a large percentage

of the tea crop and there was insufficient time remaining in the growing season to yield another harvest. As a result, sales for

the final quarter were limited. The Company is actively pursuing additional financing and has had discussions with various third

parties, although no firm commitments have been obtained. Management believes these efforts, combined with projected sales for

fiscal 2016, will generate sufficient cash flows from future operations to pay the Company's obligations and realize positive cash

flow. There is no assurance any of these transactions will occur.

In April 2012, through our subsidiary companies,

we secured a 100 million Rand financing (approximately $13 million at the time of financing, $6.5 million at current exchange rates)

with the Land and Agriculture Bank of South Africa, which has been used to build infrastructure and further operations. During

the year ended June 30, 2015, the Company borrowed a total of $5,300,000 from third parties to sustain operations and complete

the construction of the production facility in South Africa.

PRODUCTS AND SERVICES

Gaelic for “plant food”,

Plandaí is a biopharmaceutical company dedicated to taking all-natural nutraceutical ingredients and unlocking their

pharmaceutical potential. Published science suggests that by delivering a therapeutic level of essential plant-based

nutrients to human cells, we can treat many of the diseases that plague humankind. From viruses to cancers, to neural

disorders like Alzheimer’s, science has shown that the botanical phytonutrients in plants have tremendous curative

properties. However, current extraction methods fail to produce products that are highly bioavailable and that remain in the

system long enough for a therapeutic effect. Plandaí’s technology releases and restructures plant nutrients into

a highly purified form that the body can more easily process while also increasing their delivery and absorption into the

blood plasma and the length of time those nutrients remain present and active.

Many common pharmaceutical products have their

origins rooted in plants and “natural” medicine. For example,

the active ingredient

of aspirin was first discovered from the bark of the willow tree. In 1763 Edward Stone of Wadham College, University

of Oxford, discovered salicylic acid, the active ingredient of aspirin, which was later synthesized by the German company Bayer

®

in

1897.

The reason that these “natural” medicines are usually supplanted by synthetic drugs can be attributed

to a few things but most notably the need to increase the absorption of the active ingredient by the human body, which is called

bioavailability

. In order to increase bioavailability in plant phytonutrients, the following barriers must be overcome,

particle size, solubility, permeability, metabolism, excretion and disposition.

Our Phytofare® botanical extracts have

overcome these challenges and, as validated in human clinical trials completed in June 2015, are delivered in a highly bioavailable

form. In practical terms, this means that we are able to deliver more of the vital plant nutrients to the blood plasma where it

remains at a therapeutic level for over 24 hours.

Compared with generic green tea extract, Plandaí’s

Phytofare

®

Catechin Complex exhibits specific advantageous properties:

|

|

1.

|

Phytofare

®

contains all of the phytonutrients in a

stable, active extract. For example, with green tea, Phytofare

®

contains all eight catechins compared to just two

catechins found in the generic. The difference is greater efficacy and improved synergy.

|

|

|

2.

|

Because Phytofare

®

consists of mostly nano-sized particles,

we can achieve greater cellular uptake.

|

|

|

3.

|

Phytofare

®

is more bioavailable than generic extracts.

In fact, it has been clinically shown to have 10 times greater bioavailability.

|

|

|

4.

|

Phytofare has four times greater residency in the blood plasma, 24

hours compared to 6. This means it can be an effective “once a day” dose.

|

|

|

5.

|

Phytofare

®

offers greater stability over generic.

In fact, studies have shown that Phytofare

®

retains over 70% of its catechin efficacy after 90-day exposure, whereas

generic catechins are completely gone.

|

|

|

6.

|

Because Phytofare® is 10x more bioactive, the dosage can be reduced

by 1/10

th

. As a result, our cost per dose is a fraction of our nearest competitor.

|

Many botanical extracts have demonstrated varying

degrees of health benefit, and many pharmaceutical drugs are either derived directly from plant extracts or are synthetic analogs

of phytonutrient molecules. Green tea catechins, for example, have shown promising in-vitro results as an anti-oxidant, with hundreds

of different published studies demonstrating its potential usefulness in weight loss, anti-viral, anti-cancer, and anti-parasitic

applications, amongst others.

In May 2015, the Company concluded a human

clinical study on Plandaí’s inaugural product, Phytofare

®

Catechin Complex made from green tea. The

test results forced us to coin a new term to describe what our extraction process was accomplishing:

phyto-availability™.

Phyto-availability™

is the combination of Phytofare

®

unique properties:

|

|

1.

|

Demonstrates ultra-high-bioavailability.

|

|

|

2.

|

Exhibits the presence of complete phyto-complexes.

|

|

|

3.

|

Greatly prolongs the presence of the phyto-complexes in the blood.

|

Plandaí’s Phytofare

®

Catechin Complex is produced from live green tea harvested locally on the Senteeko Tea Estate in Mpumalanga, South Africa, and

then processed on a state-of-the-art extraction facility constructed onsite using funds obtained from the Land and Agriculture

Bank of South Africa. The facility became operational in late 2014, with initial sales commencing in the fourth quarter of fiscal

2015.

The Company is actively developing additional

products including a Phytofare

®

citrus complex. The citrus extraction investigations commenced at the Senteeko research

facility in October 2015 and the product is anticipated for a late-2016 release to market.

On August 30, 2013, Plandaí entered

into a world license agreement with North-West University in Potchefstroom, South Africa, which granted the Company the exclusive

right to use, manufacture and formulate the University’s Pheroid

®

technology for entrapped Phytofare®

extracts. Pheroid

®

is a patented colloidal emulsion and entrapment system for protecting botanical compounds against

metabolism in the stomach acids and then delivering such compounds into the blood plasma. For a botanical drug to have a therapeutic

effect, it must reach the site of action in sufficient quantities. The Pheroid

®

drug delivery system enhances the

absorption of the botanical extract through protection and delivery to the plasma, which was expressly confirmed in clinical studies

2015 with Phytofare

®

catechin complex formulated in Pheroid

®

. The combination of Phytofare

®

entrapped in Pheroid

®

was brought to market in early 2016 and is being marketed under the tradename “Ph

2

.”

Plandaí continues to develop its biopharmaceutical

base with live plant materials and is actively pursuing developing Phytofare® extracts from citrus and tomato fruits, artemisia

and cannabis.

This research includes developing a non-psychoactive

cannabinoid extract through the Company’s wholly-owned subsidiary, Plandaí Biotechnology – Uruguay, SA. Plandaí

Uruguay is the first and only company to receive a license from the Republic of Uruguay to product cannabis-based extract for pharmaceutical

research. Following testing to verify the extract’s bioavailability and lack of psychoactive properties, the plan is to commence

animal research on neural disorders such as Parkinson’s, Alzheimer’s, MS, epilepsy, and post-concussion syndrome in

order to determine definitively if cannabis possesses medicinal properties meriting further human trials.

