TIDMAREC

RNS Number : 3775M

Arecor Therapeutics PLC

14 September 2023

Arecor Therapeutics plc

("Arecor", the "Company" or the "Group")

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2023

Strong progress across proprietary portfolio and partnered

revenue-generating collaborations

Cambridge, UK, 14 September 2023: Arecor Therapeutics plc (AIM:

AREC), a globally focused biopharmaceutical company advancing

today's therapies to enable healthier lives, today announces its

interim results for the six months ended 30 June 2023.

Sarah Howell, Chief Executive Officer of Arecor, said : "We have

made further, strong progress across the business towards our

ambition to transform patient care by enhancing existing

therapeutic medicines and, in doing so, building a significant

self-sustaining biopharmaceutical company.

"Our revenues increased by 141%, compared to 1H 22, and our

belief in the growth potential of the business is reinforced by

significant progress by our partners under license, as well as

development progress across our in-house proprietary product

portfolio. We have seen significant partnering traction with the

first product incorporating the Arestat(TM) technology, AT220,

progressing towards commercialisation, positive clinical and

development advances from Inhibrx and Hikma, as well as the signing

of new revenue-generating collaborations.

"Through the remainder of 2023 and into 2024, we expect key data

from AT278, achievement of anticipated further partnering

milestones and continued commercial traction for Ogluo(R). We look

forward, with confidence, to further material progress in the near-

and medium-term towards our long-term ambitions for the Group."

Operational highlights (including post period events)

-- AT278 - Second Phase I clinical trial of ultra-rapid acting,

ultra-concentrated insulin in people with Type 2 diabetes ongoing,

with good progress in recruitment following first patient dosing in

March

-- AT247 - Phase I clinical data for ultra-rapid acting insulin

delivered by continuous subcutaneous infusion over three days via

an insulin pump, reinforcing potential to enable a fully closed

loop artificial pancreas system, presented at American Diabetes

Association (ADA) 83rd Scientific Sessions meeting in June

-- AT307 - the specialty hospital, ready-to-use injectable

medicine, transferred to Hikma in January, and which triggered a

milestone payment to the Group in the period; achieved a recent

positive meeting with Food and Drug Administration confirming

abbreviated 505(b)(2) regulatory pathway

-- Initiation of Inhibrx' registration-enabling clinical trial of AT292 (INBRX-101)

-- Regulatory approval by partner expected in coming months for

first product incorporating Arestat(TM) technology, AT220

-- Three additional revenue generating technology partnerships

entered into with new and existing pharmaceutical and biotech

partners, bringing the total number of new partnerships signed

since IPO to 11

-- Continued sales growth of Ogluo(R) with roll-out across

additional key European territories, adding Denmark, Norway and

Austria to existing markets of Germany and the UK; exclusive

commercialisation agreement signed with Goodlife in the BeNeLux

region

-- Strengthening of robust IP portfolio with key patents granted

in US, Europe, China and India protecting proprietary diabetes

portfolio, enhanced monoclonal antibody platform and high value

biologics formulations

-- Appointment of Dr. Manjit Rahelu as Chief Business Officer

Financial highlights

-- Revenue of GBP1.7 million increased by 141% (H1 2022: GBP0.7 million)

-- Total income of GBP2.3 million, increased by 103% (H1 2022: GBP1.1 million)

-- Investment in R&D of GBP2.9 million (H1 2022: GBP4.8 million)

-- Loss after tax for the period of GBP4.5 million (H1 2022: GBP4.4 million)

-- Cash, cash equivalents and short-term investments of GBP8.2

million at 30 June 2023 (30 June 2022: GBP13.7 million)

-- Post period: R&D tax credit of GBP1.3 million received on 3 August 2023

Analyst conference call today

Dr Sarah Howell, Chief Executive Officer, and Susan Lowther,

Chief Financial Officer, will host a meeting and webcast for

analysts and investors at 11.00 am UK time today. Join the webcast

here . A copy of the interim results presentation will be released

later this morning on the Company website at www.arecor.com. Please

contact Consilium Strategic Communications for details on

arecor@consilium-comms.com / +44 203709 5700.

For more information, please contact:

Arecor Therapeutics plc www.arecor.com

Dr Sarah Howell, Chief Executive Tel: +44 (0) 1223 426060

Officer Email: info@arecor.com

Susan Lowther, Chief Financial Officer Tel: +44 (0) 1223 426060

Email: info@arecor.com

Mo Noonan, Communications Tel: +44 (0) 7876 444977

Email: mo.noonan@arecor.com

Panmure Gordon (UK) Limited (NOMAD

and Broker)

Freddy Crossley, Emma Earl (Corporate Tel: +44 (0) 20 7886 2500

Finance)

Rupert Dearden (Corporate Broking)

Consilium Strategic Communications

Chris Gardner, David Daley, Lindsey Tel: +44 (0) 20 3709 5700

Neville Email: arecor@consilium-comms.com

Notes to Editors

About Arecor

Arecor Therapeutics plc is a globally focused biopharmaceutical

group transforming patient care by bringing innovative medicines to

market through the enhancement of existing therapeutic products. By

applying our innovative proprietary formulation technology

platform, Arestat(TM) , we are developing an internal portfolio of

proprietary products in diabetes and other indications, as well as

working with leading pharmaceutical and biotechnology companies to

deliver enhanced formulations of their therapeutic products. The

Arestat (TM) platform is supported by an extensive patent portfolio

. For further details please see our website, www.arecor.com

This announcement contains inside information for the purposes

of the retained UK version of the EU Market Abuse Regulation (EU)

596/2014 ("UK MAR").

