false

2024-09-10

0001424404

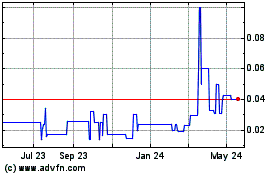

Wolverine Resources Corp.

0001424404

2024-09-10

2024-09-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 10, 2024

WOLVERINE RESOURCES CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

000-53767

|

98-0569013

|

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

#55, 11020 Williams Road

Richmond, British Columbia, Canada

V7A 1X8

(Address of principal executive offices) (ZIP Code)

Registrant’s telephone number, including area code: (778) 297-4409

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b -2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.02 Unregistered Sales of Equity Securities

On September 10, 2024, we issued 15,260,000 shares of our common stock in a private placement at a purchase price of CDN $0.025 (USD $0.01825) raising gross proceeds of CDN $281,500 (USD $278,495). We have issued all of the shares to twenty-four (24) non-US persons (as that term is defined in Regulation S of the Securities Act of 1933) in an offshore transaction relying on Regulation S and/or Section 4(2) of the Securities Act of 1933.

On September 10, 2024, we issued 500,000 shares of our common stock in a private placement at a purchase price of USD $0.02 raising gross proceeds of USD $10,000. We have issued all of securities to one (1) U.S. persons (as that term is defined in Regulation S of the Securities Act of 1933) relying upon Rule 506 of Regulation D of the Securities Act of 1933.

On September 10, 2024, we issued 100,000 shares of our common stock in a private placement at a purchase price of USD $0.025 raising gross proceeds of USD $2,500. We have issued all of securities to one (1) U.S. persons (as that term is defined in Regulation S of the Securities Act of 1933) relying upon Rule 506 of Regulation D of the Securities Act of 1933.

On September 10, 2024, we issued 8,090,000 shares of our common stock pursuant to debt settlement agreements with twenty-two (22) individuals. The deemed price of the shares issued was CDN $0.025 (USD $0.01825) per share. We have issued all of the shares to twenty-two (22) non-US persons (as that term is defined in Regulation S of the Securities Act of 1933) in an offshore transaction relying on Regulation S and/or Section 4(2) of the Securities Act of 1933.

On September 26, 2024, we issued 200,000 shares of our common stock pursuant to a debt settlement agreement with one (1) individuals. The deemed price of the shares issued was CDN $0.025 (USD $0.01825) per share. We have issued all of the shares to one (1) non-US person (as that term is defined in Regulation S of the Securities Act of 1933) in an offshore transaction relying on Regulation S and/or Section 4(2) of the Securities Act of 1933.

On September 10, 2024, we issued 100,000 shares of our common stock pursuant to debt settlement agreements with two (2) individuals. The deemed price of the shares issued was USD $0.0.1825 per share. We have issued all of securities to two (2) U.S. persons (as that term is defined in Regulation S of the Securities Act of 1933) relying upon Rule 506 of Regulation D of the Securities Act of 1933.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

WOLVERINE RESOURCES CORP.

| /s/Richard Haderer |

| Richard Haderer |

| CFO and Director |

| Date October 24, 2023 |

THIS PRIVATE PLACEMENT SUBSCRIPTION AGREEMENT (THE "SUBSCRIPTION AGREEMENT") RELATES TO AN OFFERING OF SECURITIES IN AN OFFSHORE TRANSACTION TO PERSONS WHO ARE NOT U.S. PERSONS (AS DEFINED HEREIN) PURSUANT TO REGULATION S UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE "1933 ACT").

NONE OF THE SECURITIES TO WHICH THIS SUBSCRIPTION AGREEMENT RELATES HAVE BEEN REGISTERED UNDER THE 1933 ACT, OR ANY U.S. STATE SECURITIES LAWS, AND, UNLESS SO REGISTERED, NONE MAY BE OFFERED OR SOLD, DIRECTLY OR INDIRECTLY, IN THE UNITED STATES OR TO U.S. PERSONS (AS DEFINED HEREIN) EXCEPT IN ACCORDANCE WITH THE PROVISIONS OF REGULATION S UNDER THE 1933 ACT, PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE 1933 ACT, OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE 1933 ACT AND IN EACH CASE ONLY IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS.

PRIVATE PLACEMENT SUBSCRIPTION

FOR NON U.S. SUBSCRIBERS

PRIVATE PLACEMENT

INSTRUCTIONS TO SUBSCRIBER:

1. COMPLETE page 2 and Schedule A of this Subscription Agreement.

2. PAYMENT for the subscription can be made by E-TRANSFER to etransfer@wolverineresourcescorp.com or WIRE TRANSFER to the BMO account below.

| BENEFICIARY |

WOLVERINE RESOURCES CORP.

#55-11020 WILLIAMS ROAD

RICHMOND, BC V7A 1X8 |

| BENEFICIARY BANK |

BMO

595 BURRARD STREET

VANCOUVER, BC V7X 1L7 |

| INSTITUTION NUMBER |

001 |

| TRANSIT NUMBER |

00040 |

| ACCOUNT NUMBER |

1656-049 |

| SWIFT CODE |

BOFMCAM2 |

3. EMAIL OR FAX a copy of page 2 of this Subscription Agreement, and all pages of Schedule A to PubCo Services Inc. at pubco@telus.net or (587) 816-6307.

WOLVERINE RESOURCES CORP.

PRIVATE PLACEMENT

The Subscriber hereby irrevocably subscribes for, and on Closing will purchase from the Company, the following securities at a price of CDN$0.025 per Share

|

_____________________ Shares

|

|

|

The Subscriber directs the Company to issue, register and deliver the certificates representing the Shares as follows:

| REGISTRATION INSTRUCTIONS: |

|

DELIVERY INSTRUCTIONS: |

| |

|

|

| |

|

|

| Name to appear on certificate |

|

Name and account reference, if applicable |

| |

|

|

| |

|

|

| SIN/Tax ID No. |

|

Contact name |

| |

|

|

| |

|

|

| Address |

|

Address |

| |

|

|

| |

|

|

| |

|

Telephone number |

| |

|

|

| |

| EXECUTED by the Subscriber this _______ day of_______________________, 2024. By executing this Agreement, the Subscriber certifies that the Subscriber and any beneficial purchaser for whom the Subscriber is acting is resident in the jurisdiction shown as the "Address of the Subscriber". The address of the Subscriber will be accepted by the Company as a representative as to the address of residency for the Subscriber. |

| |

|

|

| WITNESS: |

|

EXECUTION BY SUBSCRIBER: |

| |

|

X |

| Signature of witness |

|

Signature of individual (if Subscriber is an individual) |

| |

|

|

| |

|

X |

| Name of witness |

|

Authorized signatory (if Subscriber is not an individual) |

| |

|

|

| |

|

|

| Address of witness |

|

Name of Subscriber (please print) |

| |

|

|

| |

|

|

| |

|

Name of authorized signatory (please print) |

| ACCEPTED this _______ day of _____________________, 2024. |

|

|

| |

|

|

| WOLVERINE RESOURCES CORP. |

|

Address of Subscriber (residence) |

| Per: |

|

|

| |

|

|

| Authorized signatory |

|

Telephone number and e-mail address |

By signing this acceptance, the Company agrees to be bound by all representations, warranties, covenants and agreements on pages 3-11 hereof.

This Subscription Agreement may be executed in any number of counterparts, each of which, when so executed and delivered, shall constitute an original and all of which together shall constitute one instrument. Delivery of an executed copy of this Subscription Agreement by electronic facsimile transmission or other means of electronic communication capable of producing a printed copy will be deemed to be execution and delivery of this Subscription Agreement as of the date hereinafter set forth.

THIS PRIVATE PLACEMENT SUBSCRIPTION AGREEMENT (THE "SUBSCRIPTION AGREEMENT") RELATES TO AN OFFERING OF SECURITIES IN AN OFFSHORE TRANSACTION TO PERSONS WHO ARE NOT U.S. PERSONS (AS DEFINED HEREIN) PURSUANT TO REGULATION S UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE "1933 ACT").