COMPETITION

The Company faces competition from a variety

of sources. There are several large companies that develop and market nutriceutical products that include bio-available compounds

including those from green tea. Many of these competitors benefit from established distribution, market-ready products, and greater

levels of financing. Plandaí intends to compete by producing higher quality extracts that exhibit greater bioavailability

and longer blood-plasma residency, producing at lower costs, and controlling a vertically integrated business approach that includes

all stages from farming through production and marketing. The Company’s unique Phyto-availability™, combined with the

patented Pheroid

®

technology, should provide several unique market advantages in the form of higher absorption,

increased bioavailability, and lower dosage requirements.

CUSTOMERS

Plandaí markets direct to nutraceutical

and supplement companies that require high-quality bio-available extracts for their products and also sells through several third

party distributors who, in turn, sell to their customers which typically also include contract manufacturers, nutraceutical and

supplement companies. In addition, the Company is developing a direct-to-consumer product based on Phytofare

®

ingredients

formulated into oral capsules.

ITEM 1A. RISK FACTORS

An investment in our securities is highly speculative,

involves a high degree of risk and is suitable only for investors with substantial means who can bear the economic risk of the

investment for an indefinite period, have no need for liquidity of the investment, and have adequate means of providing for their

current needs and contingencies. An investment in the securities should only be made by persons able to bear the risk in the event

the investment results in a total loss.

We Have Historically Lost Money and Losses May Continue in the

Future

We have historically lost money. The

loss for the fiscal year June 30, 2015 was $10,072,344 and future losses are likely to occur. Accordingly, we may experience

significant liquidity and cash flow problems if we are not able to raise additional capital as needed and on acceptable terms.

No assurances can be given we will be successful in reaching or maintaining profitable operations.

We Will Need to Raise Additional Capital to Finance Operations

Our operations have thus far relied almost

entirely on external financing to fund our operations. Such financing has historically come from a combination of borrowings

and from the sale of common stock and assets to third parties. Until we reach a point where revenues exceed costs, we will

need to raise additional capital to fund our anticipated operating expenses and future expansion. Among other things, external

financing will be required to cover our operating costs. We cannot assure you that financing whether from external sources

or related parties will be available if needed or on favorable terms. The sale of our common stock to raise capital may cause

dilution to our existing shareholders. Our inability to obtain adequate financing will result in the need to curtail business

operations. Any of these events would be materially harmful to our business and may result in a lower stock price.

There is Substantial Doubt About Our Ability

to Continue as a Going Concern Due to Recurring Losses and Working Capital Shortages, Which Means that We May Not Be Able to Continue

Operations Unless We Obtain Additional Funding

Our independent certified public accountant

has stated in their report included in this filing that we have suffered recurring losses from operations that raise

substantial doubt about our ability to continue as a going concern.

The Company has experienced recurring operating

losses and we currently have a working capital deficiency. There is a possibility that our revenues will not be sufficient to meet

our operating costs. To date our liabilities have greatly exceeded our current assets. There is a substantial doubt that we can

continue as a going concern.

There can be no assurance that we will continue

to generate revenues from operations or obtain sufficient capital on acceptable terms, if at all. Failure to obtain such

capital or generate such operating revenues would have an adverse impact on our financial position and results of operations and

ability to continue as a going concern. Our operating and capital requirements during the next fiscal year and thereafter

will vary based on a number of factors, including the level of sales and marketing activities for our services and products. There

can be no assurance that additional private or public finances, including debt or equity financing, will be available as needed

or, if available, on terms favorable to us. Any additional equity financing may be dilutive to stockholders and such additional

equity securities may have rights, preferences or privileges that are senior to those of our existing common stock.

Furthermore, debt financing, if available,

will require payment of interest and may involve restrictive covenants that could impose limitations on our operating flexibility.

Our failure to be able to successfully obtain additional future funding may jeopardize our ability to continue our business

and operations.

Our Common Stock May Fluctuate Significantly

Our common stock has experienced, and is likely

to experience in the future, significant price and volume fluctuations, that could adversely affect the market price of our common

stock without regard to our operating performance. In addition, we believe that factors such as quarterly fluctuations in

our financial results and changes in the overall economy or the condition of the financial markets could cause the price of our

common stock to fluctuate substantially. Substantial fluctuations in our stock price could significantly reduce the price of our

stock.

There is no Assurance of Continued Public

Trading Market and Being a Low Priced Security May Affect the Market Value of Our Stock

Our common stock is currently quoted on the

Pink Sheets. As a result, an investor may find it difficult to dispose of, or to obtain accurate quotations as to the market value

of our stock. Our stock is subject to the low-priced security or so called "penny stock" rules that impose additional

sales practice requirements on broker-dealers who sell such securities. The Securities Enforcement and Penny Stock Reform Act of

1990 requires additional disclosure in connection with any trades involving a stock defined as a penny stock (generally, according

to recent regulations adopted by the SEC, any equity security that has a market price of less than $5.00 per share, subject to

certain exceptions that we no longer meet). For example, brokers/dealers selling such securities must, prior to effecting the transaction,

provide their customers with a document that discloses the risks of investing in such securities. Included in this document are

the following:

- the bid and offer price quotes in and for the "penny

stock," and the number of shares to which the quoted prices apply,

- the brokerage firm's compensation for the

trade, and

- the compensation received by the brokerage

firm's sales person for the trade.

In addition, the brokerage firm must send the investor:

- a monthly account statement that

gives an estimate of the value of each "penny stock" in the investor's account, and

- a written statement of the investor's financial

situation and investment goals.

If the person purchasing the securities is

someone other than an accredited investor or an established customer of the broker/dealer, the broker/dealer must also approve

the potential customer's account by obtaining information concerning the customer's financial situation, investment experience

and investment objectives. The broker/dealer must also make a determination whether the transaction is suitable for the customer

and whether the customer has sufficient knowledge and experience in financial matters to be reasonably expected to be capable of

evaluating the risk of transactions in such securities. Accordingly, the Commission's rules may limit the number of potential purchasers

of the shares of our common stock.

Resale restrictions on transferring "penny

stocks" are sometimes imposed by some states, which may make transactions in our stock more difficult and may reduce the value

of the investment. Various state securities laws pose restrictions on transferring "penny stocks" and as a result, investors

in our common stock may have the ability to sell their shares of our common stock impaired.

There can be no assurance we will have market

makers in our stock. If the number of market makers in our stock should decline, the liquidity of our common stock could be impaired,

not only in the number of shares of common stock which could be bought and sold, but also through possible delays in the timing

of transactions, and lower prices for the common stock than might otherwise prevail. Furthermore, the lack of market makers could

result in persons being unable to buy or sell shares of the common stock on any secondary market.