Corporate overview

Arecor's ambition is to transform patient care by enhancing

existing therapeutic medicines and, in doing so, build a

significant self-sustaining biopharmaceutical company. We have

continued to make significant progress towards this goal across all

areas of the business during the first half of 2023. We have

further built the foundations for future growth through our

portfolio of proprietary and partnered programmes which is

progressing strongly, and our commercial subsidiary, Tetris Pharma,

with its scalable sales, marketing and distribution platform.

Revenues have increased by 141% versus H1 2022. Trading for the

full year remains in line with the Board's expectations subject to

continued sales momentum and partnership milestones anticipated in

the remainder of 2023.

We continue to deliver on our strategy for our lead proprietary

diabetes product candidates AT278 and AT247, generating additional

clinical data to further demonstrate their superior profiles

compared with gold standard insulins available to patients today.

There remains a very significant patient need for even faster

acting and ultra-concentrated insulins which are key unmet needs in

the pursuit of the development of a fully closed loop artificial

pancreas system, as well as enabling longer wear miniaturised

insulin delivery devices, and their use in high insulin users. In

this field, Arecor's insulins have the potential to significantly

improve healthcare outcomes for people living with diabetes. We

continue to build the value of our insulin programmes through the

development of clinical strategies and data packages which would

best realise their future potential and maximise partnering

opportunities and value in the growing diabetes market.

We have also further progressed our in-house proprietary

pipeline of speciality hospital products underpinned by our

extensive know-how and expertise in the delivery of novel

ready-to-use ("RTU") and ready-to-administer ("RTA") formulations

for highly complex point-of-care medicines. There is a growing

demand for these superior RTA and RTU products to enable fast, safe

and effective treatment options for patients and caregivers in the

hospital setting. Our proven expertise and track record, utilising

our proprietary technology platform, Arestat(TM), in developing

these difficult to achieve stable and efficacious liquid

formulation product formats allows us to bring superior products to

patients and caregivers, and presents a clear opportunity for

Arecor to negotiate high-value co-development and commercialisation

license collaborations with pharmaceutical partners.

Our three programmes which have progressed through to license -

one from our internal Specialty Hospital Products franchise and two

from our technology partnership model, where we apply the platform

to develop novel formulations of our partners proprietary products

- are advancing well under our partners' control. These

partnerships with leading biotech and biopharma companies validate

the need, and demonstrate the opportunity, for the Arestat(TM)

platform and are testament to our world-leading expertise and

innovation in formulation science.

The expansion of our pipeline of revenue-generating technology

partnership deals with leading healthcare companies further

validates the strength of our technology and its value to our

partners in the development of enhanced formulations of their

proprietary products which would otherwise be unachievable. These

partnerships, which have continued to build steadily since Arecor's

IPO, provide both near-term revenue at the pre-license stage with

significant future license upside potential.

In Tetris Pharma, the speciality pharmaceutical company we

acquired in August 2022, we have an opportunity to accelerate our

commercially driven strategy. Its lead commercial stage diabetes

product, Ogluo(R), is a ready-to-use glucagon auto-injector pen to

treat severe hypoglycaemia and meets a key patient need. The sales

momentum seen in the UK market, and progress with its pan-European

commercial roll-out, continues to support our belief in the

complementary nature of the Tetris Pharma acquisition and the

growth potential of this important product for people with

diabetes.

Operational Review (including post period events)

Internal proprietary pipeline

The Arestat(TM) enabled novel formulations of insulin within our

diabetes franchise are designed to accelerate insulin absorption

post injection, enabling more precise and effective management of

blood glucose levels for people living with diabetes, particularly

around difficult to manage mealtimes.

Recruitment of Type 2 subjects for the second Phase I clinical

study of AT278, our ultra-rapid, ultra-concentrated insulin

candidate, is progressing well. We are currently considering

increasing the number of subjects within the study from 32 to 42 to

increase the power of the study, and in turn, to increase the value

of the results for patients with high insulin needs. If

implemented, this will result in a short delay in the reporting of

results into early 2024 and we will provide more details in the

coming weeks. The randomised, double-blind Phase I cross-over study

in people with Type 2 diabetes receiving one subcutaneous dose (0.5

U/kg) of AT278, in a euglycemic clamp setting, compares the

pharmacokinetic (PK) and pharmacodynamic (PD) profile with

NovoRapid(R) and Humulin(R) R U-500. AT278 has the potential to

disrupt the market for insulin treatment as the first concentrated,

yet very rapid acting insulin, and thereby become the gold standard

insulin for the growing population of people with diabetes with

high daily insulin needs. It has the potential to be a critical

enabler in the development of next generation miniaturised insulin

delivery systems that are beginning to dominate segments of the

market.