NONE OF THE SECURITIES TO WHICH THIS SUBSCRIPTION AGREEMENT RELATES HAVE BEEN REGISTERED UNDER THE 1933 ACT, OR ANY U.S. STATE SECURITIES LAWS, AND, UNLESS SO REGISTERED, NONE MAY BE OFFERED OR SOLD, DIRECTLY OR INDIRECTLY, IN THE UNITED STATES OR TO U.S. PERSONS (AS DEFINED HEREIN) EXCEPT IN ACCORDANCE WITH THE PROVISIONS OF REGULATION S UNDER THE 1933 ACT, PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE 1933 ACT, OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE 1933 ACT AND IN EACH CASE ONLY IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS.

PRIVATE PLACEMENT SUBSCRIPTION

(Non U.S. Subscribers Only)

TO: Wolverine Resources Corp. (the "Company")

#55-11020 Williams Road, Richmond,

British Columbia, Canada V7A 1X8

Purchase of Shares

1. SUBSCRIPTION

1.1 The undersigned (the "Subscriber") hereby irrevocably subscribes for and agrees to purchase the number of shares of the Company's common stock (the "Shares") as set out on page 2 of this Subscription Agreement at a price of CDN$0.025 per Share (such subscription and agreement to purchase being the "Subscription"), for the total subscription price as set out on page 2 of this Subscription Agreement (the "Subscription Proceeds"), which Subscription Proceeds are tendered herewith, on the basis of the representations and warranties and subject to the terms and conditions set forth herein. The Shares are referred to as the "Securities".

1.2 The Company hereby agrees to sell, on the basis of the representations and warranties and subject to the terms and conditions set forth herein, to the Subscriber the Shares. Subject to the terms hereof, the Subscription Agreement will be effective upon its acceptance by the Company.

1.3 Unless otherwise provided, all dollar amounts referred to in this Subscription Agreement are in lawful money of the United States of America.

2. PAYMENT

2.1 The Subscription Proceeds must accompany this Subscription Agreement. The Subscriber authorizes the Company's lawyers to deliver the Subscription Proceeds to the Company if the Subscription Proceeds are delivered to the Company's lawyers, without further instructions required.

2.2 The Subscriber acknowledges and agrees that this Subscription Agreement and any other documents delivered in connection herewith will be held by the Company's lawyers on behalf of the Company. In the event that this Subscription Agreement is not accepted by the Company for whatever reason within 90 days of the delivery of an executed Subscription Agreement by the Subscriber, or the minimum offering amount is not achieved by that time, this Subscription Agreement, the Subscription Proceeds and any other documents delivered in connection herewith will be returned to the Subscriber at the address of the Subscriber as set forth in this Subscription Agreement without interest or deduction.

2.3 Where the Subscription Proceeds are paid to the Company, the Company may treat the Subscription Proceeds as a non-interest bearing loan and may use the Subscription Proceeds prior to this Subscription Agreement being accepted by the Company.

2.4 If resident in Canada, the Subscriber must complete, sign and return to the Company an executed copy of this Subscription Agreement, the Questionnaire attached hereto as Schedule A (the "Questionnaire") and any other schedules attached hereto.

2.5 The Subscriber shall complete, sign and return to the Company as soon as possible, on request by the Company, any documents, questionnaires, notices and undertakings as may be required by regulatory authorities, stock exchanges and applicable law.

3. CLOSING

3.1 Closing of the purchase and sale of the Shares shall occur on or before ____________________, 2024 or on such other date as may be determined by the Company in its sole discretion (the "Closing Date"). The Subscriber acknowledges that Shares may be issued to other subscribers under this offering (the "Offering") before or after the Closing Date. The Company, may, at its discretion, elect to close the Offering in one or more closings, in which event the Company may agree with one or more subscribers (including the Subscriber hereunder) to complete delivery of the Shares to such subscriber(s) against payment therefore at any time on or prior to the Closing Date.

4. ACKNOWLEDGEMENTS OF SUBSCRIBER

4.1 The Subscriber acknowledges and agrees that:

(a) none of the Securities have been registered under the Securities Act of 1933, as amended (the "1933 Act"), or under any state securities or "blue sky" laws of any state of the United States, and are being offered only in a transaction not involving any public offering within the meaning of the 1933 Act, and, unless so registered, may not be offered or sold in the United States or to U.S. Persons (as defined herein), except pursuant to an effective registration statement under the 1933 Act, or pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the 1933 Act, and in each case only in accordance with applicable state and provincial securities laws;

(b) the Company will refuse to register any transfer of any of the Securities not made in accordance with the provisions of Regulation S, pursuant to an effective registration statement under the 1933 Act or pursuant to an available exemption from, or in a transaction not subject to, the registration requirements of the 1933 Act;

(c) by completing the Questionnaire, the Subscriber is representing and warranting that the Subscriber satisfies one of the categories of registration and prospectus exemptions provided for in National Instrument 45-106 ("NI 45-106") adopted by the Canadian Securities Administrators (the "CSA");

(d) the decision to execute this Subscription Agreement and purchase the Shares agreed to be purchased hereunder has not been based upon any oral or written representation as to fact or otherwise made by or on behalf of the Company and such decision is based solely upon a review of publicly available information regarding the Company available on the website of the United States Securities and Exchange Commission (the "SEC") available at www.sec.gov (the "Company Information");

(e) the Subscriber and the Subscriber's advisor(s) have had a reasonable opportunity to review the Company Information and to ask questions of and receive answers from the Company regarding the Offering, and to obtain additional information, to the extent possessed or obtainable without unreasonable effort or expense, necessary to verify the accuracy of the information contained in the Company Information, or any other document provided to the Subscriber;

(f) the books and records of the Company were available upon reasonable notice for inspection, subject to certain confidentiality restrictions, by the Subscriber during reasonable business hours at its principal place of business and that all documents, records and books pertaining to this Offering have been made available for inspection by the Subscriber, the Subscriber's attorney and/or advisor(s);

(g) by execution hereof the Subscriber has waived the need for the Company to communicate its acceptance of the purchase of the Shares pursuant to this Subscription Agreement;

(h) the Company is entitled to rely on the representations and warranties and the statements and answers of the Subscriber contained in this Subscription Agreement and the Questionnaire and the Subscriber will hold harmless the Company from any loss or damage it may suffer as a result of the Subscriber's failure to correctly complete this Subscription Agreement and the Questionnaire;

(i) the Subscriber will indemnify and hold harmless the Company and, where applicable, its respective directors, officers, employees, agents, advisors and shareholders from and against any and all loss, liability, claim, damage and expense whatsoever (including, but not limited to, any and all fees, costs and expenses whatsoever reasonably incurred in investigating, preparing or defending against any claim, lawsuit, administrative proceeding or investigation whether commenced or threatened) arising out of or based upon any acknowledgment, representation or warranty of the Subscriber contained herein, the Questionnaire or in any other document furnished by the Subscriber to the Company in connection herewith, being untrue in any material respect or any breach or failure by the Subscriber to comply with any covenant or agreement made by the Subscriber to the Company in connection therewith;

(j) the issuance and sale of the Shares to the Subscriber will not be completed if it would be unlawful or if, in the discretion of the Company acting reasonably, it is not in the best interests of the Company;

(k) the Subscriber has been advised to consult the Subscriber's own legal, tax and other advisors with respect to the merits and risks of an investment in the Securities and with respect to the applicable resale restrictions, and it is solely responsible (and the Company is not in any way responsible) for compliance with:

(i) any applicable laws of the jurisdiction in which the Subscriber is resident in connection with the distribution of the Securities hereunder, and

(ii) applicable resale restrictions;