We Could Fail to Retain or Attract Key Personnel

Our future success depends in significant part

on the continued services of Roger Duffield, our Chief Executive Officer. We cannot assure we would be able to find an appropriate

replacement for key personnel. Any loss or interruption of our key personnel's services could adversely affect our ability

to develop our business plan.

Nevada Law and Our Charter May Inhibit a Takeover of Our Company

That Stockholders May Consider Favorable

Provisions of Nevada law, such as its business

combination statute, may have the effect of delaying, deferring or preventing a change in control of our Company. As a result,

these provisions could limit the price some investors might be willing to pay in the future for shares of our common stock.

We have a history of operating

losses and expect to incur losses for the foreseeable future. We may never generate revenues or, if we are able to generate revenues,

achieve profitability.

Through June 30, 2015, our operations

were focused on product development and in bringing production capacity online, and our revenues to date have mostly consisted

of sales of timber, avocado and macadamia nuts from our farms in South Africa with limited sales of our Phytofare

®

product line. We have incurred losses in each year of our operations, and we expect to continue to incur operating losses for the

foreseeable future. These operating losses have adversely affected and are likely to continue to adversely affect our working capital,

total assets and shareholders’ equity.

The Company and its prospects

should be examined in light of the risks and difficulties frequently encountered by early stage companies in new and rapidly

evolving markets. These risks include, among other things, the speed at which we can scale up operations, our complete

dependence upon development of products that currently have no market acceptance, our ability to establish and expand our

brand name, our ability to expand our operations to meet the commercial demand of our clients, our development of and

reliance on strategic and customer relationships and our ability to minimize fraud and other security risks.

The process of developing our products

requires significant clinical, development and laboratory testing and clinical trials. In addition, commercialization of our product

candidates can require that we obtain necessary regulatory approvals and establish sales, marketing and manufacturing capabilities,

either through internal hiring or through contractual relationships with others. We expect to incur substantial losses for the

foreseeable future as a result of anticipated increases in our research and development costs, including costs associated with

conducting preclinical testing and clinical trials, and regulatory compliance activities.

Our ability to generate revenues

and achieve profitability will depend on numerous factors, including success in:

|

|

·

|

Developing and testing product candidates;

|

|

|

·

|

Receiving regulatory approvals;

|

|

|

·

|

Commercializing our products;

|

|

|

·

|

Establishing a favorable competitive position.

|

Many of these factors will depend

on circumstances beyond our control. We cannot assure you that we will ever become profitable.

We

expect to incur substantial additional operating expenses over the next several years as our research, development, pre-clinical

testing, and clinical trial activities increase. The amount of future losses and when, if ever, we will achieve profitability are

uncertain. Our first product has generated limited commercial revenue to date. Our ability to generate revenue and achieve profitability

will depend on, among other things, successful completion of the development of additional product candidates; the successful testing

of our product in both in

in vitro

and

in vivo

trials; establishing manufacturing, sales, and marketing arrangements

with third parties; and raising sufficient funds to finance our activities. We might not succeed at any of these undertakings.

If we are unsuccessful at some or all of these undertakings, our business, prospects, and results of operations may be materially

adversely affected.

We face intense competition in

the markets targeted by our lead product. Many of our competitors have substantially greater resources than we do, and we expect

that all of our products will face intense competition from existing or future drugs.

We expect that all of our products

will face intense competition from existing and future products marketed by large companies. These competitors may successfully

market products that compete with our products, successfully identify and develop products earlier than we do, or develop products

that are more effective or cost less than our products.

These competitive factors could

require us to conduct substantial new research and development activities to establish new product targets, which would be costly

and time consuming. These activities would adversely affect our ability to commercialize products and achieve revenue and profits.

Competition and technological

change may make our products and technologies less attractive or obsolete.

We

compete with established pharmaceutical and food additive companies that are pursuing other products for the same indications we

are pursuing and that have greater financial and other resources. Other companies may succeed in developing products earlier than

us, or developing products that are more effective than our products. Research and development by others may render our technology

or products obsolete or noncompetitive, or result in treatments or cures superior to any product we develop. We face competition

from companies that internally develop competing technology or acquire competing technology from universities and other research

institutions. As these companies develop their technologies, they may develop competitive positions that may prevent, make futile,

or limit our product commercialization efforts, which would result in a decrease in the revenue we would be able to derive from

the sale of any products.

It is too early to determine whether

our products will be accepted by the marketplace as readily as these or other competing treatments. There can be no assurance that

third party manufacturers and consumers will prefer our products to competing products in the market.

Furthermore, the nutraceutical and

food additive industries are diverse, complex, and rapidly changing. By its nature, the business risks associated therewith are

numerous and significant. The effects of competition, intellectual property disputes, and market acceptance preclude us from forecasting

revenues or income with certainty or even confidence.

If we fail to protect our intellectual

property rights, our ability to pursue the development of our technologies and products would be negatively affected.

Our success will depend in part

on our ability to protect our intellectual property. This is done, in part, by obtaining patents and trademarks and then maintain

adequate protection of our technologies, tradenames and products. If we do not adequately protect our intellectual property, competitors

may be able to use our technologies to produce and market products in direct competition with us and erode our competitive advantage.

Some foreign countries lack rules and methods for defending intellectual property rights and do not protect proprietary rights

to the same extent as the United States. Many companies have had difficulty protecting their proprietary rights in these foreign

countries. We may not be able to prevent misappropriation of our proprietary rights.

We

are currently seeking patent protection for numerous processes and finished products. However, the patent process is subject to

numerous risks and uncertainties, and there can be no assurance that we will be successful in protecting our products by obtaining

and defending patents. These risks and uncertainties include the following: patents that may be issued or licensed may be challenged,

invalidated, or circumvented, or otherwise may not provide any competitive advantage; our competitors, many of which have substantially

greater resources than us and many of which have made significant investments in competing technologies, may seek, or may already

have obtained, patents that will limit, interfere with, or eliminate our ability to make, use, and sell our potential products

either in the United States or in international markets; there may be significant pressure on the United States government and

other international governmental bodies to limit the scope of patent protection both inside and outside the United States for treatments

that prove successful as a matter of public policy regarding worldwide health concerns; countries other than the United States

may have less restrictive patent laws than those upheld by United States courts, allowing foreign competitors the ability to exploit

these laws to create, develop, and market competing products.