In June, the positive results from the second Phase I clinical

trial investigating Arecor's ultra-rapid acting insulin product

candidate, AT247, when delivered by continuous subcutaneous

infusion, were shared in a poster presentation at the American

Diabetes Association (ADA) 83rd Scientific Sessions meeting. The

data clearly demonstrates faster insulin absorption than the

currently available, gold standard, rapid acting insulins,

NovoRapid(R) and Fiasp(R), reinforcing AT247's potential to enable

even more effective disease management for people with Type I

diabetes. The availability of a truly ultra-rapid acting insulin is

a critical step towards a fully closed loop artificial pancreas

system, a potentially life changing treatment option for people

living with diabetes that has the potential to improve health

outcomes and reduce the significant burden of managing this chronic

disease.

Our Specialty Hospital Products franchise is developing

medicines that are administered within the hospital setting by

health care professionals, particularly during the treatment of

serious infections, cancer and emergency care. Leveraging our

Arestat(TM) technology, we are developing RTU and RTA medicines

within this franchise, which provide significant benefits at the

point of care by avoiding complex reconstitutions procedures and in

doing so enabling fast, safe and effective treatment options for

patients and caregivers. These products provide future high-value

licensing opportunities to Arecor.

Partnership agreements

The Group's three licensed programmes, under milestone and

royalty-based agreements or equivalent, have also advanced. Arecor

continues to expect the first product incorporating its Arestat(TM)

technology, AT220, to be commercialised by its partner under a

royalty-generating license agreement in a multi-billion dollar

market. Our partner has taken key regulatory steps towards

commercialisation and, while timing of launch is in our partner's

control, we anticipate first sales could come in late 2023 or the

early months of 2024.

Hikma continues to progress AT307, a RTU injectable medicine

after its milestone-triggering transfer from Arecor in January. A

positive pre-investigational new drug application (pre-IND) meeting

between Hikma and the FDA confirms development of AT307 in the US

under the FDA's abbreviated 505(b)(2) regulatory pathway. This

pathway provides companies with an abbreviated regulatory review

process when evidence of safety and clinical efficacy generated for

an originator product is deemed suitable to be relied upon in new

marketing applications. This also further validates a fundamental

assumption within our business that the abbreviated 505(b)(2)

pathway can be utilised across our specialty hospital portfolio,

where we are developing enhanced, RTU and RTA formulations of

existing therapeutic products.

Inhibrx is advancing towards dosing of the first patient in a

registration-enabling trial of AT292 (INBRX-101), an Arestat(TM)

formulated optimized recombinant human AAT-Fc fusion protein, for

treatment of patients with emphysema due to alpha-1 antitrypsin

deficiency, which would trigger a milestone to Arecor under the

terms of the license agreement. The initial read-out from the

Inhibrx ElevAATe trial is expected to occur in late 2024, and if

successful, will potentially provide the final data required for a

regulatory submission for this product.

We continue to build a strong portfolio of pre-license

technology partnerships in which our partners fully fund the

development work with the option for each partner to acquire rights

to the new proprietary formulation and associated intellectual

property under a technology licensing model. This offers the

potential for Arecor to generate significant future revenue through

associated milestone and royalty payments, or equivalent. We have

established three new revenue generating portfolio collaborations

so far in 2023 bringing the total technology partnerships with the

Group to 11 since IPO, including:

1. In February, we entered into an additional formulation study

agreement with an existing top five global pharmaceutical partner,

building on a collaboration formed in 2022, to develop improved,

stable, high concentration, liquid formulations of its proprietary

product.

2. In July, we entered into a collaboration to support the

ongoing development of a biosimilar product with a leading

biopharmaceutical company. This follows an earlier technology

partnership with the same company.

3. In August, we signed an agreement with a top 10

pharmaceutical company to develop an enhanced antibody formulation

for one of its investigational drugs.

Tetris Pharma

The European commercial roll out of key diabetes product,

Ogluo(R), continues to gain traction with growing sales in the UK,

and additional launches in Austria, Denmark and Norway during the

first half of 2023 complementing existing markets in Germany and

the UK. As planned, Ogluo(R) sales now represent a significant

proportion of total Tetris Pharma sales and, as a result of our

commercial strategies and focus, we have seen continuing growth in

the UK as our primary market. We anticipate this momentum in

Ogluo(R) sales to continue through the remainder of 2023 and

beyond.

The team at Tetris Pharma is focused on accelerating market

adoption of Ogluo(R) to maximise its value in launched countries.

Earlier this month, Tetris Pharma established an exclusive

commercialisation agreement with Goodlife, who will act as sole

partner for the import, marketing and distribution of Ogluo(R) in

the BeNeLux region. Goodlife is expected to launch the product in

The Netherlands during H1 2024.