(l) the Subscriber has not acquired the Shares as a result of, and will not itself engage in, any "directed selling efforts" (as defined in Regulation S under the 1933 Act) in the United States in respect of any of the Securities which would include any activities undertaken for the purpose of, or that could reasonably be expected to have the effect of, conditioning the market in the United States for the resale of any of the Securities; provided, however, that the Subscriber may sell or otherwise dispose of any of the Shares pursuant to registration of any of the Shares pursuant to the 1933 Act and any applicable state securities laws or under an exemption from such registration requirements and as otherwise provided herein;

(m) the Subscriber is outside the United States when receiving and executing this Subscription Agreement and is acquiring the Shares as principal for its own account, for investment purposes only, and not with a view to, or for, resale, distribution or fractionalization thereof, in whole or in part, and no other person has a direct or indirect beneficial interest in such Shares;

(n) the statutory and regulatory basis for the exemption claimed for the offer and sale of the Shares, although in technical compliance with Regulation S, would not be available if the offering is part of a plan or scheme to evade the registration provisions of the 1933 Act;

(o) the Company has advised the Subscriber that, if the Subscriber is a Canadian resident, the Company is relying on an exemption from the requirements to provide the Subscriber with a prospectus and to sell the Shares through a person registered to sell securities and, as a consequence of acquiring the Shares pursuant to this exemption, certain protections, rights and remedies provided, including statutory rights of rescission or damages, will not be available to the Subscriber;

(p) neither the SEC nor any other securities commission or similar regulatory authority has reviewed or passed on the merits of any of the Securities;

(q) no documents in connection with this Offering have been reviewed by the SEC or any state securities administrators;

(r) there is no government or other insurance covering any of the Securities; and

(s) this Subscription Agreement is not enforceable by the Subscriber unless it has been accepted by the Company, and the Subscriber acknowledges and agrees that the Company reserves the right to reject any subscription for any reason.

5. REPRESENTATIONS, WARRANTIES AND COVENANTS OF THE SUBSCRIBER

5.1 The Subscriber hereby represents and warrants to and covenants with the Company (which representations, warranties and covenants shall survive the Closing Date) that:

(a) the Subscriber is not a U.S. Person (as defined herein);

(b) the Subscriber is not acquiring the Shares for the account or benefit of, directly or indirectly, any U.S. Person (as defined herein);

(c) the Subscriber is resident in the jurisdiction set out on page 2 of this Subscription Agreement;

(d) the Subscriber:

(i) is knowledgeable of, or has been independently advised as to, the applicable securities laws of the securities regulators having application in the jurisdiction in which the Subscriber is resident (the "International Jurisdiction") which would apply to the acquisition of the Shares,

(ii) is purchasing the Shares pursuant to exemptions from prospectus or equivalent requirements under applicable securities laws or, if such is not applicable, the Subscriber is permitted to purchase the Shares under the applicable securities laws of the securities regulators in the International Jurisdiction without the need to rely on any exemptions,

(iii) acknowledges that the applicable securities laws of the authorities in the International Jurisdiction do not require the Company to make any filings or seek any approvals of any kind whatsoever from any securities regulator of any kind whatsoever in the International Jurisdiction in connection with the issue and sale or resale of any of the Securities, and

(iv) represents and warrants that the acquisition of the Shares by the Subscriber does not trigger:

A. any obligation to prepare and file a prospectus or similar document, or any other report with respect to such purchase in the International Jurisdiction, or

B. any continuous disclosure reporting obligation of the Company in the International Jurisdiction, and

the Subscriber will, if requested by the Company, deliver to the Company a certificate or opinion of local counsel from the International Jurisdiction which will confirm the matters referred to in subparagraphs (ii), (iii) and (iv) above to the satisfaction of the Company, acting reasonably;

(e) the Subscriber is acquiring the Shares as principal for investment only and not with a view to, or for, resale, distribution or fractionalization thereof, in whole or in part, and, in particular, it has no intention to distribute either directly or indirectly any of the Securities in the United States or to U.S. Persons (as defined herein);

(f) the Subscriber is outside the United States when receiving and executing this Subscription Agreement;

(g) the Subscriber understands and agrees not to engage in any hedging transactions involving any of the Securities unless such transactions are in compliance with the provisions of the 1933 Act and in each case only in accordance with applicable state securities laws;

(h) the Subscriber acknowledges that it has not acquired the Shares as a result of, and will not itself engage in, any "directed selling efforts" (as defined in Regulation S under the 1933 Act) in the United States in respect of any of the Securities which would include any activities undertaken for the purpose of, or that could reasonably be expected to have the effect of, conditioning the market in the United States for the resale of any of the Securities; provided, however, that the Subscriber may sell or otherwise dispose of any of the Shares pursuant to registration of any of the Shares pursuant to the 1933 Act and any applicable state securities laws or under an exemption from such registration requirements and as otherwise provided herein;

(i) the Subscriber has the legal capacity and competence to enter into and execute this Subscription Agreement and to take all actions required pursuant hereto and, if the Subscriber is a corporation, it is duly incorporated and validly subsisting under the laws of its jurisdiction of incorporation and all necessary approvals by its directors, shareholders and others have been obtained to authorize execution and performance of this Subscription Agreement on behalf of the Subscriber;

(j) the entering into of this Subscription Agreement and the transactions contemplated hereby do not result in the violation of any of the terms and provisions of any law applicable to, or, if applicable, the constating documents of, the Subscriber, or of any agreement, written or oral, to which the Subscriber may be a party or by which the Subscriber is or may be bound;

(k) the Subscriber has duly executed and delivered this Subscription Agreement and it constitutes a valid and binding agreement of the Subscriber enforceable against the Subscriber;

(l) the Subscriber has received and carefully read this Subscription Agreement;

(m) the Subscriber (i) has adequate net worth and means of providing for its current financial needs and possible personal contingencies, (ii) has no need for liquidity in this investment, and (iii) is able to bear the economic risks of an investment in the Securities for an indefinite period of time, and can afford the complete loss of such investment;

(n) the Subscriber has the requisite knowledge and experience in financial and business matters as to be capable of evaluating the merits and risks of the investment in the Securities and the Company, and the Subscriber is providing evidence of knowledge and experience in these matters through the information requested in the Questionnaire;

(o) the Subscriber understands and agrees that the Company and others will rely upon the truth and accuracy of the acknowledgements, representations, warranties, covenants and agreements contained in this Subscription Agreement and the Questionnaire, and agrees that if any of such acknowledgements, representations and agreements are no longer accurate or have been breached, the Subscriber shall promptly notify the Company;

(p) the Subscriber is aware that an investment in the Company is speculative and involves certain risks, including the possible loss of the investment;

(q) the Subscriber is purchasing the Shares for its own account for investment purposes only and not for the account of any other person and not for distribution, assignment or resale to others, and no other person has a direct or indirect beneficial interest is such Shares, and the Subscriber has not subdivided his interest in the Shares with any other person;

(r) the Subscriber is not an underwriter of, or dealer in, the shares of the Company's common stock, nor is the Subscriber participating, pursuant to a contractual agreement or otherwise, in the distribution of the Shares;

(s) the Subscriber has made an independent examination and investigation of an investment in the Securities and the Company and has depended on the advice of its legal and financial advisors and agrees that the Company will not be responsible in anyway whatsoever for the Subscriber's decision to invest in the Securities and the Company;

(t) if the Subscriber is acquiring the Shares as a fiduciary or agent for one or more investor accounts, the Subscriber has sole investment discretion with respect to each such account, and the Subscriber has full power to make the foregoing acknowledgements, representations and agreements on behalf of such account;

(u) the Subscriber is not aware of any advertisement of any of the Shares and is not acquiring the Shares as a result of any form of general solicitation or general advertising including advertisements, articles, notices or other communications published in any newspaper, magazine or similar media or broadcast over radio or television, or any seminar or meeting whose attendees have been invited by general solicitation or general advertising;

(v) no person has made to the Subscriber any written or oral representations:

(i) that any person will resell or repurchase any of the Securities,

(ii) that any person will refund the purchase price of any of the Securities,

(iii) as to the future price or value of any of the Securities, or

(iv) that any of the Securities will be listed and posted for trading on any stock exchange or automated dealer quotation system or that application has been made to list and post any of the Securities of the Company on any stock exchange or automated dealer quotation system; and

(w) the Subscriber acknowledges and agrees that the Company shall not consider the Subscriber's Subscription for acceptance unless the undersigned provides to the Company, along with an executed copy of this Subscription Agreement:

(i) a fully completed and executed Questionnaire in the form attached hereto as Schedule A, and

(ii) such other supporting documentation that the Company or its legal counsel may request to establish the Subscriber's qualification as a qualified investor.