Moreover, any patents issued to us

may not provide us with meaningful protection, or others may challenge, circumvent or narrow our patents. Third parties may also

independently develop products similar to our products, duplicate our unpatented products or design around any patents on products

we develop. Additionally, extensive time is required for development, testing and regulatory review of a potential product. While

extensions of patent term due to regulatory delays may be available, it is possible that, before any of our product candidates

can be commercialized, any related patent, even with an extension, may expire or remain in force for only a short period following

commercialization, thereby reducing any advantages of the patent.

In

addition, the United States Patent and Trademark Office (the "PTO") and patent offices in other jurisdictions have often

required that patent applications concerning biotechnology-related inventions be limited or narrowed substantially to cover only

the specific innovations exemplified in the patent application, thereby limiting the scope of protection against competitive challenges.

Thus, even if we or our licensors are able to obtain patents, the patents may be substantially narrower than anticipated.

Our success depends in part on patent

applications that are licensed exclusively to us and other patents to which we may obtain assignment or licenses. We may not be

aware, however, of all patents, published applications or published literature that may affect our business either by blocking

our ability to commercialize our product candidates, by preventing the patentability of our product candidates to us or our licensors,

or by covering the same or similar technologies that may invalidate our patents, limit the scope of our future patent claims or

adversely affect our ability to market our product candidates.

In addition to patents, we rely on

a combination of trade secrets, confidentiality, nondisclosure and other contractual provisions, and security measures to protect

our confidential and proprietary information. These measures may not adequately protect our trade secrets or other proprietary

information. If they do not adequately protect our rights, third parties could use our technology, and we could lose any competitive

advantage we may have. In addition, others may independently develop similar proprietary information or techniques or otherwise

gain access to our trade secrets, which could impair any competitive advantage we may have.

Patent protection and other intellectual

property protection is crucial to the success of our business and prospects, and there is a substantial risk that such protections

will prove inadequate.

If testing or clinical trials

for our product candidates are unsuccessful or delayed, we will be unable to meet our anticipated development and commercialization

timelines.

We rely and expect to continue to

rely on third parties, including clinical research organizations and outside consultants, to conduct, supervise or monitor some

or all aspects of testing or clinical trials involving our product candidates. We have less control over the timing and other aspects

of testing or clinical trials than if we performed the monitoring and supervision entirely on our own. Third parties may not perform

their responsibilities for our testing or clinical trials on our anticipated schedule or, for clinical trials, consistent with

a clinical trial protocol. Delays in preclinical and clinical testing could significantly increase our product development costs

and delay product commercialization. In addition, many of the factors that may cause, or lead to, a delay in the clinical trials

may also ultimately lead to denial of regulatory approval of a product candidate.

The commencement of clinical trials can be delayed for a variety

of reasons, including delays in:

|

|

·

|

demonstrating sufficient safety and efficacy to obtain regulatory approval to commence a clinical trial;

|

|

|

·

|

reaching agreement on acceptable terms with prospective contract research organizations and trial sites;

|

|

|

·

|

manufacturing sufficient quantities of a product candidate; and

|

|

|

·

|

obtaining institutional review board approval to conduct a clinical trial at a prospective site.

|

Once a clinical trial has begun,

it may be delayed, suspended or terminated due to a number of factors, including:

|

|

·

|

ongoing discussions with the FDA or other regulatory authorities regarding the scope or design of our clinical trials;

|

|

|

·

|

failure to conduct clinical trials in accordance with regulatory requirements;

|

|

|

·

|

lower than anticipated recruitment or retention rate of patients in clinical trials;

|

|

|

·

|

lack of adequate funding to continue clinical trials; or

|

|

|

·

|

negative results of clinical trials

|

If clinical trials are unsuccessful,

and we are not able to obtain regulatory approvals for our product candidates under development, we will not be able to commercialize

these products, and therefore may not be able to generate sufficient revenues to support our business.

If we are unable to hire additional qualified personnel, our

ability to grow our business may be harmed.

Over time we will need to hire additional

qualified personnel with expertise in clinical testing, clinical research and testing, government regulation, formulation and manufacturing,

financial matters and sales and marketing. We compete for qualified individuals with numerous biopharmaceutical companies, universities

and other research institutions. Competition for such individuals is intense, and we cannot be certain that our search for such

personnel will be successful. Attracting and retaining qualified personnel will be critical to our success.

Data provided by collaborators

and others upon which we rely that has not been independently verified could turn out to be false, misleading, or incomplete.

We rely on third-party vendors,

scientists, and collaborators to provide us with significant data and other information related to our projects, clinical trials,

and our business. If such third parties provide inaccurate, misleading, or incomplete data, our business, prospects, and results

of operations could be materially adversely affected.

Successful development of future products is uncertain

.

Our development of current and future

product candidates is subject to the risks of failure and delay inherent in the development of new biotech products, including:

delays in product development, clinical testing, or manufacturing; unplanned expenditures in product development, clinical testing,

or manufacturing; failure to receive regulatory approvals; emergence of superior or equivalent products; inability to manufacture

on its own, or through any others, product candidates on a commercial scale; and failure to achieve market acceptance.

If a significant portion of these

development efforts are not successfully completed, required regulatory approvals are not obtained or any approved products are

not commercially successfully, our business, financial condition, and results of operations may be materially harmed.

We may never obtain the regulatory

approvals we need to market some of our product candidates.

Following completion of clinical

trials, the results are evaluated and, depending on the outcome, may be submitted to the FDA in the form of an NDA in order to

obtain approval to commence commercial marketing using the desired claims. While FDA approval will not be required to sell our

products, in order to make certain health-related claims, FDA approval may be required. In responding to an NDA, the FDA may require

additional testing or information, may require that the product labeling be modified, may impose post-approval study or reporting

requirements or other restrictions on product distribution, or may deny the application. The FDA has established performance goals

for review of NDAs - six months for priority applications and ten months for standard applications. However, the FDA is not required

to complete its review within these time periods. The timing of final FDA review and action varies greatly, but can take years

in some cases and may involve the input of an FDA advisory committee of outside experts.

To date, we have not submitted an

NDA to the FDA or an equivalent application to any foreign regulatory authorities for any of our product candidates and have no

immediate plans to do so.

It is possible that none of our

product claims will be approved for marketing. Failure to obtain regulatory approvals, or delays in obtaining regulatory approvals,

may adversely affect the successful commercialization of any products we develop, may impose additional costs on us or our collaborators,

may diminish any competitive advantages that we or our partners may attain, and/or may adversely affect our receipt of revenues

or royalties.

Even if we obtain regulatory

approval to make market claims about our products, our products may not be accepted by the market.

Even if we receive regulatory approval

to make specific marketing claims for one or more of our products, consumers may not accept it or use it. Acceptance and use of

our products will depend upon a number of factors including: perceptions by members of the health care community, including physicians,

about the safety and effectiveness of our products; cost-effectiveness of our product relative to competing products; and effectiveness

of marketing and distribution efforts by us and our licensees and distributors, if any.