With Ogluo(R), Tetris Pharma is targeting market share within an

existing c.GBP100 million market across the licensed territory. The

momentum we are seeing, and the increasingly pan-European focus of

our commercial efforts, provide the Group with continued confidence

in Ogluo(R). Sales of Gvoke(R) in the US ( Ogluo(R) is sold by

Xeris Pharmaceuticals, Inc. in the US under the registered name

Gvoke(R)) also remain strong with latest quarter on quarter growth

of 36% and, while the market dynamics clearly differ, the US

experience provides further support for the Group's belief in the

growth potential of the product in the UK and Europe.

Intellectual Property portfolio

Arecor's broad and robust global patent portfolio has >75

granted patents across key territories protecting both the

Arestat(TM) technology platform as well as the enhanced versions of

therapeutic medicines that we develop leveraging Arestat(TM). To

date, during 2023, the portfolio was bolstered with the addition of

five key patents:

-- In February, the Indian Patent Office granted a patent

(IN412485) protecting novel formulations of the Group's proprietary

insulin products, AT247 and AT278, until 2038.

-- In February, the United States Patent and Trademark Office

granted two patents (US11534402 and US11534403) protecting the

novel formulations of high-concentration adalimumab until 2038.

-- In June, the European Patent Office granted a key patent

(EP3518892), protecting novel formulations of AT278 and AT247.

-- In June, the China National Intellectual Property

Administration granted a further patent (CN110582285) protecting

AT278 and AT247.

Finance

The consolidated financial results for the period ended 30 June

2023 reflect the performance of Arecor Therapeutics plc and its

trading subsidiaries; Arecor Limited and Tetris Pharma Ltd.

The acquisition of Tetris Pharma Ltd occurred on 4 August 2022

and therefore its results are not included in the comparatives for

the six-month period to 30 June 2022. The full year comparatives to

31 December 2022 include five months of trading by Tetris Pharma

Ltd for the post-acquisition period.

Total income for the six months to 30 June 2023 of GBP2.3

million (H1 2022: GBP1.1 million) reflected increased revenue and

grant income. Revenue recognised in the period of GBP1.7 million

(H1 2022: GBP0.7 million), included sales of pharmaceutical

products of GBP1.2 million (H1 2022: Nil).

Other operating income of GBP0.6 million (H1 2022: GBP0.4

million) was grant income received from a GBP2.8 million grant

awarded by Innovate UK in March 2021.

Investment in R&D of GBP2.9 million (H1 2022: GBP4.8

million) was lower than the prior period and reflected the costs of

the current clinical trial for AT278. R&D expenditure in the

period ended 30(th) June 2022 included the US Phase I clinical

trial for AT247 and the second clinical study for AT278 which was

initiated in the first quarter of 2023.

Sales, General and Administrative costs of GBP4.4 million (H1

2022: GBP1.6 million) increased over the prior period and included

expenditure on product sales and distribution by Tetris Pharma Ltd

which was nil in the six months to 30 June 2022. On a like for like

basis the SG&A costs for the period excluding Tetris Pharma Ltd

were GBP1.9 million (H1 2022: GBP1.6 million)

The total loss after tax for the six-month period was GBP4.5

million (H1 2022: GBP4.4 million).

The Group ended the first half of the year with cash, cash

equivalents and short-term investments of GBP8.2 million (30 June

2022: GBP13.7 million).

We continue to manage cash carefully as part of our working

capital. There were two notable post period end receipts; GBP0.4

million grant receivable in early July (2022: GBP0.1 million) for

costs incurred in H1 and GBP1.3 million R&D tax credit for the

year ended 31 December 2022 (2022: GBP0.8 million) which was

received in early August. The increased R&D tax credit was due

to the level of R&D expenditure in the year ended 31 December

2022 which included costs of the US AT247 clinical study and AT278

preparatory work for the study initiated in 2023.

Contingent consideration

The acquisition of Tetris Pharma Ltd included up to a further

GBP4.0 million contingent consideration which may become payable,

consisting of three earn out payments, subject to Tetris Pharma Ltd

achieving sales and EBITDA targets in each of the three years

following completion.

The additional consideration is considered to be contingent on

future performance which is uncertain and therefore was not

included in the assessment of goodwill in the audited financial

statements for the year ended 31 December 2022.

The first earn out payment was subject to Tetris Pharma Ltd

achieving mid-single-digit million-pound net sales and a low

single-digit million-pound EBITDA loss in the 12-month period

following completion.

Earn out accounts, prepared by an independent accountant, have

determined that the first earn out target was not achieved and

therefore a payment of GBP1.0 million contingent consideration for

the first earn out period was not triggered.

Summary and outlook

We have seen further substantial progress across our in-house

proprietary products pipeline, partnered portfolio and commercial

operations during the period as we build a broad, robust platform

from which to become a significant self-sustaining

biopharmaceutical company.