5.2 In this Subscription Agreement, the term "U.S. Person" shall have the meaning ascribed thereto in Regulation S promulgated under the 1933 Act and for the purpose of the Subscription Agreement includes any person in the United States.

6. ACKNOWLEDGEMENT AND WAIVER

6.1 The Subscriber has acknowledged that the decision to purchase the Shares was solely made on the Company Information. The Subscriber hereby waives, to the fullest extent permitted by law, any rights of withdrawal, rescission or compensation for damages to which the Subscriber might be entitled in connection with the distribution of any of the Shares.

7. REPRESENTATIONS AND WARRANTIES WILL BE RELIED UPON BY THE COMPANY

7.1 The Subscriber acknowledges that the acknowledgements, representations and warranties contained herein and in the Questionnaire are made by it with the intention that they may be relied upon by the Company and its legal counsel in determining the Subscriber's eligibility to purchase the Shares under applicable securities legislation, or (if applicable) the eligibility of others on whose behalf it is contracting hereunder to purchase the Shares under applicable securities legislation. The Subscriber further agrees that by accepting delivery of the certificates representing the Shares, it will be representing and warranting that the acknowledgements representations and warranties contained herein and in the Questionnaire are true and correct as of the date hereof and will continue in full force and effect notwithstanding any subsequent disposition by the Subscriber of such Shares.

8. RESALE RESTRICTIONS

8.1 The Subscriber acknowledges that any resale of the Securities will be subject to resale restrictions contained in the securities legislation applicable to the Subscriber or proposed transferee. The Subscriber acknowledges that none of the Securities have been registered under the 1933 Act or the securities laws of any state of the United States. None of the Securities may be offered or sold in the United States unless registered in accordance with federal securities laws and all applicable state securities laws or exemptions from such registration requirements are available.

9. LEGENDING AND REGISTRATION OF SUBJECT SECURITIES

9.1 The Subscriber hereby acknowledges that upon the issuance thereof, and until such time as the same is no longer required under the applicable securities laws and regulations, the certificates representing the Shares will bear a legend in substantially the following form:

THE SECURITIES REPRESENTED HEREBY HAVE BEEN OFFERED IN AN OFFSHORE TRANSACTION TO A PERSON WHO IS NOT A U.S. PERSON (AS DEFINED HEREIN) PURSUANT TO REGULATION S UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE "1933 ACT").

NONE OF THE SECURITIES REPRESENTED HEREBY HAVE BEEN REGISTERED UNDER THE 1933 ACT, OR ANY U.S. STATE SECURITIES LAWS, AND, UNLESS SO REGISTERED, MAY NOT BE OFFERED OR SOLD, DIRECTLY OR INDIRECTLY, IN THE UNITED STATES (AS DEFINED HEREIN) OR TO U.S. PERSONS EXCEPT IN ACCORDANCE WITH THE PROVISIONS OF REGULATION S UNDER THE 1933 ACT, PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE 1933 ACT, OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE 1933 ACT AND IN EACH CASE ONLY IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS. IN ADDITION, HEDGING TRANSACTIONS INVOLVING THE SECURITIES MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE 1933 ACT. "UNITED STATES" AND "U.S. PERSON" ARE AS DEFINED BY REGULATION S UNDER THE 1933 ACT.

9.2 The Subscriber hereby acknowledges and agrees to the Company making a notation on its records or giving instructions to the registrar and transfer agent of the Company in order to implement the restrictions on transfer set forth and described in this Subscription Agreement.

10. COLLECTION OF PERSONAL INFORMATION

10.1 The Subscriber acknowledges and consents to the fact that the Company is collecting the Subscriber's personal information for the purpose of fulfilling this Subscription Agreement and completing the Offering. The Subscriber's personal information (and, if applicable, the personal information of those on whose behalf the Subscriber is contracting hereunder) may be disclosed by the Company to (a) stock exchanges or securities regulatory authorities, (b) the Company's registrar and transfer agent, (c) Canadian tax authorities, (d) authorities pursuant to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (Canada) and (e) any of the other parties involved in the Offering, including legal counsel, and may be included in record books in connection with the Offering. By executing this Subscription Agreement, the Subscriber is deemed to be consenting to the foregoing collection, use and disclosure of the Subscriber's personal information (and, if applicable, the personal information of those on whose behalf the Subscriber is contracting hereunder) and to the retention of such personal information for as long as permitted or required by law or business practice. Notwithstanding that the Subscriber may be purchasing Shares as agent on behalf of an undisclosed principal, the Subscriber agrees to provide, on request, particulars as to the identity of such undisclosed principal as may be required by the Company in order to comply with the foregoing.

11. COSTS

11.1 The Subscriber acknowledges and agrees that all costs and expenses incurred by the Subscriber (including any fees and disbursements of any special counsel retained by the Subscriber) relating to the purchase of the Shares shall be borne by the Subscriber.

12. GOVERNING LAW

12.1 This Subscription Agreement is governed by the laws of the State of Nevada. The Subscriber, in its personal or corporate capacity and, if applicable, on behalf of each beneficial purchaser for whom it is acting, irrevocably attorns to the exclusive jurisdiction of the Courts of the State of Nevada.

13. SURVIVAL

13.1 This Subscription Agreement, including without limitation the representations, warranties and covenants contained herein, shall survive and continue in full force and effect and be binding upon the parties hereto notwithstanding the completion of the purchase of the Shares by the Subscriber pursuant hereto.

14. ASSIGNMENT

14.1 This Subscription Agreement is not transferable or assignable.

15. SEVERABILITY

15.1 The invalidity or unenforceability of any particular provision of this Subscription Agreement shall not affect or limit the validity or enforceability of the remaining provisions of this Subscription Agreement.

16. ENTIRE AGREEMENT

16.1 Except as expressly provided in this Subscription Agreement and in the agreements, instruments and other documents contemplated or provided for herein, this Subscription Agreement contains the entire agreement between the parties with respect to the sale of the Shares and there are no other terms, conditions, representations or warranties, whether expressed, implied, oral or written, by statute or common law, by the Company or by anyone else.

17. NOTICES

17.1 All notices and other communications hereunder shall be in writing and shall be deemed to have been duly given if mailed or transmitted by any standard form of telecommunication. Notices to the Subscriber shall be directed to the address on page 2 and notices to the Company shall be directed to it at the first page of this Subscription Agreement.

18. COUNTERPARTS AND ELECTRONIC MEANS

18.1 This Subscription Agreement may be executed in any number of counterparts, each of which, when so executed and delivered, shall constitute an original and all of which together shall constitute one instrument. Delivery of an executed copy of this Subscription Agreement by electronic facsimile transmission or other means of electronic communication capable of producing a printed copy will be deemed to be execution and delivery of this Subscription Agreement as of the date hereinafter set forth.

SCHEDULE A

CANADIAN QUESTIONNAIRE

All capitalized terms herein, unless otherwise defined, have the meanings ascribed thereto in the Subscription Agreement.

The purpose of this Questionnaire is to assure the Company that the Subscriber will meet certain requirements of National Instrument 45-106 ("NI 45-106"). The Company will rely on the information contained in this Questionnaire for the purposes of such determination.