If we fail to establish marketing,

sales and distribution capabilities, or fail to enter into arrangements with third parties, we will not be able to create a market

for our product candidates.

Our sales strategy is to

control, directly or through contracted third parties, all or most aspects of the product development process, including

marketing, sales and distribution. In order to generate sales of our products, we must either acquire or develop an internal

marketing and sales force with technical expertise and with supporting distribution capabilities or make arrangements with

third parties to perform these services for us. The acquisition or development of a sales and distribution infrastructure

would require substantial resources, which may divert the attention of our management and key personnel and defer our product

development efforts. To the extent that we enter into marketing and sales arrangements with other companies, our revenues

will depend on the efforts of others. These efforts may not be successful. If we fail to develop adequate sales, marketing

and distribution channels, or enter into arrangements with third parties, we will experience delays in product sales and

incur increased costs.

The establishment of a marketing,

sales, and distribution capability would significantly increase our costs, possibly requiring substantial additional capital. In

addition, there is intense competition for proficient sales and marketing personnel, and we may not be able to attract individuals

who have the qualifications necessary to market, sell, and distribute our products.

We face the risk of product liability claims and may not be able

to obtain insurance.

Our business exposes us to the risk of product

liability claims that are inherent in the development of consumer products. If the use of one of our products harms people, we

may be subject to costly and damaging product liability claims brought against us by clinical trial participants, consumers, or

others selling our products. Our inability to obtain sufficient product liability insurance at an acceptable cost to protect against

potential product liability claims could prevent or inhibit the commercialization of products we develop, alone or with collaborators.

We currently do not carry clinical trial insurance or product liability insurance. We intend to obtain such insurance in the future.

We cannot predict all of the possible harms or side effects that may result and, therefore, the amount of insurance coverage we

hold now or in the future may not be adequate to cover all liabilities we might incur. If we are unable to obtain insurance at

an acceptable cost or otherwise protect against potential product liability claims, we will be exposed to significant liabilities,

which may materially and adversely affect our business and financial position. If we are sued for any injury allegedly caused by

our or our collaborators' products, our liability could exceed our total assets and our ability to pay the liability. A product

liability claim or series of claims brought against us would decrease our cash and could cause our stock price to fall.

Farming and Agriculture Represents a Significant

Aspect of our Operations Which Can Be Affected by Adverse Weather Conditions

The manufacture of our products relies on the

use of live plant material that requires our production facility to be located adjacent to the source of raw materials. Accordingly,

it is impractical in most instances to import raw materials for production in the event natural disasters or adverse weather affects

our crops. Hail, drought, flooding and fires are potential risks in our area, any or a combination of which could impact our ability

to harvest raw materials and produce our extracts. We do not carry insurance covering crop failure or business interruption due

to weather or disaster. As a result, if we are unable to harvest, it could have a material adverse effect on our ability to satisfy

customer demands and generate revenues.

Our Primary Operations are in South Africa

Which Does Not Presently Have Stable Utilities Infrastructure and Which Also Can Be Affected by Escalating Labor Rates and Other

Overhead

Our production facility is located in rural

South Africa. In recent years, South Africa in general has suffered from an unstable utilities infrastructure that, as a result,

can cause temporary power blackouts. Since our factory is connected to the municipal power grid, a loss of power for an extended

period of time can result in the loss of any product currently in production. Repetitive instances of power loss could materially

impact our ability to produce finished products and impact our ability to continue as a going concern. We are in the process of

installing backup generators to protect against power interruption, but these will not be operational until later in 2016. In addition,

the South African legislation has the authority to regulate the wages paid to laborers and, in the past, has increased the base

labor rates dramatically and without notice. While some of the farm labor we use is contracted through third parties, a sudden,

significant increase in labor rates could have a short-term effect on our cost to produce finished goods and impact our cash flows.

EMPLOYEES

The

Company, including subsidiaries, currently employs between 180-250 full time employees (depending on the season), of which

15 are engaged in management and operations, with the remainder in farming, maintenance and operating the factory. Management

expects to increase the number of employees engaged in production in the coming months and as the factory increases

production. We assess employee relations to be excellent.

ITEM 1 B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

The Company, through its subsidiary, Dunn Roman

Holdings, controls notarial leases in South Africa encompassing over 3,300 hectares (approx. 8,150 acres) of tea plantations, farms

and associated buildings. Of this amount, 285 hectares have been returned to full tea production with another 165 presently undergoing

rejuvenation so that total tea production will be approximately 450 hectares (1,100 acres) for the 2016/2017 production season.

The remaining property includes housing, roads, timber, water retention, etc.

The Company also leases office space in London,

England and White River, South Africa.

We believe that our existing facilities

are suitable and adequate to meet our current business requirements.

ITEM 3. LEGAL PROCEEDINGS

None.

ITEM 4. MINING SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS

AND ISSUER PURCHASES OF EQUITY SECURITIES

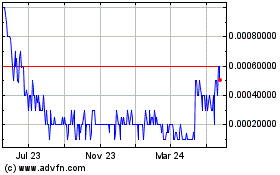

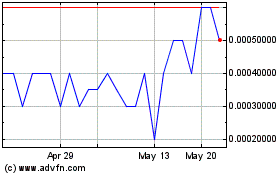

Shares of the Company's common stock are quoted

and traded from time to time on the OTC.BB with the trading symbol "PLPL." The following table sets forth the high and

low bid information for the Company’s common stock for each quarter within the two fiscal years. The prices reflect inter-dealer

prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

|

Quarter Ending

|

|

Quarterly High

|

|

Quarterly Low

|

|

9/30/2013

12/31/2013

3/31/2014

6/30/2014

|

|

$0.82

$0.60

$3.12

$1.08

|

|

$0.40

$0.12

$0.21

$0.28

|

|

9/30/2014

|

|

$0.60

|

|

$0.23

|

|

12/31/2014

|

|

$0.44

|

|

$0.26

|

|

3/31/2015

|

|

$0.32

|

|

$0.22

|

|

6/30/2015

|

|

$0.28

|

|

$0.21

|

Secondary trading of our shares may be subject to certain state

imposed restrictions.

The ability of individual shareholders to trade

their shares in a particular state may be subject to various rules and regulations of that state. A number of states require that

an issuer's securities be registered in their state or appropriately exempted from registration before the securities are permitted

to trade in that state.

From time-to-time we may grant options or warrants,

or promise registration rights to certain shareholders. We have no control over the number of shares of our common stock that our

shareholders sell. The price of our common stock may be adversely affected if large amounts are sold in a short period of time.

Our shares most likely will be subject to the

provisions of Section 15(g) and Rule 15g-9 of the Exchange Act, commonly referred to as the "penny stock" rule.

