UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C

Information

Statement Pursuant to Section 14(c)

of

the Securities Exchange Act of 1934

Check

the appropriate box:

| ☒ |

Preliminary Information Statement |

| ☐ |

Confidential, for Use of

the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| ☐ |

Definitive Information Statement |

VoIP-PAL.COM

INC.

(Name

of Registrant as Specified in its Charter)

Payment

of Filing Fee (Check all boxes that apply):

☒

No fee required

☐

Fee paid previously with preliminary materials

☐

Fee computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange

Act Rules 14c-5(g) and 0-11

(1)

Title of each class of securities to which transaction applies:

(2)

Aggregate number of securities to which transaction applies:

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

(4)

Proposed maximum aggregate value of transaction:

(5)

Total fee paid:

VoIP-PAL.COM

INC.

7215

Bosque Boulevard, Suite 102

Waco,

TX 76710-4020

February

6, 2025

Dear

Stockholder:

We

are furnishing the enclosed information statement to you in connection with a proposal to increase our authorized capital from (a) 8,000,000,000

shares of common stock, par value $0.001, to 9,000,000,000 shares of common stock, par value $0.001 (the “Common Stock Increase”),

and (b) 1,000,000 shares of preferred stock, par value $0.01, to 2,000,000 shares of preferred stock, par value $0.01 (the “Preferred

Stock Increase” and, together with the Common Stock Increase, the “Authorized Capital Increases”).

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Our

board of directors reviewed and approved the Common Stock Increase and the Preferred Stock Increase by consent resolutions dated January

30, 2025 and October 8, 2024, respectively. The holders of a majority of our issued and outstanding stock approved the Authorized Capital

Increases by written consent dated effective January 30, 2025. However, pursuant to applicable securities laws the Authorized Capital

Increases will not be effected until at least 20 days after a definitive information statement has been sent to our stockholders who

did not previously consent to the Authorized Capital Increases.

| By

Order of the Board of Directors: |

|

| |

|

| /s/

Emil Malak |

|

| |

|

| Emil

Malak |

|

| Chief

Executive Officer |

|

INFORMATION

STATEMENT

Introduction

The

holders of a majority of the issued and outstanding stock of VoIP-Pal.Com Inc. (“we”, “our”, “us”)

have taken an action by written consent without a meeting, pursuant to Section 78.207 of the Nevada Revised Statutes (the “NRS”),

to approve an increase in our authorized capital from (a) 8,000,000,000 shares of common stock, par value $0.001, to 9,000,000,000 shares

of common stock, par value $0.001 (the “Common Stock Increase”), and (b) 1,000,000 shares of preferred stock, par value $0.01,

to 2,000,000 shares of preferred stock, par value $0.01 (the “Preferred Stock Increase” and, together with the Common Stock

Increase, the “Authorized Capital Increases”). The purpose of the Common Stock Increase is to provide us flexibility to issue

additional shares of our common stock (the “Common Stock”), which management believes will better position us to attract

financing, and the purpose of the Preferred Stock Increase is to provide us with the flexibility to issue additional shares of our preferred

stock, once designated, in order to support certain of our contractual obligations.

In

particular, we are a party to a share transfer agreement between with Digifonica Intellectual Properties (DIP) Limited (“DIP”)

and Digifonica (International) Limited dated June 25, 2013, as amended on July 18, 2013, October 6, 2013, October 31, 2013, November

25, 2013, March 17, 2014, April 21, 2021 and April 23, 2023, which obligates us to, among other things, issue to DIP that number of shares

of Series A preferred stock (“Series A Stock”) that allows DIP to retain voting rights equivalent to 40% of our outstanding

share capital. Promptly following the completion of the Preferred Stock Increase, we anticipate designating 500,000 of the additional

shares of preferred stock as Series A Stock.

This

information statement is being filed pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and provided to our stockholders pursuant to Rule 14c-2 under the Exchange Act.

WE

ARE NOT ASKING FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

We

were incorporated under the laws of the State of Nevada and our Common Stock is registered under Section 12(g) of the Exchange Act. Our

Common Stock is currently quoted on the OTCQB tier of the OTC Markets under the trading symbol VPLM. We are a fully-reporting Exchange

Act company.