The Subscriber covenants, represents and warrants to the Company that:

1. the Subscriber has such knowledge and experience in financial and business matters as to be capable of evaluating the merits and risks of the transactions detailed in the Subscription Agreement and the Subscriber is able to bear the economic risk of loss arising from such transactions;

2. the Subscriber is (tick one or more of the following boxes):

|

(A)

|

a director, executive officer, employee or control person of the Company or an affiliate of the Company

|

☐ |

| |

|

|

|

(B)

|

a spouse, parent, grandparent, brother, sister or child of a director, executive officer, founder or control person of the Company or an affiliate of the Company

|

☐ |

| |

|

|

|

(C)

|

a parent, grandparent, brother, sister or child of the spouse of a director, executive officer, founder or control person of the Company or an affiliate of the Company

|

☐ |

| |

|

|

|

(D)

|

a close personal friend of a director, executive officer, founder or control person of the Company

|

☐ |

| |

|

|

|

(E)

|

a close business associate of a director, executive officer, founder or control person of the Company or an affiliate of the Company

|

☐ |

| |

|

|

|

(F)

|

an accredited investor

|

☐ |

| |

|

|

|

(G)

|

a company, partnership or other entity of which a majority of the voting securities are beneficially owned by, or a majority of the directors are, persons described in paragraphs A to F

|

☐ |

| |

|

|

|

(H)

|

a trust or estate of which all of the beneficiaries or a majority of the trustees or executors are persons described in paragraphs A to F

|

☐ |

| |

|

|

|

(I)

|

purchasing as principal Securities with an aggregate acquisition cost of not less than CDN$150,000

|

☐ |

3. if the Subscriber has checked box B, C, D, E, G or H in Section 2 above, the director, executive officer, founder or control person of the Company with whom the undersigned has the relationship is:

(Instructions to Subscriber: fill in the name of each director, executive officer, founder and control person which you have the above-mentioned relationship with. If you have checked box G or H, also indicate which of A to F describes the securityholders, directors, trustees or beneficiaries which qualify you as box G or H and provide the names of those individuals. Please attach a separate page if necessary).

4. if the Subscriber is resident in Ontario, the Subscriber is (tick one or more of the following boxes):

|

(A)

|

a founder of the Company

|

☐ |

| |

|

|

|

(B)

|

an affiliate of a founder of the Company

|

☐ |

| |

|

|

|

(C)

|

a spouse, parent, brother, sister, grandparent or child of a director, executive officer or founder of the Company

|

☐ |

| |

|

|

|

(D)

|

a person that is a control person of the Company

|

☐ |

| |

|

|

|

(E)

|

an accredited investor

|

☐ |

| |

|

|

|

(F)

|

purchasing as principal Securities with an aggregate acquisition cost of not less than CDN$150,000

|

☐ |

5. if the Subscriber has checked box A, B, C or D in Section 4 above, the director, executive officer, founder or control person of the Company with whom the undersigned has the relationship is:

(Instructions to Subscriber: fill in the name of each director, executive officer, founder, affiliate and control person which you have the above-mentioned relationship with.)

6. if the Subscriber has ticked box F in Section 2 or box E in Section 4 above, the Subscriber satisfies one or more of the categories of "accredited investor" (as that term is defined in NI 45-106) indicated below (please check the appropriate box):

☐ (a) a Canadian financial institution as defined in National Instrument 14-101, or an authorized foreign bank listed in Schedule III of the Bank Act (Canada);

☐ (b) the Business Development Bank of Canada incorporated under the Business Development Bank Act (Canada);

☐ (c) a subsidiary of any person referred to in any of the foregoing categories, if the person owns all of the voting securities of the subsidiary, except the voting securities required by law to be owned by directors of that subsidiary;

☐ (d) an individual registered or formerly registered under securities legislation in a jurisdiction of Canada, as a representative of a person or company registered under securities legislation in a jurisdiction of Canada, as an adviser or dealer, other than a limited market dealer registered under the Securities Act (Ontario) or the Securities Act (Newfoundland);

☐ (e) an individual registered or formerly registered under the securities legislation of a jurisdiction of Canada as a representative of a person referred to in paragraph (d);

☐ (f) the government of Canada or a province, or any crown corporation or agency of the government of Canada or a province;

☐ (g) a municipality, public board or commission in Canada and a metropolitan community, school board, the Comite de gestion de la taxe scholaire de l'ile de Montreal or an intermunicipal management board in Québec;

☐ (h) a national, federal, state, provincial, territorial or municipal government of or in any foreign jurisdiction, or any agency thereof;

☐ (i) a pension fund that is regulated by either the Office of the Superintendent of Financial Institutions (Canada) or a pension commission or similar regulatory authority of a jurisdiction of Canada;

☐ (j) an individual who either alone or with a spouse beneficially owns, directly or indirectly, financial assets (as defined in NI 45-106) having an aggregate realizable value that, before taxes but net of any related liabilities, exceeds CDN$1,000,000;

☐ (k) an individual whose net income before taxes exceeded CDN$200,000 in each of the two more recent calendar years or whose net income before taxes combined with that of a spouse exceeded $300,000 in each of those years and who, in either case, reasonably expects to exceed that net income level in the current calendar year;

☐ (l) an individual who, either alone or with a spouse, has net assets of at least CDN $5,000,000;

☐ (m) a person, other than an individual or investment fund, that had net assets of at least CDN$5,000,000 as reflected on its most recently prepared financial statements;

☐ (n) an investment fund that distributes it securities only to persons that are accredited investors at the time of distribution, a person that acquires or acquired a minimum of CDN$150,000 of value in securities, or a person that acquires or acquired securities under Sections 2.18 or 2.19 of NI 45-106;

☐ (o) an investment fund that distributes or has distributed securities under a prospectus in a jurisdiction of Canada for which the regulator or, in Québec, the securities regulatory authority, has issued a receipt;

☐ (p) a trust company or trust corporation registered or authorized to carry on business under the Trust and Loan Companies Act (Canada) or under comparable legislation in a jurisdiction of Canada or a foreign jurisdiction, acting on behalf of a fully managed account managed by the trust company or trust corporation, as the case may be;

☐ (q) a person acting on behalf of a fully managed account managed by that person, if that person (i) is registered or authorized to carry on business as an adviser or the equivalent under the securities legislation of a jurisdiction of Canada or a foreign jurisdiction, and (ii) in Ontario, is purchasing a security that is not a security of an investment fund;

☐ (r) a registered charity under the Income Tax Act (Canada) that, in regard to the trade, has obtained advice from an eligibility advisor or an advisor registered under the securities legislation of the jurisdiction of the registered charity to give advice on the securities being traded;

☐ (s) an entity organized in a foreign jurisdiction that is analogous to any of the entities referred to in paragraphs (a) to (d) or paragraph (i) in form and function;

☐ (t) a person in respect of which all of the owners of interests, direct, indirect or beneficial, except the voting securities required by law are persons or companies that are accredited investors;

☐ (u) an investment funds that is advised by a person registered as an advisor or a person that is exempt from registration as an advisor; or

☐ (v) a person that is recognized or designated by the securities regulatory authority or, except in Ontario and Québec, the regulator as (i) an accredited investor, or (ii) an exempt purchaser in Alberta or British Columbia after this instrument comes into force;

The Subscriber acknowledges and agrees that the Subscriber may be required by the Company to provide such additional documentation as may be reasonably required by the Company and its legal counsel in determining the Subscriber's eligibility to acquire the Securities under relevant legislation.

IN WITNESS WHEREOF, the undersigned has executed this Questionnaire as of the ________ day of__________________________, 2024.

| If an Individual: |

|

If a Corporation, Partnership or Other Entity: |

| |

|

|

| |

|

|

| Signature |

|

Print or Type Name of Entity |

| |

|

|

| |

|

|

| Print or Type Name |

|

Signature of Authorized Signatory |

| |

|

|

| |

|

|

| |

|

Type of Entity |

THIS PRIVATE PLACEMENT SUBSCRIPTION AGREEMENT (THE "SUBSCRIPTION AGREEMENT") RELATES TO AN OFFERING OF SECURITIES IN AN OFFSHORE TRANSACTION TO PERSONS WHO ARE NOT U.S. PERSONS (AS DEFINED HEREIN) PURSUANT TO REGULATION S UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE "1933 ACT").