Section 15(g) sets forth certain requirements for transactions in

penny stocks and Rule 15g-9(d)(1) incorporates the definition of penny stock as that used in Rule 3a51-1 of the Exchange Act.

The SEC generally defines penny stock to be

any equity security that has a market price less than $5.00 per share, subject to certain exceptions. Rule 3a51-1 provides that

any equity security is considered to be a penny stock unless that security is: registered and traded on a national securities exchange

meeting specified criteria set by the SEC; authorized for quotation on the NASDAQ Stock Market; issued by a registered investment

company; excluded from the definition on the basis of price (at least $5.00 per share) or the issuer's net tangible assets; or

exempted from the definition by the SEC. Broker-dealers who sell penny stocks to persons other than established customers and accredited

investors (generally persons with assets in excess of $1,000,000 or annual income exceeding $200,000, or $300,000 together with

their spouse), are subject to additional sales practice requirements.

For transactions covered by these rules, broker-dealers

must make a special suitability determination for the purchase of such securities and must have received the purchaser's written

consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, unless exempt, the

rules require the delivery, prior to the first transaction, of a risk disclosure document relating to the penny stock market. A

broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, and current

quotations for the securities. Finally, monthly statements must be sent to clients disclosing recent price information for the

penny stocks held in the account and information on the limited market in penny stocks. Consequently, these rules may restrict

the ability of broker-dealers to trade and/or maintain a market in our common stock and may affect the ability of shareholders

to sell their shares.

As of June 30, 2015, there were approximately

212 holders of record of our common stock. This number does not include an indeterminate number of shareholders whose shares are

held by brokers in street name.

TRANSFER AGENT

We have appointed Signature Stock Transfer,

Inc., with offices at 2301 Ohio Drive, Suite 100, Plano, TX 75093, phone number 972-612-4120, as transfer agent for our shares

of common stock. The transfer agent is responsible for all record-keeping and administrative functions in connection with the common

shares and stock warrants.

DIVIDEND POLICY

We do not plan to pay dividends at this time

or anytime soon. The board of directors will decide on any future payment of dividends, depending on our results of operations,

financial condition, capital requirements, and any other relevant factors. However, we expect to use any future earnings for operations

and in the business.

RECENT SALES OF UNREGISTERED SECURITIES.

During the year ended June 30, 2014, the Company

issued 24,737,868 shares, net of cancellations, of unregistered, restricted common stock which were issued under an exemption from

registration provided by Rule 144 of the Securities Act of 1933, as follows:

|

|

·

|

On January 15, 2014, the Company issued 2,036,000 shares of unregistered

restricted common stock to satisfy a loan obligation of $500,000, which was owed to the Company’s Chief Executive Officer.

The recipient of those shares was an accredited investor, and the issuances of these shares was exempt from registration under

the Securities Act in reliance on an exemption provided by Section 4(2) of that Act.

|

|

|

·

|

The Company issued 540,000 of unregistered restricted common stock

to a third party as consideration for extending an equity line of credit. The recipient of the shares was an accredited investor,

and the issuance was exempt from registration under the Securities Act in reliance on an exemption provided by Section 4(2) of

that Act.

|

|

|

·

|

During the quarter ended March 31, 2014, the Company issued 1,100,000

shares of restricted common stock in exchange for 15% interest in Dunn Roman Holdings-Africa (Pty) Ltd. and 10% interest in Green

Gold Biotechnologies, (Pty) Ltd. Each of the recipients of those shares was an accredited investor, and each of the issuances of

these shares was exempt from registration under the Securities Act in reliance on an exemption provided by Section 4(2) of that

Act.

|

|

|

·

|

1,316,833 shares of restricted common stock were sold to unaffiliated

third parties in exchange for cash proceeds of $655,000. Each of the recipients of those shares was an accredited investor, and

each of the issuances of these shares was exempt from registration under the Securities Act in reliance on an exemption provided

by Section 4(2) of that Act.

|

|

|

·

|

2,000,000 shares of restricted common were issued to former officers

and directors of the Company’s subsidiary, Dunn Roman Holdings-Africa. These shares were issued as part of a settlement in

connection with: 1) terminating their employment and resigning from the subsidiary board of directors; and 2) extending the lease

and purchase option on the Company’s White River, South Africa, office space, which is owned by one of these officers, by

an additional five years. At the time of issuance, the shares had a value of $740,000 based on the closing bid price on the date

of issuance. Each of the issuances of these shares was exempt from registration under the Securities Act in reliance on an exemption

provided by Section 4(2) of that Act.

|

|

|

·

|

7,997,035 shares of unregistered common stock were issued to unaffiliated

third parties upon the conversion of $4,649,428 in notes payable, line of credit, convertible debentures and associated interest.

The recipients of the shares were accredited investors, and each of the issuances of these shares was exempt from registration

under the Securities Act in reliance on an exemption provided by Section 4(2) of that Act.

|

|

|

·

|

9,998,000 shares of restricted common stock were issued to officers

of the Company, employees, and third party service providers, for services previously rendered. At the time of issuance, these

shares had a value of $2,141,436 based on the closing bid price on the date of grant. Each of the issuances of these shares was

exempt from registration under the Securities Act in reliance on an exemption provided by Section 4(2) of that Act.

|

|

|

·

|

250,000 shares of common stock previously issued for services were

returned to treasury and cancelled.

|

During the year ended June 30, 2015, the Company

issued 33,411,308 shares of unregistered, restricted common stock, which were issued under an exemption from registration provided

by Rule 144 of the Securities Act of 1933, as follows:

|

|

·

|

In April 2014, the Company

agreed to issue an additional 70,000 shares to acquire the remaining 2% interest in Dunn Roman, bringing its total ownership in

that entity to 100%. The shares were issued in 2015, and were exempt from registration under the Securities Act in reliance on

an exemption provided by Section 4(2) of that Act.

|

|

|

·

|

The Company issued 1,298,400 restricted common shares for $286,700

cash. Each of the issuances of these shares was exempt from registration under the Securities Act in reliance on an exemption provided

by Section 4(2) of that Act.

|

|

|

·

|

The Company issued 26,769,400 restricted common shares for services

valued at $5,608,514. Each of the issuances of these shares was exempt from registration under the Securities Act in reliance on

an exemption provided by Section 4(2) of that Act.

|

|

|

·

|

The Company issued 144,296

restricted common shares for the conversion of convertible debt and interest in the amount of $46,992. Each of the issuances of

these shares was exempt from registration under the Securities Act in reliance on an exemption provided by Section 4(2) of that

Act.

|

|

|

·

|

The Company issued 1,629,212

common shares on the exercise of 1,666,666 warrants with a strike price of $0.01. The issuances of these shares was exempt from

registration under the Securities Act in reliance on an exemption provided by Section 4(2) of that Act. These warrants were exercised

in a “cashless” transaction, resulting in fewer shares being issued than warrants exercised. The warrants were originally

issued as part of 5,000,000 warrants issued to the various license owners of Diego Pellicer, which, in aggregate, were valued at

$5,749,985 at issuance and then subsequently deemed impaired in total.

|

|

|

·

|

The Company issued 3,500,000

common shares as settlement on the cancellation of a long-term consulting contract.

