Anpario PLC Director/PDMR Shareholding (7748O)

12 October 2021 - 5:20PM

UK Regulatory

TIDMANP

RNS Number : 7748O

Anpario PLC

12 October 2021

Anpario plc

("Anpario" or the "Company")

Director/PDMR Shareholding

Anpario announces that, on 11 October 2021, it has allotted a

total of 50,000 new Ordinary Shares. The Ordinary Shares have been

issued at a subscription price of 620 pence per Ordinary Share,

being the closing price of an Ordinary Share on 8 October 2021,

pursuant to The Anpario plc Employees' JSOP (the "Plan").

The Ordinary Shares have been issued into the respective joint

beneficial ownership of (i) Marc Wilson, Group Finance Director,

and (ii) the trustee of the Trust upon and subject to the terms of

joint ownership agreements ("JOAs") respectively entered into

between the Director concerned, the Company and the Trustee. The

subscription price has been paid by the Trust out of funds advanced

to it by the Company.

The terms of the JOAs provide, inter alia, that if jointly owned

shares become vested and are sold, the proceeds of sale will be

divided between the joint owners so that the participating Director

receives an amount equal to any growth in the market value of the

jointly owned Ordinary Shares above the initial market value of 620

pence per share, less a "carrying cost" (equivalent to simple

interest at 4.5 per cent per annum on the initial market value) and

the Trust receives the initial market value of the jointly owned

shares plus the carrying cost. Jointly owned Ordinary Shares will

become vested if the participant remains with the Company for a

minimum period of 3 years.

Effect of the transactions

The beneficial interests held before and after the above

transactions and remaining unchanged are:

Director Ordinary shares SAYE options

Marc Wilson 9,676 5,577

---------------- -------------

The jointly owned Ordinary Shares held by the Directors of the

Company before and after the above transactions will be:

Interests in jointly owned New interests in jointly owned Interests in jointly owned

Ordinary Shares prior to the Ordinary Shares issued under Ordinary Shares following the

Director transactions: JSOP transactions

Marc Wilson 20,000 50,000 70,000

--------------------------------- --------------------------------- ---------------------------------

An application has been made to the London Stock Exchange plc

for the admission to trading on AIM of 50,000 Ordinary Shares in

respect of these shares awarded under the JSOP. It is expected that

admission of these new Ordinary Shares will become effective on 15

October 2021 ("Admission"). These new Ordinary Shares will rank

pari passu in all respects with the existing Ordinary Shares in

issue.

Following Admission, the Company's total issued share capital is

23,678,196 Ordinary Shares. The Company holds 440,388 Ordinary

Shares in Treasury. Therefore, the total number of voting rights in

the Company is 23,237,808. This figure may be used by shareholders

as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change to their interest in, the Company under the FCA's Disclosure

and Transparency Rules.

Share plan limits

On 16 September 2016, Anpario announced limits on future awards

made under its share plans. That limit is the total number of new

shares over which future awards may be made, when added to the

total number of shares issued and issuable under awards granted on

16 September 2016 and any awards which are outstanding as at that

date shall not exceed 16.3% of the total of the number of shares in

issue from time to time.

The JSOP award mentioned above substantially utilises the

remaining headroom under this share plan limit. Anpario considers

it necessary to have in place a competitive senior executive

employment package, including equity awards and to ensure that

existing managers and directors are properly incentivised. As such,

a review is currently being undertaken to determine potential

future changes to share plan limits and awards, once this process

has concluded then further details will be announced as

appropriate.

Enquiries:

Anpario plc

Richard Edwards, CEO +44(0) 777 6417 129

Marc Wilson, Group Finance Director +44(0) 1909 537380

Karen Prior, Corporate Responsibility Director

& Company Secretary +44(0) 1909 537380

Peel Hunt LLP (NOMAD) +44 (0)20 7418 8900

Adrian Trimmings

Andrew Clark

Will Bell

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHMZMMGVZRGMZG

(END) Dow Jones Newswires

October 12, 2021 02:20 ET (06:20 GMT)

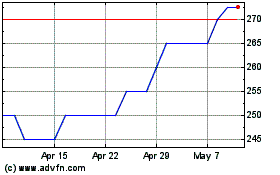

Anpario (LSE:ANP)

Historical Stock Chart

From Mar 2024 to Apr 2024

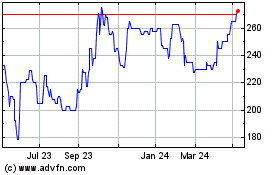

Anpario (LSE:ANP)

Historical Stock Chart

From Apr 2023 to Apr 2024