NONE OF THE SECURITIES TO WHICH THIS SUBSCRIPTION AGREEMENT RELATES HAVE BEEN REGISTERED UNDER THE 1933 ACT, OR ANY U.S. STATE SECURITIES LAWS, AND, UNLESS SO REGISTERED, NONE MAY BE OFFERED OR SOLD, DIRECTLY OR INDIRECTLY, IN THE UNITED STATES OR TO U.S. PERSONS (AS DEFINED HEREIN) EXCEPT IN ACCORDANCE WITH THE PROVISIONS OF REGULATION S UNDER THE 1933 ACT, PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE 1933 ACT, OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE 1933 ACT AND IN EACH CASE ONLY IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS.

PRIVATE PLACEMENT SUBSCRIPTION

FOR CANADIAN SUBSCRIBERS

PRIVATE PLACEMENT

INSTRUCTIONS TO SUBSCRIBER:

1. COMPLETE page 2 and Schedule A of this Subscription Agreement.

2. PAYMENT for the subscription can be made by E-TRANSFER to etransfer@wolverineresourcescorp.com or WIRE TRANSFER to the BMO account below.

| BENEFICIARY |

WOLVERINE RESOURCES CORP.

#55-11020 WILLIAMS ROAD

RICHMOND, BC V7A 1X8 |

| BENEFICIARY BANK |

BMO

595 BURRARD STREET

VANCOUVER, BC V7X 1L7 |

| INSTITUTION NUMBER |

001 |

| TRANSIT NUMBER |

00040 |

| ACCOUNT NUMBER |

1656-049 |

| SWIFT CODE |

BOFMCAM2 |

3. EMAIL OR FAX a copy of page 2 of this Subscription Agreement, and all pages of Schedule A to PubCo Services Inc. at pubco@telus.net or (587) 816-6307.

WOLVERINE RESOURCES CORP.

PRIVATE PLACEMENT

The Subscriber hereby irrevocably subscribes for, and on Closing will purchase from the Company, Flow-Through Common Shares ("Shares") at a price of CDN$0.025 per Share

|

_____________________ Shares

|

|

|

The Subscriber directs the Company to issue, register and deliver the certificates representing the Shares as follows:

| REGISTRATION INSTRUCTIONS: |

|

DELIVERY INSTRUCTIONS: |

| |

|

|

| |

|

|

| Name to appear on certificate |

|

Name and account reference, if applicable |

| |

|

|

| |

|

|

| SIN/Tax ID No. |

|

Contact name |

| |

|

|

| |

|

|

| Address |

|

Address |

| |

|

|

| |

|

|

| |

|

Telephone number |

| |

|

|

| |

| EXECUTED by the Subscriber this _______ day of_______________________, 2024. By executing this Agreement, the Subscriber certifies that the Subscriber and any beneficial purchaser for whom the Subscriber is acting is resident in the jurisdiction shown as the “Address of the Subscriber”. The address of the Subscriber will be accepted by the Company as a representative as to the address of residency for the Subscriber. |

| |

|

|

| WITNESS: |

|

EXECUTION BY SUBSCRIBER: |

| |

|

X |

| Signature of witness |

|

Signature of individual (if Subscriber is an individual) |

| |

|

|

| |

|

X |

| Name of witness |

|

Authorized signatory (if Subscriber is not an individual) |

| |

|

|

| |

|

|

| Address of witness |

|

Name of Subscriber (please print) |

| |

|

|

| |

|

|

| |

|

Name of authorized signatory (please print) |

| ACCEPTED this _______ day of _____________________, 2024. |

|

|

| |

|

|

| WOLVERINE RESOURCES CORP. |

|

Address of Subscriber (residence) |

| Per: |

|

|

| |

|

|

| Authorized signatory |

|

Telephone number and e-mail address |

By signing this acceptance, the Company agrees to be bound by all representations, warranties, covenants and agreements on pages 3-11 hereof.

This Subscription Agreement may be executed in any number of counterparts, each of which, when so executed and delivered, shall constitute an original and all of which together shall constitute one instrument. Delivery of an executed copy of this Subscription Agreement by electronic facsimile transmission or other means of electronic communication capable of producing a printed copy will be deemed to be execution and delivery of this Subscription Agreement as of the date hereinafter set forth.

THIS PRIVATE PLACEMENT SUBSCRIPTION AGREEMENT (THE "SUBSCRIPTION AGREEMENT") RELATES TO AN OFFERING OF SECURITIES IN AN OFFSHORE TRANSACTION TO PERSONS WHO ARE NOT U.S. PERSONS (AS DEFINED HEREIN) PURSUANT TO REGULATION S UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE "1933 ACT").

NONE OF THE SECURITIES TO WHICH THIS SUBSCRIPTION AGREEMENT RELATES HAVE BEEN REGISTERED UNDER THE 1933 ACT, OR ANY U.S. STATE SECURITIES LAWS, AND, UNLESS SO REGISTERED, NONE MAY BE OFFERED OR SOLD, DIRECTLY OR INDIRECTLY, IN THE UNITED STATES OR TO U.S. PERSONS (AS DEFINED HEREIN) EXCEPT IN ACCORDANCE WITH THE PROVISIONS OF REGULATION S UNDER THE 1933 ACT, PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE 1933 ACT, OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE 1933 ACT AND IN EACH CASE ONLY IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS.

PRIVATE PLACEMENT SUBSCRIPTION

(Canadian Subscribers Only)

TO: Wolverine Resources Corp. (the "Company")

#55-11020 Williams Road, Richmond,

British Columbia, Canada V7A 1X8

Purchase of Shares

1. SUBSCRIPTION

1.1 The undersigned (the "Subscriber") hereby irrevocably subscribes for and agrees to purchase the number of shares of the Company's common stock as set out on page 2 of this Subscription Agreement at a price of CDN$0.025 per Share (such subscription and agreement to purchase being the "Subscription"), for the total subscription price as set out on page 2 of this Subscription Agreement (the "Subscription Proceeds"), which Subscription Proceeds are tendered herewith, on the basis of the representations and warranties and subject to the terms and conditions set forth herein. The Shares are referred to as the "Securities".

1.2 The Company hereby agrees to sell, on the basis of the representations and warranties and subject to the terms and conditions set forth herein, to the Subscriber the Shares. Subject to the terms hereof, the Subscription Agreement will be effective upon its acceptance by the Company.

1.3 Unless otherwise provided, all dollar amounts referred to in this Subscription Agreement are in lawful money of the United States of America.

2. PAYMENT

2.1 The Subscription Proceeds must accompany this Subscription Agreement. The Subscriber authorizes the Company's lawyers to deliver the Subscription Proceeds to the Company if the Subscription Proceeds are delivered to the Company's lawyers, without further instructions required.

2.2 The Subscriber acknowledges and agrees that this Subscription Agreement and any other documents delivered in connection herewith will be held by the Company's lawyers on behalf of the Company. In the event that this Subscription Agreement is not accepted by the Company for whatever reason within 90 days of the delivery of an executed Subscription Agreement by the Subscriber, or the minimum offering amount is not achieved by that time, this Subscription Agreement, the Subscription Proceeds and any other documents delivered in connection herewith will be returned to the Subscriber at the address of the Subscriber as set forth in this Subscription Agreement without interest or deduction.

2.3 Where the Subscription Proceeds are paid to the Company, the Company may treat the Subscription Proceeds as a non-interest bearing loan and may use the Subscription Proceeds prior to this Subscription Agreement being accepted by the Company.