The

issuances of these shares was exempt from registration under the Securities Act in reliance on an exemption provided by Section

4(2) of that Act.

|

ITEM 6. SELECTED FINANCIAL DATA.

Not Applicable.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS.

ANALYSIS OF OPERATIONS

FOR THE YEARS ENDED JUNE 30, 2015

AND 2014

SALES

During the year ended June 30, 2015, the Company

recorded revenues of $92,878 compared to revenues of $265,735 for the year ended June 30, 2014. In the 2014 fiscal year, revenues

principally included the sale of a license agreement of $197,000, plus sales from the Company’s on-location employee grocery

store. In 2015, sales primarily consisted of sales from the shop store combined with sales of Phytofare® extract during the

fourth quarter. The macadamia and avocado farm was subleased to a third party during 2014 and the rental income derived from that

property is offset against rent expense. The Company anticipates that future revenues will consist principally of Phytofare

®

.

Revenues were lower than anticipated due to a severe hail storm in Q4 of 2015 which damaged most of the crop prior to harvest,

limiting the amount of Phytofare

®

that could be produced and sold in the first full quarter of operations.

OPERATING EXPENSES

Expenses were $8,942,465 and $5,009,813 for

the years ended June 30, 2015 and June 30, 2014, respectively. The increase is primarily attributable to the issuance of 20,000,000

shares of the Company’s stock to the CEO as a one-time bonus, which resulted in a non-cash compensation expense of $4.6 million.

Additional shares for services in 2015 totaled $1,008,500. Additionally, Professional Services increased from $153,556 in 2014

to $546,672 in 2015, attributable to increased legal costs. For the year ended June 30, 2015, Other General and Administrative

(G&A) expenses decreased from $1,087,390 to $314,691. In 2014, G&A included 500,000 shares (valued at $800,000 on date

of issuance), issued to two former employees who served as directors and officers of the South African subsidiaries. The shares

were issued as settlement on outstanding claims against the Company. Depreciation expense increased from $188,525 to $414,019 resulting

from the Company placing the factory in service on January 1, 2015, which triggered the recording of depreciation on that asset.

OTHER INCOME (EXPENSES)

Total Other Income and Expenses decreased from

an expense of $11,303,034 in the year ended June 30, 2014 to a net of $1,222,777 in the year ended June 30, 2015. In the June 30,

2014 fiscal year, the Company recorded $5,749,985 in impairment expense associated with writing down the license purchased from

Diego Pellicer, and $3,170,681 in change in value of the derivative liability with the issuance and subsequent conversion of convertible

debt instruments. Neither of these items recurred in 2015. Interest expense was $793,236 in 2014 compared to $928,751 in 2015.

The increase in interest related to an increase in long-term debt. The Company recorded $295,000 resulting from the fair value

of 3,500,000 shares paid to cancel a long-term consulting contract in the year ended June 30, 2015. Other Finance Costs decrease

from $1,069,412 in 2014 to $2,332 in 2015. Finance costs in 2014 consisted of 540,000 shares of common stock, valued at $1.98 per

share, issued to secure an equity line of credit.

LIQUIDITY AND CAPITAL RESOURCES

As of June 30, 2015, the Company had current

assets of $418,159 compared to current liabilities of $15,147,347. Current liabilities include $14,526,216 of Long Term Debt which

consists of $8,772,334 that becomes payable over the coming twelve months, and $5,753,879 in Long Term Debt that will not be due

in the coming 12 months but for which the Company is not in compliance on debt covenants. While the debt has not been called and

the lender has indicated that it does not intend to enforce the debt covenants, the Company has listed the long-term portion as

a current liability since the lender could exercise the default provisions of the loan.

Total assets as of June 30, 2015 were $8,504,581

compared to total liabilities of $16,821,317. Assets consist primarily of fixed assets, net of depreciation, of $8,009,956 while

liabilities consist primarily of notes payable of $14,526,213, net of discount of $375,687.

During the year ended June 30, 2015, the Company

used cash in operations of $2,703,939, compared to $2,829,873 in the prior year. Cash used in investing activities was $856,853

and $491,960 for the years ended June 30, 2015, and 2014, respectively, which consisted entirely of the purchase of fixed assets.

Cash from financing activities was $4,033,699 in the year ended June 30, 2015, which included proceeds of $286,700 from the sale

of common stock and $5,300,000 from the issuance of notes payable, which was offset by payments on long-term debt of $1,533,001.

In 2014, cash from financing activities was $2,445,987, which included proceeds of $655,000 from the sale of common stock, $2,348,192

from long term borrowing, $309,980 from the issuance of convertible debt, and $25,000 from a line of credit. This was offset by

$625,317 in payments on loans from related parties, $244,416 paid to retire convertible debt, and $22,452 paid on long-term debt.

PLAN OF OPERATION

In 2012, the Company executed a 49-year notarial

lease, giving it control over 3,237 hectares (approx. 8,000 acres) of plantation properties in South Africa. Over the preceding

three years, Plandaí has been active in rejuvenating the tea estate, which involved removing overgrowth, paring and fertilizing

the tea bushes, refurbishing housing for onsite management and farm workers, and repairing the roads and bridges. The Company also

constructed a 100,000ft

2

extraction facility on site, which was certified operational in December 2014 and began producing

extract for sale in April 2015. The Company uses this proprietary extraction facility to manufacture its Phytofare® bio-available

extracts, with an initial emphasis on green tea grown on the Senteeko estate. Commencing in fiscal 2016, the Company began finalizing

extraction techniques to support producing the citrus complex extract during the dormant tea-harvesting period.

During 2015, Plandaí undertook several

clinical investigations in preparation for releasing product to market. These studies were designed to establish both oral and

topical bioavailability and met with favorable results. These studies confirmed that our Phytofare

®

catechin complex

contains all 8 catechins compared to just 2 in generic tea extracts. It was also shown that Phytofare

®

has 10 times

greater bioavailability than generics and has 4 times greater residency in the blood plasma, 24 hours compared to 6. From an anti-aging

standpoint, studies showed that a topical application of Phytofare

®

produced substantial improvement in skin hydration,

roughness and scaliness.

