ALTYN PLC: 1st Quarter Results

11 May 2021 - 4:00PM

UK Regulatory

TIDMALTN

AltynGold Plc

("AltynGold" or the "Company")

First quarter production results and financial update

AltynGold is pleased to announce its 1Q21 production results and

financial update.

Highlights:

-- Revenues soared by almost 120% year-over-year mainly driven by improved

gold poured production and also by higher gold price during the 1Q21

compared to 1Q20.

-- Production went up by almost 43% year-over-year and the quantity of

contained gold increase more than by 70% year-over-year. The positive

momentum in production growth and improving contained gold is expected to

be increased over the coming quarters.

-- Average grade improved by almost 20% year-over-year from 1.49g/t to

1.78g/t. The Company plans improving grade further in the upcoming

quarters due to the new equipment.

-- After the planned maintenance completed in 3Q20 the Company demonstrated

uninterrupted production in 4Q20 and continued demonstrating it during

1Q21 as well. Despite of more severe weather conditions during cold and

snowy first three months of 2021, growth of milled ore production

increased by 43% year-over-year.

-- In September 2019 the Company agreed a facility with Bank Center Credit

JSC (BCC) for an amount of US$17m. As of 1Q21 the Company has repaid

US$4.71m of the bank facility.

-- The Company has significantly improved its financial position in 2020 and

1Q21. The Company's Net Debt to EBITDA ratio has steadily improved over

the last years: 5.6x in 2018, 4.7x in 2019 and 1.6x in 2020. Management

maintains a positive view on the Company's capacity to raise funding for

the Company's upcoming capital requirements at attractive terms.

-- On COVID-19 update, the Company did not experience any negative effect or

interruptions on its production operations during the quarter. All

operational processes continued at a regular pace despite of unfavorable

weather conditions during the quarter. The management of the Company

continues cooperating with the authorities and monitoring the situation

on the virus with regular PCR testing of all staff. The health and safety

of our employees is the top priority of the Company.

1Q20 1Q21

Ore mined tons 92,324 131,733

Contained gold ounces 4,376 7,462

Ore milled tons 92,909 132,834

Average gold grade gr/tone 1.49 1.78

Gold poured ounces 3,380 6,272

Revenue USD m 4.58 10.06

Further Information:

For further information please contact:

AltynGold Plc

Rajinder Basra

+44 (0) 207 932 2455

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014.

Information on the Company

AltynGold Plc (LSE:ALTN) is an exploration and development

company, which is listed on the main market segment of the London

Stock Exchange.

To read more about AltynGold Plc please visit our website

www.altyngold.uk

View source version on businesswire.com:

https://www.businesswire.com/news/home/20210510005654/en/

CONTACT:

Altyn Plc

SOURCE: Altyn Plc

Copyright Business Wire 2021

(END) Dow Jones Newswires

May 11, 2021 02:00 ET (06:00 GMT)

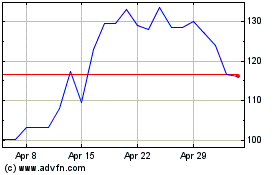

Altyngold (LSE:ALTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

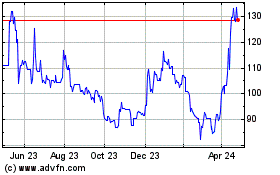

Altyngold (LSE:ALTN)

Historical Stock Chart

From Apr 2023 to Apr 2024