We are pleased to report that revenue recognised in H1 has

materially increased compared to the comparative period to 30 June

2022. Trading for the full year remains in line with the Board's

expectations subject to continued sales momentum and partnership

milestones anticipated in the remainder of 2023.

Revenue in the period included milestone and sales of

pharmaceutical products in addition to formulation development

revenue reported in the comparative period to 30 June 2022. This

gives a broad revenue mix without a dependency on a single product

or revenue stream.

As our partnered programmes progress we will recognise further

milestone revenue and with the expected commercial launch of AT220,

annually recurring royalties which would bring a solid revenue

foundation and more clarity to forward looking forecasts. Our

partnered programmes are under the direction of our partners and

the timing of revenue recognition is outside of our direct control

which can result in recognition occurring in different financial

periods compared to our expectations.

We anticipate a number of further milestones from these existing

partnerships through the remainder of the year and beyond. Whilst

we continue to actively engage with our partners to understand

their plans, our focus is on delivering consistent year on year

revenue growth.

With the expected commercial launch of the first product

incorporating the Arestat(TM) technology, AT220, additional

milestones from existing partnerships, and the signing of new

revenue-generating agreements anticipated through the remainder of

2023 and into 2024, as well as key data from AT278 and continued

commercial traction for Ogluo(R) , we look forward with confidence

to further material progress in the near- and medium-term towards

our long-term ambitions for the Group.

Arecor Therapeutics plc

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2023

Consolidated Statement of Comprehensive Income

Notes Period ended Period Year ended

30 June 2023 ended 30 31 December

June 2022 2022

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Revenue 3 1,669 693 2,403

Other operating income 609 429 1,132

--------------- ------------ --------------

Total Income 2,278 1,122 3,535

--------------- ------------ --------------

Research and Development (2,858) (4,763) (8,613)

Sales, General and Administrative 4 (4,375) (1,587) (5,552)

Operating loss (4,955) (5,228) (10,630)

--------------- ------------ --------------

Finance income 164 3 109

Finance expense 6 (10) (9) (21)

Loss before tax (4,801) (5,234) (10,542)

--------------- ------------ --------------

Taxation 7 273 867 1,282

Loss for the period (4,528) (4,367) (9,260)

=============== ============ ==============

Basic and diluted loss per

share (GBP) 8 (0.15) (0.16) (0.32)

There were no other items of comprehensive income during the

periods under review.

Arecor Therapeutics plc

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2023

Consolidated Statement of Financial Position

Notes 30 June 30 June 2022 31 December

2023 2022

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Assets

Non-current assets

Intangible Assets 1,815 26 1,918

Goodwill 1,484 - 1,484

Property, Plant and Equipment 720 346 838

Other receivables 48 48 48

4,067 420 4,288

Current assets

Trade and other receivables 9 4,671 1,466 2,215

Inventory 1,564 68 1,131

Current tax receivable 1,598 1,642 1,325

Cash and cash equivalents 10 6,610 13,717 4,765

Short term investments 10 1,619 - 8,041

--------- ------------ -----------

16,062 16,893 17,477

Current liabilities

Trade and other payables 11 (6,254) (2,568) (3,526)

Lease liabilities (116) (127) (202)

(6,370) (2,695) (3,728)

Non-current liabilities

Lease liabilities (51) (42) (86)

Deferred tax (496) - (496)

(547) (42) (582)

Net Assets 13,212 14,576 17,455

========= ============ ===========

Equity

Share capital 12 306 278 306

Share premium account 28,976 23,348 28,976

Share-based payment reserve 1,143 912 893

Other reserves 11,455 11,455 11,455

Merger relief reserve 2,014 - 2,014

Foreign exchange reserve 14 - (8)

Retained earnings (30,696) (21,417) (26,181)

--------- ------------ -----------

Shareholder's funds 13,212 14,576 17,455

Arecor Therapeutics plc

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2023

Consolidated Statement of Changes in Equity

Share-based Merger Foreign

Share Share payment relief Other exchange Retained Total

capital premium reserve reserve reserves reserve losses equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

For the period ended

30

June 2022

Balance at 1 January

2022 278 23,348 519 - 11,455 - (17,051) 18,549

Loss for the period - - - - - - (4,367) (4,367)

Total comprehensive

loss

for the period - - - - - - (4,367) (4,367)

Transactions with

owners:

Share-based

compensation - - 393 - - - - 393

----------------------- ---------- ---------- ------------ --------- ---------- ---------- --------- ---------

Total transactions

with

owners - - 393 - - - (4,367) (3,974)

Balance at 30 June

2022

(Unaudited) 278 23,348 912 - 11,455 - (21,417) 14,576

For the period ended

31

December 2022

Balance at 1 July 2022 278 23,348 912 - 11,455 - (21,417) 14,576

Loss for the period (4,894) (4,894)

Total comprehensive

loss

for the period (4,894) (4,894)