In April 2015, we shipped the first green-tea

based Phytofare™ Catechin Complex to customers. Production was unfortunately halted in May 2015 after a severe hail storm

destroyed most of the harvestable tea and the remaining growing season was too short to allow for a final June harvest. Production

can commence 30 days after sufficient rainfall, which historically has meant that tea harvesting can resume in late September.

Sales for the coming year are expected to be focused in Europe, Asia and Africa and customers will primarily consist of contract

manufacturers, nutraceutical extract distributors, and finished product manufacturers.

The annual tea harvest generally encompasses

approximately 240 days, commencing with the rainy season in late September and continuing through early June, weather permitting.

Under normal harvest conditions, Plandaí has the capacity to process 10 tons of live tealeaf every day, yielding up to 36

tons of Phytofare® Catechin Complex each season. As discussed in Risk Factors, above, production is weather dependent and requires

a combination of adequate rainfall and sufficient sunlight to maximize production. During the eight months of tea production, the

Company expects to produce approximately 36 tons of finished product, which equates to potential sales of three tons per month

of Phytofare

®

. When combined with Pheroid®, a nano-encapsulation technology licensed from North West University,

Potchefstroom, South Africa, the yield doubles, creating the potential for 72 tons of salable product per year. Modifications are

under way to increase the processing capacity to handle up to 20 tons of green leaf per day, which would further double output.

Such modifications include adding additional equipment and preparing additional acreage for harvest. The Company anticipates that

such increases will be implemented incrementally over the coming year as demand for product increases.

Plandaí is currently preparing to produce

its Phytofare® Citrus Complex, which will be targeted to address soft tissue injuries, cold and flu symptom relief, and capillary

integrity. We anticipate validating the product in the second half of 2016 and then developing the final product for market release.

Plandaí has entered into several distribution

agreements covering nutraceutical sales in North America, India, Europe and parts of Africa, with additional markets opening in

the coming months. The Company also sells directly to certain customers that fall outside the areas covered by our distribution

agreements.

The Company's long-term existence is dependent

upon our ability to execute our operating plan and to obtain additional debt or equity financing to fund payment of obligations

and provide working capital for operations. In April 2012, the Company through majority-owned subsidiaries of Dunn Roman Holdings,

Inc., executed final loan documents on a 100 million Rand (approx. $13 million USD based on exchange rate at the time of the loan

and $6.5 million at current exchange rates) financing with the Land and Agriculture Bank of South Africa. During the current year,

the Company began repaying principal and interest at the rate of R2,300,000 per month (approximately $140,000) and has made a total

of 12 payments thus far. The Company is negotiating with the Land Bank to defer future payments an additional twelve months to

free-up cash flow for operations and expansion. As of June 30, 2015 and through the date of this report, the Company had not received

a notice of default from the Land Bank. However, inasmuch as the loans are in default, the Company has classified the entire balance

owed as a current liability for reporting purposes.

During the year ended June 30, 2015, the Company

borrowed $5,300,000 from an unaffiliated third party at 6% annual interest. Principal and interest became due February 1, 2016;

however, the Company restructured repayment terms of the notes to July 1, 2016.

ACQUISITIONS

The Company does not anticipate making any acquisitions in the coming

twelve months.

TRENDS

Green tea and green tea extracts have become

ever-present in consumer products throughout Europe, Asia and the Americas. Every major beverage manufacturer has a green tea-infused

product, but there are also countless other green tea-derived products that have flooded the market in recent years, including:

-

Ice cream

-

Soda

-

Shampoo & conditioner

-

Lotion and skin care products for anti-aging

-

Nail polish

-

Nutraceuticals

-

Weight loss supplements

-

Food additive

-

Soap

Worldwide, sales for antioxidants, primarily

green tea, was $34 billion in 2010. Sports supplements have also surged in recent years. In 2010, total worldwide sales were $4.7

billion, of which the US market comprised 66%, and growing at a rate of 15% per year. The Phytofare® Citrus Complex targets

multiple markets including sports medicine and nutrition, dietary supplements, and cold symptom relief. The nutriceutical market

is even larger, with $176 billion being spent on food, beverages and supplements fortified with bioactive ingredients including

proteins, vitamins and minerals. Of this amount, $48.8 billion is spent on dietary supplements alone. The United States comprises

32.8% of the worldwide market for nutriceuticals.

Initially, Plandaí will focus on developing markets within

the following target industries:

|

|

·

|

Fortification of food and beverages

|

|

|

·

|

Wellness

|

|

|

·

|

Dietary supplements

|

|

|

·

|

Nutri-cosmetics

|

|

|

·

|

Cosmeceutics

|

|

|

·

|

Botanical drugs

|

|

|

·

|

Athletic supplements

|

As food and beverage additives, Phytofare

®

extracts can be added to virtually any consumable product or converted into tablet/capsule form to provide the health benefits

in a highly bioavailable form. This creates a nearly limitless opportunity for food and beverage companies to incorporate Phytofare

®

-infused

products into their product line. Likewise, supplement manufactures, who have long-touted antioxidant infused-products can now

begin incorporating an extract that actually delivers on their claims.

In August 2013, Plandaí entered into

an exclusive world license agreement with North-West University that provides for the manufacture, formulation and use of Phytofare

®

extracts entrapped in Pheroid

®

for animal and human use. The Pheroid

®

entrapment system provides

a stable delivery tool for getting Phytofare

®

to the target tissues through topical creams, capsules, or an oral

liquid. The Pheroid

®

technology entraps nano particles and protects them until absorbed by cells. The process of

glycolysis then breaks down the protective coating, releasing the phytonutrients into the tissues. This technology opens up several

additional products lines for Plandaí in the areas of skin care, hair care and beverages. The first Phytofare/Pheroid product,

brand named Ph

2

Catechins™, was introduced in early calendar 2016 and is expected to be available in stores under

various brand names by the end of 2016.

CRITICAL ACCOUNTING POLICIES

The preparation of our financial statements

in conformity with accounting principles generally accepted in the United States requires us to make estimates and judgments that

affect our reported assets, liabilities, revenues, and expenses, and the disclosure of contingent assets and liabilities. We

base our estimates and judgments on historical experience and on various other assumptions we believe to be reasonable under the

circumstances. Future events, however, may differ markedly from our current expectations and assumptions. While there

are a number of significant accounting policies affecting our financial statements, we believe the following critical accounting

policies involve the most complex, difficult and subjective estimates and judgments.

Revenue recognition

The Company presently derives its revenue from

the sale of botanical extracts and recognizes revenues when the product is shipped. As the Company’s product is a food additive,

it cannot be returned and resold, thus the Company’s policy is that returns are allowed only if the product is deemed defective

or non-conforming. As each batch of Phytofare

®

is tested by an independent laboratory to ensure purity and then