2.4 If resident in Canada, the Subscriber must complete, sign and return to the Company an executed copy of this Subscription Agreement, the Questionnaire attached hereto as Schedule A (the "Questionnaire") and any other schedules attached hereto.

2.5 The Subscriber shall complete, sign and return to the Company as soon as possible, on request by the Company, any documents, questionnaires, notices and undertakings as may be required by regulatory authorities, stock exchanges and applicable law.

3. CLOSING

3.1 Closing of the purchase and sale of the Shares shall occur on or before ____________________, 2024 or on such other date as may be determined by the Company in its sole discretion (the "Closing Date"). The Subscriber acknowledges that Shares may be issued to other subscribers under this offering (the "Offering") before or after the Closing Date. The Company, may, at its discretion, elect to close the Offering in one or more closings, in which event the Company may agree with one or more subscribers (including the Subscriber hereunder) to complete delivery of the Shares to such subscriber(s) against payment therefore at any time on or prior to the Closing Date.

4. ACKNOWLEDGEMENTS OF SUBSCRIBER

4.1 The Subscriber acknowledges and agrees that:

(a) none of the Securities have been registered under the Securities Act of 1933, as amended (the "1933 Act"), or under any state securities or "blue sky" laws of any state of the United States, and are being offered only in a transaction not involving any public offering within the meaning of the 1933 Act, and, unless so registered, may not be offered or sold in the United States or to U.S. Persons (as defined herein), except pursuant to an effective registration statement under the 1933 Act, or pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the 1933 Act, and in each case only in accordance with applicable state and provincial securities laws;

(b) the Company will refuse to register any transfer of any of the Securities not made in accordance with the provisions of Regulation S, pursuant to an effective registration statement under the 1933 Act or pursuant to an available exemption from, or in a transaction not subject to, the registration requirements of the 1933 Act;

(c) by completing the Questionnaire, the Subscriber is representing and warranting that the Subscriber satisfies one of the categories of registration and prospectus exemptions provided for in National Instrument 45-106 ("NI 45-106") adopted by the Canadian Securities Administrators (the "CSA");

(d) the decision to execute this Subscription Agreement and purchase the Shares agreed to be purchased hereunder has not been based upon any oral or written representation as to fact or otherwise made by or on behalf of the Company and such decision is based solely upon a review of publicly available information regarding the Company available on the website of the United States Securities and Exchange Commission (the "SEC") available at www.sec.gov (the "Company Information");

(e) the Subscriber and the Subscriber's advisor(s) have had a reasonable opportunity to review the Company Information and to ask questions of and receive answers from the Company regarding the Offering, and to obtain additional information, to the extent possessed or obtainable without unreasonable effort or expense, necessary to verify the accuracy of the information contained in the Company Information, or any other document provided to the Subscriber;

(f) the books and records of the Company were available upon reasonable notice for inspection, subject to certain confidentiality restrictions, by the Subscriber during reasonable business hours at its principal place of business and that all documents, records and books pertaining to this Offering have been made available for inspection by the Subscriber, the Subscriber's attorney and/or advisor(s);

(g) by execution hereof the Subscriber has waived the need for the Company to communicate its acceptance of the purchase of the Shares pursuant to this Subscription Agreement;

(h) the Company is entitled to rely on the representations and warranties and the statements and answers of the Subscriber contained in this Subscription Agreement and the Questionnaire and the Subscriber will hold harmless the Company from any loss or damage it may suffer as a result of the Subscriber's failure to correctly complete this Subscription Agreement and the Questionnaire;

(i) the Subscriber will indemnify and hold harmless the Company and, where applicable, its respective directors, officers, employees, agents, advisors and shareholders from and against any and all loss, liability, claim, damage and expense whatsoever (including, but not limited to, any and all fees, costs and expenses whatsoever reasonably incurred in investigating, preparing or defending against any claim, lawsuit, administrative proceeding or investigation whether commenced or threatened) arising out of or based upon any acknowledgment, representation or warranty of the Subscriber contained herein, the Questionnaire or in any other document furnished by the Subscriber to the Company in connection herewith, being untrue in any material respect or any breach or failure by the Subscriber to comply with any covenant or agreement made by the Subscriber to the Company in connection therewith;

(j) the issuance and sale of the Shares to the Subscriber will not be completed if it would be unlawful or if, in the discretion of the Company acting reasonably, it is not in the best interests of the Company;

(k) the Subscriber has been advised to consult the Subscriber's own legal, tax and other advisors with respect to the merits and risks of an investment in the Securities and with respect to the applicable resale restrictions, and it is solely responsible (and the Company is not in any way responsible) for compliance with:

(i) any applicable laws of the jurisdiction in which the Subscriber is resident in connection with the distribution of the Securities hereunder, and

(ii) applicable resale restrictions;

(l) the Subscriber has not acquired the Shares as a result of, and will not itself engage in, any "directed selling efforts" (as defined in Regulation S under the 1933 Act) in the United States in respect of any of the Securities which would include any activities undertaken for the purpose of, or that could reasonably be expected to have the effect of, conditioning the market in the United States for the resale of any of the Securities; provided, however, that the Subscriber may sell or otherwise dispose of any of the Shares pursuant to registration of any of the Shares pursuant to the 1933 Act and any applicable state securities laws or under an exemption from such registration requirements and as otherwise provided herein;

(m) the Subscriber is outside the United States when receiving and executing this Subscription Agreement and is acquiring the Shares as principal for its own account, for investment purposes only, and not with a view to, or for, resale, distribution or fractionalization thereof, in whole or in part, and no other person has a direct or indirect beneficial interest in such Shares;

(n) the statutory and regulatory basis for the exemption claimed for the offer and sale of the Shares, although in technical compliance with Regulation S, would not be available if the offering is part of a plan or scheme to evade the registration provisions of the 1933 Act;

(o) the Company has advised the Subscriber that, if the Subscriber is a Canadian resident, the Company is relying on an exemption from the requirements to provide the Subscriber with a prospectus and to sell the Shares through a person registered to sell securities and, as a consequence of acquiring the Shares pursuant to this exemption, certain protections, rights and remedies provided, including statutory rights of rescission or damages, will not be available to the Subscriber;

(p) neither the SEC nor any other securities commission or similar regulatory authority has reviewed or passed on the merits of any of the Securities;

(q) no documents in connection with this Offering have been reviewed by the SEC or any state securities administrators;

(r) there is no government or other insurance covering any of the Securities; and

(s) this Subscription Agreement is not enforceable by the Subscriber unless it has been accepted by the Company, and the Subscriber acknowledges and agrees that the Company reserves the right to reject any subscription for any reason.

5. REPRESENTATIONS, WARRANTIES AND COVENANTS OF THE SUBSCRIBER

5.1 The Subscriber hereby represents and warrants to and covenants with the Company (which representations, warranties and covenants shall survive the Closing Date) that:

(a) the Subscriber is not a U.S. Person (as defined herein);

(b) the Subscriber is not acquiring the Shares for the account or benefit of, directly or indirectly, any U.S. Person (as defined herein);

(c) the Subscriber is resident in the jurisdiction set out on page 2 of this Subscription Agreement;

(d) the Subscriber:

(i) is knowledgeable of, or has been independently advised as to, the applicable securities laws of the securities regulators having application in the jurisdiction in which the Subscriber is resident (the "International Jurisdiction") which would apply to the acquisition of the Shares,

(ii) is purchasing the Shares pursuant to exemptions from prospectus or equivalent requirements under applicable securities laws or, if such is not applicable, the Subscriber is permitted to purchase the Shares under the applicable securities laws of the securities regulators in the International Jurisdiction without the need to rely on any exemptions,

(iii) acknowledges that the applicable securities laws of the authorities in the International Jurisdiction do not require the Company to make any filings or seek any approvals of any kind whatsoever from any securities regulator of any kind whatsoever in the International Jurisdiction in connection with the issue and sale or resale of any of the Securities, and