Transactions with

owners

Share-based

compensation 111 111

Issue of shares on

acquisition

of Tetris Pharma Ltd 7 2,014 2,021

Issue of shares for

working

capital purposes 20 5,980 6,000

Share Issue expense (352) (352)

Issue of shares on

exercise

of share options 1 1

Reserve Transfer (130) 130 -

Foreign Exchange

movements (8) (8)

----------------------- ---------- ---------- ------------ --------- ---------- ---------- --------- ---------

Total transactions

with

owners 28 5,628 (19) 2,014 - (8) 130 7,773

Balance at 31 December

2022 (audited) 306 28,976 893 2,014 11,455 (8) (26,181) 17,455

Arecor Therapeutics plc

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2023

Consolidated Statement of Changes in Equity (continued)

Share-based Merger Foreign

Share Share payment relief Other exchange Retained Total

capital premium reserve reserve reserves reserve losses equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

For the period ended

30

June 2023

Balance at 1 January

2023 306 28,976 893 2,014 11,455 (8) (26,181) 17,455

Loss for the period - - - - - - (4,528) (4,528)

Total comprehensive

loss

for the period - - - - - - (4,528) (4,528)

Transactions with

owners:

Share-based

compensation - - 263 - - - - 263

Reserve Transfer - - (13) - - - 13 -

Foreign Exchange

movements - - - - - 22 - 22

----------------------- ---------- ---------- ------------ --------- ---------- ---------- --------- ---------

Total transactions

with

owners - - 250 - - 22 (4,515) 7,773

Balance at 30 June

2023

(unaudited) 306 28,976 1,143 2,014 11,455 14 (30,696) 13,212

Arecor Therapeutics plc

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2023

Consolidated Statement of Cash Flows

Period ended 30 June 2023 Period ended 30 June 2022 Year ended 31 December 2022

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Cash flow from operating

activities

Loss before tax (4,801) (5,234) (10,542)

Finance income (164) (3) (109)

Finance costs 10 9 21

Share-based compensation 263 393 503

Depreciation 198 85 248

Amortisation 103 4 93

Foreign exchange movements 132 76 (69)

-------------------------- -------------------------- ----------------------------

(4,259) (4,670) (9,855)

Changes in working capital

(Increase)/ decrease in

inventory (433) (68) 587

(Increase)/ decrease in trade

and other receivables (2,456) (43) (48)

Increase/(decrease) in trade and

other payables 2,728 427 (2,198)

Tax received - - 734

-------------------------- -------------------------- ----------------------------

(161) 316 (925)

Net cash used in operating

activities (4,420) (4,354) (10,780)

Cash flow from investing

activities

Acquisition of subsidiary net of

cash acquired - - 284

Purchase of property, plant &

equipment (73) (100) (299)

Purchase of intangible assets - - (46)

Short term investments 6,422 - (8,041)

Interest received 164 3 109

Net cash used in investing

activities 6,513 (97) (7,993)

Cash flow from financing

activities

Issue of ordinary shares - - 6,000

Share issue costs - - (352)

Capital payments on lease

liabilities (114) (63) (165)

Interest paid on lease

liabilities (10) (9) (21)

Repayment of working capital

facility - - (295)

Other interest paid - - (7)

Net cash (used in) / generated

by financing activities (124) (72) 5,160

Net (decrease) / increase in

cash and cash equivalents 1,969 (4,523) (13,613)

Exchange (losses) / gains on

cash and cash equivalents (124) (76) 62

Cash and cash equivalents at

beginning of period or

financial year 4,765 18,316 18,316

Cash and cash equivalents at end

of period or financial year 6,610 13,717 4,765

========================== ========================== ============================

Arecor Therapeutics plc

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2023

Notes to the financial information

COMPANY INFORMATION

Arecor Therapeutics plc ("Arecor" or the "Company") is a public

limited company registered in England and Wales at Chesterford

Research Park, Little Chesterford, Saffron Walden, CB10 1XL with

registered number 13331147.

The principal activity of the Company is to act as a holding

company. The Group has two wholly owned trading subsidiaries;

Arecor Limited and Tetris Pharma Ltd.

Tetris Pharma Ltd and its wholly owned subsidiary Tetris Pharma

B.V were acquired on 4th August 2022.

1. BASIS OF PREPARATION

The financial statements for the period ended 30 June 2023

incorporate the results of Arecor Therapeutics plc and its trading

subsidiaries. The consolidated interim financial statements for the

period to 30 June 2023 are unaudited and were approved by the board

of directors on 13 September 2023.

The consolidated interim financial statements have been prepared

in accordance with UK-adopted International Accounting Standards

("IFRS") in conformity with the requirements of the Companies Act

2006. The financial information has been prepared on the basis of

IFRS that the Directors expect to be applicable at 31 December

2023.

The financial information contained in these interim financial

statements does not constitute statutory accounts as defined in

section 434 of the Companies Act 2006. These interim financial

statements do not include all of the information and disclosures

required in the annual financial statements. The financial

information for the six months ended 30 June 2023 and 30 June 2022

is unaudited.