Information

about us can be found our most recent annual report on Form 10-K for the fiscal year ended September 30, 2024, filed with the Securities

and Exchange Commission (the “SEC”). Additional information about us can be found in our public filings that can be accessed

electronically by means of the SEC’s home page on the Internet at http://www.sec.gov as well as by other means from the offices

of the SEC.

We

will incur all costs associated with preparing, printing and mailing this information statement.

Item

1. Information Required by Items of Schedule 14A

Date,

Time and Place Information

There

will not be a meeting of our stockholders to approve the Authorized Capital Increases and we are not required to hold a meeting under

the NRS when a corporate action has been approved by the written consent of holders of a majority of our stock entitled to vote on the

matter. This information statement is being mailed on or about February 17, 2025 to the holders of our stock as of January 30, 2025.

Dissenters’

Right of Appraisal

Under

the NRS, our stockholders do not have dissenters’ rights in connection with the Authorized Capital Increases.

Voting

Securities and Principal Holders Thereof

The

record date for the determination of stockholders entitled to consent to the each of the Common Stock Increase and the Preferred Stock

Increase was January 30, 2025 (the “Record Date”). As of the Record Date we had 3,639,945,275 issued and outstanding shares

of Common Stock plus 926,438 issued and outstanding shares of Series A Stock.

Each

share of our Common Stock entitles the holder thereof to one vote per share on any matter that may come before a meeting or vote of our

stockholders, while each share of our Series A Stock entitles the holder thereof to 1,550 votes per share on any such matter.

The

Authorized Capital Increases were approved by the holders of a majority of our stock entitled to vote on the Record Date. In each case,

the vote required to approve the applicable corporate action was 50% of the shares entitled to vote plus one vote, a simple majority.

The actual affirmative vote was 51.23% of the shares.

Under

applicable securities laws, we are not permitted to effect the Authorized Capital Increases until at least 20 days after we distribute

a definitive information statement to our stockholders who have not previously consented to the corporate actions.

Security

Ownership of Certain Beneficial Owners and Management

The

following table sets forth the ownership, as of the Record Date, of our Common Stock by each of our directors, by all of our executive

officers and directors as a group and by each person known to us who is the beneficial owner of more than 5% of any class of our securities.

As of the Record Date there were 3,639,945,275 issued and outstanding shares of our Common Stock and 1,000,000 issued and outstanding

shares of our Series A Stock. All persons named have sole or shared voting and investment power with respect to the securities, except

as otherwise noted. The number of securities described below includes shares which the beneficial owner described has the right to acquire

within 60 days of the date of this information statement.

For

purposes of computing the percentage of outstanding shares of our Common Stock held by each person or group of persons, any shares that

such person or persons has the right to acquire within 60 days of the date of this information statement is deemed to be outstanding,

but is not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. The inclusion herein of

any shares listed as beneficially owned does not constitute an admission of beneficial ownership.

| Class | |

Beneficial

Owner Information | |

Number

of Shares | | |

Percentage

of Class (%) | |

| Common

Stock | |

Emil

Malak (1) | |

| 2,419,109,945 | (2) | |

| 40.43 | |

Common

Stock | |

Gavin

McMillan (3) | |

| 49,266,667 | | |

| 1.34 | |

| Common

Stock | |

Jin

Kuang (5) | |

| 30,888,235 | (6) | |

| 0.84 | |

| Common

Stock | |

Kevin

Williams (7) | |

| 110,024,290 | (8) | |

| 2.94 | |

| Common

Stock | |

Dennis

Chang (9) | |

| 102,975,248 | (10) | |

| 2.75 | |

| Common

Stock | |

Clifton

Saylor (11) | |

| 215,372,927 | (12) | |

| 5.76 | |

| Common

Stock | |

Austin

McDonald (13) | |

| 67,561,717 | (14) | |

| 1.38 | |

| | |

Officers

and Directors as a Group | |

| 2,744,666,455 | | |

| 55.44 | |

| Series

A Preferred Stock (15) | |

Emil

Malak (1) | |

| 926,438 | (16) | |

| 100 | |

| | |

Officers

and Directors as a Group | |

| 926,438 | | |

| 100 | |

| (1) | Emil

Malak is our Chief Executive Officer and director. |

| (2) | Includes

76,215,946 shares held by Barbara Baggio, the spouse of Mr. Malak, plus

warrants to purchase 2,297,893,999 shares and options to purchase 45,000,000 shares

each held by Mr. Malak directly. |

| | (3) | Gavin

McMillan is our President. |

| | (4) | Includes

1,600,000 shares, plus warrants to purchase 40,000,000 shares and options to purchase 7,666,667

shares. |

| (5) | Jin

Kuang is our Chief Financial Officer. |

| (6) | Includes

888,235 shares, plus warrants to purchase 25,000,000 shares and options to purchase