(iv) represents and warrants that the acquisition of the Shares by the Subscriber does not trigger:

A. any obligation to prepare and file a prospectus or similar document, or any other report with respect to such purchase in the International Jurisdiction, or

B. any continuous disclosure reporting obligation of the Company in the International Jurisdiction, and

the Subscriber will, if requested by the Company, deliver to the Company a certificate or opinion of local counsel from the International Jurisdiction which will confirm the matters referred to in subparagraphs (ii), (iii) and (iv) above to the satisfaction of the Company, acting reasonably;

(e) the Subscriber is acquiring the Shares as principal for investment only and not with a view to, or for, resale, distribution or fractionalization thereof, in whole or in part, and, in particular, it has no intention to distribute either directly or indirectly any of the Securities in the United States or to U.S. Persons (as defined herein);

(f) the Subscriber is outside the United States when receiving and executing this Subscription Agreement;

(g) the Subscriber understands and agrees not to engage in any hedging transactions involving any of the Securities unless such transactions are in compliance with the provisions of the 1933 Act and in each case only in accordance with applicable state securities laws;

(h) the Subscriber acknowledges that it has not acquired the Shares as a result of, and will not itself engage in, any "directed selling efforts" (as defined in Regulation S under the 1933 Act) in the United States in respect of any of the Securities which would include any activities undertaken for the purpose of, or that could reasonably be expected to have the effect of, conditioning the market in the United States for the resale of any of the Securities; provided, however, that the Subscriber may sell or otherwise dispose of any of the Shares pursuant to registration of any of the Shares pursuant to the 1933 Act and any applicable state securities laws or under an exemption from such registration requirements and as otherwise provided herein;

(i) the Subscriber has the legal capacity and competence to enter into and execute this Subscription Agreement and to take all actions required pursuant hereto and, if the Subscriber is a corporation, it is duly incorporated and validly subsisting under the laws of its jurisdiction of incorporation and all necessary approvals by its directors, shareholders and others have been obtained to authorize execution and performance of this Subscription Agreement on behalf of the Subscriber;

(j) the entering into of this Subscription Agreement and the transactions contemplated hereby do not result in the violation of any of the terms and provisions of any law applicable to, or, if applicable, the constating documents of, the Subscriber, or of any agreement, written or oral, to which the Subscriber may be a party or by which the Subscriber is or may be bound;

(k) the Subscriber has duly executed and delivered this Subscription Agreement and it constitutes a valid and binding agreement of the Subscriber enforceable against the Subscriber;

(l) the Subscriber has received and carefully read this Subscription Agreement;

(m) the Subscriber (i) has adequate net worth and means of providing for its current financial needs and possible personal contingencies, (ii) has no need for liquidity in this investment, and (iii) is able to bear the economic risks of an investment in the Securities for an indefinite period of time, and can afford the complete loss of such investment;

(n) the Subscriber has the requisite knowledge and experience in financial and business matters as to be capable of evaluating the merits and risks of the investment in the Securities and the Company, and the Subscriber is providing evidence of knowledge and experience in these matters through the information requested in the Questionnaire;

(o) the Subscriber understands and agrees that the Company and others will rely upon the truth and accuracy of the acknowledgements, representations, warranties, covenants and agreements contained in this Subscription Agreement and the Questionnaire, and agrees that if any of such acknowledgements, representations and agreements are no longer accurate or have been breached, the Subscriber shall promptly notify the Company;

(p) the Subscriber is aware that an investment in the Company is speculative and involves certain risks, including the possible loss of the investment;

(q) the Subscriber is purchasing the Shares for its own account for investment purposes only and not for the account of any other person and not for distribution, assignment or resale to others, and no other person has a direct or indirect beneficial interest is such Shares, and the Subscriber has not subdivided his interest in the Shares with any other person;

(r) the Subscriber is not an underwriter of, or dealer in, the shares of the Company's common stock, nor is the Subscriber participating, pursuant to a contractual agreement or otherwise, in the distribution of the Shares;

(s) the Subscriber has made an independent examination and investigation of an investment in the Securities and the Company and has depended on the advice of its legal and financial advisors and agrees that the Company will not be responsible in anyway whatsoever for the Subscriber's decision to invest in the Securities and the Company;

(t) if the Subscriber is acquiring the Shares as a fiduciary or agent for one or more investor accounts, the Subscriber has sole investment discretion with respect to each such account, and the Subscriber has full power to make the foregoing acknowledgements, representations and agreements on behalf of such account;

(u) the Subscriber is not aware of any advertisement of any of the Shares and is not acquiring the Shares as a result of any form of general solicitation or general advertising including advertisements, articles, notices or other communications published in any newspaper, magazine or similar media or broadcast over radio or television, or any seminar or meeting whose attendees have been invited by general solicitation or general advertising;

(v) no person has made to the Subscriber any written or oral representations:

(i) that any person will resell or repurchase any of the Securities,

(ii) that any person will refund the purchase price of any of the Securities,

(iii) as to the future price or value of any of the Securities, or

(iv) that any of the Securities will be listed and posted for trading on any stock exchange or automated dealer quotation system or that application has been made to list and post any of the Securities of the Company on any stock exchange or automated dealer quotation system; and

(w) the Subscriber acknowledges and agrees that the Company shall not consider the Subscriber's Subscription for acceptance unless the undersigned provides to the Company, along with an executed copy of this Subscription Agreement:

(i) a fully completed and executed Questionnaire in the form attached hereto as Schedule A, and

(ii) such other supporting documentation that the Company or its legal counsel may request to establish the Subscriber's qualification as a qualified investor.

5.2 In this Subscription Agreement, the term "U.S. Person" shall have the meaning ascribed thereto in Regulation S promulgated under the 1933 Act and for the purpose of the Subscription Agreement includes any person in the United States.

6. ACKNOWLEDGEMENT AND WAIVER

6.1 The Subscriber has acknowledged that the decision to purchase the Shares was solely made on the Company Information. The Subscriber hereby waives, to the fullest extent permitted by law, any rights of withdrawal, rescission or compensation for damages to which the Subscriber might be entitled in connection with the distribution of any of the Shares.

7. REPRESENTATIONS AND WARRANTIES WILL BE RELIED UPON BY THE COMPANY

7.1 The Subscriber acknowledges that the acknowledgements, representations and warranties contained herein and in the Questionnaire are made by it with the intention that they may be relied upon by the Company and its legal counsel in determining the Subscriber's eligibility to purchase the Shares under applicable securities legislation, or (if applicable) the eligibility of others on whose behalf it is contracting hereunder to purchase the Shares under applicable securities legislation. The Subscriber further agrees that by accepting delivery of the certificates representing the Shares, it will be representing and warranting that the acknowledgements representations and warranties contained herein and in the Questionnaire are true and correct as of the date hereof and will continue in full force and effect notwithstanding any subsequent disposition by the Subscriber of such Shares.

8. RESALE RESTRICTIONS

8.1 The Subscriber acknowledges that any resale of the Securities will be subject to resale restrictions contained in the securities legislation applicable to the Subscriber or proposed transferee. The Subscriber acknowledges that none of the Securities have been registered under the 1933 Act or the securities laws of any state of the United States. None of the Securities may be offered or sold in the United States unless registered in accordance with federal securities laws and all applicable state securities laws or exemptions from such registration requirements are available.

9. LEGENDING AND REGISTRATION OF SUBJECT SECURITIES

9.1 The Subscriber hereby acknowledges that upon the issuance thereof, and until such time as the same is no longer required under the applicable securities laws and regulations, the certificates representing the Shares will bear a legend in substantially the following form:

THE SECURITIES REPRESENTED HEREBY HAVE BEEN OFFERED IN AN OFFSHORE TRANSACTION TO A PERSON WHO IS NOT A U.S. PERSON (AS DEFINED HEREIN) PURSUANT TO REGULATION S UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE "1933 ACT").