Financial statements for year ended 31 December 2022 have been

filed with the Registrar of Companies for Arecor Therapeutics plc

(Company registration number 13331147). The audit report for this

period, previously filed, was unmodified.

All intra-Group transactions, balances, income and expenses have

been eliminated in full on consolidation.

Tetris Pharma Ltd was acquired by Arecor Therapeutics plc on

4(th) August 2022 and is therefore not included in the comparatives

for the six-month period to 30 June 2022. The full year

comparatives to 31 December 2022 contain five months of trading by

Tetris Pharma Ltd for the post-acquisition period.

The financial information is presented in Sterling, which is the

functional currency of the Group and has been rounded to the

nearest GBP000.

2. PRINCIPAL ACCOUNTING POLICIES

The interim financial statements have been prepared in

accordance with the accounting policies set out in the audited

financial statements for the period ended 31 December 2022 and

IFRS. There have been no changes to the accounting policies or the

application of the accounting standards during the period of

review.

a) Going Concern

The Directors have reviewed current cash and short- term

investments together with forecast receivables to support forecast

operating expenditure and planned investment in R&D.

Sensitivities included the impact of reduced receivables and

mitigating actions. The review indicated that in potential downside

scenarios, cash flow forecasts extended to a period beyond 12

months from the date of approval of the consolidated interim

results.

In reaching their decision to prepare these unaudited interim

financial statements on a going concern basis, the Directors have a

reasonable expectation that the Group has adequate resources to

continue in operational existence for the foreseeable future.

Accordingly, they continue to adopt the going concern basis in

preparing these unaudited interim financial statements.

3. REVENUE AND OPERATING SEGMENTS

Year ended

Period ended Period ended 31 December

30 June 2023 30 June 2022 2022

UK 1,190 101 1,136

Switzerland 77 33 240

Rest of Europe 124 22 108

USA 248 492 784

India 30 135

Rest of World - 45 -

Total revenue 1,669 693 2,403

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision makers.

Information reported includes revenue by project, expenditure by

type and department, cashflows and EBITDA for the Group.

The Board of Directors has been identified as the chief

operating decision makers, who are responsible for allocating

resources, assessing the performance of the operating segment and

making strategic decisions. Accordingly, the Directors consider

there to be a single operating segment.

Year ended

Period ended Period ended 31 December

30 June 2023 30 June 2022 2022

Formulation development projects 342 693 1,352

Milestones from licence agreements 108 - -

Sale of pharmaceuticals 1,219 - 1,051

Total revenue 1,669 693 2,403

Revenue from formulation development projects has been

recognised as the performance obligations set out in agreements are

satisfied over time.

Revenue from Milestones defined in license agreements has been

recognised when a milestone is achieved.

Sales of pharmaceuticals are product sales which have been

recognised as the rights and obligations pertaining to those items

are transferred to the buyer.

4. SALES, GENERAL AND ADMINISTRATIVE COSTS

Operating expenditure which is not considered as Research and

Development is treated as Sales, General and Administrative costs.

This includes Finance, HR, Administrative and sales and marketing

and Business Development teams, building facilities, sale of

pharmaceutical products and costs relating to the Board of

Directors.

5. SHARE BASED COMPENSATION

The Company operates an All-Employee Share Option Plan (AESOP)

and grants share options to eligible employees. The options vest

over time.

The Company's Long Term Incentive Plan (LTIP) is principally

used to grant options to Executive directors and senior management.

The LTIP options vest after three years subject to meeting

performance criteria as defined in the option agreement. These can

be a combination of both operational objectives and share price

performance compared to a benchmark. These performance conditions

are approved by the Board on each occasion prior to the grant of

the options. Ordinary shares acquired on exercise of the LTIP

options are subject to a holding period of a minimum of one year

from the date of vesting.

The movement in share options in the period was as follows:

Number of Options

Balance at 31 December 2021 1,414,944

Options lapsed (13,497)

Balance at 30 June 2022 1,401,447

AESOP options granted 312,750

LTIP options granted 270,000

AESOP options exercised (131,433)

Options lapsed (224,961)

Balance at 31 December 2022 1,627,803

AESOP options granted 86,250

LTIP options granted 190,000

AESOP options exercised (7,471)

Options lapsed (235,167)

Balance at 30 June 2023 1,661,415

Shared Based Payment charges to the Statement GBP000

of Comprehensive Income

Period to June 2023 263

Period to June 2022 393

Year to December 2022 504

6. FINANCE EXPENSES

In the period ended 30 June 2023, the finance expenses of

GBP10,000 were interest costs on finance leases (period ended 30

June 2022: GBP9,000).

7. TAXATION

Year ended

Period ended Period ended 31 December

30 June 2023 30 June 2022 2022

R&D Tax credit receivable 273 867 1,282

Total taxation 273 867 1,282

On 1 April 2023 the UK Governments rates of tax relief for loss

making SME R&D tax credits decreased from 14.5% to 10%. On the

same date, the tax relief for the RDEC scheme increased from 13% to

20%. The Group utilises both schemes and has calculated the balance

receivable based on the applicable rates for expenditure incurred

before and after the date of transition.