5,000,000 shares. |

| (7) | Kevin

Williams is our director. |

| (8) | Includes

6,171,885 shares, plus warrants to purchase 93,852,405 shares and options to purchase

10,000,000 shares. |

| (9) | Dennis

Chang is our director. |

| (10) | Includes

1,647,595 shares, plus warrants to purchase 91,327,653 shares and options to purchase

10,000,000 shares. |

| (11) | Clifton

Saylor is our director. |

| (12) | Includes

87,333,334 shares held by the Saylor Marketing, Inc., Profit Sharing Plan, of which Mr. Saylor

is the trustee, 8,629,846 shares held by Mr. Saylor jointly with his spouse, and 19,409,747

shares held by Mr. Saylor directly, plus warrants to purchase 80,000,000 shares and options

to purchase 20,000,000 shares each held by Mr. Saylor directly. |

| (13) | Austin

McDonald is our director. |

| (14) | Includes

6,561,717 shares, plus warrants to purchase 61,000,000 shares. |

| (15) | Each

share of our Series A preferred stock entitles the holder to 1,550 votes per share on any

matter that may come before a meeting or vote of our stockholders. |

| (16) | Represents

votes equivalent to 1,435,978,900 shares of our common stock. |

Amendment

of Charter, Bylaws or Other Documents

We

are undertaking the Authorized Capital Increases in order to provide flexibility to issue additional shares of our Common Stock and preferred

stock as described above.

The

Authorized Capital Increases will be effective upon filing a Certificate of Amendment with the Nevada Secretary of State pursuant to

Section 78.209 of the NRS.

Item

2. Statement that Proxys are not Solicited

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Item

3. Interest of Certain Persons in or in Opposition to Matters to be Acted Upon

No

director, officer, associate of any director or officer, or any other person, has any substantial interest, direct or indirect, by security

holdings or otherwise, in the Authorized Capital Increases that is not shared by all of our stockholders pro rata and in accordance

with their respective interests.

Item

4. Proposals by Security Holders

None.

Item

5. Delivery of Documents to Security Holders Sharing an Address

We

will deliver only one copy of this information statement to multiple stockholders sharing an address unless we have received contrary

instructions from one or more of such stockholders.

We

undertake to deliver promptly upon written or oral request a separate copy of this information statement to any stockholder at a shared

address to which a single copy of the document was delivered. A stockholder can notify us that he or she wishes to receive a separate

copy of this information statement or any future Information Statement by writing to us at 7215 Bosque Boulevard, Suite 102, Waco, TX

76710-4020, or by telephoning us at 1-954-495-4600.

Stockholders

sharing the same address can also request delivery of a single copy of annual reports to security holders, information statements or

Notices of Internet Availability of Proxy Materials if they are receiving multiple of such documents in the same manner.

| By

Order of the Board of Directors: |

|

| |

|

| Date:

February 6, 2025 |

|

| |

|

| /s/

Emil Malak |

|

| |

|

| Emil

Malak |

|

| Chief

Executive Officer |

|

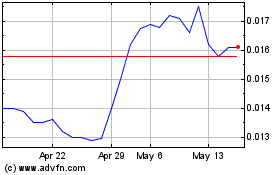

Voip Pal Com (QB) (USOTC:VPLM)

Historical Stock Chart

From Jan 2025 to Feb 2025

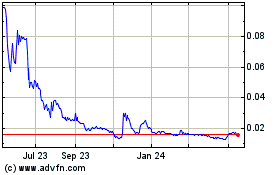

Voip Pal Com (QB) (USOTC:VPLM)

Historical Stock Chart

From Feb 2024 to Feb 2025