8. EARNINGS PER SHARE

Basic earnings per share is calculated by dividing the loss

attributable to ordinary shareholders by the

weighted average number of ordinary shares outstanding during

the period.

Given the Company's reported loss for the periods and financial

year, share options were not taken into account when determining

the weighted average number of ordinary shares in issue during the

year as they would be anti-dilutive, and therefore the basic and

diluted loss per share are the same.

Basic and diluted loss per share

Period ended Period ended Year ended

30 June 2023 30 June 31 December 2023

2022

Loss for the period (GBP000) (4,528) (4,367) (9,260)

Weighted average number of ordinary shares (number) 30,619,091 27,835,024 28,936,088

Loss per share from continuing operations (GBP per share) (0.15) (0.16) (0.32)

============== ============= ==================

9. TRADE AND OTHER RECEIVABLES

Year ended

Period ended Period ended 31 December

30 June 2023 30 June 2022 2022

Trade receivables 3,688 157 664

Other receivables 175 273 273

Grant receivables 423 83 562

Prepayments 385 953 716

Total Trade and other receivables 4,671 1,466 2,215

The growth in Trade receivables of GBP3.7 million reflects the

gross sales of pharmaceutical products by Tetris Pharma Ltd, which

were nil in the period ended 30 June 2022.

Trade receivables for pharmaceutical products are gross of

rebates payable to wholesalers. Rebates are reported in Trade

payables and accruals.

Grant receivables of GBP0.4 million reflect the timing of

reimbursement of expenditure incurred in the first half of the year

and an increase over the prior period grant receivable of GBP0.1

million.

10. CASH AND CASH EQUIVALENTS AND SHORT TERM INVESTMENTS

Year ended

Period ended Period ended 31 December

30 June 2023 30 June 2022 2022

Cash and cash equivalents 6,610 13,717 4,765

Short term investments 1,619 - 8,041

Total cash, cash equivalents

and short term investments 8,229 13,717 12,806

Short term investments relate to balances held in either fixed

term accounts with a six-month maturity or notice accounts with a

95 day notice period.

All significant cash, cash equivalents and short-term

investments are deposited in the UK with large international

banks.

11. TRADE AND OTHER PAYABLES

Year ended

Period ended Period ended 31 December

30 June 2023 30 June 2022 2022

Trade payables 2,779 1,508 1,709

Other tax and social security 123 97 120

Other creditors 1,172 - 217

Contract liabilities 682 188 206

Accruals 1,498 775 1,274

Total Trade and other payables 6,254 2,568 3,526

The growth in Trade payables and Accruals include rebate amounts

due to wholesalers on the sales of pharmaceutical products by

Tetris Pharma Ltd, which were nil in the prior period ended 30 June

2022.

Other creditors of GBP1.2 million includes VAT payable and stock

provisions which were nil in the prior period.

12. EQUITY

Share Capital

At 30 June At 30 June At 31 December

2023 2022 2022

Number Number Number

Allotted, called up and fully

paid

Ordinary shares of GBP0.01 30,625,654 27,835,024 30,618,183

Total share capital 30,625,654 27,835,024 30,618,183

=========== =========== ===============

At 30 June At 30 June At 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Allotted, called up and fully

paid

Ordinary shares of GBP0.01 306 278 306

Total share capital 306 278 306

=========== =========== ===============

13. EVENTS AFTER THE BALANCE SHEET DATE

In accordance with a Sale and Purchase Agreement dated 1(st)

August 2022, the acquisition of Tetris Pharma Ltd included

contingent consideration of three earn out payments, which may

become payable on the first, second and third anniversary following

completion.

The first earn out payment was subject to Tetris Pharma Ltd

achieving mid-single-digit million-pound net sales and a low

single-digit million-pound EBITDA loss in the 12-month period

following completion.

Earn out accounts were prepared by an independent accountant and

have been provided to the previous shareholders of Tetris Pharma

Ltd. The earn out accounts determined that the first earn out

target was not achieved and therefore contingent consideration of

GBP1,000,000 for the first earn out period was not triggered.

14. COPIES OF THE INTERIM REPORT

Copies of the consolidated interim financial statements are

available to the public free of charge from the Company at

Chesterford Research Park, Little Chesterford, Saffron Walden, CB10

1 XL during normal business hours for 14 days from today.

Copies are also available on the Company's website at

www.arecor.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EANNDFEPDEFA

(END) Dow Jones Newswires

September 14, 2023 02:00 ET (06:00 GMT)

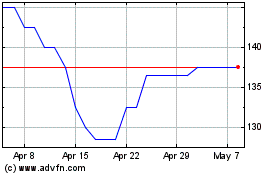

Arecor Therapeutics (LSE:AREC)

Historical Stock Chart

From Apr 2024 to May 2024

Arecor Therapeutics (LSE:AREC)

Historical Stock Chart

From May 2023 to May 2024